ALL IN ONE MEGA PACK INCLUDES:

Co Operative Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Co Operative Bank Startup Budget Info

Highlights

A Cooperative Bank's business model involves a unique financial, governance, and ownership structure that benefits its members. Members can benefit from the lending and deposit models and also enjoy voting rights, a dividend policy, and eligibility for loans. A Cooperative Bank's profitability model largely depends on its risk management and social responsibility, which also impacts the community at large. Membership requirements are necessary for access to the bank's benefits, and a loan portfolio is essential for the bank's success. If you're a startup or established company, consider using a co-operative bank financial model to raise funds, calculate cash flow projections, and develop future budgets.

A successful cooperative bank has a unique financial structure, governance structure, and ownership structure, ensuring that members' needs come first. Besides providing deposit and lending services, cooperative banks focus on member benefits, social responsibility, and community impact. Members of cooperative banks have voting rights and benefit from dividend policies while the lending model considers profitability and risk management. The cooperative bank's loan portfolio and deposit model should align with the overall business model research to ensure feasibility and growth rate. This Co Operative Bank Financial Plan for Business Plan enables a highly customized, integrated, and scalable forecast for those seeking to start their own cooperative bank.

Description

A co-operative bank, unlike traditional banks, uses a unique business model that prioritizes the financial, governance, ownership, and social responsibility interests of its members. The co-operative bank's financial structure is designed to optimize its profitability model by focusing on a lending and deposit model that provides customer-centric benefits with low-interest rates. The co-operative bank's governance structure implies that members have a say in managing the business, and their voting rights aid in decision-making processes. Ownership structure also follows member ownership, which aligns greater benefits for members, and membership requirements require membership of at least one share. By having a dividend policy that targets and rewards members based on their investment size, members profit through community investment, and loans that go to the community. Co-operative banks are founded on social responsibility, showing their community impact by empowering the local economy, promoting entrepreneurship, and taking on social projects. Risk management is also a top priority of co-operative banks.Co Operative Bank Financial Plan Reports

All in One Place

A cooperative bank operates under a unique business model, ownership structure, and governance structure, which puts the members' interests first. It offers various member benefits, including voting rights and dividend policies. The lending and deposit models aim to provide affordable financial services to the community while maintaining profitability and risk management. Cooperative banks also promote social responsibility and community impact through their operations. Membership requirements are flexible, and the loan portfolio adapts to the changing needs of members. The financial structure remains robust and holistic, accommodating changes in the accounting year.

