ALL IN ONE MEGA PACK INCLUDES:

Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Bank Startup Budget Info

Highlights

This tool empowers financial institutions to create a comprehensive 5-year banking three statement model template using GAAP or IFRS formats. It includes the proforma income statement, financial statements, and financial ratios, allowing professionals to evaluate a bank's business model, banking strategy, banking revenue model, banking industry model, banking risk model, banking profitability model, banking performance model, banking cost model, banking valuation model, banking asset-liability model, banking capital model, banking liquidity model, and banking income statement model. Unlike other models, this tool is entirely unlocked, giving users the power to edit all details to fit their specific banking business needs. It is an essential tool for financial institutions looking to sell their business or want to gauge their potential revenue streams and financial viability.

The banking business model is complex and multifaceted, requiring financial institutions to carefully consider various factors when structuring their strategies to achieve profitability, manage risk, and maintain liquidity. One key aspect of this process is financial modeling for banks, which involves creating models to project revenue, costs, asset and liability management, capital needs, and other critical data points. By using a banking valuation model, for example, firms can assess the value of their assets and investments, while a banking risk model can help identify potential areas of risk and develop strategies to mitigate them. Other important modeling considerations include the banking income statement model, banking cost model, and banking liquidity model, among others. Ultimately, these models serve as invaluable tools for financial institutions seeking to maximize their performance and growth in an increasingly competitive industry.

Description

This efficient Excel Financial Model, crafted by expert professionals, offers comprehensive support in computing startup summaries, detailed monthly and yearly income statement templates, key expenses, and KPIs for meticulous analysis of banking business model. The bottom-up financial model for banks allows easy estimation of break-even sales, while the model's user-friendly design and structure ensure accurate determination of ROI, banking revenue model, and banking cost model.

Our professional team has created a dynamic bank business plan financial projections template excel that provides unique features, helping financial institutions calculate their cash flows, including startup summaries, detailed monthly and yearly profit and loss forecasts, NPV, cash inflow, and outflow, and ratios for comprehensive financial modeling for banks.

Bank Financial Plan Reports

All in One Place

Our financial modeling solution offers customizable features to cater to the distinct needs of various financial institutions, including banking business, strategy, revenue, risk, profitability, performance, cost, valuation, income statement, and asset-liability models. Our versatile five-year projection template in Excel is user-friendly and enables seamless modification, including the addition or deletion of assumptions as per your business requirements. Excel experts can tailor our financial planning model with ease.

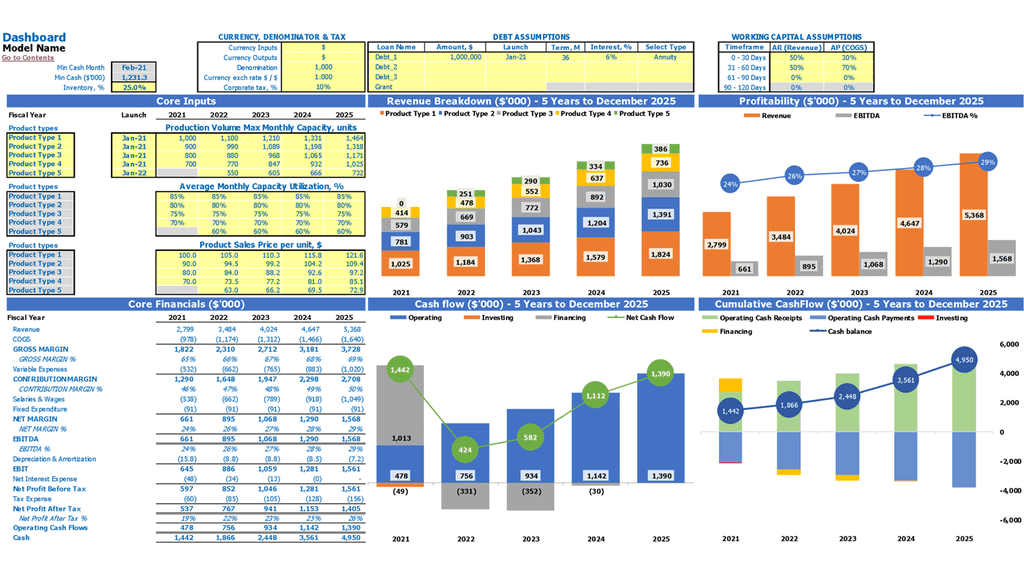

Dashboard

Our startup provides a comprehensive financial modeling solution for the banking industry. Our software includes various models such as the banking business model, revenue model, profitability model and risk model. We also offer models for asset-liability, capital and liquidity management. Our dashboard feature integrates all spreadsheets and proforma statements, simplifying the process of measuring key performance indicators. Users can customize their dashboard through month-by-month or year-on-year basis, providing real-time financial insights. Our financial modeling for banks is a valuable tool to optimize banking strategy and enhance overall performance.

