ALL IN ONE MEGA PACK INCLUDES:

Architecture Firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Architecture Firm Startup Budget Info

Highlights

Financial planning is crucial for architecture firms in order to ensure long-term success. This includes revenue forecasting, cost management, profitability analysis, budgeting, cash flow management, financial performance metrics, financial dashboards, pricing strategies, financial modeling, accounting, tax planning, financial reporting, investment analysis, and financial risk management. A comprehensive five-year financial model template is available specifically for architecture firms to use for fundraising and business planning. This tool guides startups and entrepreneurs in evaluating startup ideas, pre-launch expenses planning, and securing funding from various sources including banks, angels, grants, and VC funds. The financial model is unlocked, allowing for customization and editing to meet specific needs.

For architecture firms, financial planning is imperative to ensure long-term sustainability and success. Revenue forecasting is essential for projecting incoming cash flow, while cost management helps optimize expenses without sacrificing quality. Profitability analysis provides insights on how to maximize profits, while budgeting ensures that funds are allocated efficiently. Cash flow management is crucial to avoid any potential financial crises, while financial performance metrics and dashboards give a comprehensive view of a firm's financial health. Pricing strategies and financial modeling aid in making informed financial decisions for architecture firms, while accounting, tax planning, financial reporting, and investment analysis ensure compliance and profitable growth. Financial risk management helps mitigate any potential financial risks that may arise. All these reports and calculations are displayed on a convenient architecture firm dashboard, keeping everything visible at a glance.

Description

The financial planning for architecture firms can be easily achieved through the use of a dynamic and adaptable startup costs template. This includes essential financial calculations and valuation charts to ensure accurate business reporting and enable informed decision-making. The architecture firm 3 statement model excel allows for the development of a financial plan, identification of initial capital investments and working capital requirements, and forecasting of monthly sales and expenses. Additionally, it provides a 5-year financial projection for the firm. This financial model template is a valuable tool for both startup plans and existing businesses, with a built-in revenue forecast and expense budget. It requires reliable and accurate reporting, includes major types of 60-month period 3-statements financial reports and KPIs reports, and additional valuation and key metrics calculations. This template serves as a valuable negotiation tool for investors and is easily adjustable based on input assumptions.

Architecture Firm Financial Plan Reports

All in One Place

Our financial planning services cater to the unique needs of architecture firms. Our expertise includes revenue forecasting, cost management, budgeting, cash flow management, and profitability analysis. We offer financial performance metrics, dashboards, and pricing strategies to help architecture firms stay competitive. Our team also provides financial modeling, accounting, tax planning, financial reporting, investment analysis, and financial risk management services. We offer a robust and expandable 3 statement model excel template that can handle future expansions and can be tailored as per your needs. Our services ensure that your business plan is well-defined and backed by solid financials.

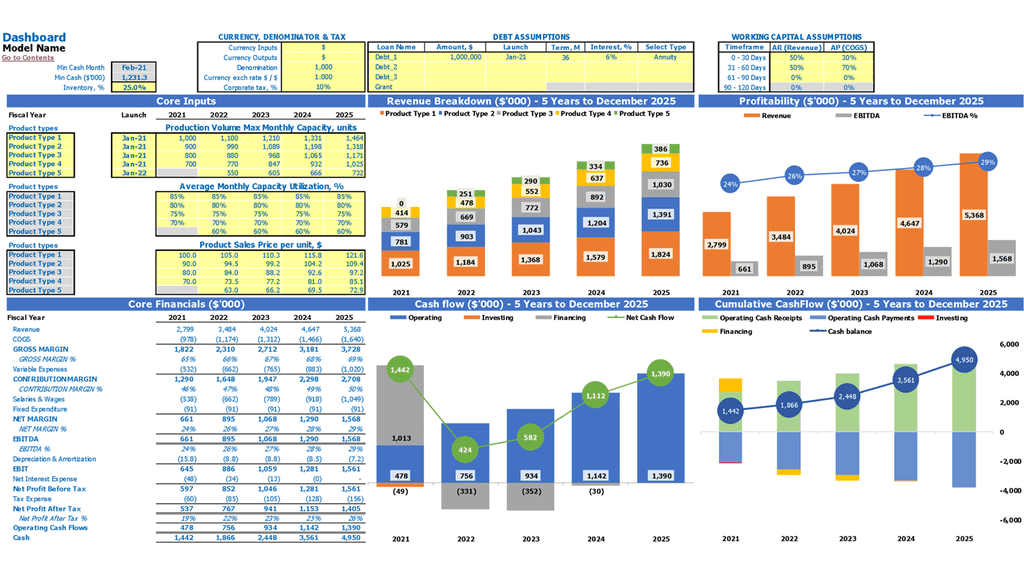

Dashboard

Architects need financial planning to strategically manage their finances. Important financial aspects for architecture firms include revenue forecasting, cost management, and profitability analysis. Budgeting and cash flow management are also crucial components. Architects can use financial performance metrics and a financial dashboard to track progress. Pricing strategies and financial modeling help to set realistic goals. Accounting, tax planning, and financial reporting are important for compliance purposes. Investment analysis and financial risk management are additional considerations. Keeping all important financial indicators in a financial model excel spreadsheet with a dashboard can help architects make informed decisions.

