ALL IN ONE MEGA PACK INCLUDES:

Circus Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Circus Startup Budget Info

Highlights

The circus financial analysis is an essential aspect of the circus business. The circus cost structure, circus revenue streams, circus budget planning, and circus financial planning should be taken into consideration to manage the circus financial performance. Additionally, the circus financial modeling, circus financial metrics, circus financial reporting, circus cash flow management, and circus financial forecasting should be evaluated to assess the circus profit margin. Our company creates a 5-year circus projection template and projected profit and loss template on the fly. The financial statements and financial ratios will be presented in GAAP or IFRS formats. This tool is primarily used to evaluate a circus business before selling it, and it is fully unlocked for editing all contents.

The circus financial analysis in Excel template provides a comprehensive overview of the circus cost structure, revenue streams, profit margin, budget planning, financial projections, forecasting, and strategies. The template includes customized financial reporting tools to help monitor the circus financial performance and optimize cash flow management. It also includes industry-specific assumptions and KPIs that enable benchmarking against industry standards. With the circus financial modeling tool, users can make informed financial decisions and create financial strategies that align with the organization's goals and objectives.

Description

Our circus financial analysis tools such as the circus budget planning and circus financial forecasting are designed to help your business stay on top of your expenses, revenue streams, and profit margins. With our circus financial reporting and circus financial metrics, our team can help you make informed decisions and adjust your financial strategy accordingly. Our circus cost structure and circus cash flow management tools can also help you identify cost-saving opportunities and improve financial performance. Ultimately, our circus financial management services aim to help your business thrive financially and achieve long-term success.Circus Financial Plan Reports

All in One Place

Our comprehensive circus financial analysis tool serves as an essential guide for new and existing circus ventures. It encompasses circus budget planning, cash flow management, financial forecasting, and projection for circus financial performance. The model includes circus financial modeling, metrics, and reporting for better financial planning and strategy. The Circus financial business forecast template offers proformas for circus revenue streams, circus cost structure, and profit margin analysis. The template also offers monthly and yearly summaries, allowing users to monitor performance over time.

