ALL IN ONE MEGA PACK INCLUDES:

Private Members Club Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Private Members Club Startup Budget Info

Highlights

Private clubs require a solid financial plan to ensure they remain profitable and sustainable. This includes having a member-owned club financial model in place, as well as a thorough understanding of private club revenue streams, operating expenses, and cash flow analysis. Budgeting and cost management are crucial components of financial planning for private clubs, along with regular financial reporting, including the profit and loss statement, balance sheet, and income statement. Utilizing financial ratios and forecasting tools can aid in investment analysis and assist in making informed decisions for the long-term success of the club. Whether starting up or looking to improve existing financial strategies, a sophisticated 5-year private club financial model can be developed with minimal previous financial planning experience and basic knowledge of Excel.

When it comes to financial planning for private clubs, it is important to have a well-structured member-owned club financial model in place. This model should include a thorough analysis of private club membership fees, along with the identification and management of private club revenue streams and operating expenses. A comprehensive private club cash flow analysis is critical to effective budgeting and cost management, as well as producing accurate and timely private club financial reporting. Private club profit and loss statements, balance sheets, and income statements should be regularly reviewed and analyzed, with financial ratios used to assess overall financial health. Finally, private club financial forecasting and investment analysis can help to guide strategic decision-making, and ensure the long-term financial viability of the club.

Description

The financial planning for private clubs is vital to ensure long-term success and profitability. The member-owned club financial model includes various aspects such as private club membership fees, revenue streams, operating expenses, cash flow analysis, budgeting, cost management, financial reporting, profit and loss statement, balance sheet, financial ratios, financial forecasting, and investment analysis. The private club's financial projections spreadsheet helps in making informed decisions regarding the private club's future feasibility and profitability. The private club's 5-year cash flow projection template excel enables efficient management and organization of the club's operations, marketing, and customer management.Private Members Club Financial Plan Reports

All in One Place

Private clubs require detailed financial planning to maintain their operations and support their members. A member-owned club financial model should include a thorough analysis of revenue streams, operating expenses, and cash flow to create an accurate budget and manage costs effectively. Regular financial reporting, including profit and loss statements, balance sheets, and income statements, can help track performance and identify areas for improvement. Financial ratios and forecasting tools can also provide valuable insights into investment analysis and overall financial health. Our 5-year projection template is an excellent choice, regardless of your financial experience background, offering versatility and precision for all your club's financial needs.

Dashboard

Financial planning for private clubs involves creating a member-owned club financial model that includes analyzing private club revenue streams, membership fees, operating expenses, and cost management. It also involves conducting a private club cash flow analysis and creating a budget, financial reporting, and financial forecasting, including investment analysis. Private club financial statements, such as profit and loss, balance sheets, and financial ratios, should be presented in charts and graphs format for easier analysis and monitoring. This helps keep private club finances under control for successful development.

Excel Financial Statement

Financial planning for private clubs involves analyzing revenue streams and operating expenses to ensure cost management while maintaining profitability. This includes budgeting, cash flow analysis, financial reporting such as profit and loss statements, balance sheets and income statements, financial ratios, and forecasting. A member-owned club financial model may also require investment analysis and the management of private club membership fees. By utilizing these tools, private clubs can maintain financial stability and make informed decisions to best serve their members.

Sources And Uses Of Cash Statement

Financial planning for private clubs is crucial for effective operations and long-term sustainability. Key elements include developing a member-owned club financial model, analyzing revenue streams and operating expenses, budgeting and cost management, financial reporting and forecasting, investment analysis, and evaluating financial ratios. This involves creating profit and loss statements, income statements, balance sheets, and cash flow analyses. An expert understanding of private club membership fees, cash management, and forecasting is essential for successful financial planning and ensuring positive outcomes.

Bep Calculation

Effective financial planning for private clubs involves an in-depth analysis of operating expenses, revenue streams, and membership fees. Club managers should use tools such as cash flow analysis, budgeting, cost management, and financial reporting in monitoring the club's financial position. Additionally, creating profit and loss and balance sheet statements, and using financial ratios aid in understanding the club's performance. Forecasting and investment analysis can help clubs project future revenue and decide on new investments. By using these approaches, clubs can achieve their break-even point, ensuring they cover their costs while generating profit.

Top Revenue

Effective financial planning is crucial for private clubs to maintain profitability. To ensure success, the member-owned club financial model must consider private club membership fees and revenue streams, while also managing private club operating expenses and analyzing cash flow. Private club budgeting and cost management tools are necessary for financial control, while private club financial reporting must include profit and loss statements, balance sheets, and income statements. In addition, private club financial ratios and forecasting are essential for investment analysis and future planning. By utilizing a comprehensive approach, private clubs can sustainably increase revenue and profitability.

