ALL IN ONE MEGA PACK INCLUDES:

Bar Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Small Bar Business Plan Info

Highlights

A comprehensive five-year financial model created specifically for bars is now available in the form of an Excel template. With prebuilt consolidated profit and loss statement format Excel, balance sheet, and cash flow analysis, the template offers key financial charts, summaries, metrics, and funding forecasts. This tool lets bar owners dive deep into their financial forecasting, financial modeling, and financial analysis activities. Employing this bar business plan Excel template can foster a bar’s financial planning and analysis capabilities, enabling it to build its financial projections and analysis with ease. Armed with the five-year financial model, entrepreneurs can approach banks, angels, grants, and VC funds with a compelling revenue model, financial projection, and cash flow forecast. Finally, editing is unlocked, allowing for a personalized experience.

Utilize our robust bar three statement financial model tool to create a comprehensive financial plan for your business, regardless of its size or stage of development. Even with minimal financial planning experience and basic Microsoft Excel knowledge, you can easily develop a revenue model, financial projection, cash flow forecast, financial analysis, budget, financial statements, financial forecasting, and financial performance metrics. Our financial planning and analysis software also offers financial reporting and business planning support, allowing you to make informed decisions based on accurate financial projections and analysis.

Description

The bar financial projection template offered by our team is a comprehensive solution for financial planning and analysis. It includes financial forecasting, budgeting, financial modeling, and financial reporting. With this revenue model, one can easily calculate financial metrics and evaluate the financial performance of the bar business. The template is highly customizable, making it suitable for startups and existing businesses. One can project financial statements like cash flow forecast, financial statements, and financial projection and analysis. In summary, our template empowers businesses to create reliable financial projections and make informed decisions based on a solid financial analysis.Business Plan For A Bar Reports

All in One Place

Effective financial planning and analysis demands a comprehensive suite of financial tools to help you master your financial metrics and ensure excellent financial performance. Our templates for budgeting, cash flow forecasting, and financial modeling will allow you to make proactive decisions based on sound financial forecasting and analysis. Our financial projections and analysis tools empower you to create clear revenue models with accurate financial statements and reporting that will enable you to optimize your business planning. Trust us to deliver reliable financial planning solutions tailored to your business needs.

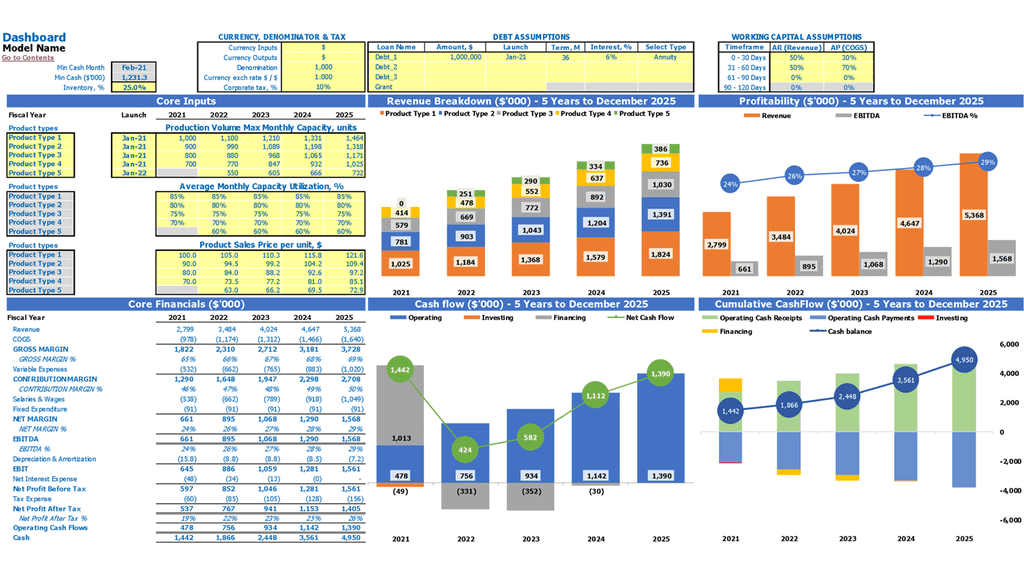

Dashboard

Utilizing a financial model for a startup can offer several benefits. It includes a comprehensive dashboard that enables financial planning and analysis, budgeting, financial forecasting, and cash flow forecast. By analyzing various financial indicators, it allows businesses to evaluate their financial performance and report financial statements accurately. With its ability to present data quickly and accurately, startups can make informed decisions based on real-time financial metrics. Moreover, it helps in building transparent and trustworthy relationships with stakeholders by promoting accounting transparency. The financial model is an essential tool for startups to optimize their financial management and adapt strategies accordingly.

