ALL IN ONE MEGA PACK INCLUDES:

Floating Hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Floating Hotel Startup Budget Info

Highlights

The floating hotel financial plan template is a comprehensive 5-year financial planning tool that covers all aspects of a company operating in the floating hotel business niche. Ideal for both start-ups and small floating hotels, this model helps to accurately estimate your start-up costs and prepares you for growth with its unlocked feature, allowing you to edit all sections. It includes a floating hotel revenue model, a cost structure, and a profit analysis among others, enabling you to conduct a thorough floating hotel feasibility study, risk assessment, return on investment, break-even analysis, and SWOT analysis. With it, you can make realistic floating hotel cash flow projections, valuations, and capital expenditure analyses. In addition, this financial plan template offers financing options to help sustain your operations and grow your business.

A floating hotel offers a unique experience for travelers, and for investors, it can be a lucrative opportunity. Conducting a feasibility study, market analysis, SWOT analysis, risk assessment, and valuation is essential to determine the feasibility and profitability of a floating hotel project. Furthermore, it is important to analyze the floating hotel revenue model, cost structure, profit analysis, and break-even analysis to develop a comprehensive floating hotel financial plan. This plan should also include cash flow projections, financing options, investment analysis, return on investment, and capital expenditure analysis. By using a projected income statement template excel, the user can save time while managing operations tasks and making crucial financial decisions related to investors and banks for acquiring funds and loans.

Description

Our team has developed a comprehensive floating hotel financial projection template that covers all aspects of business planning and financial management. Our template includes key financial statements and charts, such as cash flow projections, cost structures, revenue models, and profit analysis. Whether you are starting a new floating hotel or looking to grow your existing business, our tool can help you make informed financial decisions and optimize your business strategy. Our template also includes valuable tools for financial planning, such as break-even analysis, return on investment, and capital expenditure analysis, as well as options for financing and market analysis. Additionally, we perform a thorough SWOT analysis and risk assessment to help identify potential challenges and opportunities that could impact your business. Overall, our floating hotel financial projection template is an essential tool for any business owner looking to improve financial performance and build a strong, sustainable business.Floating Hotel Financial Plan Reports

All in One Place

Our floating hotel feasibility study offers a comprehensive analysis of the market, cost structure, revenue model, financing options, and risk assessment. Our financial planning includes a floating hotel cash flow projection and a break-even analysis, as well as a return on investment and investment analysis. Our valuation incorporates a capital expenditure analysis, while our SWOT analysis evaluates the hotel's strengths, weaknesses, opportunities, and threats. Our pro forma income statement template excel is a flexible tool that can be customized to fit specific business needs, with easily editable tabs for revenue projections and growth forecasts.

