ALL IN ONE MEGA PACK INCLUDES:

Personal Training Service Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Personal Training Business Plan Info

Highlights

A 5 year financial forecasting model is required for personal training businesses seeking to evaluate their startup idea or plan their startup costs. This model template is suitable for any size or stage of development, and minimal previous financial planning experience and basic knowledge of Excel is all that is needed for quick and reliable results. With this personal training service financial model, you can analyze revenue streams, budget expenses, and project financial performance metrics such as cash flow and return on investment for fitness coaching, gym financial planning, wellness programs, health coaching, nutrition coaching, strength training, weight loss services, exercise programs, and other healthy lifestyle services.

Developing a successful personal training business model requires careful fitness coaching finance planning and gym financial planning. Personal trainers need to consider multiple revenue streams, such as health coaching pricing strategy, wellness program cost analysis, fitness consulting profitability, strength training income analysis, and weight loss service cash flow. Proper fitness service budgeting and nutrition coaching return on investment analysis are also crucial components to consider. Physical fitness business metrics, like exercise program financial projections and healthy lifestyle service expenses, must be carefully tracked to ensure a profitable fitness instruction financial performance. Our 5-year personal training service projection plan is an affordable solution that calculates the necessary financial and valuation reports. By presenting investors with clear, actionable financial plans, you can secure the funding you need to succeed in the personal training business.

Description

Our personal training service financial modeling tool provides comprehensive financial analysis and reporting for investors and operational management. With this excel financial model template, you can create a financial plan for your business, estimate initial capital investment and working capital requirements, forecast monthly sales and expenses, and generate a 5-year financial projection. This personal training service excel tool includes a built-in revenue forecast, a 60-month in-depth 3-statement financial model, KPIs charts, valuation and key metrics calculations. You can easily adjust input assumptions to fit your business needs and the excel tool will automatically calculate all outputs. This model does not require any professional finance knowledge or technical skills and can be used by anyone for planning and operating a successful personal training business.Personal Trainer Business Reports

All in One Place

Our comprehensive personal training business model financial template allows for more accurate and informed fitness coaching finance planning. It integrates foundational financial reporting, including income and expenditure templates, pro forma balance sheets for start-ups, and cash flow statements in Excel. Unlike simplified models that use only profit and loss projections, our 5-year cash flow projection template provides scenario planning and analyses how changes in your business model impact monthly profit and loss, projected balance sheets, and cash flow. This allows for better health coaching pricing strategies, wellness program cost analysis, and improved fitness consulting profitability.

Dashboard

Transparency is key to success in the personal training business model. Sharing your financial planning, projections, and performance metrics with stakeholders builds trust and allows for valuable feedback that can improve the bottom line. Giving stakeholders access to cash flow statements, budgeting, and pricing strategies can also deepen your understanding of the business model and its potential for profitability. Don't overlook the importance of analyzing revenue streams from fitness coaching, wellness programs, nutrition coaching, and other healthy lifestyle services. Utilize financial performance metrics to optimize your gym's financial planning and strength training programs.

Business Financials Template

As an owner of a personal training business, it's important to have a solid financial plan in place. This includes creating a budget for fitness coaching, analyzing the cost of wellness programs and establishing pricing strategies for health coaching. It's also essential to consider the various revenue streams of personal training, such as strength training income and weight loss service cash flow. Using financial statements such as the income statement, balance sheet and cash flow statement can help to better understand the financial performance and profitability of the physical fitness business.

Sources And Uses Of Funds Statement

Sound financial planning is key to running a successful personal training business. Understanding revenue streams and expenses is crucial in creating a profitable fitness coaching business model. Fitness professionals must calculate costs and develop pricing strategies for health coaching and wellness programs, while analyzing the return on investment for nutrition coaching and weight loss services. Strength training and exercise program financial projections should be regularly reviewed to ensure profitability, while careful tracking of sources and uses of income will provide valuable insight into a physical fitness business's financial performance. Utilizing effective business metrics will help drive financial success.

Break Even Revenue Calculator

Using the CVP chart in your pro forma projection is essential to determine when your fitness coaching business will become profitable. This calculation highlights the point at which your company's revenue exceeds expenses, providing insight into your breakeven sales in dollars. With a solid understanding of your financial planning, from gym expenses to health coaching pricing strategies, you can efficiently manage your personal training revenue streams. By analyzing metrics such as strength training income and weight loss service cash flow, you can accurately project financial performance and optimize your fitness instruction for maximum return on investment.