A Financial Statement

Our excel pro forma template provides comprehensive financial planning and analysis for businesses by enabling the creation of accurate and detailed financial projections, cash flow forecasts, and financial statements. This tool aids in budgeting and financial forecasting, allowing business owners to monitor financial performance against key financial metrics. Furthermore, it facilitates effective communication of financial results using graphs and charts, which are useful for stakeholders such as potential investors. Our tool is a reliable aid in creating a successful revenue model and ensuring financial success for any business venture.

Source And Use Of Funds

This 5 year cash flow projection template excel provides a comprehensive overview of a company's financial planning and analysis. It includes detailed financial forecasting, budgeting, and financial analysis to determine the company's revenue model, financial metrics, and financial performance. Additionally, financial projections and analysis are created to make informed business planning decisions. The financial statements breakdown the sources and uses of funds, which accurately depicts how the company spends its money. Overall, this tool ensures that a business has a clear understanding of its financial projections and cash flow forecast.

Break Even Formula Excel

For effective financial planning and analysis, it is imperative to understand the nuances between sales, revenue, and profit. Conducting a BEP calculation involves a thorough analysis of a company's revenue model and sales projection. Financial forecasting, modeling, and budgeting should all take into consideration the revenue and cash flow forecast. Accurate financial statements and reporting ensure a comprehensive view of financial performance, aided by utilizing relevant financial metrics. Ultimately, BEP calculation enables businesses to not only project revenue, but accurately forecast and analyze profit potential to refine their business planning.

Top Revenue

A company's revenue model heavily relies on its gross sales or revenue as shown in the projected income statement template, which investors and analysts closely monitor. Quarterly or annual financial statements and metrics allow stakeholders to evaluate trends in profit and revenue, which are essential in financial analysis and forecasting. Additionally, the top line of a P&L statement Excel indicates a company's sales or revenue, and an increase in this area would lead to top-line growth and a positive impact on financial performance. Proper financial planning, budgeting, and reporting ensure accurate financial projections and analysis.

Small Business Top Expenses List

For startups and fast-growing companies, controlling expenses is crucial for achieving financial success. Closely monitoring large expenses is especially important to avoid losses. Our pro forma template offers four categories of expenses, with the option to add additional data to the 'other' category. It's important to maintain accurate financial statements and use financial metrics to analyze performance. Financial planning and analysis, budgeting, cash flow forecasting, and financial modeling are all important tools for creating a sound revenue model and accurate financial projections. By making this a priority, companies can achieve long-term financial stability.

Business Plan For Bar Expenses

Costs

The key to a successful business lies in its financial planning, forecasting, and analysis. A bar business plan template xls provides an effective way of projecting costs and determining the financial viability of a business. Financial statements, metrics, and projections are important tools for tracking against objectives and measuring performance. A well-planned budget is essential for securing funding from investors and obtaining loans. It also helps identify weaknesses and areas that require attention to achieve company goals. A comprehensive revenue model, cash flow forecast and financial analysis is necessary for financial planning and analysis, and ultimately, for the success of the business.

Initial Startup Costs

Accurate financial planning and analysis are crucial for any business, and this involves preparing financial forecasts and projections while using appropriate financial metrics. To achieve this, a robust revenue model and cash flow forecast must be established, alongside effective budgeting and financial analysis. The use of financial planning tools such as pro forma balance sheets and detailed capital expenditure planning can provide valuable insights towards sound business planning. Additionally, financial reporting and transparent financial statements are necessary to track financial performance and ensure the financial projections and analysis are up-to-date.

Loan opt-in

Manage your loans efficiently with our feasibility study template excel! The 'Capital' tab includes a loan amortization schedule with pre-built formulas for easy internal calculations of loans, interest, and equity. Stay on top of your financial planning and analysis with this tool, and make informed business planning decisions based on accurate financial projections and analysis. Our template also provides financial metrics to track the financial performance of your business. For comprehensive financial forecasting and modeling, use our template's financial statements, cash flow forecast, and revenue model to create reliable financial projections.

