ALL IN ONE MEGA PACK INCLUDES:

Crowdfunding Marketplace Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Crowdfunding Marketplace Startup Budget Info

Highlights

Our team offers a comprehensive and effective 5-year financial projection model for crowdfunding platforms in both equity and debt crowdfunding. We can help you create a sound financial plan, including financial statements and ratios, in GAAP or IFRS formats. Our crowdfunding business plan template allows you to evaluate your startup idea and plan your costs with ease. We unlock all features so you can edit and customize the model to fit your specific needs. We also provide peer-to-peer lending financial models and crowdfunding return on investment analysis, as well as risk assessment and funding models. Our expertise in crowdfunding marketing strategy enables us to deliver a detailed revenue model and stream analysis that can help you grow and expand your business. Let us help you maximize your crowdfunding profitability today.

The crowdfunding platform financial model is an essential tool for businesses seeking to raise capital through crowdfunding. It provides comprehensive projections on the financial performance and viability of a crowdfunding campaign. The equity crowdfunding financial plan, debt crowdfunding financial projections, and crowdfunding investment model are critical in identifying the funding model that suits your business. A crowdfunding business plan includes a profitability analysis, risk assessment, and revenue streams to aid in achieving a positive return on investment. The peer-to-peer lending financial model is useful in forecasting revenue, profitability, and risk that align with your crowdfunding marketing strategy. Finally, a crowdfunding valuation model and crowdfunding ROI analysis are crucial in attracting potential investors and making informed decisions about crowdfunding funding models.

Description

Our crowdfunding platform financial model is the ultimate tool for entrepreneurs and investors looking to make informed financial decisions. With accurate analysis and reporting, our model offers a complete picture of your crowdfunding venture's financial health. Whether you're interested in equity crowdfunding, debt crowdfunding, or peer-to-peer lending, our financial plan template contains all the necessary tools to establish crucial financial statements and projections. From cash flow projections to profit and loss forecasts, our model will provide you with the key metrics you need to make sound investment decisions. Additionally, our model enables you to forecast your revenue model, calculate risk assessments, and establish a marketing strategy that will set your venture apart from the competition. So why wait? Let us help you build a profitable crowdfunding venture today!Crowdfunding Marketplace Financial Plan Reports

All in One Place

Crowdfunding platforms require a well-designed financial model that incorporates elements such as revenue streams, funding models, return on investment, risk assessment, financial projections, and valuation to optimize profitability. A solid crowdfunding business plan should include a comprehensive marketing strategy that accounts for potential revenue sources and the costs associated with each. Peer-to-peer lending models should focus on risk management and analysis, while equity or debt crowdfunding should prioritize financial planning and projections to attract investors. Ultimately, a successful crowdfunding campaign requires a holistic approach that considers all financial aspects of the business.

