ALL IN ONE MEGA PACK INCLUDES:

Beer Bar Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Beer Bar Feasibility Study Info

Highlights

A five-year financial model startup is crucial for beer bars to secure capital from investors. The financial model helps early-stage startups to evaluate the feasibility of their business idea and plan for startup costs. Craft beer bar financial plan includes revenue streams, profit margins, inventory management, marketing strategy, pricing strategy, location analysis, staffing plan, equipment costs, licensing requirements, industry trends, customer demographics, and menu development. With an accurate financial model, beer bar owners can assess the feasibility of their business idea and make informed decisions to sustain profitability and long-term success.

The brewery bar financial model we offer generates a comprehensive 5 year forecast and projected income statement, along with break even analysis and financial metrics in both GAAP and IFRS formats. Our craft beer bar financial plan considers all important aspects of the business, including startup costs, revenue streams, profit margins, inventory management, marketing and pricing strategies, location analysis, staffing plan, equipment costs, licensing requirements, industry trends, customer demographics, and menu development. With our financial model, you can confidently enter the competitive beer bar market and make informed business decisions for your startup or existing establishment.

Description

Our craft beer bar financial plan is a comprehensive tool designed to help you make informed decisions regarding your brewery bar. It covers everything from startup costs and inventory management to location analysis and staffing plan. Our beer bar revenue streams section will help you identify potential sources of income, while the beer bar profit margins section will provide insight into how much you can expect to make on each sale. Our beer bar marketing strategy and beer bar pricing strategy sections will help you attract customers and set prices that will allow you to be competitive while still turning a profit. Finally, our beer bar customer demographics and beer bar menu development sections will give you the information you need to tailor your offerings to your target market. With our comprehensive beer bar financial plan, you'll be equipped to launch and run a successful craft beer bar.Beer Bar Financial Plan Reports

All in One Place

A successfully managed brewery or craft beer bar must create a comprehensive financial plan. This includes analyzing startup costs, revenue streams, profit margins, inventory management, marketing and pricing strategies, and location analysis. The staffing plan and equipment costs must also be taken into account. It is important to keep up with licensing requirements and industry trends, while focusing on the customer demographics and menu development. A three statement financial model is essential to consolidate projected profit and loss statements, balance sheet forecasts, and cash flow projections. This tool requires regular updates to ensure accurate financial management.

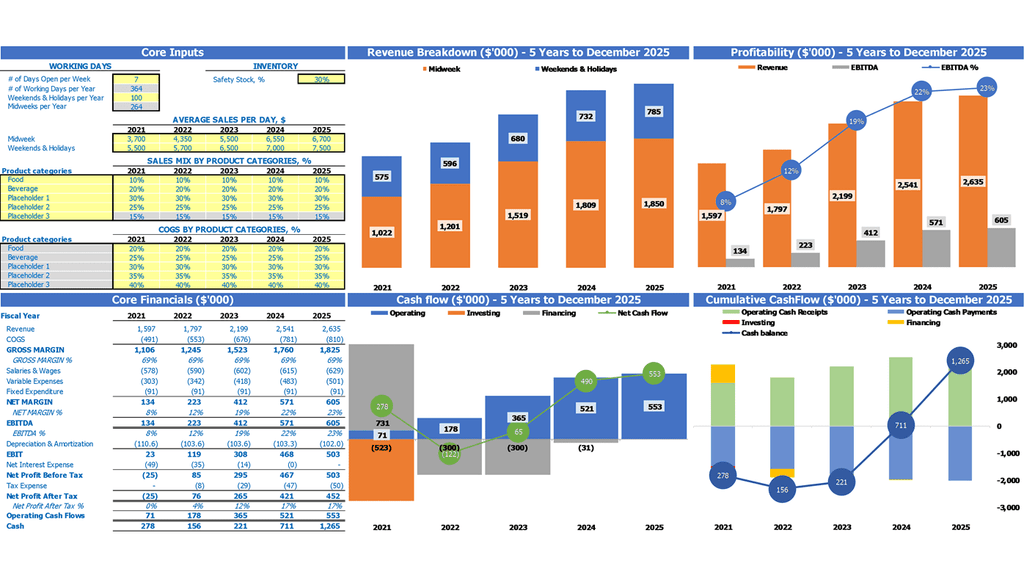

Dashboard

Crafting a successful brewery bar requires careful financial planning. To create a solid financial model for your craft beer bar, consider startup costs, revenue streams, and profit margins. You'll also need to manage inventory, develop a marketing strategy, and carefully analyze location and customer demographics. Make sure to create a thorough pricing strategy and staffing plan, taking into account equipment costs and licensing requirements. Stay up-to-date with industry trends and work to develop a menu that appeals to your target audience. Consider using financial plan templates and dashboard tools to streamline financial statement tracking and analysis.

