ALL IN ONE MEGA PACK INCLUDES:

Coal Mining Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Coal Mining Startup Budget Info

Highlights

Our coal mining financial projection model is designed specifically for startups and entrepreneurs seeking to secure funding and plan their business operations. Our model includes a five-year revenue projection, a cash flow forecast, and a profitability analysis tailored specifically to the coal mining industry. In addition, our model offers a risk assessment, cost management, investment evaluation, capital budgeting, debt management, and equity financing components for comprehensive financial planning. Our financial reporting capabilities ensure full transparency to investors and stakeholders, while our tax planning feature allows for optimized tax liabilities. Our model is fully customizable and unlocked, allowing for easy editing and adaptability to changing market conditions. Use our coal mining financial model excel spreadsheet to secure funding from banks, angels, grants, and VC funds.

The coal mining industry model is designed to help coal mining businesses manage and reduce financial risk. With its comprehensive financial analysis, it provides projection of coal mining revenue, cash flow forecast, profitability analysis, asset valuation, risk assessment, cost management, investment evaluation, capital budgeting, financial planning, debt management, equity financing, tax planning and financial reporting. The template allows businesses to plan for the future and make informed decisions based on accurate financial information. Designed by finance experts, the coal mining financial forecast template is easy to use and requires no technical skills to operate.

Description

The coal mining financial pro forma template is a comprehensive Excel model that allows businesses to perform financial planning and analysis for coal mining services. It features three financial statements, including a projected profit and loss statement template, a projected balance sheet template, and a cash flow budget template excel, enabling users to forecast revenue and expenses for up to 60 months. Moreover, this model offers various financial analysis tools, such as sales analysis, feasibility matrices, and diagnostic tools. It also provides options for financing, including equity funding from investors. With its user-friendly interface, this model is suitable for businesses of all sizes and backgrounds.Coal Mining Financial Plan Reports

All in One Place

Looking to analyze the financials of a coal mining industry model? Our comprehensive tools include revenue projection, cash flow forecast, profitability analysis, asset valuation, risk assessment, cost management, investment evaluation, capital budgeting, financial planning, debt management, equity financing, tax planning, and financial reporting. Our intuitive and user-friendly Excel template is both expandable and versatile to meet your business needs. Customize your sheets easily and efficiently with our powerful financial projections spreadsheet. Get started today!

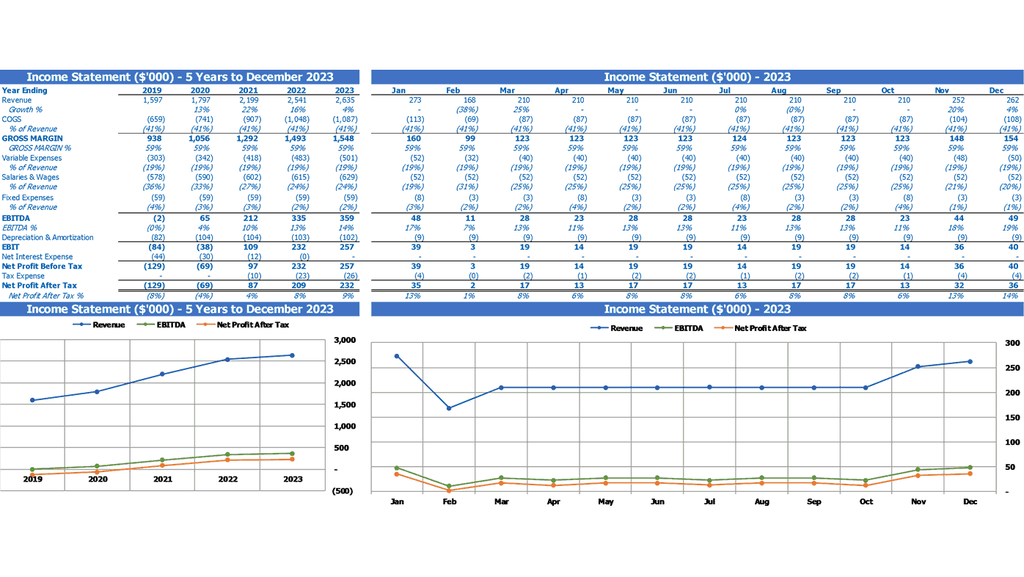

Dashboard

This coal mining industry model incorporates a range of financial analyses and planning tools, including cash flow forecasting, revenue projections, asset valuation, profitability analysis, cost management, and risk assessment. It also includes capital budgeting, investment evaluation, debt management, equity financing, tax planning, and financial reporting. By using this financial model template excel, you can track KPIs, manage expenses, monitor sales, and optimize profits to meet and exceed your financial goals. Share an intuitive dashboard with stakeholders to provide an overview of your three-statement financial model.

