ALL IN ONE MEGA PACK INCLUDES:

Deli Restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Deli Restaurant Feasibility Study Info

Highlights

The deli restaurant financial planning involves creating and analyzing the restaurant financial statements, such as the income statement, balance sheet, and cash flow statement. In order to develop a successful restaurant business plan, financial modeling for deli, financial projections for deli, restaurant revenue forecasting, and break-even analysis are important. Understanding the cost of goods sold for deli and restaurant profit margins are essential for restaurant budgeting and cash flow management. Utilizing a restaurant financial analysis template, such as the five-year deli restaurant projected income statement template excel, can assist with fundraising and business planning for startups and entrepreneurs. This template includes key financial charts, summaries, metrics, funding forecasts, and is created with the mind of the deli restaurant business. In addition, the deli restaurant financial projection startup tool can help estimate required startup costs, and it is unlocked for all to edit.

This financial analysis tool is specifically designed for deli restaurant startups, offering a comprehensive business plan that covers all aspects of deli restaurant financial planning. With the ability to project financials for up to five years, it includes critical elements such as restaurant budgeting, revenue forecasting, break-even analysis, and cost of goods sold. The financial modeling for deli businesses enables users to adjust a variety of inputs, including product types, expenses, and startup costs on a per-unit basis. This tool provides a restaurant income statement, balance sheet, and cash flow statement, enabling optimal restaurant cash flow management and highlighting restaurant profit margins throughout the planning process. Overall, this restaurant financial analysis template is an essential resource for anyone looking to open a successful deli restaurant business.

Description

Our deli restaurant financial model excel spreadsheet is a comprehensive tool to assist in analyzing and projecting financial outcomes. It incorporates financial statements and tables needed to create informed business decisions. The financial model can forecast revenue and expenses for up to 60 months, and it includes three financial statements. This deli restaurant three statement model template excel is applicable for startups or existing businesses of any size. The model includes tools for planning, operating, and creating a successful deli restaurant. With this excel deli restaurant model, no professional finance knowledge or technical skills are required.Deli Restaurant Financial Plan Reports

All in One Place

Entrepreneurs in the restaurant industry must prioritize restaurant financial analysis, including deli business plans, financial projections, and cost of goods sold for delis. Restaurant budgeting, break-even analysis, and cash flow management are important aspects to address, as well as closely monitoring restaurant profit margins. Utilizing financial modeling and forecasting tools such as a restaurant income statement, balance sheet, and cash flow statement can aid in making critical financial decisions. A 3 statement model Excel can provide a clear performance roadmap, enabling entrepreneurs to make informed decisions based on cash flow and burn rate projections.