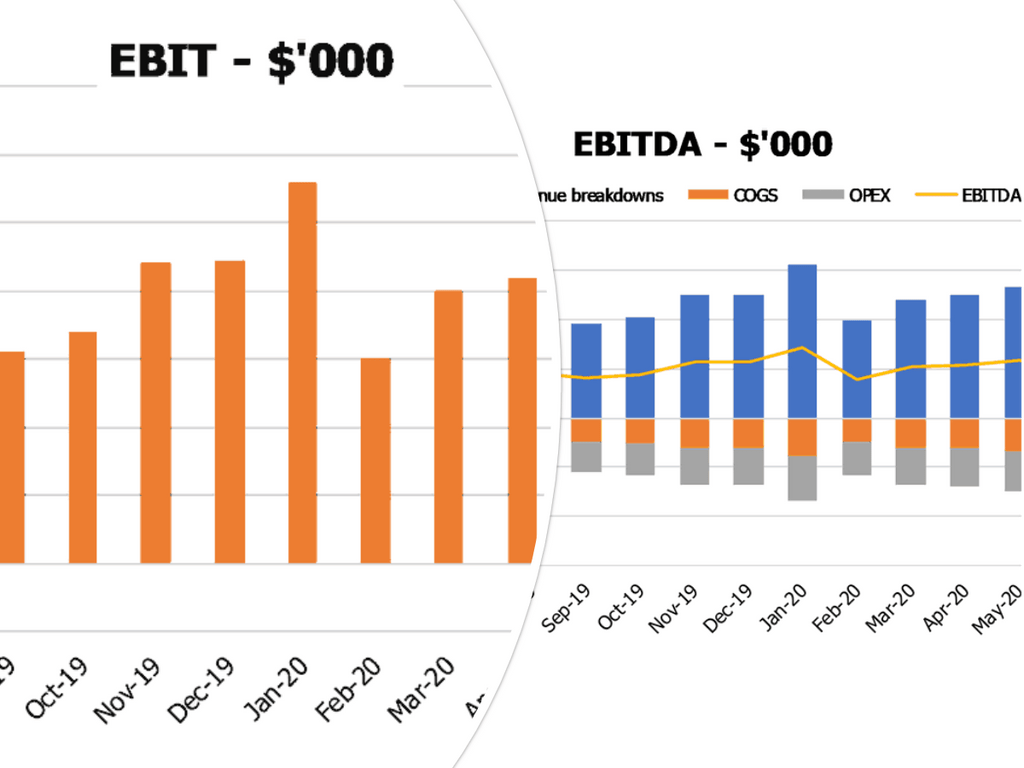

Dashboard

A cooperative bank has a unique business model that prioritizes member benefits, social responsibility, and community impact. Its financial structure, ownership structure, governance structure, lending model, deposit model, and profitability model all revolve around these core values. The cooperative bank's risk management strategies center on balancing financial stability with social responsibility. Membership requirements, voting rights, and dividend policies also support member ownership and control. The cooperative bank's loan portfolio reflects its commitment to social responsibility, meeting the financing needs of underserved communities while ensuring financial sustainability.

Business Financial Statement Template Xls

Cooperative banks operate under a unique business model that emphasizes community impact and member benefits. Their financial structure, ownership and governance are designed to prioritize the needs of their members. Cooperative banks offer loans, deposits and other financial services with a focus on social responsibility and risk management. Membership requirements include voting rights, and a dividend policy that reflects profits. Their loan portfolio is managed to maximize profitability while benefiting the community. These banks are invested in improving the lives of their members and demonstrating their role as socially responsible financial institutions.

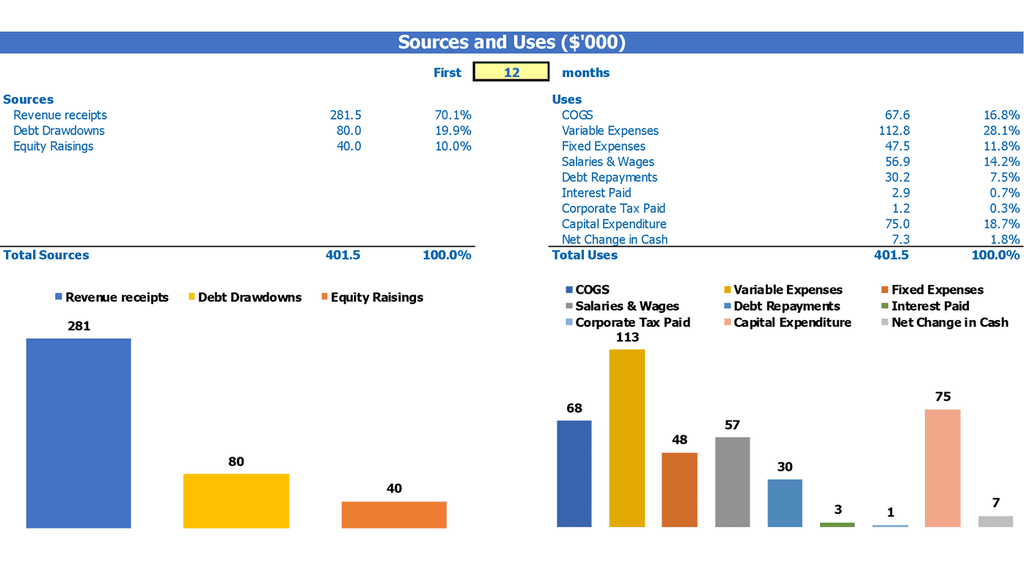

Sources And Uses Of Funds Statement

The cooperative bank business model revolves around providing benefits to its members through its ownership, governance, lending, and deposit models. The profitability model and risk management strategies are designed to ensure sustainability while maintaining social responsibility and community impact. Membership requirements include voting rights, which are exercised to decide on dividend policy and loan portfolio. The pro forma template's sources and uses of cash highlight the transparency of the deployment of funds by the bank.