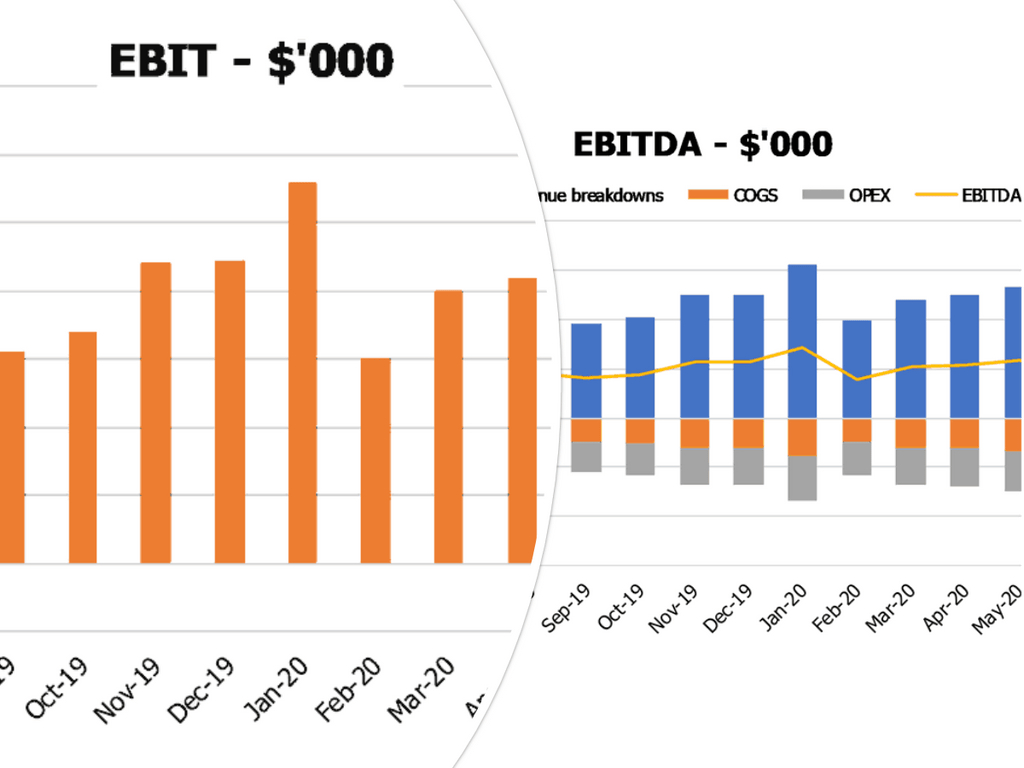

Financial Statements Format

Financial planning for architecture firms involves a range of activities including revenue forecasting, cost management, profitability analysis, budgeting, cash flow management, and financial reporting. To make informed decisions and maximize financial performance, architects need to use financial performance metrics, financial dashboards, pricing strategies, financial modeling, accounting, tax planning, and investment analysis. Additionally, financial risk management is crucial in the architectural industry. By developing a comprehensive financial projection model, architects can produce robust financial statements that are easy to comprehend, which is essential when seeking funding from lenders or investors.

Sources And Uses Of Cash Statement

The sources and uses of funds statement is a vital financial planning tool for architecture firms. It helps stakeholders understand how the company plans to finance its projects and where the capital will go. The statement must balance the sources with the uses of funds. The business owner should mention the funding sources and uses on a line-by-line basis. If the Sources section is bigger than the Uses section, the company may plan for business expansion. If the Uses section is bigger than the Sources section, the company may require additional equity.

Break Even Excel

Financial planning for architecture firms involves various factors such as revenue forecasting, cost management, and profitability analysis. It also includes budgeting, cash flow management, financial performance metrics, and financial dashboards. Financial modeling, accounting, tax planning, financial reporting, investment analysis, pricing strategies, and financial risk management are equally important in running a successful architecture firm. One of the effective ways to ensure financial stability is by conducting break-even calculations. It helps understand the relationship between variable and fixed costs and the revenue earned by the firm, ultimately leading to informed decision-making.

