ALL IN ONE MEGA PACK INCLUDES:

Aquaponics Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Aquaponic Farm Business Plan Info

Highlights

This five-year aquaponics business plan template xls is designed to assist startups and entrepreneurs in creating a feasibility study and determining the cost and income projections for their business. Included in the templates are financial projections such as cash flow analysis, income projections, and a break-even analysis. The profitability calculator and investment analysis are useful tools for determining the return on investment and funding options that may be available. The template also includes financial planning and financial management tools. Designed with the mindset of the aquaponics business, the revenue model and funding forecasts can be used to secure funding from banks, angels, grants, and VC funds. All templates are unlocked so that users can edit them.

Introducing an innovative and user-friendly aquaponics financial plan startup! Get ahead of the game and showcase your impressive knowledge and business acumen by confidently presenting a thoroughly researched aquaponics feasibility study, including a detailed analysis of aquaponics start-up costs, aquaponics cost analysis, aquaponics revenue model, aquaponics profitability calculator, and aquaponics financial projections. Our aquaponics financial planning tools also include aquaponics cash flow analysis, aquaponics income projections, aquaponics return on investment, aquaponics break-even analysis, and aquaponics funding options. Impress investors with our easy-to-use yet robust aquaponics financial plan startup, designed for minimal planning experience and very basic knowledge of Excel.

Description

The aquaponics financial forecasting model is a vital tool for any entrepreneur in the aquaponics industry. It provides a comprehensive framework to develop solid financial plans and analyze financial goals, creating a starting point for financial strategy development. Additionally, the aquaponics excel pro forma template is an invaluable resource that provides an overview of your business's current financials and growth projections. This model uses a bottom-up method to forecast production volume and derives revenue by applying pricing assumptions. Detailed forecasts for operating expenses and capital expenditures are incorporated to create a pro forma income statement and a cash flow budgeting and forecasting. Finally, the aquaponics 5 year projection plan enables you to manage your business by providing a clear and easy-to-understand framework for financial planning and analysis.Aquaponics Commercial Farm Reports

All in One Place

Aquaponics financial planning is crucial for startups. A well-crafted aquaponics business plan includes a feasibility study, cost analysis, and income projections. It also entails investment and cash flow analysis, profitability calculator, revenue model, and financial projections. A break-even analysis and return on investment analysis helps business owners identify when they can expect to recoup their investment. As a startup financial model in excel template, entrepreneurs can explore various funding options to sustain their ventures. Ultimately, aquaponics financial modeling for startups enables entrepreneurs to make informed decisions that lead to financial success.

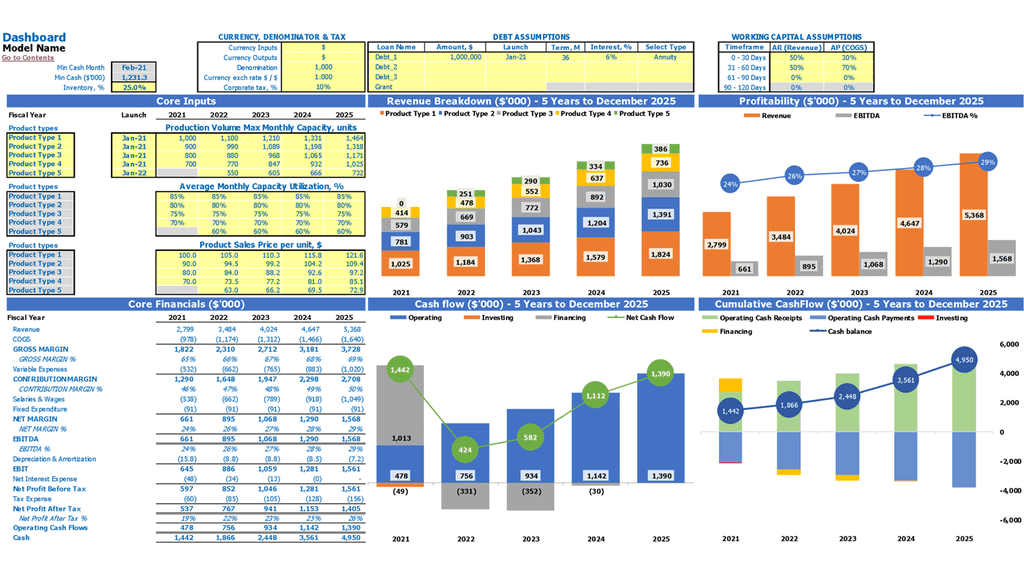

Dashboard

Our aquaponics financial planning services include a comprehensive aquaponics business plan, feasibility study, cost analysis, revenue model, and more. We also offer financial tools such as a profitability calculator, cash flow analysis, return on investment, and funding options. Our financial projections are based on reliable data and will help you create a solid financial strategy for your aquaponics start-up. With our expertise, you can be sure that your financial management will be efficient and successful.