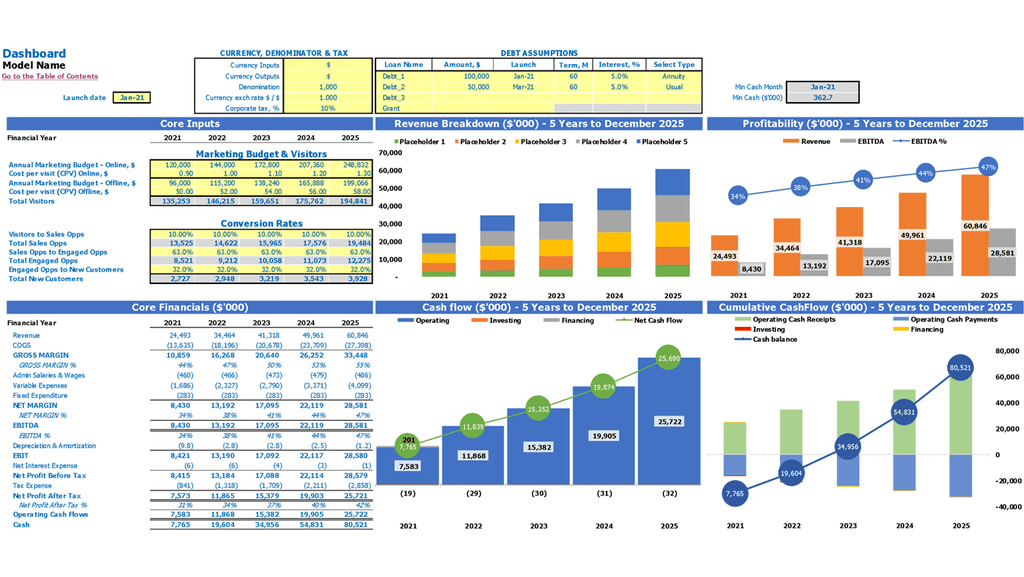

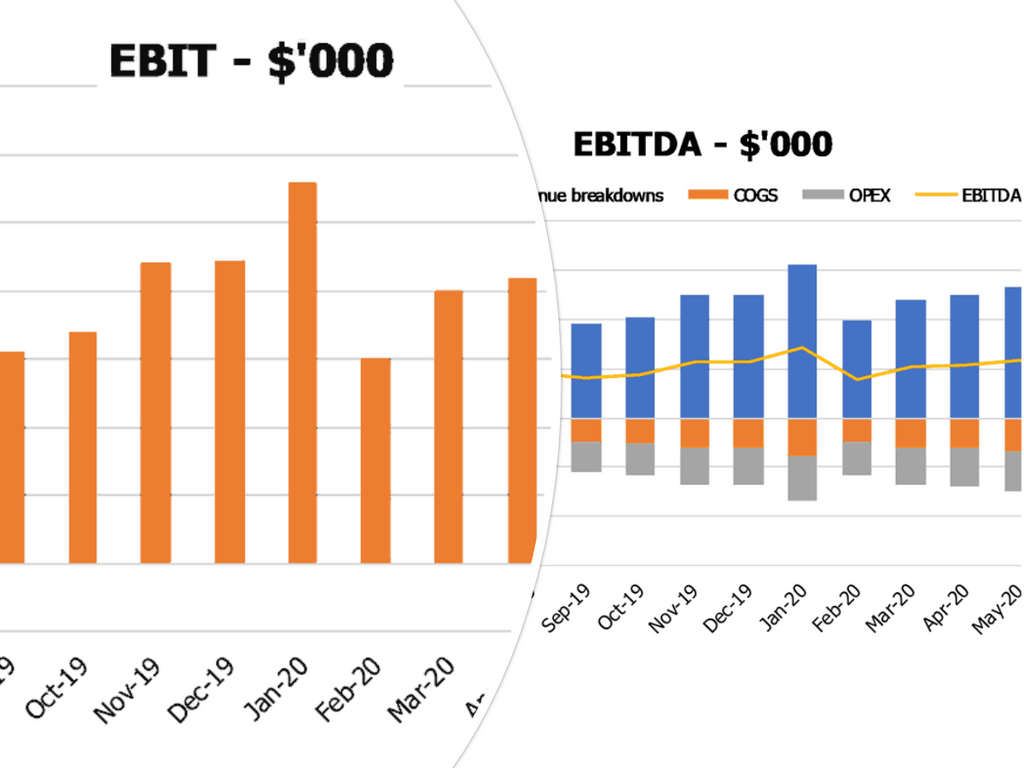

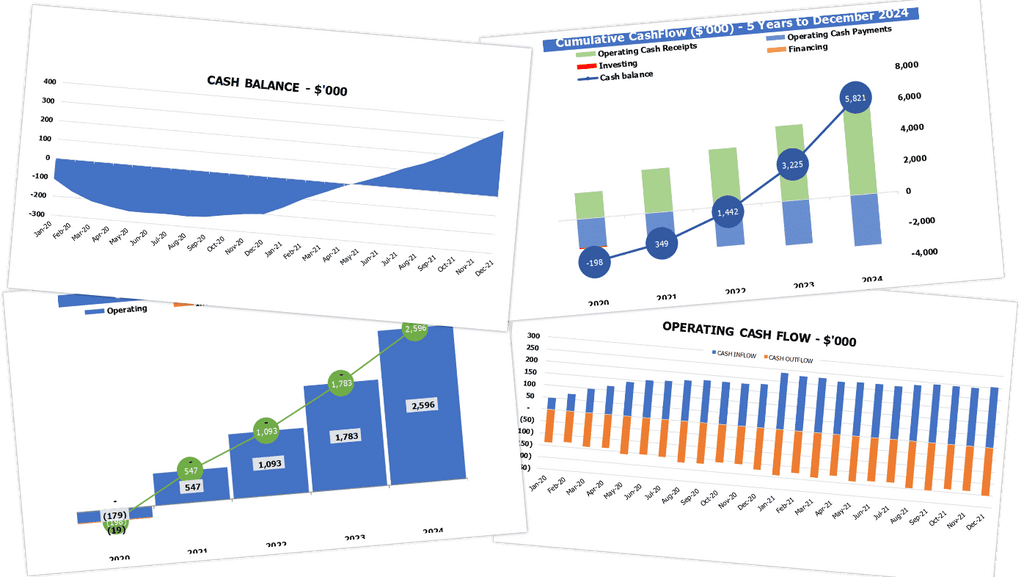

Dashboard

Our restaurant financial analysis includes comprehensive financial planning, budgeting, and modeling services. We specialize in developing deli business plans, financial projections, and revenue forecasting. Our expert team provides cost of goods sold for delis, restaurant profit margins, and break-even analysis. We also offer food service financials, income statements, balance sheets, and cash flow statements. By utilizing our Dashboard tab, our clients can easily view financial snapshots in the form of graphs, charts, and summaries, ready to be copied into pitch decks. Let us help you manage your restaurant cash flow and maximize your profits.

