ALL IN ONE MEGA PACK INCLUDES:

Mortage Broker Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Mortage Broker Startup Budget Info

Highlights

A five-year mortgage broker business plan, complete with financial modeling, is crucial for startups and entrepreneurs seeking funding. Our Excel template includes key financial charts, summaries, metrics, and funding forecasts specifically tailored to the mortgage broker industry. Our mortgage broker revenue streams, profit margins, income statements, cash flow analyses, break-even analyses, and financial forecasts can be used to evaluate startup ideas, plan startup pre-launch expenses, and secure funding from banks, angels, grants, and VC funds. Our unlocked template allows for customization to ensure that every aspect of your business is tailored to your pricing strategy, market analysis, and competitive analysis.

The mortgage broker business plan is critical to managing risk, ensuring profitability, and attracting investors. Financial modeling for mortgage brokers provides an in-depth analysis of future financial projections, equips them with the right pricing strategy, and helps them with budgeting, financial forecasting, and performance metrics. The mortgage broker income statement, cash flow analysis, break-even analysis, and financial ratios are some of the key tools used in financial modeling. A good understanding of mortgage broker revenue streams, profit margins, cost analysis, market analysis, and competitive analysis is also required. With our mortgage broker startup pro forma template, all these needs are met, making it easier for anyone with knowledge of finance to keep track of financial health.

Description

This mortgage broker financial plan template Excel is a comprehensive tool for financial planning in the mortgage broker industry. Our team has created a dynamic yet reliable framework that informs users about short and long-term financial variable performances. This tool serves as an excellent starting point for developing a financial strategy and performing a financial analysis of your business. It includes essential financial statements such as profit and loss forecast, cash flow analysis, and projected balance sheet for a startup business, along with break-even analysis calculation, Diagnostic Sheet, startup summary Plan, and more. Additionally, it calculates relevant financial performance ratios and KPIs required by banks and investors to estimate business profitability and liquidity. Furthermore, this startup cost spreadsheet will help you make vital financial decisions by managing expenses and asset accounts for your mortgage broker business to ensure future growth and success.

Mortage Broker Financial Plan Reports

All in One Place

A mortgage broker business plan involves various critical factors such as financial modeling, revenue streams, profit margins, income statement, cash flow analysis, break-even analysis, financial forecasting, budgeting, performance metrics, financial ratios, cost analysis, pricing strategy, market analysis, and competitive analysis. In preparing the financial projection, businesses usually use a p&l template excel that contains three financial statements: the income statement, cash flow statement, and balance sheet. All companies, regardless of size, must prepare a financial plan template excel to ensure resource accountability and sound business decisions.

Dashboard

As a mortgage broker, having a sound financial plan is key to success. This includes understanding revenue streams, profit margins, income statements, cash flow analysis, break-even analysis, financial forecasting, budgeting, performance metrics, financial ratios, cost analysis, pricing strategy, market and competitive analysis. A business plan excel financial template can help generate important data for effective forecasting. Using graphs or charts to visualize the data makes it easier to manipulate and interpret. By having all the necessary information, mortgage brokers can make informed decisions for their business.

Detailed Financial Statement

When creating a mortgage broker business plan, it's essential to incorporate financial modeling that includes revenue streams, profit margins, and performance metrics. The income statement, cash flow analysis, and break-even analysis should also be included, along with financial forecasting, budgeting, and market analysis. Use financial ratios to measure success and perform cost analysis to adjust pricing strategy accordingly. Ultimately, the three statement financial model template should be easy to understand and intuitive if being evaluated by others. A comprehensive financial plan is crucial for the success of a mortgage broker business.

Sources And Uses Of Funds Statement

In crafting a comprehensive mortgage broker business plan, financial modeling is key. Understanding revenue streams, profit margins, and cash flow analysis is critical to creating an effective budget, analyzing performance metrics, and determining pricing strategies. Market and competitive analysis should drive financial forecasting, and cost analysis should be carefully considered. Within the business plan itself, the sources and uses of cash statement is critical in understanding where capital comes from and how it is spent. This statement is especially important during times of restructuring or M&A activity.

Break Even Calculation

A successful mortgage broker business plan requires financial modeling, which includes a mortgage broker income statement, cash flow analysis, and break-even analysis. To properly forecast revenue streams and profit margins, analyzing mortgage broker financial ratios and cost analysis is crucial. Budgeting and pricing strategy are necessary for financial forecasting. Performance metrics are also valuable in determining market and competitive analysis. When conducting a break-even analysis, it's important to distinguish between sales, revenue, and profit to ensure accurate financial planning for a mortgage broker.

