ALL IN ONE MEGA PACK INCLUDES:

Internet Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Internet Bank Startup Budget Info

Highlights

Impress investors and raise capital for your early-stage startup with a five-year horizon projection template for your internet bank business. This model will help you evaluate your business and make necessary adjustments before selling it. Unlock and edit all aspects of the template to showcase your online banking model, digital banking financial model, mobile banking strategy, banking technology solutions, virtual banking strategy, digital transformation in banking, fintech partnerships, digital lending solutions, banking platform integration, and online financial services. Stay ahead of internet banking trends and banking industry disruption with innovative financial technology solutions that focus on transforming banking services and enhancing banking customer experience.

A solid financial model is essential for impressing bankers and investors in the banking industry. With the growing trend of online banking, digital banking, and mobile banking strategies, it is necessary to transform banking services, customer experiences, and platform integrations. Banking industry disruption has paved the way to financial technology innovation, such as virtual banking strategies and digital lending solutions, as well as fintech partnerships. Incorporating banking technology solutions and online financial services have become crucial for banking institutions to stay competitive in the market. To achieve success, it is essential to keep up with internet banking trends and adopt a digital transformation in banking.

Description

The banking industry disruption and financial technology innovation have paved the way for digital transformation in banking. As a result, virtual banking strategy and online financial services have become the norm. To stay ahead of the game, banking platform integration and fintech partnerships are crucial for banking services transformation. Mobile banking strategy and banking customer experience are also key in the digital banking financial model. Digital lending solutions are also becoming increasingly popular. Our banking technology solutions can help you navigate these internet banking trends and optimize your business performance.Internet Bank Financial Plan Reports

All in One Place

In today's banking industry, the focus is on digital transformation and fintech partnerships to meet the needs of tech-savvy consumers. Online banking models and mobile banking strategies are on the rise, and banking technology solutions are being developed to enhance the customer experience. Banking services transformation and virtual banking strategies are major trends, and banks are increasingly integrating their platforms for easy access to financial services. Innovative digital lending solutions are also being adopted by banks. Our cash flow projection template excel is a great tool for designing your start-up financial plan, regardless of your level of financial expertise.

Dashboard

In the banking industry, digital transformation is disrupting traditional banking services. An online banking model coupled with a mobile banking strategy is now necessary to improve the banking customer experience. Internet banking trends are changing rapidly and a banking technology solution strategy is needed to integrate digital lending solutions and virtual banking platforms. Fintech partnerships are becoming more prevalent, as the banking services transformation relies on financial technology innovation. Banking platform integration will help create an all-in-one financial dashboard for financial professionals to assess company financial data accurately and provide real-time insights to the management and stakeholders.

Startup Financial Statement

Our expertly crafted digital banking solutions incorporate cutting-edge financial technology innovation and industry trends to transform the customer banking experience. We offer virtual banking strategies that integrate seamlessly with mobile and online banking models, while also leveraging fintech partnerships and digital lending solutions. Our banking platform integration makes it easy for customers to access online financial services through a streamlined digital platform, and we constantly strive to disrupt the banking industry with strategic financial services transformation. Our team of specialists takes care of the technical details, ensuring a professionally polished customer experience.

Sources And Uses Table

The banking industry has undergone a digital transformation, with a shift towards virtual banking strategies, online financial services, and mobile banking solutions. The advent of financial technology innovation has disrupted traditional banking models, and banking technology solutions are continuously integrated into banking platform services. The banking customer experience is enhanced with digital lending solutions and fintech partnerships. Internet banking trends show an inclination towards digital banking financial models, driving banking services transformation. The focus is on banking platform integration and digital convenience to improve the overall customer experience. A feasibility study is necessary to understand the investments that companies need to make to stay financially productive and increase revenues.

Break Even Sales Calculator

Utilizing financial models like CVP and break-even analysis can greatly improve a company's chances of success. By understanding the relationship between fixed and variable costs and revenue, management can make informed decisions about pricing and sales targets. As digital transformation continues to shape the banking industry, online banking models, mobile banking strategies, and virtual banking strategies are becoming increasingly popular. To stay ahead of the curve, banking technology solutions and partnerships with fintech innovators can help banks transform their services and enhance their customer experience with digital lending solutions and banking platform integration.