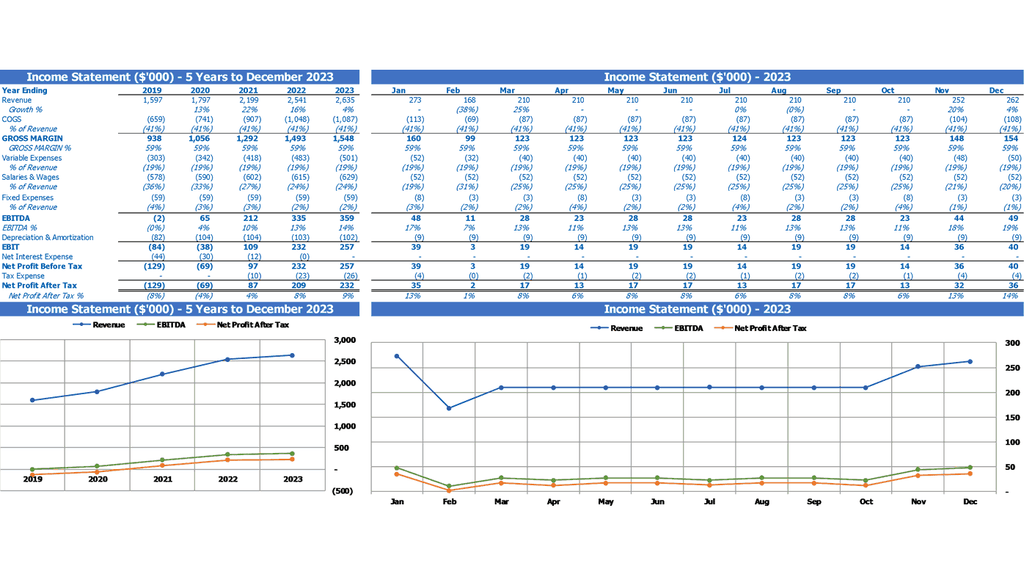

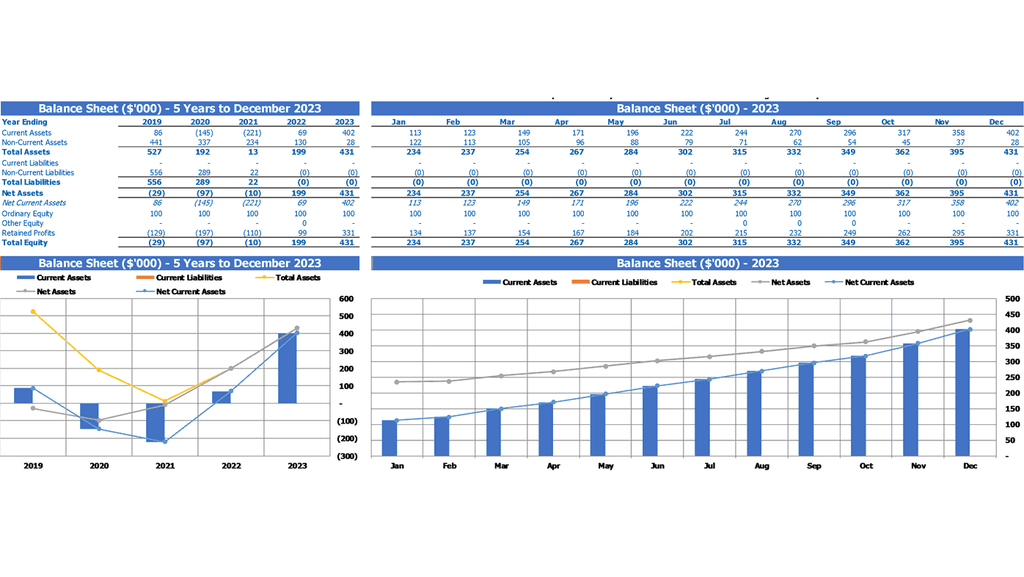

Business Financial Statements

Effective restaurant financial planning involves creating a deli business plan that incorporates financial projections for deli, restaurant budgeting, and restaurant revenue forecasting. Cost of goods sold for deli and restaurant profit margins can be analyzed through financial modeling for deli. Important tools such as restaurant break-even analysis, cash flow management, and food service financials require the use of the three core statements: Income Statement, Balance Sheet, and Cash Flow Statement, which provide valuable insight into the company's financial performance. Engaging in a professional financial analysis can help guide decisions related to maximizing revenue and minimizing expenses.

