ALL IN ONE MEGA PACK INCLUDES:

Convenience Store Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Convenience Store Startup Budget Info

Highlights

Maximize your convenience store financial management with our comprehensive suite of tools. Our state-of-the-art platform generates a 5-year convenience store business plan template xls, a cash flow analysis template, and a financial dashboard complete with core metrics in GAAP/IFRS formats automatically. Use our convenience store financial forecasting tools to carry out a convenience store financial analysis and create a profitability model, a revenue model, and a break-even analysis. Our convenience store financial planning software also helps you to create financial projections, an income statement, and a balance sheet. With our financial ratios and financial statement analysis features, you can monitor your convenience store financial performance to make data-driven decisions. Use our platform to create a rock-solid convenience store financial strategy, get funded by banks or investors, and unlock the power of financial planning.

This convenience store Excel financial plan startup is designed to optimize your financial management by providing comprehensive tools for analyzing your convenience store's financial performance. With features such as convenience store revenue models, financial analysis, break-even analysis, cash flow analysis, financial planning, financial projections, income statements, balance sheets, financial ratios, financial management, financial forecasting, financial performance, financial metrics, and financial statement analysis, this tool has everything you need to make informed financial decisions. Additionally, the valuation table included in this plan will provide you with an estimation of your store's future equity value, making it an attractive investment opportunity for lenders and investors. Furthermore, the financial model guides you in calculating initial startup costs and making a five-year forecast to better understand your customers and build a customer acquisition strategy to convert visitors into recurring customers.

Description

Our convenience store financial analysis provides an in-depth view into the financial performance of your business. Through our expert financial management and forecasting, we have developed a comprehensive set of financial metrics and ratios to assess the profitability and cash flow of your store. With our detailed convenience store income statement and balance sheet analysis, you can track your revenue model and break even analysis, while identifying areas for potential improvement. Our convenience store financial projections and planning model enable you to visualize the future potential of your business, and to make informed decisions around resource allocation, investing and debt service coverage. Whether you are a small or medium-sized business looking to grow, our financial statement analysis services can help you achieve your goals.Convenience Store Financial Plan Reports

All in One Place

Our convenience store financial analysis tool incorporates important financial models such as revenue, break even, and cash flow analysis. It also includes financial planning and projections, income and balance sheets, and ratios for effective financial management. With our tool, users can monitor financial performance through metrics and statement analysis, enabling them to make informed decisions for their business. These elements are consolidated within an easy-to-use template, providing a holistic understanding of the convenience store's financial health to help drive growth and profitability.