Top Revenue

Maximize your company's revenue with the help of our online financial services and banking technology solutions. With the changing internet banking trends and banking services transformation, implementing a virtual banking strategy and digital transformation in banking is crucial. Our banking platform integration and fintech partnerships can further enhance the banking customer experience. Additionally, our digital lending solutions can revolutionize the banking industry disruption. Our digital banking financial model and mobile banking strategy can be instrumental in financial technology innovation. With our assistance, you can have a clear projection of your revenue streams with the Top revenue tab and projected cash flow statement template excel.

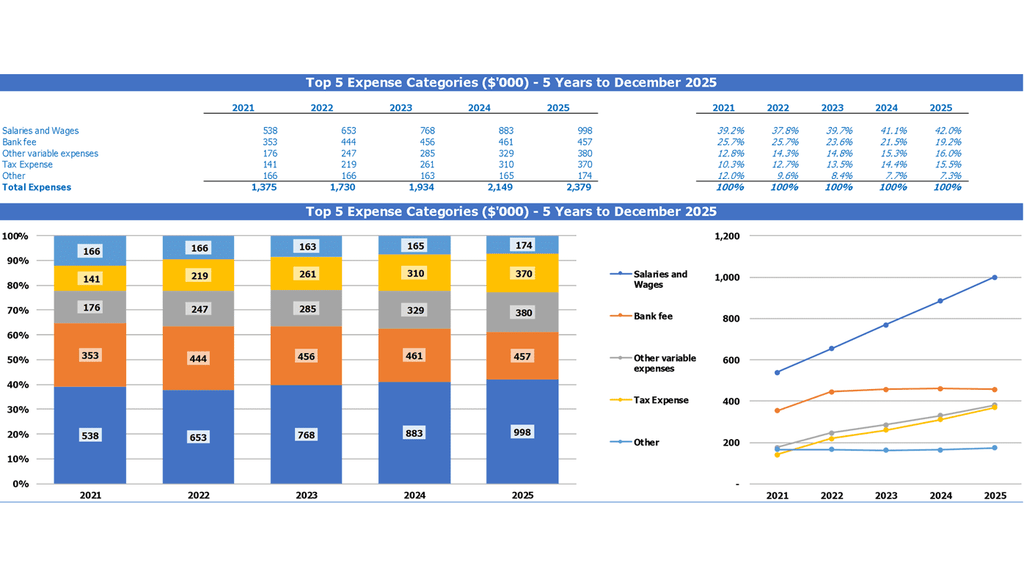

Business Top Expenses List

In today's digital era, banks must keep up with the latest internet banking trends to remain competitive. Incorporating fintech partnerships and digital lending solutions can help banks stay ahead of the game in terms of banking technology solutions. A virtual banking strategy and online banking model can enhance the banking customer experience, while a mobile banking strategy can allow for easy access to online financial services. Moreover, banking platform integration and banking services transformation can help banks achieve digital transformation in banking, while a digital banking financial model can disrupt the banking industry in a positive way.

Internet Bank Financial Projection Expenses

Costs

Our suite of digital banking solutions and fintech partnerships are revolutionizing the banking industry, with cutting-edge technology innovations and virtual banking strategies that put the customer experience first. Our online banking model and mobile banking strategy integrate seamlessly with our banking platform to provide flexible and convenient banking services transformation. With our digital lending solutions and banking technology solutions, we're disrupting traditional banking industry trends and paving the way for the future of financial services. Our financial projection templates and feasibility studies offer intuitive cost management and forecasting structures, making it easier for organizations to project expenses and budget for long-term growth.

Capital Expense Budget

Investing in CAPEX is crucial for any business, especially in the banking industry's digital transformation. Keeping up with online banking trends, fintech partnerships, and implementing banking technology solutions requires a significant amount of capital expenditure. Historical data of capital expenditures is valuable to plan and project the company's budget responsibly. It is essential for banking platforms integration, virtual banking strategy, and digital lending solutions that focus on improving the customer experience. Therefore, CAPEX investment is a bellwether for the future quality of the banking industry and a significant expenditure in the course of business.

Loan Financing Calculator

Keeping track of loan repayment schedules is crucial for startups and growing businesses, as they determine important loan details such as principal amount, terms, maturity period, and interest rate. It is a critical part of cash flow analysis as it impacts cash flow projections and reflects the principal debt amount in balance sheets. Repayments are an integral part of financial activities and cash flow forecasts. Hence, keeping an eye on loan repayments is vital for businesses seeking stability and growth.

