ALL IN ONE MEGA PACK INCLUDES:

Mortgage Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Mortgage Bank Startup Budget Info

Highlights

Developing a comprehensive financial analysis of mortgage loans is crucial for banking loan portfolio management and financial planning. Mortgage lending institutions must use financial modeling for banks to assess risk and evaluate the profitability of mortgage loans. This involves utilizing mortgage underwriting models to determine borrower creditworthiness and risk assessment frameworks to evaluate the overall mortgage banking industry. Banks must also consider mortgage origination processes and mortgage servicing models to determine the financial performance of banks. Additionally, banking credit risk modeling and asset-liability management are essential for ensuring the stability and success of the mortgage banking industry.

In the highly competitive mortgage banking industry, it is critical for financial institutions to have sound financial planning and analysis tools that can support their mortgage loan origination, underwriting, and servicing processes. Financial modeling for banks, in particular, can help mortgage lending institutions to perform accurate mortgage loan analysis, conduct mortgage risk assessment, and manage their loan portfolio effectively. Through sophisticated financial modeling, banks can also forecast future cash flows and assess the financial performance of their mortgage business. Additionally, banking credit risk modeling and asset-liability management can help to manage the risk associated with mortgage lending. Our mortgage underwriting model, mortgage servicing model, and financial forecasting for banks are among the key financial tools that can help mortgage lenders to build a profitable and sustainable business.

Description

Our team has created a comprehensive mortgage bank business projection template, complete with financial statements and performance metrics. This tool is vital for financial modeling for banks and mortgage lending institutions as it enables them to make informed decisions by considering all operational risk factors through mortgage loan analysis. Our five-year forecast helps businesses manage their operations effectively through banking financial planning and banking credit risk modeling. The template highlights key aspects of a mortgage banking industry, such as mortgage underwriting model, mortgage risk assessment, mortgage origination process, banking asset-liability management, and mortgage servicing model. Our financial projections for banks help evaluate the financial performance of banks, providing key insights into financial forecasting for banks and banking loan portfolio management.Mortgage Bank Financial Plan Reports

All in One Place

Our comprehensive mortgage banking financial projections template includes everything needed for both start-ups and established businesses. It incorporates financial modeling for banks, mortgage loan analysis, mortgage risk assessment, banking loan portfolio management, and more. The template contains essential resources such as financial analysis of mortgage loans, mortgage underwriting models, and mortgage servicing models. It also provides banking asset-liability management, financial forecasting for banks, and banking credit risk modeling. Our user-friendly template includes pro-forma templates for key financial statements, profit and loss forecasts, balance sheet forecasts, and pro forma cash flow projections alongside monthly and annual summaries and performance reports.

Dashboard

The mortgage banking industry relies heavily on financial forecasting to guide decision-making, especially in mortgage lending institutions. This requires financial modeling for banks, such as mortgage loan analysis, mortgage risk assessment, and banking credit risk modeling. To manage a banking loan portfolio, asset-liability management and mortgage servicing models are used. Additionally, mortgage underwriting models help to ensure financial performance is optimized during the mortgage origination process. Overall, financial planning and analysis are essential to ensure the continued success of the mortgage banking industry.

Excel Financial Reporting

For mortgage lending institutions, financial modeling is crucial in understanding the complex mortgage banking industry. Financial analysis of mortgage loans, mortgage risk assessment, and banking loan portfolio management aid in the banking financial planning process. Mortgage underwriting models and mortgage origination processes are essential to successfully manage banking asset-liability management. Meanwhile, banking credit risk modeling and mortgage servicing models help with mortgage loan analysis. Furthermore, financial forecasting and performance evaluations assist in determining the financial performance of banks. Understanding basic financial statement templates, such as the income statement, balance sheet, and cash flow statement, also aid in financial planning.

Sources And Uses Of Funds Statement Template

Financial analysis is crucial in the mortgage banking industry, from mortgage loan analysis to banking loan portfolio management. A mortgage lending institution must consider factors such as mortgage risk assessment, mortgage underwriting model, and mortgage origination process. Additionally, financial modeling for banks, banking financial planning, financial forecasting for banks, and banking asset-liability management are essential to ensure the optimal performance of banks. Among the tools used are mortgage servicing model and banking credit risk modeling. Accurate financial analysis of mortgage loans and the entire loan portfolio is essential to maintain compliance and profitable operations.