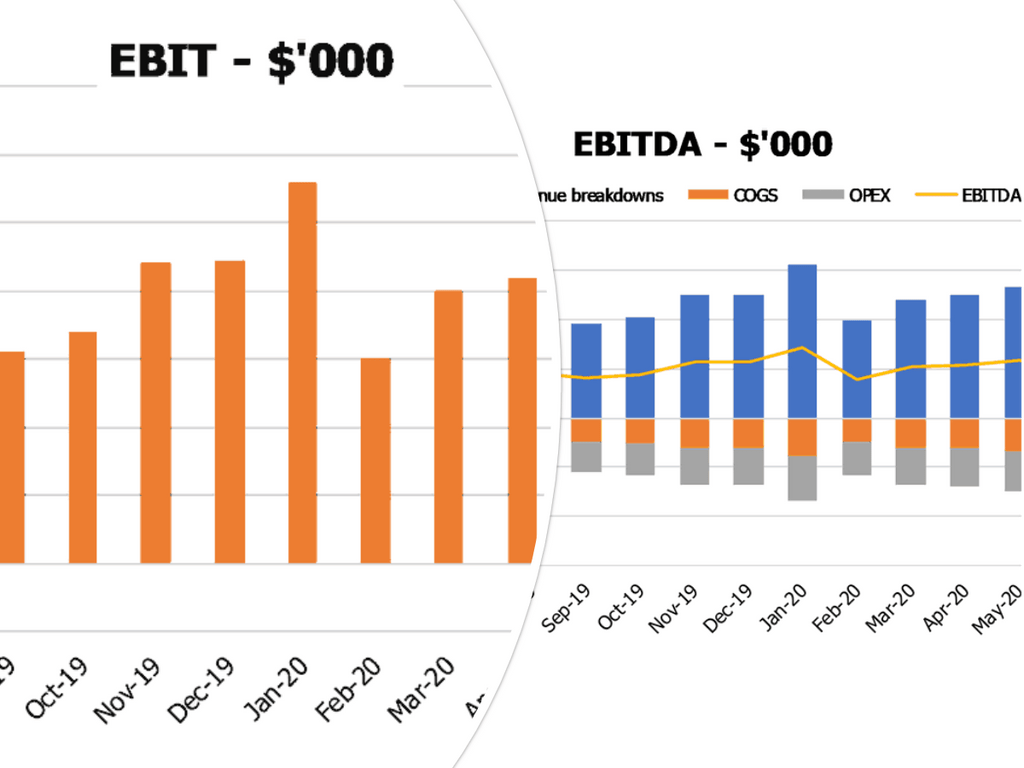

Dashboard

Our comprehensive financial analysis tool for convenience stores includes a user-friendly dashboard with integrated cash flow, balance sheet and chart templates. Our users can prepare monthly and annual financial statement breakdowns, as well as access figures and charts to obtain the information needed for accurate financial planning, forecasting, and performance monitoring. Our convenience store financial management solution also includes financial ratios, income and cash flow statements, and balance sheet analysis for more in-depth insight into your business's financial health.

Company Financial Statement

Our comprehensive financial analysis for convenience store owners includes break-even analysis, cash flow analysis, and financial statement analysis to measure profitability and performance. Our financial planning and forecasting models offer accurate financial projections and performance metrics, allowing business owners to stay on top of their finances and make informed decisions. Through our financial management services, convenience store owners can effectively communicate financial data to stakeholders and investors, showcasing their revenue, income statements, balance sheets, and financial ratios in easy-to-understand graphs and charts.