Excel Financial Reporting

Our coal mining financial analysis model offers a comprehensive approach to evaluating the profitability and sustainability of coal mining operations. It includes revenue projections, cash flow forecasts, asset valuations, risk assessments, and investment evaluations. Our model also incorporates cost management, capital budgeting, financial planning, debt management, equity financing, tax planning, and financial reporting. With this model, coal mining companies can assess the impact of various factors and make informed decisions to optimize their operations and maximize their financial returns.

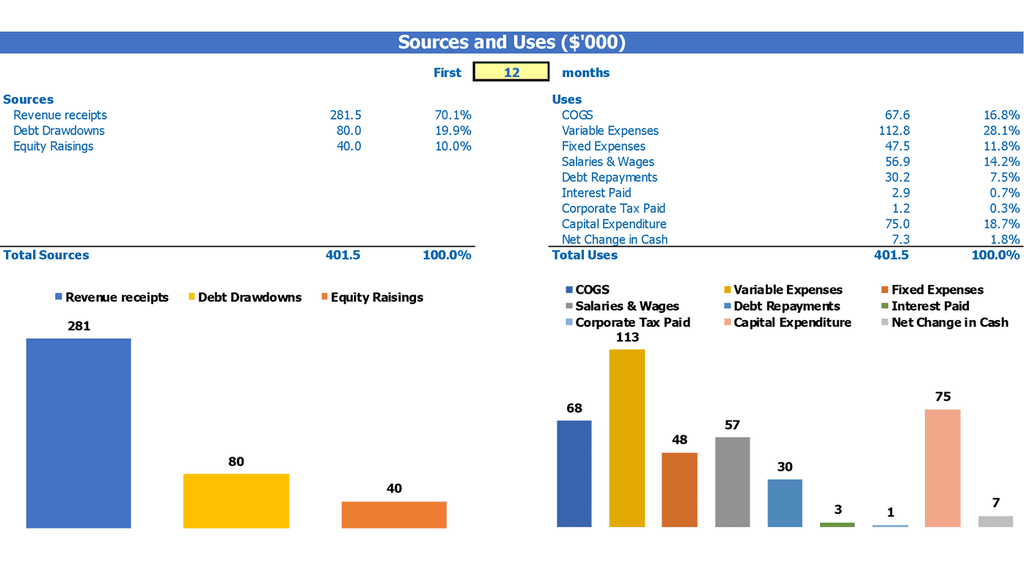

Sources And Uses Chart

The financial plan for our coal mining industry model ensures efficient management of funds by covering financial reporting, cost management, and tax planning. We also evaluate the profitability of our coal mining assets using revenue projections, cash flow forecasts, and risk assessments. Our investment evaluation strategy incorporates capital budgeting, debt management, and equity financing to maximize returns. Our financial planning tab provides a comprehensive overview of the sources and uses of capital, allowing users to analyze our funding structure.

