ALL IN ONE MEGA PACK INCLUDES:

Commercial Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Commercial Bank Startup Budget Info

Highlights

A reliable and sophisticated bank financial analysis model is crucial to evaluate the financial performance and profitability of any commercial bank operating in the banking industry. The bank financial analysis model should include a bank balance sheet model, income statement model for banks, commercial bank financial statement analysis model, bank financial risk model, bank stress testing model, bank capital adequacy model, bank financial ratios model, bank asset liability management model, bank credit risk model, and bank financial forecasting model. These models are necessary to forecast the bank's financial performance, assess the bank's risks, and determine the bank's capital requirements to operate successfully in the banking industry.

The banking industry financial model is a comprehensive framework that provides a holistic view of a commercial bank's financial performance using various financial analysis models. The bank balance sheet model along with the income statement model for banks and various other bank financial analysis models are used to analyze a bank's financial data such as the bank's profitability model, financial risk model, capital adequacy model, financial ratios model, asset liability management model, credit risk model, financial forecasting model, and stress testing model. These models are useful in assessing and forecasting a bank's financial health, identifying potential risks, and making informed management decisions.

Description

Our bank financial analysis model provides a comprehensive understanding of the banking industry financials, including the bank balance sheet model and income statement model for banks, allowing you to assess bank financial performance through various financial ratios. The model also includes a bank stress testing model to analyze the bank financial risk and a bank capital adequacy model to assess the adequacy of the bank's capital. Additionally, the bank financial forecasting model enables you to forecast future financial performance, making it an invaluable tool for making informed business decisions in the commercial banking model. The bank asset liability management model and bank credit risk model provide further insights into the bank's financial health, allowing you to identify areas for improvement and make data-driven decisions.

Commercial Bank Financial Plan Reports

All in One Place

A bank's financial analysis can be done using several models, including the bank balance sheet and income statement models, commercial banking and profitability models, financial forecasting, and stress testing models. The banking industry's financial model may also include the bank financial ratios model, asset liability management model, capital adequacy model, and credit risk model. Using these models can help banks evaluate their financial performance and risk, and make informed decisions. Similar to a startup's financial model, the key is to have a complete and accurate picture of the financials to conduct scenario planning and forecast potential changes.

Dashboard

Our banking industry financial model offers a range of tools to analyze the financial performance of commercial banks. This includes our bank balance sheet model, income statement model for banks, bank profitability model, bank financial risk model, and more. With our bank financial analysis model, you can assess the financial health of a bank, conduct stress testing, ensure capital adequacy, and evaluate credit risk. Our bank financial forecasting model and asset liability management model enable you to make informed decisions and create accurate financial projections. Our bank financial ratios model provides valuable insights into a bank's financial performance.

Company Financial Report

Our comprehensive banking financial modeling tools include a variety of models for financial analysis in the banking sector, such as the bank balance sheet model, income statement model, and commercial banking model. Our models are designed to evaluate bank financial performance, profitability, risk, and stress testing, and ensure capital adequacy. We offer bank financial forecasting models, as well as asset liability management models to help banks manage their balance sheets effectively. Our bank financial ratios model helps understand the financial health of banks, using key ratios to create valuable insights for decision-making across the banking industry.

