ALL IN ONE MEGA PACK INCLUDES:

Casino Hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Casino Hotel Startup Budget Info

Highlights

The financial projections for a casino resort revenue and hotel feasibility study require a comprehensive market research report and hospitality industry analysis. It is important to consider costs such as cost of goods sold, operating expenses, and capital expenditure in order to conduct a break-even analysis and assess the debt service coverage ratio. The cash flow statement should be regularly reviewed to ensure a positive return on investment, as well as considering metrics such as net present value and internal rate of return. Occupancy rates for the casino hotel will also impact financial projections and should be closely monitored throughout the planning process. Our casino hotel startup financial plan template offers a 5-year financial planning model that can be fully customized and is suitable for both startups and established businesses.

Conducting a hotel feasibility study and market research report is essential to understand the potential revenue for a casino resort. Analyzing the hospitality industry and examining the cost of goods sold and operating expenses are crucial factors to consider. Performing a break-even analysis can help determine the number of casino hotel occupancy needed to cover capital expenditures and debt service coverage ratio. Furthermore, calculating return on investment, net present value, and internal rate of return can provide insight into long-term profitability. Creating a cash flow statement is an effective way to track and project revenue and expenses. With a well-executed financial projection, casino hotels can have a clearer understanding of their financial performance and make informed decisions to achieve financial success.

Description

Our expert team has created the casino hotel financial modeling excel template suited for your business needs. By using this powerful tool, you can make informed decisions based on accurate financial reporting and projections. Our template includes a range of input tables, charts, and accounting statements such as cost of goods sold, market research reports, and cash flow statements. In addition, our casino hotel excel pro forma financial statements template provides insights into break-even analyses, debt service coverage ratios, and return on investment calculations. With a focus on capital expenditures and operating expenses, the financial model also addresses factors such as casino resort revenue, hospitality industry analysis, and casino hotel occupancy. Rely on our 5-year financial projections and casino hotel business model to empower your decision-making process today.Casino Hotel Financial Plan Reports

All in One Place

Our comprehensive hotel feasibility study incorporates extensive market research reports and hospitality industry analysis to provide financial projections for your casino resort revenue. Our break-even analysis includes the cost of goods sold, capital expenditure, and operating expenses, while our cash flow statement and debt service coverage ratio provide a complete picture of your financial health. Our return on investment, net present value, and internal rate of return analysis inform your capital expenditures and help plan your casino hotel occupancy levels. With our professional P&L template in Excel, you can present your financials to investors with confidence.