Top Revenue

Successful personal training businesses rely on careful financial planning and analysis of revenue streams. Fitness coaching finance, gym financial planning, and fitness service budgeting all play a role in the personal trainer's revenue streams. Pricing strategies for health coaching, wellness programs, and weight loss services require careful cost analysis. Fitness consulting profitability and income analysis for strength training are also essential metrics. Additionally, healthy lifestyle services such as nutrition coaching should always strive for a high return on investment. Engaging and professional financial performance metrics are necessary for any physical fitness business to achieve sustained success.

List of Top Expenses

This comprehensive financial model template provides insight into the company's budgeting and financial planning for fitness services. It breaks down the expenses into four categories, including attracting customers and paying employees. The strength training income analysis and healthy lifestyle service expenses are all covered in this model. Additionally, it includes pricing strategies and cost analysis for nutrition coaching and weight loss services. Overall, this model helps personal trainers and fitness coaches understand their revenue streams, financial performance, and profitability metrics within the fitness industry.

Personal Training Business Expenses

Costs

Our financial planning tools, including the startup costs spreadsheet and financial projections template, are essential for personal training businesses and fitness coaching finance. We help businesses identify and focus on weak areas, such as limited resources and funding, while highlighting expenses essential for connecting with investors and securing loans. Our services include budgeting, cost analysis, pricing strategies, and return on investment analysis for wellness programs, strength and weight loss services, and nutrition and health coaching. Our physical fitness business metrics guide businesses to financial success, ensuring profitability and sustainable cash flow.

Start Up Budget

Maximizing profits within a personal training business model requires thorough financial planning and analysis. Personal trainers must carefully evaluate revenue streams, budget for fitness services, analyze costs for wellness programs, and develop pricing strategies for health coaching and nutrition services. Understanding financial projections and analyzing cash flow for strength training, weight loss services, and exercise programs is critical in tracking business metrics and measuring financial performance. As with any business, investing in capital expenditures is necessary to improve performance and expand offerings. Effective asset acquisition and management can help ensure long-term success for personal trainers and fitness professionals.

Loan Repayment Schedule

As a personal training business owner, you need to have a sound financial plan to stay afloat in the competitive fitness market. This involves careful budgeting for fitness services, analyzing the cost of wellness programs, developing pricing strategies for health coaching, and identifying revenue streams for personal trainers. To maximize profitability, you should also conduct income and expense analysis for strength training, weight loss, nutrition coaching, and fitness instruction. By monitoring key metrics such as cash flow, return on investment, and financial performance, you can make informed decisions to grow your physical fitness business.

Personal Training Financial Plan Metrics

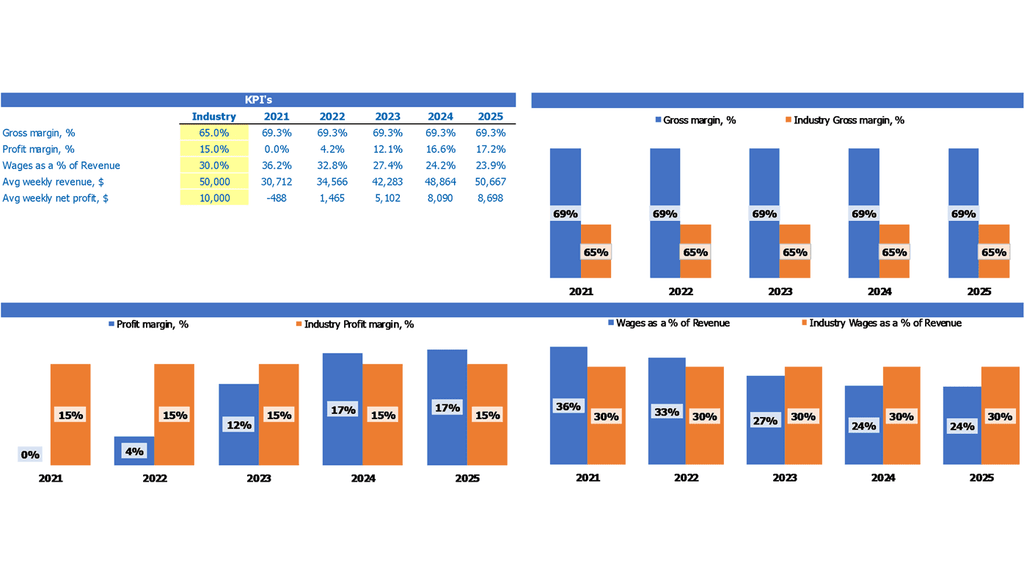

Performance KPIs

In order to build a successful personal training business model, it is crucial to have a solid understanding of fitness coaching finance. From gym financial planning to personal trainer revenue streams, it is important to prioritize fitness service budgeting. Factors such as health coaching pricing strategy, wellness program cost analysis, and fitness consulting profitability all play a role in the strength training income analysis and weight loss service cash flow. When creating exercise program financial projections, it is important to consider healthy lifestyle service expenses and nutrition coaching return on investment. Keep track of physical fitness business metrics, including fitness instruction financial performance, to ensure success in the industry.