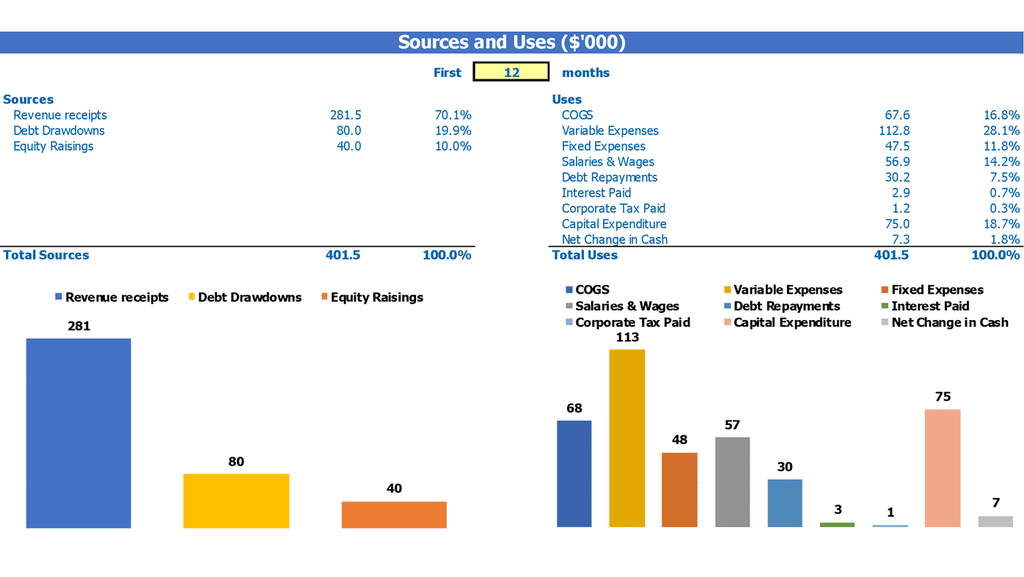

Use Of Funds

The sources and uses statement is a crucial element of any restaurant financial plan, providing a summary of where capital will come from and how it will be spent. By accurately modeling financial projections for a deli or restaurant, owners can anticipate costs, manage profit margins and maximize cash flow. Understanding the cost of goods sold for a deli and revenue forecasting can help guide budgeting decisions and ensure long-term viability. Additionally, break-even analysis and cash flow management can help restaurants navigate mergers and acquisitions or restructuring efforts. A sound financial plan, including an income statement, balance sheet, and cash flow statement, is essential to success in the food service industry.

5 Year Breakeven

Every successful deli business plan needs a solid foundation of restaurant financial analysis. Our financial modeling for deli includes restaurant budgeting, cost of goods sold, and restaurant profit margins. We provide detailed financial projections for deli, which includes restaurant revenue forecasting, restaurant break-even analysis, and restaurant cash flow management. Our food service financials include a detailed restaurant income statement, restaurant balance sheet, and restaurant cash flow statement. Our financial model template includes a break-even point in unit sales calculation that every start-up must understand to determine the suitability of the business venture.

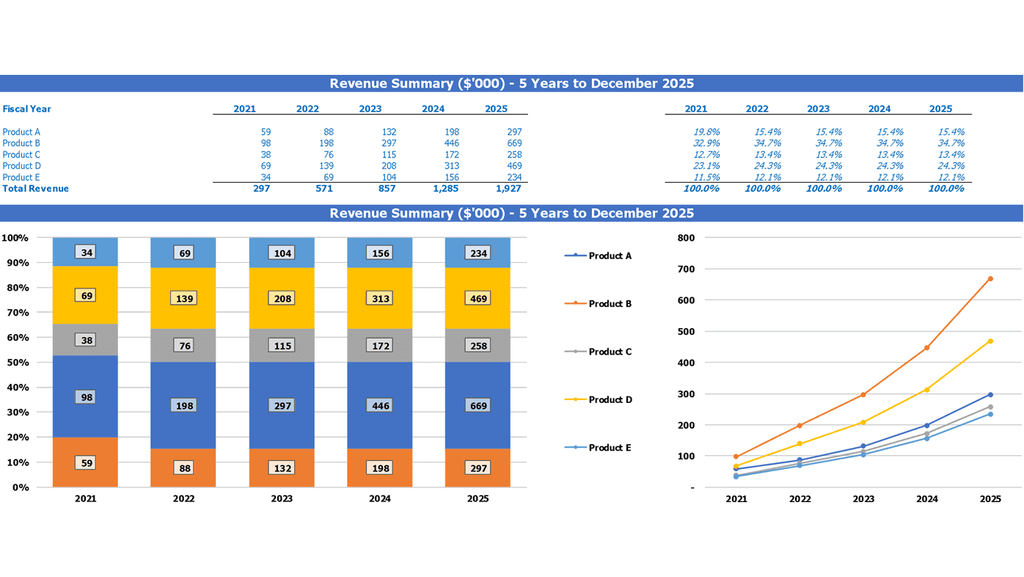

Top Revenue

Our financial modeling template analyzes revenue streams and breaks them down by product or service to simplify forecasting. We offer comprehensive restaurant budgeting with financial planning and projections for deli managers. Our expert deli business plan includes cost of goods sold for deli, restaurant profit margins, and revenue forecasting for optimal results. We employ restaurant cash flow management techniques and provide precise information on restaurant financials through the restaurant income statement, balance sheet, and cash flow statement for informed decision making. Plus, our restaurant break-even analysis guarantees sound financial performance.