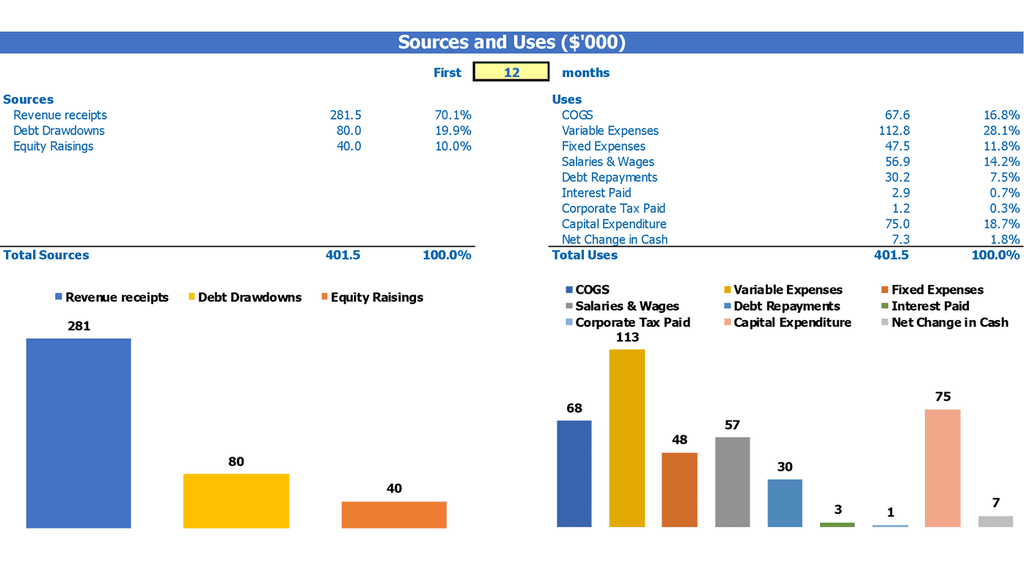

Sources And Uses Of Funds Statement Template

Various models such as the bank balance sheet model, income statement model for banks, and commercial banking model are used for bank financial analysis. The banking industry financial model includes the bank financial performance model, commercial bank financial statement analysis model, and bank profitability model. In addition, there are bank financial risk models, bank stress testing models, bank capital adequacy models, bank financial ratios models, bank asset liability management models, bank credit risk models, and bank financial forecasting models. These models provide a detailed overview of a bank's financial position and help in making informed decisions. One such example is the sources and uses statement, providing a summary of funding sources for business activities.

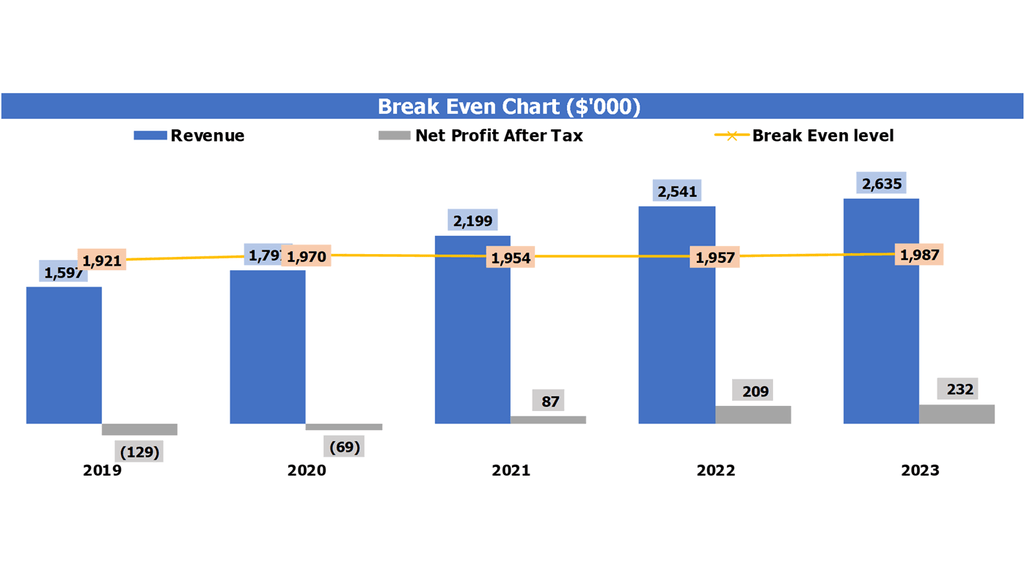

Break Even Analysis Chart

Several financial analysis models are available for the banking industry to evaluate performance, risk, and profitability. These models include the bank balance sheet and income statement models, commercial banking and financial statement analysis models, capital adequacy ratios, asset liability management models, financial forecasting, and stress testing models. To assess the financial health of a bank, analysts calculate various ratios using data from bank financial statements. This includes credit risk, profitability, and financial risk ratios. In-depth analysis using these models enables banks to address weaknesses, make better decisions, and forecast their financial future.

