ALL IN ONE MEGA PACK - CONSIST OF:

Hotel Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HOTEL ACQUISITION REAL ESTATE PROFORMA TEMPLATE INFO

Highlights

Generates 5-year Hotel Acquisition real estate excel, pro forma cash flow projection, financial dashboard, and core metrics in GAAP/IFRS formats automatically. Use Hotel Acquisition financial modeling real estate development before acquiring Hotel Acquisition business, and get funded by banks or investors. Unlocked - edit all.

This Hotel Acquisition Excel reit financial model is an excellent and dynamic ready-to-use Excel tool to create an efficient and comprehensive financial plan to summarize key financial metrics and reports. It will help you to check profitability outcomes, plan annual incomes and pre-exports, investments, and assess employees salaries etc. All content of this model is integrated and connected with each other in a well-structured and deal-proven way, enabling the user to determine the changes in one variable affect the overall outcome. For Investment appraisal, we have also included NPV with a Free excel template cash flow statement to accurately determine the companys actual worth.

Description

This Inventory Control Software Excel Financial Model will help you to:

- Present main economics of an investment opportunity;

- Estimate rates of return and measure NPV for a Hotel Acquisition;

- Measure operating, capital and financing costs;

- Present the cash flow of an investment;

- Perform valuation of an investment property;

- Assess the feasibility of the refinancing option and an amount of taking out;

- Assess a range of rental and exit scenarios;

- Assess a range of financing options.

The contents are as follows:

- Dashboard Tab: flexible acquisition and exit dates, mortgage financing assumptions, re-financing assumptions, acquisition costs, growth rates, and sale costs assumptions.

- The renovation schedule based on the number of units renovated and flexible timing of renovation.

- Equity Waterfall Tab: Includes 10 years of monthly cash flow, costs and revenues, IRR, Equity Multiple, Profit Margin, Net Profit, DSCR, Debt Yield, Operating Margin, Cash on Cash, NPV, DCF.

- Monthly Cash Flow: includes operating revenues, operating costs, NOI, capital costs (leasing fees and CAPEX), debt service, and net income.

- Annual Cash Flow.

- Rent Roll with a flexible number of units. Projection of the operating expenses and additional income.

- Project Financing with senior debt amortization, re-financing option, supplemental loan option, and mezzanine financing.

Key Metrics

- Cost/Square Footage (Sqm), Sale Price/Unit, Net Rental Revenue;

- NOI, Debt Service, Net Leveraged Cash Flow;

- NPV, DCF Valuation;

- DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit.

- Exit value for the property is calculated automatically based on NOI for a period and cap rate you assume in your projection.

HOTEL ACQUISITION REAL ESTATE MODEL REPORTS

All in One Place

We made a totally specific pro forma excel template real estate that disengages the financial focus: financial statements, operating costs, utilizing plan, cap table, valuation, and actuals declaring. It contains improvement guesses and revenue projections, and you can without a very remarkable stretch change or delete any data or projection. The real estate cash flow model structure licenses widening it by adding additional nuances or financial deciding methodologies for unequivocal business types. All cells and formulas are thoroughly open and opened so you can modify or change anything in Hotel Acquisition financing real estate development.

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

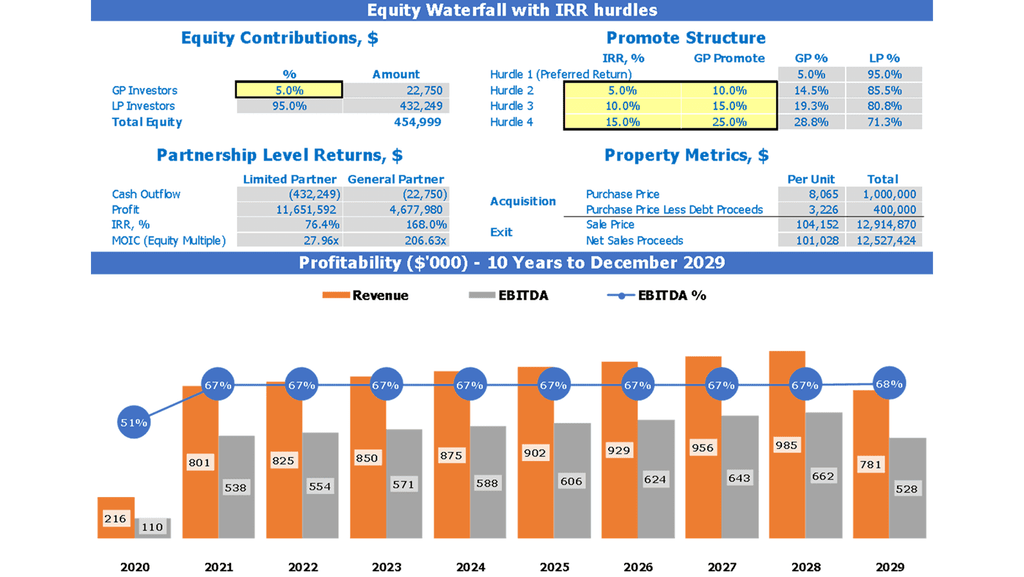

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

NOI & EBITDA

Net Operating Income and EBITDA chart

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

HOTEL ACQUISITION PRO FORMA EXCEL TEMPLATE ADVANTAGES

Flexible number of rooms as well as multiple income streams from Food and Beverage

Rev per Available Room (RevPAR) by years calculation

Land loan with paid-current or accruing interest

Permanent Finance: the model also covers a permanent financing, so once we actually have built out the property and the project has been stabilized, we can refinance the project if we don't decide to sell right way.

Hotel Cash Flow: includes operating revenues, operating costs, NOI, capital costs, debt service, and net income