ALL IN ONE MEGA PACK INCLUDES:

Brewery Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Brewery Startup Budget Info

Highlights

Our brewery financial model is a comprehensive tool to assist in crafting a solid business plan for a craft or microbrewery. It includes financial analysis, planning, forecasts, and projections, presented in GAAP/IFRS formats. The model generates a five-year bottom-up financial model, cash flow analysis excel, financial dashboard, and core metrics. This tool is essential for estimating required startup costs and creating brewery financial feasibility. The spreadsheet is unlocked for editing, allowing breweries to customize the model to their individual needs. Our brewery start-up financial model facilitates financial strategy development, financial forecast management, and brewery financial performance analysis.

Our software offers a comprehensive brewery financial model that includes financial planning, feasibility, forecasting, management, and analysis. With just a few inputs, our tool generates a professional and engaging brewery business plan, projected income statement template excel, break even analysis, and financial metrics in GAAP/IFRS formats automatically. The craft brewery financial model and microbrewery financial model are tailor-made for startups looking to excel in their financial performance. With our brewery financial projections and financial statement analysis, investors feel confident in investing in your brewery. Our brewery financial strategy is data-driven, making it easy for you to manage your finances efficiently. Try our brewery financial modeling tool today and experience optimized financial performance in your brewery.

Description

Starting a brewery business requires efficient financial planning, which is crucial for its success. To expand your business, you need to have in-depth financial insights to guide your decision-making process. This is where our craft brewery financial model can prove to be invaluable as it provides accurate reporting and forecasting. This startup financial model contains all relevant input statements with charts to help you make informed decisions, including sales and return projections. Developed by qualified professionals, our microbrewery financial model provides an income and expenditure template and KPIs to measure business performance in detail. It also shows a visual summary of data through different graphic representations. With our financial model, you can stay ahead of the curve and make informed business decisions throughout your brewery's journey.Brewery Financial Plan Reports

All in One Place

Need to develop a financial plan for your brewery business? Our brewery financial model tool can help you create custom financial projections such as sales, costs, expenses, and investments in just a few clicks. It's an excellent way to test the feasibility of your craft brewery business plan and discover whether you need additional funding. With editable tables and forecasting features, you can modify the data and plug in your own assumptions to create a comprehensive proforma business plan template. Start planning your brewery financial strategy today with our user-friendly brewery financial modeling tool.