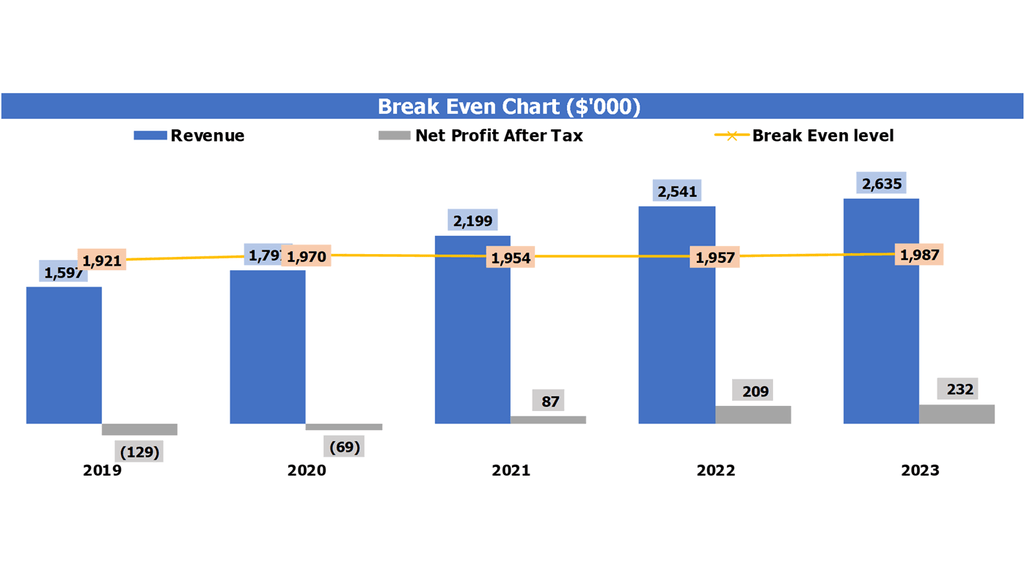

Break Even Point In Dollars

Utilizing financial analysis, the coal mining industry model will determine projected revenue, cash flow and asset valuation for profitability and risk assessment. Coal mining cost management coupled with investment evaluation, capital budgeting and financial planning ensures optimal debt management and equity financing. Tax planning and financial reporting, aided by a break even chart, calculate the sales prices and unit sales necessary to cover total costs for maximum profitability. To achieve financial success in coal mining, a comprehensive financial analysis and planning approach is essential.

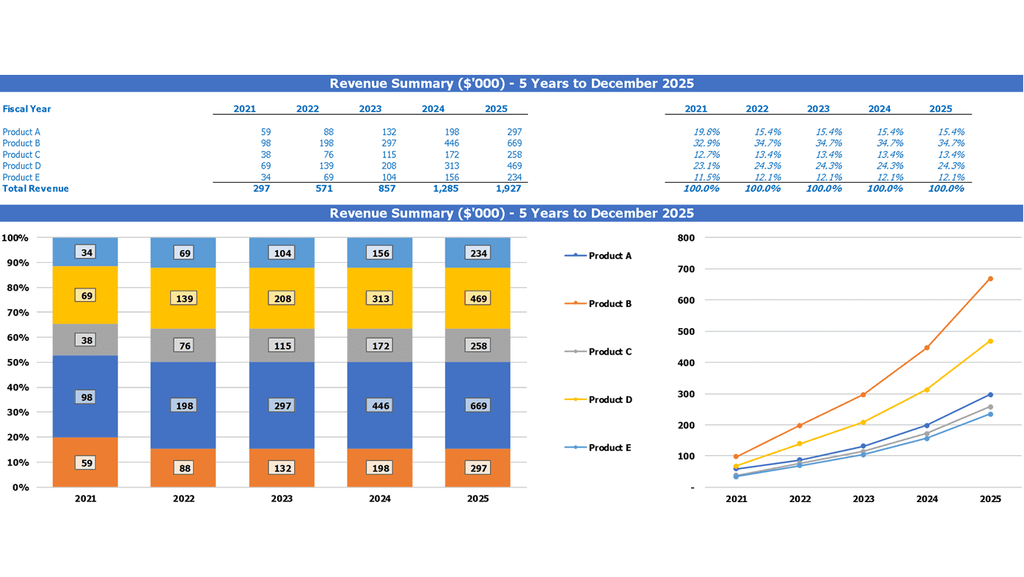

Top Revenue

Analyzing the financial aspects of the coal mining industry is crucial for successful business operations. Our team specializes in financial planning, risk assessment, investment evaluation, and debt management. With our expertise in coal mining asset valuation, cost management, and profitability analysis, we provide valuable insights to forecast your revenue streams and cash flow, allowing for effective capital budgeting and equity financing. Our tax planning and financial reporting services ensure compliant and efficient operations. Let us help you organize and present financial information, making informed decisions for your coal mining business.