Bep Calculation

Utilize financial modeling to assess the mortgage banking industry's performance, including mortgage lending, credit risk modeling, loan portfolio management, and underwriting. Conduct mortgage loan analysis and risk assessment to ensure efficient and effective mortgage origination and servicing. Develop banking financial planning strategies through asset-liability management to maximize financial forecasting and performance. Utilize sophisticated techniques, such as break-even analysis, to determine the point when a company's cost and revenue will be equal. By calculating the contribution margin, businesses can determine pricing strategies and improve profitability. Employing these methodologies provides a comprehensive approach to financial analysis of mortgage loans and other banking services.

Top Revenue

Expert financial modeling is essential for the success of a mortgage lending institution. The mortgage banking industry relies on financial analysis of mortgage loans, mortgage risk assessment, and banking loan portfolio management. Effective mortgage underwriting models and mortgage servicing models also play a vital role. Moreover, banking asset-liability management, financial forecasting for banks, and banking credit risk modeling are critical for sound financial planning. To stay ahead of the competition, financial performance of banks must be at peak levels, with comprehensive mortgage loan analysis and financial projections using advanced tools, such as the 3-year financial projection template excel.

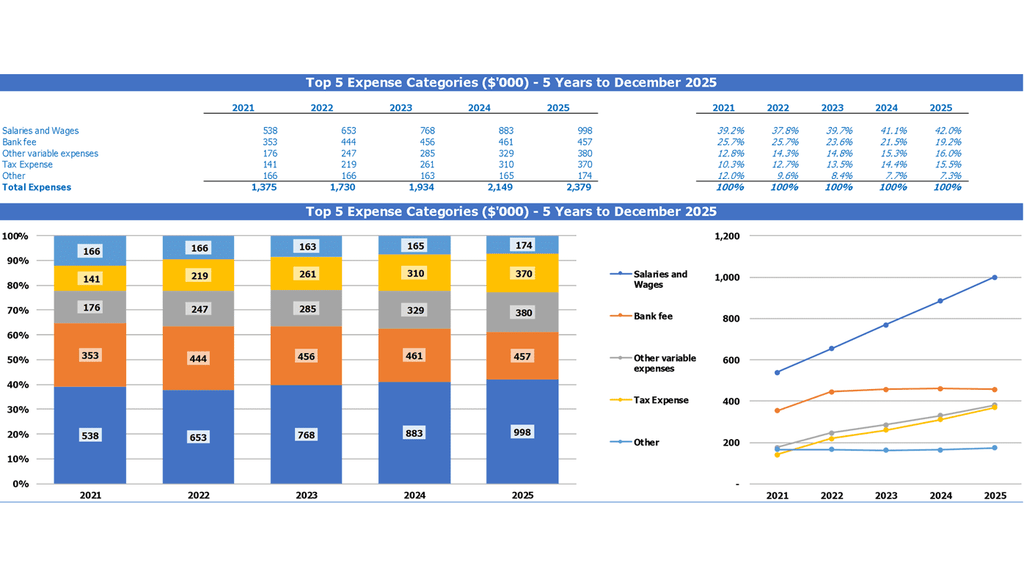

Company Top Expenses List

Mortgage lending institutions rely on financial modeling to conduct mortgage loan analysis and assess mortgage risk. They also use banking financial planning, asset-liability management, and loan portfolio management to optimize their financial performance. Mortgage underwriting models, servicing models, and credit risk modeling are some of the tools used in the mortgage banking industry. Additionally, financial forecasting and analysis of mortgage loans are essential for informed decision making during the mortgage origination process. Overall, managing costs and monitoring expenses is crucial for achieving profitability for businesses in the banking and mortgage industry.

Mortgage Bank Financial Projection Expenses

Costs

The mortgage banking industry relies heavily on financial modeling for banks to manage loan portfolios and assess risk. Mortgage loan analysis, underwriting models, and servicing models are all essential components of banking financial planning. Mortgage lending institutions use financial analysis of mortgage loans to forecast future earnings and ensure proper asset-liability management. As with any financial institution, banking credit risk modeling is crucial in determining the financial performance of banks. By putting in place mortgage origination processes, institutions can ensure instant and organized loan processing.