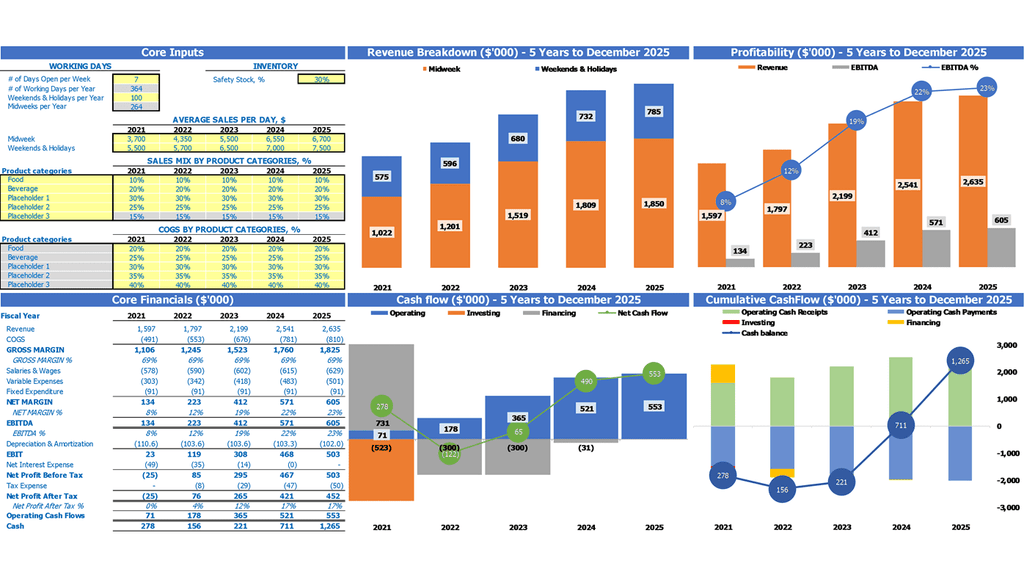

Dashboard

Our comprehensive financial model is designed specifically for breweries, offering essential metrics and inputs required for financial analysis. With pre-built templates for Balance Sheets, Profit and Loss statements, and Cash Flow forecasts, users can easily track financial performance and projections. The all-in-one dashboard provides clear and concise information in graphical formats, making it simple to assess financial feasibility, plan and forecast brewery financial strategy and management, and track the brewery's financial performance. Whether you're starting or scaling your brewery business, this financial model can help you make informed decisions and achieve success.

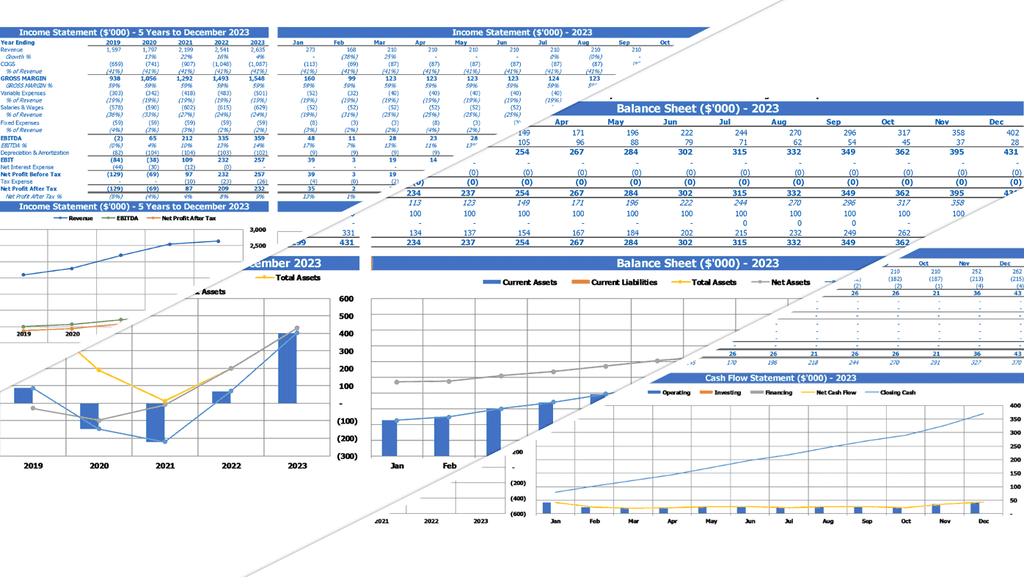

Accounting Financial Statement

Craft a comprehensive brewery business plan with accurate financial projections using our brewery financial modeling and planning tools. Our microbrewery financial model is flexible enough to handle various assumptions, generating easy-to-understand financial statements that are required by investors and lenders. Our brewery financial feasibility services will help you assess the viability of your brewery startup and develop a reliable brewery financial strategy. Stay on top of your brewery financial performance with our brewery financial management services, with brewery financial metrics that will help you track your progress against your goals.

