ALL IN ONE MEGA PACK INCLUDES:

Saas Actuals Opt In Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Saas Actuals Opt In Financial Model For Startup Info

Highlights

Utilize our innovative saas financial model to accurately compare actuals vs forecast, and develop a powerful opt in model that leverages the benefits of software as a service. Our financial projections incorporate revenue recognition, subscription model, churn rate, customer lifetime value, cash flow forecasting, pricing strategy, market analysis, competitive analysis, growth rate, and financial planning and analysis to provide you with a comprehensive and detail-oriented plan. Our saas actuals opt in startup costs spreadsheet helps you to secure funding from banks or investors after generating a 5-year financial projection excel, cash flow forecast excel, financial dashboard, and core metrics in GAAP/IFRS formats, all while still being fully unlocked to allow for easy customization.

The software as a service (SaaS) financial model is an essential tool for any business looking to succeed in the subscription model. It enables businesses to analyze financial projections, revenue recognition, churn rate, customer lifetime value, cash flow forecasting, pricing strategy, market analysis, and competitive analysis. The actuals vs forecast analysis provides valuable insights into the growth rate and financial planning and analysis. The saas actuals opt-in model is a great way to access accurate and reliable data that can be used to make informed decisions that help businesses improve their revenue streams and increase profitability.

Description

Our saas financial model offers valuable insights into the financial projections of a software as a service business. It helps in monitoring actuals vs forecast and identifying the factors responsible for the difference. The template is designed keeping in mind an opt in model and subscription model of revenue recognition. The financial planning and analysis tool also covers topics like churn rate, customer lifetime value, cash flow forecasting, pricing strategy, market analysis, and competitive analysis. The model targets the growth rate of the business and offers financial projections to help make informed business decisions. It is an essential tool to build a profitable and sustainable SaaS business.Saas Actuals Opt In Financial Model Reports

All in One Place

Our Saas financial model is customizable to fit your business needs. We offer an opt-in model for financial planning and analysis, including actuals vs forecast, revenue recognition, churn rate, and customer lifetime value. Our subscription model allows for cash flow forecasting and pricing strategy analysis. We provide thorough market and competitive analysis with growth rate projections. Our financial projections include a 5-year plan with modular start-up financial statements, operating costs, hiring plan, equity cap table, seed valuation, and reporting. Our easily-editable business plan Excel financial template structure allows for additional details and forecasting methods.

Dashboard

To properly analyze finances and make accurate predictions, a wealth of data is required. Utilizing a SaaS financial model, businesses can achieve this. It encompasses various critical elements, such as revenue recognition, cash flow forecasting, customer lifetime value, and pricing strategy. In addition, conducting a market and competitive analysis can help define a subscription or opt-in model. Using pro forma balance sheet and projected profit and loss templates, financial planning and analysis can be conducted. The 3-way financial model is an all-encompassing tool that organizes financial data into charts and graphs that can easily be customized for efficiency.

Accounting Financial Statement

Our Saas financial model includes an opt-in model subscription strategy to help analyze competitive and market analysis. With a focus on actuals vs forecast, revenue recognition, and growth rate, our software as a service includes financial projections, customer lifetime value, and churn rate analysis. Our pricing strategy and cash flow forecasting allow for detailed financial planning and analysis. Additionally, our model incorporates pre-built templates and sheets to generate key calculations, which can be sensitized for forecasts. Create visually appealing presentations with our charts, tables, and presentation material to summarize and present results to potential investors.

Sources And Uses Table

The sources and uses of cash statement is a vital tool in financial planning and analysis. It shows a clear picture of where the money comes from and where it goes. This statement is essential in mergers, acquisitions, and restructuring decisions. As a company engages in pricing strategy, market and competitive analysis, and growth rate forecasting in subscription models such as software as a service, it is necessary to keep track of actuals vs forecast and revenue recognition. Monitoring churn rate and customer lifetime value also helps in cash flow forecasting.

Break Even Revenue Calculator

As a SaaS company, creating a solid financial model is crucial for success. Track actuals vs forecast to identify gaps and adjust projections accordingly. Consider an opt-in subscription model and analyze market and competitive factors to inform pricing strategy. Revenue recognition and cash flow forecasting are key aspects to monitor, as well as calculating churn rate and customer lifetime value. Use financial planning and analysis to project growth rates and determine the break-even point in sales dollars. Don't forget to also establish a safety margin to avoid incurring losses.

