ALL IN ONE MEGA PACK INCLUDES:

Land Development Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Land Development Bank Startup Budget Info

Highlights

With our comprehensive suite of services in financial analysis, investment banking, market research, and credit risk management, we are proud to offer our clients turn-key solutions to commercial real estate asset and property management needs. From mortgage lending and loan origination to risk assessment and portfolio management, we specialize in delivering tailored solutions to help our clients achieve their goals in the capital markets. Let our team of experienced professionals use GAAP/IFRS compliant financial modeling and industry-leading core metrics to help you get funded and unlock the potential of your real estate development projects today.

As an investment banking firm, we specialize in providing comprehensive financial analysis services that help our clients make informed decisions. Our expertise spans across various domains, including real estate development, commercial property management, mortgage lending, credit risk management, capital markets, loan origination, and portfolio management. We leverage market research and financial modeling to provide customized solutions to our clients. Our team also provides valuable risk assessment services, enabling our clients to mitigate financial risks and optimize their profits. Our 5-year financial projection template is a dynamic dashboard that provides a clear depiction of a company's financial health. It includes useful financial performance tools to ensure steady growth and profitability. By using tables, graphs and financial projections, we can create an easy to follow Financial Plan that can help our clients to comprehend every detail of their business operations.

Description

The financial analysis carried out in the land development bank business revenue model template created by Financial Model Business Consultants is integral for evaluating the financial health of a land development bank company both in the present and future. The template is designed to help you determine the financial requirements of your business and also forecast its operations’ viability. The land development bank Excel pro forma template provided has been tested and refined across numerous actual land development bank ventures, and it comes with 5-year monthly and yearly financial statements, essential financial details, relevant KPIs, financial ratios, cash burn analysis, debt service coverage ratio, valuation analysis, startup costs, and business bank loans and equity funding from the investors’ table. This template is user-friendly and can be tailored to your specific business needs by entering your company data into the input assumption sheet, and it is perfect for obtaining loans, submitting feasibility reports, and financial planning.Land Development Bank Financial Plan Reports

All in One Place

Our financial analysis solutions include bank loans, investment banking, market research, credit risk management, asset management, commercial real estate, property management, mortgage lending, loan origination, risk assessment, portfolio management, and capital markets. Our team creates robust financial models for real estate development projects, allowing you to test all possible scenarios and quickly identify the best strategies. Our templates are designed to be customized to your unique needs, ensuring you have the tools and insights necessary to make informed decisions for your business.

Dashboard

Our financial modeling startup provides a cutting-edge financial dashboard, allowing for accurate analysis and insightful KPI monitoring. With visual charts and graphs, our platform ensures precise data interpretation. Our dashboard enables clients to perform top-notch financial analysis and present revenue forecasts, earnings, and profit and loss projections, showcasing your company's potential. Furthermore, our toolstreamlines cash flow projection process. It is an all-in-one solution for financial planning, market research, and portfolio management. Whether you require asset management, bank loan, mortgage lending, or risk assessment, our platform is tailored to meet your needs.

Startup Financial Statements

Financial analysis of a company's performance is crucial, and analyzing core financial statements like the income and expenditure statement, pro forma balance sheet, and cash flow statement is essential. Investment banking, mortgage lending, commercial real estate, and property management rely on these statements to assess credit risk, loan origination, and risk assessment. Capital markets and asset management utilize financial modeling and portfolio management to optimize profits. Market research and insight into real estate development aid in successful decision-making for investors seeking bank loans for startup businesses.

Sources And Uses Of Capital

The financial model template for startups assists in comprehending the sources and uses of funds statement. It summarizes where the capital will arise from and how it will be used in an organized manner. It is necessary for the total amount of sources and uses to be balanced. The statement is especially vital during a recapitalization, restructuring, or M&A procedure.

Break Even Revenue Calculator

With our expertise in financial analysis and investment banking, we can provide comprehensive services to clients in commercial real estate, mortgage lending, and property management. Our team has a strong background in market research, risk assessment, loan origination, credit risk management, and portfolio management, enabling us to create robust financial modeling and provide expert guidance on capital markets and asset management. Additionally, we can assist with loan origination and risk assessment, allowing our clients to make strategic decisions that lead to success. Whether it's a bank loan or a real estate development proposal, we're here to help achieve a profitable outcome.

