ALL IN ONE MEGA PACK INCLUDES:

Industrial Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Industrial Bank Startup Budget Info

Highlights

A financial model for an industrial bank is vital to ensuring its success. This model should take into account an industrial bank business model, revenue and profitability models, as well as growth, lending and investment models. Additionally, an industrial bank is required to have a strong risk management model, one for asset-liability management, as well as capital adequacy, credit risk, liquidity risk, and interest rate risk models. Stress testing and regulatory compliance models are also important for industrial banks to stay within regulatory limits.

Our software generates an industrial bank financial modeling excel template automatically, which includes cash flow pro forma, financial dashboard, and core metrics in GAAP/IFRS formats, covering five years. This is a great industrial bank startup financial projection template for evaluating startup ideas, planning pre-launch expenses, and securing funding from banks, angels, grants, and VC funds. Moreover, the template is unlocked and editable, providing you with complete control over your financial plans.

An industrial bank's revenue model is based on its lending and investment activities, while its profitability model relies on effective risk management, asset-liability management, and regulatory compliance. The capital adequacy model ensures that the bank can withstand financial stress and meet regulatory requirements. The credit risk model is used to evaluate the creditworthiness of borrowers and manage credit risk exposure, while the liquidity risk model ensures sufficient funding to meet obligations. The interest rate risk model is used to manage interest rate volatility and its impact on net interest income. Lastly, the stress testing model is employed to assess the potential impact of severe economic shocks on the bank's financial health.

Description

Our industrial bank business model includes multiple financial models to ensure profitability and growth. Our revenue model focuses on lending and investment income, while our profitability model considers asset-liability management and capital adequacy. We also have credit, liquidity, and interest rate risk models, as well as stress testing and regulatory compliance models, to assess potential challenges and make informed decisions. Our industrial bank lending model emphasizes responsible lending practices to reduce risk and maintain customer satisfaction. Overall, our comprehensive financial models allow us to project and manage the financial health of our industrial bank.Industrial Bank Financial Plan Reports

All in One Place

An industrial bank's success greatly relies on its financial model. A sound revenue model, lending and investment model, solid risk management and asset-liability and credit risk models all contribute to its profitability, growth and capital adequacy. To meet regulatory compliance, stress testing is crucial to an investment's viability. Investors want to see the numbers, which is why a financial projection template in Excel is essential. Without a concrete business plan and 3-way financial model, investors are unlikely to support start-ups. Crafting a carefully planned financial projection template Excel can make all the difference.

Dashboard

Create a comprehensive financial model for your industrial bank with our template. Our model includes revenue, profitability, growth, lending, investment, risk management, asset-liability management, capital adequacy, credit risk, liquidity risk, interest rate risk, stress testing, and regulatory compliance models. Our dashboard feature consolidates all information from the other spreadsheets and proforma statements, allowing you to choose and set KPIs. The dashboard automatically gathers financial reporting information and calculates it for the specified period. Customize the dashboard to fit your preferences and change it as needed.

Company Financial Reports

Our Industrial Bank Business Model incorporates a comprehensive Financial Model, Revenue Model, Profitability Model, Growth Model, Lending and Investment Model, Risk Management Model, Asset-Liability Management Model, Capital Adequacy Model, Credit Risk Model, Liquidity Risk Model, Interest Rate Risk Model, Stress Testing Model, and Regulatory Compliance Model. Our models automatically generate the essential annual financial statements, which are tied to the main assumptions. Upon updating the assumptions with your desired inputs, the model reflects your company's financials.

Source And Use Of Funds

The financial projection of an industrial bank outlines diverse models that ensure its growth, profitability, and regulatory compliance. These models include the lending, investment, risk management, and revenue models, among others. In particular, the asset-liability, capital adequacy, and credit risk models ensure the bank's stability, while the stress testing and liquidity risk models protect against systemic shocks. Moreover, the Sources and Uses of Capital statement, a key part of the 5-year financial projection, discloses the sources and purposes of the bank's funds, reassuring stakeholders of prudent financial management.

5 Year Breakeven

Our industrial bank's success depends on a solid financial model that takes into account revenue, profitability, growth, lending, investment, risk management, and compliance. To ensure our bank's sustainability, we use different models such as the asset-liability management model, credit risk model, liquidity risk model, and stress testing model. Additionally, we prioritize our capital adequacy model to ensure sufficient reserve requirements are met. By using our break-even analysis, investors can evaluate the required sales volume to ensure a return on investment and a timeframe for success.