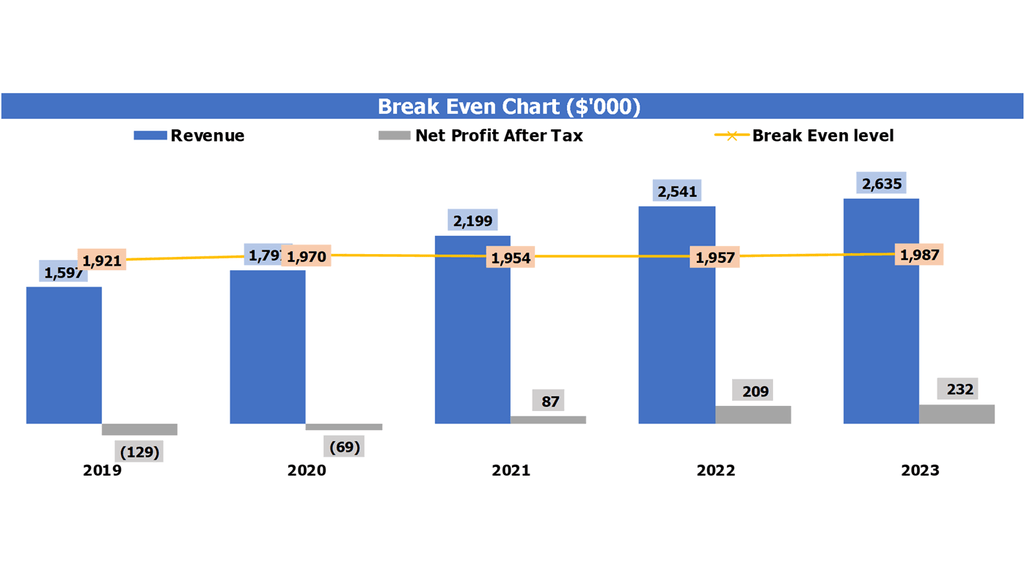

Break Even Chart Excel

The cooperative bank business model emphasizes financial and governance structures that prioritize member benefits, community impact, and social responsibility. Ownership and voting rights are distributed among members, who also benefit from the bank's lending and deposit models. The bank's lending portfolio, dividend policy, and profitability model emphasize risk management and sustainable growth. Membership requirements and governance help ensure the bank remains accountable to its members and community. This model allows for a break even analysis calculation which empowers companies in determining their product price that helps cover costs and generates sufficient revenue.