Top Revenue

Our financial modeling services offer architecture firms valuable tools for revenue forecasting, cost management, profitability analysis, budgeting, and cash flow management. With financial performance metrics, a financial dashboard, pricing strategies, accounting, tax planning, financial reporting, investment analysis, and financial risk management included in our services, we provide comprehensive financial planning. Using our financial projection model, detailed breakdowns per annum of revenue streams can be clearly seen, including Top Revenue analysis based on each offering and revenue depth and bridge breakdowns through our business forecast template. Trust us to help you manage your finances to optimize performance.

List of Top Expenses

Financial planning for architecture firms involves various aspects such as revenue forecasting, cost management, profitability analysis, budgeting, cash flow management, financial performance metrics, financial dashboard, pricing strategies, financial modeling, accounting, tax planning, financial reporting, investment analysis, and financial risk management. One important aspect is the expenses, which can be accurately determined through the financial model startup. It includes costs for attracting customers, unexpected expenses, and salary payments to workers that are specific to the company's needs. These can be monitored and managed to ensure the firm's financial success.

Architectural Firm Financial Statements Expenses

Costs

Effective financial planning is essential for architecture firms to achieve profitability and maximize financial performance. Our services include revenue forecasting, cost management, financial modeling, tax planning, and investment analysis. We also provide a financial dashboard and reporting system to help you monitor key financial metrics. Our pricing strategies ensure that your services are appropriately priced to optimize revenue. With our expertise, you can mitigate financial risks and plan for a successful future for your architecture firm. Let us help you take your financial planning to the next level.

Start Up Expenses

This professional cash flow statement template excel helps architecture firms with revenue forecasting and financial planning. The revenue is analyzed in detail by breaking down revenue streams by product or service. The tool also offers cost management and profitability analysis for effective financial performance metrics. In addition, it provides budgeting, cash flow management, financial dashboard, pricing strategies, financial modeling, accounting, tax planning, financial reporting, investment analysis, and financial risk management to ensure profitability and sustainable growth for architecture firms.

Loan Payment Calculator

Effective financial planning is crucial for architecture firms to ensure sustained growth and profitability. Revenue forecasting, cost management, and budgeting are some important tools that can aid in the process. Additionally, financial performance metrics and dashboards provide an at-a-glance view of how the business is performing, whilst financial modeling and investment analysis can help in making informed decisions. Tax planning and financial reporting are also essential, as is financial risk management. Lastly, developing pricing strategies can help maximize profits. To maximize the effectiveness of financial planning, architecture firms should also consider using loan amortization schedule templates to keep track of loan information.

Financial Planning For Architects Metrics

Performance KPIs

Calculating the cost of acquiring new customers is crucial for start-ups and growing businesses. This metric determines the effectiveness of marketing efforts in attracting new customers. The lower the amount, the better. This financial performance metric is included in our architecture firm pro forma template, as it helps with financial planning, revenue forecasting, and budgeting. By analyzing this metric, architecture firms can optimize their pricing strategies, financial modeling, and cash flow management. Proper cost management, profit analysis, accounting, tax planning, financial reporting, investment analysis, and risk management can improve financial performance and increase profitability.

Cash Flow Forecasting Model

Financial planning for architecture firms requires revenue forecasting, cost management, and profitability analysis. Budgeting and cash flow management are also important, as are financial performance metrics and the use of a financial dashboard. Pricing strategies and financial modeling can help firms make informed decisions, while accounting and tax planning ensure compliance and minimize risk. Financial reporting and investment analysis are also crucial. Finally, financial risk management must be a priority to ensure the long-term success of the firm. Careful planning and accurate calculations are key to promoting growth and profitability in the architecture industry.

Business Benchmarks

Financial planning for architecture firms involves various strategies, including revenue forecasting, cost management, profitability analysis, budgeting, cash flow management, financial performance metrics, financial dashboard, pricing strategies, accounting, tax planning, financial reporting, investment analysis, and financial risk management. These approaches aim to evaluate financial indicators, measure performance, identify potential risks, and ensure positive outcomes. Therefore, controlling and recording all indicators is crucial to make informed decisions and develop effective strategies for architecture firms. By adopting a comprehensive financial modeling approach, architecture firms can enhance their financial planning and boost their profitability in the long term.

Profit And Loss Forecast

Financial planning is crucial for architecture firms to achieve profitability and sustainability. This includes revenue forecasting, cost management, budgeting, cash flow management, and financial performance metrics. A financial dashboard is a helpful tool to monitor these indicators in real-time. Architecture firms should also consider pricing strategies and financial modeling to ensure their services remain competitive. Accounting, tax planning, financial reporting, investment analysis, and financial risk management are also crucial components for long-term success. Utilizing annual projected profit and loss templates can aid in achieving financial goals and increasing overall profitability.