Top Revenue

An industrial bank's financial success depends on carefully planned revenue, profitability, growth, lending, and investment models. A comprehensive approach includes risk management, asset-liability and capital adequacy modeling, credit and liquidity risk assessment, interest rate and stress testing models, and regulatory compliance. To accurately project future revenue streams, it's essential to examine historical data and incorporate growth rate assumptions. For detailed financial planning, our financial model business plan offers all necessary components for ensuring the industrial bank's long-term success.

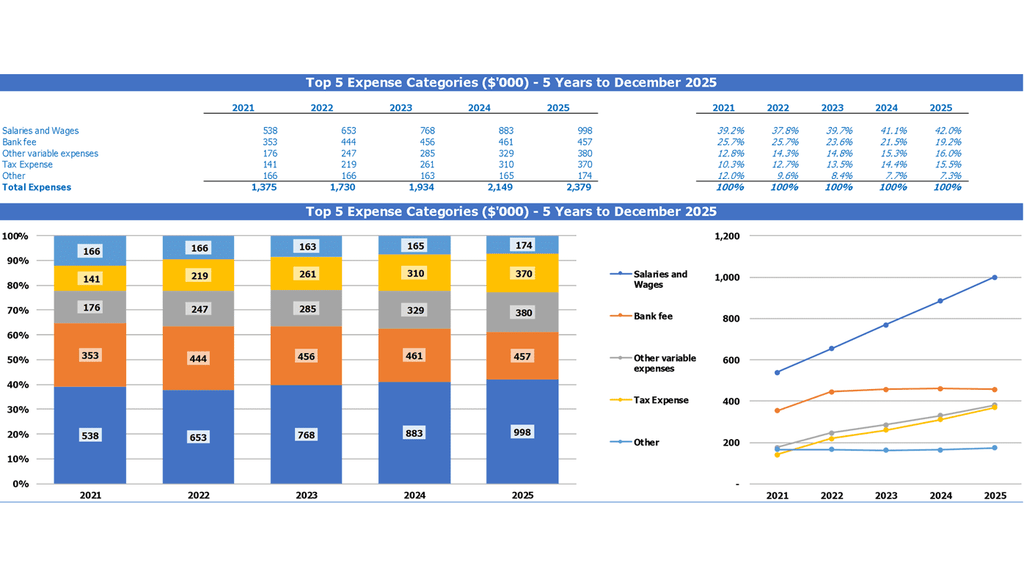

Business Top Expense Categories

Industrial bank's success depends on a well-defined business model that incorporates diverse financial strategies. An effective financial model for industrial banks should encompass revenue and profitability models that work towards ensuring sustainable growth. Additionally, effective lending and investment models should reduce risks by implementing asset-liability management, capital adequacy, and credit risk models. Industrial banks should invest in modeling interest rate, liquidity, and stress-testing models for robust risk management. Regulatory compliance models should also be incorporated to ensure that the bank complies with various financial regulations.

Industrial Bank Financial Projection Expenses

Costs

An efficient and effective industrial bank requires a robust financial model to ensure its success. The revenue, profitability, growth, and lending models must align with its investment, risk management, asset-liability management, capital adequacy, credit risk, liquidity risk, interest rate risk, stress testing, and regulatory compliance models. A well-integrated industrial bank business plan financial projections template helps to identify and address the company's weaknesses, thereby allowing it to improve and achieve its goals. Additionally, clear and organized communication of expenses is crucial when seeking investments or applying for loans during the startup phase.

Start Up Budget

The industrial bank business model requires a thorough financial model for revenue, profitability, growth, lending, and investment. The asset-liability management model maintains balance, while the capital adequacy model ensures solvency. Credit risk and liquidity risk models are necessary, as are interest rate risk and stress testing models. Regulatory compliance models help to avoid penalties or fines. Investment expenditures are often necessary, and a financial projection template can be a valuable tool in determining the outlook for capital expenditure, credit costs, and startup costs.

