ALL IN ONE MEGA PACK INCLUDES:

Business Brokerage Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Business Brokerage Startup Budget Info

Highlights

A successful business broker must possess strong industry knowledge, be well-versed in market trends and industry regulations, and have a thorough understanding of the business broker valuation methods and due diligence process. They should have a comprehensive business plan that includes an exit strategy and acquisition strategy to ensure they achieve success for their clients. Additionally, a business broker's fee structure and commission rates should be transparent and fair, and they should offer financing options to increase their clients' chances of success. Ultimately, a business broker's success rate relies on their ability to accurately conduct a market analysis and provide legal considerations that protect their clients' interests.

As a business broker, it is essential to have in-depth industry knowledge and a thorough understanding of market trends and regulations. To ensure a high success rate, business brokers employ various selling methods, including market analysis, business valuation techniques that accurately determine the worth of a company, and due diligence processes that investigate the company's financials and legal considerations. A structured fee plan, acquisition strategy, and exit strategy, along with financing options, can help establish the best course of action for sellers seeking to maximize their profits. Commission rates usually differ depending on the broker's expertise and services offered. A comprehensive business plan, including research, analysis, and reporting, is essential to untangling the complexities and challenges of selling any business.

Description

At the core of any successful business brokerage is a well-designed business plan that takes into account all the key factors that contribute to success in this industry. This includes an in-depth understanding of business broker commission rates, valuation methods, fee structure, selling process, success rate, market analysis, industry knowledge, financing options, due diligence process, exit strategy, acquisition strategy, market trends, industry regulations, and legal considerations. Our team has developed a comprehensive business brokerage business plan template that provides all the necessary information and tools you need to build a solid foundation for your business and achieve long-term success in this competitive industry.Business Brokerage Financial Plan Reports

All in One Place

We offer a comprehensive business brokerage service including business valuation, market analysis, and due diligence process. Our industry experts have in-depth knowledge of current market trends and industry regulations. Our fee structure is competitive and transparent, with commission rates based on the success rate of our selling and acquisition strategies. We also offer financing options and exit strategies to ensure a smooth transition for both buyers and sellers. Our fully-integrated financial model is ideal for startups preparing for investor meetings, with all financial reports easily accessible for an investor-friendly presentation.

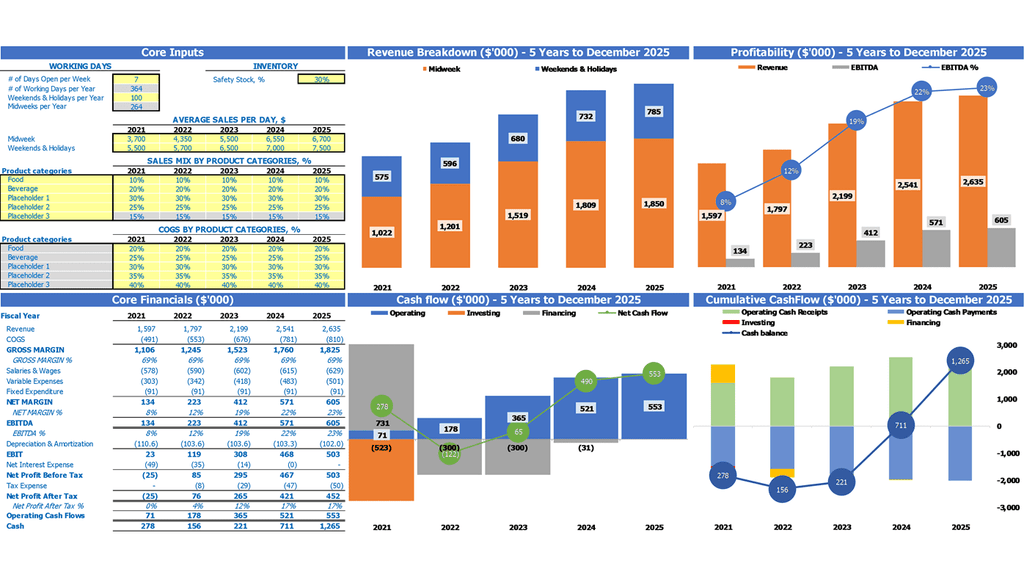

Dashboard

When choosing a business broker, it's important to consider factors such as commission rates, valuation methods, fee structures, and success rates. A good broker should possess industry knowledge and be able to provide market analysis, financing options, and due diligence and exit strategies. They should also have a comprehensive understanding of market trends, industry regulations, and legal considerations. An effective business plan and acquisition strategy are essential for achieving successful sales. Look for a broker who offers a transparent fee structure and provides clear and concise data and analysis to help you make informed decisions about your business.

