ALL IN ONE MEGA PACK INCLUDES:

Dropshipping Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Dropshipping Startup Budget Info

Highlights

A proven and sustainable dropshipping business model demands a sound financial plan for dropshipping. Business owners need to focus on diversified revenue streams, eCommerce dropshipping finances, dropshipping profit margins, cash flow management, inventory management, payment processing, sales forecasting, marketing budget, and expenses management. Effective dropshipping budgeting strategies and pricing strategies should be implemented while conducting dropshipping financial analysis. A well-planned financial roadmap helps in determining the return on investment and further aids entrepreneurs in attracting investors, securing loans from banks, and obtaining grants or VC funds for business growth.

The dropshipping business model has gained popularity in recent years, and proper financial planning is essential for success. Creating a financial plan for dropshipping should consider revenue streams, profit margins, budgeting strategies, cash flow management, pricing strategy, inventory and payment processing, sales forecasting, marketing budget, expenses, return on investment, and financial analysis. The dropshipping Excel financial model is a useful tool for this purpose, enabling users to evaluate profitability outcomes, plan annual incomes and investments, and assess employee salaries. The model also includes NPV and a projected cash flow statement for precise investment appraisal and determining the company's actual worth.

Description

The financial plan for dropshipping is a vital aspect of running an e-commerce dropshipping business model. It is important to consider different factors such as dropshipping revenue streams, dropshipping profit margins, budgeting strategies, inventory management, payment processing, cash flow management, sales forecasting, marketing budget, expenses, and return on investment. With dropshipping financial analysis, one can effectively determine the performance of the business and make informed decisions for growth and expansion. It is crucial to have a well-organized and detailed financial plan in place to ensure the success of your dropshipping business.

Dropshipping Model Reports

All in One Place

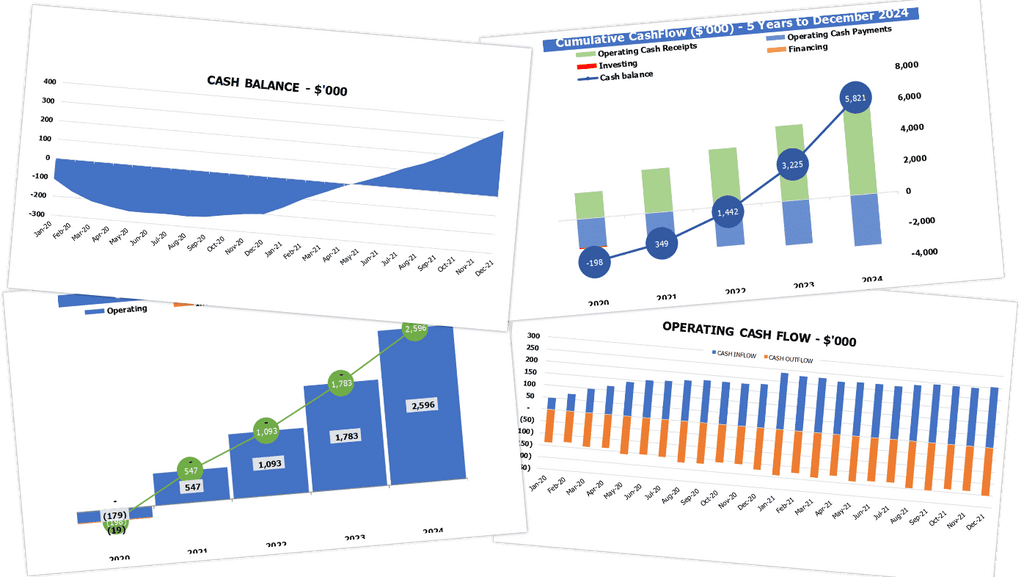

Our dropshipping financial plan utilizes a professional Excel spreadsheet to provide a clear view of your ecommerce dropshipping finances, including revenue streams, profit margins, budgeting strategies, cash flow management, pricing strategy, inventory management, payment processing, sales forecasting, marketing budgeting, expenses, return on investment, and financial analysis. This all-in-one tool helps you visualize the future financial impact of strategic decisions, with pro forma income statements, projected balance sheets, and five-year cash flow projections. The dashboard updates automatically to provide you all the essential KPIs for your startup business.