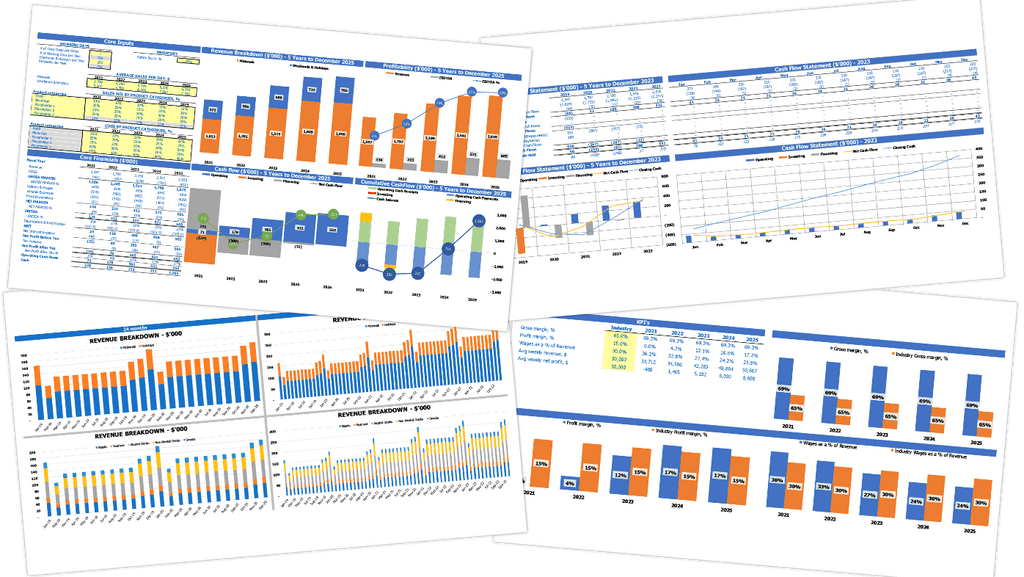

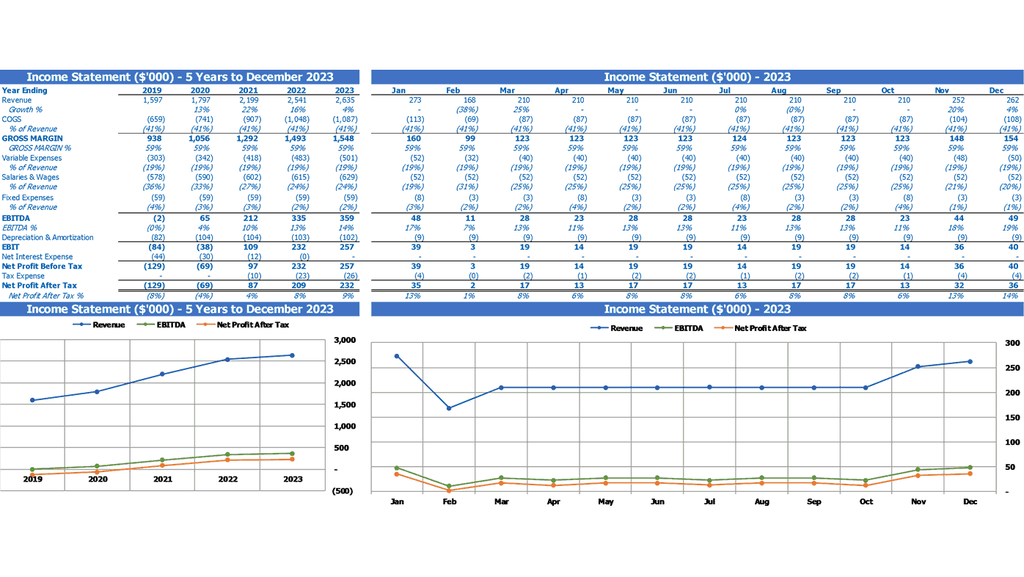

Dashboard

Planning and managing a circus's finances involves analyzing revenue streams, managing cost structures, and accurately forecasting financial performance. Effective circus financial management requires creating budgets, projections, and models that consider key financial metrics. To ensure profitability, circus financial reporting should provide clients with monthly or yearly statements that can be accessed digitally or through charts. Using a five-year projection plan can help keep cash flow management organized and provide valuable insights for making strategic financial decisions.

Company Financial Reporting

Our circus financial management services include comprehensive analysis, planning, and forecasting using a range of financial metrics, modeling, and reporting tools. We work closely with clients to develop a robust circus cost structure and revenue streams, enabling us to create accurate circus financial projections and budget planning templates. Our circus cash flow management services are designed to optimize your circus profit margin, while our circus financial reporting packages are tailored to meet the needs of internal stakeholders and external investors alike. Whether you're looking for help with circus financial strategy or simply need to improve your circus financial performance, we've got you covered.