Top Revenue

Our services include financial analysis, investment banking, commercial real estate, mortgage lending, credit risk management, and more. We specialize in market research, property management, loan origination, risk assessment, financial modeling, portfolio management, and capital markets. Our team provides expert guidance for real estate development and bank loans. We prioritize revenue modeling and help clients develop accurate revenue projections using our comprehensive financial forecasting model. Get started with our excel pro forma template and begin crafting your best revenue projections today.

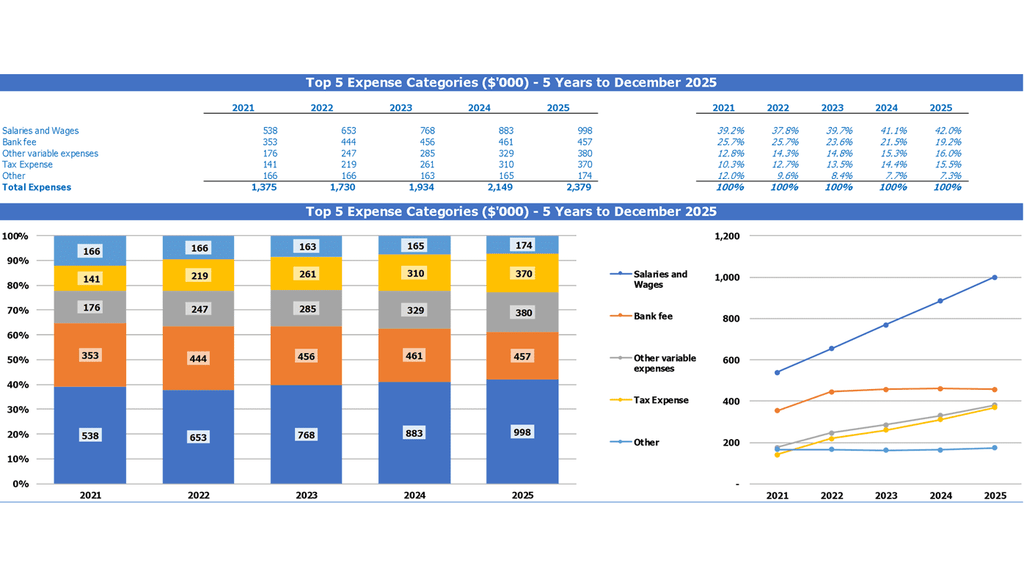

List of Top Expenses

When it comes to financial analysis, it's important to consider all expenses made in a year. This is where a bank loan or investment banking comes in for real estate development or commercial real estate investments. Through market research and credit risk management, loan origination can help assess financial modeling for effective portfolio management. For those needing help with property management or mortgage lending, professional risk assessment and asset management services are available to keep expenses within budget and adjust for unexpected needs. Our team offers a startup financial plan template suited to each company's unique requirements.

Land Development Bank Financial Projection Expenses

Costs

Our comprehensive financial analysis services encompass various areas such as investment banking, mortgage lending, and credit risk management. We specialize in commercial real estate development, market research, property and asset management, loan origination, risk assessment, and portfolio management. Our team of experts also provides reliable financial modeling and capital markets advice to help you achieve your business objectives. Maximizing the use of our bank loans and managing costs is crucial for successful business operations, and our templates are designed to make this journey seamless. Our startup financial plan template includes all the necessary tools to assist you in making informed decisions to drive your business forward.

Capital Expenditure Forecast

Understanding the CAPEX expenses of a land development bank is crucial for enhancing its performance. This refers to all expenses incurred for development purposes, avoiding operating costs like salaries. It helps identify the areas in which resources should be invested. As it varies per business, its report must be highlighted in the business model description.

Loan Payment Calculator

For start-ups and growing businesses, managing loan repayment schedules is essential. A loan schedule should provide a detailed breakdown of the company's debt, including the amounts and maturity terms. It plays a crucial role in financial analysis, impacting cash flow forecasts and balance sheets. Loan repayment schedules include both principal repayments and interest expenses, further affecting cash flow and debt balance. It's essential to conduct regular market research and risk assessments to ensure proper credit risk management, loan origination, and portfolio management. Investment banking, commercial real estate, mortgage lending, property management, and asset management are critical areas that require expertise and financial modeling.