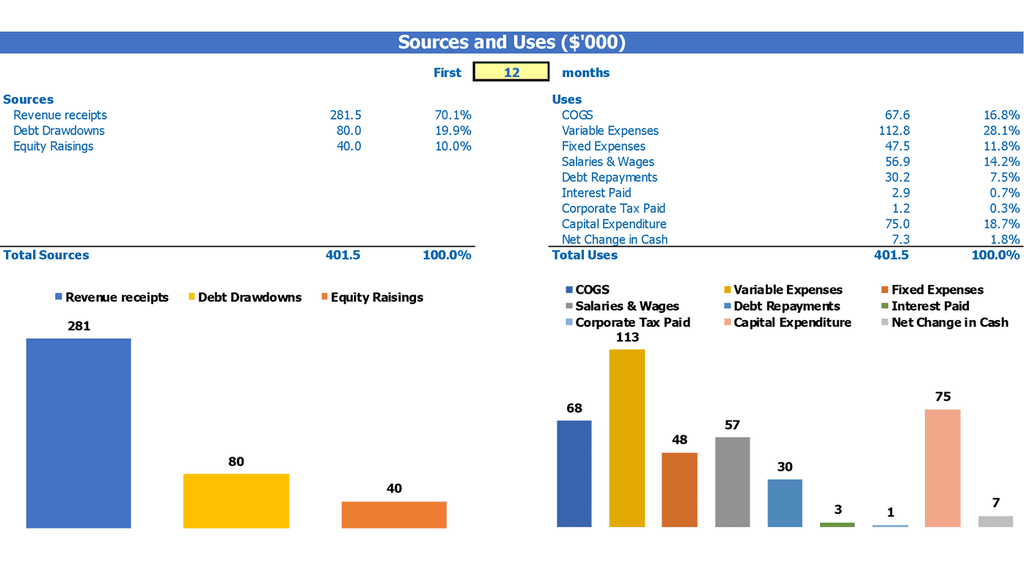

Sources And Uses Of Funds

When analyzing a convenience store's financial performance, it is crucial to use various financial tools such as cash flow analysis, financial planning, income statement, balance sheet, financial ratios, and statement analysis. The profitability model, revenue model, and break-even analysis help to determine the store's financial health. Moreover, financial projections, financial metrics, and forecasting offer insights into the store's future. The sources and uses statement of funds also gives a clear understanding of the company's financing sources and spending policies, such as business loans, investors' money, share issue, and others.

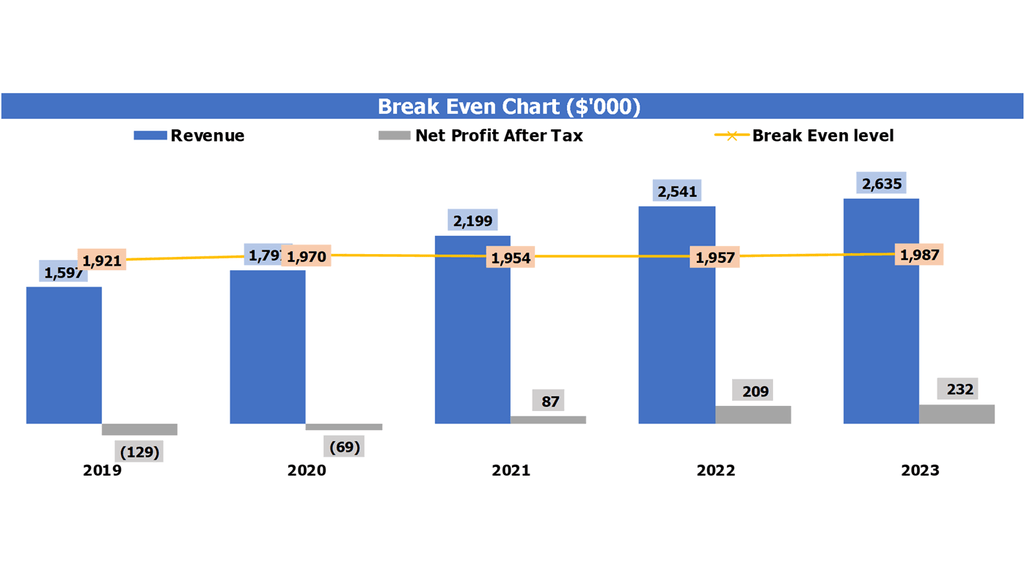

Break Even In Unit Sales

The convenience store financial analysis includes various tools such as break even analysis, cash flow analysis, financial forecasting and financial statement analysis. By utilizing these tools, you can better understand your convenience store financial performance and use financial metrics to inform financial management decisions. With a clear understanding of your convenience store revenue model and financial projections outlined in the income statement and balance sheet, you can effectively plan for profitability and use financial ratios to track success over time. Effective financial management is key for achieving profitability in your convenience store business.