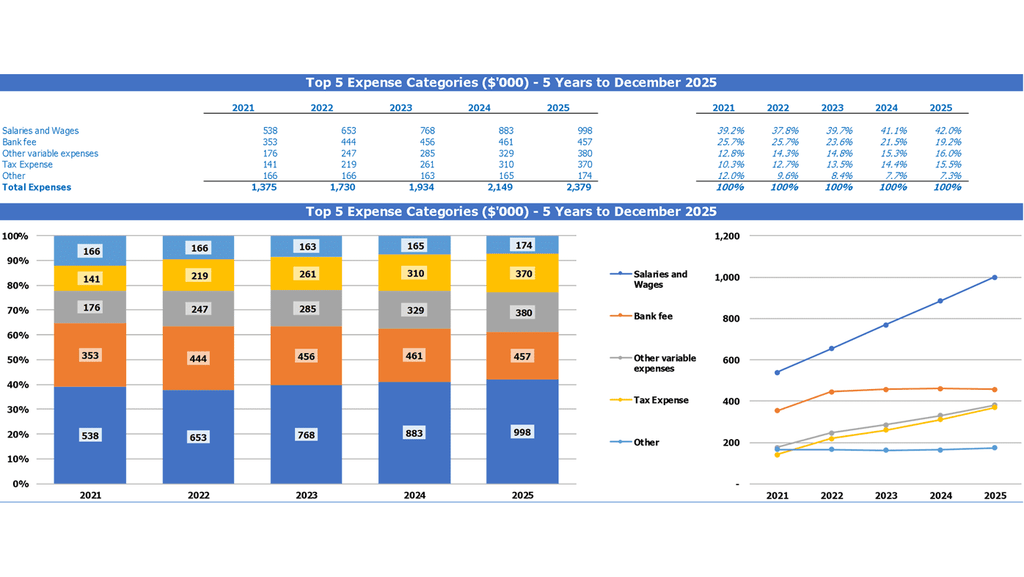

Business Top Expense Categories

Analyze the financial health of your coal mining industry model with comprehensive tools like a coal mining revenue projection, cash flow forecast, and profitability analysis. Evaluate asset valuation, risk assessment, investment evaluation, capital budgeting, debt management, equity financing, tax planning, and financial reporting to optimize your coal mining cost management. To make informed decisions for the future, generate a summary cost report using expense reports to track expenses by category and organize at tax time. Use this data to implement a rational financial projection model template and analyze development scenarios for profitable coal mining financial planning.

Coal Mining Financial Projection Expenses

Costs

Our coal mining financial model excel templates provide essential data for financial analysis, including projections on revenue, cash flow, profitability, asset valuation, risk assessment, and cost management. Our models also include tools for investment evaluation, capital budgeting, financial planning, debt management, equity financing, tax planning, and financial reporting. Our startup cost analysis provides crucial data to prevent underfunding or excessive cost increases. Our interactive proforma allows users to regulate expenses and create spending plans, giving them a clear picture of their financial situation.

Start Up Expenses

A coal mining industry model requires a thorough financial analysis to predict future revenue and cash flow. This involves coal mining revenue projection, cash flow forecast, profitability analysis, asset valuation, risk assessment, cost management, investment evaluation, and capital budgeting. Additionally, coal mining financial planning, debt management, equity financing, tax planning, and financial reporting must be considered. To effectively manage CAPEX spending, a table reflecting expenses on purchases that capitalize on the projected balance sheet is necessary. Such expenses are considered as investments and are not reflected directly in the profit loss statement.

Loan opt-in

Our comprehensive financial model for the coal mining industry offers a range of analysis tools including revenue projections, cash flow forecasts, asset valuation, risk assessment, cost management, capital budgeting, financial planning, debt management, equity financing, tax planning, and financial reporting. Using our state-of-the-art pro forma template, you can easily track and analyze your loans with a user-friendly loan amortization schedule that is pre-built with formulas to calculate interest and equity. This will enable you to make informed decisions about your coal mining investments and maximize your profitability.

Coal Mining Income Statement Metrics

Performance KPIs

The coal mining industry model requires a comprehensive financial analysis to evaluate profitability, expenses, and asset valuation. This includes revenue projection, cash flow forecast, and risk assessment to determine investment opportunities. Additionally, cost management, tax planning, debt and equity financing, and financial reporting are crucial for a successful coal mining business. Capital budgeting and financial planning should also be considered with payback periods in mind, allowing for the opportunity to weigh expenses against revenues generated by new clients when making investment decisions.