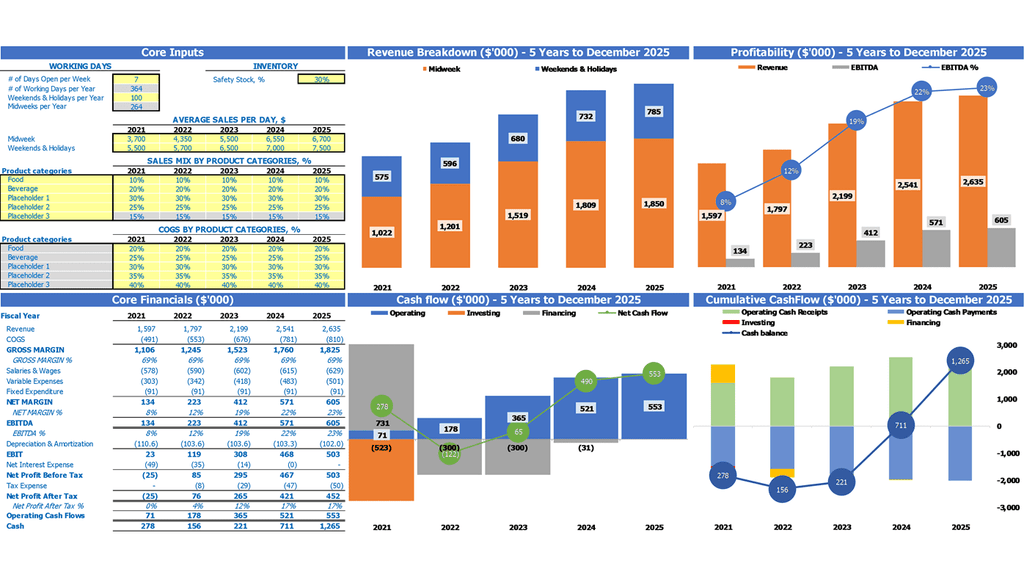

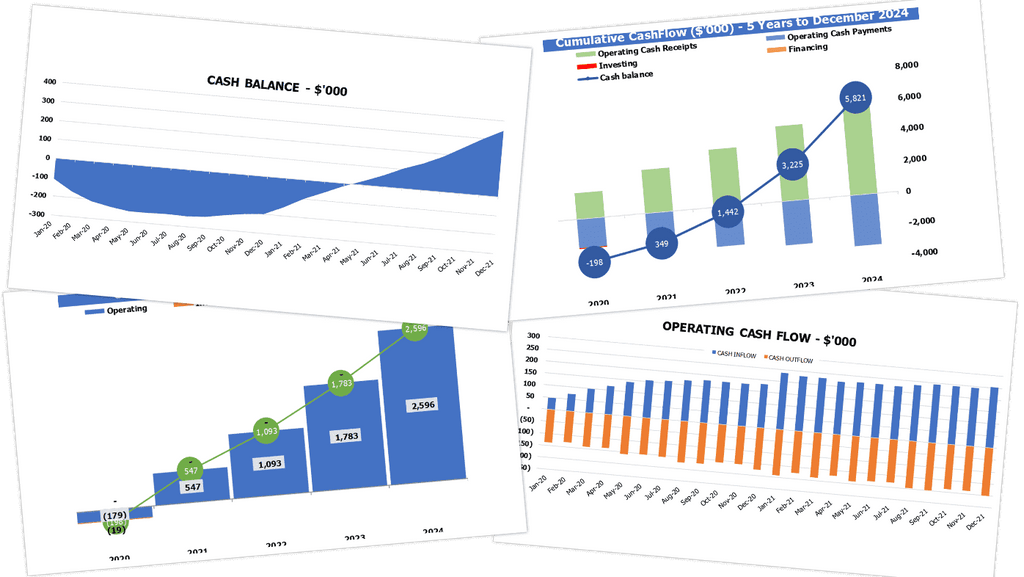

Dashboard

Our comprehensive hospitality industry analysis incorporates a detailed market research report, hotel feasibility study, and break-even analysis to guide you in determining cost of goods sold and operating expenses. Our financial projections also include casino resort revenue and casino hotel occupancy data for robust profitability forecasts. Additionally, we provide insights on capital expenditure, cash flow statement, debt service coverage ratio, return on investment, net present value, and internal rate of return to enhance your decision-making process. Our financial dashboard presents all critical financial metrics at a particular point in time, ensuring that you have a snapshot of your business revenue breakdown by year and cumulative cash flows.

Startup Financial Statements Examples

The comprehensive startup financial plan boasts crucial components that allow business owners to determine the viability and growth of their venture. These components include market research reports, hospitality industry analysis, hotel feasibility studies, financial projections, and a break-even analysis. Additional data, such as cost of goods sold, operating expenses, and capital expenditure, permit the owner to calculate cash flow statements, net present value, and internal rate of return. Furthermore, metrics like casino resort revenue, casino hotel occupancy, and debt service coverage ratios enable the owner to forecast the return on investment for their project.