Top Revenue

Creating a successful mortgage broker business plan requires financial modeling and analysis, including revenue stream projections, income statements, cash flow analysis, break-even analysis, and financial forecasting. Financial performance metrics, ratios, and cost analysis should be used in conjunction with market and competitive analysis to develop a pricing strategy. To accurately predict revenue streams, growth rate assumptions based on past data must be considered. Use an effective business plan forecast template to develop a sound revenue stream financial plan.

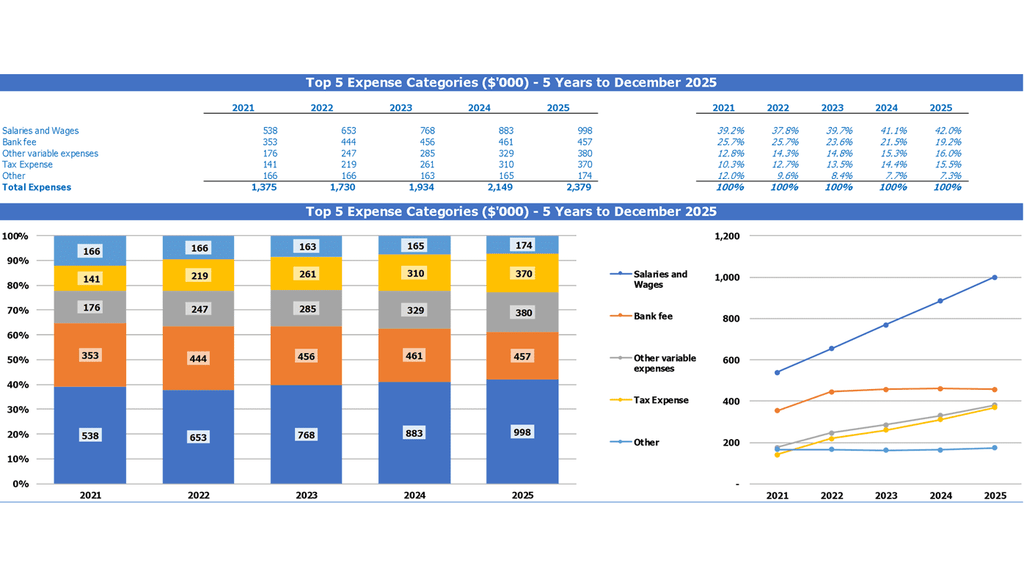

Business Top Expenses Spreadsheet

Our mortgage broker business plan includes financial modeling, revenue streams, profit margins, income statement, cash flow analysis, break-even analysis, financial forecasting, budgeting, performance metrics, financial ratios, cost analysis, pricing strategy, market analysis, and competitive analysis. Our expense report feature generates an internal cost-detailing report which helps in organizing expenses by category for tax purposes. The financial model can also be used for future forecasting and development scenarios. Analyzing actual costs against projected costs ensures success for mortgage broker business growth.

Mortage Broker Financial Projection Expenses

Costs

The success of any mortgage broker business plan depends on managing expenses and understanding revenue streams, profit margins, and income statements. Effective financial modeling can identify issues and allow for quick solutions through budgeting, cash flow analysis, break-even analysis, forecasting, and performance metrics. Cost analysis, pricing strategy, market analysis, and competitive analysis can also improve financial ratios and overall business success. Our three-statement model template is a reliable tool to manage finances and plan for growth while identifying potential issues. Find your ideal financial model excel template with our expert team.

CAPEX Cost

As a mortgage broker, it is important to have a solid business plan that covers financial modeling, revenue streams, profit margins, income statements, cash flow analysis, break-even analysis, financial forecasting, budgeting, performance metrics, financial ratios, cost analysis, pricing strategy, market analysis, and competitive analysis. One crucial aspect of this is the startup budget, which includes capital expenditures or CAPEX. By using a financial model spreadsheet, mortgage brokers can effectively manage their finances with accuracy and achieve success.

Debt Repayment Plan

Creating a successful mortgage broker business plan requires careful financial planning and analysis. Financial modeling for mortgage brokers should include revenue streams, profit margins, income statements, cash flow analysis, break-even analysis, financial forecasting, budgeting, performance metrics, and financial ratios. It's important to also conduct market and competitive analysis and develop a pricing strategy. Cost analysis can help identify opportunities for cost savings while monitoring loan profiles and repayment schedules is crucial to understanding cash flow impact. Loan repayment schedules should be monitored closely to ensure they align with the business plan's cash flow projections.