Loan Financing

An industrial bank's success heavily relies on their revenue, profitability, growth, and risk management models. To ensure financial stability, they need to have effective lending and investment models, as well as asset-liability and capital adequacy management models in place. Credit and liquidity risk models along with interest rate and stress testing models are necessary to mitigate potential risks. Compliance with regulations is also critical. A financial forecast that includes an amortization plan with pre-built algorithms can help manage repayment schedules, and our excel template has the necessary tools for this.

Industrial Bank Income Statement Metrics

Profitability KPIs

In creating a financial model for an industrial bank, it is important to consider the various aspects that contribute to its success. This includes revenue, profitability, growth, lending, investment, and risk management models, as well as capital adequacy, credit risk, liquidity risk, interest rate risk, stress testing, and regulatory compliance models. One key metric to focus on is the internal rate of return (IRR), which measures the return on investment generated by the bank's net cash flow. A higher IRR can make the bank more appealing to investors and stakeholders.

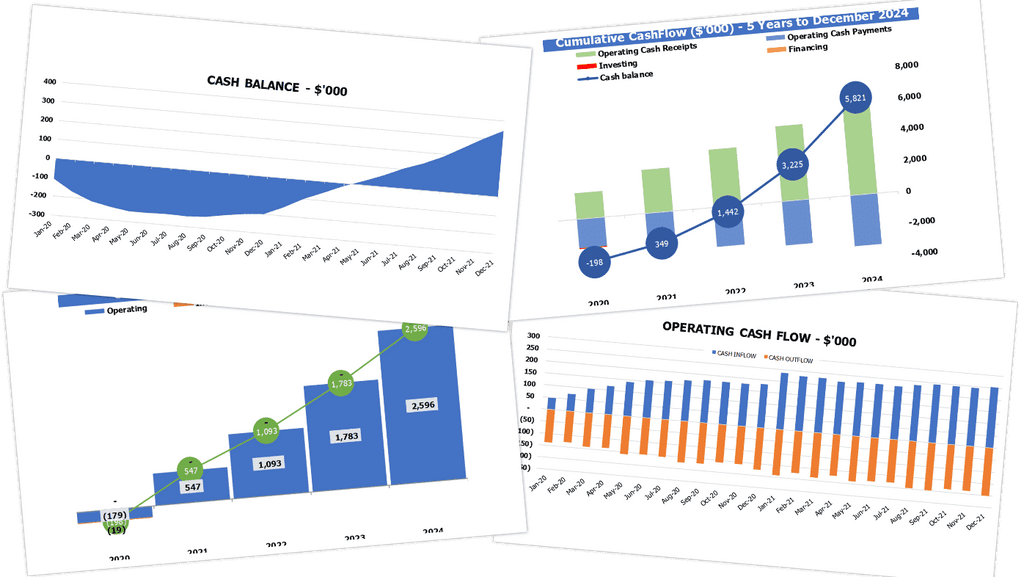

Cash Flow Budgeting And Forecasting

The financial model for an industrial bank is complex and involves various components such as revenue, profitability, growth, lending, and investment. To ensure sustained success, an industrial bank must also have a robust risk management system in place, which includes asset-liability management, capital adequacy, credit risk, liquidity risk, interest rate risk, stress testing, and regulatory compliance models. These models help in assessing the bank's performance and identifying potential areas of improvement while also ensuring that it maintains a healthy cash flow position to attract more funding opportunities.