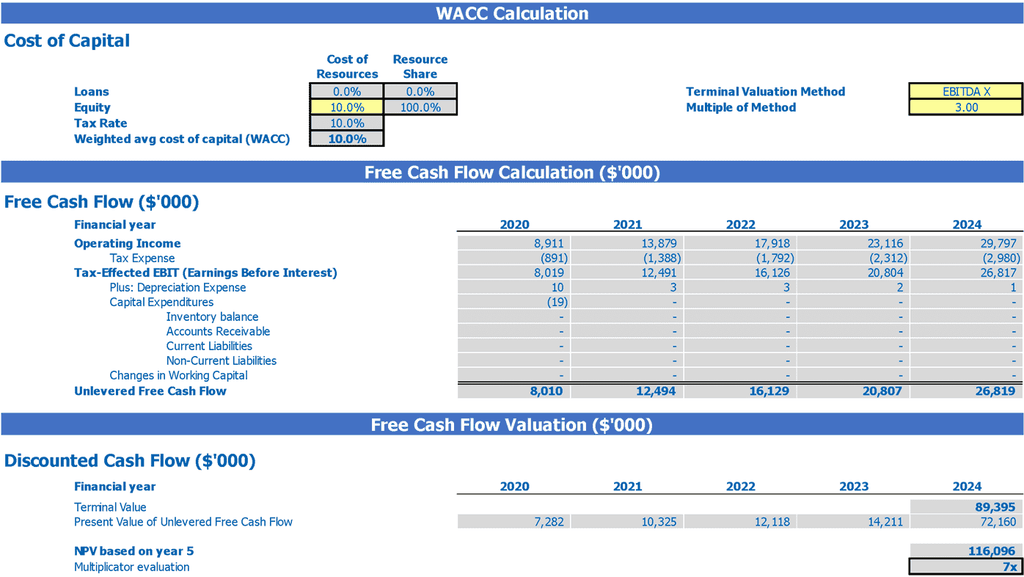

Capital Budgeting Analysis

Mortgage lending institutions rely on financial modeling and mortgage loan analysis to manage their loan portfolios effectively. The mortgage banking industry requires rigorous financial planning, including mortgage underwriting models, risk assessment, and forecasting. The mortgage origination process and servicing models are of utmost importance to ensure the financial performance of banks. Banking asset-liability management and credit risk modeling also play a crucial role in managing the loan portfolio effectively. To financial analysts, CapEx refers to the expenses related to acquiring or improving fixed assets, and projecting them accurately is vital for startups to achieve their financial goals.

Debt Repayment Plan

Banks and mortgage lending institutions rely on financial modeling to manage risk and make informed decisions on mortgage loans. This involves mortgage loan analysis, mortgage risk assessment, and financial analysis of mortgage loans. The mortgage banking industry also utilizes financial forecasting and asset-liability management to optimize loan portfolio management. Additionally, mortgage origination process and mortgage servicing models are crucial considerations for banks. Robust banking credit risk modeling is pivotal for analyzing the financial performance of banks and ensuring successful loan amortization.

Mortgage Bank Income Statement Metrics

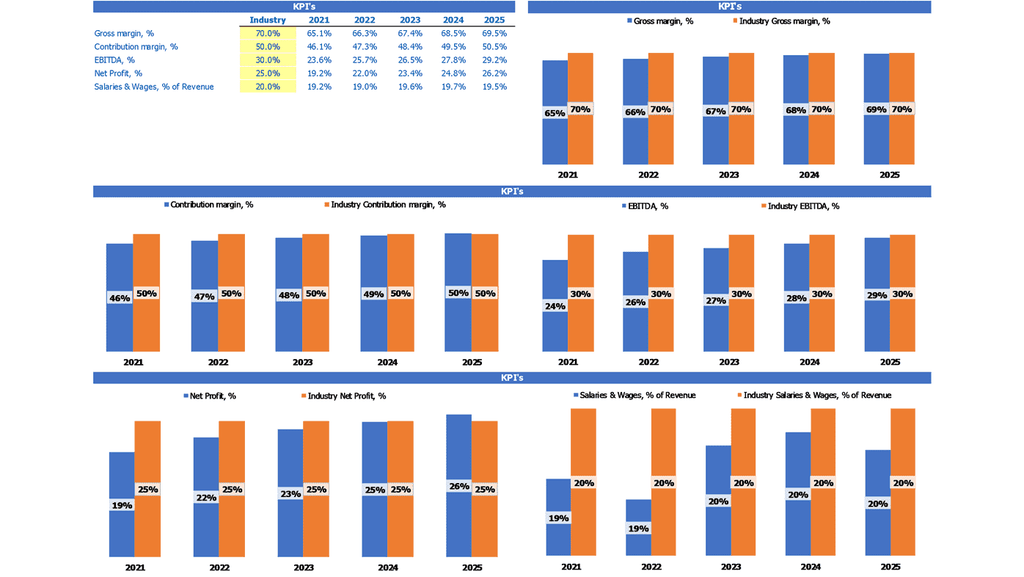

Profitability KPIs

In the mortgage banking industry, financial modeling and analysis play a vital role in decision making. Mortgage lending institutions utilize financial forecasting and risk assessment techniques to manage loan portfolios effectively. Mortgage underwriting models and servicing models are used to evaluate credit risk and monitor the financial performance of banks. Additionally, banking asset-liability management and financial planning are crucial for mortgage loan analysis and origination process. EBITDA is an essential tool for banks to measure their operating performance by calculating earnings minus interest, taxes, depreciation, and amortization expenses.