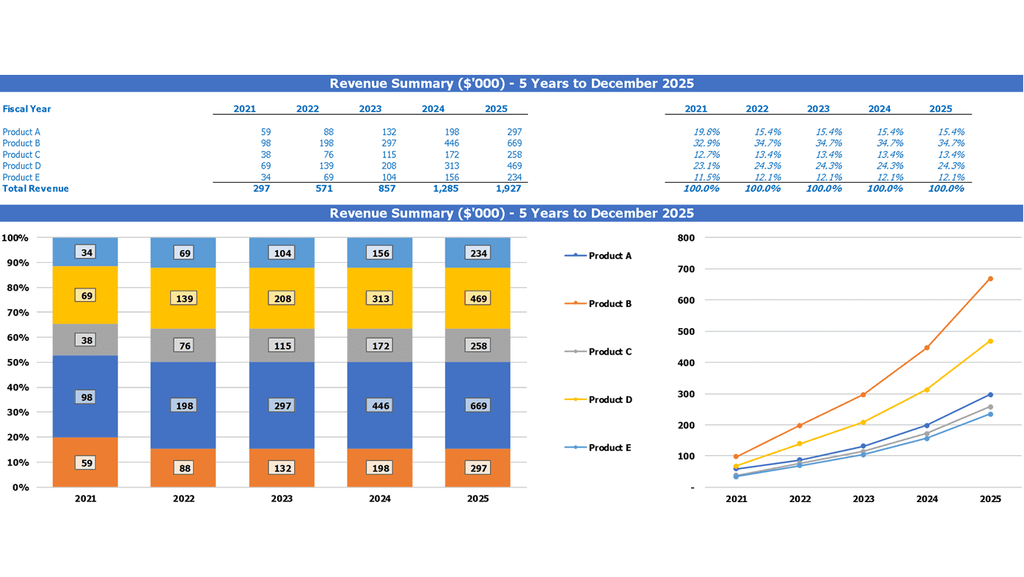

Top Revenue

In order to ensure the success of your convenience store, it's important to conduct a thorough financial analysis. This includes developing a revenue model and conducting a break even analysis to determine profitability. Cash flow analysis and financial planning are crucial components of any successful business plan, as are financial projections and income statements. Utilizing financial ratios and performance metrics can help measure the effectiveness of your financial management. Ultimately, conducting regular financial statement analysis is key to ensuring the health and sustainability of your business.

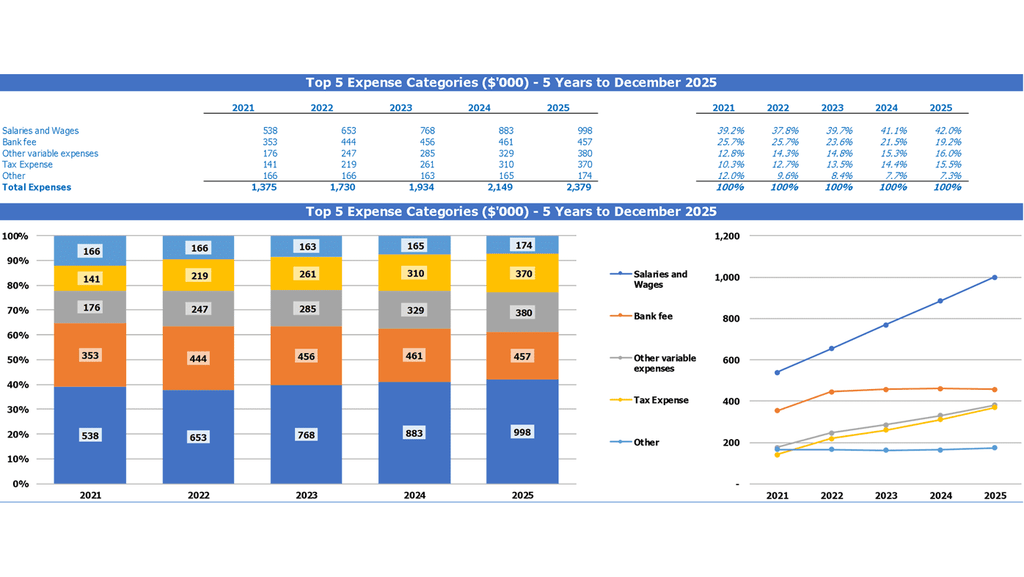

Business Top Expenses List

For convenience store financial management, it is crucial to understand the convenience store revenue model as well as analyze financial statements such as the convenience store income statement and balance sheet. Utilizing tools such as convenience store financial forecasting and financial ratios can aid in developing a profitability model and financial projections. Conducting a convenience store break even analysis and cash flow analysis can also provide a comprehensive overview of financial performance. By keeping track of convenience store financial metrics, conducting financial planning, and using financial statement analysis, convenience store owners can manage spending and improve profitability.