Startup Financial Statements

Understanding a banking business model is essential for assessing its profitability and performance. Financial modeling for banks involves various factors, including banking industry models, banking risk models, and banking revenue models. A banking cost model, banking capital model, and banking liquidity model are crucial for managing a firm's capital management. Proper evaluation of a banking institution's asset-liability model and banking valuation model is also essential for effective banking strategy and decision-making. Additionally, accurately analyzing a banking income statement model helps identify the primary operating activities that contribute to revenue.

Sources And Uses Of Funds Statement

The banking industry relies on a diverse range of models to generate revenue and maintain profitability. From risk and liquidity modeling to income statement and asset-liability modeling, banks use data analysis to inform their business, financial, and strategic decision-making. Capital modeling is also critical for banks, ensuring that they raise and allocate funds in line with their objectives and obligations. Whether for internal guidance or stakeholder transparency, accurate financial modeling is essential for banks to achieve success in a rapidly evolving and competitive marketplace.

Break Even Point Calculation

Financial modeling is crucial for the banking industry to determine their banking business model and ensure profitability. They use various models such as banking strategy model, banking revenue model, banking risk model, banking profitability model, banking performance model, banking cost model, banking valuation model, banking asset-liability model, banking capital model, banking liquidity model, and income statement model. Financial modeling for banks assists in determining the break even point, sales volume required to cover costs, and the time needed for profitability, ensuring that the financial institution model is successful. These models help banks plan their developmental stages and adjust their strategies accordingly.

Top Revenue

Financial institutions rely on various banking models to evaluate and manage their operations. These models include banking business, revenue, profitability, risk, performance, cost, valuation, asset-liability, capital, and liquidity models. Financial modeling for banks is an essential tool for simulating potential scenarios to better understand their profitability and financial attractiveness. Additionally, firms use income statement models to forecast demand, better allocate resources and analyze revenue depth and bridges. By doing so, banks can make data-driven decisions, optimize their operations and achieve their desired financial outcomes.

Business Top Expense Categories

Transform your banking business with our comprehensive financial modeling tools that include banking industry, risk, profitability, and valuation models. Our asset-liability and income statement models come equipped with cost and revenue frameworks, while our liquidity and capital models help you manage your banking operations efficiently. Our Top expenses tab provides a user-friendly interface that lets you track expenses quickly and effortlessly. Use our banking strategy model to devise business strategies that lead to sustainable growth and profits in the long run. Take your banking institution to the next level with our bespoke financial modeling for banks.

Bank Financial Projection Expenses

Costs

Financial modeling plays a crucial role in determining the success of a banking institution. A well-designed banking business model, financial institution model and banking strategy model can support effective decision-making and optimize profitability. A banking revenue model, banking risk model, income statement model, asset-liability model, cost model, capital model, and liquidity model are just a few of the many models used in banking. Financial modeling for banks allows organizations to project future cash flow, forecast expenses and budget for up to five years, providing a clear understanding of the available finances.

CAPEX Budget

A comprehensive banking business model must include a capital model that outlines all expenditures to drive growth and improve performance. Unlike operating expenses, capital budgeting analysis focuses solely on development and expansion costs. Capital expenditure reports provide clarity on where to allocate resources and should be mentioned in any business model description. Because CAPEX spending varies significantly across businesses, it is essential to incorporate this aspect into banking industry models. Proper financial modeling for banks must include banking revenue and cost models, asset-liability and liquidity models, and banking risk models, among others.

Loan opt-in

Our financial modeling for banks encompasses various important models like banking business model, banking revenue model, banking profitability model, and banking risk model. Our diverse banking industry model includes banking cost model, banking valuation model, banking capital model, and banking liquidity model. We also offer banking performance model and banking income statement model. Besides, our comprehensive banking asset-liability model covers loan amortization schedule template that reflects your repayment schedule, and our business forecast template has pre-built formulas with instalment amount, principal and interest for each period.