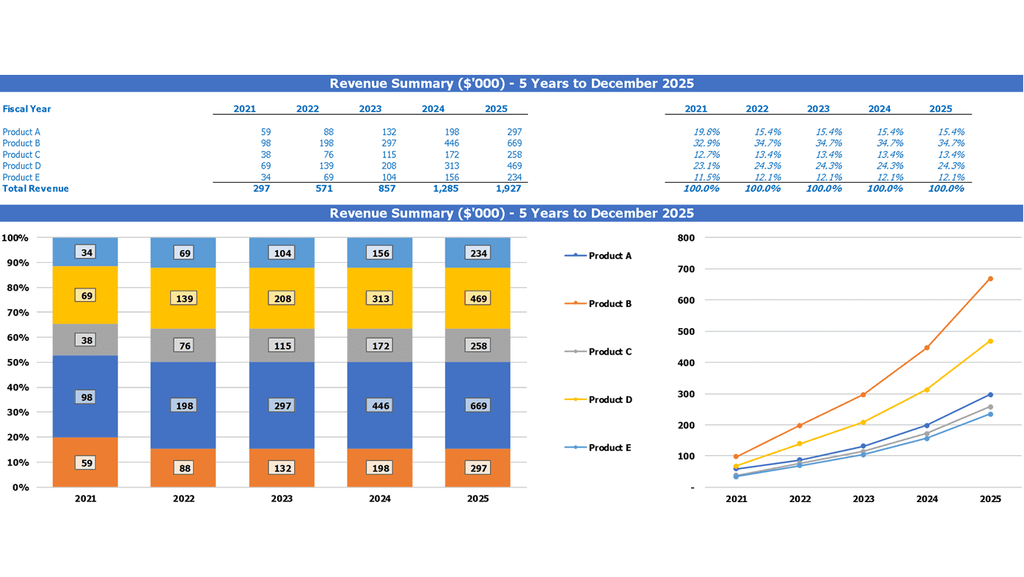

Top Revenue

There are various financial models used in the banking industry, such as the bank balance sheet model, income statement model, and commercial banking model. To perform comprehensive bank financial analysis, professionals also use tools like the banking industry financial model, bank financial performance model, and the commercial bank financial statement analysis model. Other essential models are the bank profitability model, bank financial risk model, bank stress testing model, bank capital adequacy model, bank financial ratios model, bank asset liability management model, bank credit risk model, and bank financial forecasting model. Using them enables efficient and insightful financial forecasting and decision-making.

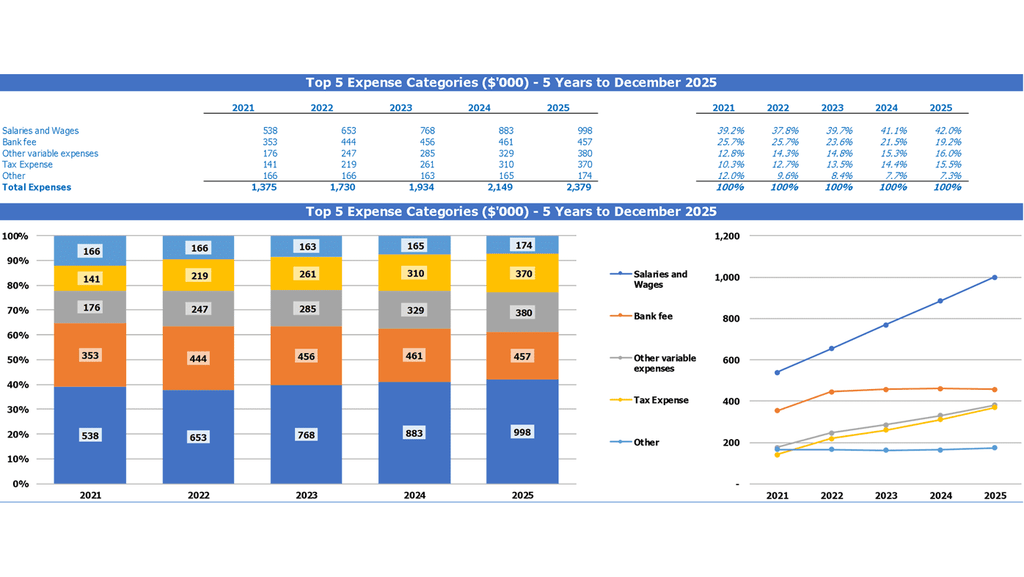

Small Business Top Expenses List

Various financial models like bank balance sheet model, income statement model for banks, and banking industry financial model can help in the analysis of a commercial bank's financial statements. The bank financial analysis model, profitability model, risk model, stress testing model, capital adequacy model, asset liability management model, credit risk model, financial forecasting model, and financial ratios model are some of the models that can be used to assess a bank's financial performance. These models can provide a detailed analysis of a bank's revenues, expenses and help in managing finances wisely.

