ALL IN ONE MEGA PACK INCLUDES:

Offshore Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Offshore Bank Startup Budget Info

Highlights

Revolutionize your offshore banking financial operations with our financial model for offshore banking. Our comprehensive financial solutions cover all aspects of offshore banking financial planning, analysis, management, and compliance. We provide a financial system that incorporates offshore banking financial structure, services, and strategies to enhance your offshore banking financial reporting and risk management.

Our offshore banking financial services include an offshore banking financial dashboard and cash flow analysis represented in GAAP/IFRS formats. Our offshore banking financial reporting generates crucial core metrics, enabling business owners to evaluate their offshore bank business effectively.

The offshore banking model we employ is customizable, ensuring your offshore banking financial strategy caters to your business requirements. The offshore banking financial risk management solution we offer is flexible, enabling offshore banking businesses to mitigate risks effectively.

Our offshore banking financial compliance solution ensures offshore banking businesses adhere to financial regulations, safeguarding their reputation and financial security. Our five-year offshore bank financial excel template is the ultimate financial tool. Unlocked and editable, it provides financial solutions and insights, making it instrumental in evaluating and selling offshore bank businesses.

The offshore banking financial model provides a comprehensive financial structure for managing and analyzing offshore banking financial operations. It includes financial planning, analysis, and strategy development for offshore banking financial services and solutions. The offshore banking financial system is subject to financial regulations and compliance, and requires financial risk management and reporting. This Excel financial forecast template is a powerful tool for offshore bank businesses, allowing financial projections and investor’s equity valuation through intuitive input tables, charts, and graphs.

Description

This offshore banking financial model is a highly adaptable tool for various business decision-making scenarios. It has been developed by our team of experts using a bottom-up approach, taking into account all essential inputs and assumptions. Our offshore banking financial planning template will help you gain a thorough understanding of the economics behind this type of business. The offshore banking financial model Excel enables users to generate a detailed 5-year monthly financial projection, including income statements, balance sheets, and cash flow models. The financial plan also includes a discounted cash flow valuation calculation based on projected free cash flows. This offshore bank financial model template also calculates all the crucial financial performance ratios and KPIs required by investors and banks to estimate business profitability and liquidity.

Utilizing a 5-year financial forecast, our offshore banking financial planning template supports efficient business management while allowing more time for key marketing activities and customer management. Our financial model for offshore banking also ensures regulatory compliance by providing thorough financial analysis that helps create a comprehensive offshore banking financial strategy for managing operations effectively. Alongside our offshore banking financial services, our financial model for offshore banking ensures accurate offshore banking financial reporting to stakeholders.

Offshore Bank Financial Plan Reports

All in One Place

Offshore banking entities require a sound financial strategy to ensure regulatory compliance and effective risk management. Financial planning, analysis and reporting are critical components of a successful offshore financial system. Offshore banking financial services must offer robust solutions and possess a solid financial structure to meet customer demands while navigating complex regulations. With an offshore banking financial model, businesses can make informed decisions and gain investor confidence. Our 3-year financial projection template excel provides a professional solution for startups seeking to create an irresistible investment pitch with attractive figures and projections for their financial operations.

Dashboard

Offshore banking requires a solid financial model that covers planning, analysis, management, compliance, and reporting. The financial structure should align with the company's offshore banking financial strategy, services, and solutions. Managing financial operations in line with offshore banking financial regulations and risk management is key to reducing financial exposure. With access to a cash flow pro forma dashboard, stakeholders can collaborate more effectively and optimize business capabilities, producing more efficient and engaging financial projections. Transparency and accountability in offshore banking financial reporting is fundamental for maintaining growth and trust with clients.

Three Types Of Financial Statements

Offshore banking offers a range of financial services, from planning and analysis to risk management and compliance. A solid financial model for offshore banking requires a comprehensive financial strategy, management, and operations that comply with relevant regulations. Financial solutions such as pro forma statements must be carefully structured to present a clear financial overview for investors. Offshore banks must also consider financial reporting and risk management to ensure their financial structure remains sound. Our expertly designed financial overview provides a tailored solution, drawing data from key financial statements to present a polished and detailed report for your presentation.

Sources And Uses Template Excel

The offshore banking model provides advanced financial solutions, services, and strategies for managing financial operations. It involves financial planning, analysis, management, and reporting to ensure compliance with regulations and risk management. The financial structure and system allow companies to identify internal finance examples and make competent planning based on them. with offshore banking, startups can benefit from financial services that optimize the source and use of funds while providing regulatory compliance. It's a modern and reliable way for companies to manage their finances while minimizing risks and maximizing returns.