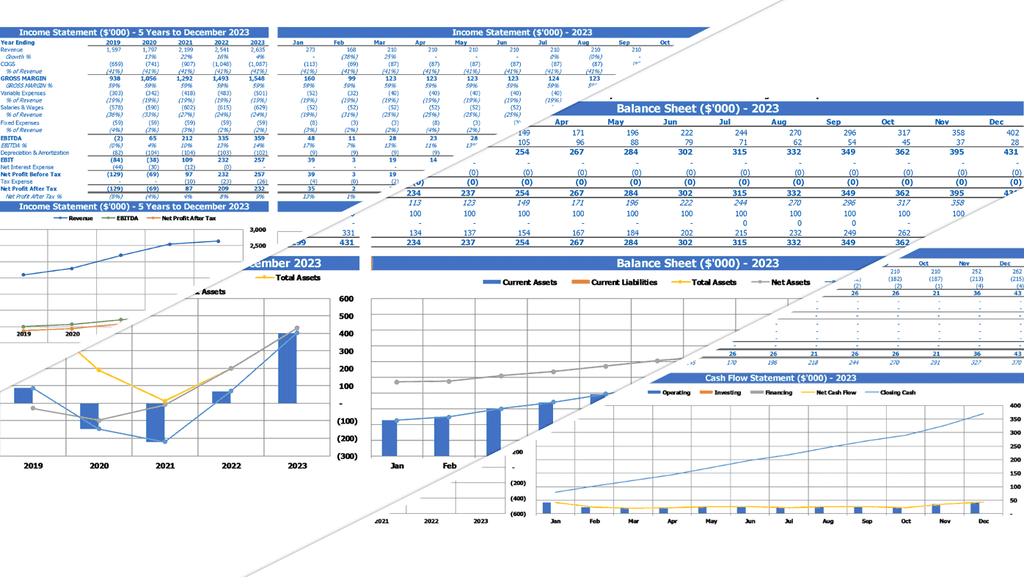

Excel Financial Statement Template

Our brewery bar financial model provides a comprehensive craft beer bar financial plan, including beer bar startup costs, beer bar revenue streams, and profit margins. Our model also covers critical aspects such as beer bar inventory management, beer bar marketing strategy, pricing strategy, beer bar location analysis, staffing plan, equipment costs, and licensing requirements. We keep a keen eye on beer bar industry trends and customer demographics to ensure the success of your beer bar. Additionally, our beer bar menu development is a must-have to attract customers and enhance revenue.