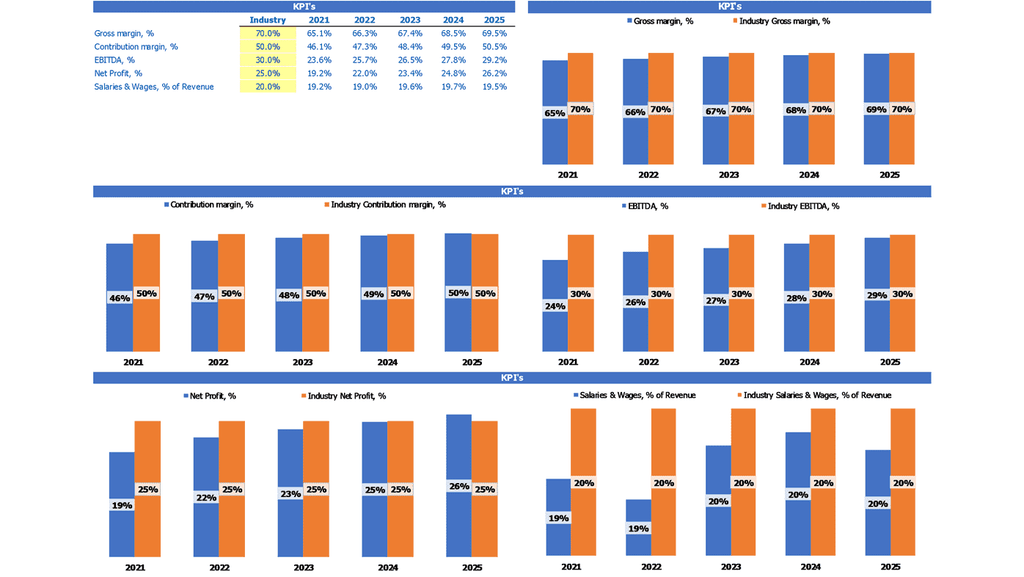

KPI Benchmarking Report

Creating a successful financial model for an industrial bank requires careful consideration of various elements including lending, investment, risk management, growth, and profitability. An effective revenue model is also essential. In addition, the bank must adhere to regulatory compliance, maintain capital adequacy, and employ asset-liability management and credit risk models. Proper implementation of interest rate risk and liquidity risk models is also necessary. Finally, stress testing is critical to ensure the bank can withstand various scenarios. Understanding the importance of benchmarking in this process is vital to achieving financial success and consistently improving the institution.

Profit Loss Projection

An industrial bank's success largely depends on its business model. A financial model for an industrial bank is essential to determine revenue and profitability. The lending and investment model must ensure risk management and asset-liability management. A strong capital adequacy model is needed to meet credit and liquidity risk factors. Comprehensive stress testing models are needed to prepare for economic downturns that impact regulatory compliance. Proper establishment of the models mentioned above determines the growth of an industrial bank.

Pro Forma Balance

An industrial bank's success heavily relies on its business model. The revenue, profitability, growth, lending, and investment models are key factors that determine its success. In addition, risk management, asset-liability management, capital adequacy, credit risk, liquidity risk, interest rate risk, stress testing, and regulatory compliance models are essential for mitigating risks and ensuring compliance. An industrial bank should prioritize developing a robust and adaptable financial model to project its financials and propose strategies based on current data for making informed decisions.

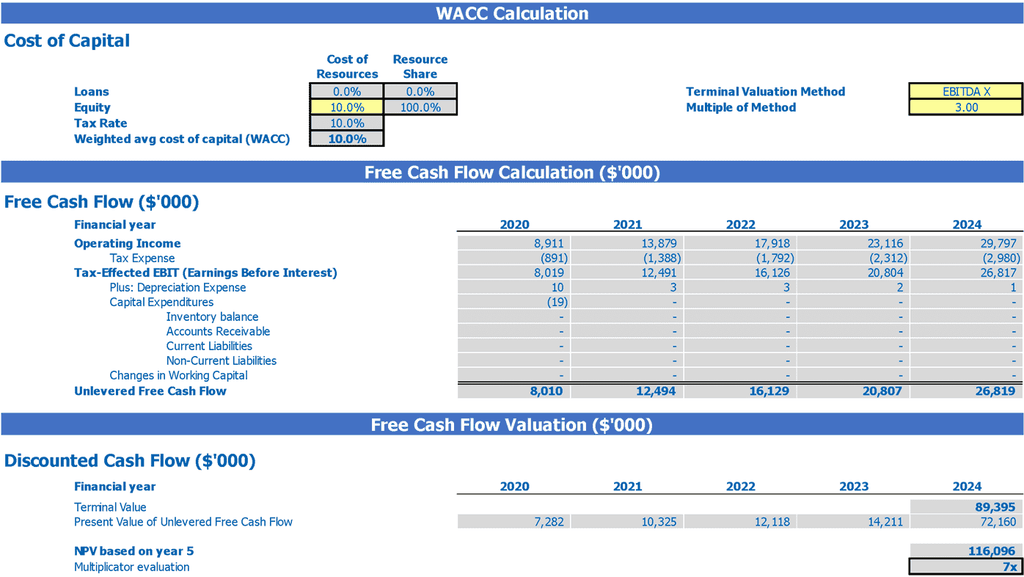

Industrial Bank Income Statement Valuation

Seed Valuation

Our industrial bank financial model encompasses various aspects such as revenue, profitability, growth, lending, investment, risk management, asset-liability, capital adequacy, credit and liquidity risk. It also includes interest rate and stress testing, as well as regulatory compliance. Our 5-year cash flow projection template offers a choice between two valuation methods, the discounted cash flow (DCF) or weighted average cost of capital (WACC), to determine the forecasted financial performance of the business. These tools aid in making informed decisions for enhancing the bank's financial stability and success.