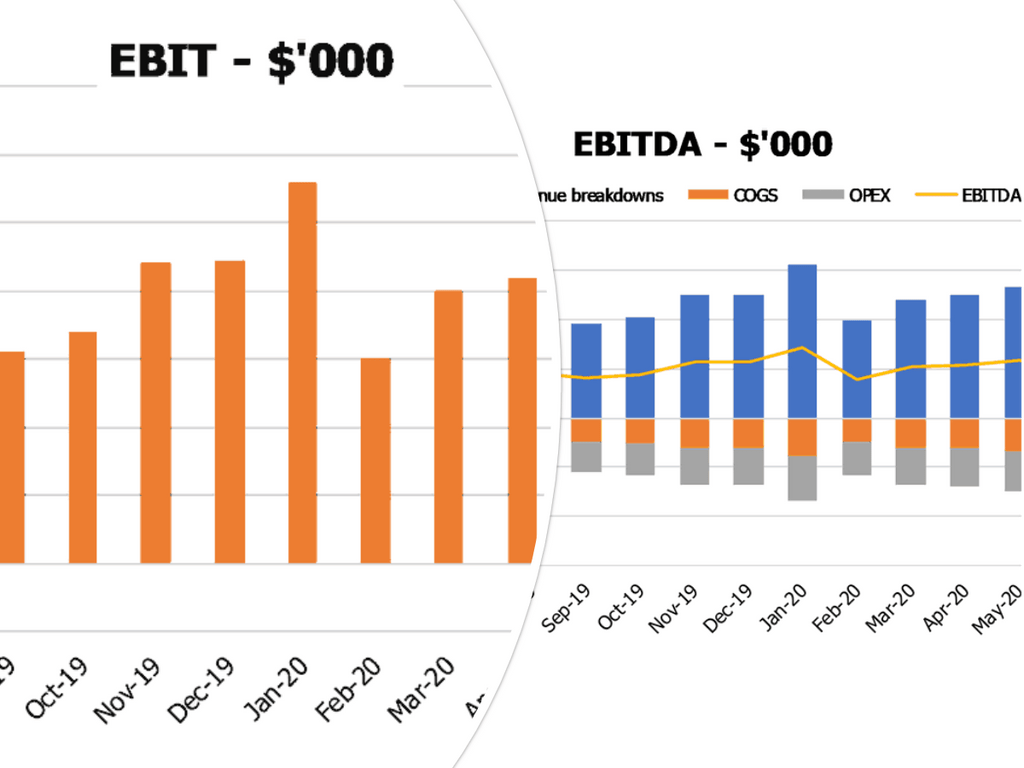

Dashboard

Our crowdfunding platform provides a comprehensive financial plan with detailed projections, ROI analysis, risk assessment, and revenue streams. We offer an equity or debt crowdfunding investment model, along with a peer-to-peer lending financial model. Our crowdfunding business plan includes a funding model, marketing strategy, and a valuation model. Our business plan Excel template also includes a customizable dashboard that consolidates all financial information and calculates key performance indicators (KPIs) automatically, helping you make informed decisions. Choose the time period and customize the dashboard as you like it, for a month-by-month or year-on-year basis.

Company Financial Report

Our crowdfunding platform offers a comprehensive financial model that includes equity and debt crowdfunding financial plans, financial projections, investment models, business plans, profitability analysis, peer-to-peer lending financial models, risk assessments, funding models, marketing strategies, revenue streams, valuation models, ROI analysis and return on investment calculations. Our tools provide entrepreneurs with the necessary financial statements, graphs, and charts to effectively communicate their financial results to stakeholders and potential investors. We help businesses achieve their fundraising goals and achieve financial success.