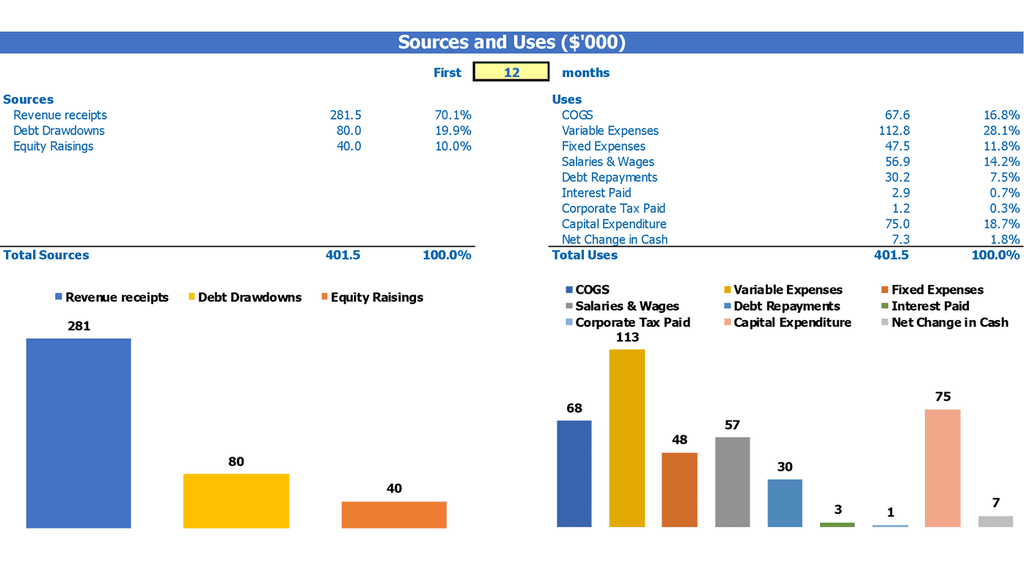

Sources And Uses Of Funds Statement

In the circus industry, financial planning and analysis play a crucial role in determining its success. Circus financial strategy includes circus cost structure, circus revenue streams, and circus profit margin. In order to achieve favorable circus financial performance, circus financial projection, circus budget planning, and circus financial forecasting should be implemented. Other key aspects of circus financial management are circus financial modeling, circus cash flow management, circus financial metrics, and circus financial reporting. With accurate circus financial analysis, a circus company can make informed decisions and achieve financial stability.

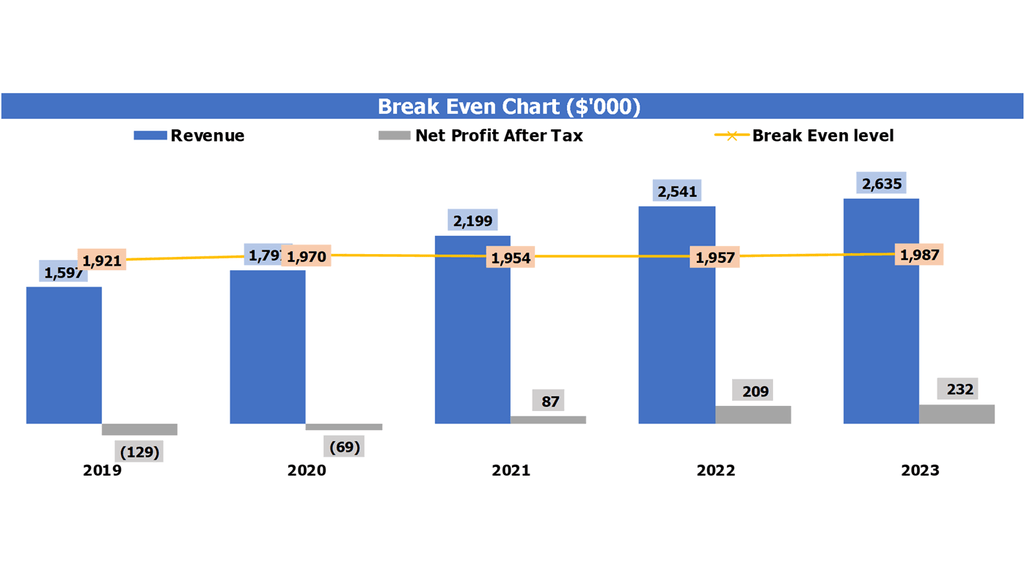

Bep Calculation

By utilizing a three-way financial model, circus cost structures are analyzed to create circus financial projections. Circus financial forecasting is then used to create a budget plan that will optimize circus revenue streams and circus profit margins. With effective circus financial management, circus cash flow management ensures that financial planning is streamlined and circus financial metrics are accurately reported. Circus financial modeling is key to understanding circus financial performance and developing a circus financial strategy that minimizes risk. Overall, circus financial analysis is crucial for the long-term success of circus companies.