Mortage Broker Income Statement Metrics

Performance KPIs

As a mortgage broker, it's crucial to have a solid business plan in place that includes financial modeling and forecasting. Understanding revenue streams, profit margins, income statements, cash flow analysis, break-even points, and budgeting is crucial. It's also important to track performance metrics, financial ratios, and conduct cost and pricing strategies as well as market and competitive analyses. Investing in good financial management practices can significantly impact your return on capital and maximize your earnings as a business owner.

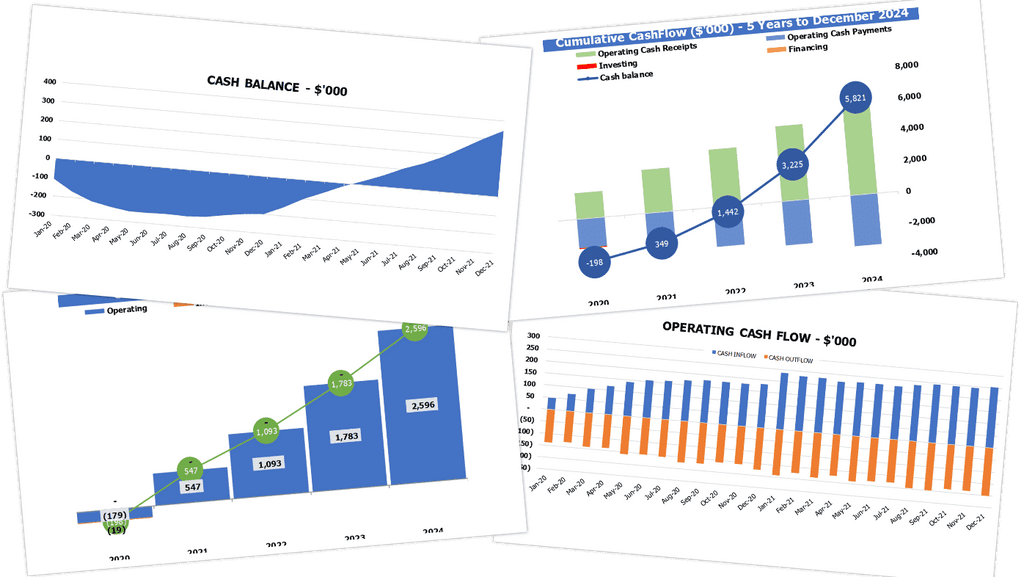

Cash Flow Statement Excel Template

As a mortgage broker, creating a solid business plan is vital. Financial modeling, cash flow analysis, and break-even analysis are all essential components of a successful plan. You must understand your revenue streams, profit margins, income statements, and performance metrics. Financial forecasting, budgeting, and cost analysis are also crucial elements. Pricing strategy should be determined through an in-depth market and competitive analysis, while financial ratios must be calculated to measure your business's progress. Using a cash flow projection excel will help you understand cash inflow and outflow, giving you a better idea of your financial standing.