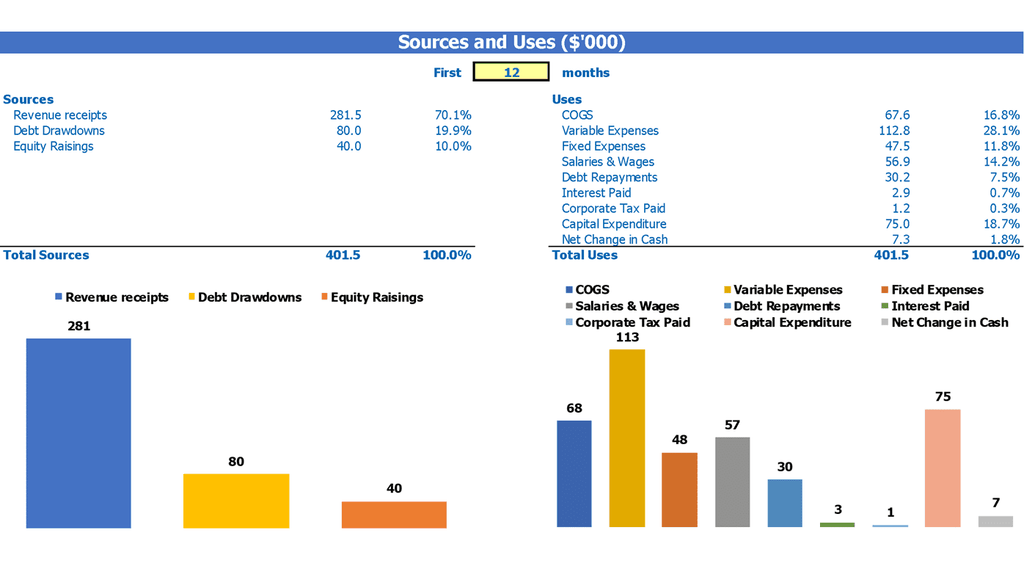

Source And Use Of Funds

Our craft beer bar financial model provides a detailed analysis of startup costs, revenue streams, profit margins, inventory management, marketing and pricing strategies, location analysis, staffing plan, equipment costs, licensing requirements and industry trends. We also focus on customer demographics and menu development. Our comprehensive sources and uses statement outlines how much financing we need and how we plan to obtain it. We include alternative funding sources such as crowdfunding campaigns, and our Uses of Funds section balances with the Sources section. This transparent approach shows our commitment to financial planning and management for long-term success.

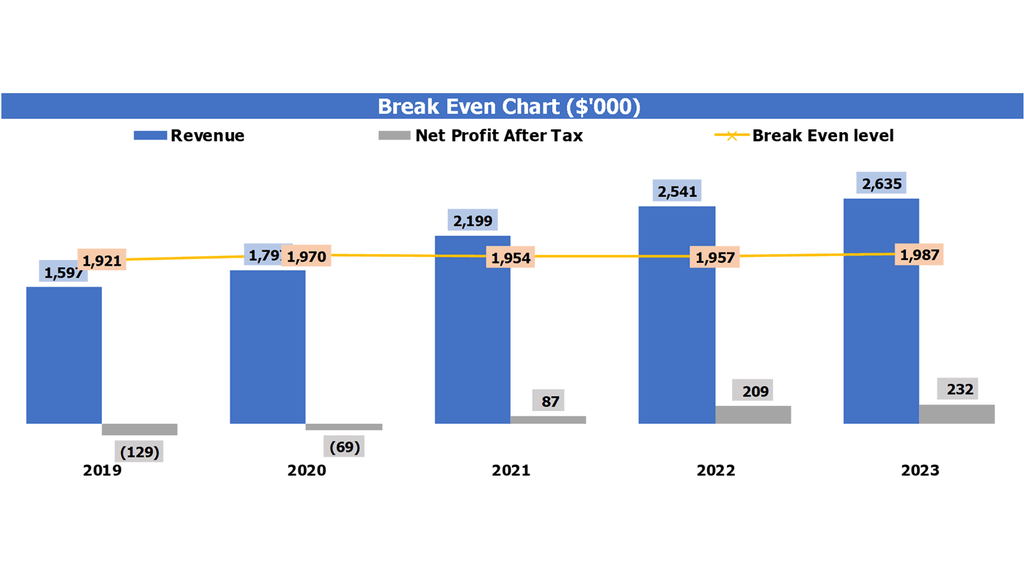

Break Even Point

When creating a financial model for a brewery or craft beer bar, understanding revenue streams and profit margins is crucial. Conduct a location analysis to determine target demographics and develop a marketing strategy accordingly. Draft a staffing plan and menu development plan to effectively manage inventory, equipment costs, and licensing requirements. It is important to differentiate between sales, revenue, and profit to accurately assess break even point and profitability. Stay up to date on industry trends to remain competitive in the market.