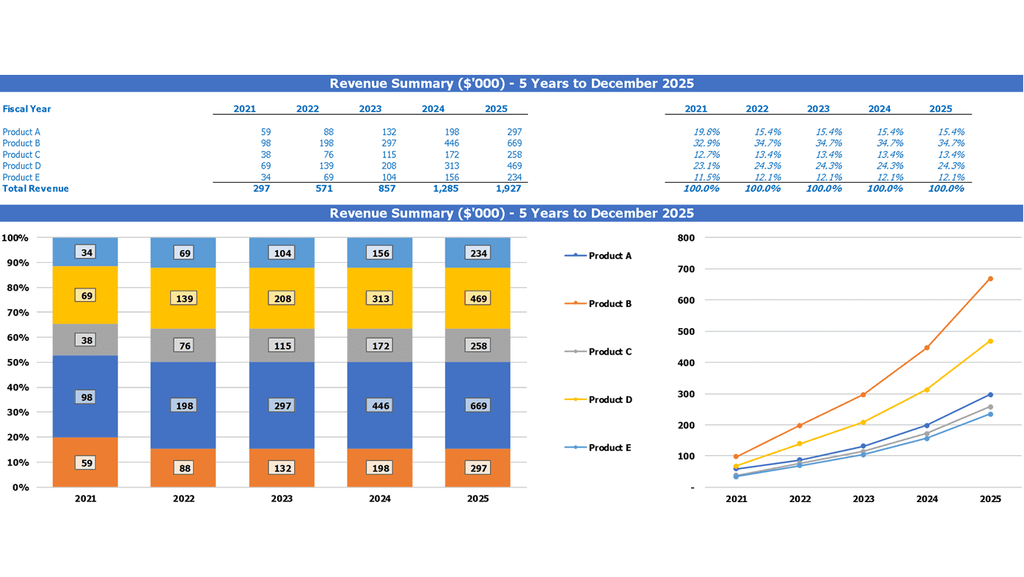

Top Revenue

The Circus can benefit from financial planning and management with tools like financial forecasting, projections, and reporting. By examining revenue streams, cost structures, and profit margins, Circus management can create a budget and strategy for optimizing financial performance. Financial metrics like cash flow management and modeling can help Circus make informed decisions about resource allocation and growth opportunities. Using revenue templates and demand reports, Circus can project financial results over various periods and compare actual performance to financial expectations. With the right financial analysis, Circus can better plan for success and achieve long-term financial stability.