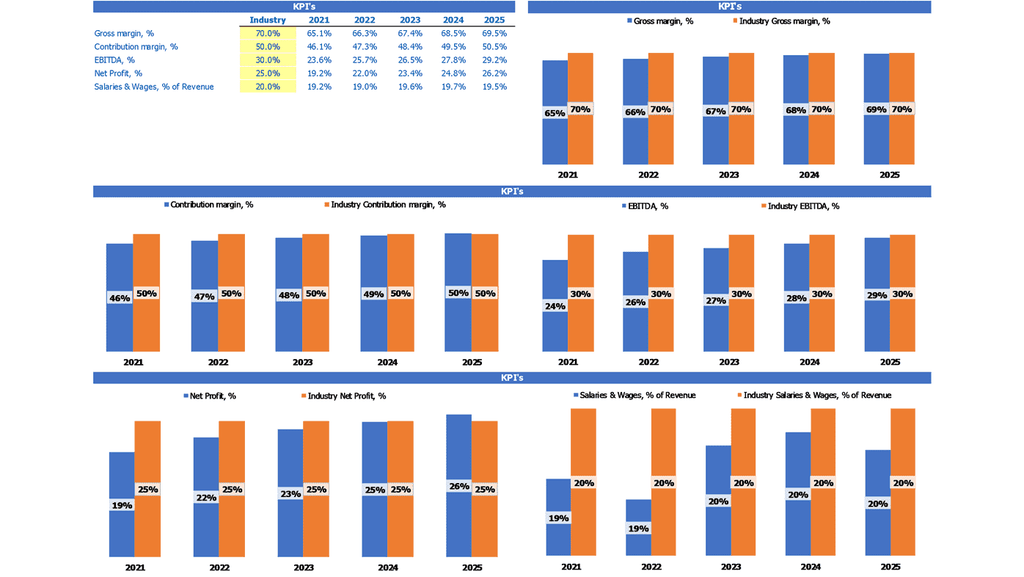

Business Benchmarks

A mortgage broker business plan should include financial modeling to evaluate performance. This includes income statements, break-even analysis, cash flow and budgeting. Financial forecasting and performance metrics should be used to measure success while cost analysis, pricing strategies and market and competitive analysis should be incorporated. Assessing the revenue streams and profit margins to include in the plan will facilitate benchmarking against other industry leaders. Useful metrics for comparison include productivity, cost margins, days payable, cost per unit, and profitability ratios. The 5-year financial projection template simplifies this process for easy comparison between similar companies within the industry.

P&L Excel Template

A mortgage broker business plan requires financial modeling to effectively manage revenue streams and profit margins. Understanding the income statement, cash flow analysis, break-even analysis, and budgeting can help predict performance metrics and financial ratios. Moreover, competitive analysis, pricing strategy, market analysis, and cost analysis are useful tools to gauge success. By projecting profit and loss statements, stakeholders can easily see how the business is balancing making a profit while meeting expenses and creditors. This financial forecasting can provide insight into the future profitability and movement of the mortgage broker's business.

Balance Sheet Forecast

Creating a mortgage broker business plan requires financial modeling for mortgage brokers, including mortgage broker revenue streams, profit margins, income statement, cash flow analysis, break-even analysis, financial forecasting, budgeting, performance metrics, financial ratios, cost analysis, pricing strategy, market analysis, and competitive analysis. The projected balance sheet for five years in Excel format is an essential tool for developing a cash flow model and allows investors to measure profitability ratios such as return on equity and return on invested capital. This data is critical when analyzing whether net income projections are realistic and determining the success of a mortgage broker's pricing strategy.

Mortage Broker Income Statement Valuation

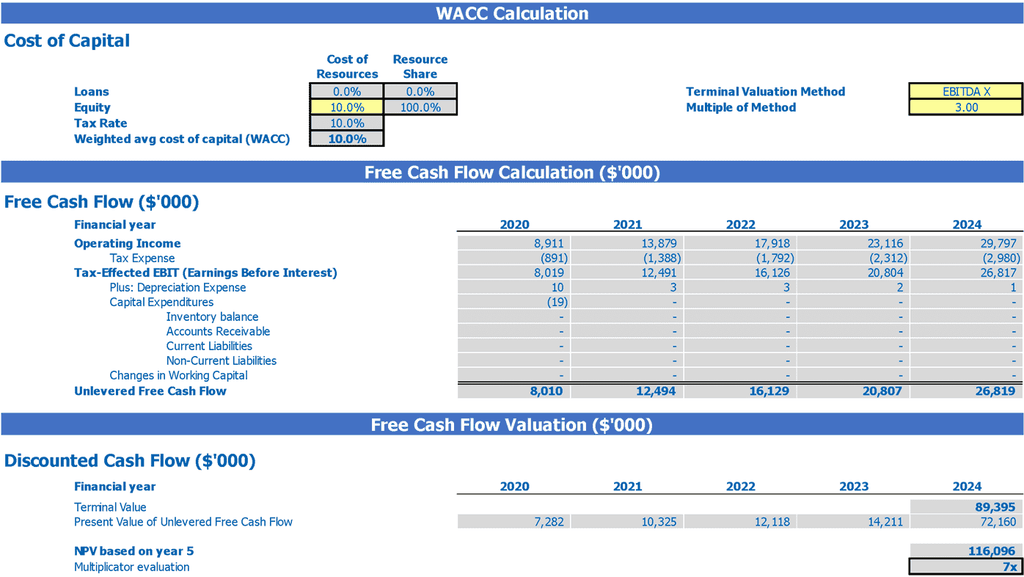

Startup Valuation Template

A successful mortgage broker business plan requires financial modeling to determine revenue streams, profit margins, and cash flow analysis. Tools such as a mortgage broker income statement, break-even analysis, and financial forecasting assist with budgeting and establishing performance metrics, financial ratios, and cost analysis. Proper pricing strategies and market and competitive analysis support growth and sustainability. When seeking capital, understanding the Weighted Average Cost of Capital (WACC) and Discounted Cash Flows (DCF) calculation is crucial for achieving favorable bank evaluations and investment opportunities.