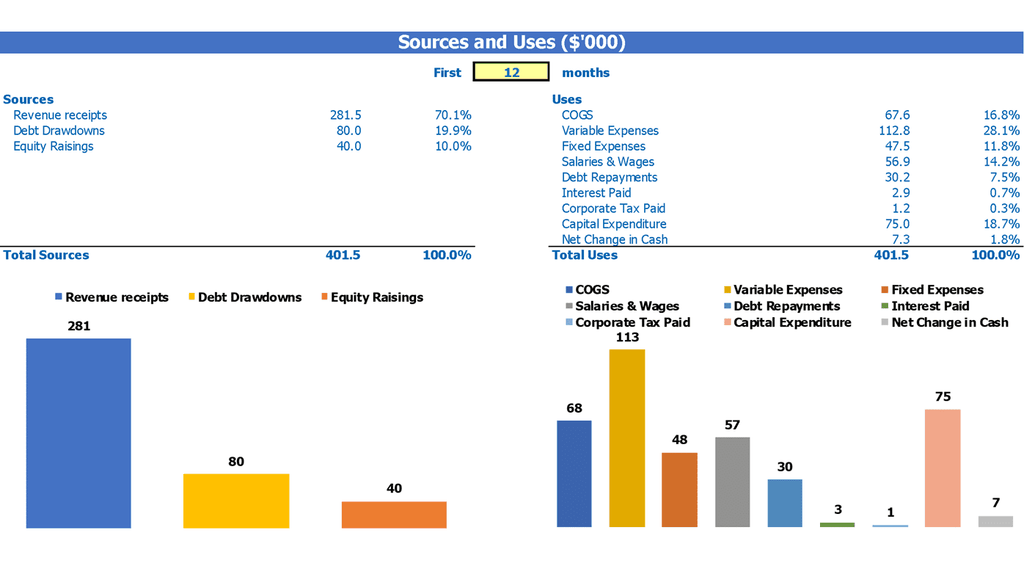

Source And Use Of Funds

For start-ups, the sources and uses of capital statement is crucial in managing funds. The table in the startup costs template displays the company's funding sources and expenses. It is necessary to understand financial projections, operating expenses, cost of goods sold, and capital expenditures to calculate the break-even point, net present value, and internal rate of return. A hotel feasibility study and market research report provide valuable insights into the hospitality industry and casino hotel occupancy, while a cash flow statement and debt service coverage ratio help analyze casino resort revenue and return on investment.

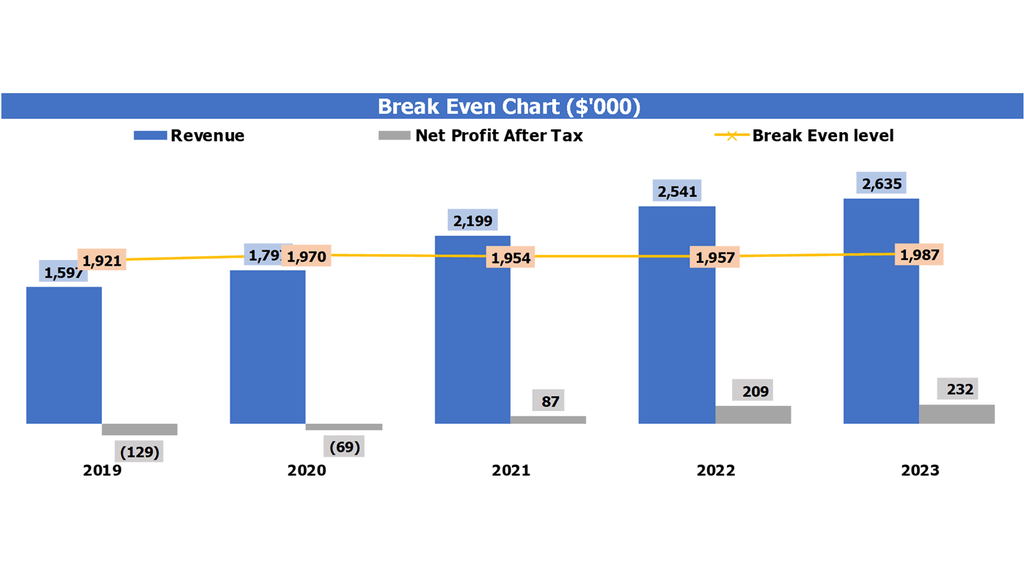

Break Even Point In Dollars

The financial projections for our hotel feasibility study have been meticulously crafted utilizing market research reports and a thorough hospitality industry analysis. Our calculations include the cost of goods sold, operating expenses, and capital expenditure for the casino resort. The break-even analysis, debt service coverage ratio, return on investment, net present value, and internal rate of return have all been examined. The cash flow statement and casino hotel occupancy rates have been taken into account to determine the casino resort revenue. Our goal is to exceed the breakeven point, ensuring the company's overall revenues surpass its expenses.