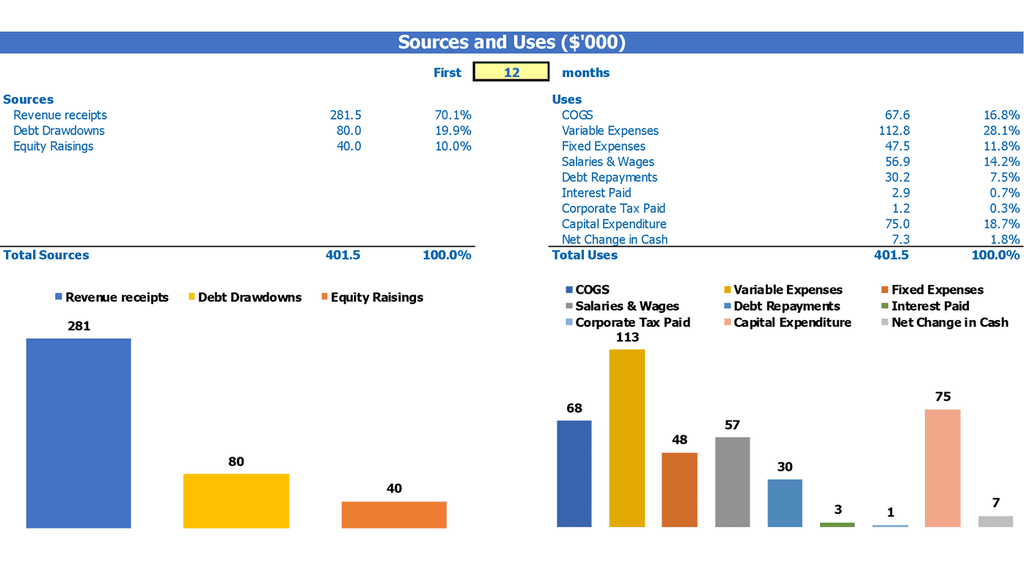

Sources And Uses Statement

Crowdfunding can be a successful way to raise capital for a business venture. It is important to have a solid crowdfunding business plan with a crowdfunding investment model, crowdfunding marketing strategy, and crowdfunding funding model. In addition, financial projections such as a crowdfunding revenue model, crowdfunding profitability analysis, crowdfunding return on investment, and crowdfunding risk assessment are crucial. A peer-to-peer lending financial model can also be considered. The crowdfunding financial plan should include funding sources and uses, profit and loss projections, and crowdfunding valuation model. All these elements contribute to an effective crowdfunding platform.

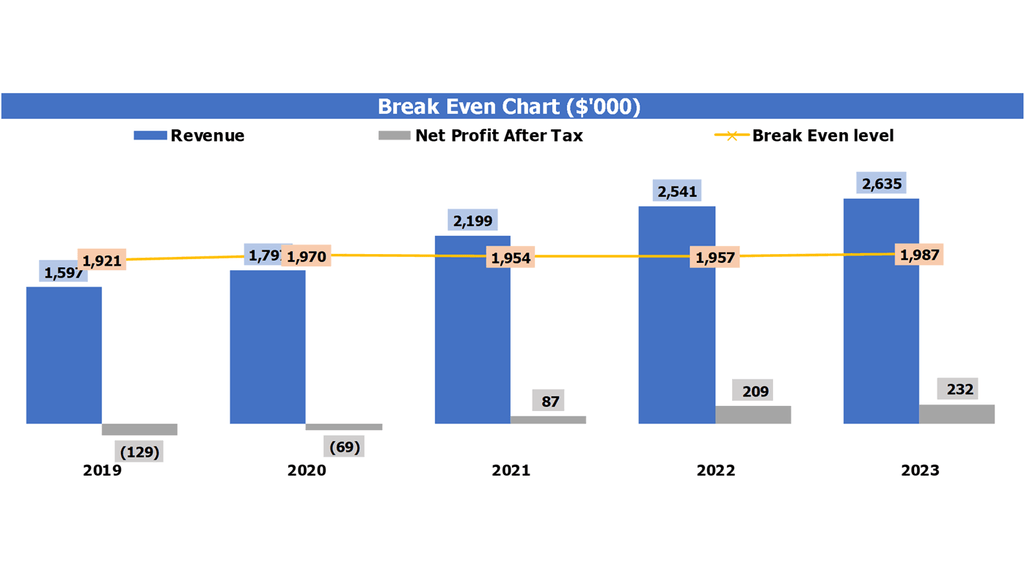

Break Even Chart

Create a comprehensive crowdfunding business plan with our financial models and projections. Our crowdfunding investment model includes a detailed financial plan, revenue model, profitability analysis, peer-to-peer lending financial model, and risk assessment. With our help, you can create a crowdfunding marketing strategy that will generate multiple revenue streams and maximize your crowdfunding return on investment. Our crowdfunding funding model is designed to help you obtain the funding you need while providing investors with accurate crowdfunding ROI analysis. Use our crowdfunding valuation model to assess the value of your business and create a successful crowdfunding campaign.