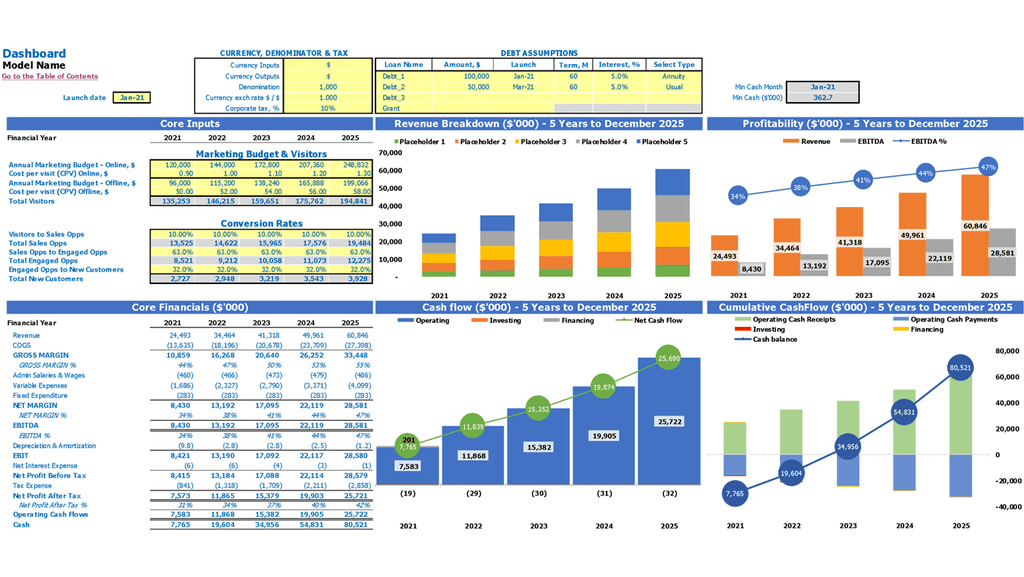

Dashboard

The financial projection tool includes a convenient Dashboard tab that presents a comprehensive snapshot of your dropshipping business finances, including charts, ratios, financial summaries, and more. This valuable information can be easily shared in a pitch deck to showcase your business's potential. Use the tool to track your dropshipping revenue streams and profit margins and develop effective budgeting strategies. Manage your cash flow and inventory, optimize your pricing and payment processing, and forecast your sales to make informed investment decisions. Analyze your dropshipping finances to achieve your desired ROI and maximize your profit potential.