Excel Break Even Formula

When it comes to offshore banking, financial planning and analysis play a critical role. An effective financial model for offshore banking includes strategies for management, risk, and compliance. It is vital to have a robust financial system and structure that enables efficient financial operations while also adhering to regulations. Offshore banking financial solutions must incorporate financial reporting and risk management to ensure sustained profitability. In this context, understanding the nuances between revenue, sales, and profit is essential for effective decision-making. A comprehensive approach to offshore banking financial planning is crucial for success.

Top Revenue

Our comprehensive financial model for offshore banking is designed to provide clients with efficient financial planning, analysis, and management solutions. With our advanced financial system, we offer an array of financial services such as risk management, compliance, and reporting. Our sophisticated financial structure includes offshore banking operations that comply with current financial regulations. Clients can easily and clearly see the breakdown of revenue streams, thanks to our innovative financial projection model template. It allows users to gain insights into revenue depth and revenue bridge breakdowns based on each offering.

Business Top Expenses Spreadsheet

Effective offshore banking requires a sound financial model and strategy that encompasses all aspects of financial planning, management, and compliance. This involves structuring efficient offshore banking financial services, operations, and solutions that comply with offshore banking financial regulations and risk management. Financial analysis and reporting are essential for gaining insight into the revenue streams and depth of offshore banking activities. The offshore banking financial structure should be organized for optimal revenue generation and growth potential, utilizing revenue bridges to achieve financial goals. Overall, successful offshore banking requires a comprehensive approach to financial management that maximizes profitability while staying compliant with regulatory requirements.

Offshore Bank Financial Projection Expenses

Costs

Our offshore banking financial model provides comprehensive financial solutions that facilitate effective offshore banking financial planning, analysis, strategy, management, and operations. Our financial system adheres to offshore banking financial regulations and compliance, and we offer customized risk management and reporting services. Our 5-year cash flow projection template assists in organizing and forecasting financial expenses, utilizing key cost-to-income percentages, payroll, and cost grouping by major categories such as COGS, fixed and variable costs, wages, and capital expenditure. Our intuitive financial structure and forecasting tools make offshore banking financial management streamlined and successful.

Capital Expenditure Plan

Offshore banking financial planning requires a solid financial model that incorporates offshore banking financial analysis and strategy. The offshore banking financial system involves financial management, services, and solutions that comply with offshore banking financial regulations and reporting standards. One critical aspect is offshore banking financial risk management. Start-up expenses and capital expenditures should be monitored closely using financial projection tools like the CAPEX plan, and cash flow budget template excel. These metrics are necessary for a company's start-up budgeting strategy and financial turnover.

Debt Repayment Plan

Managing financial operations in offshore banking requires expertise in financial planning, analysis, and risk management. A strong financial structure and system complemented with compliance and regulatory requirements ensure efficient financial management. Monitoring and reporting on loans, repayment schedules, and cash flow forecasting are crucial for growing enterprises. A standardized loan repayment schedule must have clear information about interests, principal repayments milestones, maintenance ratios, and other key covenants with line-by-line breakdowns. It should also link the closing debt balance onto the balance sheet, showing how regular expenses and repayments impact cash flow statements.