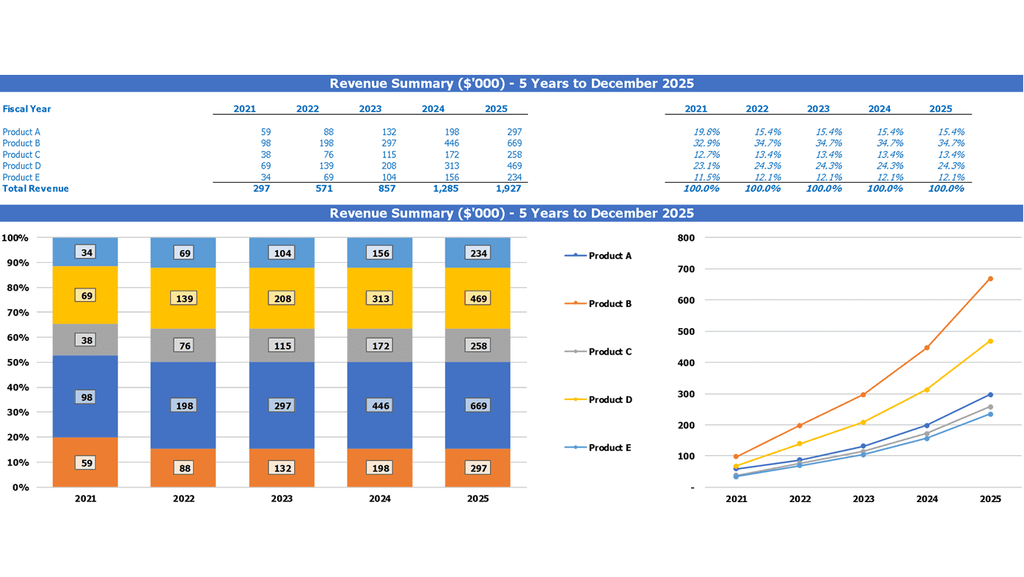

Top Revenue

A comprehensive crowdfunding business plan should include financial models, projections, funding and investment models, ROI analysis, risk assessment, marketing strategies, revenue streams, and valuation models. Analyzing the revenue potential and financial attractiveness of different scenarios is crucial for profitable crowdfunding. The pro forma Excel template can help you identify revenue trends and anticipate demand levels for your crowdfunding platform. By using this report, you can plan your resources accordingly to maximize your return on investment and minimize risk.

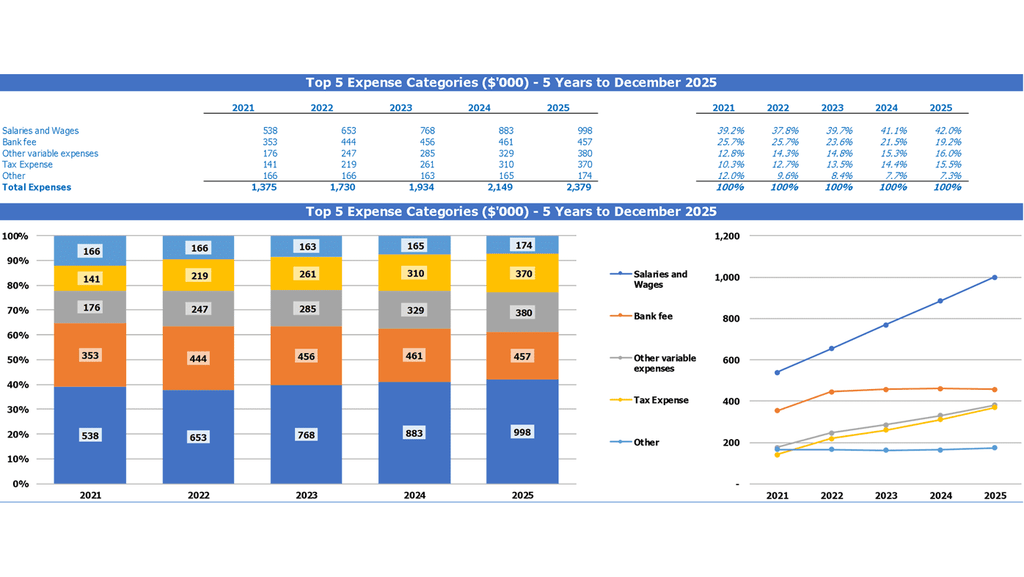

Company Top Expenses List

Our financial plan includes a comprehensive crowdfunding revenue model that analyzes revenue streams and incorporates a crowdfunding investment model, crowdfunding ROI analysis, and crowdfunding valuation model. Our crowdfunding platform also includes a crowdfunding marketing strategy and crowdfunding funding model. Additionally, our platform offers a crowdfunding profitability analysis and crowdfunding risk assessment to help businesses make informed decisions. We also provide an equity crowdfunding financial plan and debt crowdfunding financial projections to help businesses manage costs, track trends, and achieve financial success.

