ALL IN ONE MEGA PACK INCLUDES:

Retail Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Retail Bank Startup Budget Info

Highlights

Designing an effective strategy for a retail banking business model is crucial for banks to increase their profitability and overall financial institution performance. A sound retail banking strategy will help banks to align their financial services model with the banking industry trends, increase their efficiency, and remain competitive in the retail banking market. Several key components of bank business growth, including banking industry revenue, bank revenue model, and financial institution efficiency, should be taken into consideration when developing a retail banking strategy. Providing an exceptional bank customer experience through retail banking operations is also essential in attracting and retaining customers. With the right retail bank startup financial model template, profit and loss projection, as well as financial statements and financial ratios in GAAP or IFRS formats, banks can project their financial performance to get funded by banks, angels, grants, and VC funds.

The retail banking business model is constantly evolving to keep up with changes in the banking industry, including shifts in customer behavior and technology advancements. To stay competitive, financial institutions must develop a sound retail banking strategy that not only prioritizes customer experience but also ensures profitability and business growth. This requires a deep understanding of the banking industry trends and competition, as well as a focus on retail banking operations, financial institution efficiency, and performance. One essential tool for achieving this is the financial services model, which helps banks forecast revenue and expenses, generate financial statements, and analyze financing options. The model also enables banks to identify key risks and track their progress towards achieving financial goals, including retail banking profitability and revenue growth.

Description

The retail banking business model has evolved over time, with financial institutions constantly reevaluating their strategies to ensure profitability and competitiveness. The banking industry revenue primarily comes from the financial services model, with the retail banking strategy and financial institution business strategy playing a crucial role. The focus is on retail banking operations, financial institution efficiency, and financial institution performance, all of which contribute to the bank revenue model and retail banking profitability. With stiff competition in the retail banking market, a strong bank customer experience becomes a significant factor for bank business growth. Keeping up with banking industry trends is essential for sustained success.Retail Bank Financial Plan Reports

All in One Place

Having a robust retail banking business model is essential for financial institutions to maintain profitability and ensure business growth. By employing a sound retail banking strategy that focuses on enhancing the customer experience while maximizing efficiency, banks can outperform their competition and meet industry trends. The financial institution business strategy should align with the bank revenue model, which can be assessed through retail banking operations and financial institution performance. To convince investors, a detailed financial services model that highlights how the bank will attain profitability is essential. A well-designed business plan that showcases a profitable retail banking market is crucial.

Dashboard

Our startup costs template tool will provide you with a professional and engaging way to present your retail banking business model or financial services model. You can use the information to improve your bank revenue model, retail banking strategy, and financial institution business strategy. Moreover, it can help you to increase retail banking profitability, financial institution performance, and bank business growth. Additionally, it provides insights into retail banking operations, financial institution efficiency, banking industry trends, retail banking market, financial institution competition, and bank customer experience. Simply copy and paste the template into your presentation deck for an impressive display of your startup costs.

Startup Financial Statement

Our financial model streamlines your retail banking business strategy by generating comprehensive annual financial statements. Simply update your inputs in the Assumptions tab, and let our excel model handle the rest. Our tool ensures bank business growth and retail banking profitability by tracking banking industry trends and improving financial institution performance. Maximize your bank revenue model and outperform financial institution competition with our efficient retail banking operations. Deliver optimal bank customer experience with our financial services model and increase your financial institution efficiency today.

Sources And Uses Of Capital

Organizations opt for the sources and uses of funds statement template to gain insights into the cash flows and funding sources of their business or startup. This helps financial institutions to design a feasible retail banking business model or financial services model, ultimately leading to improved bank revenue model and retail banking profitability. A well-defined retail banking strategy can assist in driving bank business growth, enhancing financial institution performance, and ensuring banking industry trends and competition are met. Moreover, financial institution efficiency and retail banking operations can be optimized, providing customers with an enhanced bank customer experience.

Break Even Revenue Calculator

The retail banking business model involves formulating a financial services model that maximizes bank revenue and retail banking profitability. To achieve this, financial institution business strategy must focus on banking industry revenue and bank business growth. Retail banking strategy entails efficient retail banking operations and financial institution efficiency, while keeping up with banking industry trends and competing for the retail banking market. A key factor in achieving bank customer experience and financial institution performance is to conduct a breakeven analysis to determine optimal timeframes and development stages for profitability.