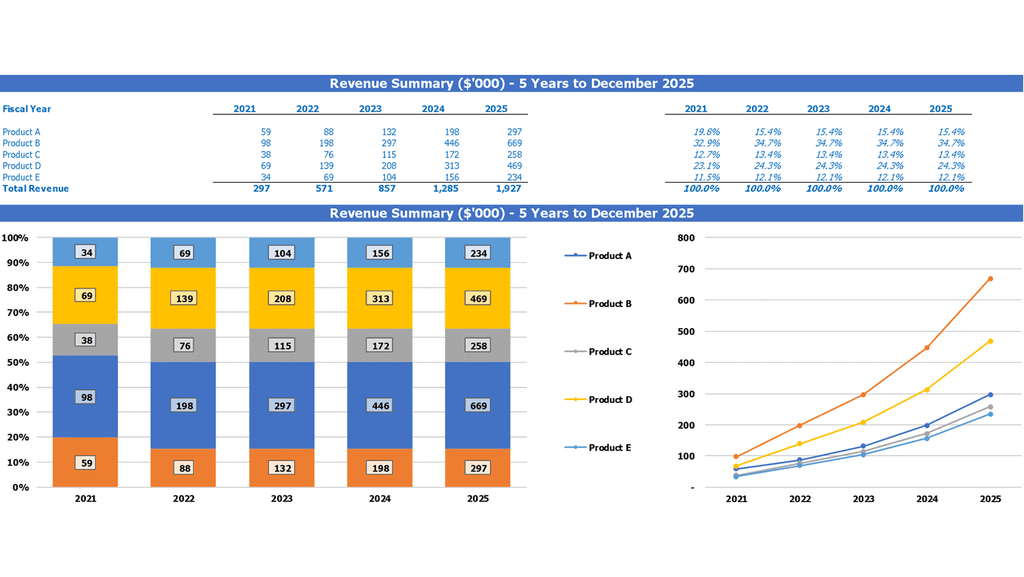

Top Revenue

Creating a solid financial plan for your craft beer bar startup is crucial to success. The revenue streams should be the focus while designing your financial model. Consider historical data as the foundation for growth rate assumptions and utilize various scenarios to project revenue. Inventory management, pricing strategies, and staffing plans must also be carefully considered. Location analysis, licensing requirements and industry trends play a key role in creating a strong marketing strategy to appeal to targeted customer demographics. Developing a carefully crafted menu will complement the atmosphere you create with your bar and equipment costs must be considered to optimize profit margins.

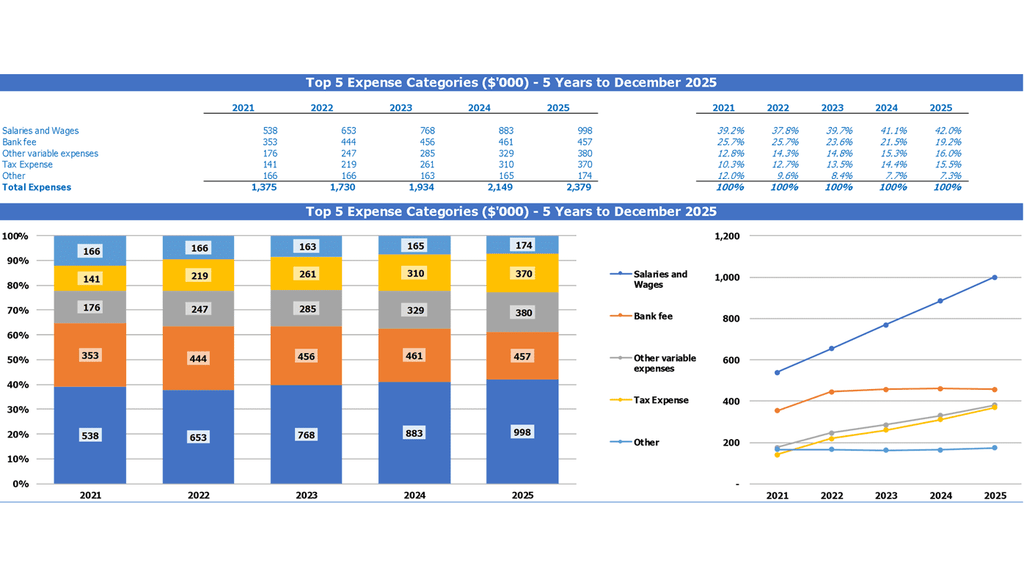

Business Top Expense Categories

Managing the finances of your brewery or craft beer bar is crucial for its success. Our financial model provides a comprehensive breakdown of expenses, from customer acquisition to fixed costs, to help you develop an effective pricing and marketing strategy. We also assist in conducting a location analysis and developing a customer demographic to optimize profit margins. Our team will help you create an inventory management system and a staffing plan. We ensure that all necessary equipment costs and licensing requirements are accounted for in our financial plan. Keep up with industry trends and a dynamic menu development to stay ahead of the competition.