Crowdfunding Marketplace Financial Projection Expenses

Costs

Early stage costs can make or break a crowdfunding campaign. For success, monitoring these costs is essential; sufficient funding and controlled expenses are key. Our crowdfunding business plan includes a financial model with proforma templates to help you create expense plans that ensure profitability and enable investment in the future of your business. With our expertise, you'll be able to assess and optimize crowdfunding roi analysis, risk assessment, and the entire funding model. Start with our crowdfunding platform, and seize the opportunities offered by peer-to-peer lending, financial projections, ROI analysis, and more.

CAPEX Budget

When creating a crowdfunding business plan, financial models like the equity crowdfunding financial plan and debt crowdfunding financial projections are crucial. It's also essential to consider crowdfunding revenue streams, funding models, and revenue models to determine profitability and ROI analysis accurately. Furthermore, marketing strategies and risk assessments must be in place, alongside the crowdfunding investment model and crowdfunding valuation model. This will help distinguish capital expenditures from other things like financial statements and depreciation, leading to a better understanding of the long-term prospects for your business. Use the financial plan template excel for accurate capital cost analysis.

Debt Repayment Schedule

Start-ups and growing companies must carefully track their loan repayment schedules to ensure financial stability. This schedule provides a detailed breakdown of each loan's amount, maturity terms, and other relevant information. It's a crucial component of cash flow analysis, impacting interest expenses, balance sheets, and cash flow projections. Maintaining a solid repayment schedule is key to achieving a positive crowdfunding return on investment, as well as providing an accurate representation of a company's financial health. Effective crowdfunding marketing strategies can enhance a business plan and maximize crowdfunding revenue streams for future growth.

Crowdfunding Marketplace Income Statement Metrics

Financial KPIs

A crowdfunding platform's financial model offers a comprehensive picture of a project's health, making it critical for investment decisions. It contains a crowdfunding investment model, revenue and valuation models, funding plans, and profit and ROI analyses. The spreadsheet is a must-have for any crowdfunding business plan, as it provides investors with relevant data concerning profitability, liquidity, and cash flow. Its revenue streams and marketing strategies make for a robust crowdfunding marketing strategy that can analyze a project's risk and success factors better. It contains both industry-specific and company-specific KPIs that offer an excellent basis for investment decisions.

Excel Spreadsheet Cash Flow

Our crowdfunding platform offers a variety of financial models and plans for investors and startups alike. Our equity and debt crowdfunding options include detailed financial projections and plans. Our crowdfunding investment model includes an analysis of return on investment, risk assessment, and funding options. We also offer marketing strategies to help promote your campaign and maximize revenue streams. Our valuation and profitability analysis provide in-depth insights into your campaign's financial health. Plus, we offer a cash flow projections template excel to monitor operating, investing, and financing cash flows on a monthly or annual basis.

KPI Benchmarking Report

A comprehensive financial plan is crucial for startups seeking crowdfunding investment. To accurately project revenue and profitability, companies should consider using an equity or debt crowdfunding financial model. Peer-to-peer lending and crowdfunding valuation models can also aid in decision-making. It's important to include a crowdfunding marketing strategy and analyze potential revenue streams before launching a campaign. Risk assessment and ROI analysis can also help inform investment decisions. Utilizing benchmarking tools can provide valuable insights and guide growth in the right direction. Don't neglect financial planning when seeking crowdfunding funding.