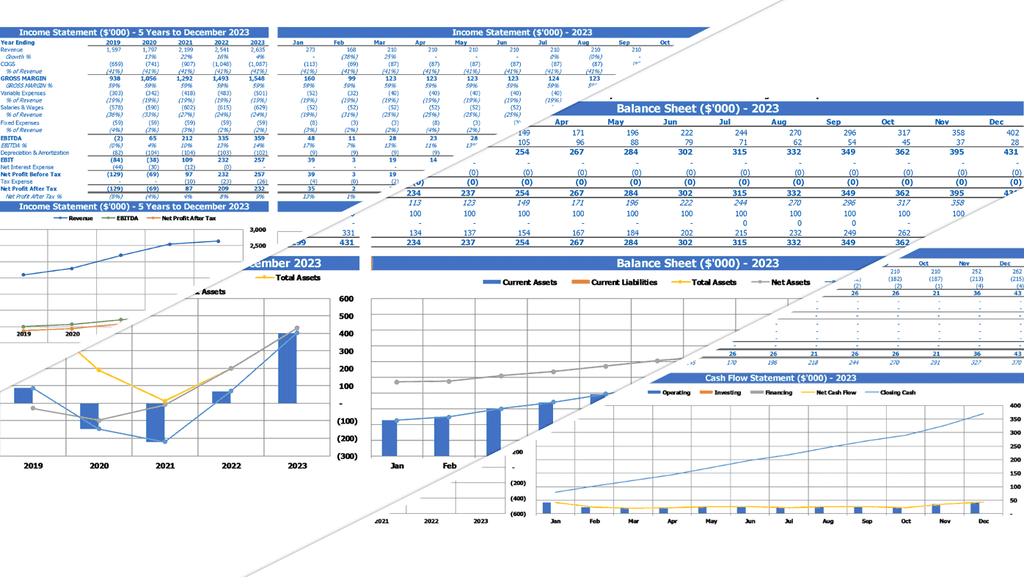

Business Financial Statement Template

When considering hiring a business broker, it's important to evaluate their industry knowledge, success rate, and fee structure. They should demonstrate expertise in market analysis, financing options, and valuation methods to help you develop an acquisition or exit strategy. They may also provide assistance with due diligence, legal considerations, and market trends. When working with a business broker, expect them to provide a thorough selling process with commission rates based on the successful completion of the transaction. Keep in mind, a broker's expertise should include financial statement analysis, including a pro forma income statement and cash flow forecast.