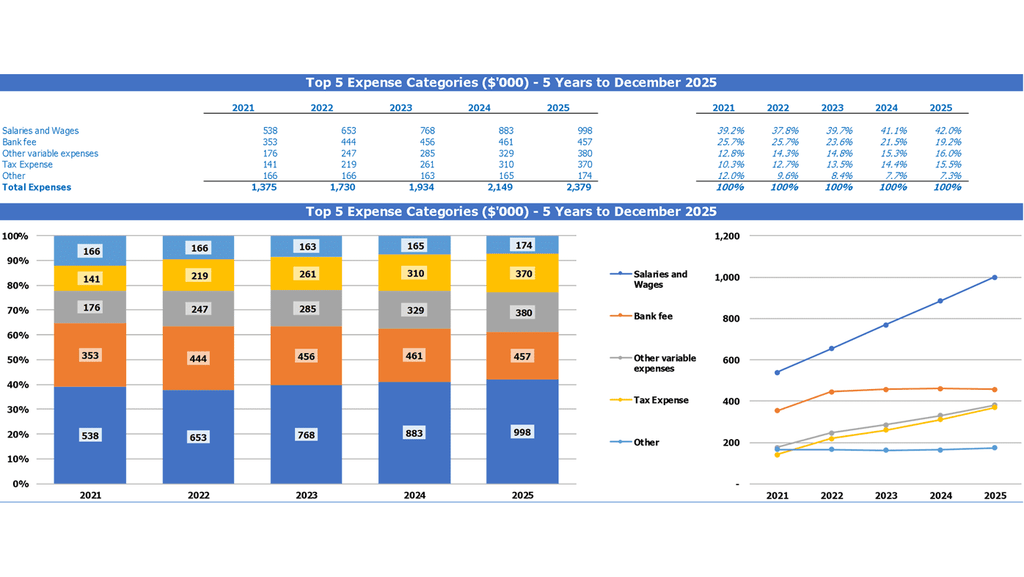

Business Top Expense Categories

The circus financial analysis focuses on the circus cost structure and revenue streams. By utilizing circus financial modeling, financial projections, and forecasting, the circus financial strategy and planning generates accurate circus financial performance metrics to increase the circus profit margin. The circus budget planning and cash flow management ensure that the circus financial reporting is thorough and transparent. The circus financial management utilizes different circus revenue streams to identify the top expenses while incorporating fixed and variable costs in the circus financial planning. The built-in annual expense chart reflects the expenses necessary to expand the circus's client base and pay its employees.

Circus Financial Projection Expenses

Costs

Our comprehensive financial planning tools, including circus financial modeling and financial analysis templates, enable business owners to make informed decisions about their circus profit margin, revenue streams, and overall financial performance. Our budget planning templates, along with financial forecasting and cash flow management tools, ensure businesses meet their financial objectives. We also offer circus financial reporting and performance metrics to provide maximum transparency and help identify areas for improvement. Our excel financial model template is the ultimate solution for budgeting and cost structure planning, offering key insights to secure funding and manage your circus finances effectively.

CAPEX Investment

CapEx start up expenses are crucial investments for any new circus venture. These expenses cover purchasing assets and play a key role in the company's development. By improving the quality of technology and equipment, these costs optimize the circus's operations and contribute to revenue streams. Proforma income statements and cash flow statements should account for these expenses, as they heavily influence the projected balance sheet template. Accurate budget planning, forecasting, and financial analysis hinges on a comprehensive understanding of a circus's cost structure, financial metrics, and profit margins. Effective financial management is key to success in the circus industry.

Loan Repayment Schedule

Our circus financial analysis involves careful circus budget planning, circus financial forecasting, and circus financial modeling to help determine circus revenue streams and circus cost structure. We use circus financial metrics and circus financial performance reports to track circus financial performance and create circus financial projections. Our circus financial strategy includes circus financial planning and circus cash flow management, while our circus financial management approach employs circus financial reporting to keep track of our circus profit margin. To ensure successful circus financial planning, we utilize a loan amortization schedule template with built-in formulas that record each loan's terms and repayment dates in our 5-year circus projection plan.