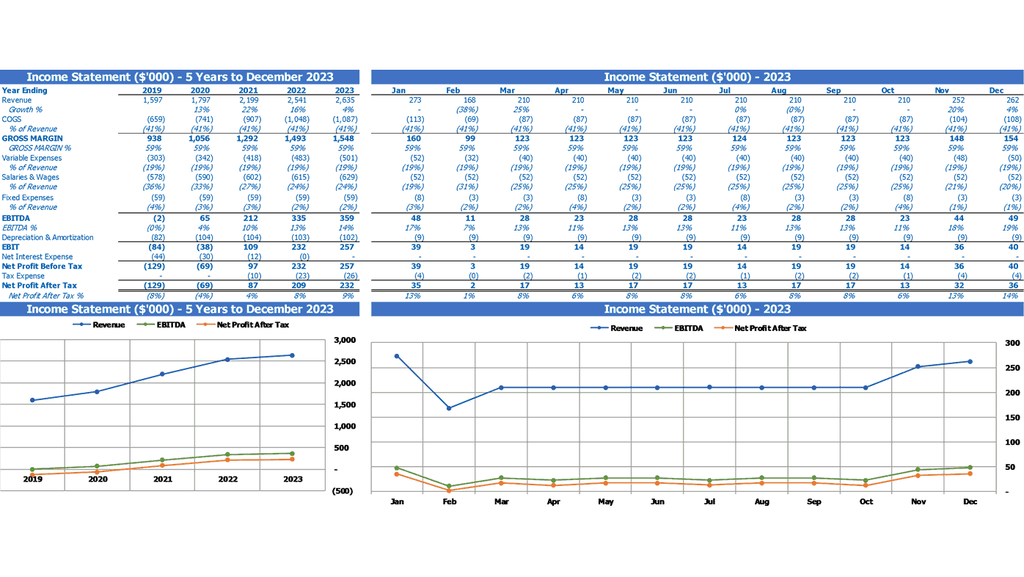

Profit And Loss Projection

Projected income statements, or profit and loss statements, are vital for demonstrating revenue streams and expense categories within a crowdfunding platform. These financial models are necessary for assessing profitability, income structure, and loan repayment capabilities for stakeholders. By utilizing financial projections, you can gauge the success of your crowdfunding business plan and potential ROI. Additionally, projected income statements provide valuable insights for evaluating your marketing strategy and risk assessment. With proper financial planning, your crowdfunding platform can successfully attract investors and generate substantial revenue streams.

Projected Balance Sheet For 5 Years In Excel Format

Creating a realistic financial plan is crucial for any crowdfunding business. The balance sheet, or financial position statement, provides a snapshot of assets, liabilities, and capital. Historical data is used to make assumptions and forecasts for the pro forma balance sheet, which is linked to the pro forma profit and loss statement. Working capital and capital expenditure assumptions are based on revenue projections. Reviewing each statement in conjunction with one another allows for a thorough analysis of the crowdfunding investment model. Proper risk assessment and a solid marketing strategy can improve crowdfunding profitability and ROI.

Crowdfunding Marketplace Income Statement Valuation

Pre Revenue Startup

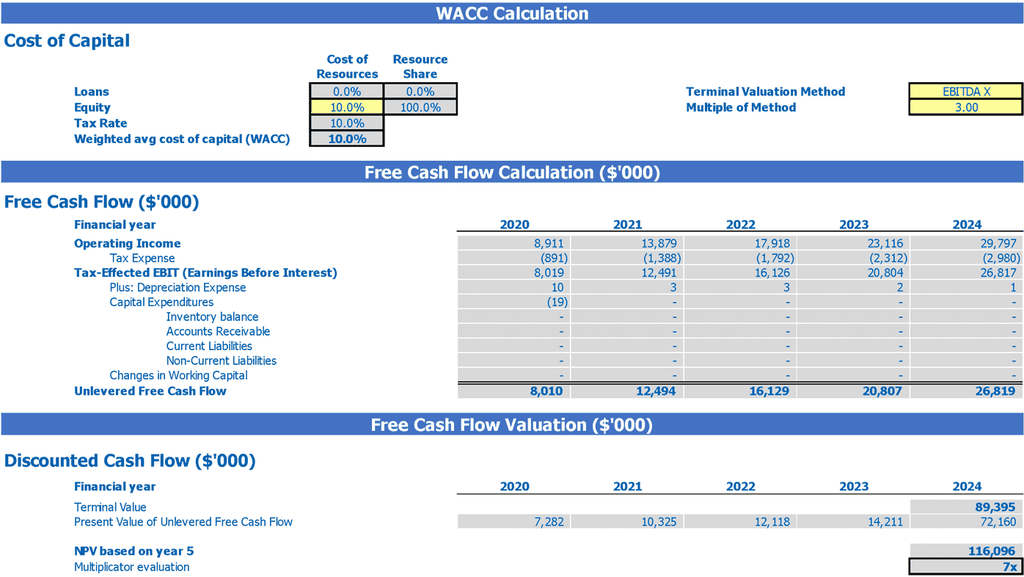

Our startup valuation template simplifies the process of calculating valuation, incorporating the Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC takes into consideration the cost of financing company capital from both equity and debt. It is used by banks to assess risk and determine minimum return on assets. DCF determines the present value of future cash flows, a prevalent method to measure ROI. The user-friendly template provides entrepreneurs with a streamlined solution to value their startup for equity crowdfunding, debt crowdfunding, and peer-to-peer lending.