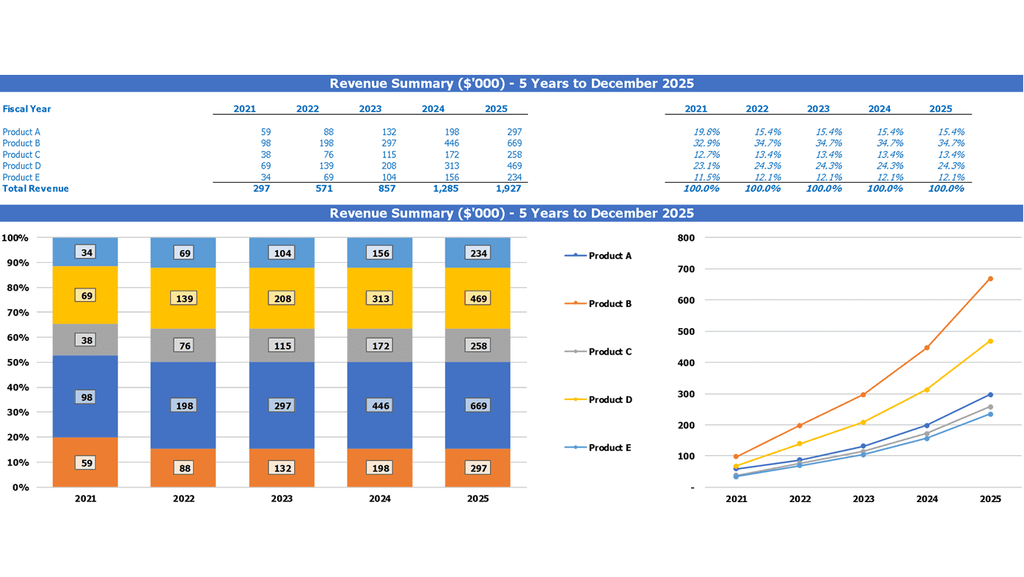

Top Revenue

Cooperative bank business model centers on an ownership structure where members have voting rights and a say in governance. The financial and lending models prioritize members' benefits, but profitability remains important for sustainability. Risk management practices and dividend policies are in place to protect members' deposits and returns. The community impact and social responsibility elements are integral aspects of the cooperative bank model, with membership requirements often including a commitment to volunteerism or community development. The loan portfolio is diverse, with a focus on supporting members' unique financial needs.

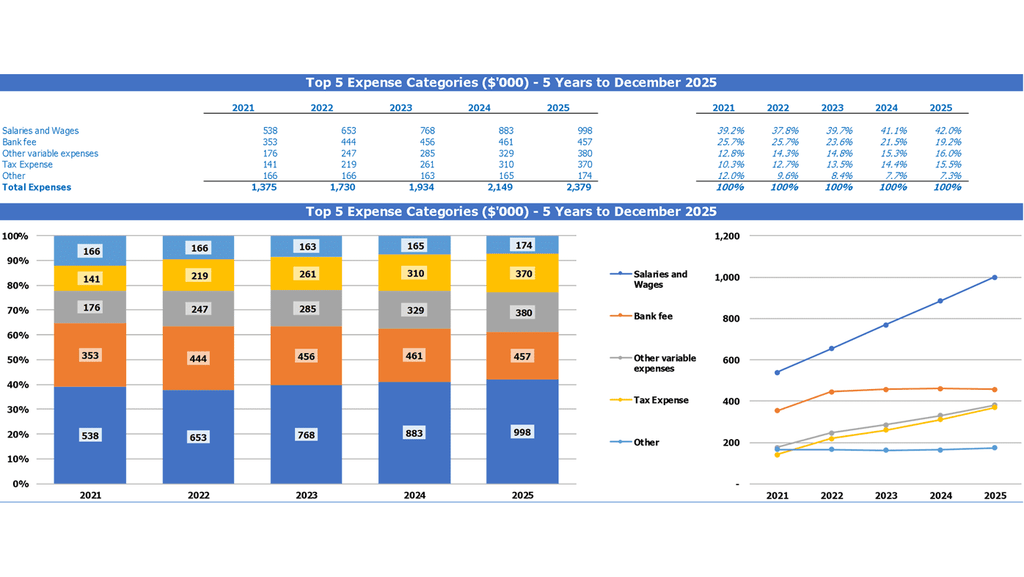

Company Top Expenses List

A cooperative bank's business model is structured around its ownership and governance structures, which are typically democratic and member-driven. The cooperative bank's financial structure is designed to benefit members through competitive lending and deposit models. A key aspect of cooperative bank profitability is risk management and social responsibility, which informs lending decisions and community impact. Membership requirements often include voting rights and dividend policy. A strong loan portfolio is essential to the cooperative bank's success, and understanding expense structures is critical to making informed decisions that benefit members.

Co Operative Bank Financial Projection Expenses

Costs

Cooperative banks operate differently from traditional banks, focusing on member benefits and community impact instead of profitability alone. The cooperative bank business model prioritizes the ownership and governance structure, ensuring members have voting rights and a say in dividend policy. The lending and deposit models also differ, with a focus on responsible risk management and social responsibility. Membership requirements often involve living or working in specific communities. A robust loan portfolio and 5-year projection plan aid in maintaining financial stability, with expense tracking creating a clear budget structure. This budget acts as a communication tool for business owners to investors and loan officers.