Commercial Bank Financial Projection Expenses

Costs

Our comprehensive banking financial analysis model includes various models like the bank balance sheet model, income statement model, commercial banking model and more. With our bank financial performance model, you can analyze bank profitability, risks, stress tests, capital adequacy, asset liability management, credit risk, and financial forecasting using our financial ratios model. Our well-designed commercial bank financial statement analysis model helps you to monitor the financial health of any banking industry by tracking its financial metrics using its integrated sheets. You can effectively manage your budgeting and workforce by using our reliable and synced bank financial forecasting model.

Development Costs

The banking industry financial model includes several essential models such as the bank balance sheet model, income statement model for banks, commercial banking model, and more. These models help to construct bank financial analysis models, commercial bank financial statement analysis models, and bank financial performance models. The bank profitability model, bank financial risk model, bank stress testing model, bank capital adequacy model, bank financial ratios model, bank asset liability management model, bank credit risk model, and bank financial forecasting model all play essential roles in the modern banking industry. These models enable better decision-making and thus enhance banking performance.

Loan Financing

Creating a well-designed bank financial analysis model is essential for accurately evaluating a bank's financial performance. Key components of this model should include a bank balance sheet model, income statement model, commercial banking model, bank profitability model, bank financial risk model, bank stress testing model, bank capital adequacy model, and bank financial ratios model. Additionally, a bank asset liability management model, bank credit risk model, and bank financial forecasting model should also be included. By incorporating these models, financial professionals can better understand a bank's strengths and weaknesses, identify potential areas for improvement, and make informed and strategic decisions.