Top Revenue

The retail banking business model heavily relies on a financial services model to generate revenue. Banks must have a solid retail banking strategy and financial institution business strategy to drive growth and profitability. It is crucial to constantly analyze the banking industry revenue and retail banking profitability to improve financial institution performance. Trends in retail banking operations and financial institution efficiency are also key aspects to stay competitive in the retail banking market. A strong bank customer experience is essential to differentiate from financial institution competition.

Small Business Top Expenses List

Developing a successful retail banking strategy requires a deep understanding of the financial institution business strategy, banking industry trends, and retail banking market. The banking industry revenue largely depends on the retail banking profitability, and the bank revenue model must be efficient to ensure sustainable bank business growth. To remain competitive in the financial institution competition, a seamless bank customer experience and financial institution efficiency are crucial. Retail banking operations and financial institution performance must be optimized to maximize the financial services model's potential. Therefore, accurate revenue forecasting and precise financial projection are essential for the retail banking business model's success.

Retail Bank Financial Projection Expenses

Costs

The retail banking business model relies heavily on the financial services model to generate bank revenue and ensure retail banking profitability. A strong retail banking strategy is essential for a financial institution's business strategy and growth, and is crucial for improving banking industry revenue. Retail banking operations must be run with efficiency to stay competitive in the financial institution market and deliver a great bank customer experience. Keeping up with banking industry trends and competition is important, and financial projections templates can help indicate areas of improvement and secure investor funding.

CAPEX Investment

Our retail banking business model is centered around a comprehensive financial services model. Our bank revenue model is designed to maximize retail banking profitability while ensuring financial institution performance and growth. Our retail banking strategy focuses on efficient banking industry revenue generation and optimizing retail banking operations. We relentlessly monitor banking industry trends to stay ahead of our financial institution competition, always prioritizing the bank customer experience. Our financial institution efficiency is bolstered by data-driven decisions, like our automatic capital expense budget, which identifies alternative sources of income to drive bank business growth.

Loan Financing Calculator

Monitoring loan repayment schedules is critical for the success of both startups and growing companies. This vital information outlines critical loan details, including principal amounts, terms, maturity periods, and interest rates. Managing loan repayments will significantly impact cash flow projections, balance sheets, and overall financial activities. Accurate cash flow analysis is essential for maintaining an efficient retail banking business model and achieving financial institution performance goals. In today's banking industry trends, the retail banking strategy should prioritize a competition-driven focus on customer experience, operating efficiencies, and revenue growth.

Retail Bank Income Statement Metrics

Profitability KPIs

The IRR financial metric is a crucial factor in the financial services model for startups. It calculates the interest rate that results in the net cash flow from investments, making it essential for investors and analysts. Typically expressed as a percentage, the IRR has significant implications for the bank revenue model, retail banking profitability, financial institution performance, and bank business growth. Understanding IRR can aid in developing a robust retail banking strategy and financial institution business strategy, optimizing retail banking operations, and enhancing the bank customer experience, given the current banking industry trends and financial institution competition.

Cash Flow Projections Template Excel

Efficient retail banking operations and a well-planned financial services model are critical to the bank revenue model and financial institution business strategy. A solid retail banking strategy that focuses on customer experience and financial institution efficiency can lead to increased retail banking profitability and sustained bank business growth. Keeping up with banking industry trends and the retail banking market is crucial in today's competitive environment, and financial institution performance is key to staying ahead. By using cash flow projection tools like excel financial reports, businesses can track their cash inflows and keep their financial obligations in check.