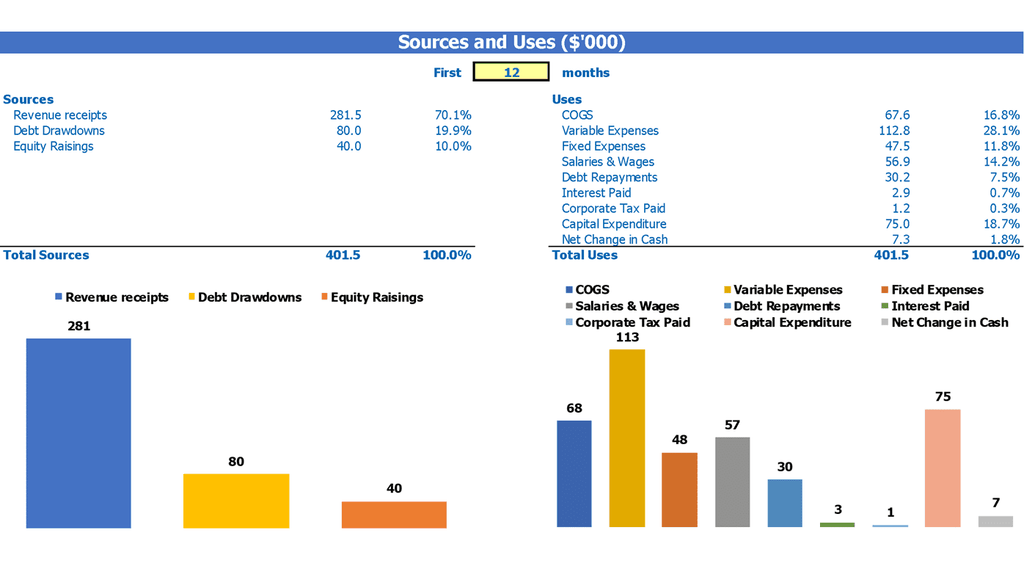

Sources And Uses Template

When choosing a business broker, it's important to consider their industry knowledge, success rates, and expertise in valuation methods and market analysis. Look into their fee structure and commission rates to ensure they align with your goals. A reliable broker will guide you through the selling process, including due diligence, financing options, and crafting an exit or acquisition strategy. Business brokers should also stay up-to-date on market trends and industry regulations while addressing any legal considerations. Ultimately, a broker's ability to provide a comprehensive business plan and effective funding strategies may lead to a successful sale.

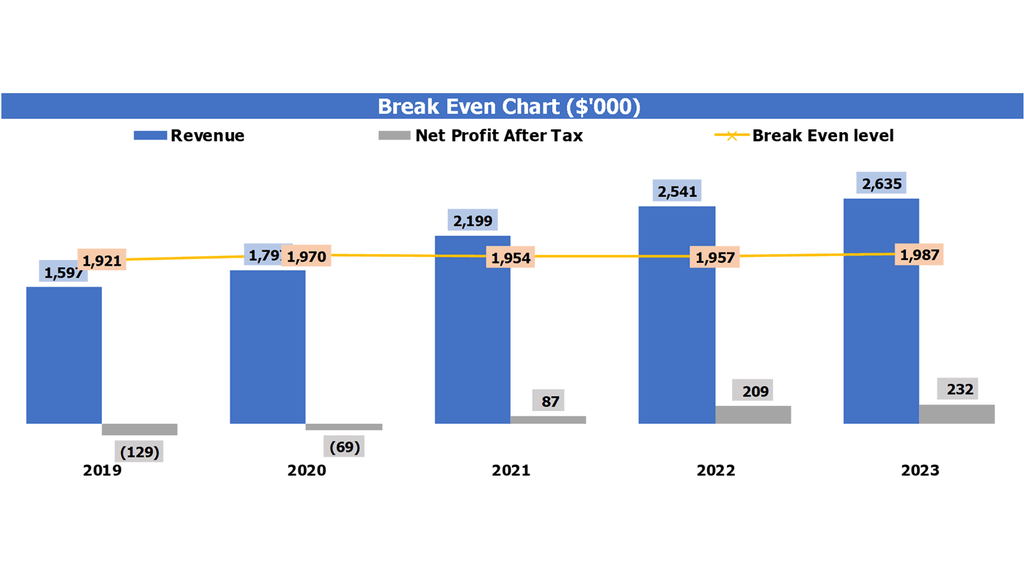

Break Even Analysis Graph

Business owners may be interested in working with a professional business broker to navigate the complex process of buying or selling a business. Business brokers bring industry knowledge and expertise to the table when it comes to market analysis, valuation methods, fee structures, and commission rates. They can also provide insights into financing options, due diligence processes, exit and acquisition strategies, market trends, and legal considerations. Working with a skilled business broker can increase a business's success rate and facilitate a smoother selling process.