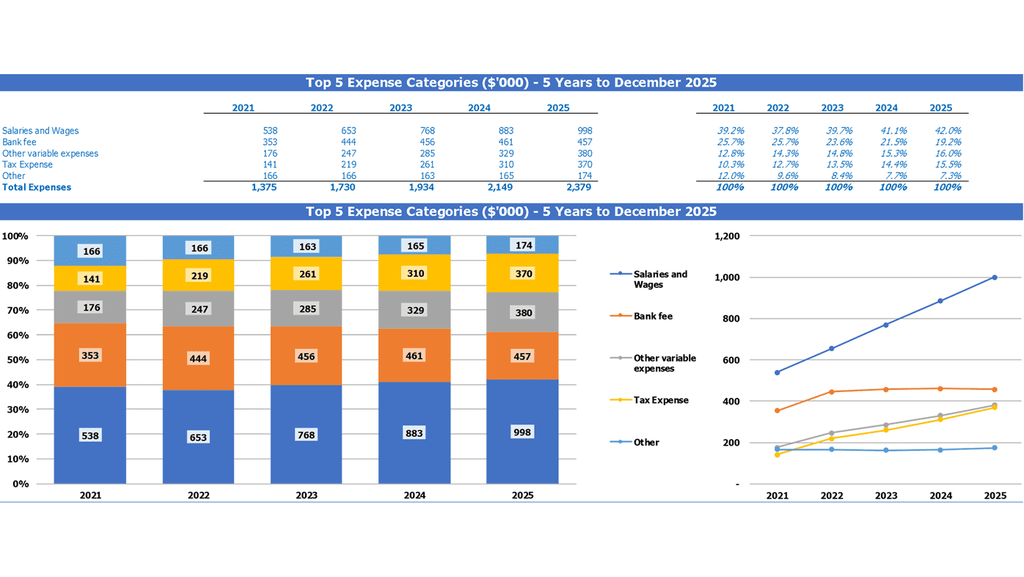

List of Top Expenses

We provide comprehensive financial services to the restaurant and deli businesses. Our financial analysis includes restaurant budgeting, cost of goods sold for deli, restaurant revenue forecasting, restaurant break-even analysis, and restaurant cash flow management. We help you create a deli business plan with financial projections and modeling. Our expertise in food service financials covers restaurant income statement, restaurant balance sheet, and restaurant cash flow statement. With our Top Expenses section in the 3 statement model excel, you can analyze categorized expenses and add custom data under the ‘Other' section, tailored to your business needs.