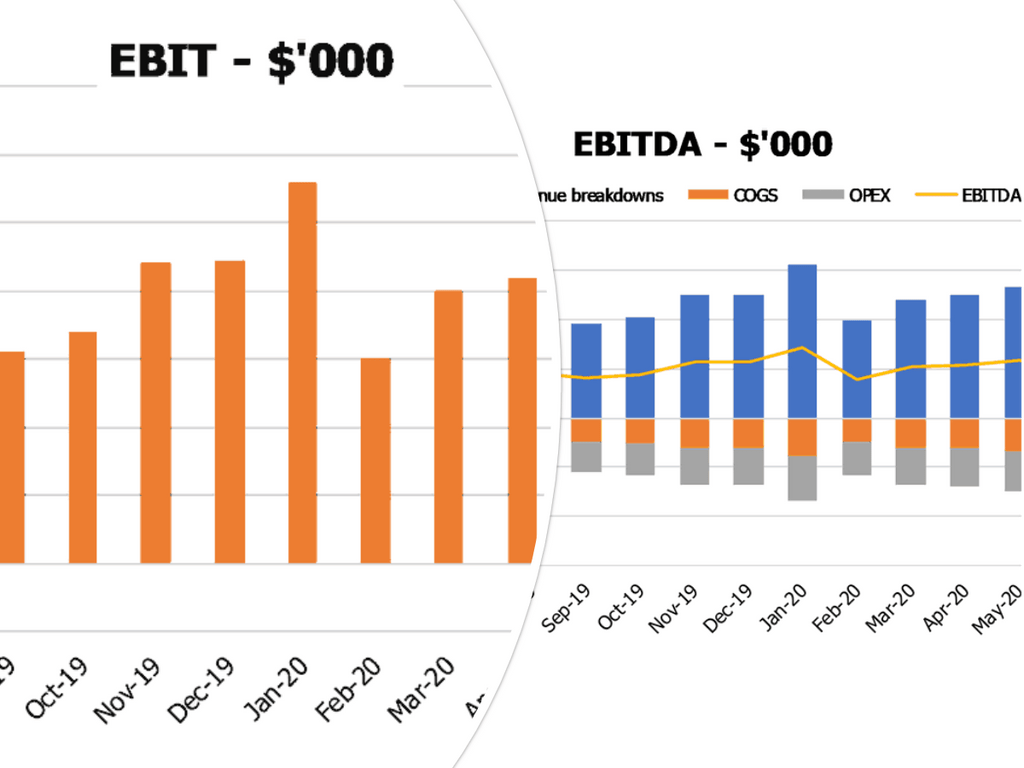

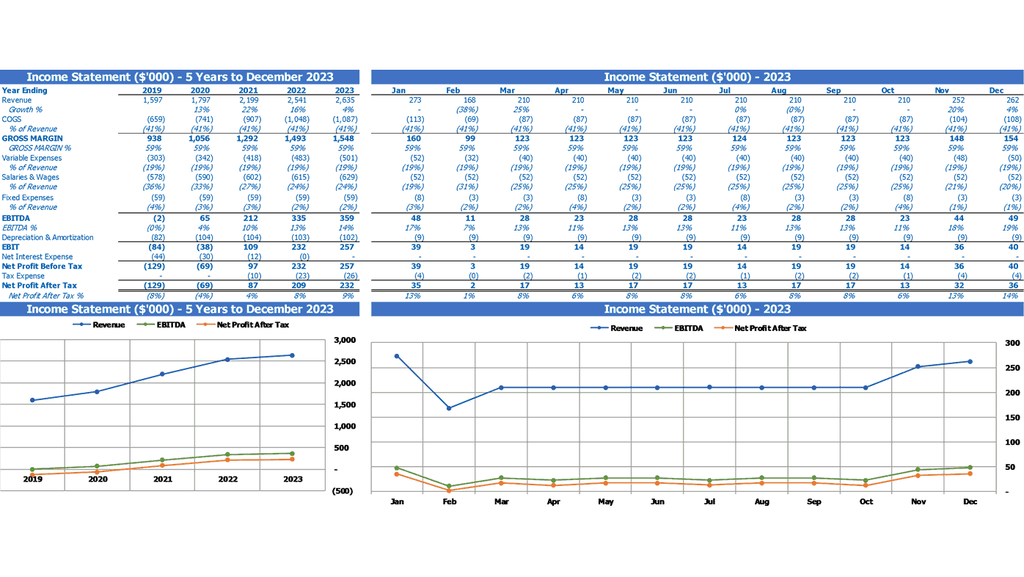

Commercial Bank Income Statement Metrics

Profitability KPIs

Our comprehensive banking industry financial model includes various financial analysis models, such as a bank balance sheet model, income statement model, and commercial bank financial statement analysis model. It also includes banking industry-specific models like a bank profitability model, bank financial risk model, commercial banking model, bank stress testing model, bank capital adequacy model, bank financial ratios model, bank asset liability management model, bank credit risk model, and bank financial forecasting model to ensure a thorough evaluation of the bank's financial performance. Our models provide a professional and engaging approach to financial analysis, crucial for any bank operation.