Offshore Bank Income Statement Metrics

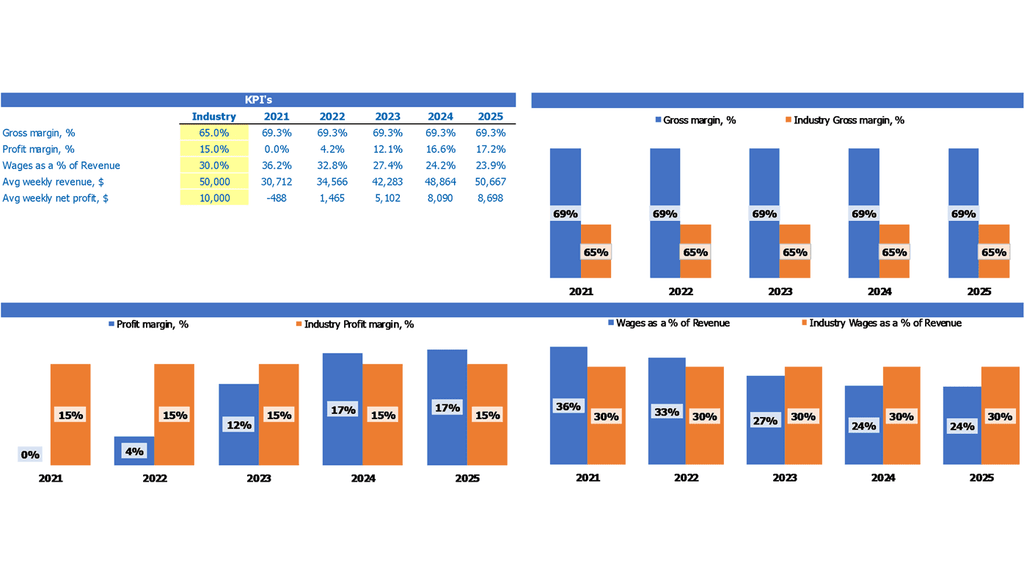

Financial KPIs

Our offshore banking financial model provides a comprehensive approach to financial analysis and planning. Our tailored financial solutions include KPIs such as revenue growth rate, gross margin, EBITDA margin, cash burn rate, runway, and funding needs. We understand the importance of industry-specific metrics, such as LTV and CAC ratios, and offer a customizable model to fit your company's needs. With our offshore banking financial services, you can effectively manage risks, comply with regulations, and optimize your financial operations and reporting. Count on us for your offshore banking financial strategy and management needs.

Excel Spreadsheet Cash Flow

Offshore banking is a complex financial model that requires proper planning, analysis, and management to achieve successful outcomes. Financial services providers offer a wide range of solutions to assist clients in navigating the system, including financial planning, risk management, compliance, and reporting. The offshore banking system operates under strict regulations, which must be closely followed to avoid legal issues. A financial strategy that includes a comprehensive financial structure and operations plan will ensure that your offshore banking activities are successful and profitable. Use a fully-integrated 5-year financial projection template to create a clearer view of your company's cash flow.

Industry Benchmarks

When it comes to offshore banking, proper financial planning, analysis, and management are crucial. Creating a financial model specifically designed for offshore banking operations can help businesses make informed decisions and maximize their results. This includes considering regulatory compliance, risk management, and reporting. Companies should also pay attention to benchmarking and relative values to identify the most effective strategies for achieving their goals. Investing the time and resources into proper financial planning and benchmarking can lead to growth opportunities and successful outcomes, particularly for start-ups.

Profit Loss Statement Template Excel

Offshore banking financial planning involves more than just income statements. While income statements show a business's profit generation ability, they don't present cash flow dynamics or necessary liabilities and assets. Thus, a three-way financial model template that includes balance sheets and cash flow statements is necessary. Understanding these statements helps determine a company's financial structure and analyze its risk management, financial compliance, and operations. Offshore banking financial services providing complete financial solutions to clients must adopt this comprehensive approach to provide a complete picture of their clients' financial positions.

Pro Forma Balance Sheet For A Startup Business

Offshore banking financial planning involves creating a comprehensive financial model for offshore banking that includes financial analysis, strategy, management, and compliance with regulations. This helps in the efficient and effective management of financial operations and the implementation of financial solutions that consider factors such as financial risk management and reporting. The financial structure of offshore banking systems includes a balance sheet that outlines the company's assets and liabilities, funds' investment, property, obligations, and overall value, which is essential for investors and stakeholders. A pro forma balance sheet template Excel can be used to show these details in a professional and engaging manner.

Offshore Bank Income Statement Valuation

Pre Revenue Startup Valuation

Our offshore banking financial strategy includes a comprehensive financial model that combines the discounted cash flow (DCF) and weighted average cost of capital (WACC) analyses. Our financial structure provides clients with tailored financial solutions and services that comply with offshore banking financial regulations and risk management strategies. Our goal is to help clients optimize their financial operations and reporting while maximizing their expected future financial performance.

Cap Table

Our offshore banking financial model provides comprehensive financial planning, analysis, strategy, management, services, solutions, systems, structure, operations, regulations, compliance, risk management, and reporting. Our expert team ensures that we incorporate the most up-to-date offshore banking standards and practices. Our business plan financial template includes a cap table that helps business owners calculate shareholder's ownership dilution. It has four rounds of funding, and users can apply all or some of them for their financial projections, making it an efficient tool for our clients.

Offshore Bank 3 Way Financial Model Template Key Features

Simple and Incredibly Practical

Easily create accurate financial projections for offshore banking startups with our user-friendly model.

Plan for Future Growth

Utilize pro forma cash flow statement template for accurate financial planning and goal-setting in offshore banking.

Identify potential shortfalls in cash balances in advance

The offshore banking financial model acts as an early warning system for cash flow management.

Better decision making

Maximize offshore banking profits with comprehensive financial planning and risk management strategies.

Get a Robust, Powerful and Flexible Financial Model

This offshore banking financial projection tool provides a customizable foundation for planning and analysis.

Offshore Bank Business Plan Financial Projections Template Advantages

Effortlessly create financial statements for offshore banks using our robust modeling tool.

Use a financial model template for offshore banking to manage professionals effectively.

Excel template streamlines offshore banking financial analysis.

{Maximize your offshore banking potential with expert financial planning and analysis}.

Determine Cash Inflows and Outflows in an offshore banking model to ensure financial compliance and effective risk management.