Projected Balance Sheet Template Excel

Financial planning is crucial for architecture firms to achieve their goals. Effective revenue forecasting, cost management, profitability analysis, and budgeting are key aspects. Cash flow management and the use of financial performance metrics and a financial dashboard are useful tools. A well-considered pricing strategy and financial modeling are also important. Accounting, tax planning, financial reporting, investment analysis and financial risk management must also be addressed. The projected balance sheet for five years is a vital report for managing assets, liabilities, and equity. Its forecast can provide data to calculate important ratios so that firms can make informed decisions.

Financial Planning For Architects Valuation

Pre Seed Valuation

The startup valuation revenue multiple spreadsheet features multiple calculators designed to aid financial planning for architecture firms. These include revenue forecasting, cost management, profitability analysis, budgeting, cash flow management, financial performance metrics, financial dashboard, pricing strategies, financial modeling, accounting, tax planning, financial reporting, investment analysis, and financial risk management. Additionally, the calculators for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) provide crucial insights into a company's risk and potential investment opportunities. Banks often rely on WACC to assess risk before approving loans, while DCF helps identify the value of future cash flows.

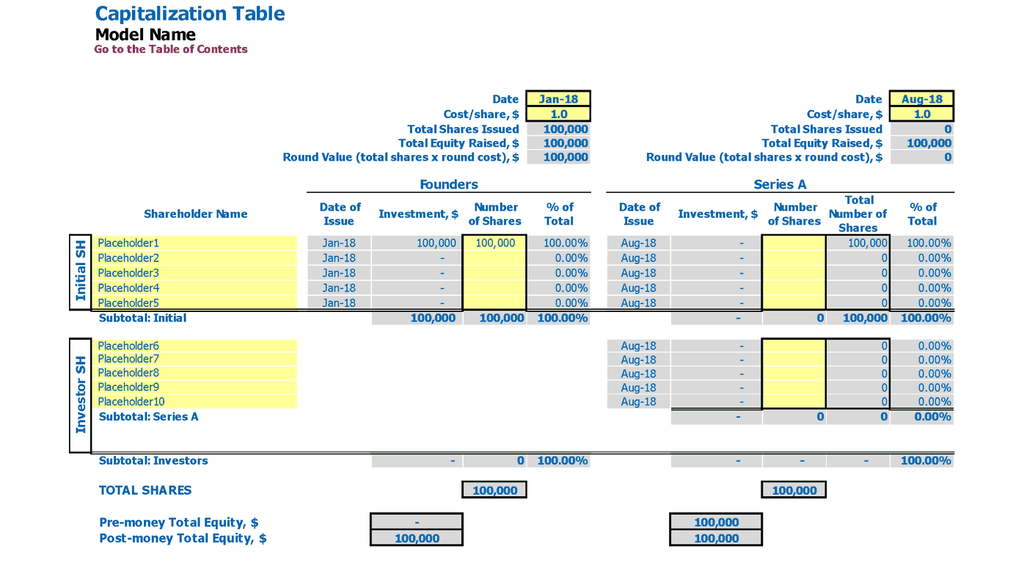

Pro Forma Cap Table

Our financial planning services cover all aspects of managing finances for architecture firms including revenue forecasting, cost management, profitability analysis, budgeting, cash flow management, financial performance metrics, financial dashboard, pricing strategies, financial modeling, accounting, tax planning, financial reporting, investment analysis, and financial risk management. Our team of experts provides tailored solutions to meet your business needs and help you achieve your financial goals. Whether you are looking to expand, manage cash flow, or improve profitability, we are here to assist you. Contact us to learn more about our services.

Architecture Firm Projected Income Statement Template Excel Key Features

Avoid cash flow problems

Regular cash flow forecasting is crucial for architecture firms to maintain financial health and make informed decisions.

Avoid Cash Flow Shortfalls

Effective cash flow management is essential for architecture firms to prevent unexpected shortfalls and ensure financial stability.

Build your plan and pitch for funding

Maximize architecture firm profits with effective financial planning, cost management, and revenue forecasting.

Manage surplus cash

Financial planning is crucial for architecture firms to manage costs, forecast revenue, and analyze profitability.

External stakeholders, such as banks, may require a regular forecast

Banks require architecture firms to provide regular pro forma projections for loan monitoring.

Architecture Firm Projected Income Statement Template Excel Advantages

Use a financial model xls to predict outcomes and make informed decisions in financial planning for architecture firms.

Maximize profitability with financial planning, revenue forecasting, cost management, budgeting, pricing strategies, and financial modeling for architecture firms.

Transform your architecture firm with financial planning and projection.

Maximize Profits: Utilize financial planning, revenue forecasting, cost management, and pricing strategies for architecture firms.

Develop financial planning for architecture firm's opening and operating costs.