CAPEX Investment

Cooperative banks offer a unique business model with a strong focus on member benefits, social responsibility, and community impact. Their financial structure often involves a deposit model and a lending model that prioritize the needs of the members. The governance and ownership structures ensure that control remains with the members, who have voting rights and receive dividends. Profitability and risk management are also important aspects, as the loan portfolios need to be managed effectively. Membership requirements may apply, but the benefits make it worthwhile, especially when considering the positive impact on the community.

Loan Payment Calculator

Cooperative banks offer a unique business model where the ownership and governance structures are managed by the members. Members benefit from the lending and deposit models, which are designed to prioritize the community's needs. The cooperative bank's profitability model is based on responsible and sustainable risk management practices. Social responsibility is a top priority, and community impact is a key focus. Membership requirements include voting rights and a dividend policy that shares profits with members. The loan portfolio undergoes careful analysis to track and manage repayment schedules, ensuring sustainable growth for the cooperative bank and its members.

Co Operative Bank Income Statement Metrics

Financial KPIs

Cooperative banks have a unique business model where members are also owners, resulting in a unique financial, governance, and ownership structure. Members benefit from lower interest rates on loans, higher interest rates on deposits, and voting rights on major decisions. The lending and deposit models prioritize community impact and social responsibility. The profitability model ensures long-term sustainability while risk management is a top priority. Membership requirements are typically simple, while dividend policy and loan portfolio are determined by the members. Visual representations of financial figures are crucial for effective monitoring and analysis, making investors and creditors more confident in the cooperative bank's financial health.

Excel Template Cash Flow Statement

Cooperative banks have a unique business model and financial structure that prioritize members over profits. Their ownership and governance structures allow for democratic decision-making and voting rights for members. Members benefit from access to loans and deposit options, as well as potential dividends. Cooperative banks also prioritize responsible risk management and social responsibility, with a focus on community impact. Membership requirements may vary, but often prioritize member participation and engagement. A strong loan portfolio and profitability model are crucial for sustaining cooperative banks in the long-term. Cash flow forecasting tools can help cooperative banks project future financial activity and avoid illiquidity.

KPI Benchmarks

Cooperative banks have a unique business model that emphasizes social responsibility and community impact. Their financial structure revolves around member ownership, allowing them to offer favorable lending and deposit models, as well as collaborative governance and voting rights. These banks prioritize their members' benefits and maintain profitability through responsible loan portfolio management and risk management practices. Additionally, they often have a dividend policy that rewards members. The startup financial model template Excel can benefit cooperative banks by providing a tab for financial benchmarking studies, enabling them to assess their competitiveness and productivity relative to industry leaders.

