ALL IN ONE MEGA PACK INCLUDES:

Private Island Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Private Island Startup Budget Info

Highlights

Our team provides a comprehensive analysis for those interested in private island ownership, covering key factors such as island acquisition financial plans, luxury island expenses, island development budgets, and island maintenance expenses. We also assist in private island financing options, island profitability assessments, island cash flow analysis, island operating costs, island tax implications, island asset management, and island financial feasibility studies. Using our expertise, we create 5-year private island startup financial models, projected income statement templates in excel, financial statements, and financial ratios in GAAP or IFRS formats. Our pro forma income statement template in excel can help secure funding from banks, angels, grants, and VC funds. All of our analyses are fully customized and easily editable to fit the client's needs.

If you're considering private island ownership, assessing the financial feasibility is crucial. Our island financial projection template excel includes a comprehensive analysis of island acquisition financial plan, island development budget, island maintenance expenses, island operating costs, island revenue projections, and island profitability assessment. Additionally, the professional model provides one with a clear understanding of island investment analysis, luxury island expenses, private island financing options, island asset management, island tax implications, and private island investment returns. The three-statement financial model is perfect for startups looking to determine the financial feasibility of their business and present their financial plan to investors, as it includes an executive summary and input assumptions. With colorful tables, graphs, and charts, our model helps you make informed decisions about your private island investment.

Description

The costs associated with private island ownership can be daunting, and it's difficult to know where to start. However, with our private island acquisition financial plan, you have access to the crucial information you need to make informed decisions about your investment. Our plan includes an assessment of luxury island expenses, island development budget, and island maintenance expenses, as well as a review of private island financing options and island tax implications. In addition, our island profitability assessment and island cash flow analysis provide you with essential insights into the island revenue projections and private island investment returns you can expect. With our island asset management and island financial feasibility study, you can rest assured that your private island is a secure investment that will continue to provide excellent returns for years to come.Private Island Financial Plan Reports

All in One Place

Investing in a private island requires careful consideration of various factors such as ownership costs, financing options, revenue projections, and operating and maintenance expenses. A financial feasibility study with detailed island investment analysis, island acquisition financial plan, luxury island expenses, island development budget, island tax implications, island asset management, island profitability assessment, island cash flow analysis, and island financial projections is a must-have. Our high-quality business projection template can help you create a professional, engaging financial model business plan that meets the requirements of even the most discerning investors.

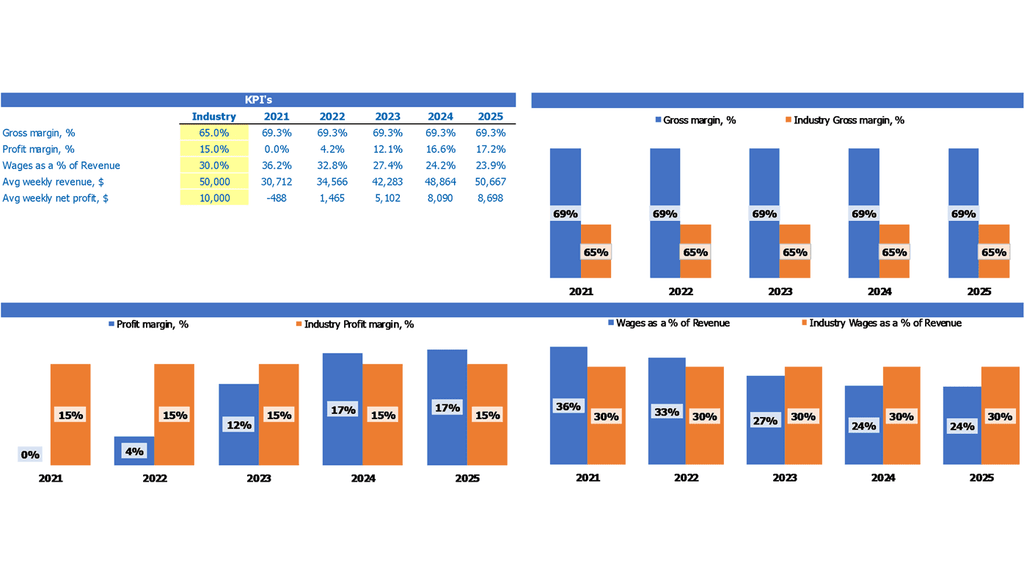

Dashboard

Investing in a private island requires a thorough financial feasibility study. Consider island acquisition financial plan, island revenue projections, island development budget, and island maintenance expenses. Moreover, take into account island operating costs, luxury island expenses, island financing options, island tax implications, and island asset management. Assess the island profitability and analyze the island cash flow to determine private island investment returns. Remember that private island ownership costs can be significant, so create a realistic island investment analysis to present to stakeholders, potential investors, and lenders. Utilize financial templates and dashboards to simplify your financial statements examples in Excel.