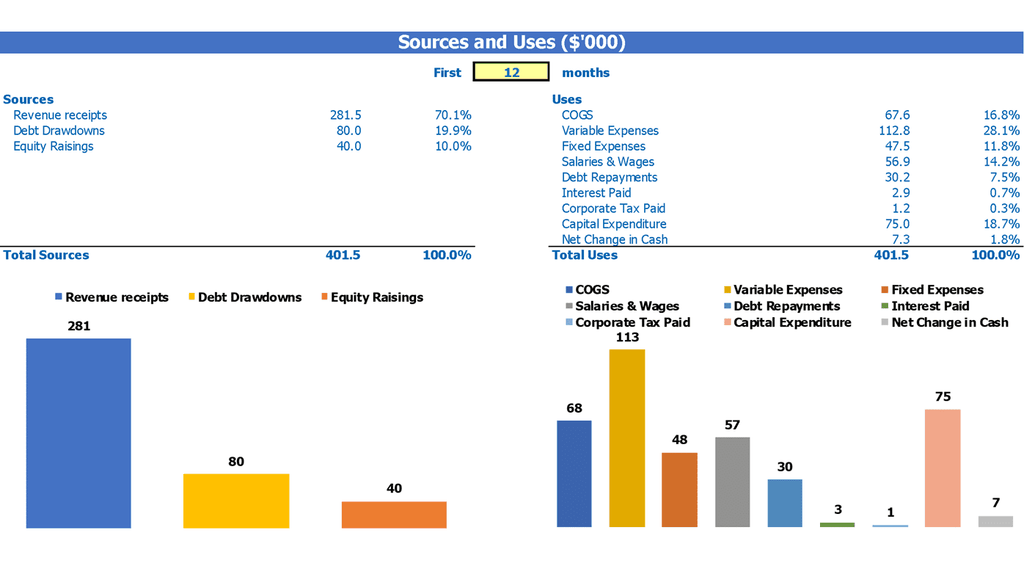

Sources And Uses Table

Maximize your brewery's profitability with our comprehensive brewery financial model. Our expert team has developed a range of tools to help you craft a winning brewery business plan, including financial planning, projections, feasibility analysis, and forecasting. Our microbrewery financial model is perfect for startups looking to establish themselves in this exciting and growing industry. Our brewery financial analysis tools and financial statement templates are designed to give you a clear picture of your company's financial performance, metrics, and management. With our brewery financial strategy, you can take your brewery to the next level, achieving greater success and profitability.

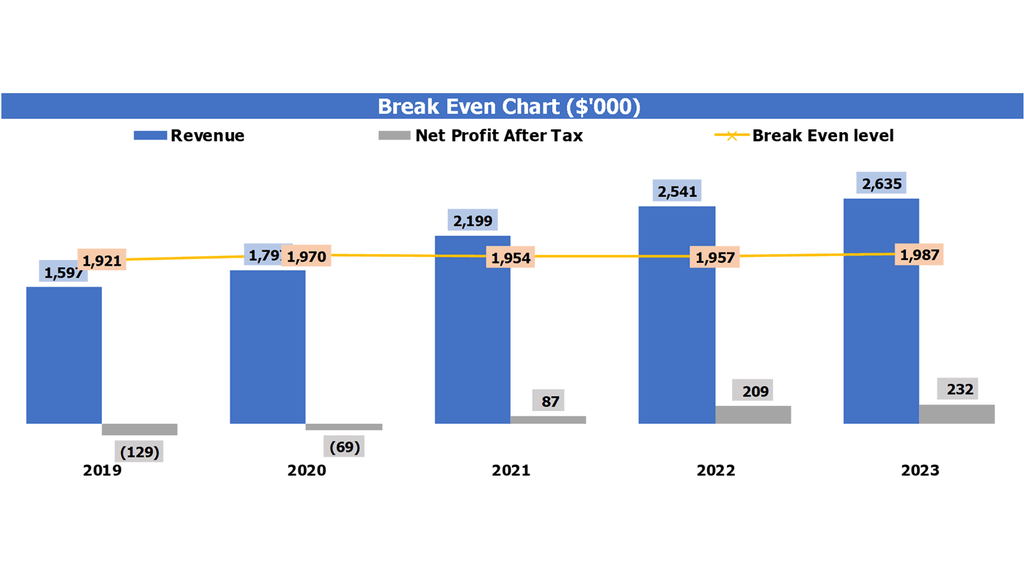

Break Even Point Excel

Brewery financial planning relies on a break even analysis to help determine profitability dates. By calculating the break even sales in dollars, financial specialists can determine if starting a brewery is financially viable. It also helps managers set prices for products and services in order to cover all costs. Brewery financial projections and financial models can assist in making these determinations, while brewery financial statements and metrics can help evaluate the company's financial performance. A solid brewery financial strategy and forecast can ensure the business remains profitable in the long term.