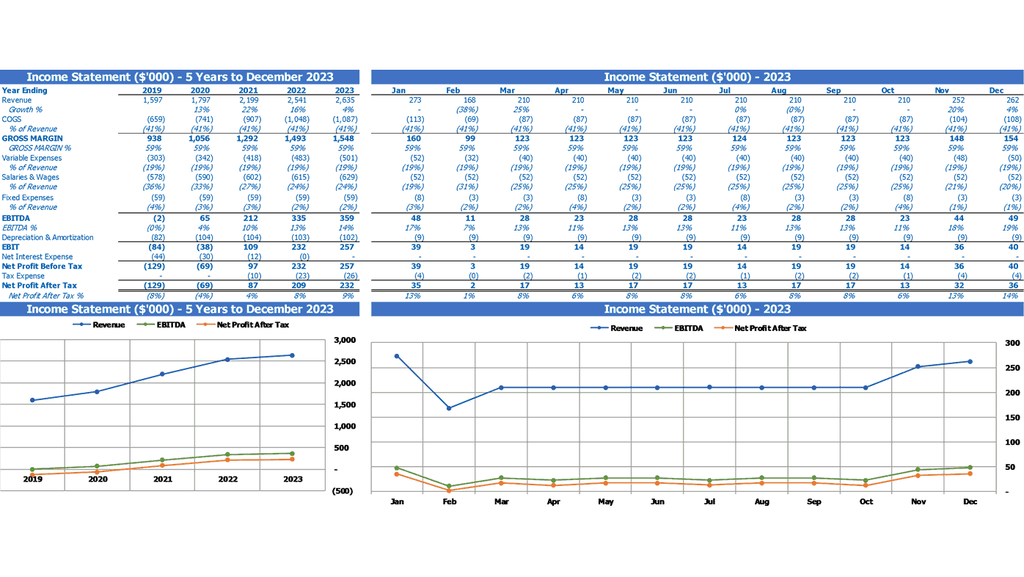

Monthly Profit And Loss Template Excel

Cooperative banks' business model focuses on member benefits and community impact. Its financial, ownership and governance structures aim to ensure profitability, risk management, social responsibility and membership requirements that grant voting rights and dividends. They have both lending and deposit models with a diversified loan portfolio. However, analyzing only income statements is not enough as it does not depict the whole picture of assets, liabilities and cash flow dynamics required to generate profit. Therefore, cooperative banks rely on a holistic approach taking into account all three key statements.

Projected Balance Sheet Template

As a cooperative bank, our ownership, governance, and financial structures prioritize member benefits, community impact, and social responsibility. Our lending and deposit models are designed to meet the needs of our members while maintaining our profitability and managing risk. Membership requirements include voting rights and access to dividend policies. Our loan portfolio is diversified to mitigate risk, and we use pro forma balance sheet templates to forecast and analyze financial data. This vital report calculates various ratios that determine our financial health and guide our decision-making for sustainable growth.

Co Operative Bank Income Statement Valuation

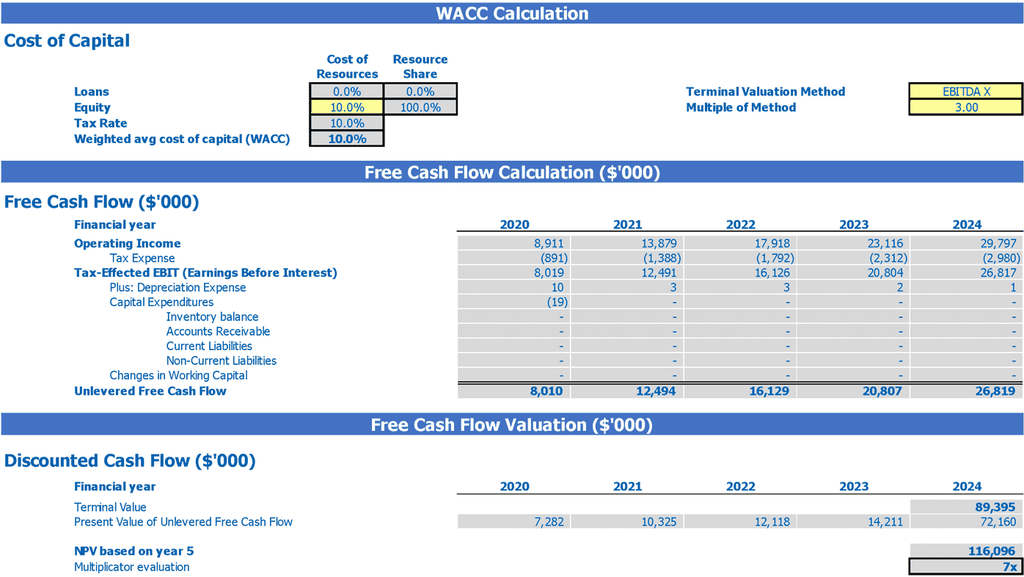

Startup Valuation Revenue Multiple

Cooperative banks differentiate themselves from traditional banks by their unique ownership, governance, and financial structure. Members of the cooperative bank enjoy numerous benefits, including voting rights and dividends. The lending and deposit models prioritize community impact and social responsibility, while strict risk management ensures profitability. Membership requirements may vary, and the loan portfolio reflects the values of the cooperative bank. Overall, the cooperative bank business model is designed to prioritize the needs of its members and the community, fostering a sustainable and ethical financial system.