Beer Bar Financial Projection Expenses

Costs

Our beer bar financial plan focuses on initial costs and startup funding to avoid major financial losses or underfunding. Our financial model template includes cost and funding information for effective expense management and planning. We also consider beer bar revenue streams and profit margins, inventory management, marketing and pricing strategies, location analysis, staffing, equipment costs, licensing requirements, industry trends, customer demographics, and menu development. Our goal is to create a comprehensive and successful financial projection for our brewery bar.

Capital Expenditure Plan

The initial startup costs of a brewery or craft beer bar include long-term assets that add value over multiple years, such as computer equipment. These costs are included in the balance sheet forecast, and the ongoing expenses, such as electricity, are included in the income statement. Depreciation expenses are listed in the profit and loss forecast and are used to reduce the value of assets shown on the balance sheet. A comprehensive startup budget is important for stakeholders to understand the company's expenditures on assets.

Debt Repayment Plan

When it comes to starting a successful beer bar, a well-planned financial model is key. This includes researching startup costs, revenue streams, profit margins, and inventory management. Performing a location analysis and creating a staffing plan are also important aspects to consider. Developing a marketing and pricing strategy can attract customers of all demographics. Additionally, considering equipment costs, licensing requirements, and industry trends can improve the overall success of the business. As with any business, monitoring and managing loans and cash flow projections are essential skills to maintain profitability. A clear understanding of how loan repayments and regular expenses impact cash flow is crucial.

Beer Bar Income Statement Metrics

Performance KPIs

In a craft beer bar's financial plan, considering the payback period is crucial. It's essential to assess the expenses associated with acquiring new customers and compare it to the potential profits they can generate. Dividing these numbers derives the payback period, which determines the time it takes for the business to recover its investment. Besides, analyzing beer bar revenue streams, profit margins, inventory management, licensing requirements, and industry trends is necessary. A comprehensive beer bar marketing strategy should also be created by developing a pricing strategy, location analysis, staffing plan, menu development, and equipment costs while considering customer demographics.