Convenience Store Financial Projection Expenses

Costs

A crucial aspect of running a successful convenience store is effective financial management. This involves analyzing the profitability model, conducting break-even and cash flow analyses, and preparing financial projections and income statements. A well-crafted cost budget helps identify expenses and prioritizes areas to save money. The financial statement analysis, including balance sheets, financial ratios, and metrics, further enhances financial planning and forecasting. Ultimately, using financial modeling excel templates equips convenience store owners with a comprehensive understanding of the business's financial performance, critical for securing investors and loans.

Development Costs

Convenience store financial management is crucial for ensuring profitability and long-term success. Key elements include conducting a convenience store financial analysis that covers break-even analysis, cash flow analysis, and financial projections. Operating expenses, including startup expenses, should be considered as investments that can grow the business. Convenience store financial planning should also include income statements, balance sheets, and financial ratios to measure performance. By using financial metrics and analysis tools like the 5-year forecast template, convenience store owners can develop a strong convenience store revenue model and make informed decisions to improve financial performance.

Debt Financing

Convenience stores need financial planning to ensure profitability. A successful financial model should include a revenue model, financial analysis, performance metrics, break-even analysis, cash flow analysis, and financial forecasting. A comprehensive financial projection template like Excel can help stores monitor loan repayments, cash flow, and p&l template. A well-curated model can give strategic insights to growing companies observing changes in their financial ratios, helping them make informed decisions to scale up their businesses. Ultimately, successful financial management and forecasting lead to profitability, sustainability, and long-term success.

Convenience Store Financial Statements Metrics

Performance KPIs

Analyzing the financial statements of a convenience store is crucial in determining its profitability and sustainability. Financial planning, projections, and performance can be evaluated using metrics such as revenue model, cash flow analysis, and financial ratios. A break-even analysis can be conducted to determine the minimum sales required to cover the store's fixed and variable costs. The income statement and balance sheet can provide insight into the store's financial management, while a financial statement analysis can be conducted to assess its overall financial health. Return on assets is a key financial metric that measures the store's earnings against the assets invested.

Cash Flow Analysis Excel

When developing a 5-year projection plan for a convenience store, cash flow analysis is crucial. The process involves creating a linked and iterative balance sheet and income statement to determine the projected cash inflow and outflow. The projected balance sheet and non-cash income statement items will drive the figures on the final excel spreadsheet cash flow. Understanding financial metrics, ratios, and performance will help with conveniences store financial planning and management, ensuring a profitable revenue model and break-even analysis. The ultimate goal is to maximize convenience store profitability and financial success.

Industry Benchmarks

Our Excel model features a comprehensive three-statement approach for analyzing the financial performance of convenience stores, including income statement, balance sheet, and cash flow analysis. We also offer financial planning and forecasting tools like break-even analysis and financial projections, with ratios and metrics to help with financial management. Our industry benchmark analysis provides meaningful insights and allows for comparison with other businesses in the same sector for optimized profitability and revenue growth.