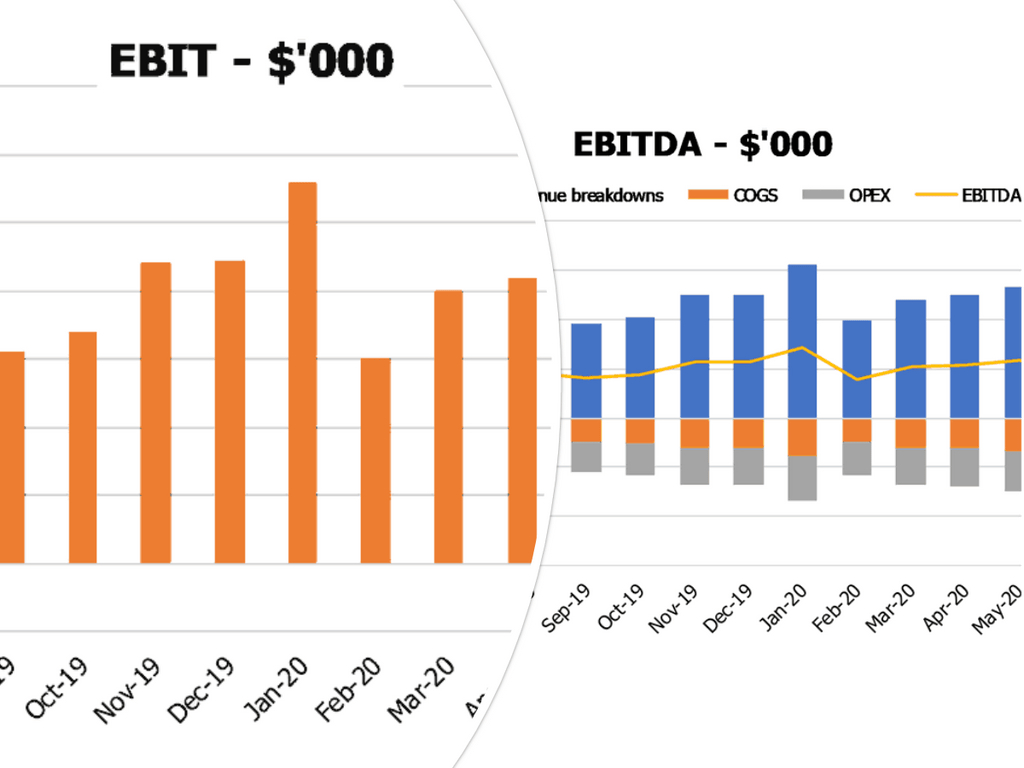

Excel Financial Report

Our aquaponics financial planning tool offers a comprehensive analysis and reporting system, including an aquaponics cost analysis, feasibility study, income projections, and revenue model. With our aquaponics financial projections and profitability calculator, investors can make sound investment decisions based on solid data. Our aquaponics funding options also help users choose the best funding options for their projects. Additionally, our tool includes financial management features such as aquaponics start-up costs, break-even analysis, cash flow analysis, and return on investment analysis. Overall, our tool provides an excellent resource for aquaponics entrepreneurs looking to make informed financial decisions.

Sources And Uses

A comprehensive aquaponics business plan requires a feasibility study, cost and income projections, cash flow and investment analysis, and a revenue model. Using a profitability calculator and financial projections, you can evaluate the return on investment and perform a break-even analysis. Funding options must also be considered, with a financial management and planning approach essential for success. An excel template with a sources and funds statement is an efficient tool to guide the process.

Break Even Calculation

The aquaponics feasibility study requires a comprehensive financial analysis to determine the profitability and potential of the business. This includes undertaking a cost analysis, cash flow analysis, and investment analysis. The aquaponics business plan should also feature a revenue model and income projections to estimate earnings. To ensure financial planning and management, one must consider funding options and use a profitability calculator to determine the return on investment. Lastly, a break-even analysis aims to determine when the company starts to become profitable, minimizing risk and maximizing profitability.