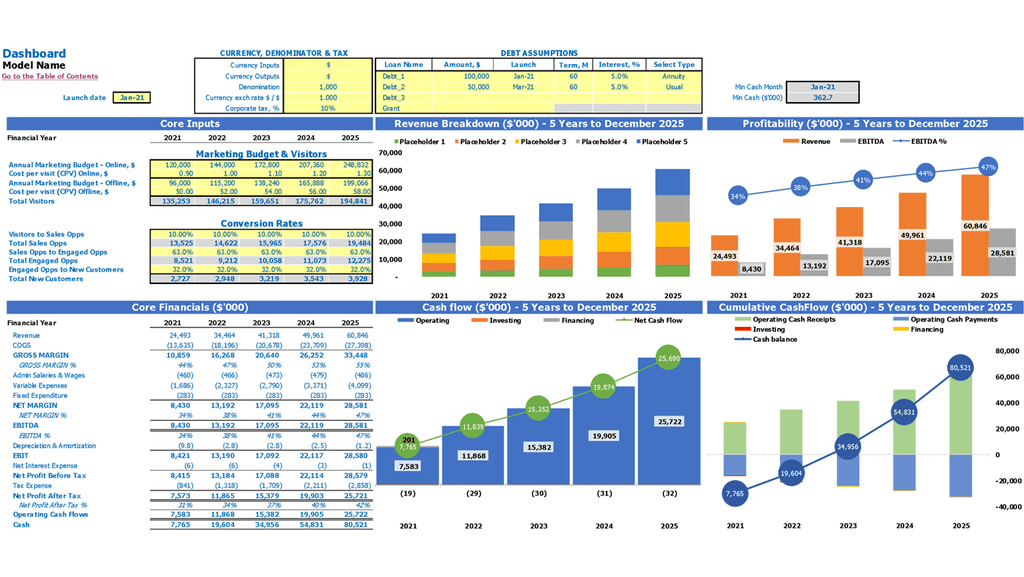

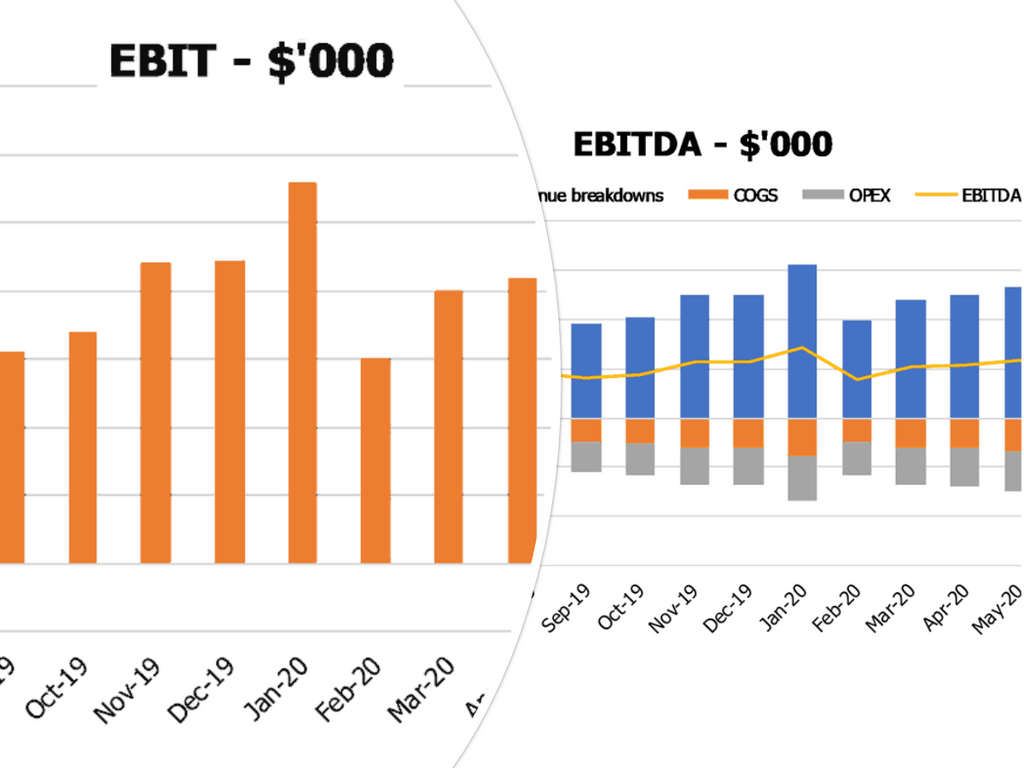

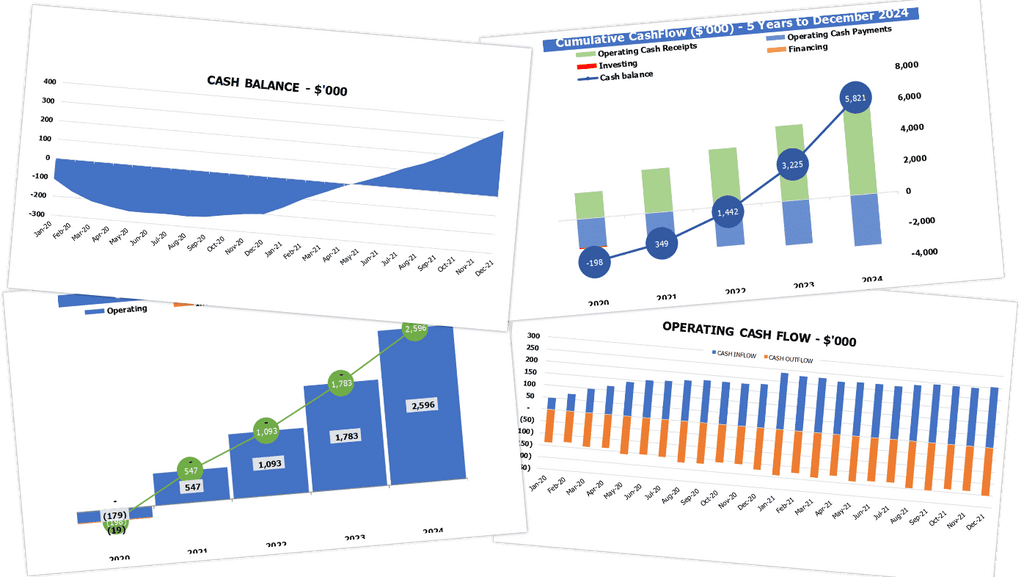

Dashboard

Conducting a comprehensive floating hotel feasibility study, including a market analysis, financial planning, and SWOT analysis, is crucial for determining the hotel's viability. A floating hotel cost structure and cash flow projection enable investors to evaluate financing options and make informed investment decisions. Profit analysis, return on investment, and break-even analysis help determine the hotel's profitability, while a risk assessment and valuation support effective risk management. Capital expenditure analysis and access to financing options are also vital for floating hotels' success in a competitive hospitality market. A dashboard with analysis and Excel financial reports can be shared with stakeholders for enhanced transparency.