Internet Bank Income Statement Metrics

Profitability KPIs

The growth of net income is a crucial metric for entrepreneurs evaluating the success of their digital banking financial model. Using internet banking trends and banking technology solutions, financial technology innovation and banking services transformation through a virtual banking strategy are essential for achieving growth. With online banking models and digital transformation in banking, banking platform integration and fintech partnerships leverage the latest banking customer experience trends, such as mobile banking strategies and digital lending solutions, to achieve financial success. These techniques lead to innovative banking industry disruption and result in the growth of net income for entrepreneurial success.

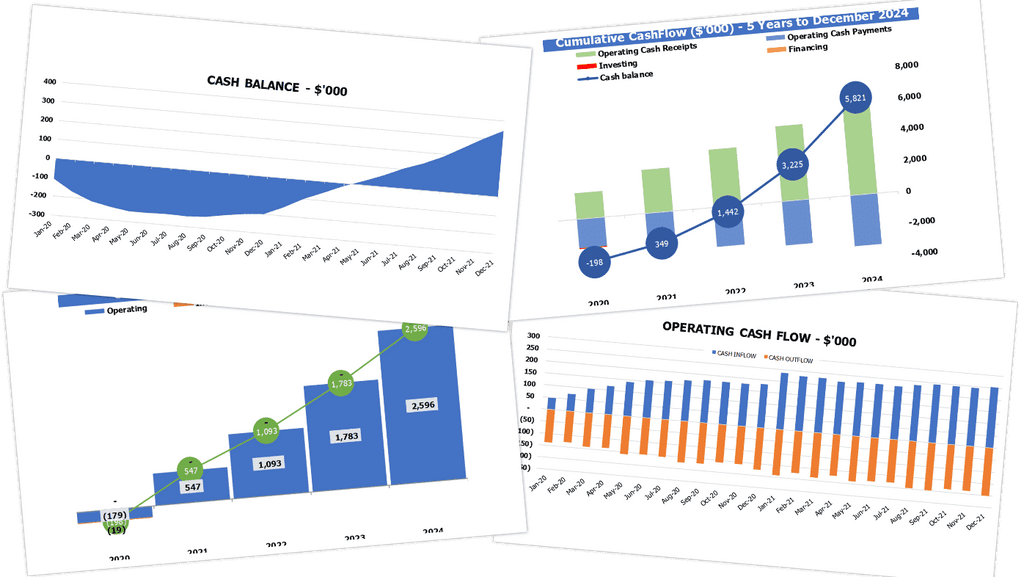

Cash Flow Projection Template For Business Plan

The success of your digital banking financial model lies in its ability to meet the current internet banking trends and offer innovative banking technology solutions. To achieve digital transformation in banking, consider a mobile banking strategy that enhances banking customer experience and integrates with banking platform. Fintech partnerships can also be leveraged to offer digital lending solutions and virtual banking strategies. Ultimately, a solid online banking model must show its capacity to generate adequate cash and pay off liabilities, ensuring that banks are confident in their investment. Your startup financial model template xls can demonstrate this potential and set you on the path to banking services transformation.