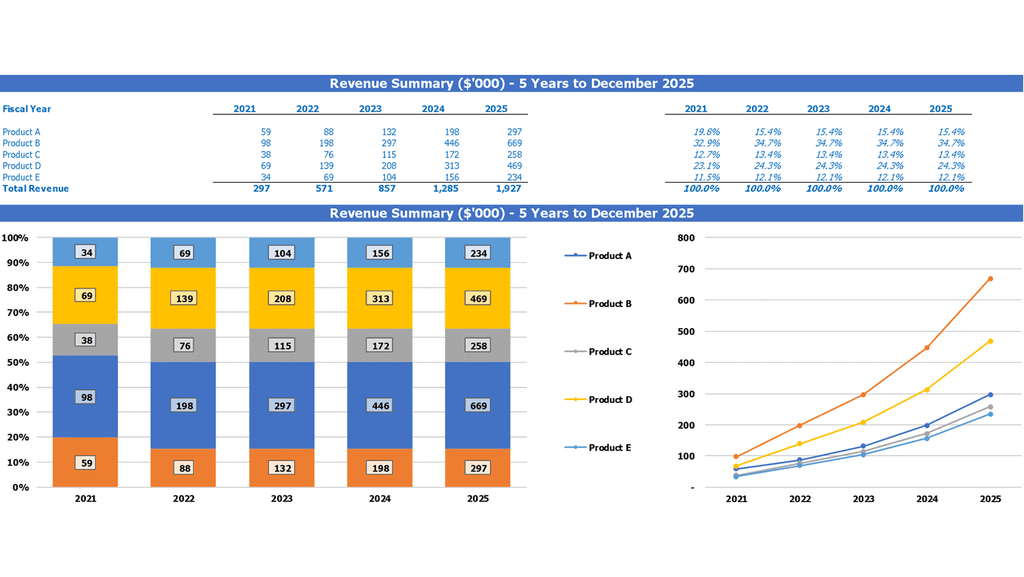

Top Revenue

The gross revenue (top line) and net profit (bottom line) are crucial to a company's financial health and are heavily scrutinized by stakeholders, investors, and equity analysts. Top-line growth refers to an increase in gross sales or revenues, which is a positive indicator of good operations and financial decision-making. A company's forecasted profit and loss statement outlines these important financial metrics, which are essential for financial planning and management, crafting a business plan and financial model, and determining the financial feasibility and strategy for a brewery startup or existing craft brewery.

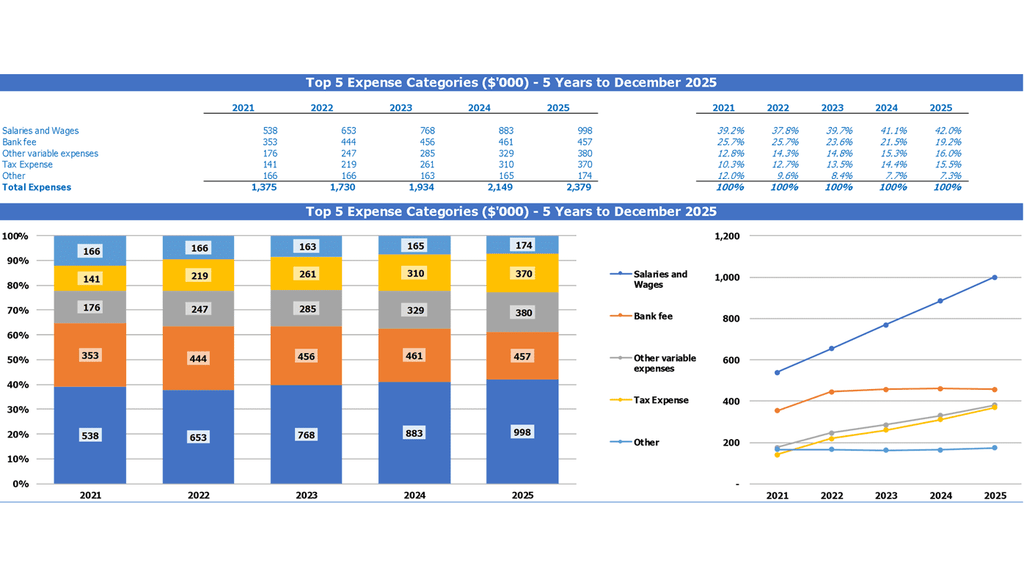

List of Top Expenses

Our comprehensive brewery financial model includes customizable expense analysis in the Top Expenses section. With four pre-allocated categories and the option to input custom data in the 'other' category, you can tailor your brewery business plan to fit your specific needs. Our financial model boasts accurate brewery financial projections and realistic brewery financial feasibility analysis, helping you fine-tune your brewery financial planning and management. Trust our brewery financial forecast to provide valuable insight into brewery financial performance and measure key brewery financial metrics, securing the successful future of your craft or microbrewery.