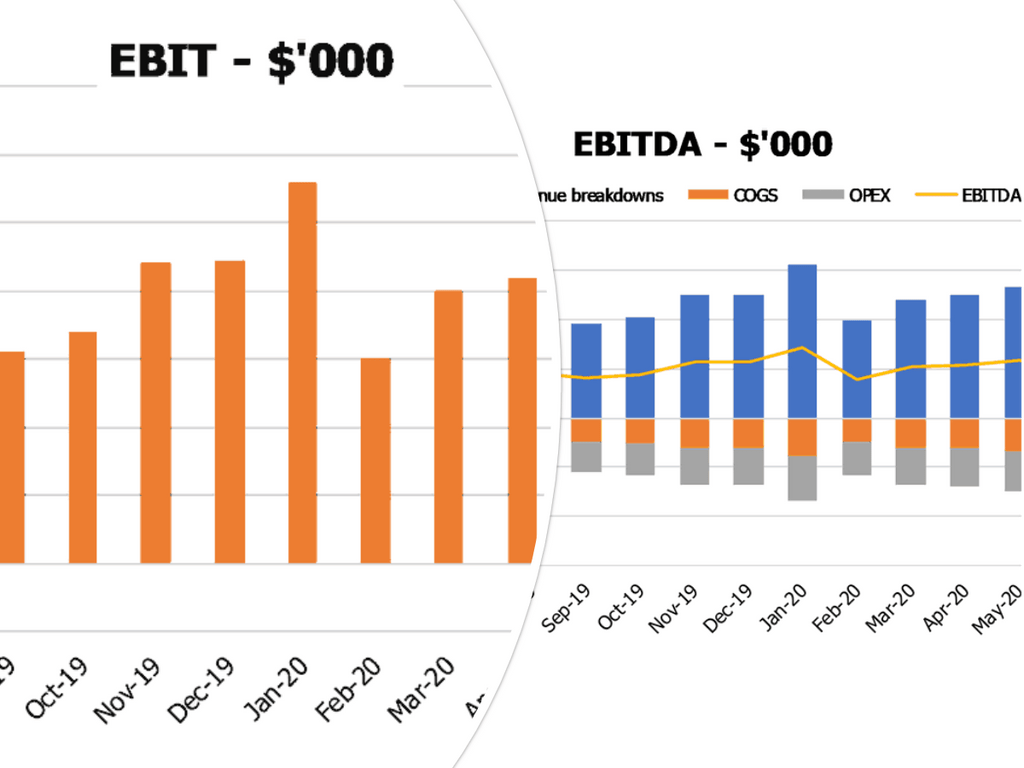

Circus Income Statement Metrics

Financial KPIs

In the circus industry, analyzing financial performance is essential. Understanding the circus cost structure and circus revenue streams can aid in circus financial planning, circus financial forecasting, circus financial modeling, and circus financial analysis. Circus financial reporting, circus cash flow management, circus financial metrics, and circus financial projections are all crucial for creating a circus financial strategy that maximizes circus profit margin. Key performance indicators (KPIs) are critical for circus budget planning and setting goals over a specific period. Investors can use KPIs to measure circus financial performance compared to promised performance before funding.

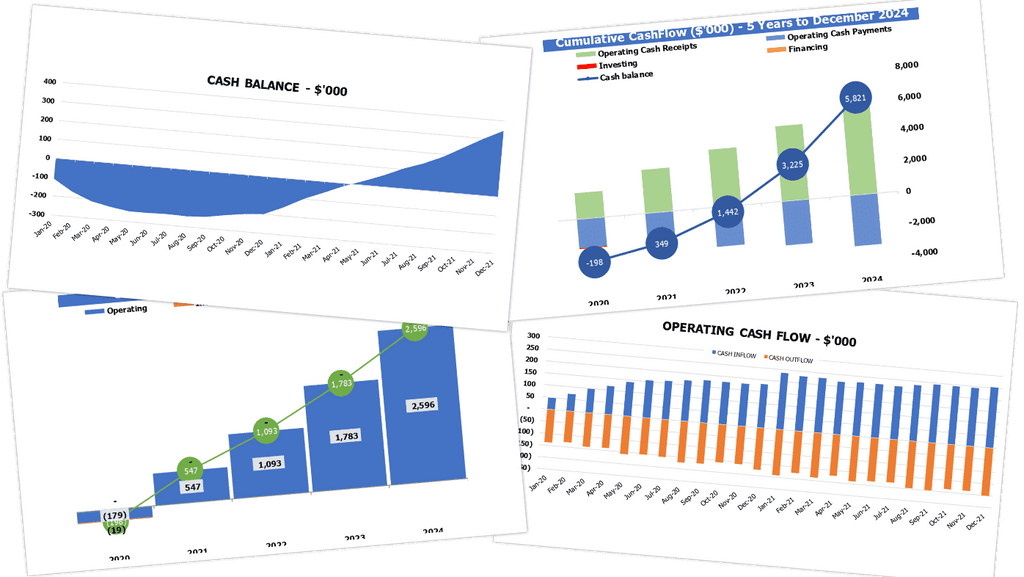

Cash Flow Forecasting Model Excel

The success of a circus company depends on its financial performance. To ensure a profitable circus, one should consider financial planning, budgeting and forecasting, cost structure and revenue streams, cash flow management, and financial reporting. Financial projections, modeling, and metrics can aid in developing a successful circus financial strategy. The pro-forma cash flow statement is a crucial financial analysis tool that tracks cash inflows and outflows. It is important to manage expenses and ensure they do not exceed revenue to achieve a healthy profit margin.