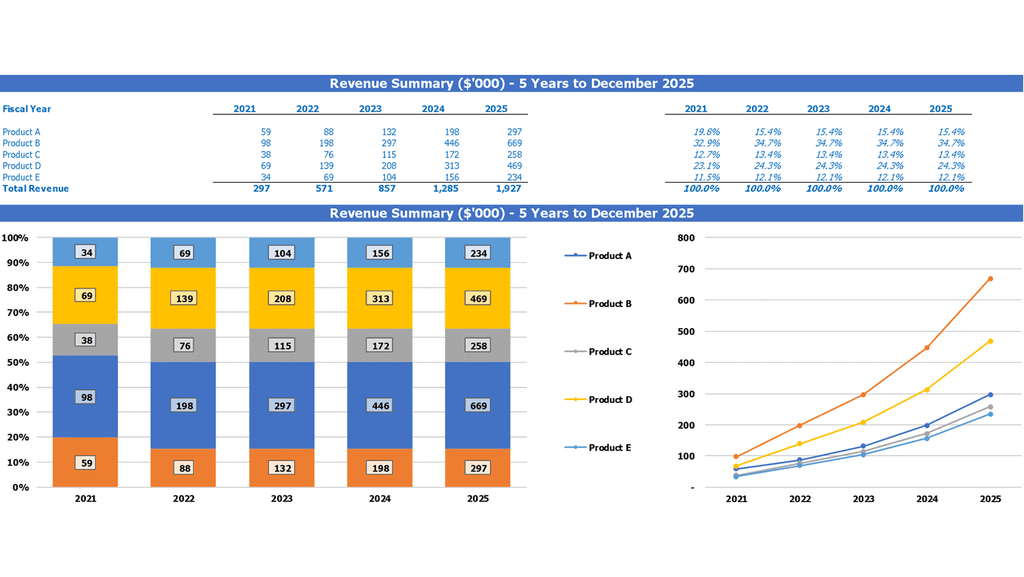

Top Revenue

A comprehensive hotel feasibility study involves examining the hospitality industry analysis, reviewing market research reports, and calculating financial projections such as the cost of goods sold, break-even analysis, and operating expenses. Additionally, it's essential to consider the casino resort revenue, casino hotel occupancy, and capital expenditure, debt service coverage ratio, return on investment, net present value, internal rate of return, and cash flow statement. The Top Revenue tab is a valuable tool for summarizing financial information, including revenue streams, revenue depth, and revenue bridge, and presenting it in an organized manner.

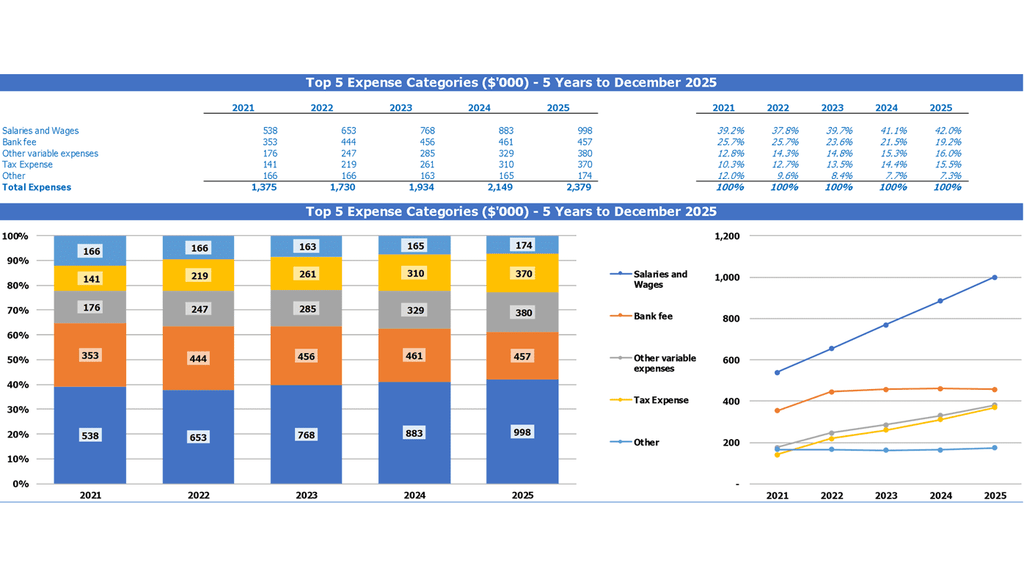

List of Top Expenses

Our expert team of analysts can provide a range of services for the hospitality industry, including hotel feasibility studies, market research reports, and financial projections. We specialize in analyzing the costs of goods sold, operating expenses, capital expenditures, and cash flow statements, alongside break-even analyses, debt service coverage ratios, returns on investment, net present values, and internal rates of return. For your convenience, our 3 statement financial model Excel template includes a Top Expenses area, grouped into four categories, with an 'Other' section, allowing you to enter any necessary data for your company. Let us help you optimize your casino resort revenue and casino hotel occupancy.