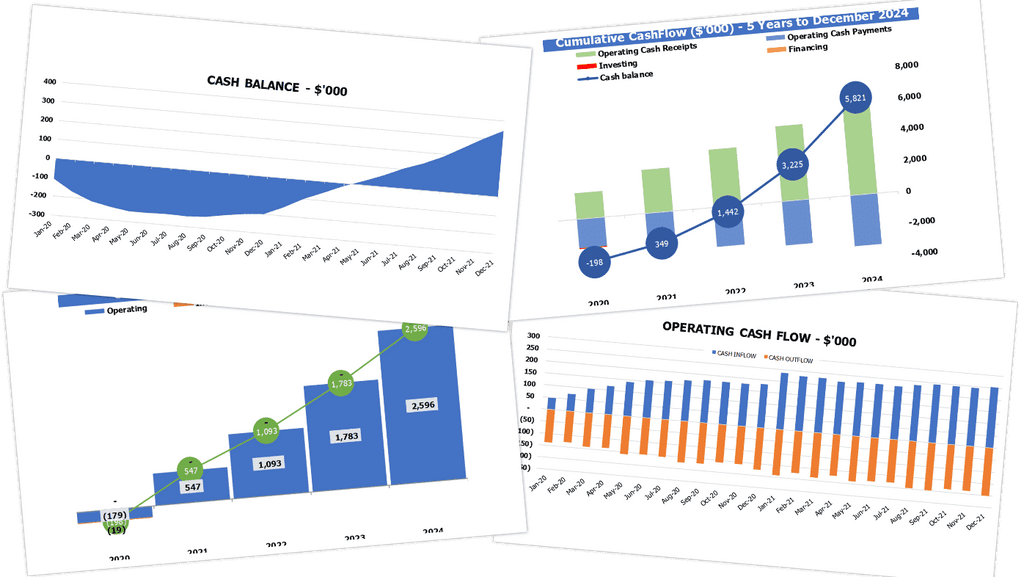

Pro Forma Cash Flow Statement Template

When it comes to the mortgage banking industry, financial modeling and analysis play a crucial role in effective banking loan portfolio management. This includes mortgage loan analysis, risk assessment, and underwriting using an underwriting model. Financial performance of banks depends on the accuracy of mortgage servicing models and asset-liability management. Additionally, banking credit risk modeling and financial forecasting are essential to determine the feasibility of the mortgage origination process. When preparing a feasibility study or cash flow projection, it's important to use a linked and iterative process, taking into account the pro forma balance sheet and non-cash items.

Industry Benchmarks

Financial modeling is crucial for mortgage lending institutions to analyze and manage risk, forecast financial performance, and make data-driven decisions. Mortgage loan analysis, underwriting models, and risk assessment help banks ensure the quality of their loan portfolio management. With mortgage origination and servicing models, as well as asset-liability management practices, banks can optimize their operations and financial outcomes. Financial forecasting and credit risk modeling enable strategic planning and adaptation to market changes. In short, tracking and evaluating key indicators are essential for the success of the mortgage banking industry, from startups to established institutions.

Income And Expenditure Template Excel

Using advanced financial modeling techniques, mortgage lending institutions can analyze and manage their mortgage loan portfolio with accuracy and efficiency. A robust mortgage underwriting model and risk assessment process can help ensure the financial performance of the organization. From mortgage origination to servicing, a comprehensive financial plan that includes banking asset-liability management and credit risk modeling can drive profitability and success. With monthly reports utilizing these tools, banks can simplify the analysis of financial actions and make informed decisions for competent management.

Projected Balance Sheet For Startup Business

Our mortgage lending institution utilizes financial modeling for banks to ensure accurate mortgage loan analysis and effective mortgage underwriting models. Our financial analysis of mortgage loans includes mortgage risk assessment, banking loan portfolio management, and banking asset-liability management. We also use financial forecasting for banks to enhance our mortgage origination process and mortgage servicing model. We prioritize banking credit risk modeling to assess the financial performance of banks and provide monthly and yearly balance sheet forecasts that are linked with excel template cash flow statements and projected income statement templates, among other relevant inputs.