Brewery Financial Projection Expenses

Costs

Investing in a brewery startup financial plan is crucial for cost projections and financial planning. Utilizing a brewery financial projection excel can aid in understanding expenses and organizing finances. This pro forma financial statements template excel provides a clear structure for budgeting and is essential when communicating with investors or creditors to ensure accuracy. A craft brewery financial model or microbrewery financial model can also help optimize financial strategy and management. Measuring brewery financial performance with the proper metrics and feasibility analysis can further drive success in the brewery business plan.

CAPEX Forecast

For a successful brewery business plan, financial planning and analysis are crucial. Utilizing a comprehensive financial model, such as a craft brewery financial model or microbrewery financial model, can help with financial feasibility, forecasting, and performance management. To monitor investments in fixed assets and PPE, financial experts compute CAPEX spending that accounts for depreciation, additions, and disposals. Additionally, capital expenditure forecasts should include leased assets. Incorporating effective financial strategies and metrics into your brewery financial statement can lead to long-term financial success.

Debt Repayment Schedule

Our brewery financial model offers a comprehensive and professional approach to financial planning, analysis and projections for both startup and established breweries. Our templates include all key financial statements, projections, cash flow forecasts, and loan amortization schedules. Our loan amortization schedule allows you to calculate your payment amounts with ease, including principal and interest calculations. Our financial metrics and management tools offer a complete and reliable picture of your brewery's financial performance, feasibility and strategy. Ensure your brewery's financial success - use our brewery financial model today.

Brewery Income Statement Metrics

Profitability KPIs

Crafting a strong financial plan is crucial for any brewery to succeed. Utilizing a well-designed financial model and analysis tools can help in creating an accurate forecast, projecting financial feasibility and determining the right financial strategy. It is important to consider factors such as brewery financial statement, management, and performance to build a brewery startup financial model for prospective investors. Calculating EBITDA can also provide key metrics to measure a brewery's operating performance. With a solid brewery financial forecast, operations can flow smoothly as financial obstacles are proactively addressed.