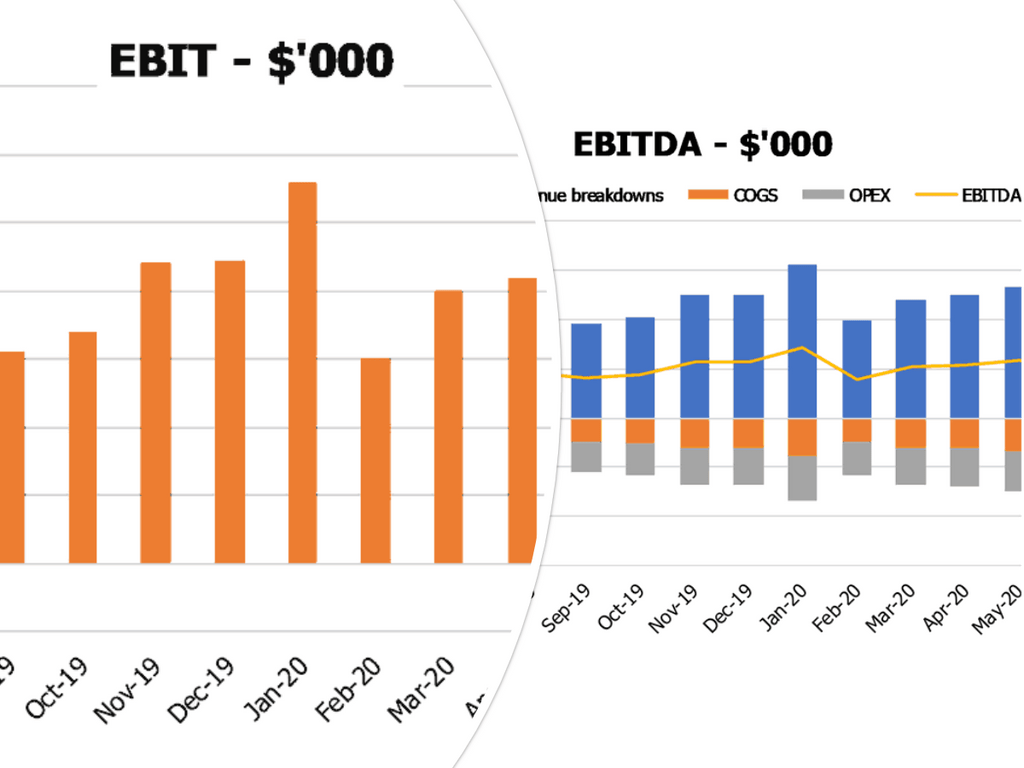

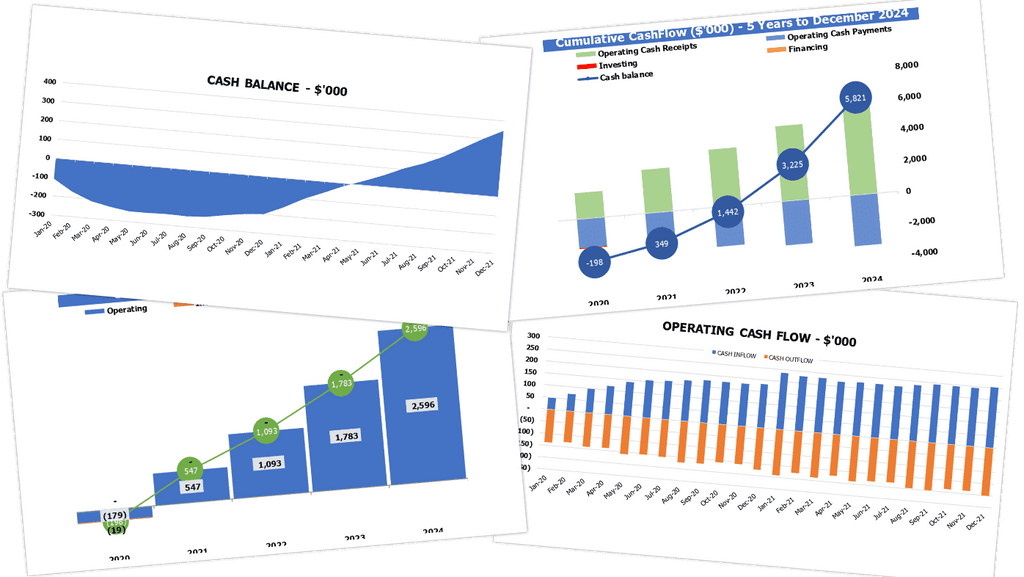

Cash Flow Chart Excel

In the coal mining industry model, financial analysis plays a vital role in predicting revenue, cash flow, and profitability. Along with asset valuation and risk assessment, cost management, capital budgeting, and investment evaluation play a significant part. Financial planning, debt and equity financing, tax planning, and financial reporting are equally essential. The projected cash flow statement presents cash inflows and outflows more comprehensively than the monthly profit and loss template. This integrated financial model provides a cash flow forecast for the next 12 months to five years, making it an invaluable tool for startups.

KPI Benchmarking Report

Utilize our comprehensive coal mining industry model for financial analysis, including revenue projections, cash flow forecasts, profitability analyses, asset valuations, risk assessments, cost management, and investment and capital budgeting evaluations. We also provide financial planning, debt management, equity financing, tax planning, and financial reporting to ensure the success of your coal mining business. Our financial benchmarking study tab allows for easy comparative analysis with other industry leaders, enabling you to identify areas for improvement and drive your business towards higher profitability. Trust our model to help you achieve lasting financial success in the coal mining industry.

Projected Income Statement

Financial analysis of the coal mining industry relies on a series of tools and models to determine profitability, risk, and valuation. From revenue projection to cash flow forecasting and cost management, each step is critical to an accurate investment evaluation. Pro forma profit and loss statements and budgeting play a significant role in financial