Casino Hotel Financial Projection Expenses

Costs

A comprehensive hotel feasibility study is essential for assessing the financial projections of a casino resort in the hospitality industry. The study includes market research reports, break-even analysis, and cost of goods sold data. The casino hotel occupancy rate and casino resort revenue are critical factors in determining the return on investment, net present value, and internal rate of return. The cash flow statement and debt service coverage ratio are crucial indicators of the project's financial health. Capital expenditure projections and operating expenses must also be considered to ensure accurate financial planning.

Capital Expenditure Plan

The financial projections are based on thorough market research report, including hospitality industry analysis and break-even analysis. The hotel feasibility study indicates a promising casino resort revenue and casino hotel occupancy. The cost of goods sold and operating expenses are thoroughly assessed to ensure appropriate debt service coverage ratio. The cash flow statement, net present value, and internal rate of return are analyzed to determine the return on investment. Additionally, the automatic CAPEX forecast considers the capital expenditure and alternative sources of income for the company in a professional and engaging manner.

Debt Repayment Plan

Conducting a hotel feasibility study with market research reports, financial projections and a break-even analysis is essential for investors in the hospitality industry. Determining casino resort revenue, cost of goods sold, and operating expenses helps establish the debt service coverage ratio, return on investment, net present value, and internal rate of return. Effective management of capital expenditures, cash flow statements, and casino hotel occupancy are crucial for success. To achieve this, companies need the right infrastructure and software to monitor loan profiles and repayment schedules. Understanding how regular expenses and loan repayments impact cash flow is vital, especially for startups and growing enterprises.

Casino Hotel Income Statement Metrics

Profitability KPIs

When conducting a hotel feasibility study or analyzing the hospitality industry, financial projections and market research reports are crucial. Calculating the cost of goods sold, applying break-even analysis, and evaluating the return on investment, net present value, internal rate of return, and debt service coverage ratio are all necessary. A casino resort revenue analysis would also include considering casino hotel occupancy rates. Additionally, a cash flow statement and capital expenditure plan will help understand operating expenses and potential profits. These metrics provide valuable insights into a business's potential for generating profit, making them an essential aspect of any feasibility study.

Cash Flow Budgeting And Forecasting

The hotel feasibility study is a key component in the hospitality industry analysis, including market research reports, financial projections, and break-even analysis. The revenue of the casino resort and casino hotel occupancy are important factors to consider, as well as operating expenses and the cost of goods sold. Capital expenditure, debt service coverage ratio, return on investment, net present value, and internal rate of return should also be included in the financial projections. It is crucial to create a cash flow statement to analyze changes in cash inflows and outflows accurately.

KPI Benchmarking Report

Financial projections, hotel feasibility studies, and market research reports are crucial in determining the success of hospitality ventures. Calculating cost of goods sold, break-even analysis, operating expenses, capital expenditures, and debt service coverage ratio aid in analyzing business performance. The analysis of casino resort revenue and casino hotel occupancy is also necessary. Financial benchmarking will help determine a company's KPIs compared to industry averages, resulting in valuable insights on return on investment, net present value, and internal rate of return. All of which, when properly utilized, will help ensure a healthy cash flow statement.