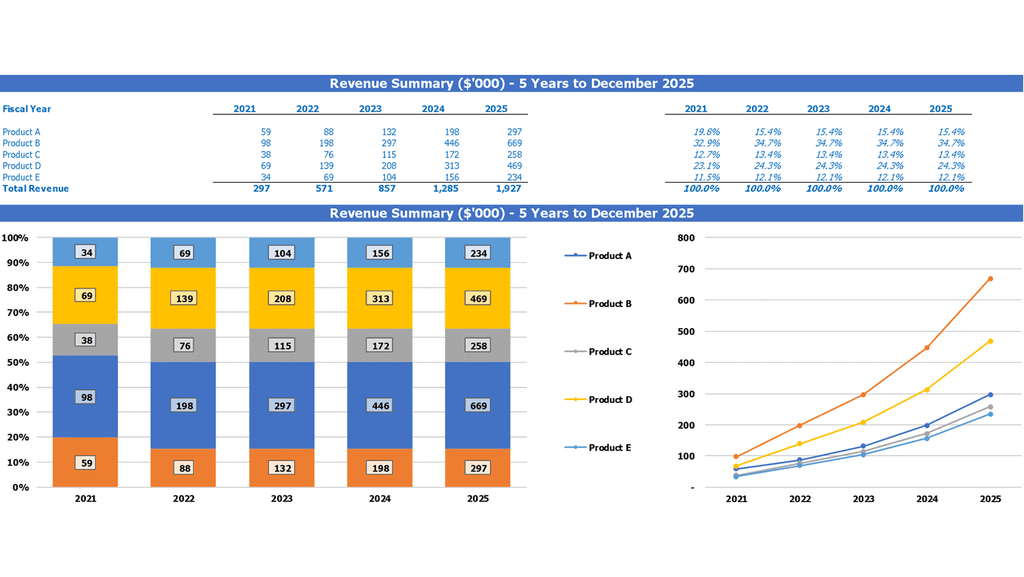

Top Revenue

As a business broker, it's important to understand various aspects of the industry, including commission rates, valuation methods, fee structure, financing options, due diligence process, exit and acquisition strategies. Familiarity with market analysis and industry regulations, legal considerations, and current trends is also vital for success. Utilizing revenue and financial analysis tools can help in developing effective business plans, pinpointing demand levels, and predicting future revenue streams. All of these factors can help increase your success rate and drive company growth strategies.

Company Top Expenses List

A comprehensive business plan includes a section on expenses which should be categorized into four groups. Business brokers offer extensive market analysis, industry knowledge and help in identifying financing options. They also have extensive knowledge of industry regulations and legal considerations. Their services include strategies to acquire or sell a business, exit strategies, and due diligence processes. Their success rate varies with experience and commission rates, which are generally based on the valuation method used. A business broker's fee structure should be transparent and aligned with the client's needs. Market trends and charts help business owners make informed decisions.