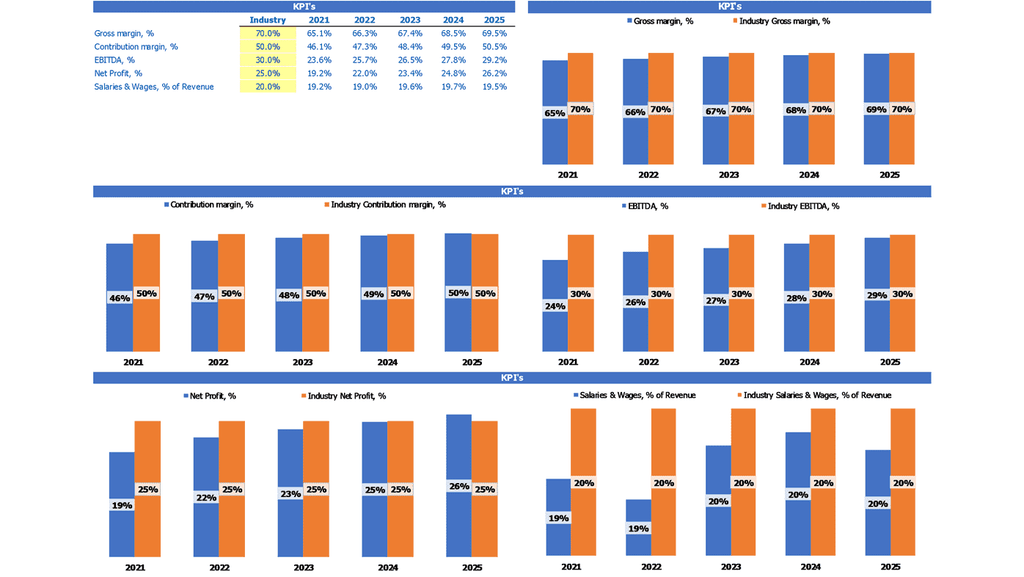

Industry Benchmarks

Tracking key financial indicators is crucial for startups and established companies alike. Our financial projection template benchmark tab calculates important metrics that help assess a company's effectiveness. We highlight and compare these indicators to provide actionable insights for strategic management. By monitoring and recording these values, businesses can determine the most effective techniques for achieving favourable outcomes. In the rapidly evolving banking industry, with internet banking trends and digital lending solutions taking center stage, tracking these metrics will help companies stay competitive and adapt to disruption through fintech partnerships and banking technology solutions.

P&L Statement Excel

To ensure profitability of an online banking model, utilizing profit and loss forecast templates in Excel is crucial. These templates help predict future losses and profits, which is especially important for startups aiming for long-term success. In addition to providing an annual report with comprehensive data, these templates also offer details on after-tax balance and net profit. By using such banking technology solutions, organizations can stay ahead of internet banking trends and achieve digital transformation in banking. These templates also facilitate virtual banking strategy, fintech partnerships, and digital lending solutions while improving the banking customer experience.

Projected Balance Sheet For Startup Business

The online banking model has undergone a transformation due to the rise of fintech partnerships and banking technology solutions, leading to digital transformation in banking. Financial technology innovation has disrupted the banking industry, resulting in virtual banking strategy and mobile banking strategy. The integration of banking platform and digital lending solutions matches internet banking trends and banking customer experience. Investment in online financial services has enabled banking services transformation, allowing for better access to customer information and value creation. The balance sheet remains a crucial tool for projecting the company's value and informing stakeholders of its assets and liabilities.