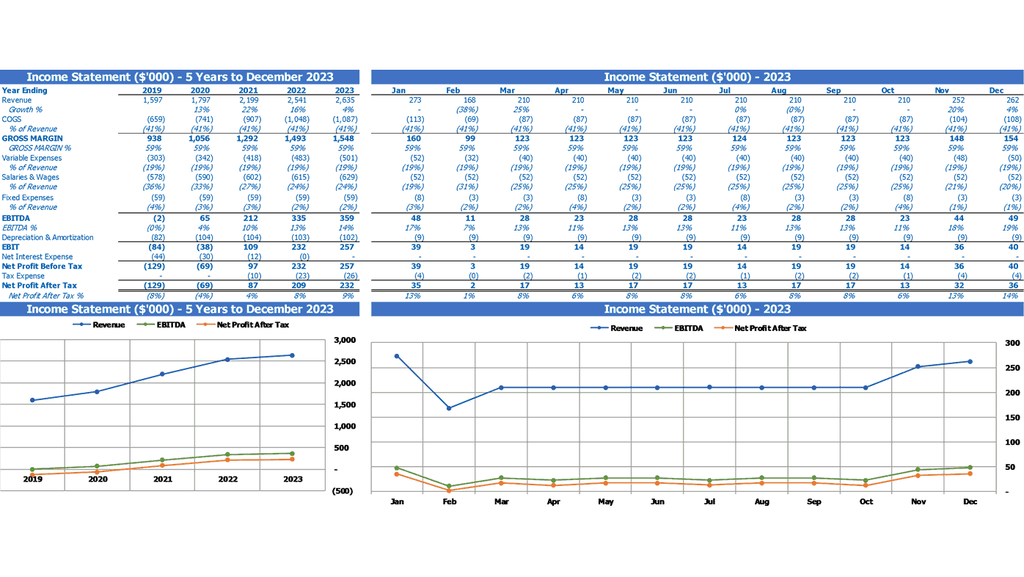

Monthly Profit And Loss Template Excel

Financial management for a convenience store requires a range of tools such as cash flow analysis, income statements, balance sheets, and financial ratios. By using these financial statements, the convenience store profit and loss can be projected, forecasting future financial performance. Calculating the net income margin using a five-year cash flow projection template in Excel is key to effective financial planning. Using a pro forma profit and loss statement is crucial to understanding where money is being spent and managing expenses over time. By keeping financial metrics under control, you can maintain and improve your convenience store's financial performance.

Projected Balance Sheet For 5 Years In Excel Format

Conducting a convenience store financial analysis entails using various tools including a convenience store revenue model, break even analysis, cash flow analysis, income statement and balance sheet, as well as financial projections, forecasting, management, and performance metrics. A fundamental aspect of this analysis is the pro forma balance sheet, which offers insights into the organization's financial status for a specific period. Our balance sheet forecast provides an excellent avenue to assess your convenience store's financial position and make strategic decisions accordingly.

Convenience Store Financial Statements Valuation

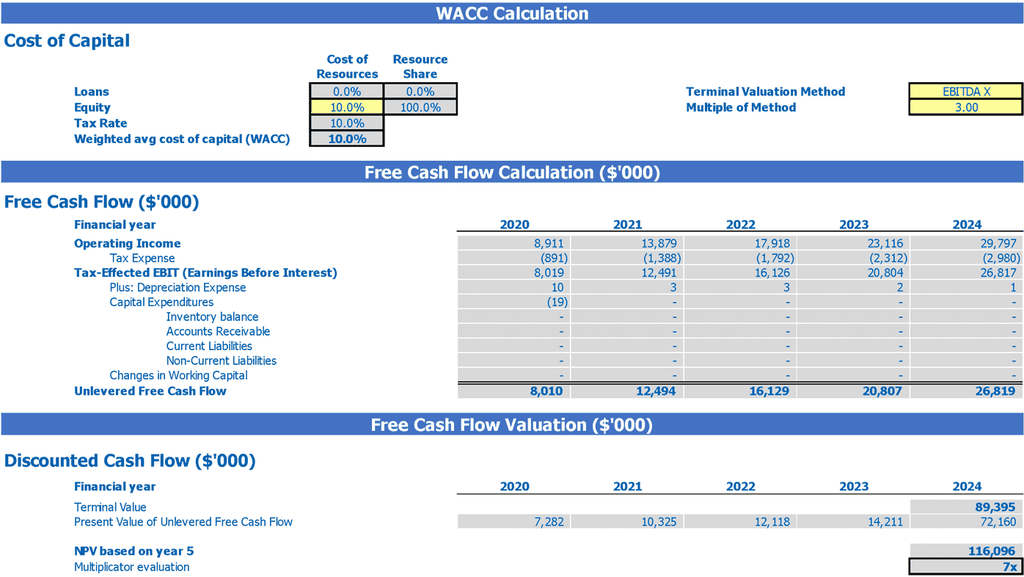

Startup Valuation Template

Maximize your convenience store's financial performance with a comprehensive financial analysis. Implement a strategic convenience store revenue model, break even analysis, cash flow analysis, financial planning, forecasting, and projections to ensure profitability. Utilize financial management tools such as balance sheets, income statements, financial ratios, and statement analysis to identify opportunities for growth and expansion. Our startup financial model template excel free includes a valuation analysis that simplifies Discounted Cash Flow analysis (DCF), residual value analysis, replacement costs, and market comparables. Improve your convenience store's financial metrics and achieve financial success today.