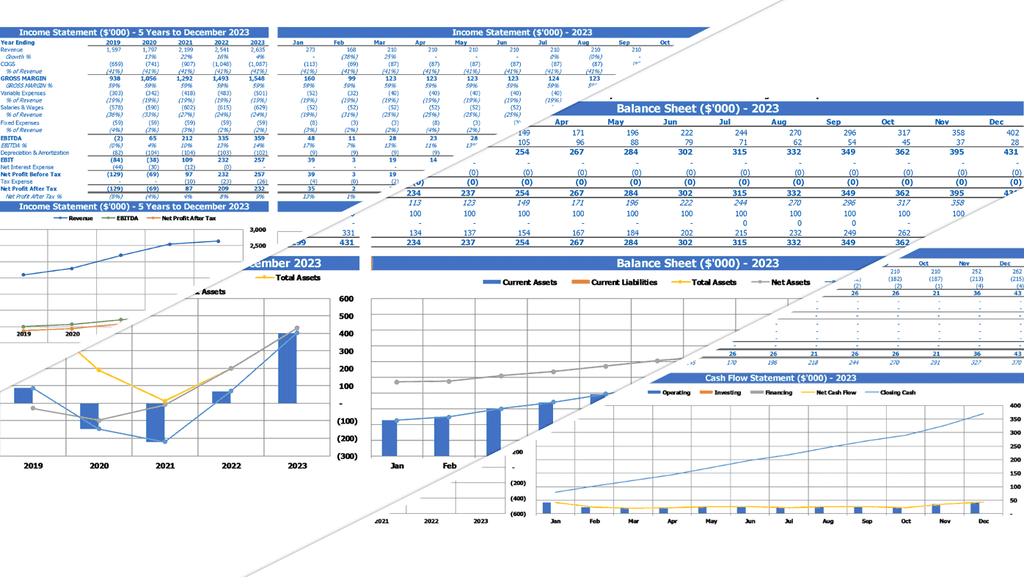

Monthly Profit And Loss Template Excel

A thorough casino feasibility study relies on financial projections and a market research report in order to analyze the hospitality industry and the cost of goods sold. By conducting a break-even analysis and factoring in casino hotel occupancy, capital expenditures, operating expenses, and debt service coverage ratio, you can calculate the return on investment, net present value, internal rate of return, and cash flow statement. This financial model template for business plan will help to inform decision making and provide confidence in your company's position.

Projected Balance Sheet For 5 Years In Excel Format

The casino hotel's projected balance sheet template showcases its assets, liabilities, and capital at a specific date, including any owned properties or equipment. This financial statement is crucial for securing loans from financial institutions, as it helps establish the level of risk involved. The template is often prepared as part of a broader financial projections plan, which may include a hotel feasibility study, casino resort revenue analysis, a break-even analysis, and more. Key financial metrics, such as the debt service coverage ratio, return on investment, net present value, and internal rate of return, can be derived from this and the cash flow statement.

Casino Hotel Income Statement Valuation

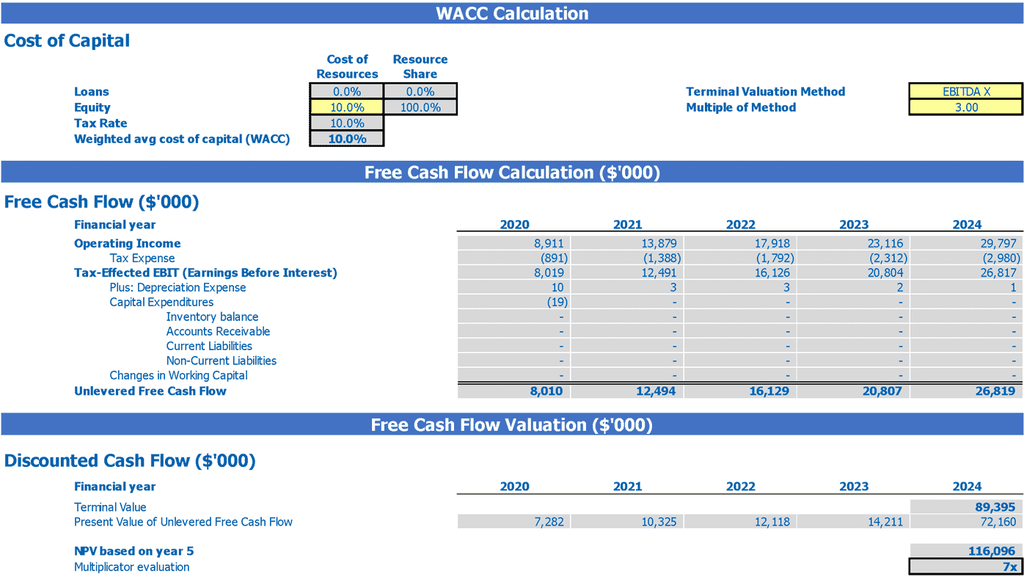

Seed Stage Valuation

The hotel feasibility study involves analyzing market research reports, financial projections, and conducting hospitality industry analysis to determine the potential return on investment. Key metrics include break-even analysis, net present value, internal rate of return, and debt service coverage ratio. Assessments of casino resort revenue, cost of goods sold, operating expenses, capital expenditures, and cash flow statements help determine the feasibility of the project. Casino hotel occupancy is also a significant factor in determining profitability. Ultimately, the goal is to generate accurate financial projections using established valuation methods to determine the potential of the project.