Excel Financial Report

Investing in a private island can be a lucrative opportunity, but it requires careful financial planning. Island ownership costs include development, maintenance, and operating expenses, as well as tax implications. To assess profitability and investment returns, a financial feasibility study should be conducted, including revenue projections, cash flow analysis, and island asset management. Financing options should also be considered when creating a comprehensive island acquisition financial plan. The costs and expenses involved in luxury island investments can be managed through a thorough island investment analysis and development budget.

Sources And Uses Of Capital

Analyze private island ownership costs with our comprehensive island investment analysis. Our team can assist with island acquisition financial plans, island revenue projections, luxury island expenses, island development budgets, and island maintenance expenses. We offer private island financing options and provide a thorough island profitability assessment, including island cash flow analysis, island operating costs, island tax implications, and island asset management. We conduct island financial feasibility studies and offer guidance on private island investment returns. Our sources and uses template in an excel format displays the financial structure of the firm and sources and uses of funds.

Break Even Sales In Dollars

Investing in a private island requires a detailed financial plan. This includes assessing private island ownership costs, island development budgets, maintenance expenses, and island operating costs. It is important to consider island revenue projections and island financing options to perform a profitability assessment and cash flow analysis. A financial feasibility study helps to determine private island investment returns and tax implications. Island asset management is crucial for long-term success. A thorough break-even revenue calculator analysis can assist in differentiating between revenue, sales, and profit. It is an essential tool in private island financial planning.

Top Revenue

When evaluating the financial feasibility of private island ownership, it is crucial to consider factors such as island acquisition financial plan, island revenue projections, luxury island expenses, private island financing options and island operating costs. An island development budget, island maintenance expenses, and island tax implications must also be taken into account. Conducting an island profitability assessment with an island cash flow analysis can help assess private island investment returns. Lastly, effective island asset management and planning through an island financial feasibility study are essential for ensuring profitable island ownership in the long run.

List of Top Expenses

Our comprehensive financial feasibility study includes an analysis of private island ownership costs, island investment analysis, island acquisition financial plan, luxury island expenses, island development budget, island maintenance expenses, private island financing options, island profitability assessment, island cash flow analysis, private island investment returns, island operating costs, and island tax implications. We also provide expert island asset management services and revenue projections, including a detailed breakdown of revenue streams by product or service for better analysis. Trust us to help you make informed decisions about your island investment.

Private Island Financial Projection Expenses

Costs

The decision to invest in private island ownership involves a complex web of financial considerations. Conducting a thorough island investment analysis, including island acquisition financial planning, island development budgeting, and island profitability assessments can help determine private island financing options and calculate island investment returns. It's crucial to consider all the costs involved, including luxury island expenses, island maintenance expenses, island operating costs, island tax implications, and island asset management. By performing a comprehensive island financial feasibility study, including island revenue projections and island cash flow analysis, investors can confidently develop an island asset management strategy that maximizes profitability.

Capital Expenditure Plan

Investing in a private island requires a comprehensive financial plan that considers numerous factors, such as island ownership costs, revenue projections, and maintenance expenses. Therefore, a thorough island financial feasibility study and island investment analysis are crucial. This analysis should include a detailed assessment of island profitability, island operating costs, island cash flow analysis, island taxation implications, and island asset management. It is also important to create an island development budget and explore private island financing options. In addition, assessing luxury island expenses is crucial to ensure the private island investment returns are worth the CapEX.

Debt Repayment Plan

Acquiring a private island requires a comprehensive financial plan that includes analyzing the ownership and operating costs, revenue projections, and profitability assessment. A feasibility study should consider development and maintenance expenses, financing options, tax implications, and asset management. A cash flow analysis and loan amortization can help determine investment returns, spreading out loan repayments over several reporting periods. A professional tone should be used, as investing in a luxury island is a significant financial decision. Monthly, quarterly, or annual payments over a designated period are typically made.