Top Revenue

For SaaS companies, financial planning and analysis must include a deep understanding of the opt-in model, pricing strategy, churn rate, and customer lifetime value. Revenue recognition, cash flow forecasting, and financial projections can provide a roadmap for growth rate and sustainable business model. To stand apart from competitors, market and competitive analysis should be conducted regularly. Actuals vs forecast must be monitored to make informed business decisions. Ultimately, the top line and bottom line of the profit and loss statement format excel are key indicators for the overall performance of any SaaS company.

Business Top Expense Categories

Our financial planning and analysis template helps companies create a roadmap to financial success. By analyzing your expenses, including subscription and churn rates, pricing strategy, and revenue recognition, our software as a service (SaaS) model allows for accurate cash flow forecasting and customer lifetime value projections. Using market and competitive analysis, we provide growth rate estimates and financial projections that are vital to any opt-in model. With our template, you can take control of your company's financial future by customizing the 'other' category to fit your specific needs.

Saas Actuals Opt In Financial Projection Expenses

Costs

Our SaaS financial model provides a subscription-based revenue recognition and opt-in model that calculates customer lifetime value, churn rate, and growth rate. Our pricing strategy is based on market and competitive analysis, and our financial planning and analysis includes cash flow forecasting and financial projections. With our actuals vs forecast comparison, you can make informed decisions and adjust your strategy accordingly. This is crucial for startups seeking investors or any company aiming to assess profitability potential. Let our cutting-edge software as a service help you achieve your financial goals.

Start Up Budget

As a financial planner, I specialize in creating SAAS financial models that cover everything from revenue recognition and subscription models to pricing and competitive analysis. Using actuals versus forecast data, I help clients optimize their opt-in model and improve cash flow forecasting. By analyzing churn rates, customer lifetime value, growth rates, and market trends, I can generate accurate financial projections that inform strategic decision-making. Whether you need help with financial planning and analysis or tracking your investment in fixed assets, I'm here to help you achieve your goals.

Loan Payment Calculator

For start-ups and early-stage growth companies, implementing a SAAS financial model could provide valuable insight into actuals vs forecasted financial projections. An opt-in subscription model paired with accurate revenue recognition can help monitor churn rate and determine customer lifetime value. Utilizing competitive and market analysis can inform pricing strategy, while a growth rate can be evaluated through financial planning and analysis. Tracking and managing loan repayment schedules is crucial for accurate cash flow forecasting, as they impact both the debt balance and 5 year projection template.

Saas Actuals Opt In Excel Financial Model Metrics

Profitability KPIs

In startup financial planning, the gross profit margin signifies a company's fiscal well-being by measuring the profit proportion earned from revenue minus the cost of sales. Seeing a rise in gross margin means minimized expenses and/or escalating revenue, improving profitability. The margin is typically expressed as a percentage and is an essential element of financial projections, cash flow forecasting, and revenue recognition. Determined by a pricing strategy and competitive and market analysis, it can be optimized through opt-in and subscription models, factoring churn rate, customer lifetime value, growth rate, actuals vs. forecast, and the software-as-a-service (SaaS) financial model.

Cash Flow Format In Excel

Financial planning and analysis are crucial for any SaaS company. By examining actuals vs forecast, revenue recognition, and cash flow forecasting, organizations can create more accurate financial projections. Utilizing an opt-in or subscription model with a strong pricing strategy can help increase customer lifetime value and reduce churn rates. Conducting market and competitive analyses and understanding growth rates can also inform financial planning. Ultimately, the use of a cash flow projection business plan can provide valuable insights for smarter financial decision-making and maximizing operations.