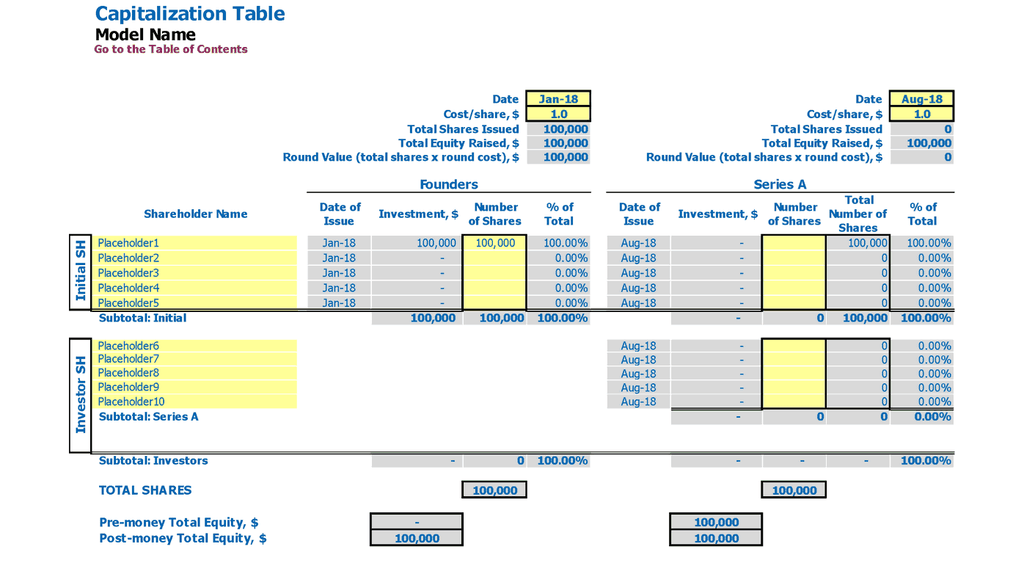

Cap Table Startup

The success of a mortgage broker heavily relies on its financial management. Creating a solid mortgage broker business plan, including financial modeling and forecasting, can help ensure your business's success. Analyzing revenue streams, profit margins, and financial ratios through cash flow and income statement analysis, break-even analysis, and cost analysis can help inform pricing strategies, budgeting, and performance metrics. Conducting market and competitive analysis can also help inform decision-making. Utilizing tools like a capitalization table can help accurately calculate investment percentages and inform financial decisions.

Mortage Broker Financial Model Excel Template Key Features

Graphical visualization in a convenient dashboard all in one

Our mortgage broker business plan includes financial modeling, revenue streams, income statements, cash flow analysis, break-even analysis, budgeting, and performance metrics.

Avoid cash flow problems

Regular cash flow forecasting is crucial for mortgage broker business success and growth.

Currency for inputs and denomination

When creating a mortgage broker business plan, it's important to conduct thorough financial modeling, including analyzing revenue streams, profit margins, income statements, cash flow, break-even points, forecasting, budgeting, performance metrics, ratios, cost analysis, pricing and market/competitive analysis, while also specifying currency and denomination preferences.

Update anytime

Utilize financial modeling tools to refine your mortgage broker business plan and optimize revenue streams.

External stakeholders, such as banks, may require a regular forecast

A well-crafted mortgage broker business plan includes financial modeling, revenue streams, income statements, cash flow analysis, break-even and forecasting analysis, budgeting, performance metrics, financial ratios, cost and pricing strategy, market and competitive analysis.

Mortage Broker Excel Financial Model Template Advantages

Create a winning mortgage broker business plan with financial modeling, revenue streams analysis, budgeting, and performance metrics.

Create a thriving mortgage broker business with comprehensive financial planning, including market analysis and pricing strategies.

Use financial modeling Excel templates to forecast mortgage broker revenue streams and profit margins.

Develop financial projections for mortgage broker using various scenarios.

Launch a successful mortgage broker business with our financial projection template, including market analysis and performance metrics.