Deli Restaurant Financial Projection Expenses

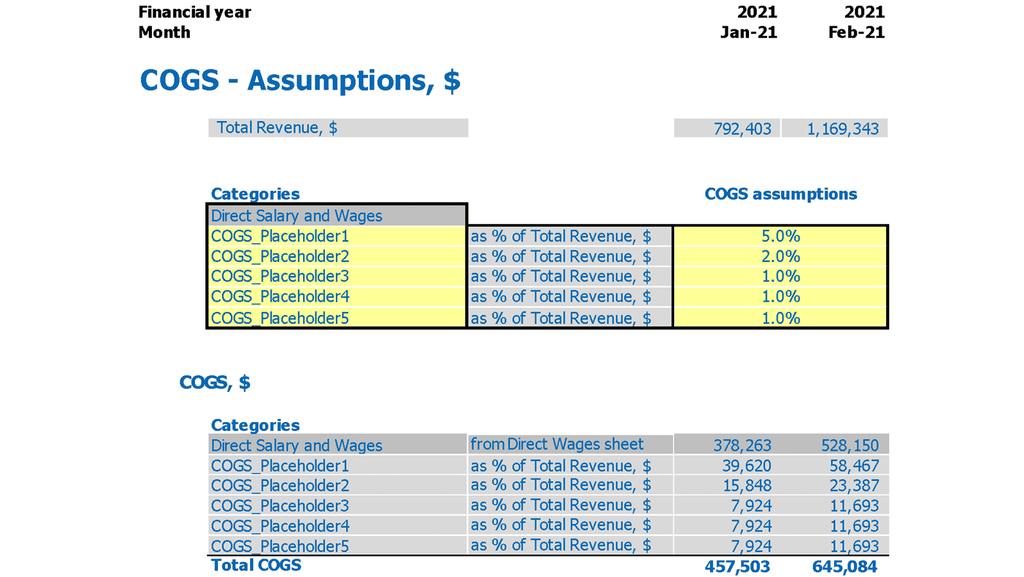

Costs

Our financial plan for the restaurant includes financial modeling and analysis tools such as cost budget creation, revenue forecasting, and break-even analysis. The modeling automatically handles accounting treatment for expenses like COGS, variable/fixed expenses, and wages. Additionally, forecasting curves can be adjusted for expense changes over time, including recurring and variable expenses. This makes our deli business plan user-friendly and allows for financial projections up to 60 months in advance, aiding in cash flow management and profit margin monitoring. Our income statement, balance sheet, and cash flow statement provide an overview of food service financials.

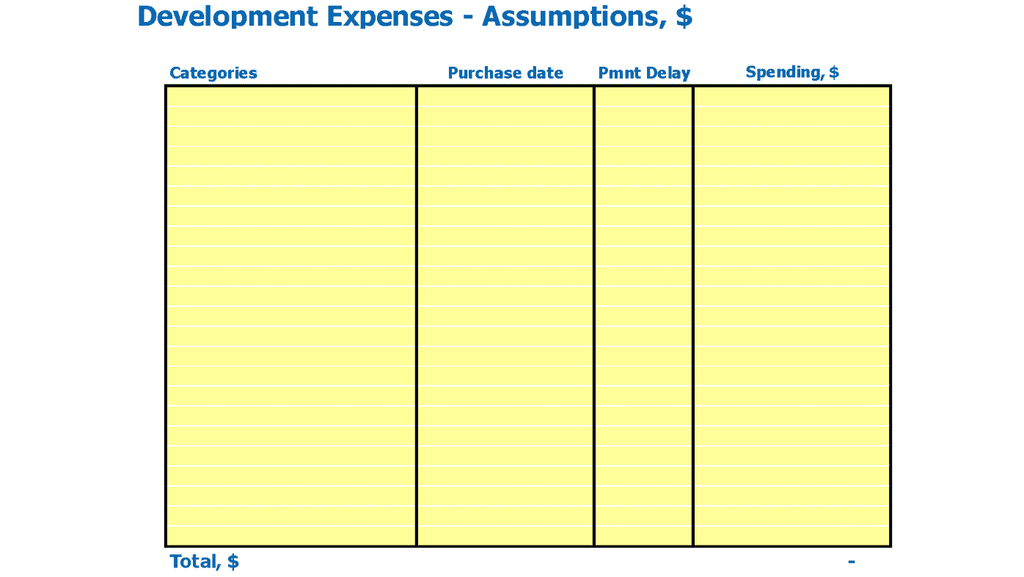

Capital Expense Budget

A comprehensive restaurant financial analysis should not overlook the capital expenditure forecast. This calculation uncovers all of the necessary resources the deli needs to stay competitive in the market. Expenditures not including staff salaries and overhead costs, allow deli owners to determine how and when to make investments to maximize profit margins. The deli business plan must include this critical report since capital expenses fluctuate widely for differing business models. Knowing how to allocate funds is crucial when working with restaurant budgeting, financial planning, projections, and cost control for deli business.