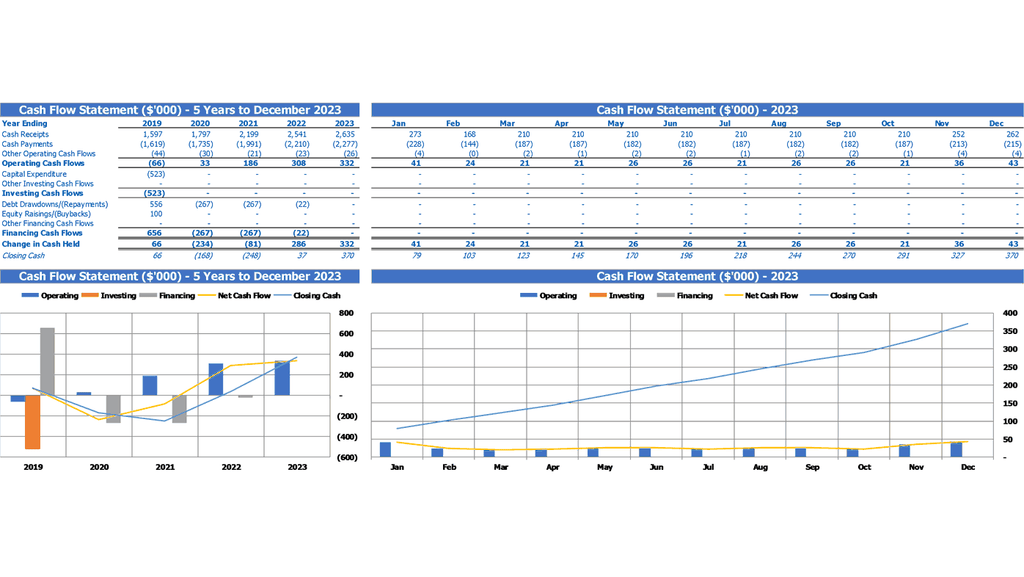

Cash Flow Projection Template For Business Plan

Having a detailed financial model is crucial for a successful brewery bar. It involves analyzing startup costs, revenue streams, profit margins, inventory management, pricing strategy, and location analysis. A well-developed staffing plan, equipment costs, and licensing requirements are also crucial factors. Examining industry trends and customer demographics can help develop a marketing strategy and menu that appeals to your target audience. A cash flow chart excel spreadsheet is a vital statement that demonstrates the business's potential for loan repayments and can aid in fundraising efforts.

KPI Benchmarking Report

Benchmarking is crucial for profit projection in beer bar startups. By comparing specific indicators of the company with those of successful competitors, it provides an objective assessment of the business's potential. Factors like unit costs, profit margins, productivity, and more, are evaluated for a complete financial analysis. As a valuable tool for startups, benchmarking helps to identify revenue streams, profit margins, inventory management, and pricing strategies. It also helps to develop a location analysis, staffing and equipment costs, menu development, marketing, and licensing requirements. By evaluating industry trends and customer demographics, benchmarking establishes optimal financial models for a successful beer bar.

Income And Expenditure Template Excel

The success of a craft beer bar heavily relies on its financial plan. This includes startup costs, revenue streams, profit margins, inventory management, pricing and marketing strategies, license requirements, location analysis, staffing plan, and equipment costs. Industry trends and customer demographics should also be considered in menu development. The first step in creating a financial model is forecasting the profit and loss statement, which drives various balance sheet and cash flow projections. This forward-looking analysis is crucial in estimating valuations and creating a successful business plan.

Balance Sheet Forecast

Creating a solid financial model is crucial for the success of a craft beer bar. It includes a thorough analysis of startup costs, revenue streams, profit margins, inventory management, pricing strategies, location analysis, staffing plans, equipment costs, licensing requirements, industry trends, customer demographics and menu development. Developing a comprehensive marketing strategy is also essential. Projections of the balance sheet enable businesses to identify current and long-term assets, liabilities and equities as well as calculate vital financial ratios to improve overall performance.

Beer Bar Income Statement Valuation

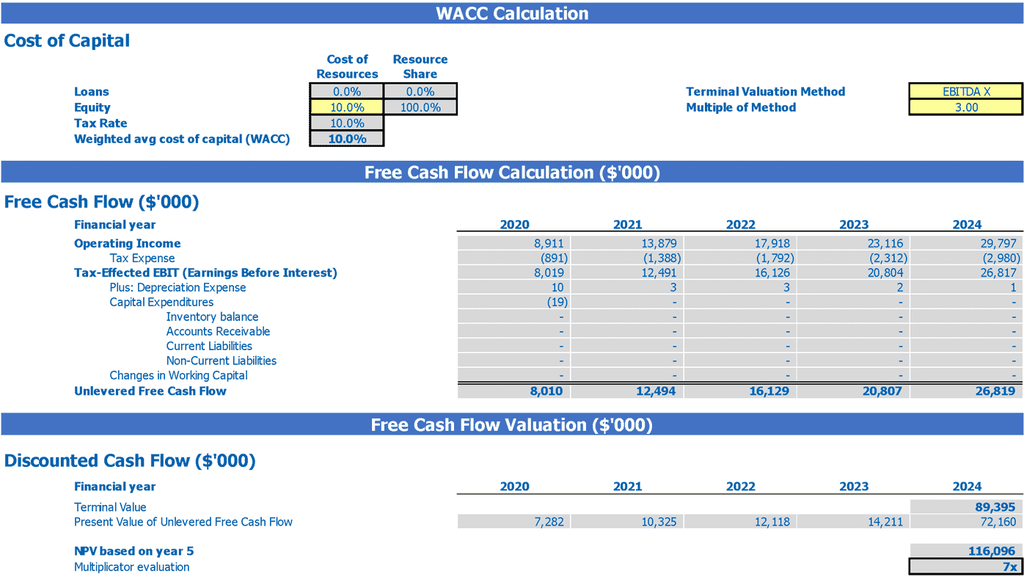

Startup Valuation

Our brewery bar financial model includes a comprehensive craft beer bar financial plan that considers beer bar startup costs, beer bar revenue streams, beer bar profit margins, beer bar inventory management, and beer bar marketing strategy. We also conduct a thorough beer bar location analysis, taking into account licensing requirements and industry trends. Our staffing plan and beer bar equipment costs are mapped out too. Additionally, we develop a pricing strategy that maximizes profit margins while considering customer demographics and menu development. Our beer bar financial model is supported by a 3 statement excel template that utilizes discounted cash flow (DCF) and weighted average cost of capital (WACC) valuation methods.