Business Top Expense Categories

Financial planning for private clubs involves analyzing and managing revenue streams, operating expenses, cash flow, and budgeting. Member-owned club financial models can be designed by analyzing financial reporting, including profit and loss statements, balance sheets, and income statements. Additionally, financial ratios, forecasting, and investment analysis can help to create a successful financial plan for private clubs. Using expense reports to track costs and organize taxes can aid in cost management and provide valuable insights for financial planning for future periods.

Private Members Club Financial Projection Expenses

Costs

Our financial planning services cater to member-owned private clubs and provide a comprehensive model for forecasting revenue streams and operating expenses. We offer efficient cash flow analysis, cost management, financial reporting, and investment analysis. Our expert team assists in creating profit and loss statements, balance sheets, and income statements. We also provide suitable financial ratios for effective decision making. Our template allows easy grouping of key expense areas and detailed expense forecasting for up to 60 months. Our pre-built forecasting curves anticipate changes in costs over time, providing a clearer financial picture for private clubs.

Capital Expenditure Plan

Financial planning for private clubs involves creating a member-owned club financial model, analyzing private club revenue streams, and managing private club operating expenses. Private club cash flow analysis, budgeting, cost management, financial reporting, and forecasting are crucial to ensure profitable operations. Private club investment analysis includes examining the profit and loss statement, balance sheet, and income statement, and calculating financial ratios. Understanding CAPEX investment is essential for private clubs to protect, develop and increase their competitiveness. This report reveals smarter investment choices, tailored to individual private club business models.

Loan Financing Calculator

Effective financial planning for private clubs involves analyzing various elements such as membership fees, revenue streams, operating expenses, and cash flow. This can be achieved through budgeting, cost management, financial reporting, and forecasting. Investment analysis and financial ratios aid in making informed decisions. Key financial documents include profit and loss statements, balance sheets, and income statements. By understanding and monitoring loan repayment schedules, private clubs can ensure cash flow sustainability and avoid unnecessary debts.

Private Members Club Income Statement Metrics

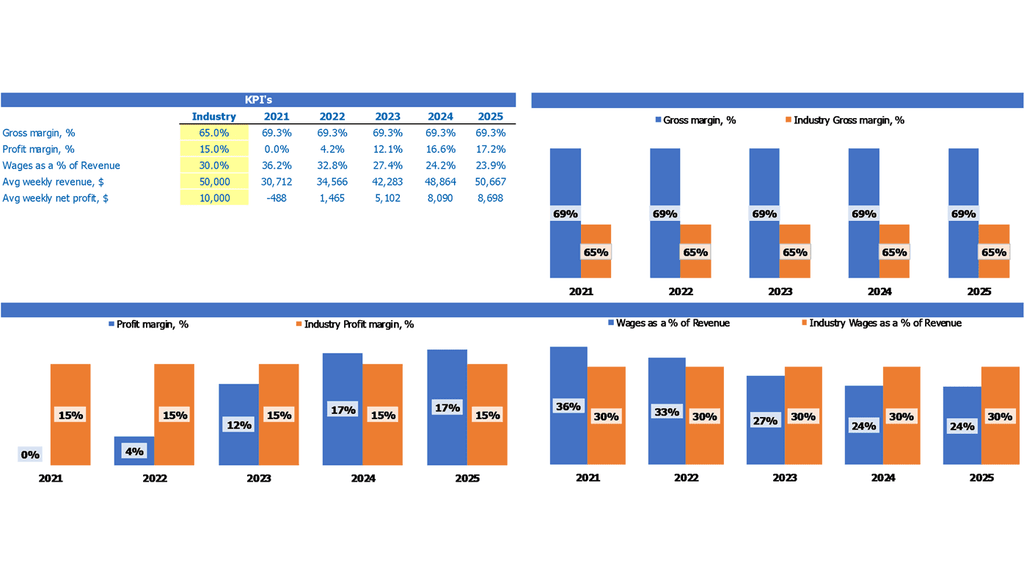

Performance KPIs

Financial planning for private clubs involves various aspects such as budgeting, cost management, and analyzing revenue streams. Private club membership fees and operating expenses play a critical role in determining the club's financial health. Conducting cash flow analysis, financial reporting, and forecasting, including investment analysis, is crucial for member-owned club financial models. Additionally, private club financial ratios, profit and loss statements, and balance sheets can help in evaluating the club's performance and return on equity. A pro forma balance sheet and profit and loss forecast are also useful metrics for calculating financial ratios for startup businesses.

