ALL IN ONE MEGA PACK INCLUDES:

Auditor Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Auditor Startup Budget Info

Highlights

A highly versatile and user-friendly auditor financial plan template excel is available for financial statement analysis, accounting audit, internal controls, audit report, financial analysis, risk assessment, audit procedures, audit evidence, audit opinion, audit planning, financial forecasting, financial ratios, financial planning, financial modeling, and financial projections. The template enables the preparation of a projected income statement template, cash flow projection excel, and Balance Sheet with monthly and annual timelines. The auditor business forecast template works for a startup or existing auditor business and can be used to get funded by banks, angels, grants, and VC funds. The template is unlocked, allowing for all necessary edits.

Performing a financial statement analysis, conducting an accounting audit, and evaluating internal controls are key components of an audit report. As part of audit planning, risk assessment is critically important, as is the thoughtful selection and execution of audit procedures and gathering of audit evidence. Interpretation of financial analysis, including financial ratios, financial forecasting, and financial projections, forms the basis for providing a reliable audit opinion that can assist with financial planning and modeling.

Description

Our financial statement analysis based on accounting audit and identification of internal controls helps our team to provide comprehensive audit report containing our audit opinion. Before beginning the audit process, we conduct a thorough risk assessment of the company. Our audit procedures include gathering and examining audit evidence to support our findings. Our team focuses on financial forecasting and uses financial ratios to assist with financial planning and financial modeling. The end result is a detailed and accurate financial projections and analysis to help our clients make informed decisions for their business.

Auditor Financial Plan Reports

All in One Place

Maximize your investors' meetings with our Bar auditor financial planning model. Our integrated system offers seamless financial statement analysis, accounting audit, risk assessment, and financial forecasting. With designated sheets for audit planning, audit procedures, and internal controls, our Pro-forma excel template presents financial ratios and projections in an investor-friendly way. The audit report and audit opinion are backed by thorough audit evidence, ensuring accurate financial analysis. Improve your financial planning and streamline investor meetings with our comprehensive tool.

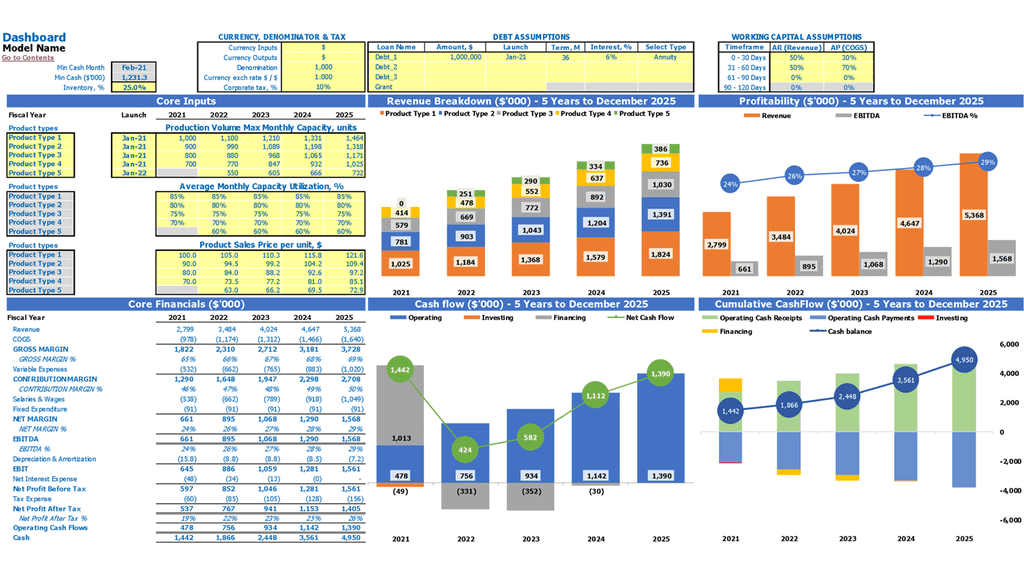

Dashboard

Performing financial statement analysis involves conducting an accounting audit and assessing the internal controls in place. The resulting audit report details the findings of the risk assessment and highlights the audit procedures and evidence obtained. The audit opinion is based on these factors and the audit planning, which includes financial forecasting, financial ratios, financial planning, financial modeling, and financial projections. These tools help you build a strong startup financial plan with attractive business plan numbers, and the Dashboard tab allows for easy access to charts and graphs for future use.

