ALL IN ONE MEGA PACK INCLUDES:

Osteopathic Center Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Osteopathic Center Startup Budget Info

Highlights

The financial management of an osteopathic center is critical for its success. A business plan must include financial projections, revenue models, cost structures, and a break-even analysis to determine the profitability of the center. To ensure financial stability, cash flow management, financial forecasting, investment analysis, return on investment, and financial modeling are essential. A five-year financial model template, created with the osteopathic center in mind, has prebuilt three statements, key financial charts, summaries, metrics, and funding forecasts built-in. Additionally, an osteopathic center feasibility study template Excel can help evaluate a startup idea and plan startup costs. Finally, all templates are unlocked and available for edit.

The osteopathic center's financial modeling tool is an essential asset for any business that wants to ensure optimal profitability and financial performance. With a comprehensive set of input tables and charts, our Excel financial model startup allows for accurate projection of financial data, including revenue and expenses, for up to five years. Our tool also generates three essential financial statements on both a monthly and annual basis, including a profit and loss forecast template, a cash flow proforma template, and a balance sheet. Additionally, our model includes feasibility matrices, diagnostic tools, and a user-friendly dashboard to make financial forecasting easy for anyone. Whether you're building a startup or analyzing an existing business, our financial modeling tool provides the necessary insights for effective financial planning, management, and investment analysis.

Description

The osteopathic center financial model provided by our team offers comprehensive financial analysis, forecasting, and modeling designed to ensure precise financial planning for your business. Our financial model consists of a detailed revenue model, cost structure, break-even analysis, cash flow projection, and profitability analysis to achieve accurate financial projections. With our osteopathic center business plan, you can make informed decisions based on reliable financial data. Our investment analysis and return on investment calculations help you analyze the potential of your business and determine the best investment strategy. At every stage of your financial planning, forecasting, and management, our team provides you with high-quality financial reports and insights to ensure that your business is on track to profitability and success.Osteopathic Center Financial Plan Reports

All in One Place

The osteopathic center business plan incorporates financial projections, revenue models, profitability and cost structures, cash flow management, break-even and investment analysis, and financial forecasting. With an emphasis on financial strategy, planning, management, and modeling, this all-encompassing approach allows for easy navigation and provides a comprehensive overview of the center's financial performance. Using this valuable tool, business owners and managers can confidently make informed decisions regarding the center's return on investment and financial success.

Dashboard

Our osteopathic center's financial plan includes a comprehensive revenue model, cost structure analysis, and cash flow management. We have also conducted profitability and break-even analyses to ensure a positive financial performance. Our financial projections and forecasting are easily accessible through our financial dashboard, which provides a snapshot of all critical financial metrics. Our investment analysis and return on investment assessments also play a significant role in shaping our financial strategy. We use financial modeling to plan and optimize our financial performance and ensure long-term financial sustainability.

Excel Financial Statement Template

Our osteopathic center business plan includes financial projections and a revenue model, as well as profitability analysis, cost structure, and cash flow management. Our financial forecasting includes break-even analysis and investment analysis, with a strong focus on return on investment. We prioritize financial performance through strategic financial management and planning, utilizing financial modeling to ensure success in our endeavors. Our model automates key financial statements and personalized assumptions, allowing for a streamlined approach to financial strategy. Let us take care of the financial details so you can focus on what matters most - your patients.

Sources And Uses Of Capital

With our comprehensive osteopathic center business plan, we offer financial projections that include revenue models, profitability analyses, costs structures, and cash flow management. Our financial forecasting includes break-even and investment analyses, return on investment, and financial performance metrics. Our financial management strategies cover planning, modeling, and an understanding of sources and uses of funds. Our team provides stakeholders with clear and engaging language, ensuring they fully comprehend how the company obtains and spends its money. We offer an accurate picture of expenses and possible outcomes, which enables informed decision-making at all levels of the organization.

Break Even In Unit Sales

Our osteopathic center business plan includes financial projections, revenue models, and profitability analysis. Our cost structure and cash flow management ensure financial forecasting and maximum return on investment. Our engaging financial strategy includes break-even analysis, investment analysis, and financial modeling. We utilize a professional break-even chart report to show annual revenue needed to break even based on fixed and variable costs, along with the number of months needed to reach profitability. Our financial performance and management ensure efficient financial planning and continued success of our osteopathic center.