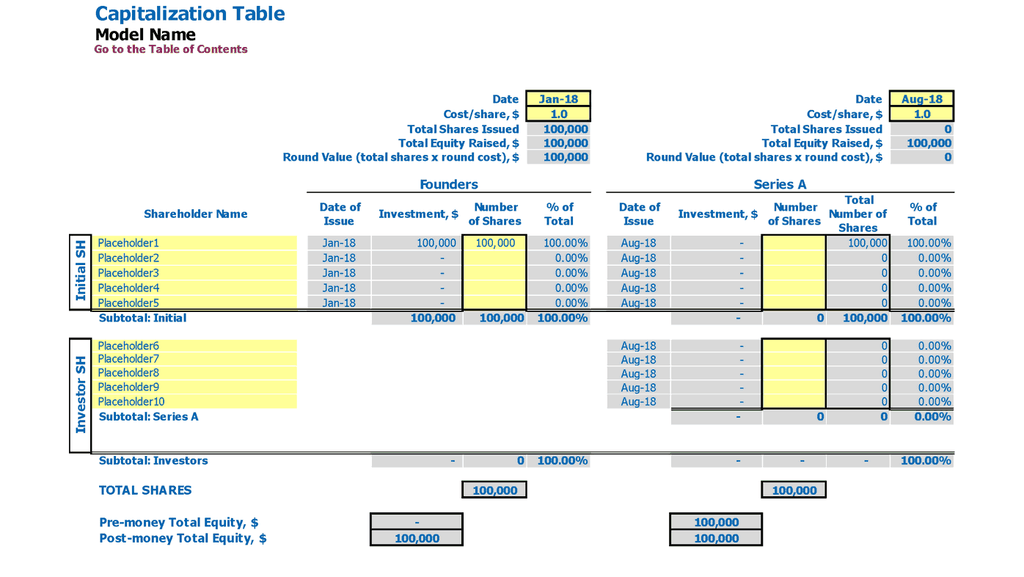

Cap Table Model

Our brewery bar financial model includes a comprehensive cap table that considers various equity shares, preferred shares, employee stock options, and convertible bonds. This valuable tool helps anticipate ownership stakes and potential dilution of existing shares as the company raises funding over four rounds in our 5-year craft beer bar financial plan. Our beer bar inventory management, licensing requirements, location and staffing plans, as well as industry trends and customer demographics are all meticulously analyzed in our beer bar startup costs and revenue streams, allowing for optimal beer bar pricing and menu development, and a successful beer bar marketing strategy.

Beer Bar Pro Forma Template Excel Key Features

Get Investors to Notice

The beer bar startup pro forma template helps entrepreneurs secure meetings with potential investors.

Build your plan and pitch for funding

Present a professional and comprehensive beer bar business plan to potential investors with our excel template.

External stakeholders, such as banks, may require a regular forecast

A beer bar with a bank loan will need to regularly provide a three statement model template to the bank.

Get a Robust, Powerful and Flexible Financial Model

Use this comprehensive beer bar financial model to create a successful business plan and adapt it to fit your unique needs.

Key Metrics Analysis

Produce beer bar financial projections with ease using customizable templates and GAAP/IFRS formats.

Beer Bar Business Financial Model Template Advantages

Track your beer bar's financials with a detailed budget plan including revenue streams, profit margins, inventory management, and more.

Excel financial model optimizes brand positioning for success.

Track startup spending with financial modeling to ensure targets are met.

The financial model predicts break-even and ROI for the craft beer bar startup.

Ensure financial feasibility with a comprehensive craft beer bar financial plan using an Excel template.