planning, while debt management, equity financing, and tax planning contribute to appraisal. Accurate financial reporting is essential to assess a company's standing and bolster its reputation. With a comprehensive approach, investors can feel confident in their decisions and prepare for success.

Projected Balance Sheet For Startup Business

Our comprehensive coal mining industry model offers financial analysis, including revenue projection, cash flow forecast, profitability analysis, asset valuation, risk assessment, cost management, investment evaluation, capital budgeting, financial planning, debt management, equity financing, tax planning, and financial reporting. Additionally, our Monthly and Yearly balance sheet template excel is integrated with other essential inputs like profit and loss forecast, culminating in an all-inclusive pro forma projection. This provides a comprehensive snapshot of your Assets, Liabilities, and Equity Accounts, providing you with valuable insights to guide your business plan.

Coal Mining Income Statement Valuation

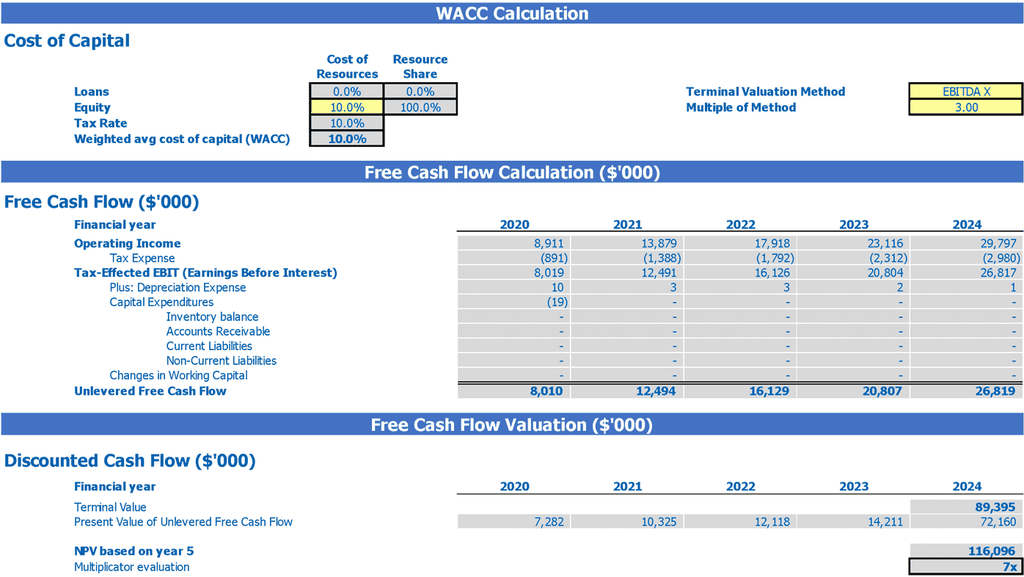

Startup Valuation Calculator Excel

The financial plan for a coal mining startup encompasses crucial components like revenue projection, cash flow forecast, profitability, risk assessment, cost management, and investment evaluation. Furthermore, the plan incorporates a comprehensive valuation analysis tab, enabling discounted cash flow valuation, residual value, replacement costs, and more. The plan's financial reporting, debt management, equity financing, and tax planning are also pivotal for long-term success. Coal mining capital budgeting and financial planning define the profitability and sustainability of the business. The plan's accurate financials and metrics ensure informed, strategic decision-making that helps achieve business objectives.