Top Revenue

A comprehensive financial plan is crucial for any osteopathic center. Investors, analysts, and stakeholders monitor revenue and profit metrics to assess financial performance. The top line is the revenue or sales growth, which impacts other financial metrics, including profitability, cash flow, and investment returns. To ensure a robust financial strategy, osteopathic centers must implement effective cost structure and cash flow management strategies, financial forecasting, and profitability analysis. A break-even analysis and return on investment analysis are also essential to evaluate business sustainability and growth potential. Employing financial modeling and performance evaluation will result in an overall successful financial management plan.

Business Top Expenses List

When creating a business plan for your osteopathic center, it's crucial to develop detailed financial projections. This includes analyzing your revenue model, cost structure, cash flow management, financial forecasting, break-even analysis, investment analysis, return on investment, and financial performance. A comprehensive financial strategy will provide you with the tools to manage your finances effectively and improve profitability. Using a financial model template will also help with cost analysis, including acquisition costs and fixed costs. With accurate financial planning and modeling, you can make informed decisions and achieve your business goals.

Osteopathic Center Financial Projection Expenses

Costs

Create a successful business plan for your osteopathic center using our financial model. With a 5-year projection template, you can manage and forecast expenses to improve cash flow management. This comprehensive financial performance analysis includes cost allocation and categorization, identifying variable and fixed expenses, payroll, COGS, and wages. Through detailed financial forecasting, you can determine the break-even point and measure return on investment. Our user-friendly model will help you develop a sound financial strategy and support financial planning for your center. Build a strong foundation for your osteopathic center with our financial modeling tool.

Capital Expense Budget

When creating a business plan for an osteopathic center, one crucial aspect is financial management. To ensure profitability, a revenue model and accurate financial projections are crucial. The cost structure, break-even analysis, investment analysis, and return on investment should also be considered. Cash flow management and financial forecasting are important tools that must be implemented to ensure financial stability. In addition, it's important to pay attention to financial models and strategies for optimal performance. By using proforma templates and historical financial data, forecasting revenue is possible with detailed assumptions.

Loan Repayment Schedule

Our osteopathic center business plan incorporates comprehensive financial projections involving revenue model, cost structure, and profitability analysis. Our financial forecasting includes a break-even analysis, investment analysis, return on investment, and cash flow management. We emphasize financial performance and management by implementing sound financial strategies, planning, and modeling. The 5-year financial projection template includes a loan amortization template with built-in formulas to track repayment schedules for each loan, regardless of its term. Monthly, quarterly or annual terms can be accommodated here to support our center's financial health.

Osteopathic Center Income Statement Metrics

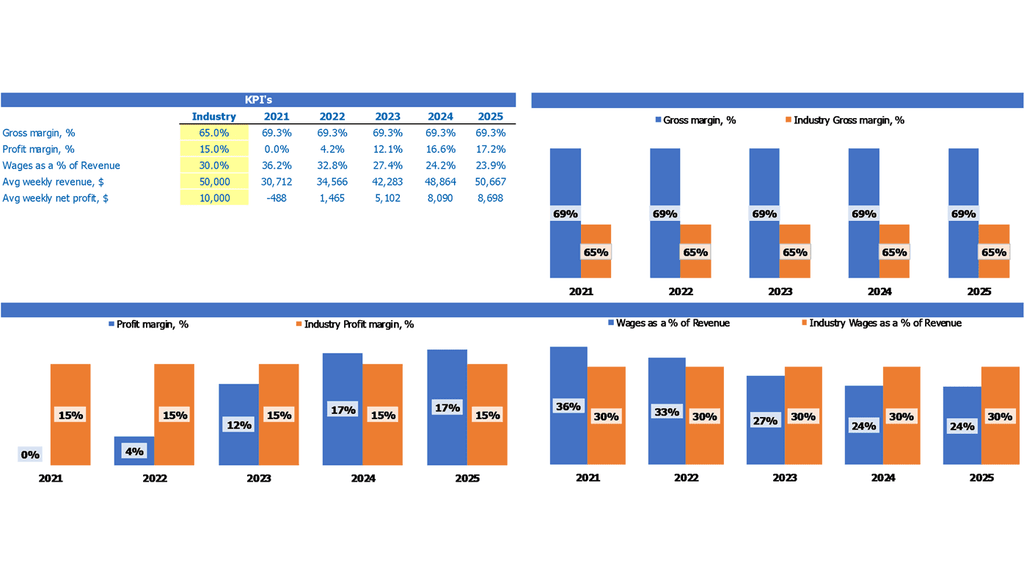

Profitability KPIs

Our osteopathic center business plan includes financial projections, revenue models, cost structures, cash flow management, and financial forecasting, among others. We conduct profitability and investment analyses, break-even analysis, and financial modeling to ensure our financial performance is optimal. Our financial management strategy focuses on return on investment (ROI) by calculating the ratio of cash inflows versus outflows from our investment activities, taking gains from net investment and dividing those by the total cost of investments. This helps us make informed financial decisions to meet our targets and deliver sustainable growth.