Private Island Income Statement Metrics

Profitability KPIs

Our private island investment analysis includes a comprehensive financial feasibility study that covers all aspects of island ownership costs, including island acquisition financial plan, luxury island expenses, island development budget, island maintenance expenses, island operating costs, island tax implications, and island asset management. Our island revenue projections and cash flow analysis allow for a thorough assessment of island profitability, investment returns, and private island financing options. With our revenue breakdown chart, users can visually analyze revenue contributions from each product on a monthly basis and make adjustments for additional financial analysis.

Cash Flow Analysis Template

Private island ownership costs, including luxury expenses, development and maintenance expenses, and tax implications, can be daunting. However, conducting an island investment analysis, including an island acquisition financial plan, island revenue projections, and island profitability assessment, can provide insight into potential private island investment returns. Utilizing private island financing options and conducting an island financial feasibility study can also help in making informed decisions about island asset management and balancing island operating costs. A cash flow analysis, using tools such as a cash flow projection template excel, can aid in proper island financial planning for long-term success.

Industry Benchmarks

When considering private island ownership, a thorough financial feasibility study is crucial. This includes analyzing island acquisition and development costs, revenue projections, and ongoing operating and maintenance expenses. Financing options, tax implications, and asset management strategies should also be considered. A cash flow analysis and profitability assessment will determine the island's investment returns. Luxury island expenses are a significant factor to consider, but with careful planning and budgeting, an island investment can yield favourable outcomes. These metrics provide invaluable insights for strategic management, making monitoring and recording all indications critical.

Profit And Loss Projection Template

Assessing the feasibility of private island ownership requires an analysis of various financial elements, including acquisition costs, development budgets, maintenance expenses, tax implications, and operating costs. To determine profitability and investment returns, revenue projections and cash flow analyses are essential. Additionally, it's crucial to investigate financing options and asset management strategies to optimize island investments. A forecasted profit and loss statement can be used to simulate expenses and revenues, including depreciation, which needs to be accounted for over several years. A comprehensive island investment analysis should consider all these factors to determine the financial viability of owning a private island.

Pro Forma Balance Sheet For A Startup Business

When considering purchasing a private island, it's essential to conduct a thorough island investment analysis, including island acquisition financial plans, island revenue projections, luxury island expenses, island development budgets, and island maintenance expenses. Private island financing options, island profitability assessments, island cash flow analyses, island operating costs, island tax implications, island asset management, and island financial feasibility studies should also be considered. Understanding these factors will help you create a successful private island ownership plan and maximize private island investment returns.

Private Island Income Statement Valuation

Pre Revenue Company

Make a professional and engaging private island financial plan with our pre-built valuation templates. Our templates automate financial data calculation for your investors. Showcase your WACC to demonstrate the minimum return on investment with our private island financial forecast. Use our free cash flow valuation to illustrate available unearmarked distribution to investors. Our discounted cash flow will determine future cash flows value in the present moment. Streamline your presentation to investors with our private island financial model.

Cap Table Model

Understanding private island ownership costs is critical to developing a financial plan for island acquisition. Luxury island expenses, island development budget, and island maintenance expenses must all be carefully analyzed, along with island revenue projections and island operating costs, to assess island profitability and investment returns. Private island financing options and island tax implications must also be considered, and island asset management requires a thorough island financial feasibility study, including an island cash flow analysis and island profitability assessment. Such analyses provide a comprehensive island investment analysis that can help ensure success in private island ownership.

Private Island Profit Loss Projection Key Features

Save time and money

Our pro forma template streamlines private island financial planning, allowing you to focus on strategy and creativity.

Easy to follow

Our private island financial modelling Excel template offers a user-friendly and comprehensive approach to analyzing island investment opportunities.

Get a robust, powerful financial model which is fully expandable

This private island financial projection template in Excel provides a strong foundation for planning and tailoring a business model.

Simple and Incredibly Practical

Maximize your private island investment returns with our easy-to-use financial projection tool and exceptional after-sales support.

Avoid Cash Flow Shortfalls

A thorough financial feasibility study is necessary for private island ownership, including revenue projections, operating costs, and financing options.

Private Island 3 Statement Financial Model Template Advantages

Create a comprehensive private island financial feasibility study for informed island investment decisions.

Conduct a financial feasibility study to assess costs, revenue projections, and investment returns for private island ownership.

Assess island financial feasibility through revenue projections, development and maintenance expenses, and financing options.

Maximize profitability with our comprehensive private island financial feasibility study.

Build trust with stakeholders by presenting a comprehensive financial feasibility study for private island ownership.