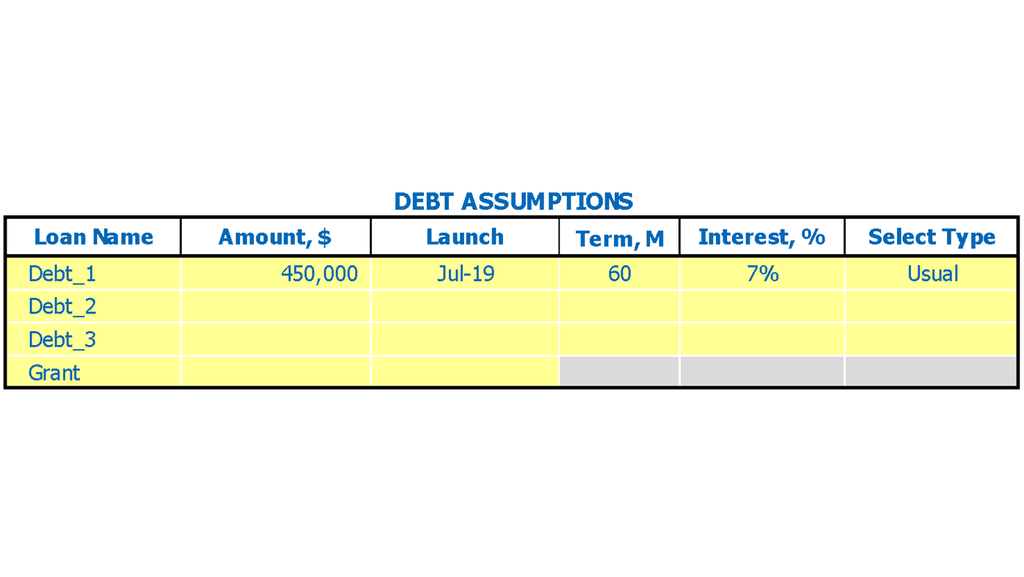

Loan Repayment Schedule

Our restaurant financial analysis involves creating financial projections and modeling for your deli business plan. We provide restaurant budgeting and financial planning, calculating restaurant profit margins and forecasting restaurant revenue. We also perform cost of goods sold for deli, break-even analysis, and cash flow management. Our food service financials include income statements, balance sheets, and cash flow statements. Using our loan amortization schedule template in our financial model, we keep track of loan repayment schedules and terms. Our built-in formulas handle all types of loans with various terms.

Deli Restaurant Income Statement Metrics

Financial KPIs

Our restaurant financial analysis includes a comprehensive deli business plan and financial modeling for deli with detailed financial projections. We provide cost of goods sold for the deli, restaurant revenue forecasting, and restaurant break-even analysis. Our food service financials also include restaurant income statement, balance sheet, and cash flow statement. Additionally, we offer restaurant budgeting, financial planning, and cash flow management. Our model template allows you to track your KPIs for up to five years, including EBITDA/EBIT, CASH FLOWS, and CASH BALANCE. Trust us to provide the essential financial insights for your food service business.

Cash Flow Forecast Template Excel

Effective restaurant financial planning involves creating a comprehensive budget and accurate financial projections to maximize profit margins. A key component of this is analyzing cost of goods sold for the deli and forecasting revenue with a break-even analysis. Additionally, conducting a regular restaurant cash flow management by creating an income statement, balance sheet, and cash flow statement is essential. Our financial modeling tools can help with these tasks and include an updated pro forma cash flow statement template for up to five years to ensure your deli business plan is sound.

KPI Benchmarking Report

Our restaurant financial analysis tool provides a comprehensive solution for deli business plan development and financial projections. Our financial modeling for deli includes restaurant budgeting, revenue forecasting, break-even analysis, and cash flow management. We also offer food service financials, income statement, balance sheet, and cash flow statement. With our benchmarking tab, companies can perform comparative analysis and evaluate their performance against industry standards. By understanding their financial indicators, restaurant profit margins, and cost of goods sold for deli, businesses can identify areas for improvement and drive financial success.

P&L Excel Template

When it comes to restaurant financial analysis, there are several key components to keep in mind. Deli business plans, financial projections, and modeling all play a critical role in restaurant budgeting and planning. It's essential to understand cost of goods sold for the deli, profit margins, revenue forecasting, and break-even analysis to achieve success. Additionally, effective cash flow management, income statements, balance sheets, and cash flow statements are integral to achieving food service financials. Utilizing a monthly profit and loss statement template can help calculate accurate projected income statement estimates, creating annual and gross profit reports.

Projected Balance Sheet Template Excel

Financial planning for restaurants is essential for success. A deli business plan should include financial projections and a break-even analysis to determine profit margins. Using a financial model for a deli helps with restaurant budgeting and forecasting revenue. Understanding the cost of goods sold for a deli is crucial to managing cash flow. With a monthly income statement, balance sheet, and cash flow statement, restaurant owners can track food service financials and make informed decisions. By linking these statements together, financial modeling for a deli can provide a complete overview of the business's financial health.