Land Development Bank Income Statement Metrics

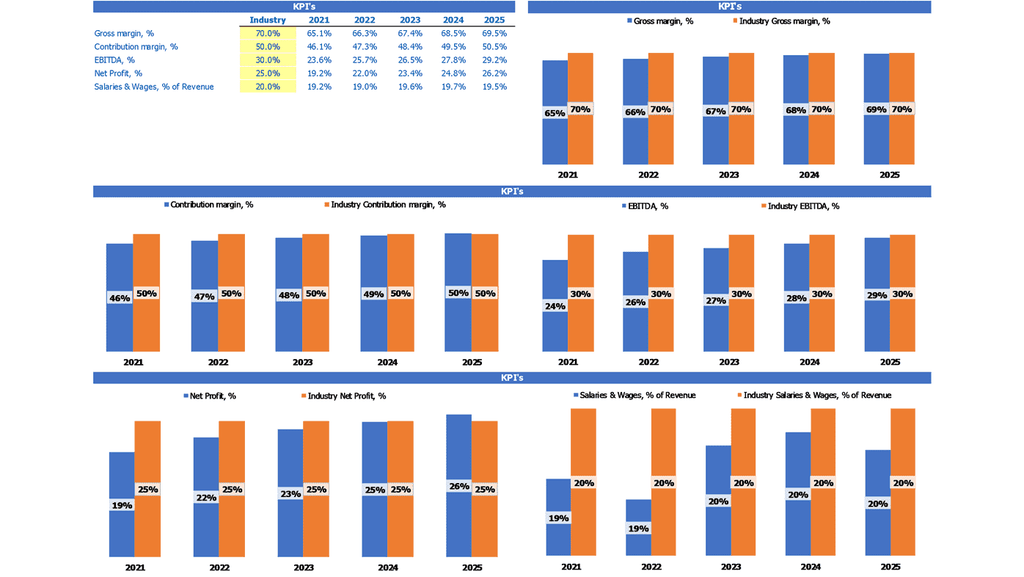

Financial KPIs

Achieve financial success using financial key performance indicators (KPIs) for your company's growth. A 5 year projection template helps to track and display market research and financial analysis as vital graphs with critical performance metrics. Furthermore, we offer top-notch bank loans and mortgage lending services, with risk assessment and credit risk management to maximize portfolio management, asset management, and loan origination in commercial real estate, investment banking, and real estate development. Contact us for financial modeling, capital markets, and property management solutions.