Top Revenue

Maximize the potential profitability of your aquaponics business with a thorough financial plan. Conduct a feasibility study, cost analysis, cash flow analysis, and return on investment analysis to assess and plan for start-up costs and future funding options. Generate income projections and use a profitability calculator to determine the best revenue model. Create a break-even analysis to determine when your business will start generating profits. Keep track of your revenue stream with a financial model excel template and develop a demand report to drive company strategy. Use these financial planning tools to ensure effective financial management and maximize growth potential.

Company Top Expenses List

Aquaponics entrepreneurs should conduct a thorough feasibility study and develop a well-detailed business plan to attract investors and secure funding. Additionally, using financial planning tools such as aquaponics cost analysis, profitability calculator, revenue model, and cash flow analysis will help in making informed decisions. Financial projections help to determine the expected return on investment and break-even analysis. Exploring funding options and financial management strategies are crucial aspects of building a successful aquaponics business.

Aquaponic Farming Business Plan Expenses

Costs

Our aquaponics business plan incorporates a comprehensive cost analysis, feasibility study, income projections, and investment analysis to provide a clear financial picture. We utilize a profitability calculator, revenue model, and cash flow analysis to determine start-up costs and financial projections. Our return on investment and break-even analysis assist with funding options and financial planning. Our financial management tools, including FTE and PTE salary costs, provide an engaging and professional tone to the process. All data flows through our 5 year projection plan, providing a tailored report to meet individual and group budgets.

Start Up Expenses

A well-crafted aquaponics business plan should include a feasibility study, cost analysis, revenue model, and financial projections such as income and investment analysis, profitability calculator, and return on investment. Financial planning and management using a cash flow analysis, break-even analysis, and funding options should also be considered. It is essential to include development costs in the business model description to determine where best to invest resources. These expenditures do not include staff salaries and operational costs. With a comprehensive financial plan, investors can make informed decisions about aquaponics' potential for growth and profitability.

Debt Repayment Schedule

When planning an aquaponics business, financial analysis is crucial for success. Conducting a feasibility study, cost analysis, and income projections are essential steps. Utilizing a profitability calculator, revenue model, and financial projections can help in making informed decisions. As a part of financial planning, it's important to determine start-up costs, cash flow analysis, return on investment, and break-even analysis. Seeking funding options and managing finances are key to financial management. Our startup financial model template can help with loan amortization schedules and repayment schedules to keep finances in check.

Aquaponics Business Plan Template Metrics

Performance KPIs

For a successful aquaponics business, it's essential to have a well-planned financial strategy that includes a comprehensive analysis of costs, revenue models, income projections, and return on investment. A feasibility study and financial planning should be conducted to determine start-up costs, funding options, and cash flow analysis. Utilizing tools like the aquaponics profitability calculator and ROE ratio can help with financial management and projection forecasting. By carefully analyzing financial data, potential investors can make informed decisions about investing in an aquaponics business.

Cash Flow Forecast Spreadsheet

When it comes to starting an aquaponics business, financial planning is essential. You need to create a thorough aquaponics business plan, conduct a feasibility study, and perform a cost analysis. Utilize tools like an aquaponics profitability calculator, revenue model, cash flow analysis, investment analysis, and return on investment calculator. Also, consider different funding options and create financial projections to assess your aquaponics start-up costs. By using a cash flow projection in excel, you can quickly and easily manage your finances and make informed financial decisions to increase your profits and grow your aquaponics business successfully.

KPI Benchmarking Report

An aquaponics business plan goes beyond just outlining your product and market. It requires a thorough aquaponics cost analysis, feasibility study, income projections, investment and financial analysis, and revenue model. These financial projections should include a cash flow analysis, return on investment analysis, break-even analysis, and funding options. Knowing the financial side of your business is crucial when making decisions, and a solid aquaponics financial planning and management can be achieved by using a profitability calculator and constantly comparing your indicators to similar companies in your industry.

Income And Expenditure Template Excel

When planning an aquaponics business, it is essential to conduct a feasibility study and cost analysis to determine start-up costs, funding options, and projected financial outcomes. Utilizing an aquaponics profitability calculator, investors can make informed financial decisions utilizing a variety of financial projections, including income and revenue models, return on investment, and break-even analysis. Incorporating financial planning and management into your business plan, with tools such as a monthly profit and loss template in excel format, can provide vital insight into the financial health of your aquaponics venture.