A Financial Statement

Our comprehensive feasibility study analyzes the floating hotel market, conducts a SWOT analysis, and assesses potential risks. We also offer a valuation and capital expenditure analysis for investment purposes. Our floating hotel financial planning includes a cash flow projection, break-even analysis, and return on investment calculation. Our experts have identified financing options and built a floating hotel revenue model and cost structure for your benefit. Our pre-built integrated financial summary, including a pro forma balance sheet, helps ensure you're pitch deck is professional and compelling.

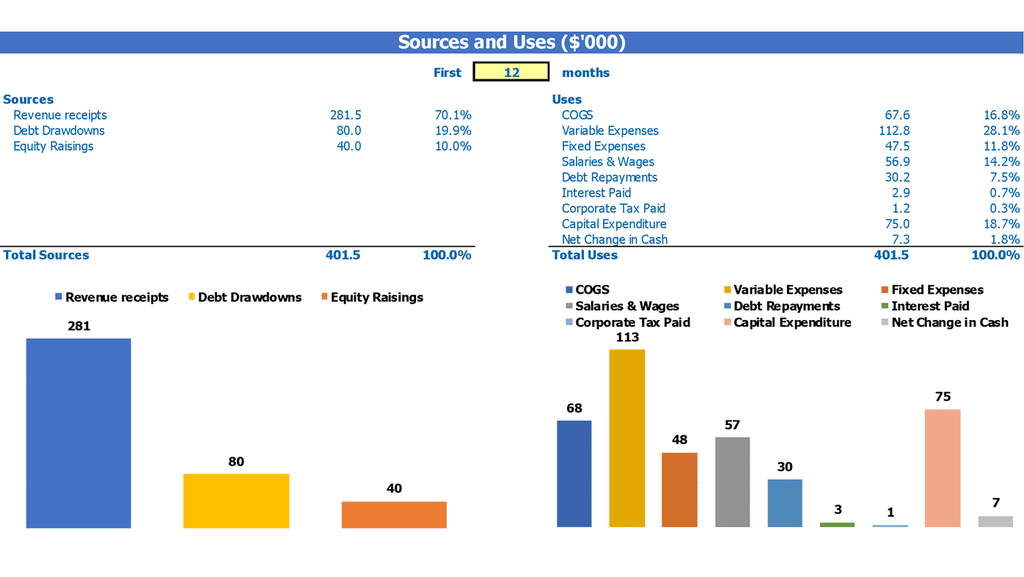

Sources And Uses Template Excel

The business plan template xls offers a valuable tool for floating hotel financial planning, including cash flow projections, revenue and cost structures, profit and investment analysis, break-even and return on investment calculations, financing options, market and SWOT analyses, risk assessments, and capital expenditure evaluations. This statement enables companies to pinpoint internal finance examples and create effective planning strategies based on them, ensuring that their floating hotel feasibility study and valuation align with industry standards and expectations. Ultimately, this can lead to increased revenue and profitability for floating hotels.

Break Even Calculation

The break-even analysis tab within our financial projection model uncovers the exact point when your floating hotel business will start to generate profits. Its calculations showcase the critical intersection where your projected revenues surpass impending expenses. Essentially, it predicts when you will begin to make a profit. By using our expert financial planning and sound business strategies, we can help you accelerate this point and increase your return on investment. Our comprehensive investment analysis provides you with valuable data, such as cost structure, cash flow projections, and market analysis, to make the best investment choices for your floating hotel.