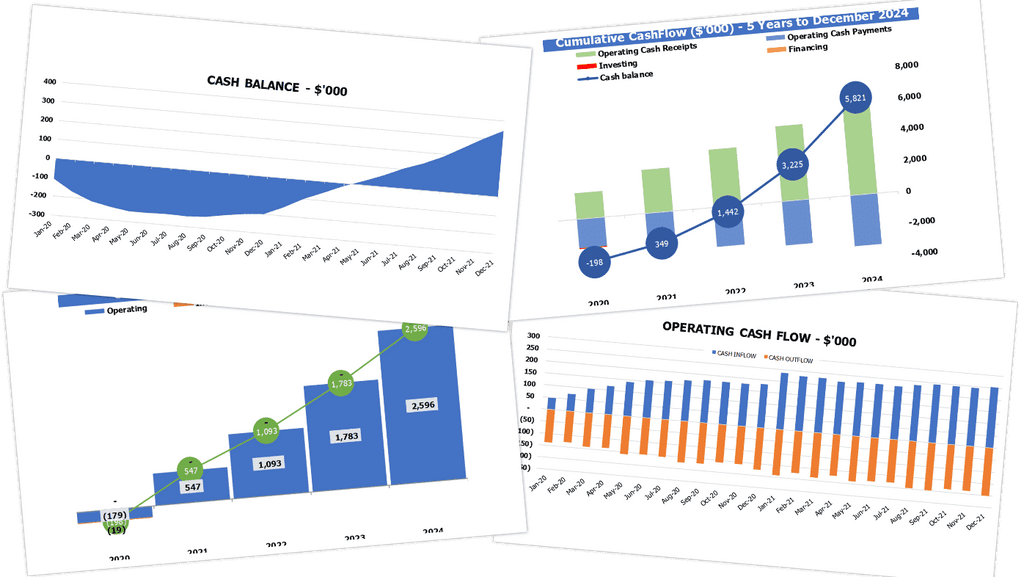

Cash Flow Projections Template Excel

A thorough financial analysis is crucial for success in the competitive world of real estate development. Investment banking professionals utilize market research and financial modeling to identify potential investment opportunities and manage risk. While loan origination and mortgage lending facilitate funding, credit risk management and portfolio management ensure profitable outcomes. Effective property management and asset management ensure commercial real estate operations are efficient and profitable. Capital markets play a vital role in providing liquidity and funding in the real estate industry. Solid risk assessment and the use of templates like cash flow analysis are imperative for maximizing success.

Industry Benchmarks

Financial modeling excel sheets contain a benchmark tab that delivers both the industry-wide average and business key performance indicators. Industry metrics are examined for analysis and comparison of relative value in benchmarking. Start-ups can leverage this practice to learn and apply the best business practices from top industry players for better financial performance results. Benchmarking is an essential activity for strategic management.

Profit Loss Projection

In the world of investment banking, financial analysis of commercial real estate projects plays a crucial role in securing bank loans and managing credit risk. Market research and risk assessment are vital components in mortgage lending and loan origination. Professional asset management, portfolio management, and capital market expertise are essential to a successful real estate development venture. Financial modeling and property management strategies are critical elements in ensuring long-term profitability and sustained growth. With a bottom-up approach, a projected P&L statement template can provide a comprehensive picture of the projected net profit and gross margin.

Projected Balance Sheet For Startup Business

The pro forma balance sheet is a crucial tool for financial analysis, providing insight into your real estate development or commercial property management business' assets, liabilities, and equity. Through market research and financial modeling, investment banking professionals can assist with loan origination, mortgage lending, and credit risk management. Capital markets and portfolio management teams can help with risk assessment and asset management, ensuring a well-rounded approach to your business's financial planning. It's important to note that the assets listed on your pro forma balance sheet may not correlate to dates before or after the snapshot, making accurate and practical financial modeling essential.

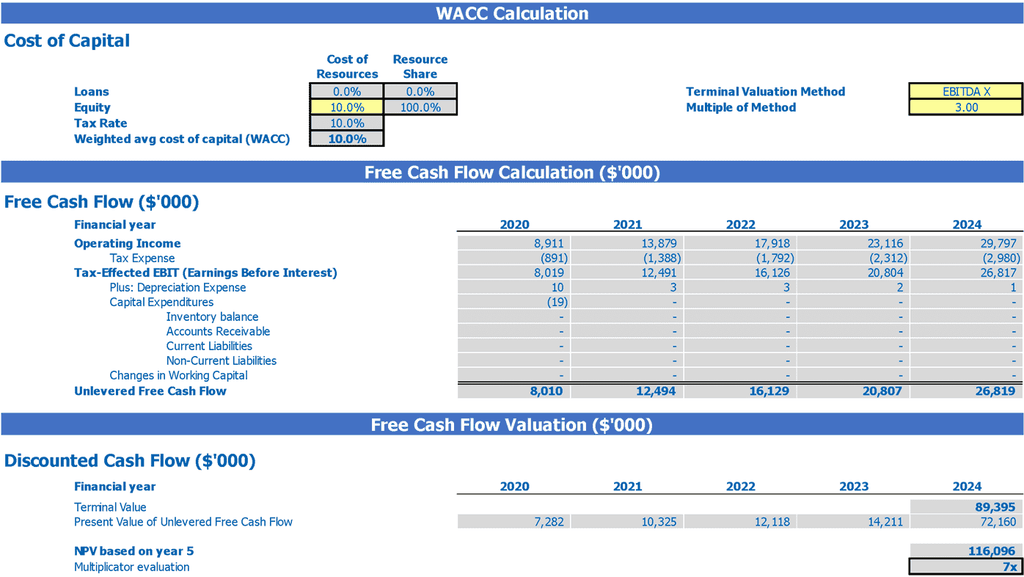

Land Development Bank Income Statement Valuation

Pre Seed Valuation

Our financial modeling excel template offers a comprehensive solution for real estate developers seeking bank loans or investment banking. Through market research and credit risk management, our team assesses the viability of your commercial real estate project, while our asset management and property management services provide effective loan origination and portfolio management. With our expert financial analysis, risk assessment, and valuation techniques, you can confidently present your investment opportunity to stakeholders using a variety of measures, including WACC, free cash flow, and discounted cash flow.