Simple Cap Table

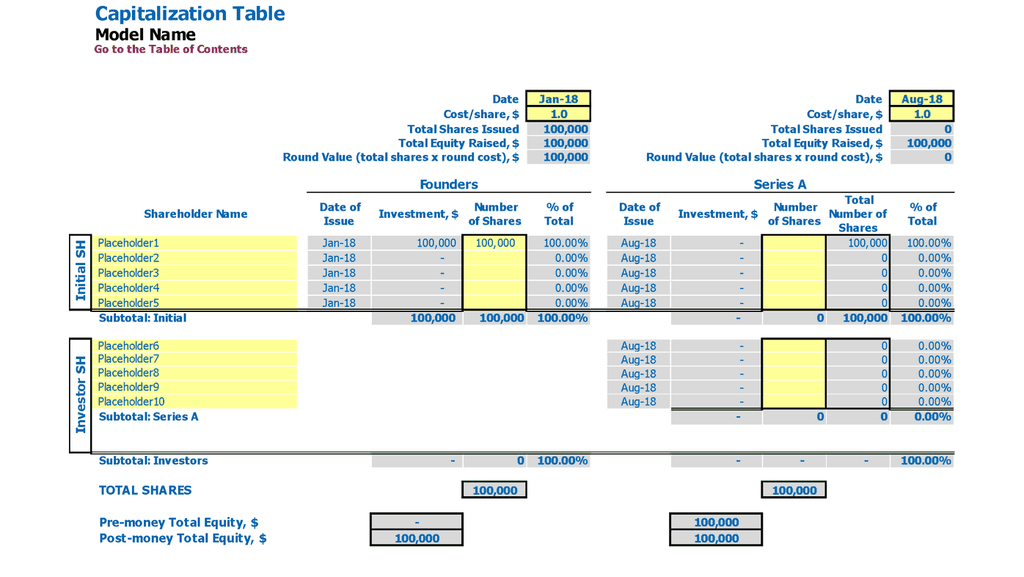

Having a well-structured cap table is crucial for startups looking to raise funds through crowdfunding platforms. Our crowdfunding financial plan incorporates a comprehensive cap table excel model that takes into account equity and debt crowdfunding financial projections, crowdfunding revenue streams, and crowdfunding return on investment. This model allows potential investors to assess the profitability and risk of the crowdfunding investment model, which is key for crowdfunding marketing strategy. By considering various financial aspects including crowdfunding valuation model and peer-to-peer lending financial model our crowdfunding funding model enables businesses to make the most informed financial decisions while working towards their crowdfunding business plan.

Crowdfunding Marketplace Financial Planning Model Key Features

Simple and Incredibly Practical

Achieve accurate financial projections with our user-friendly crowdfunding financial model template suitable for all business sizes and stages.

We do the math

Effortlessly create accurate financial projections with our user-friendly cash flow statement template.

Simple-to-use

Create a professional crowdfunding financial plan with ease using our user-friendly Excel model.

Manage surplus cash

A cash flow statement excel template can guide managers on what to do with surplus cash.

Avoid Cash Flow Shortfalls

Proactively using a cash flow forecasting template can prevent unexpected shortfalls and help plan for market fluctuations in crowdfunding.

Crowdfunding Marketplace Excel Financial Model Template Advantages

Impress investors with a comprehensive financial plan using our startup financial plan template.

Conduct thorough financial projections for your crowdfunding platform's profitability analysis.

Using a Crowdfunding Marketplace Financial Projection Excel can prevent miscommunications and ensure accurate financial forecasting.

Track and analyze business performance with a 3-year financial projection template on Excel.

Utilize crowdfunding financial projections to determine capital needs for your investment.