Basic Financial Statement Template

Effective financial statement analysis involves multiple elements, including risk assessment, internal controls, and audit procedures. An accounting audit allows for a thorough review of financial evidence and informed audit opinion. Audit planning and reporting require a professional tone and attention to detail. Financial forecasting, modeling, and projections use tools such as financial ratios to understand and evaluate a company's performance, as shown in the significant insights offered by profit and loss and pro forma balance sheet templates. Understanding capital management with cash flow projections is also essential to overall analysis.

Sources And Uses Of Funds Statement

Our team of experienced auditors conduct comprehensive financial statement analysis, using state-of-the-art audit procedures to examine internal controls, risk assessment, and audit evidence. The resulting well-researched audit report provides an informed audit opinion, based on sound audit planning and financial forecasting. We also utilize financial ratios, modeling, and projections to assist companies in their financial planning, budgeting, and monitoring. Start-ups will find the sources and uses template excel particularly helpful, as it facilitates the management of funds by displaying key funding sources alongside corresponding expenditure activities.

Break Even Chart Excel

We offer a comprehensive financial modeling service that includes risk assessment, financial forecasting, and financial statement analysis. Our team of experts conducts an accounting audit and evaluates internal controls to prepare the audit report. We also perform audit planning and procedures to gather audit evidence for an unbiased audit opinion. Our financial analysis includes using financial ratios and projections to assist in financial planning. With our innovative 3-way financial model, we integrate a worksheet with your Excel financial statement to automatically generate break-even analysis and return on investment calculations.

Top Revenue

The process of auditing financial statements involves analyzing and assessing financial data to ensure accuracy and compliance with accounting standards. This includes evaluating internal controls, conducting risk assessments, and gathering audit evidence. After completing audit procedures, an audit report is issued, which outlines the auditor's opinion on the financial statements. Additionally, financial forecasting and planning can be done through financial statement analysis, using tools such as financial ratios and projections. A financial modelling excel template can provide an annual breakdown of revenue streams and supporting revenue bridges, making it a useful tool for businesses.

Business Top Expenses List

Effective financial planning requires more than just controlling expenses. Engage a professional accounting firm to conduct financial statement analysis, accounting audit, and risk assessment to identify potential internal control weaknesses. The audit procedures will involve a thorough review of your financial analysis and evidence to produce an audit report with an audit opinion. With sound audit planning, the use of financial forecasting, ratios, modeling, and projections can help you better understand where your finances are heading, enabling you to optimize operations, make profitable investments, and achieve high returns.

Auditor Financial Projection Expenses

Costs

Financial statement analysis is crucial for companies to ensure proper financial planning and forecasting. An accounting audit helps in identifying the risks and internal controls necessary to safeguard the company's finances. Auditors use various audit procedures to gather audit evidence and provide an audit report with an audit opinion. Financial ratios help assess the company's financial health and aid in making informed financial decisions. Effective audit planning and risk assessment are necessary for companies to create financial projections and models to cover their financial shortcomings. A well-prepared pro forma income statement template in excel can aid in cost budgeting, communicating with investors, and obtaining loans.

Initial Startup Costs

Our financial statement analysis includes an accounting audit with a focus on risk assessment and internal controls. Our audit procedures involve thorough examination of financial evidence to provide a comprehensive audit report and opinion. We take into consideration financial forecasting and projections, utilizing financial ratios and modeling for effective financial planning. Our audit planning carefully considers planned capital expenditure, ensuring strategic allocation of resources for increased growth and development. Including our report in your business model will aid in determining the most beneficial asset investment for optimal value.

Loan Financing

Financial statement analysis involves the examination of a company's financial health through various tools like financial ratios, risk assessment, and financial forecasting. This process relies heavily on audit procedures and internal controls, as well as accounting audits to verify the accuracy of financial statements. Once complete, an audit report is issued along with the auditor's opinion. Financial modeling and projections are also crucial in developing a comprehensive financial plan that includes a loan amortization schedule. This schedule helps companies monitor their debt repayments and plan how to pay off their loans effectively.