KPI Benchmarks

Our circus financial analysis tools include a cash flow management template that measures your business' profit margin and compares it to industry standards. By using our financial modeling and reporting features, you can easily forecast your revenue streams and plan budgets accordingly. Our pro forma template allows you to benchmark against competitors' metrics and identify areas for improvement in your cost structure. With our financial strategy tools, you can optimize your circus financial performance and plan for future growth. Trust us for expert circus financial planning and management.

Income And Expenditure Template Excel

When it comes to circus financial analysis, a well-thought-out budget plan is crucial. Circus financial planning should include projections, forecasts, and modeling of revenue streams, cost structures, and cash flow management. Circus financial metrics and performance reporting should be regularly evaluated to ensure profitability. While the P&L statement Excel sheet is important in revealing the business's monetary funds and performance, it may not necessarily align with the circus's cash flow. Therefore, a pro forma profit and loss statement template generated without cash flow may be incomplete. Accurate calculations are essential for financial strategy and management.

Balance Sheet Forecast

In analyzing a circus' financial performance, it's important to consider the multiple revenue streams and cost structure. Through financial planning and strategy, a circus can create financial projections and maintain cash flow management for long-term success. Metrics such as profit margin and financial reporting can aid in financial analysis and budget planning. Utilizing financial forecasting and modeling, a circus can project its future financial health, including the amount of investment needed to support sales and profits. The balance sheet forecast is a key tool for understanding the overall financial picture of a circus.

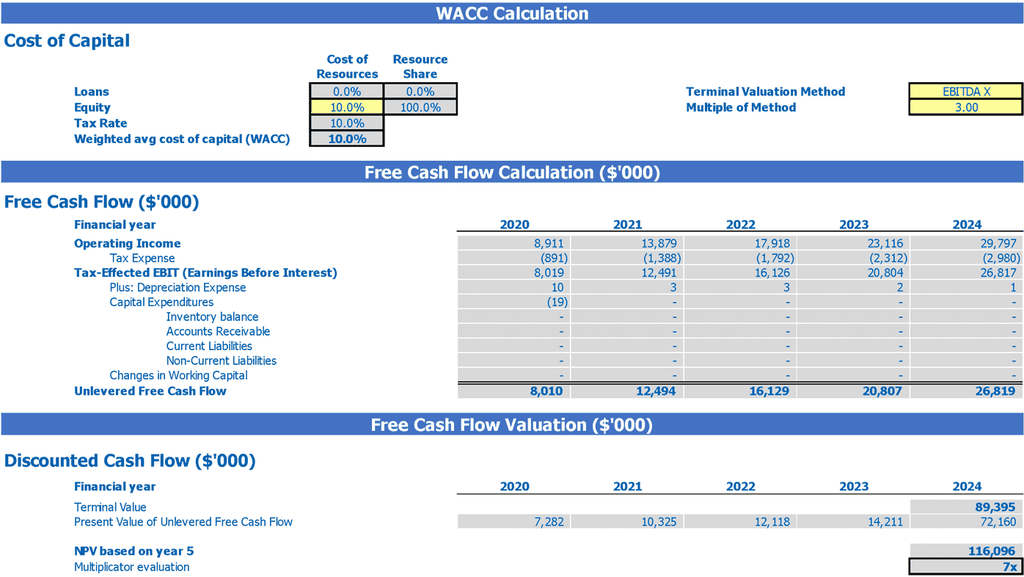

Circus Income Statement Valuation

Startup Valuation

The circus financial plan for startup is a comprehensive tool that provides valuable insights on various aspects of financial management. It covers the circus cost structure, revenue streams, budget planning, financial projections, cash flow management, financial forecasting, performance metrics, and reporting. In particular, investors can benefit from pre-revenue startup valuation data, such as WACC, FCF, and DCF, which show minimum return rates, available funds, and future cash flow values. These metrics enable investors and stakeholders to make informed decisions regarding the company's financial strategy and performance.