Bar Start Up Business Plan Metrics

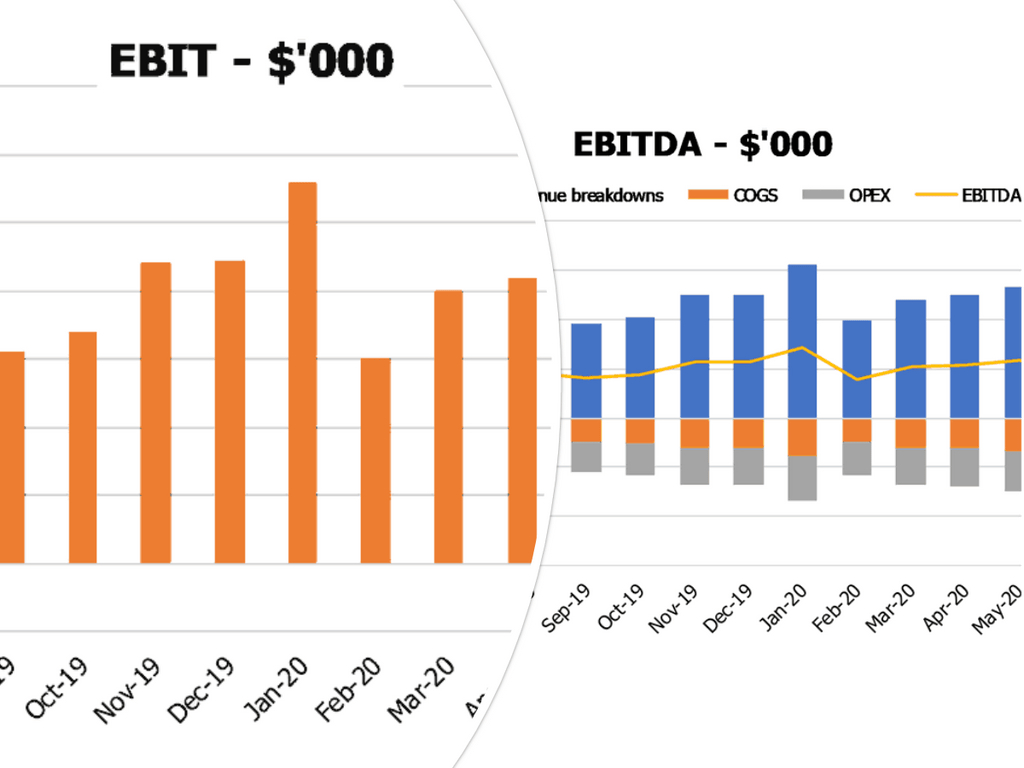

Profitability KPIs

Our business planning excel template offers a comprehensive financial model with various metrics, such as earning growth and net income growth. Monitoring growth and profitability is crucial to financial planning and analysis, and our profit and loss projection helps ensure the success of our company. By tracking sales and revenue growth, we can measure our earnings growth and financial performance accurately.

Cash Flow Chart Template

In order to establish a successful startup, financial planning and analysis are essential. Creating a cash flow forecast and financial projection allows for better budgeting and revenue modeling. Accurate financial forecasting and modeling not only provides insight into a company's financial performance, but is also necessary for securing investments or bank loans. Financial statements and metrics, along with financial reporting, aid in identifying areas for improvement and overall analysis of a company's financial health. A professionally conducted financial analysis can help with business planning and decision-making.

Industry Benchmarks

Financial planning and analysis is a crucial aspect of building a startup. Benchmarking, an analysis tool that compares your financial performance with other companies in the same industry, is an important part of financial forecasting and modeling. By understanding your financial metrics and using tools like cash flow forecasts and budgeting, you can make informed decisions about your revenue model and financial statements. This can lead to better financial performance and projections. In short, benchmarking is a key tool for startups looking to improve their financial planning and reporting.

Monthly Profit And Loss Template Excel

Financial planning and analysis is crucial for any business to succeed. Proper financial forecasting, budgeting, and financial analysis can help a company determine its financial metrics and performance. Financial statements, such as cash flow forecasts and revenue models, can provide insights into the business's financial projection. Using a financial model template excel is a great way to prepare a P&L statement, which is the heart of the company's profitability. Without careful financial reporting and business planning, a company is taking risks that could negatively impact its bottom line.