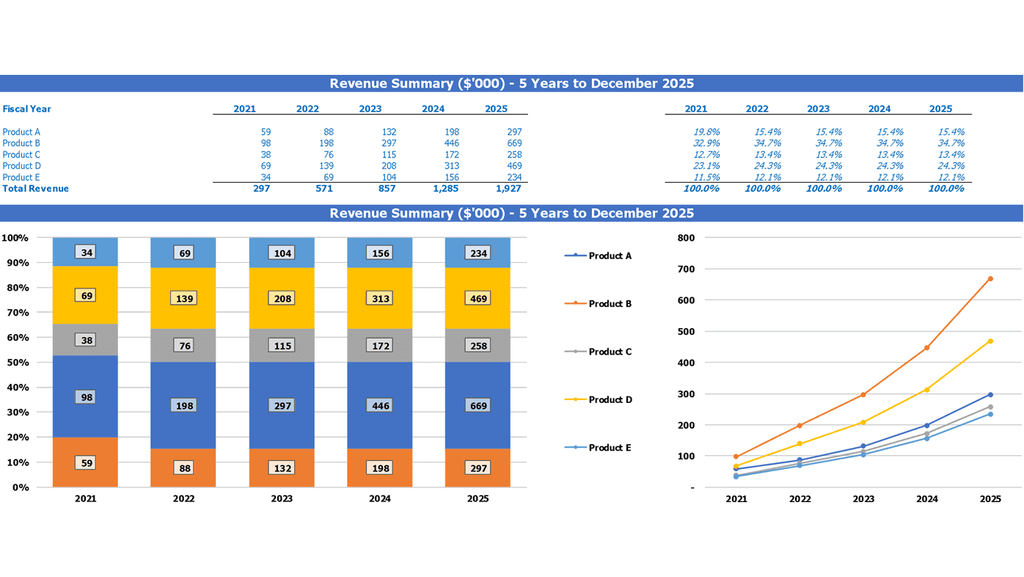

Top Revenue

Our comprehensive financial planning tool includes detailed analysis of your floating hotel's revenue model, cost structure, profit and cash flow projections, break-even and return on investment analysis, financing options, market and SWOT analysis, risk assessment, valuation, and capital expenditure analysis. Our specialized 3 statement model excel also allows you to analyze revenue streams by product or service category, with a separate tab for detailed analysis. Make informed decisions and maximize your profitability with our floating hotel feasibility and investment analysis.

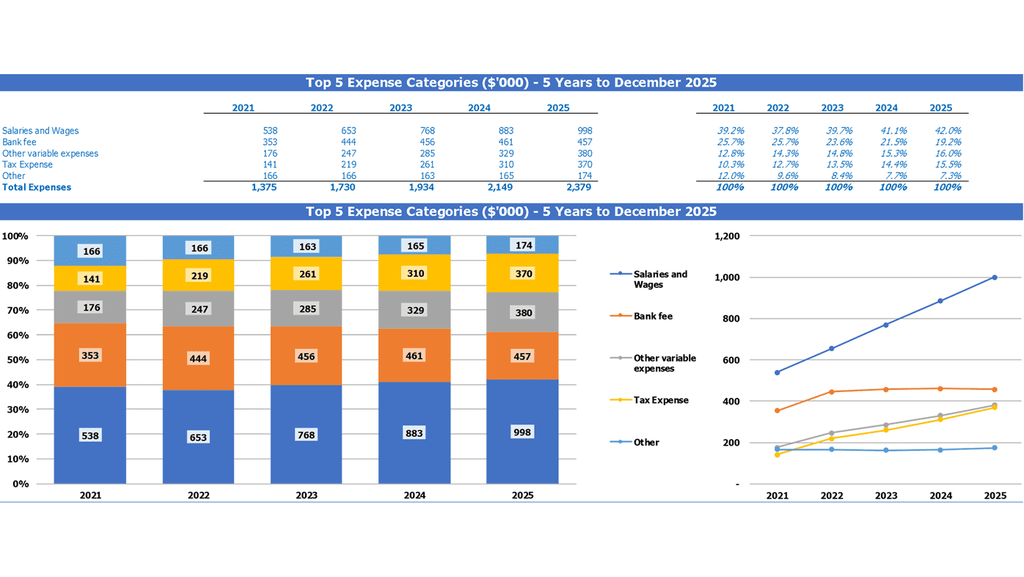

Business Top Expenses List

This startup financial model template includes a Top Expenses tab that breaks down costs into four categories, with an option for miscellaneous expenses under "Other." Our comprehensive set of tools covers every aspect of financial planning, including feasibility studies, market analysis, SWOT analysis, and risk assessment. The floating hotel investment analysis also provides cash flow projections, break-even analysis, return on investment, and capital expenditures analysis. We offer multiple financing options and thorough valuation reports to guide decision-making and maximize profits.