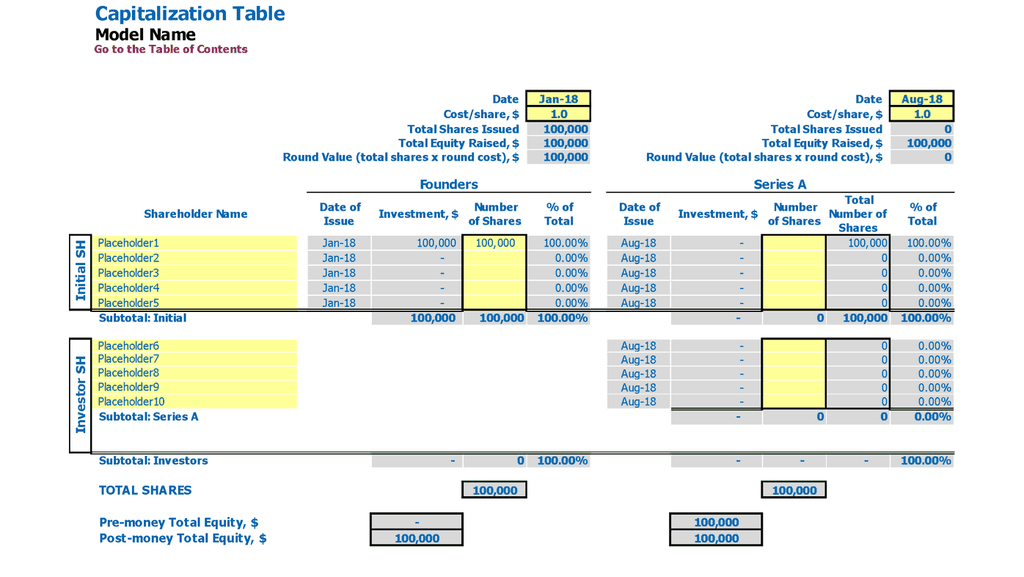

Cap Table Template

Circus financial management involves careful budget planning, forecasting, modeling, and reporting for optimal financial performance. Revenue streams and cost structure analysis ensures profitable profit margins. Metrics and projections are tracked for cash flow management, while financial strategy guides cash flow planning. Like a capitalization table, financial reporting reflects the many ways securities are split among investors. Overall, a detailed financial analysis is essential for the long-term success of a circus, which relies on steady financial performance and planning to succeed.

Circus Financial Plan For Startup Key Features

All necessary reports

Our circus financial template includes all necessary reports and calculations for lenders.

Run different scenarios

Utilizing cash flow projections allows for testing various variables and adjusting financial strategies to improve the circus's financial performance.

It is part of the reports set you need

Circus financial planning is vital in minimizing risk and ensuring sustainable growth.

Build your plan and pitch for funding

Maximize circus profit margins through strategic financial planning and analysis of revenue streams, cost structure, cash flow, and performance metrics.

Avoid cash flow problems

Regular cash flow forecasting is crucial for circus financial management and can help identify potential gaps and improve the overall health of the business.

Circus 5 Year Financial Projection Advantages

Utilize the Circus Financial Analysis tool to optimize profit margins and revenue streams.

Develop a strong circus financial strategy by analyzing revenue streams, cost structure, cash flow management, and financial forecasting.

Use circus financial model template to improve your circus's financial performance and plan for growth.

Use the circus financial analysis tools to create a strategic plan with financial forecasting and budget planning.

Develop a comprehensive financial strategy for the circus that includes cost structure analysis, revenue streams, cash flow management, forecasting, and reporting.