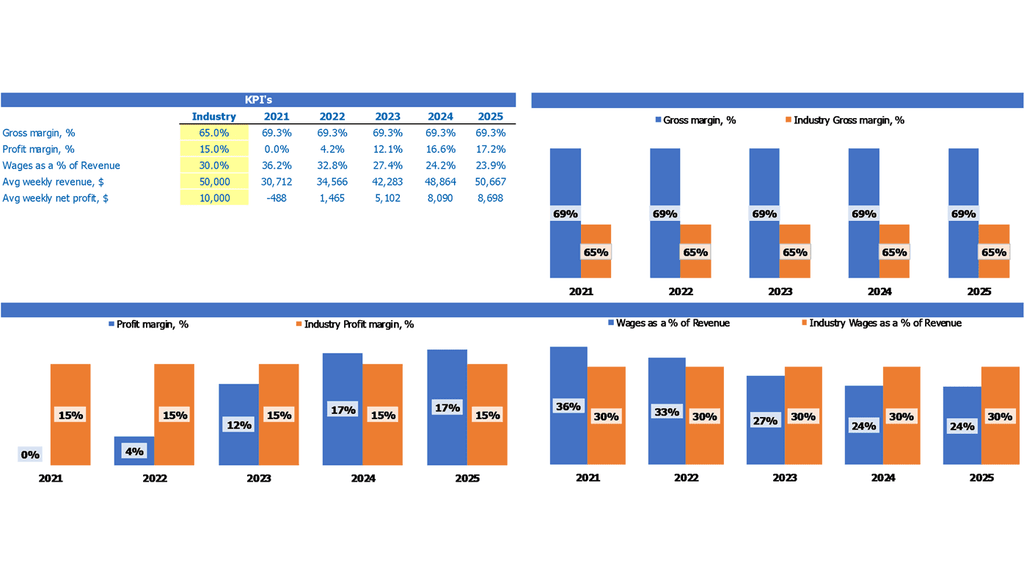

Industry Benchmarks

Financial modeling for start-ups is critical, and a 5-year cash flow projection Excel template benchmark tab is a great tool. This includes industry-wide averages to compare with company business and financial key performance indicators. Start-ups can learn best practices from experienced industry companies and incorporate them in their financial projections. Benchmarking analysis and financial planning and analysis help build a business and financial strategy for successful revenue recognition, churn rate reduction, and increasing customer lifetime value. Opt-in models, subscription models, market analysis, competitive analysis, pricing strategy, and growth rate analysis are all important factors to consider.

Profit Loss Statement Template Excel

To gain a deeper insight into your SaaS business, financial planning and analysis using an opt in model is crucial. By comparing actuals versus forecasts and utilizing revenue recognition, you can create accurate financial projections and forecast cash flow. To determine pricing strategy and understand market and competitive analysis, incorporating growth rate and customer lifetime value is necessary. This information will help you conduct an effective diagnosis of your business’s strengths and weaknesses, allowing you to make good decisions for your startup.

Projected Balance Sheet For Startup Business

Our Software as a Service (SaaS) financial model analyzes revenue recognition, subscription and opt-in models, churn rate, pricing strategy, competitive and market analysis, customer lifetime value and growth rate. Our team of financial analysis experts revolutionize financial planning and analysis for you by linking monthly and yearly projections to cash flow forecasting and projected profit and loss statements, giving you a comprehensive overview of your pro forma financial statements. Our Excel templates allow you to track actuals vs forecast, and optimize your pricing strategies for maximum revenue.

Saas Actuals Opt In Financial Projection Template Valuation

Startup Valuation Calculator

Our all-in-one Financial Planning and Analysis tool encompasses market and competitive analysis, subscription and opt-in financial models, churn rates, customer lifetime value, and revenue recognition. With our pricing strategy and growth rate projections, users can forecast financial projections and cash flow. Incorporating actuals vs forecast reports and discounted cash flow valuation, our software-as-a-service (SaaS) Subscription model supports startup valuation for investors' return-on-investment. This pre-built template is an essential tool for evaluating the potential of any company in the SaaS industry.

Cap Table Excel

Our SaaS financial model incorporates an opt-in model that helps with cash flow forecasting and pricing strategy. By conducting market analysis and competitive analysis, we can accurately project growth rates and churn rates to determine customer lifetime value. We use an actuals vs forecast approach to revenue recognition and employ financial planning and analysis to improve our subscription model. Our 3 year financial projection template also includes an equity cap table that highlights ownership breakdown and informs investors of potential financial gains upon exit.

Saas Actuals Opt In Simple Financial Projections Template Key Features

Investors ready

Our SaaS company utilized an opt-in subscription model with a pricing strategy based on competitive and market analysis to improve our financial projections and ensure proper revenue recognition, while also closely monitoring churn rate and customer lifetime value through regular financial planning and analysis, resulting in accurate actuals vs forecast and confident cash flow forecasting.

Saves you time

Using saas financial model streamlines cash flow forecasting, leaving more time for product development and customer engagement.

Save Time and Money

Start planning your Saas financial model with ease using Actuals Opt In and avoid the hassle of expensive consultants and technical aspects.

Predict the Influence of Upcoming Changes

Use a cash flow chart template to forecast cash inflows and outflows, and create 'what if' scenarios for equipment purchases or product launches.

Manage accounts receivable

Improve cash flow forecasting with a tool that tracks invoices and bills, and models different payment dates.

Saas Actuals Opt In Startup Costs Spreadsheet Advantages

Assess your Saas financial model with actuals vs forecast and opt in for financial planning and analysis.

Demonstrate your repayment potential with a comprehensive SaaS financial model.

Attract top talents with the help of an Excel financial forecast template for SaaS businesses.

Easily create accurate financial projections with our saas financial model and cash flow forecasting tools.

Impress investors with a comprehensive saas financial model, including market and competitive analysis, growth rate, revenue recognition, and pricing strategy.