Excel Template Cash Flow Statement

The osteopathic center business plan includes financial projections and a revenue model which incorporates a cash flow management system. Our profitability and cost structure analysis informs our financial forecasting and break-even analysis. Our investment analysis calculates the return on investment, and our financial performance is monitored through financial modeling. Our financial strategy is based on financial planning which includes the development of a pro forma cash flow projection alongside a pro forma balance sheet template excel and a profit and loss projection. By examining cash movement, we aim to make informed decisions that will ensure the success of the osteopathic center.

KPI Benchmarking Report

The financial projections and revenue model for an osteopathic center are vital for ensuring profitability. A well-structured cost and cash flow management plan, along with financial forecasting and modeling, are key to financial planning. Break-even analysis, investment analysis, and return on investment are necessary for the business plan. The feasibility study template excel, including benchmark key indicators and comparative analyses, helps with financial performance and management. Strategic planning is dependent on these key indicators, enabling informed decision-making for the company’s financial strategy.

Projected Income Statement

Developing a comprehensive financial plan for an osteopathic center involves more than just profit and loss projections. A holistic approach to financial modeling, including analyzing the revenue model, cost structure, cash flow management, and investment analysis, is vital to ensure profitability and long-term success. By incorporating financial forecasting, break-even analysis, and return on investment metrics, the center can optimize its financial performance and develop a sound financial strategy. To achieve this, a range of financial tools and planning techniques, such as income statements and financial modeling, must be utilized.

Pro Forma Balance

Forecasted financial reports such as the balance sheet and profit and loss statement are crucial for stakeholders in a company. When used in tandem, they offer insight into how much investment is required for the company to achieve desired sales and profitability. In particular, predicting the projected balance sheet as part of financial forecasting and planning allows companies to prepare for future revenue levels. This tool is especially important for startups, as it gives them an idea of their financial situation in the near future and helps them plan accordingly.

Osteopathic Center Income Statement Valuation

Startup Valuation Multiples

The business plan for the osteopathic center includes financial projections and analysis, such as revenue models, cost structures, cash flow management, forecasting, break-even analysis, investment analysis and return on investment. Financial performance and management strategies are also vital parts of the plan with emphasis on financial planning and modeling. WACC, DCF, and FCF are calculated in the seed stage valuation worksheet to determine capital costs, assess risks and evaluate potential investments. DCF evaluates future cash flows, while WACC is used by banks to decide whether to provide loans.

Captable

Our comprehensive business plan for the osteopathic center includes financial projections and a revenue model to ensure profitability. We have conducted a cost structure analysis and cash flow management strategy for effective financial forecasting. Additionally, our investment and return on investment analysis have been utilized in our financial modeling. Our financial management strategy involves break-even analysis, with a focus on maximizing financial performance. Our tailored financial planning ensures sound financial strategy and the use of pro forma templates for financial record-keeping. Our excel-based cap table template helps monitor tangible assets and potential profits for investors.

Osteopathic Center Financial Plan Excel Key Features

Investors ready

Our osteopathic center's business plan includes comprehensive financial projections and analysis, including revenue models, cost structures, and cash flow management.

Get a Robust, Powerful and Flexible Financial Model

Use our osteopathic center financial modeling tool to create a profitable business plan with detailed financial projections.

Identify potential shortfalls in cash balances in advance

Financial forecasting for an osteopathic center is crucial for successful financial management and informed decision-making.

Run different scenarios

Utilize a 5-year cash flow projection template to adjust input amounts and forecast the impact on cash flow for better financial management.

Gaining trust from stakeholders

Creating a comprehensive financial plan, including revenue models and cost structures, is essential for the success and profitability of an osteopathic center.

Osteopathic Center Startup Financial Model Template Excel Advantages

Regularly updated financial projections may be necessary for external stakeholders, such as banks, to assess the osteopathic center's financial performance and management.

Create a comprehensive financial plan using our business forecast template for your osteopathic center's profitability and growth.

The 5-year cash flow projection template aids in monitoring spending and ensuring it aligns with the osteopathic center's financial goals.

Maximize your osteopathic center's financial potential with our comprehensive startup pro forma template.

Maximize Your Profit Potential with Comprehensive Financial Planning for Your Osteopathic Center.