Pro Forma Balance Sheet Template Excel

In the realm of financial planning and analysis, it is essential to utilize tools such as financial projections, budgeting, financial forecasting and modeling. These processes assist in the creation of revenue models and financial statements, as well as the measurement of financial metrics and performance. The pro forma balance sheet template excel is an indispensable report that displays both current and long-term assets, liabilities and equity. Through this, vital calculations of ratios are made possible, making it an integral part of any business planning and financial projection.

Bar Start Up Business Plan Valuation

Startup Valuation Calculator Excel

Proper preparation is crucial when presenting to investors. Our bar 3 way financial model template includes valuation templates to help you demonstrate financial projections and analysis. With our template, you can easily showcase the minimum return on capital invested in operations using the weighted average cost of capital (WACC) valuation. You can also provide shareholders and creditors alike with an overview of the total cash flow available. And, with our discounted cash flow template, you can show the value of future cash flows relative to the current time, meeting the expectations of many investors.

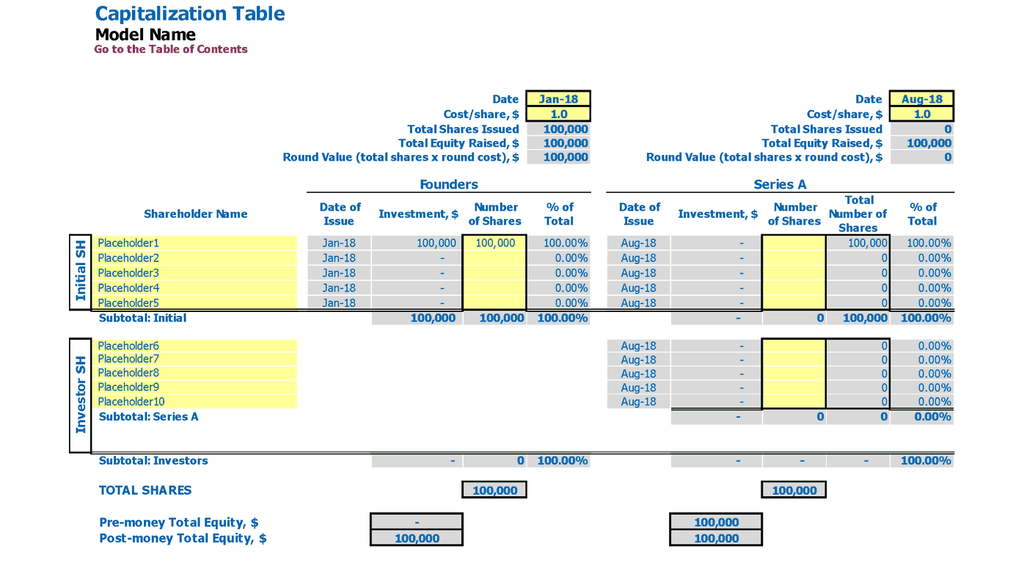

Cap Table Excel

Financial planning and analysis require several tools to ensure a business's financial soundness. A cap table is an invaluable resource for calculating shareholder dilution and financing projections. It includes data on limits and four funding rounds, each with the option to apply them separately or in tandem. Financial metrics and statements aid in financial analysis and forecasting, while budgeting and cash flow forecasting help to develop a revenue model. Consistent financial reporting is an essential part of successful business planning, as financial projections and analysis provide insight into financial performance and inform financial projection models.

Bar Projected Cash Flow Statement Template Excel Key Features

Get a robust, powerful financial model which is fully expandable

Maximize financial planning with a customizable bar revenue model template in Excel.

Get a Robust, Powerful and Flexible Financial Model

Utilize this comprehensive bar revenue model to conduct professional financial analysis and forecasting for optimal financial performance.

Simple-to-use

Use our Excel bar business plan template for accurate financial forecasting and analysis, no advanced skills needed.

Gaining trust from stakeholders

Utilize financial forecasting to build investor confidence and secure future investments.

Plan for Future Growth

Using a pro forma cash flow statement template can give insight and aid in financial planning and analysis for future business growth.

Bar P&L Template Excel Advantages

Make informed hiring decisions by analyzing bar startup financial projections through financial planning and analysis.

Stimulate your team with comprehensive financial modeling and analysis.

Maximize brand positioning with Excel-based financial modeling.

Refine your financial projections and analysis using the bar financial forecast template to ensure accurate revenue models and cash flow forecasting.

Our financial plan template ensures accurate financial forecasting and analysis for startups.