Mortgage Bank Income Statement Valuation

Pre Money Valuation Startup

We offer comprehensive solutions to the mortgage banking industry. Our services comprise financial modeling, mortgage loan analysis, mortgage risk assessment, and banking loan portfolio management. We also provide banking financial planning, mortgage origination process, and banking asset-liability management. Our mortgage underwriting model, mortgage servicing model, and banking credit risk modeling ensure the financial performance of banks. Furthermore, our financial analysis of mortgage loans and financial forecasting for banks is unmatched. With us, your mortgage lending institution can access data-driven insights and make informed financial decisions.

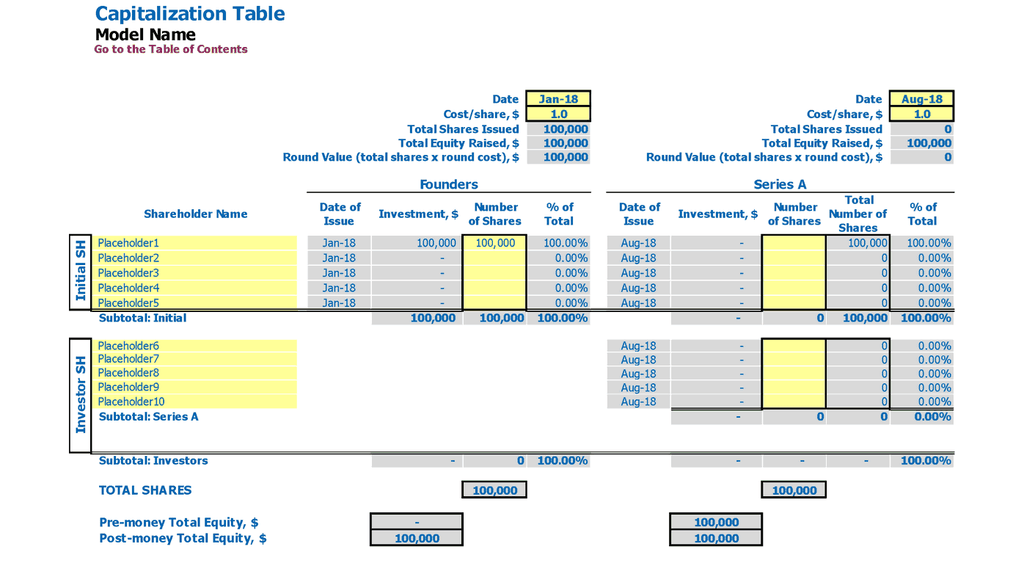

Cap Table Excel

Financial institutions in the mortgage banking industry, must conduct financial analysis of mortgage loans by using mortgage underwriting models, mortgage risk assessment, and mortgage loan analysis to effectively manage their loan portfolio. They also require financial modeling for banks, banking financial planning, financial forecasting for banks, banking asset-liability management, banking loan portfolio management among others, to ensure profitable financial performance. Additionally, mortgage lending institutions must utilize mortgage origination process and mortgage servicing models with banking credit risk modeling to achieve accurate mortgage loan assessment and efficiently capture the detailed listing of the company's securities as shown by the cap table.

Mortgage Bank 3 Statement Model Excel Key Features

Avoid Cash Flow Shortfalls

Mortgage lending institutions use financial modeling and analysis to manage loan portfolios and assess risk.

Get a Robust, Powerful and Flexible Financial Model

This mortgage banking financial model provides a strong foundation for business planning and customization.

Saves you time

Maximize efficiency in the mortgage banking industry with advanced financial modeling for mortgage loan analysis and risk assessment.

Get it Right the First Time

Gain insight on mortgage lending institutions' financial analysis, risk assessment, and loan portfolio management through comprehensive financial modeling for banks.

Manage accounts receivable

Mortgage lending institutions use financial modeling for mortgage loan analysis and risk assessment.

Mortgage Bank Financial Projection Excel Template Advantages

Use financial modeling to assess mortgage loan risk for a lending institution.

Utilize financial modeling to project expenses for mortgage lending institution in the coming periods.

Utilize financial modeling and risk assessment to enhance mortgage loan analysis at your lending institution.

Design various financial models for mortgage lending institutions to analyze loan portfolios and assess risk.

Maximize profits and reduce risks with our comprehensive financial modeling template for mortgage lending institutions.