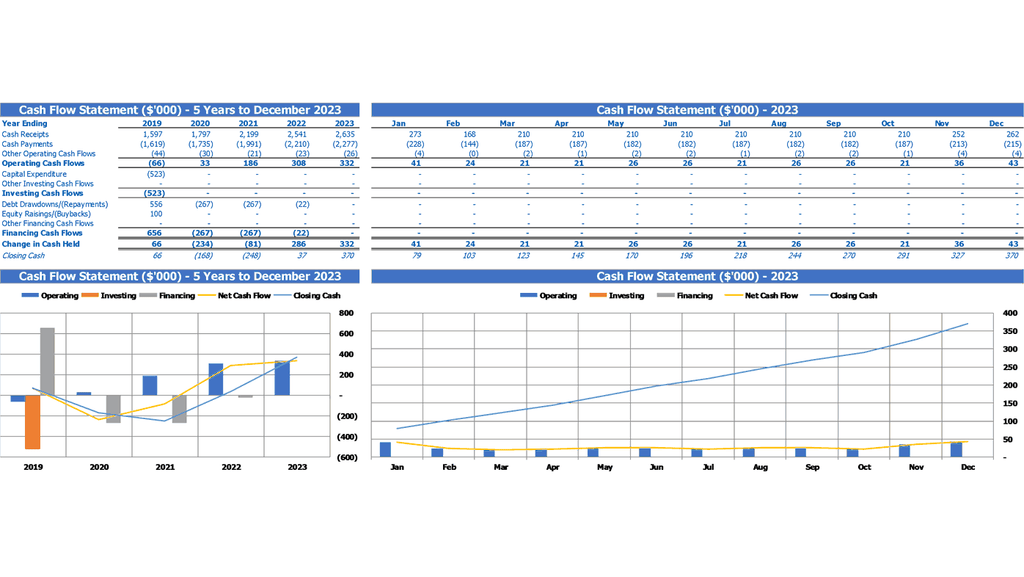

Cash Flow Forecast

A brewery business plan financial model is essential for success in the craft beer industry. It is crucial to have a microbrewery financial model in place to ensure that you can execute your financial strategy effectively. Your brewery financial projections and statements, along with a feasibility analysis, will help you forecast your performance accurately. Brewery financial modeling and metrics will help you to make informed decisions, manage your finances efficiently, and increase your revenue. Apply these methods and use an excel spreadsheet cash flow to help you optimize your operations and achieve your goals.

KPI Benchmarking Report

Financial benchmarking is crucial for breweries, especially those just starting out. Utilizing industry-wide data, a financial model can be developed to determine the key performance indicators and assess financial feasibility. The benchmarking analysis measures the company's financial results against industry best practices. With this data, a brewery can create a solid financial plan and forecasting strategy to ensure financial success. Overall, financial modeling and benchmarking are valuable tools for managing and improving brewery financial performance.

Forecasted Income Statement

Crafting a brewery business plan requires accurate financial modeling and analysis to ensure the brewery's financial feasibility, forecasting, and performance management. A comprehensive brewery startup financial model must include financial statements and projections, which cover ratios, percentages, expenses, and profits. Implementing a robust brewery financial strategy is key to achieving a successful brewery business, and brewery financial metrics should be used as a metric of success. Investing time and effort into brewery financial planning can help entrepreneurs reap the rewards of a well-run brewery business.

Projected Balance Sheet Template

Our brewery business plan includes a well-crafted financial model to ensure your brewery's financial feasibility, strategy, and management. Our craft brewery financial model and microbrewery financial model offer financial projections and performance metrics for 5 years, including a projected balance sheet in an excel format. This enables you to present a comprehensive financial statement to stakeholders, featuring total assets, total liabilities, and shareholders' equity. Trust our brewery startup financial model to help you build a sustainable financial plan for your brewery.