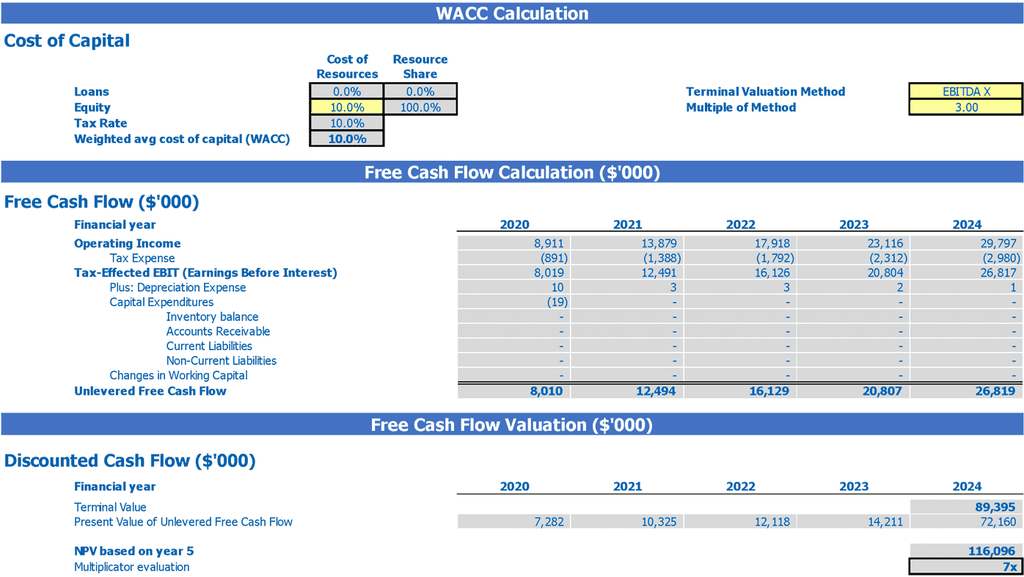

Deli Restaurant Income Statement Valuation

Startup Valuation Model

This excel template for deli business financial analysis includes a valuation multiples spreadsheet for creating a startup financial model. The templates offer tools such as weighted average cost of capital, discounted cash flows, and free cash flows. These are important indicators for creditors, investors, and business owners to plan and budget restaurant profit margins and forecast revenue. The WACC offers insight into capital cost as a risk assessment measure, while the DCF is useful for comparing and selecting investment opportunities. These financials will help achieve success by managing the cost of goods sold, cash flow, and income statements.

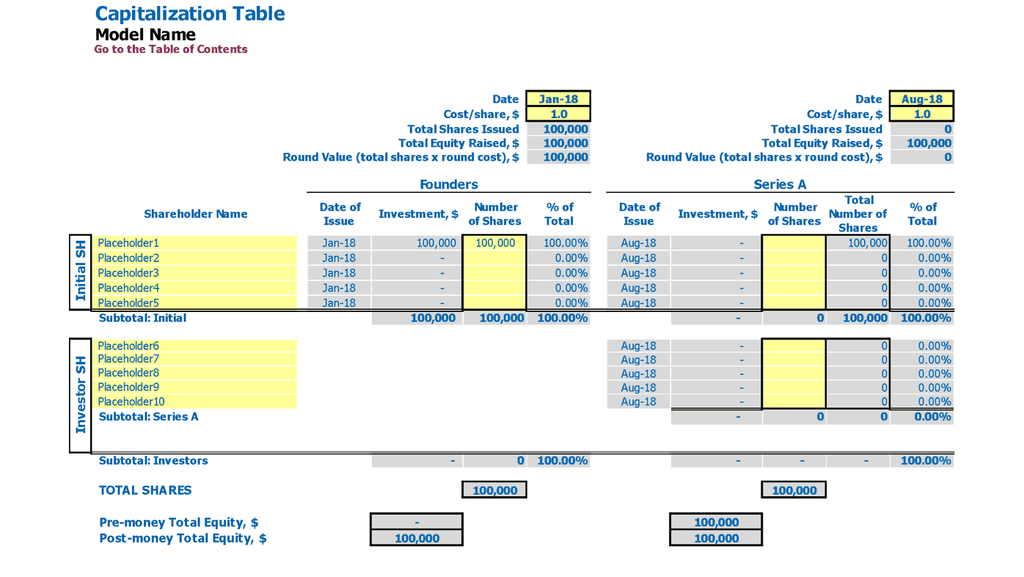

Cap Table For Startups

A Pro Forma Cap Table offers a comprehensive overview of a company's financial standing, including ownership structure, percentage of shares held by investors, and expenditure. This table provides detailed information on equity shares, preferred shares, options, and other security indicators, giving a clear picture of the company's securities. It is a vital tool for deli business planning, financial modeling, restaurant revenue forecasting, and restaurant financial analysis. With accurate financial projections for deli and restaurant budgeting, break-even analysis, and cash flow management, food service financials can be efficiently managed through income and cash flow statements, and balance sheet analysis.

Deli Restaurant Startup Financial Model Template Excel Free Key Features

Saves you time

Maximize business growth with restaurant financial planning tools like Business Plan Template Xls.

Get Investors to Notice

Use our deli financial modeling to impress investors and secure funding for your restaurant.

Print-ready Reports

Our restaurant financial analysis includes print-ready reports with pro forma profit and loss, cash flow chart, balance sheet, and financial ratios.

Investors ready

I created a comprehensive financial analysis for a deli, including profit and loss, cash flow, balance sheet, and ratios.

Simple-to-use

Effortlessly create reliable financial projections for your deli with our sophisticated business plan template, no Excel expertise required.

Deli Restaurant Financial Model Advantages

Utilize deli business plan and financial modeling for accurate restaurant financial analysis.

Make informed decisions with our deli restaurant financial analysis tools.

Create a comprehensive financial analysis for your deli business plan using an Excel template.

Create a comprehensive financial model for your restaurant or deli business using an Excel template.

Utilize a bottom-up financial model to effectively manage surplus cash in your deli restaurant.