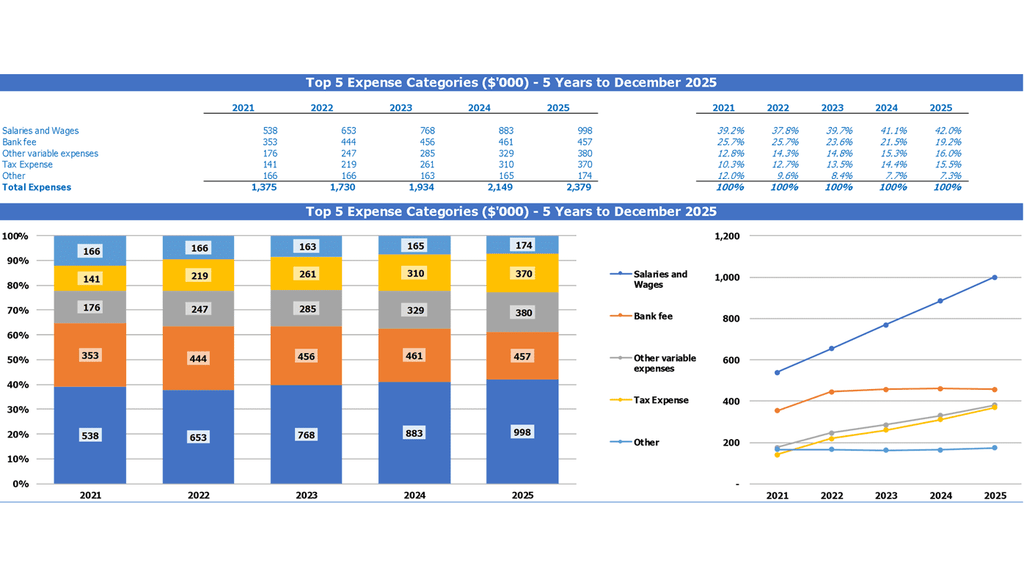

Business Brokerage Financial Projection Expenses

Costs

A competent business broker can offer industry knowledge, market analysis, financing options, and legal considerations while guiding clients through every stage of the selling process. They'll also have proven business plan templates, exit and acquisition strategies, and due diligence processes to ensure a higher success rate. Additionally, understanding commission rates, valuation methods, fee structures, and market trends is crucial in finding a reputable broker. Above all, working with a professional business broker can help save clients money and time by minimizing expenses and maximizing profits throughout the transition.

Initial Startup Costs

As an expert in the business brokerage industry, I offer a deep understanding of market trends and industry regulations to guide clients through the selling or acquisition process. My success rate is high thanks to a thorough due diligence process, comprehensive valuation methods, and strategic exit or acquisition strategies. I also offer advice on financing options and legal considerations. My fee structure is transparent, and commission rates are fair. With a sound business plan and my industry knowledge, clients can achieve their goals while minimizing risk and maximizing return on investment.

Debt Financing

When looking to buy or sell a business, partnering with a business broker can greatly improve your chances for success. These brokers have industry knowledge and use market analysis and valuation methods to help determine the right fee structure and commission rates. They can also assist with financing options and guide you through the due diligence process, as well as help create an exit or acquisition strategy. It's important to work with a reputable broker who is aware of industry regulations and legal considerations to ensure a successful transaction.

Business Brokerage Income Statement Metrics

Performance KPIs

When seeking out the services of a business broker, it is important to consider various factors such as commission rates, valuation methods, and fee structures. A successful broker should have a thorough understanding of market analysis, industry knowledge, and current trends. In addition, financing options, due diligence process, exit and acquisition strategies, and legal considerations should be taken into account. A competent broker can help with business planning, and assist in ensuring a favorable payback period in the financial plan startup. Understanding industry regulations and having a high success rate can make all the difference in securing a profitable transaction.