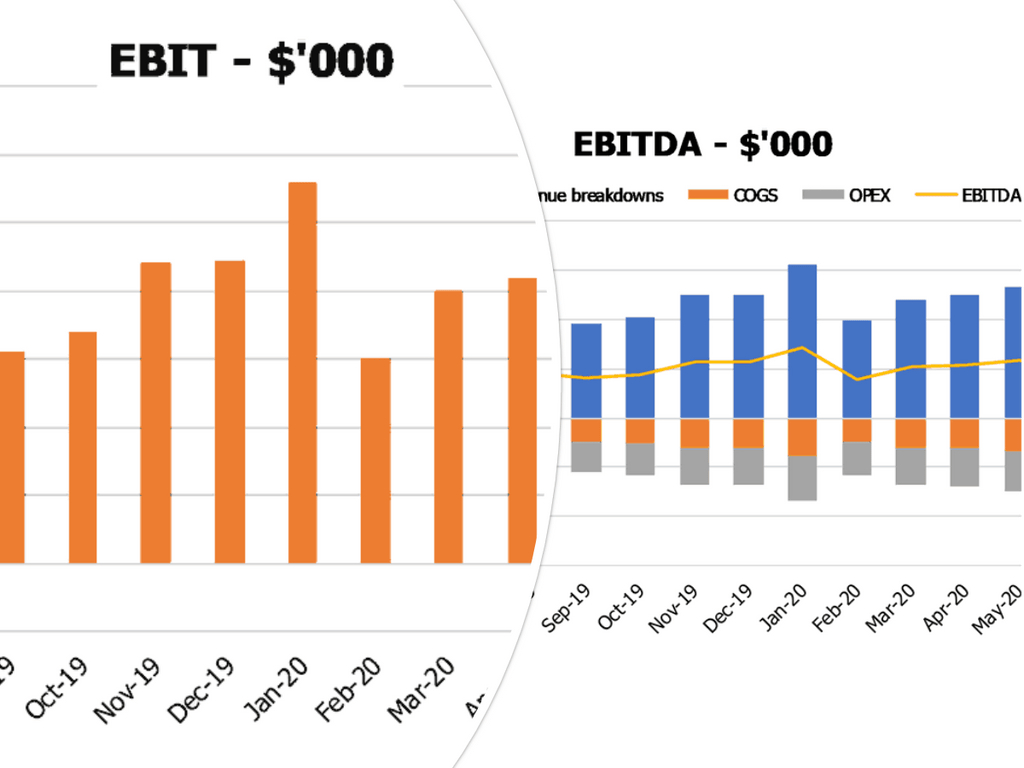

Bank Income Statement Metrics

Financial KPIs

In order to achieve business success, it is important for financial institutions to understand and implement various banking models such as banking revenue, risk, and profitability models. Additionally, banking KPIs provide critical insight into the financial performance of an institution and its cost structures. These metrics allow for a laser-focus on goals and targets, making them essential for both company owners and investors. Utilizing banking models and KPIs in financial projections templates is crucial for accurately assessing the overall health and success of a financial institution.

Excel Spreadsheet Cash Flow

Effective banking business models must incorporate financial institution, strategy, revenue, risk, profitability, performance, cost, valuation, asset-liability, capital, liquidity, and income statement models. An essential aspect of financial modeling for banks is the ability to manage cash flows and generate sufficient cash to settle liabilities, which banks evaluate through cash flow forecasting. Startups must comprehend that banking institutions demand assurances of loan repayment, highlighting the need for accurately projecting financial performance.

KPI Benchmarking Report

The use of financial models is essential in the banking industry. A banking business model includes various models like financial institution, revenue, risk, profitability, performance, cost, valuation, asset-liability, capital, liquidity and income statement models. Financial modeling is used to compare a bank's performance by taking average indicators from the industry. Benchmarking is a reliable method to evaluate a bank's productivity and set new standards of work. Banks are advised to utilize benchmarking to study all the features of their business and achieve their goals with minimal financial losses.

P&L Statement Excel

Developing a successful banking business model involves creating financial institution strategies that maximize revenue and profitability while managing risk and ensuring liquidity. Financial modeling for banks involves using various models such as banking asset-liability models, banking cost models, and banking valuation models to optimize performance. Our banking income statement model makes it easier for you to calculate your profit and loss statement, ensuring accurate projections and increased efficiency. With our automated projected profit and loss statement template, you can easily calculate actual and projected revenues, making financial planning a breeze.