Brewery Income Statement Valuation

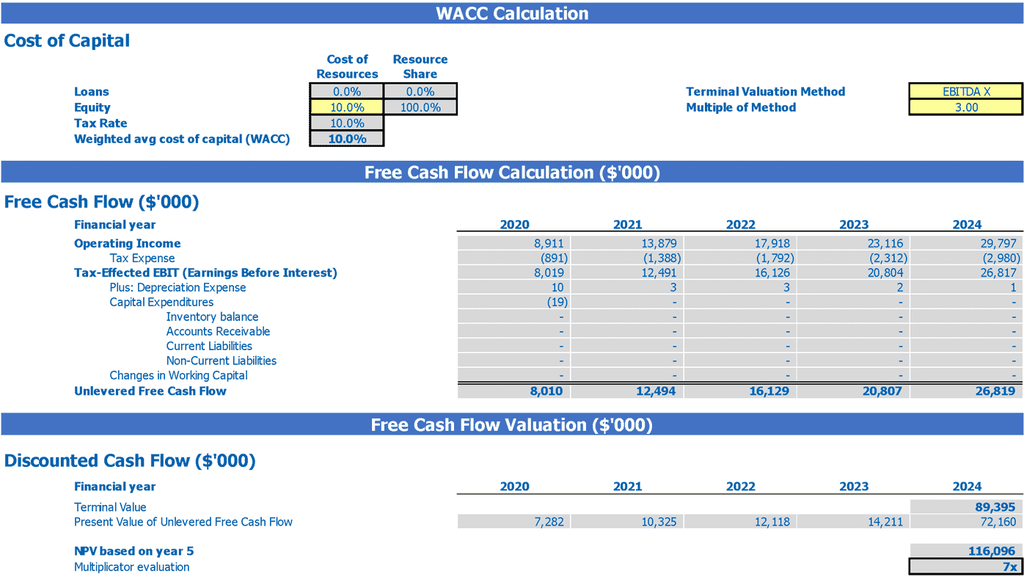

Pre Money Valuation Startup

Our brewery financial model is designed to help you prepare a professional business plan and impress your investors. Our free template includes built-in valuation templates, such as the weighted average cost of capital and discounted cash flow, to showcase the minimum return on investment and future cash flows. With our craft brewery financial model, you can easily analyze your financial feasibility, forecast performance, and plan your financial strategy. We also provide financial statements, projections, and metrics for all stakeholders, including shareholders and creditors. Build your brewery startup financial model with us today and secure your funding!

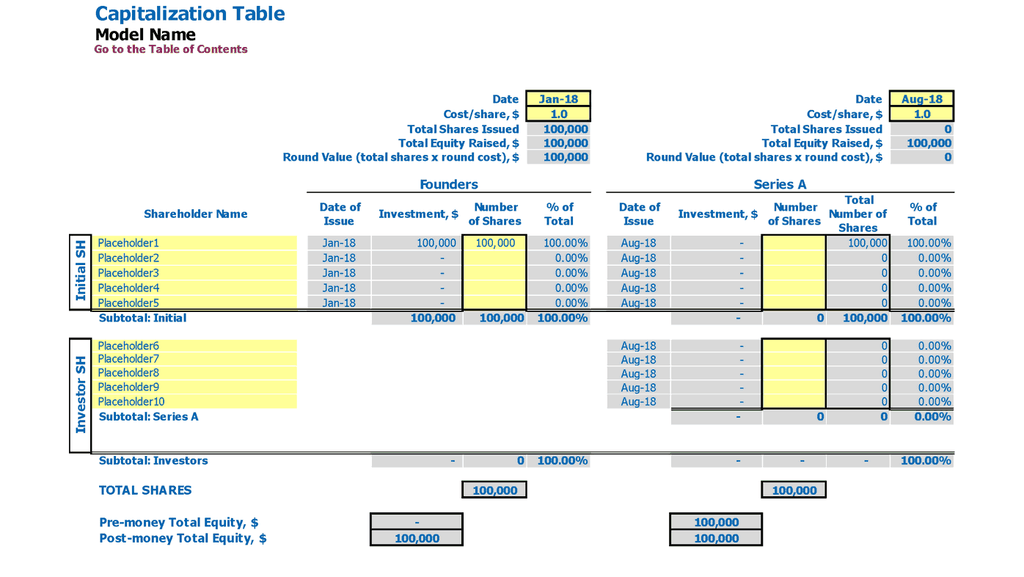

Captable

Utilize the 3-statement financial model template that efficiently calculates cash flow projections and forecasted profit and loss statements. This model also includes a crucial capitalization table that aids in predicting future financial outcomes. The 5-year forecasting template assesses sales and EBITDA projections, making it an excellent tool to evaluate investors' investments. Incorporating a cap table model can significantly contribute to the development and growth of your brewery business plan.

Brewery Financial Projections Spreadsheet Key Features

Run different scenarios

Using a pro forma cash flow statement template allows for playing with variables to see the impact on cash flow, such as forecasting the effect of new staff on wage costs.

Manage surplus cash

Craft brewery financial planning includes cash flow projections to manage surplus cash for reinvestment or debt repayments.

Consistent formatting

Professional formatting and clear tab organization improves model accessibility for testing new hypotheses.

Works for startups

Our brewery business plan includes a comprehensive financial model with projections and analysis.

Avoid cash flow problems

Regular cash flow forecasting is crucial for brewery financial management and can help identify potential gaps and improve financial health.

Brewery Financial Projection Model Template Advantages

Make informed hiring decisions using professional brewery financial modeling in Excel.

Optimize financial management with a comprehensive brewery business plan and financial model.

Maximize brewery success with a comprehensive 5-year financial model, mitigating potential obstacles.

Identify brewery strengths and weaknesses with a 5-year financial model projection plan.

A budget financial model provides a clear overview of a brewery's expenses and income over specific periods for comparison and analysis.