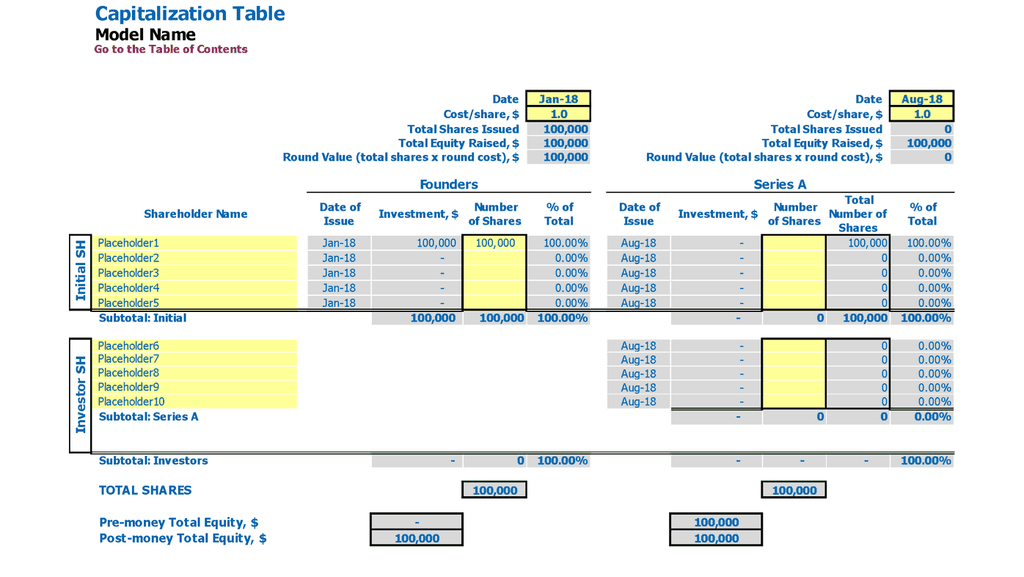

Pro Forma Cap Table

Conducting a comprehensive financial analysis is crucial to managing the convenience store's financial performance. The store's revenue, profitability, and cash flow can be analyzed using various financial planning tools, including break even analysis, income statements, balance sheets, financial ratios, and cash flow analysis. By using financial projections and metrics, convenience store financial management can make informed decisions. A financial statement analysis enables the store to assess its financial strength, identify areas for improvement and set goals to achieve optimum financial performance.

Convenience Store Business Financial Model Template Key Features

Currency for inputs and denomination

Customize the 3-way financial model template with your preferred currency and denomination to analyze convenience store financial performance.

Saves you time

Maximize your convenience store profitability with our efficient cash flow statement format and focus on business development.

Save time and money

"Maximize convenience store profits with our financial analysis tools and expertise."

Consistent formatting

Organized tabs and formatting aid in revising and testing convenience store financial models.

Build your plan and pitch for funding

Utilize a comprehensive convenience store financial analysis to improve profitability and financial performance.

Convenience Store Financial Plan For Startup Advantages

A well-crafted budget financial model can optimize convenience store profitability and financial performance.

Pro forma projection simplifies assumption entry for comprehensive convenience store financial analysis.

Efficiently analyze convenience store financial statements with our comprehensive tools and techniques.

Utilize our comprehensive financial model template for your convenience store's financial planning and analysis.

Record your convenience store's financial performance using various financial analysis tools.