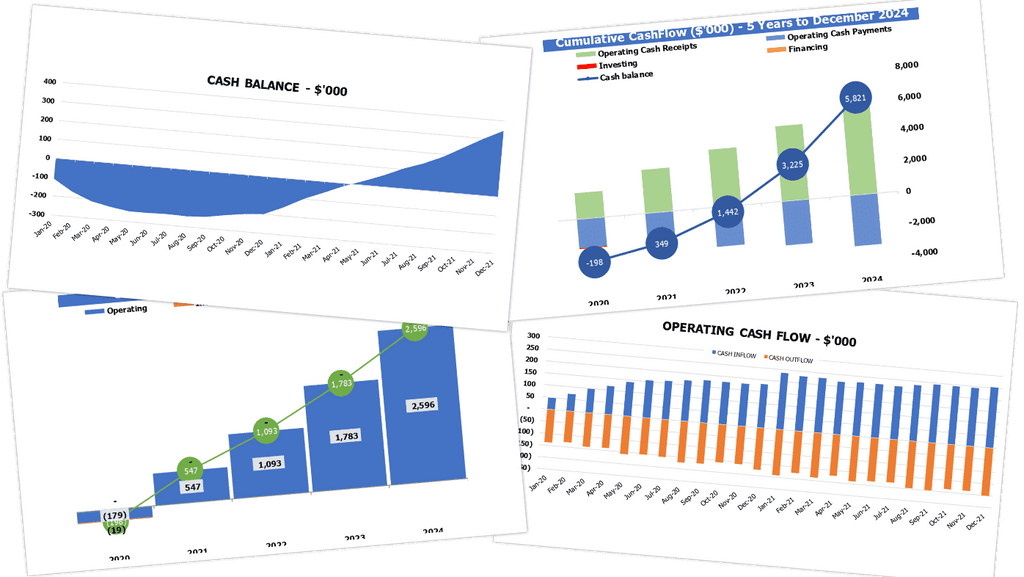

Cash Flow Statement Excel Template

The banking industry relies on various financial models to analyze its performance and manage risks. These models include the bank balance sheet model, income statement model, and commercial banking model. Bank financial analysis models help banks evaluate their profitability, risk, and capital adequacy. Additionally, stress testing models and asset liability management models provide insights into a bank's financial performance under various scenarios. Other important models include the bank credit risk model, financial forecasting model, and bank financial ratios model. These models enable banks to make informed decisions and optimize their financial strategies.

KPI Benchmarking Report

Bank financial modeling includes several models such as the bank balance sheet, income statement, financial analysis, profitability, risk, and forecasting models. These models help evaluate the financial performance of commercial banks and conduct stress testing and capital adequacy assessments. Additionally, financial ratios, asset liability management, and credit risk models are used to analyze the banking industry's financial performance. Financial benchmarking strategies are essential for analyzing financial modeling of companies, particularly for startups, as it helps compare their results with best-practice companies in the industry, enabling better financial and strategic management decisions.

Profit And Loss Statement Template Excel

Various financial models are utilized in the banking industry to analyze the financial performance, risk, stress and capital adequacy of commercial banks. These models include bank balance sheet model, income statement model for banks, commercial banking model, banking industry financial model, bank financial analysis model, bank profitability model, bank financial risk model, bank stress testing model, bank capital adequacy model, bank financial ratios model, bank asset liability management model, bank credit risk model, and bank financial forecasting model. These models help banks determine their financial position and make informed decisions.

Projected Balance Sheet Template Excel

Several models are available for analyzing the financial performance and risk of banks. These include the bank balance sheet model, income statement model for banks, commercial banking model, banking industry financial model, and bank financial analysis model. Additionally, there are several specialized models, such as the bank profitability model, bank financial risk model, and bank stress testing model. The bank capital adequacy model, bank financial ratios model, bank asset liability management model, bank credit risk model, and bank financial forecasting model are other useful tools for evaluating the financial health of banks.