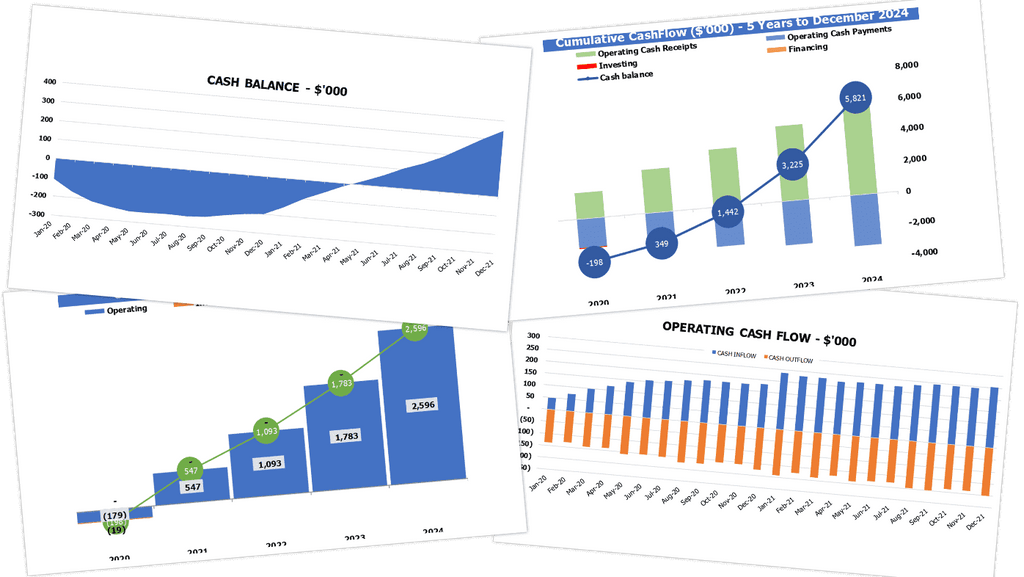

Cash Flow Forecast Template Excel

When working with smaller businesses, it's important to consider more than just the net income on a forecast income statement. A forecast cash flow statement takes into account financing activities like business loans or capital raises, providing crucial insight into potential future cash needs, burn rate, and runway. This is especially important for businesses with simple accounting where net income and cash flow may be closely aligned. By factoring in financing activities, business brokers can provide more accurate and comprehensive valuations and exit strategies to help their clients succeed.

Business Benchmarks

As a business broker, success relies on industry knowledge and expertise in a range of areas, from market analysis and trends to legal considerations and financing options. To achieve the best commission rates and fee structure, brokers need to have a thorough understanding of valuation methods, due diligence processes, and exit and acquisition strategies. By developing a solid business plan and staying on top of industry regulations, brokers can increase their success rate and ensure they can offer clients the best possible service.

Projected Profit And Loss Statement

When it comes to buying or selling a business, working with a business broker can make a significant difference in the outcome. These professionals have expertise in market analysis and industry trends and can provide valuable advice on financing and due diligence. Fee structures typically involve commission rates based on the sale price, while successful brokers often have a solid business plan and both acquisition and exit strategies. Working with brokers who understand legal considerations and industry regulations is also crucial for a successful transaction. Valuation methods and knowledge of financing options are other keys to getting the best deal.

Pro Forma Balance

A business broker's industry knowledge and experience in financial analysis and valuation methods play a crucial role in determining the success rate of a selling process. A broker's fee structure may include commission rates and financing options, while the due diligence process and exit strategy require market analysis and legal considerations. A broker's acquisition strategy and business plan should align with market trends and industry regulations. In summary, understanding the pro forma balance sheet and key financial metrics can aid in facilitating a profitable transaction.

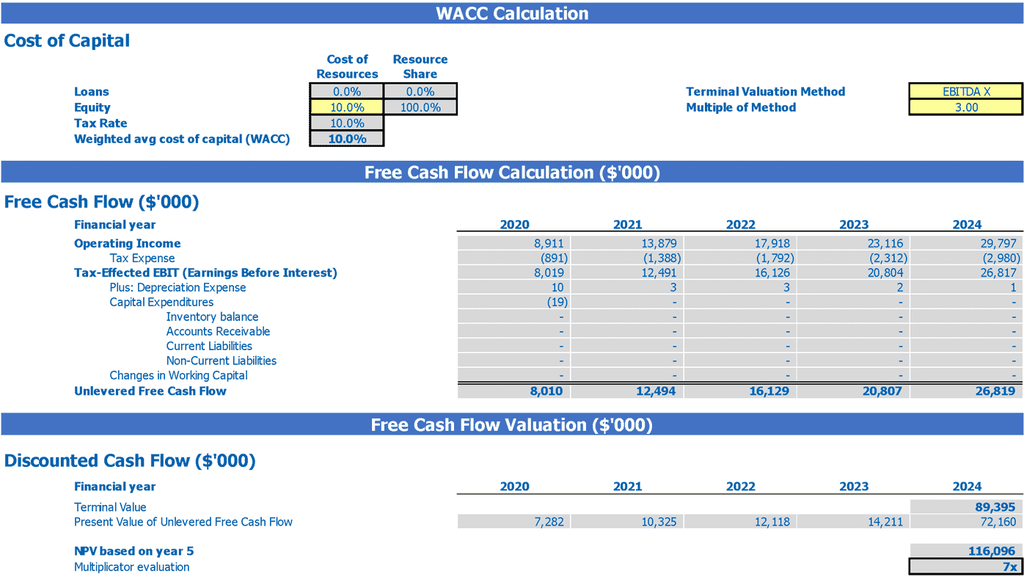

Business Brokerage Income Statement Valuation

Pre Revenue Company

Our business brokers have extensive industry knowledge and use various valuation methods to determine the true worth of your business. Our fee structure and commission rates are competitive and transparent. We ensure a successful selling process by conducting thorough due diligence and providing financing options for potential buyers. We also offer exit and acquisition strategies tailored to your specific needs. Our business plans and market analyses take into account the latest trends and industry regulations to ensure legal considerations are met. Trust us to help you navigate the complex world of business transactions.