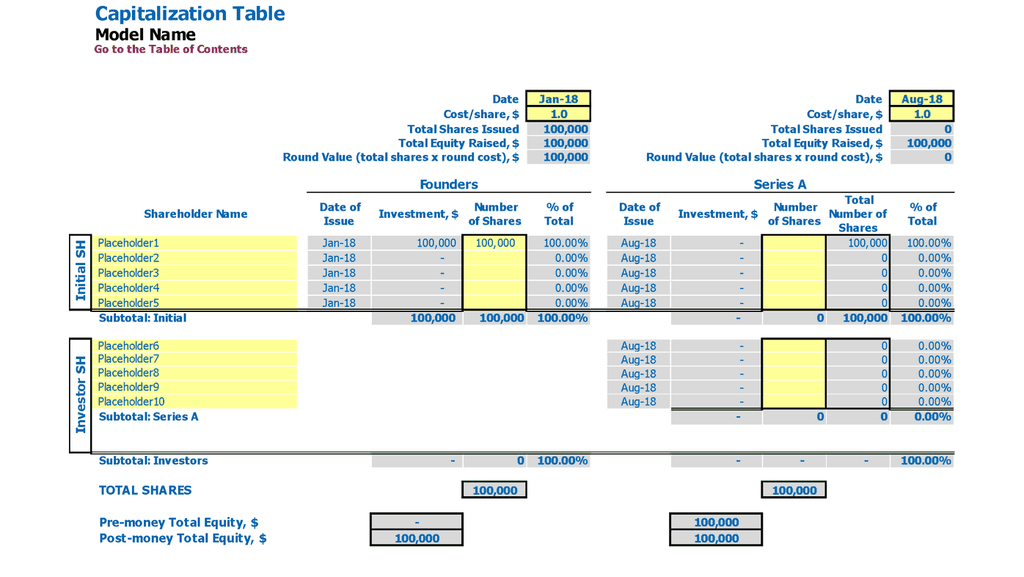

Capitalization Table

The pro forma cap table provides a clear picture of the ownership structure after each financing round, including the percentage of dilution. Our cooperative bank business model emphasizes on member benefits and social responsibility, with a focus on community impact. Our financial and governance structures prioritize risk management and profitability, with a lending and deposit model that aligns with our members' needs. Membership requirements include voting rights and a dividend policy that reflects our commitment to our members. Our loan portfolio analysis ensures sustainable growth for both our cooperative and our members.

Co Operative Bank Business Plan Financial Projections Template Excel Key Features

Simple-to-use

Easily plan your cooperative bank's financial, governance, ownership, lending, and deposit models for maximum member benefits, profitability, risk management, social responsibility, and community impact.

Get a Robust, Powerful and Flexible Financial Model

Use this comprehensive cooperative bank financial model template to plan your business model and tailor it to your specific needs.

We do the math

Cooperative banks offer member benefits, community impact, social responsibility, and a unique ownership and governance structure.

Generate growth inspiration

A cooperative bank's financial, governance, ownership structures, and member benefits prioritize community impact and social responsibility.

Predict the Influence of Upcoming Changes

Cooperative bank's ownership, governance, and lending models prioritize member benefits, social responsibility, and community impact over profitability.

Co Operative Bank Budget Financial Model Advantages

The cooperative bank business model prioritizes member benefits, community impact, and social responsibility.

A cooperative bank's financial, ownership, and governance structures prioritize member benefits, social responsibility, and community impact.

Develop a detailed budget for starting and sustaining a cooperative bank, accounting for all relevant financial and operational considerations.

The cooperative bank's financial structure prioritizes member benefits and community impact.

Cooperative banks prioritize member benefits, community impact, and social responsibility in their financial, lending, and deposit models.