Cash Flow Forecasting Tools

Effective financial planning is crucial for the success of any personal training business. As a fitness coach or personal trainer, it is essential to understand the various revenue streams that contribute to your income. It is vital to establish a pricing strategy that makes your fitness service accessible and profitable, while also analyzing the costs and cash flow associated with your wellness program. Understanding business metrics like return on investment, income analysis, and financial projections can help you plan for strength training, weight loss, nutrition coaching, and other healthy lifestyle services that maximize profitability and meet your financial goals.

KPI Benchmarks

Maximizing revenue and profitability in the personal training business model requires smart financial planning. Analyzing revenue streams, budgeting expenses, and assessing pricing strategies for fitness coaching and wellness programs are essential for success. Tools like Excel templates can aid in financial projections, cost analyses, and income analysis for strength training, weight loss services, and nutrition coaching. By utilizing fitness consulting metrics and return on investment analysis, personal trainers can optimize their financial performance and build a sustainable business. Benchmarking against industry standards and successful competitors can provide valuable insights to guide future growth.

Proforma Income Statement

Financial planning is essential for any personal training business model. Use tools such as a 5-year cash flow projection template to project profit and loss statements, net income percentages, and gross margins. This analysis helps assess business prospects and sets expectations for profit. By understanding your financial position, you gain the confidence to make informed decisions and strengthen your operations. Proper budgeting and return on investment analysis for fitness coaching, wellness programs, and nutrition coaching are key to maximizing profitability. Use physical fitness business metrics to measure financial performance, including revenue streams from strength training, weight loss services, exercise programs, and more.

Projected Balance Sheet Template Excel

For any personal training business model, financial planning and analysis play a crucial role. It's important to create revenue streams, budget expenses, and analyze profitability. Metrics such as cash flow, income analysis, and return on investment are also significant factors. Additionally, a pricing strategy for health coaching should be considered, along with cost analysis for wellness programs and nutrition coaching. When creating financial projections, the balance sheet forecast is a vital tool. Providing information on assets, liabilities, and equity, it is necessary for calculating essential ratios. Understanding these factors can ensure viable financial performance and success.

Personal Training Financial Plan Valuation

Startup Valuation Revenue Multiple

Our personal training business model provides comprehensive fitness coaching finance services, including gym financial planning and personal trainer revenue streams. We also offer fitness service budgeting and health coaching pricing strategies, wellness program cost analysis, and fitness consulting profitability. Our strength training income analysis and weight loss service cash flow solutions help with exercise program financial projections while our healthy lifestyle service expenses and nutrition coaching return on investment can elevate your fitness instruction financial performance. Our physical fitness business metrics enable you to make informed decisions about your business. Our ready-made seed stage valuation template with the three-way financial model offers investors an overview of your business's financial health.

Cap Table

Entrepreneurs in the personal training industry must stay on top of their financial planning game. From budgeting and pricing strategies to cost analyses and income projections, it's important to focus on metrics that truly matter, such as revenue streams, cash flow, and return on investment. Establishing a solid business model that includes strength training, weight loss services, health and wellness programs, and nutrition coaching is key to achieving financial success. Along with monitoring financial performance, fitness professionals must also strive to keep track of their cap table, allowing them to make informed decisions about funding, employee options, and acquisition offers.

Personal Training Service Pro Forma Template Excel Key Features

It is part of the reports set you need

Create a 5-year cash flow projection for your fitness business to ensure sustainable growth and minimize risk.

Gaining trust from stakeholders

Incorporate monthly projected cash flow statements to build investor confidence in your fitness business.

Print-ready Reports

Maximize your personal training business model with comprehensive financial planning and analysis tools, such as income projections, cash flow templates, and financial ratios.

Currency for inputs and denomination

Specify currency and denomination preferences in financial models for startups.

Predict the Influence of Upcoming Changes

Use financial planning tools like cash flow charts and forecasting to make informed decisions for your fitness business.

Personal Training Service Financial Plan Template Excel Advantages

Maximize revenue with a 5-year financial projection template tailored to your personal training business.

Utilize financial projection templates to identify payment issues in your personal training business.

Maximize revenue streams and profitability by utilizing a comprehensive financial plan for your personal training business.

Conduct financial analysis using 2 valuation methods to model a profitable personal training business.

Maximize your profits by utilizing a comprehensive financial model to calculate startup costs for your personal training business.