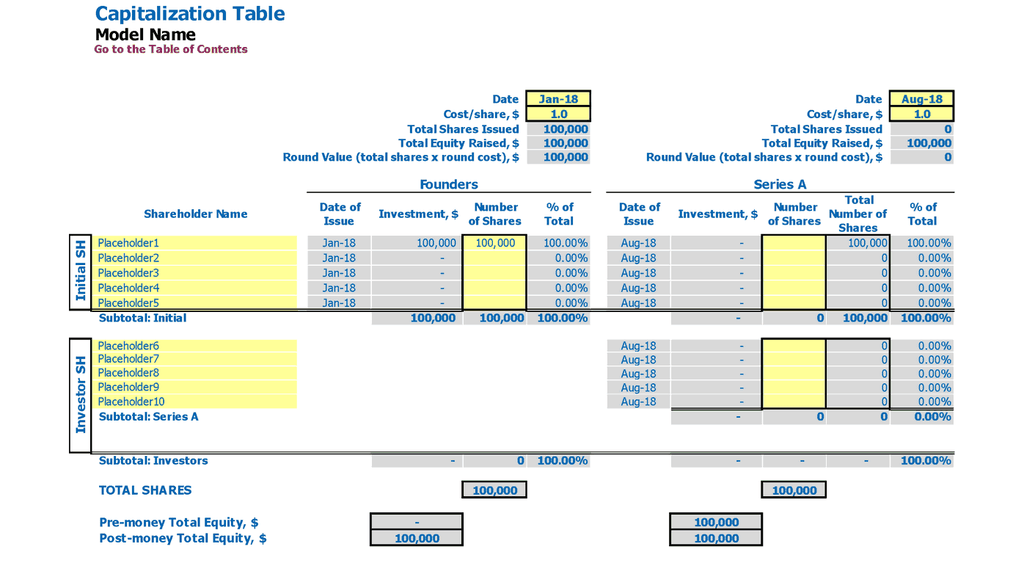

Simple Cap Table

A crucial tool for startups is a financial model template that includes a cap table. This spreadsheet outlines the company's ownership structure and displays the equity and preferred shares, options, and stakeholder prices. It provides a clear picture of who owns what and at what value. By utilizing this cap table template, startups can conduct financial analysis, market research, and risk assessment. Investment banking, mortgage lending, and commercial real estate firms also benefit from cap table templates when making loan origination decisions, credit risk management, asset management, and portfolio management.

Land Development Bank Startup Financial Projection Template Key Features

Investors ready

Our financial analysis package includes print-ready templates for monthly profit and loss statements, cash flow forecasts, balance sheets, and financial ratios.

5 years forecast horizon

Create a comprehensive 5-year financial analysis spreadsheet for a land development bank, with automatic annual summaries.

Saves you time

With our financial analysis services, you can focus on business development while we handle cash flow statements.

Plan for Future Growth

Utilize cash flow projection templates to accurately plan and achieve financial goals for your business.

Identify cash gaps and surpluses before they happen

Conducting financial analysis and risk assessment is crucial in investment banking and commercial real estate for effective portfolio management.

Land Development Bank Financial Projection Excel Template Advantages

Utilize the land development bank's financial analysis and investment banking expertise to create a professional business plan template for securing a bank loan.

Our investment banking team offers financial analysis and risk assessment for commercial real estate loan origination.

Regularly update profit loss projections to satisfy external stakeholders such as banks.

Present a compelling 5-year financial analysis for a real estate development project to attract investment banking and capital markets attention.

Create a solid financial plan for your real estate venture with expert loan origination and portfolio management services.