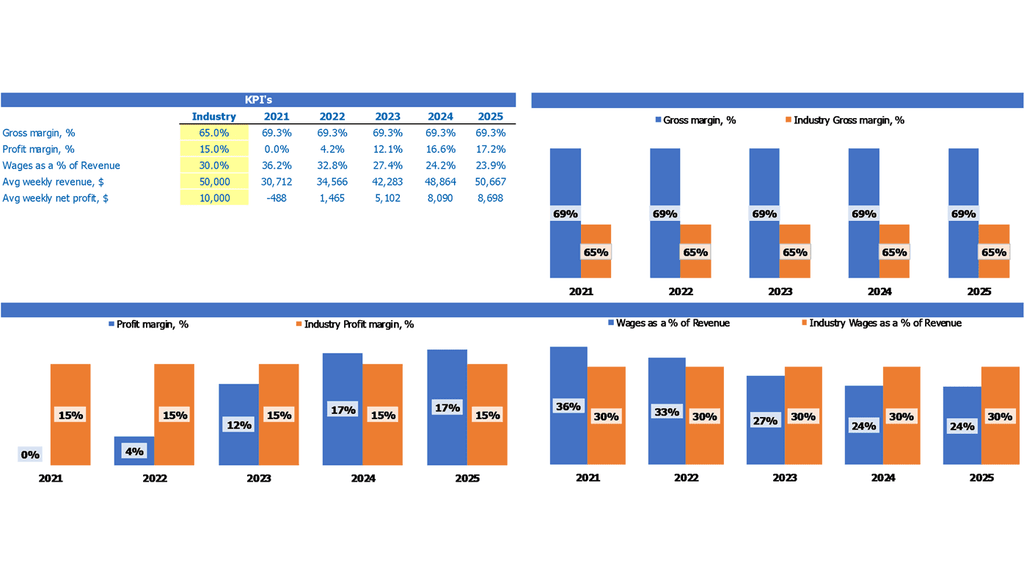

Industry Benchmarks

The retail banking business model relies heavily on effective financial services and revenue models to ensure profitability and growth in a highly competitive industry. To stay ahead of the game, financial institutions must focus on their banking strategy and operational efficiency while also keeping an eye on industry trends and competition. Additionally, ensuring a positive customer experience is crucial for bank business growth and financial institution performance. Startups can benefit greatly from benchmarking and financial planning to make informed decisions and guarantee success. Keeping track of all financial data and indicators is essential for strategic management.

Projected Profit And Loss Statement Template

In the competitive world of retail banking, the bank revenue model has shifted towards a financial services model. To drive retail banking profitability, banks are required to implement an efficient retail banking business model and financial institution business strategy. The key to bank business growth and financial institution performance is to stay on top of evolving banking industry trends while ensuring retail banking operations run smoothly. With intense financial institution competition, it's crucial to prioritize the bank customer experience and maintain financial institution efficiency to succeed in the retail banking market.

Pro Forma Balance Sheet For A Startup Business

A pro forma balance sheet in Excel reflects the financial structure of your retail banking business model, showcasing assets like buildings, equipment, and liabilities, and capital at a specific date. It's essential to highlight loan security in the assets section, aligning with the banking industry trends. A strong retail banking strategy and financial institution business strategy must prioritize the bank revenue model, retail banking profitability, and financial institution performance to ensure efficient banking industry revenue and bank business growth. Elevating the retail banking market requires enhancing banking operations, financial institution efficiency, and customer experience while competing with other financial institutions.

Retail Bank Income Statement Valuation

Startup Company Valuation

Understanding the retail banking business model is crucial for financial institutions to improve their revenue models and profitability. The banking industry revenue and financial institution business strategy rely heavily on the effectiveness of retail banking operations and efficiency. To achieve bank business growth, it is important to stay updated with banking industry trends and financial institution competition. Bank customer experience is a significant factor that influences retail banking strategy and financial institution performance. Therefore, financial services model and retail banking profitability depend on how banks cater to the customers' needs and expectations.

Capitalization Table

The retail banking business model is undergoing significant changes due to the evolving financial services model. Banks are exploring new ways to increase revenue and profitability through a strategic approach to retail banking operations. Financial institutions are enhancing their business strategy to improve efficiency, performance, and growth in the highly competitive retail banking market. With the focus on customer experience, banking industry trends are also driving the need for innovative approaches to retain customers. Bank revenue models are being reimagined to align with the changing needs of today's consumer, ensuring a compelling financial services model for the years ahead.

Retail Bank Financial Modeling For Startups Key Features

Simple and Incredibly Practical

Our retail banking strategy includes efficient financial modeling to drive bank business growth and profitability.

Get a Robust, Powerful and Flexible Financial Model

Maximize your retail banking profitability with this versatile financial services model and stay ahead of banking industry trends.

Gaining trust from stakeholders

Regularly sharing monthly cash flow forecasts with stakeholders builds confidence, trust, and makes fundraising easier.

Get a robust, powerful financial model which is fully expandable

An adaptable retail banking business model template for startups with customizable sheets for tailored requirements.

Manage accounts receivable

Improving cash flow management through Excel-based monthly statements can identify systematic late payments.

Retail Bank Budget Financial Model Advantages

This free Excel template predicts cash shortfalls in advance for startup financial models.

Forecasting profits helps businesses navigate interactions with experts, such as lawyers or advisors.

Efficient 5-year projection plan streamlines assumption entry for retail banking business model.

Ensure adequate cash flow to cover employee and supplier payments with a thorough financial plan.

Using a well-crafted financial services model can improve retail banking profitability and drive bank business growth.