Floating Hotel Financial Projection Expenses

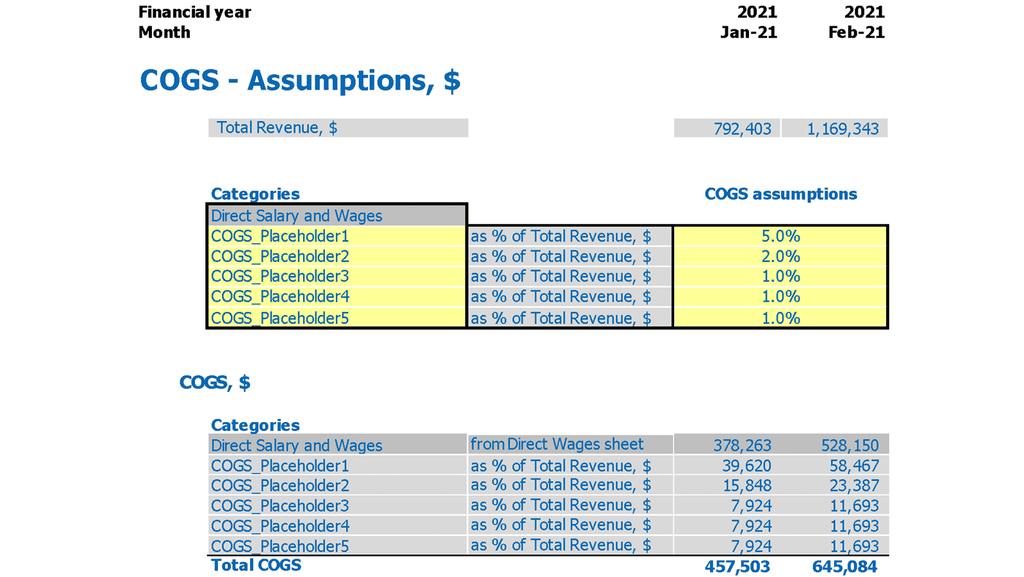

Costs

A floating hotel feasibility study requires a comprehensive analysis of its revenue model, cost structure, and profit projection. Using tools like cash flow projections, break-even analysis, and ROI evaluation can help determine the viability of the project. Market analysis, SWOT assessment, and risk evaluation are also critical for floating hotel valuation. Capital expenditure analysis should also be factored in while exploring financing options. A thorough understanding of these factors can aid in financial planning and convince potential investors to fund the project.

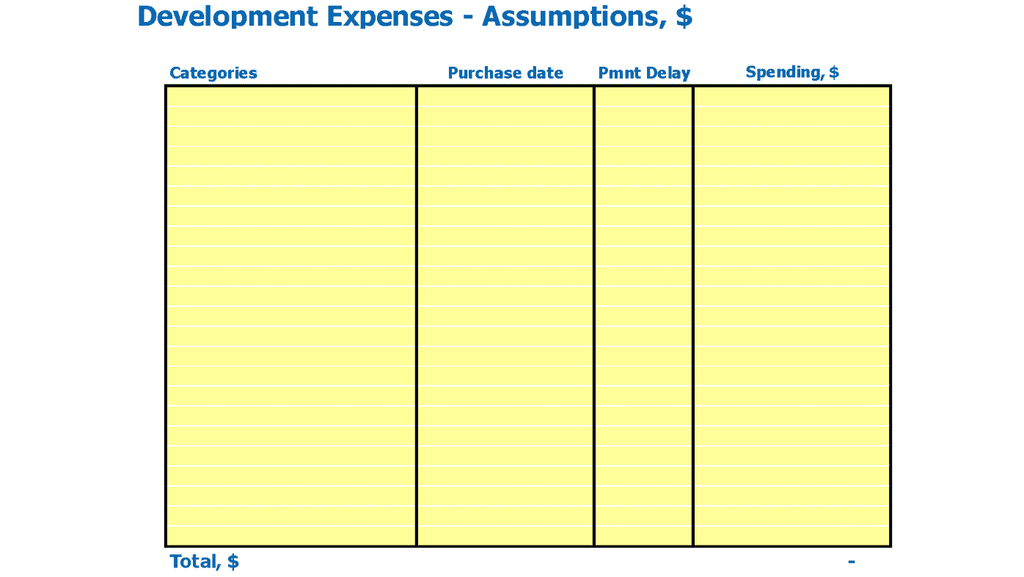

Development Costs

Implementing a strategic CAPEX budget is essential for boosting a company's financial standing. This budget should cover all necessary investments and identify innovative methods of management and technological advancements. With this approach, the company can improve its revenue and cost structure, leading to a successful profit analysis. A floating hotel feasibility study, cash flow projection, break-even analysis, and return on investment calculation should be included, alongside market and SWOT analysis, risk assessment, and valuation. The company should also explore various financing options to ensure adequate capital expenditure analysis and progressive financial planning.