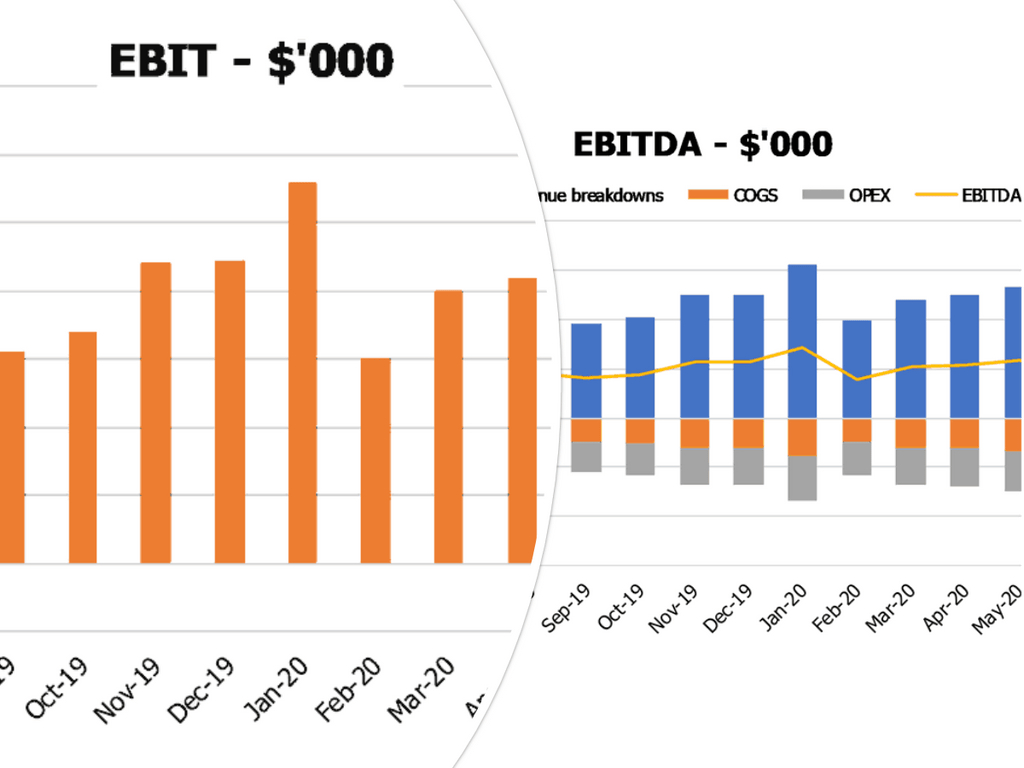

Auditor Income Statement Metrics

Performance KPIs

When conducting financial statement analysis, one key metric to consider is the return on assets. This can be calculated by utilizing data from both the pro forma balance and p&l statement template excel. By comparing profitability to asset value, investors and business owners can gain insight into a company's efficiency. Effective risk assessment and audit procedures, including internal controls and audit evidence, play a crucial role in determining an accurate audit opinion. Proper audit planning, financial forecasting, and utilizing financial ratios and modeling can aid in making informed financial projections.

Cash Flow Pro Forma

The financial statement analysis is critical for any business's success. The accounting audit helps evaluate the internal controls, risk assessment, and audit procedures to ensure accurate audit evidence. The audit report provides an audit opinion based on the financial analysis, financial ratios, and financial projections. Financial planning including forecasting and modeling is essential to determine the net cash flow, initial and ending cash balances. The cash flow excel sheet tracks cash in and out transactions, working capital, long-term debt, and annual revenue. This model is ideal for cash flow management and attracting funding.

Business Benchmarks

Our financial statement analysis involves accounting audits and assessment of internal controls to ensure accurate financial forecasting. Our audit procedures provide substantial audit evidence for a reliable audit report that includes risk assessment and audit opinion. Our financial analysis incorporates financial ratios and modeling, and financial planning includes audit planning for improved financial projections. The benchmarking tab in our 5 year forecast template calculates industry and financial benchmarks to provide keen insights into the company's performance and areas of improvement. Overall, our services are aimed at helping companies make informed financial decisions.

Profit Loss Projection

A crucial aspect of financial planning is financial statement analysis, which involves accounting audit and risk assessment, among others. Internal controls are established to support audit procedures and provide reliable audit evidence. An audit report typically includes an audit opinion, highlighting any potential issues or recommendations. Financial analysis can include the use of financial ratios, financial forecasting, and financial modeling to create financial projections. A thorough audit planning process is essential to ensure accurate and reliable financial statements for decision-making purposes.