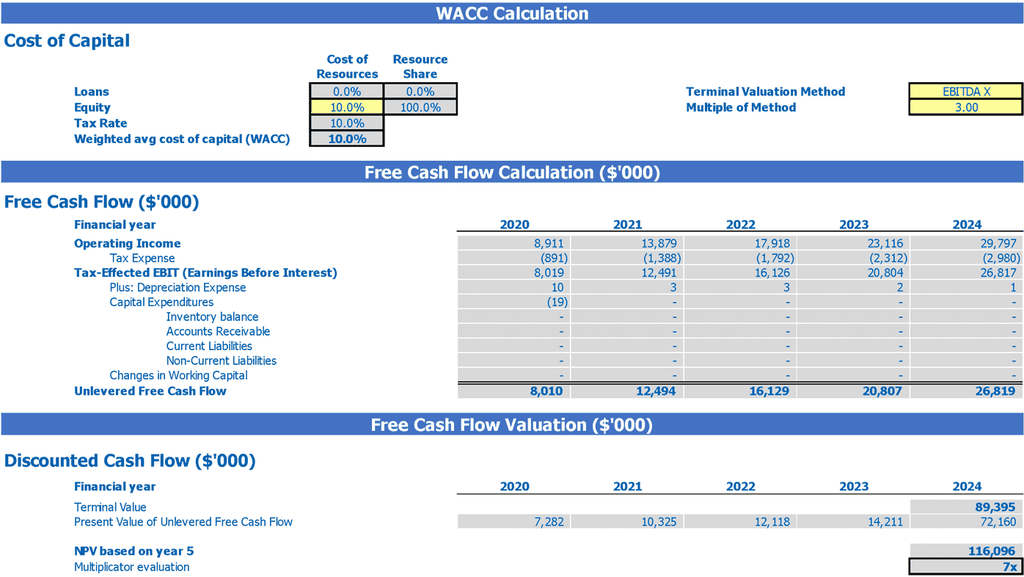

Commercial Bank Income Statement Valuation

Startup Valuation Calculator Excel

Our banking financial modeling tool offers comprehensive features for analysis, including a bank balance sheet model, income statement model, and commercial banking model. Our platform empowers you to assess financial performance, risk, profitability, and capital adequacy, utilizing our bank financial analysis model, banking industry financial model, and bank financial ratios model. You can also forecast future outcomes using our bank financial forecasting model and perform stress testing with our bank stress testing model. With our cutting-edge technology, you can create customized financial statements for a complete overview using our bank financial statement analysis model.

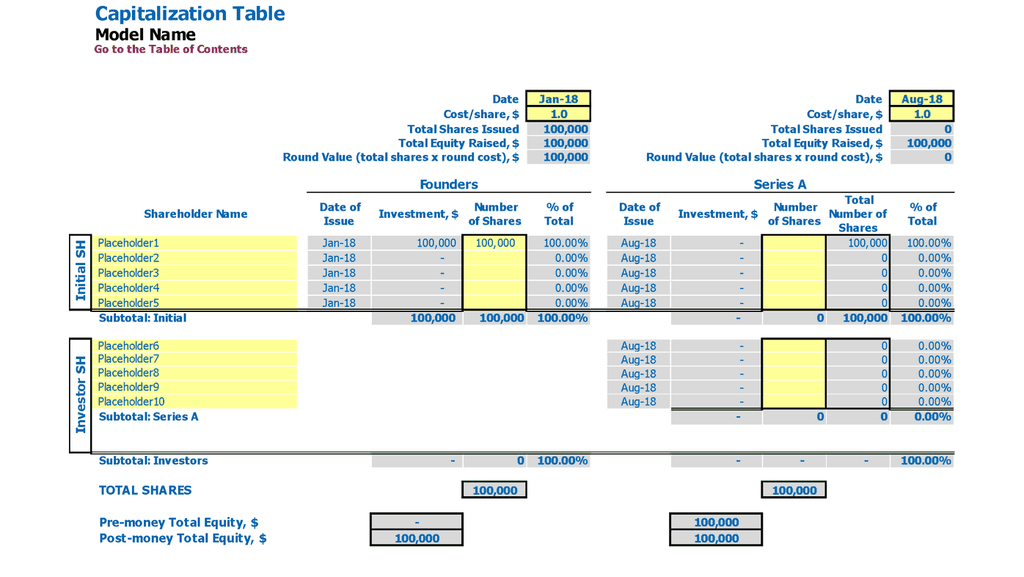

Cap Table Excel

Our suite of financial models provide comprehensive analysis of bank financials. Our bank balance sheet model, income statement model for banks, commercial banking model, and banking industry financial model offer a thorough understanding of a bank's financial performance. Our models include a bank financial analysis model, bank profitability model, bank financial risk model, bank stress testing model, bank capital adequacy model, bank financial ratios model, bank asset liability management model, bank credit risk model, and bank financial forecasting model. These models empower financial professionals to make informed decisions and effectively analyze a bank's financial position.

Commercial Bank Pro Forma Income Statement Template Excel Key Features

Track your spending and staying within budget

Use advanced financial modeling to analyze bank performance and forecast future financial outcomes.

Simple and Incredibly Practical

Easily forecast commercial bank financial performance with a user-friendly model.

We do the math

Choose from our extensive range of comprehensive banking financial models for accurate forecasting and analysis without the need for extensive formula writing, programming, or expensive external consultants.

Predict the Influence of Upcoming Changes

Utilize a bank financial analysis model to assess bank profitability, financial risk, and stress testing.

Currency for inputs and denomination

Choose the best banking industry financial model, such as the bank balance sheet, income statement, and financial ratios models.

Commercial Bank Business Plan Financial Projections Template Advantages

The bank uses a variety of financial models, including balance sheet, income statement, and risk analysis, to ensure profitability and capital adequacy.

Utilize a comprehensive bank financial analysis model to evaluate profitability, risk, and forecast future performance.

Use a reliable and accurate commercial bank financial forecasting model to minimize risk.

Excel template predicts startup's break-even and ROI.

Maximize profits with a comprehensive bank financial analysis model.