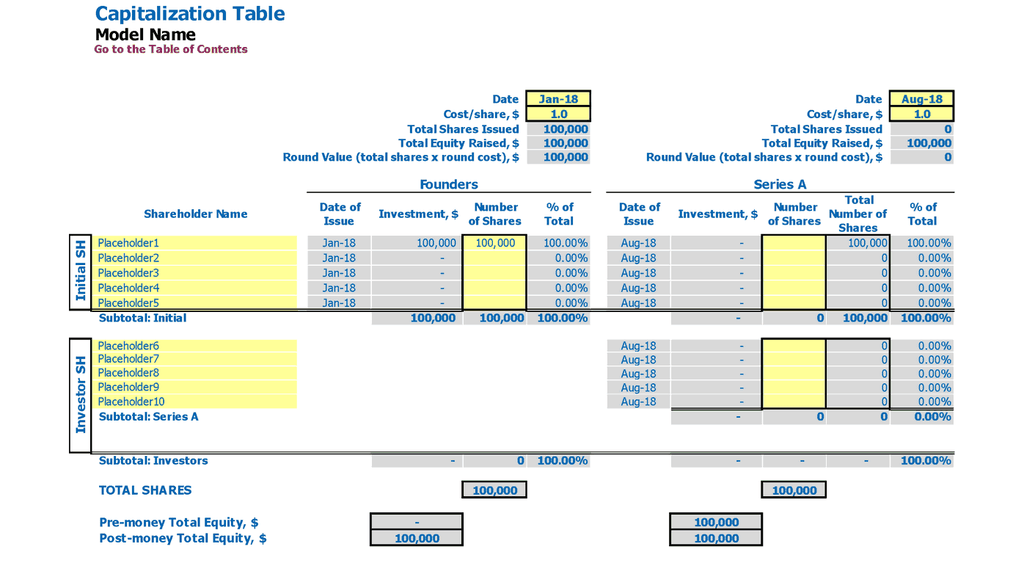

Capitalization Table

Our industrial bank business model encompasses various financial models to ensure profitability and growth. Our lending and investment models prioritize risk management and regulatory compliance. Our revenue model focuses on interest income and fees generated from our services. Our asset-liability and capital adequacy models help maintain our financial stability. Our credit risk, liquidity risk, interest rate risk, stress testing, and regulatory compliance models ensure the safety of our investments and operations. Furthermore, our financial plan template integrates cap table models into our cash flows, demonstrating the impact of funding rounds on equity and dilution.

Industrial Bank Business Financial Model Template Key Features

Integrated Model to convince Investors

Xls Business Plan Template streamlines industrial bank financial models for investor-friendly presentations.

Prove You Can Pay Back the Loan You Requested

The industrial bank's profitability, growth, and risk management models are crucial for its success.

Identify cash gaps and surpluses before they happen

Developing a comprehensive financial model is crucial for an industrial bank to ensure profitability, growth, and regulatory compliance.

Easy to follow

The industrial bank financial model template includes 15+ separate tabs, each with a specific planning category.

Confidence in the future

Our financial model helps plan, manage risks, forecast cash flow, and assess prospects for industrial banks.

Industrial Bank Financial Model Startup Advantages

This financial plan template promotes team alignment for startup success.

The Industrial Bank's Revenue Model efficiently predicts cash balance deficiencies.

The Three Statement Model Template anticipates cash gaps and surpluses for an industrial bank.

A startup develops a comprehensive financial model for an industrial bank, covering payroll, expenses, benefits, taxes, and regulatory compliance.

Create a comprehensive 5-year financial model for an industrial bank, incorporating cost assumptions and plans for growth, risk management, and regulatory compliance.