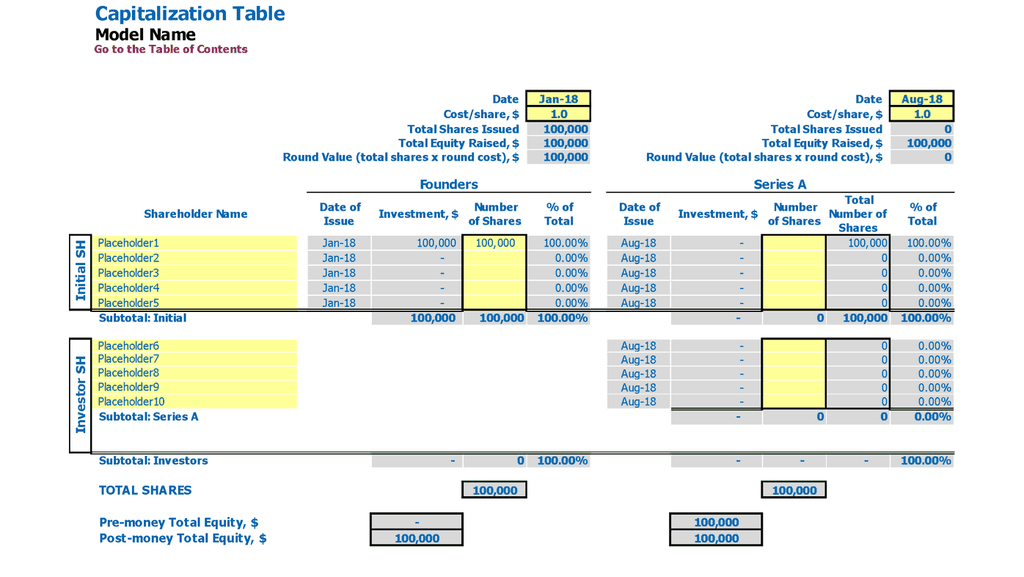

Pro Forma Cap Table

Assessing financial viability is crucial in the coal mining industry model. Financial analysis is essential, with the need for accurate coal mining revenue projections, cash flow forecasts, and profitability analysis. Asset valuation and risk assessment are also critical. Cost management, investment evaluation, capital budgeting, financial planning, debt management, equity financing, tax planning, and financial reporting are essential components of this arduous process. Furthermore, a precise understanding of cap tables is necessary for start-ups, providing insightful details about ownership stakes and investor expenses to help make informed decisions about equity issuances.

Coal Mining Financial Model Business Plan Key Features

Simple-to-use

Efficient coal mining financial projections for all business sizes, with minimal planning experience and Excel knowledge required.

Identify cash gaps and surpluses before they happen

Financial analysis of the coal mining industry includes revenue projection, profitability, risk assessment, cost management, and investment evaluation.

Spot problems with customer payments

Analyze coal mining profitability, risk, and asset valuation with financial planning, budgeting, and reporting techniques.

All necessary reports

Our Excel template includes all necessary financial reports and calculations for coal mining industry analysis.

Currency for inputs and denomination

Customize income statement template in excel with preferred currency and denomination to reflect your financial preferences.

Coal Mining Financial Modeling For Startups Advantages

Choose from 161 currencies for settlements, ensuring comprehensive financial analysis of coal mining industry model.

Efficiently manage coal mining finances with a comprehensive 5-year projection tool that simplifies assumption input.

The financial projection model template incorporates 161 currencies for inputs and outputs, providing a comprehensive tool for coal mining industry financial analysis.

A comprehensive financial model for coal mining industry aids in better decision-making.

Optimize coal mining startup financial decisions with our pro forma template.