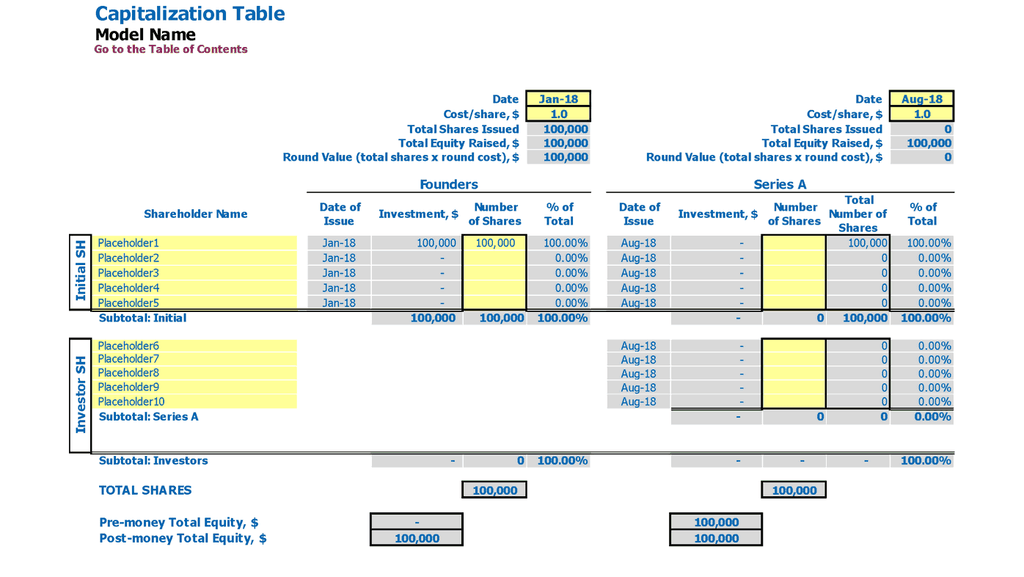

Equity Cap Table

Our comprehensive hospitality industry analysis includes market research reports, financial projections, and break-even analysis, as well as cost of goods sold and operating expenses. Our casino resort revenue projections, casino hotel occupancy rates, and debt service coverage ratio calculations provide a clear view of return on investment and internal rate of return. Our capital expenditure and cash flow statement analysis, when combined with net present value computation, help investors make informed decisions. We prioritize professional engagement and accuracy when creating customized feasibility study templates Excel or cap table templates for startups.

Casino Hotel Financial Planning Model Key Features

Manage surplus cash

Financial forecasting tools help managers plan for cash surplus and reinvest in opportunities or repay debts in the hospitality industry.

Confidence in the future

Our financial projections model in Excel helps you anticipate costs, cash flow, and ROI for your hospitality business.

Predict the Influence of Upcoming Changes

Conduct a thorough hospitality industry analysis to determine feasibility and financial projections for a casino resort.

Better decision making

Create Excel cash flow templates to improve decision-making; forecast variants will give you confidence to choose between staffing and equipment investment.

Get it Right the First Time

Discover the benefits and drawbacks of using a casino hotel financial plan template, including financial projections and market research reports.

Casino Hotel 3 Way Financial Model Template Advantages

Maximize profitability with a comprehensive financial plan template that includes market research, break-even analysis, and ROI projections.

Maximize your business potential with our comprehensive casino hotel business plan template xls, including financial projections and market research analysis.

Create financial projections to estimate cash flow, return on investment, and debt service coverage ratio for a casino resort based on market research and hospitality industry analysis.

Maximize ROI using a comprehensive financial model including market research, feasibility study, and financial projections.

Maximize ROI and manage cash flow with thorough financial projections and analysis in a hotel feasibility study.