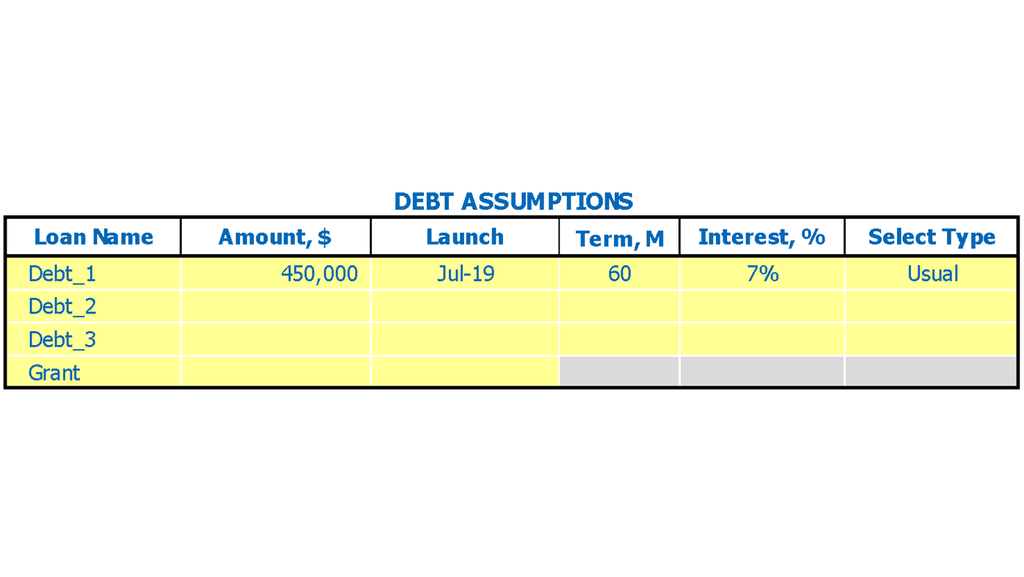

Loan opt-in

A thorough floating hotel feasibility study must include a market analysis, SWOT analysis, and risk assessment. It should also include a detailed financial plan that covers everything from revenue and cost structures to cash flow projections, return on investment, and break-even analysis. Additionally, potential investors must be presented with a capital expenditure analysis, various financing options, and a valuation. As a key component of the financial plan, a loan payback schedule must be included along with interest expenditures, as it impacts the cash flow proforma and the closing debt level for start-up companies. Principal repayments should be included in the company's cash flow chart excel.

Floating Hotel Income Statement Metrics

Profitability KPIs

With our floating hotel financial planning tool, you can easily analyze the revenue breakdown of your venture. Our three way financial model presents a proforma chart that breaks down revenue contributions from each product on a monthly basis, making it easy for users to visualize and interpret essential financial data. You can even adjust the period and add new products for further analysis. Our tool is the perfect solution for conducting a floating hotel profit analysis, feasibility study, SWOT analysis, risk assessment, market analysis, valuation, capital expenditure analysis, cash flow projection, return on investment and financing options review.

Cash Flow Statement

A thorough feasibility study, including SWOT and market analysis, is essential for a floating hotel investment. A detailed cost structure and revenue model should be created to determine break-even points, expected profit margins, and potential return on investment. Additionally, a cash flow projection and financial planning should be completed to identify financing options and evaluate capital expenditure. A risk assessment and valuation should also be conducted to ensure profitability. By carefully analyzing these factors, businesses can successfully plan and manage their finances, ultimately increasing income and capital turnover.

Business Benchmarks

Our comprehensive financial analysis includes a range of tools and strategies to help you make informed decisions about your floating hotel investment. Our services include a thorough market analysis, a detailed cost structure breakdown, and a SWOT assessment to identify potential risks and opportunities. We will also provide a full cash flow projection and break-even analysis, as well as in-depth valuation and investment analysis to determine the best financing options and return on investment calculations. Our expert team will work with you to develop a customized financial plan that takes into account all of the unique aspects of your floating hotel concept, ensuring that you achieve optimal results for your business.