Projected Balance Sheet Template Excel

Financial institutions use various models to evaluate their banking business, including banking revenue, risk, profitability, and valuation models. They also employ financial modeling for banks, asset-liability, capital, liquidity, and income statement models. These models help to determine their banking strategy, performance, and cost model, enabling them to assess their financial position accurately. A pro forma balance sheet is one of the financial statement formats that provide a summary of an entity's total assets, liabilities, and shareholders' equity at a specific period. Our excel projected balance sheet template allows financial institutions to record and evaluate their enterprise's financial position effectively.

Bank Income Statement Valuation

Startup Company Valuation

In the realm of banking, having a sound financial model is crucial. Financial institutions require precise calculations to determine their profitability and risk, and our excel template has all the necessary components to do just that. With a dedicated valuation tab, users can easily perform a Discounted Cash Flow calculation that takes into account the bank's Cost of Capital among other inputs. The result is a comprehensive view of the bank's performance, giving management a clear picture of how to move forward.

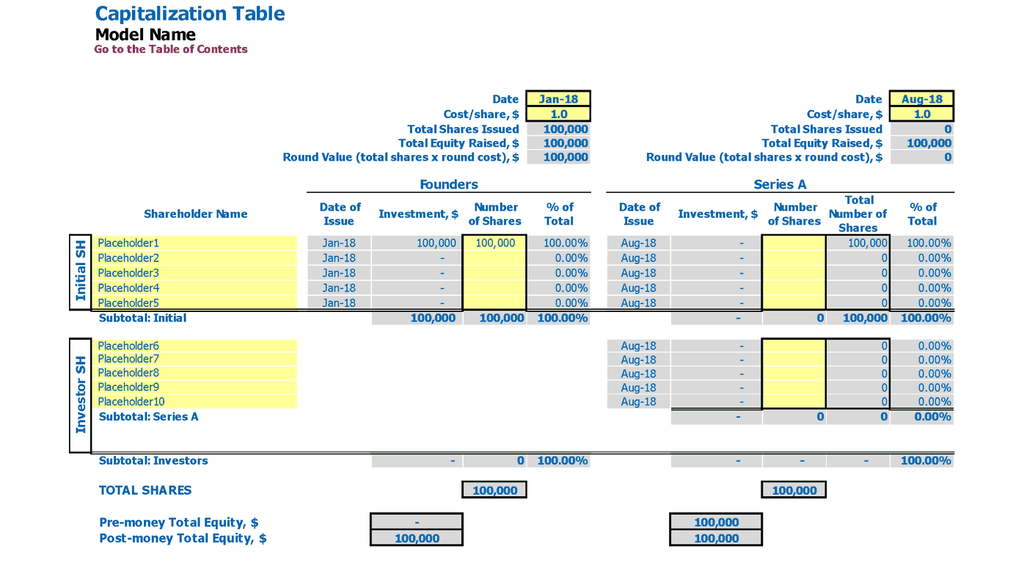

Cap Table Excel

The banking industry relies heavily on financial modeling to project revenue and evaluate risk. A strong banking business model considers factors such as profitability, performance, costs, and liquidity. Financial institutions use models such as the asset-liability model and the capital model to manage risk and ensure financial stability. Meanwhile, the income statement model helps evaluate revenue streams and identify opportunities for growth. By utilizing these various banking models, financial institutions can make informed decisions that support successful operations and sustained growth.

Bank Financial Plan Template Excel Key Features

Confidence in the future

Our financial modeling services help banks optimize their profitability and manage risks.

All necessary reports

Our Excel template streamlines the process of creating a comprehensive financial model for banks.

Predict the Influence of Upcoming Changes

Using a comprehensive banking business model can help financial institutions forecast performance and manage risks.

Identify potential shortfalls in cash balances in advance

The banking financial model template acts as a crucial early warning system for cash flow.

Avoid cash flow problems

Regular cash flow forecasting is crucial for maintaining the financial health of a business.

Bank Business Plan Forecast Template Advantages

Maximize your business potential with a comprehensive financial modeling plan tailored to your banking needs.

Improve decision-making with a comprehensive financial plan template for bank startups.

Create accurate financial projections with a comprehensive banking financial modeling tool.

Excel's Pro Forma Financial Statements Template aids in tracking progress and making informed decisions.

Adopting a pro forma template mitigates the risk of pursuing unfavorable opportunities in the banking industry.