Internet Bank Income Statement Valuation

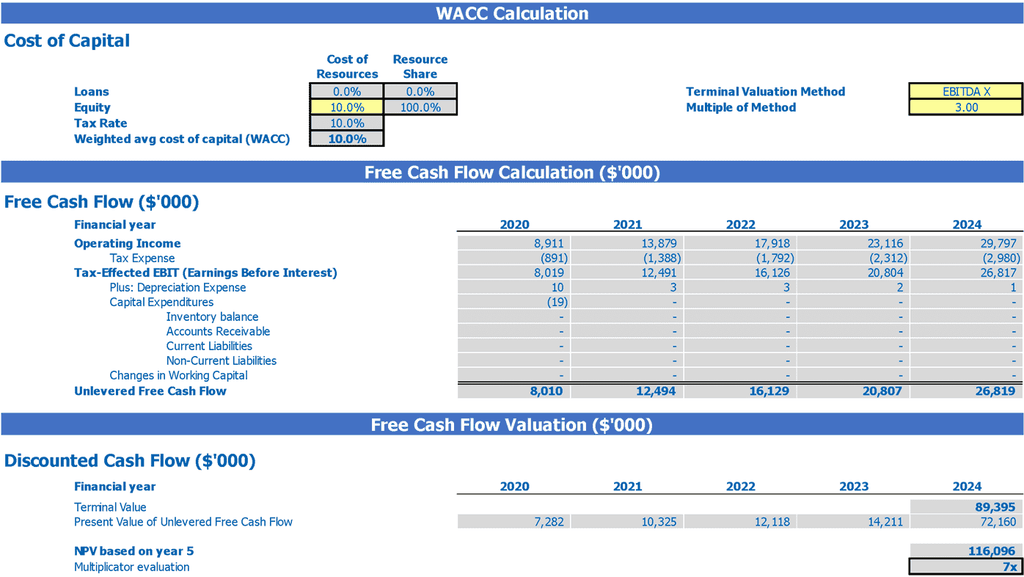

Startup Valuation Model

The ever-evolving digital landscape of the banking industry calls for a robust online banking model that integrates cutting-edge banking technology solutions to transform banking services and enhance the banking customer experience. The emergence of new internet banking trends and digital lending solutions has led to financial technology innovation, banking industry disruption, and virtual banking strategies. Banking platform integration and fintech partnerships are key to achieving digital transformation in banking. With a mobile banking strategy and online financial services, financial forecast analysis becomes easier, making it possible to capture potential investors.

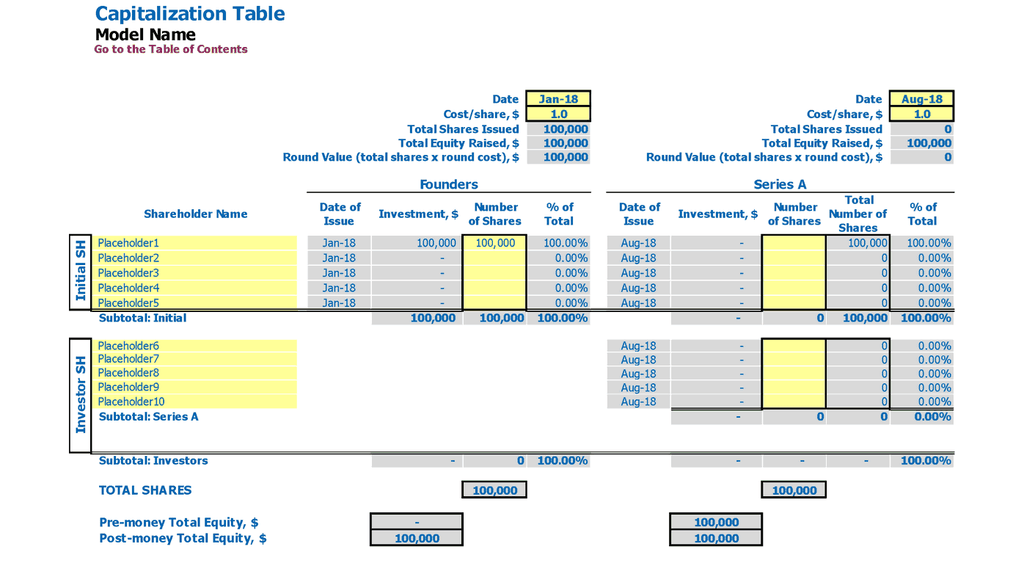

Captable

The banking industry is undergoing a transformation fueled by financial technology innovation. Internet banking trends show that online banking models are increasing, with mobile banking strategies at the forefront of digital transformation in banking. Banking technology solutions aim to enhance banking customer experiences, and virtual banking strategies reflect this trend. Banking platform integration, fintech partnerships, and digital lending solutions can achieve these goals. A cap table excel is essential for start-ups as it shows the company's overall ownership structure, depicting equity shares, preferred shares, options, and stakeholders' prices for such securities.

Internet Bank Business Forecast Template Key Features

Convenient All-In-One Dashboard

Comprehensive financial reports with detailed projections and analysis, including graphs and KPIs, are available.

Run different scenarios

A business plan cash flow template allows for playing with variables to forecast cash flow impact.

Integrated Model to convince Investors

The Cash Flow Statement Template Excel is designed to showcase assumptions, calculations, and outputs in an investor-friendly manner.

It is part of the reports set you need

Creating an Internet Bank Financial Projection is a vital step for sustainable business growth and risk management.

Update anytime

Optimize financial operations with banking technology solutions and digital transformation strategies.

Internet Bank Financial Projection Startup Advantages

Elevate your financial institution's online presence with innovative digital banking solutions and fintech partnerships.

Use our digital lending solutions to transform your banking services and enhance the customer experience with a virtual banking strategy.

Record your digital banking financial model for online financial services revenue.

Predict financial outcomes for online banking through analyzing revenues and expenses.

Utilizing a projected cash flow statement template in Excel can provide valuable insights for making adjustments, such as reducing expenses.