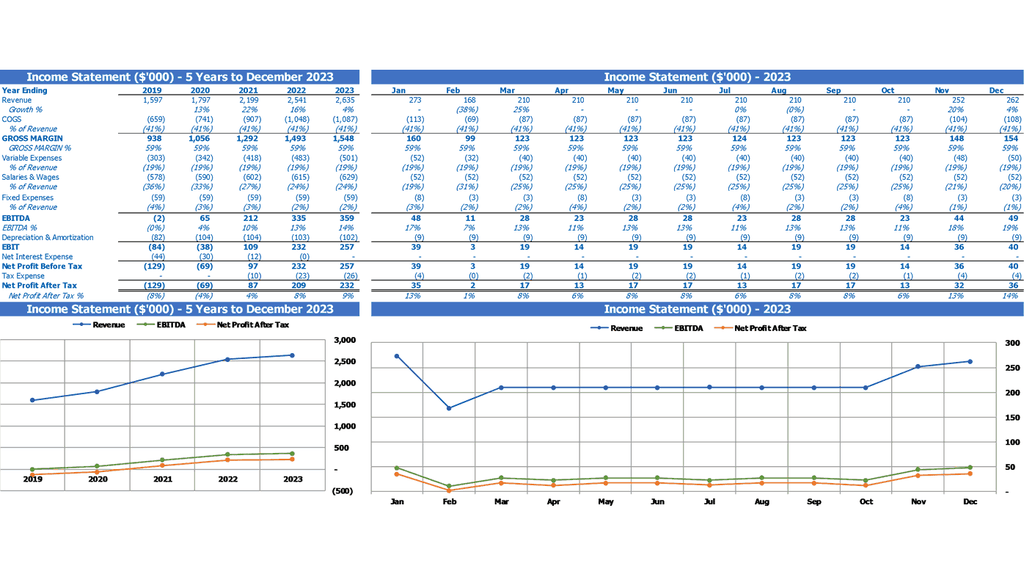

Forecast Income Statement

Conducting a feasibility study and profit analysis is crucial when planning to invest in a floating hotel. This includes a comprehensive SWOT analysis, market analysis, and risk assessment. It's important to determine the cost structure, financing options, and capital expenditure analysis. A cash flow projection and financial planning should be developed, as well as a break-even analysis and return on investment calculation. A valuation of the floating hotel will determine the potential profitability, which can be communicated using an income statement to stakeholders. Use forecasted income statements to determine future profit expectations.

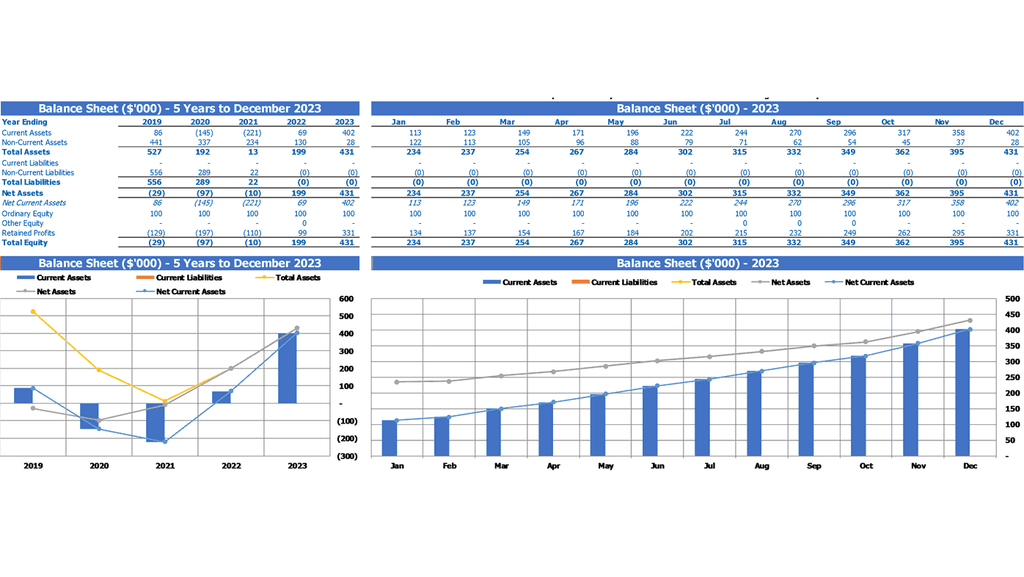

Pro Forma Balance Sheet Template Excel

The feasibility study of a floating hotel necessitates a detailed analysis of its revenue model, cost structure, profit potential, and financial planning. In addition, examining the break-even point, return on investment, and cash flow projections is critical when evaluating financing options and determining the hotel's market potential through SWOT and risk assessments. Valuation and capital expenditure analysis are also essential to assess the projected balance sheet's significance, which determines the investment required to back the profit and sales shown in the profit and loss projection template. The balance sheet forecast acts as a barometer of the company's future financial state.