Projected Balance Sheet For 5 Years In Excel Format

An aquaponics business plan must include crucial financial analysis such as a feasibility study, income projections, investment analysis, and financial projections. A profitability calculator, revenue model, cash flow analysis, and return on investment analysis are necessary to determine the break-even point and funding options to maintain financial planning and management. Forecasts of pro forma balance sheets, income and expenditure template excel, and cash flow proforma template all integrate and flow to develop the cash flow analysis spreadsheet. Pro forma balance forecasting can measure profitability ratios and help investors analyze net income projections' realism.

Aquaponics Business Plan Template Valuation

Pre Revenue Valuation

This financial tool is an essential part of any aquaponics business plan. The pre seed valuation spreadsheet provides calculators for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC is important for assessing the company's cost of generating capital. Banks use this tool to evaluate the risk of loaning money to a company. DCF is crucial for analyzing investment opportunities and shows the value of future cash flows. Understanding these financial projections and analyses can help in creating a profitable aquaponics venture.

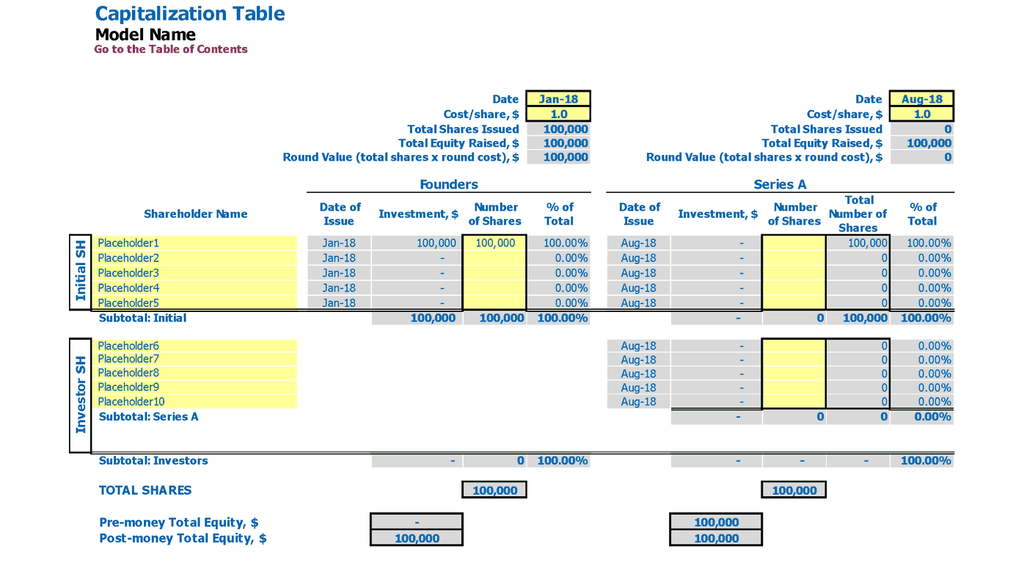

Cap Table Startup

We offer comprehensive financial planning tools for aquaponics businesses. Our services include aquaponics cost analysis, feasibility study, income projections, investment analysis, funding options, and financial management. Our aquaponics financial plan template features a cap table model that shows ownership breakdown of your start-up at different periods. This tool will provide investors with the necessary information to make informed decisions about exit strategies. Our aquaponics profitability calculator, revenue model, cash flow analysis, financial projections, and break-even analysis tools will help you make informed decisions about your aquaponics business plan.

Aquaponics 3 Way Financial Model Key Features

Easy to follow

Our aquaponics financial plan provides transparent and organized startup structure.

Saves you time

Maximize business growth by utilizing aquaponics financial planning tools and focusing on product development and customer satisfaction.

Identify potential shortfalls in cash balances in advance

The aquaponics financial model excel is essential for early warning and cash flow projections.

Avoid cash flow problems

Regular cash flow forecasting is crucial for managing and growing your aquaponics business.

We do the math

Streamline your aquaponics financial planning with Excel Financial Model Template, no programming or expensive consultants required!

Aquaponics Excel Financial Model Template Advantages

Impress potential investors with a professional aquaponics business plan using financial planning tools such as a profitability calculator, cash flow analysis, and investment analysis.

Develop a comprehensive financial plan for an aquaponics business, including cost analysis, income projections, and funding options.

Use Aquaponics financial tools to attract top talent.

Our aquaponics financial planning model predicts the effects of future alterations.

Avoid misunderstandings with Aquaponics Excel Financial Model.