Monthly Cash Flow Statement Format In Excel

Financial planning for private clubs involves analyzing the member-owned club financial model and identifying various revenue streams and operating expenses. With a cash flow analysis, budgeting, and cost management plan, private club owners can oversee their club's financial reporting regularly, including the profit and loss statement and balance sheet. Using financial ratios and investment analysis, owners can make data-driven decisions for future financial forecasting. By implementing strategic financial planning, private clubs can set membership fees appropriately and distribute finances efficiently to create a sustainable business model.

Business Benchmarks

Effective financial planning is critical for private clubs. Our member-owned club financial model includes comprehensive tools for budgeting, cost management, and financial reporting, including profit and loss statements, balance sheets, and income statements. We also utilize financial ratios and forecasting to help clubs make informed investment decisions. Our model has a unique tab that facilitates financial benchmarking, comparing a club's performance against industry competitors to determine its competitiveness, efficiency, and productivity. This helps clubs make informed decisions to optimize their revenue streams and operating expenses, as well as set membership fees that are equitable and sustainable.

Forecasted Profit And Loss Statement

Effective financial planning for private clubs involves creating a member-owned club financial model, analyzing private club revenue streams, operating expenses, and cash flow with a private club cash flow analysis. Utilizing private club budgeting, cost management, financial reporting, and a private club profit and loss statement, balance sheet, and income statement can effectively manage private club membership fees. Private club financial ratios and forecasting can provide valuable insights into private club investment analysis, ensuring financial stability and growth for the future. Implementing a dependable excel template for monthly P&L reports can provide security and convenience in forecasting future incomes.

Pro Forma Balance Sheet Template Excel

Financial planning for private clubs involves careful consideration of various factors such as member-owned club financial models, private club membership fees, revenue streams, operating expenses, cash flow analysis, budgeting, cost management, financial reporting, profit and loss statement, balance sheet, financial ratios, financial forecasting, and investment analysis. A well-designed financial model, such as the template Excel, provides an up-to-date overview of the club's financial position, linking balance sheets, cash flow projections, and profit-loss statements, all of which are critical for decision-making and investment analysis.

Private Members Club Income Statement Valuation

Pre Money Valuation Startup

Efficient financial planning is crucial for private clubs to remain profitable. This includes member-owned club financial models, budgeting, cost management, and financial reporting. Private club revenue streams such as membership fees, operating expenses, and cash flow analysis should be carefully analyzed. Profit and loss statements, balance sheets, financial ratios, forecasting, and investment analysis should also be taken into account. The use of professional tools such as templates for calculating WACC, DCF, and FCF can greatly assist business owners, creditors, and investors alike in assessing company viability and potential for growth.

Simple Cap Table

Financial planning for private clubs is crucial for their sustainability. A member-owned club financial model should include various revenue streams like membership fees or events. Private club operating expenses must be closely monitored, and cost management strategies should be implemented. Cash flow analysis, budgeting, and financial reporting should also be part of the financial plan. Profit and loss statements, balance sheets, and income statements should be regularly checked, and financial ratios should be analyzed. Financial forecasting and investment analysis can also provide valuable insights for private club managers.

Private Members Club Financial Model Excel Template Key Features

Simple and Incredibly Practical

Easily project your private club's financials with our user-friendly yet advanced Excel tool.

Update anytime

Private clubs can benefit from financial planning, including member-owned club financial models, analyzing revenue streams, managing expenses, and creating budgets, profit and loss statements, balance sheets, and financial ratios to forecast and analyze investments.

Get it Right the First Time

Maximize success with a private club's 5-year financial forecast model, analyzing revenue streams, expenses, ratios, and investment potential.

We do the math

Streamline private club financial planning with Profit Loss Projection's user-friendly features.

Save Time and Money

Efficiently plan and manage private club finances with our user-friendly financial template, avoiding complex formulas and external consultants.

Private Members Club Business Financial Model Template Advantages

Maximize private club profitability with a comprehensive financial plan incorporating budgeting, cost management, cash flow analysis, and investment analysis.

Streamline financial planning for private clubs with an all-in-one startup financial plan template that simplifies assumptions entry.

Enhance financial management for private clubs with Excel-based models.

Maximize private club financial management with an excel template that includes financial planning, analysis, and reporting.

Maximize your private club's financial potential through expert financial planning, cost management, and analysis of revenue streams and expenses.