Floating Hotel Income Statement Valuation

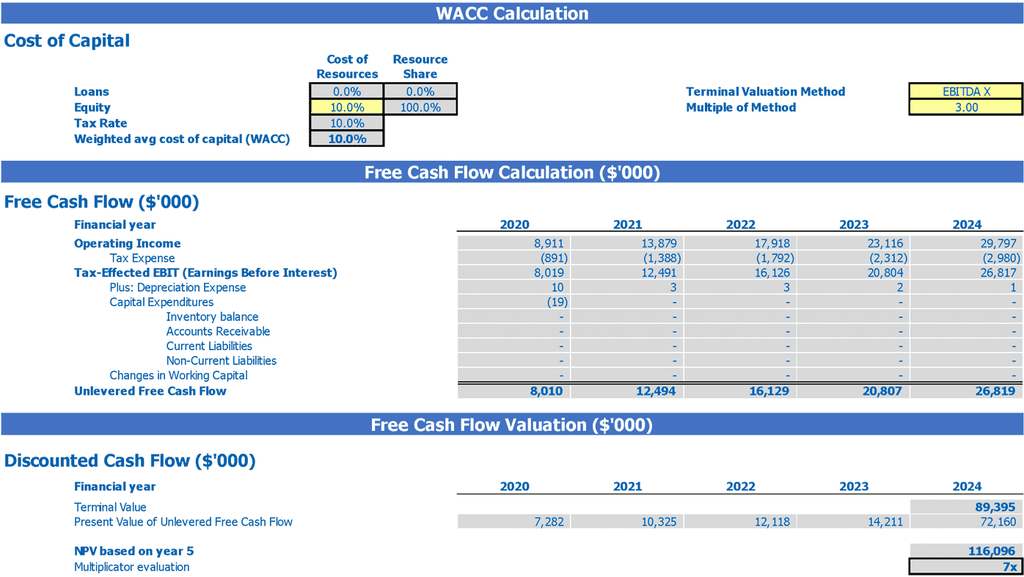

Seed Valuation

Our comprehensive floating hotel financial model template startup offers valuable data for your investors. It includes a floating hotel revenue model, cost structure, profit analysis, feasibility study, investment analysis, cash flow projection, financial planning, break-even analysis, return on investment, financing options, market analysis, SWOT analysis, risk assessment, valuation, and capital expenditure analysis. The WACC calculates the minimum return on enterprise funds invested in capital, while free cash flow valuation reflects the cash flow available to all investors. Discounted cash flow analysis estimates the future value of cash flows in relation to the present.

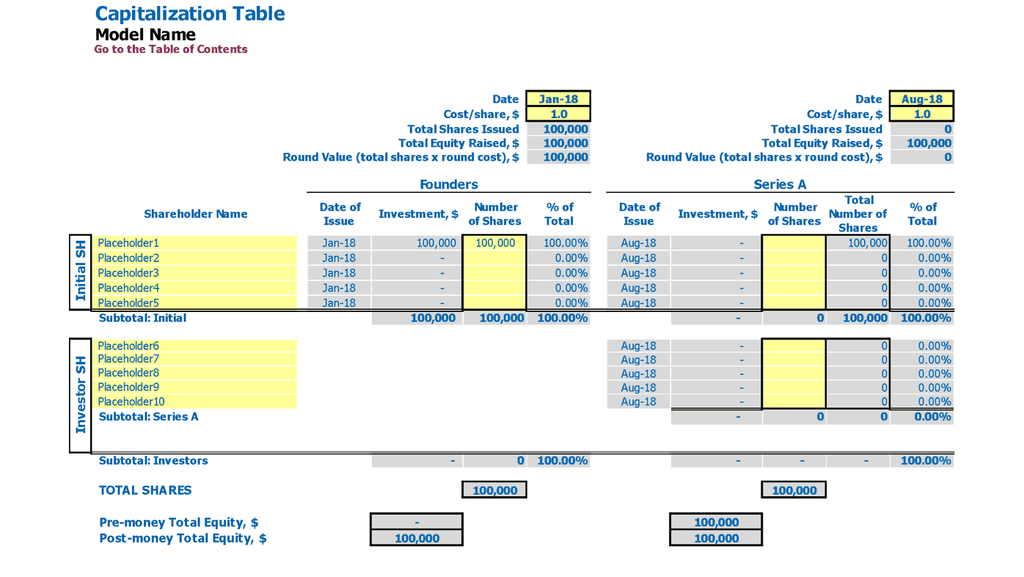

Cap Table For Startups

Undoubtedly, the cap table model is a vital aspect of any startup or established company. It offers an in-depth understanding of the shares and the ownership interest of each investor, as well as their expenses. By preparing a pro forma cap table, you can easily calculate the ownership percentage of each investor in the company. This will help you make informed decisions concerning expansion, financing options, and overall financial planning. Therefore, it is essential to conduct an accurate cap table analysis to ensure optimal business performance and profitability.

Floating Hotel Three Statement Model Template Key Features

It is part of the reports set you need

Conduct a comprehensive floating hotel financial analysis, including market and risk assessment, to determine feasibility and ROI.

Convenient All-In-One Dashboard

Comprehensive financial analysis for a floating hotel project, including forecasting reports and performance reviews.

Simple-to-use

Easily analyze the financial feasibility of your floating hotel with a free, user-friendly Excel template.

Get it Right the First Time

Explore the benefits and drawbacks of a floating hotel with comprehensive financial planning tools.

Simple-to-use

Get quick and reliable results with our excel template for floating hotel financial planning, regardless of business size or experience.

Floating Hotel Excel Pro Forma Template Advantages

Develop a comprehensive financial plan for a floating hotel, including market and risk analysis, cash flow projections, and investment analysis.

Create a comprehensive revenue model for your floating hotel, including cash flow projections and break-even analysis.

Optimize floating hotel profits with comprehensive financial planning.

Impress investors with a comprehensive financial plan using a floating hotel financial plan template excel.

Maximize your business potential with our comprehensive floating hotel financial model template.