Projected Balance Sheet Template Excel

Financial statement analysis involves examining a company's financial health and making informed decisions based on audit reports, internal controls and risk assessment. Through audit procedures, financial modeling and analysis of financial evidence, an audit opinion is formed to aid financial planning and projection. Financial forecasting using financial ratios and projections, as well as examining financial statements, can disclose the amount of investment required to support profits, making the balance sheet forecast paramount. Overall, financial statement analysis helps guide a company's financial decisions by providing a comprehensive view of its financial situation.

Auditor Income Statement Valuation

Pre Revenue Startup Valuation

Our comprehensive financial excel template offers all the tools you need in one place. Conduct financial statement analysis, accounting audits and risk assessments with ease using our user-friendly features. Our detailed audit procedures and audit evidence allow for accurate financial analysis and planning, including financial forecasting and modeling. Explore financial ratios and projections using our advanced tools for assessing internal controls and audit planning. With our audit report and audit opinion, you can confidently present your findings and make informed decisions. For a reliable and efficient approach to financial planning, choose our auditor financial excel template.

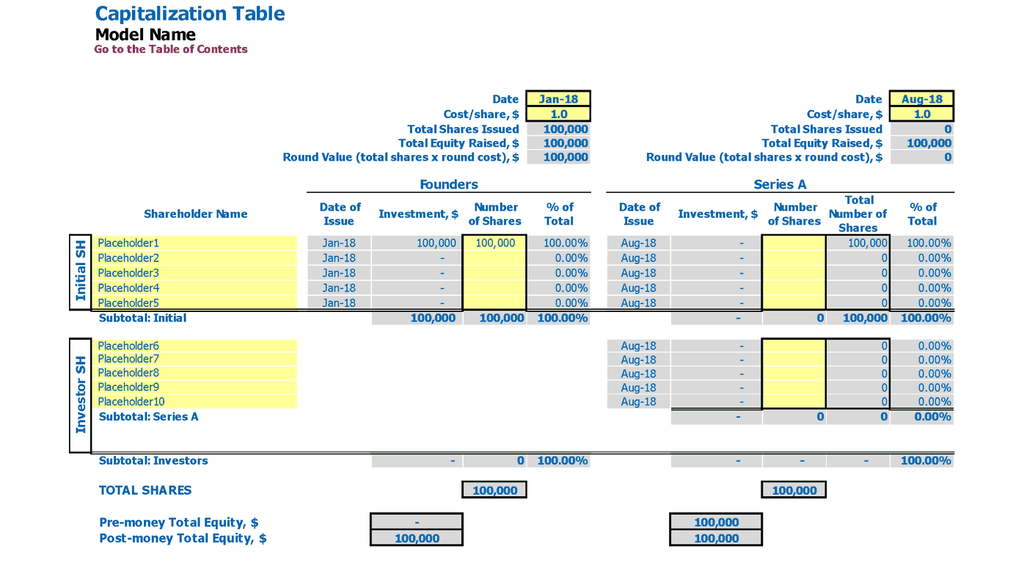

Simple Cap Table

Our financial model template incorporates a cap table, a fundamental tool for start-ups. It factors in equity shares, preferred shares, employee stock options, convertible bonds, and other relevant factors. The equity cap table includes four rounds of funding and is instrumental in predicting shareholder ownership and possible dilution of existing shares.

Auditor Five Year Financial Projection Template Key Features

Get a robust, powerful financial model which is fully expandable

Utilize the auditor's 5-year cash flow projection template in Excel for financial planning and forecasting with the option to tailor sheets to specific needs.

Manage surplus cash

Financial statement analysis and risk assessment provide crucial information for effective financial planning and forecasting.

Confidence in the future

Our financial modeling tool enables comprehensive financial planning and forecasting for the next 5 years, including risk assessment and analysis of financial ratios.

Build your plan and pitch for funding

Our audit report includes thorough financial statement analysis and risk assessment utilizing effective audit procedures and evidence.

Get Investors to Notice

Maximize investor meetings with the help of our auditor financial plan excel.

Auditor Startup Financial Plan Advantages

Utilize financial forecasting and analysis tools like P&L Excel templates to predict cash flow fluctuations.

Improve business decisions with financial statement analysis and risk assessment.

Effortlessly create income statements and balance sheets with professional financial modeling tools.

Use the Auditor Pro Forma Template Excel to simulate various scenarios for financial statement analysis.

Ensure adequate cash flow for suppliers and employees with a comprehensive financial planning template.