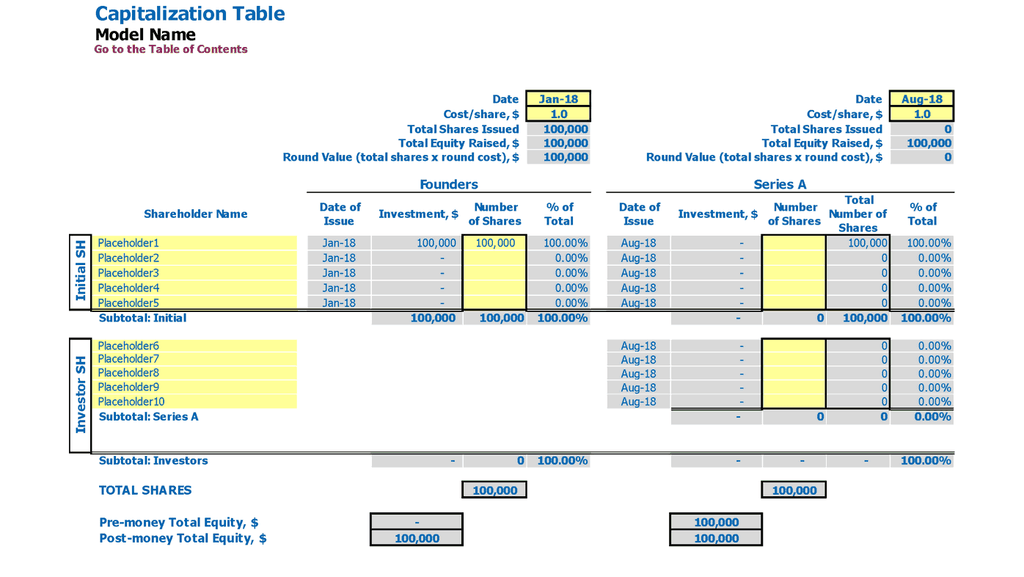

Capitalization Table

Business brokers apply their industry knowledge and market analysis to assist clients with selling their businesses while maximizing the success rate. They employ various valuation methods and fee structures, as well as commission rates that cater to clients' needs. Brokerage firms also provide due diligence processes and financing options to potential buyers. In addition, brokers consider exit and acquisition strategies, market trends, legal considerations, and industry regulations. Much like a cap table for startups, a business broker devises a business plan for its clients by evaluating their financial projections and applying proven strategies to reach their goals.

Business Brokerage Projected Income Statement Template Excel Key Features

Simple-to-use

Our business brokerage offers an easy-to-use 3 statement financial model excel template for businesses of all sizes and stages.

We do the math

Get all the essential features for business brokerage, from market analysis to legal considerations, with Startup Costs Spreadsheet.

Convenient All-In-One Dashboard

Our business broker fee structure includes a commission based on the success rate of our selling process, industry knowledge, and due diligence.

Investors ready

A professional business broker can help you navigate the complex selling process, including market analysis, due diligence, and exit strategy.

Avoid cash flow problems

Business brokers provide industry knowledge, market analysis, due diligence, financing options, and exit/acquisition strategies to improve success rates and commission rates.

Business Brokerage 5 Year Financial Projection Template Advantages

Utilize a business broker's industry knowledge and expertise to navigate legal considerations and market trends during the selling process.

Our business brokers offer a variety of services, including market analysis, industry knowledge, and financing options, to help clients run successful transactions with favorable commission rates and fee structures.

Maximize profits with a customized business broker fee structure and expert industry knowledge.

{Maximize your profits with a trusted business broker who offers industry knowledge, strategic planning, and due diligence processes.}

Maximize profits with a business broker who uses industry knowledge, market analysis, and effective selling processes to achieve a successful transaction with competitive commission rates and a transparent fee structure.