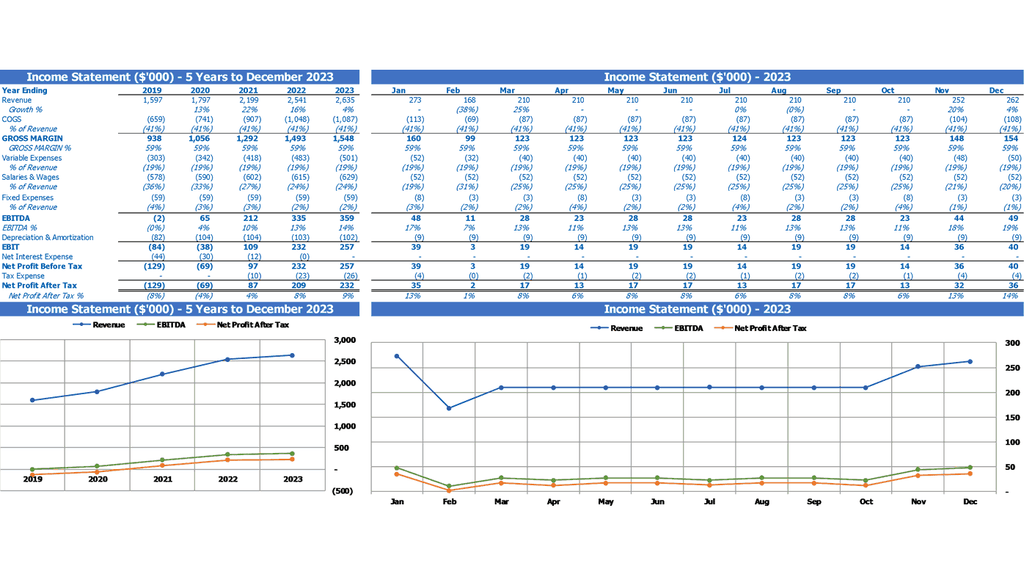

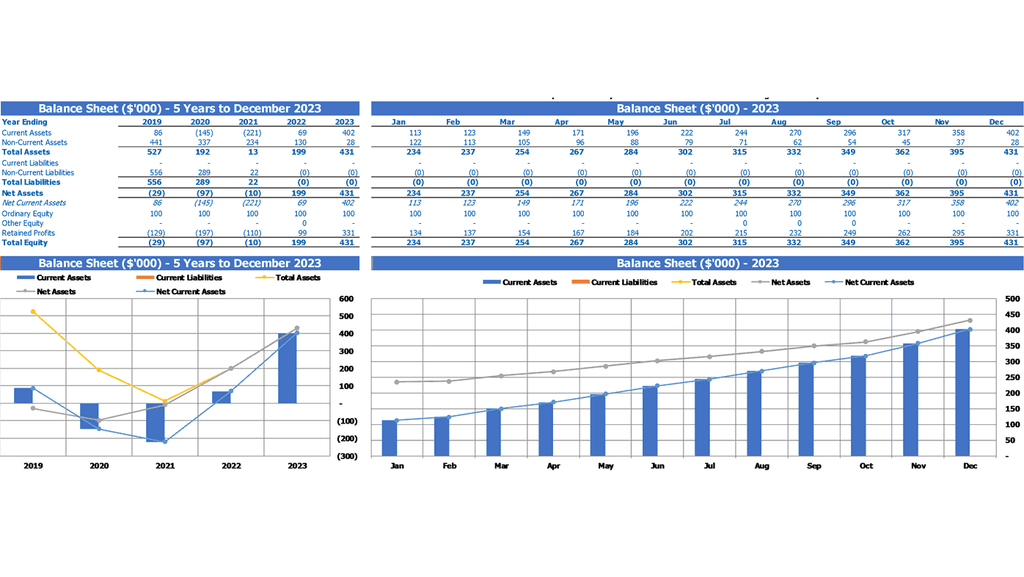

Accounting Financial Statement

To ensure success in an ecommerce dropshipping venture, it's essential to have a solid financial plan. From budgeting strategies to inventory and payment processing management, every aspect of dropshipping finances needs careful consideration. A dropshipping pricing strategy, sales forecasting, and marketing budget are crucial in generating revenue streams and optimizing profit margins. To analyze the company's return on investment, a financial analysis of all three accounting statements is essential. While the profit and loss forecast excel template provide insights into core operating activities, the balance sheet and cash flow projections are more focused on capital management structures. Effective cash flow management is key to success in dropshipping.

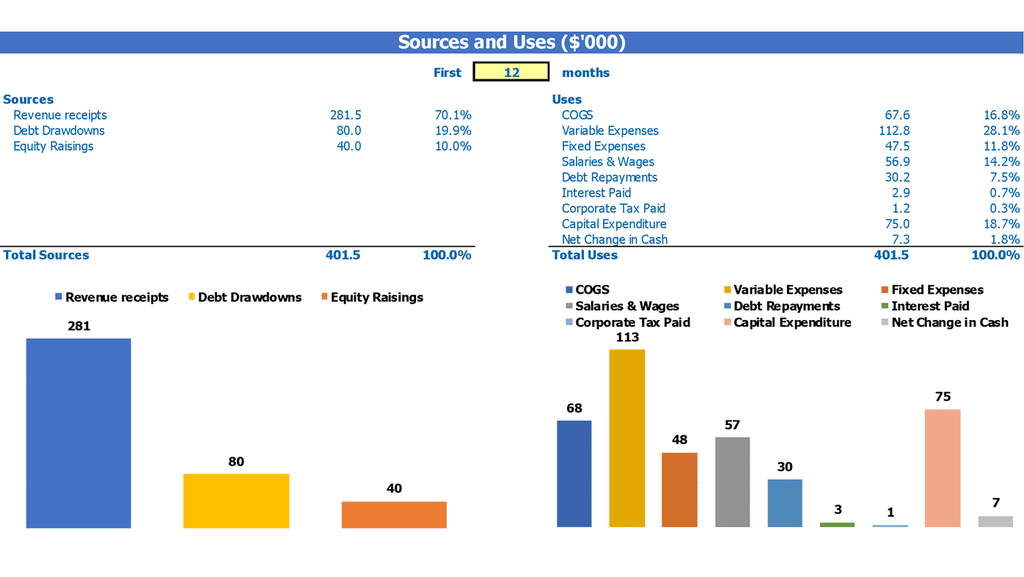

Sources And Uses Of Funds

Proper financial planning is essential for success in dropshipping. Consider implementing dropshipping budgeting strategies and a cash flow management plan to ensure profitability. Analyzing dropshipping revenue streams and expenses is also important for determining dropshipping profit margins and return on investment. Utilize effective pricing strategies, inventory management, payment processing, and sales forecasting for optimized financial performance. Moreover, allocate a proper dropshipping marketing budget and stay vigilant about financial analysis to make informed decisions regarding refinancing, restructuring, recapitalization, and/or mergers & acquisitions. Statement of Sources and Uses of Funds is integral to all these strategies and should reflect each amount in perfect balancing has to prepare for a better e-commerce dropshipping finances.

Cvp Graph

To make sound financial decisions for your dropshipping business, it's essential to analyze your revenue streams and profit margins. Utilize budgeting strategies to manage expenses, project sales forecasts, and allocate funds for marketing. Develop an efficient inventory management system, payment processing, and cash flow management to enhance your business's financial health. Use a pricing strategy that balances competitiveness with profitability. To ensure a solid return on investment, conduct regular financial analysis and utilize break-even revenue calculators to determine profits at various sales levels. Strive to maintain a solid safety margin to weather any sales decline.

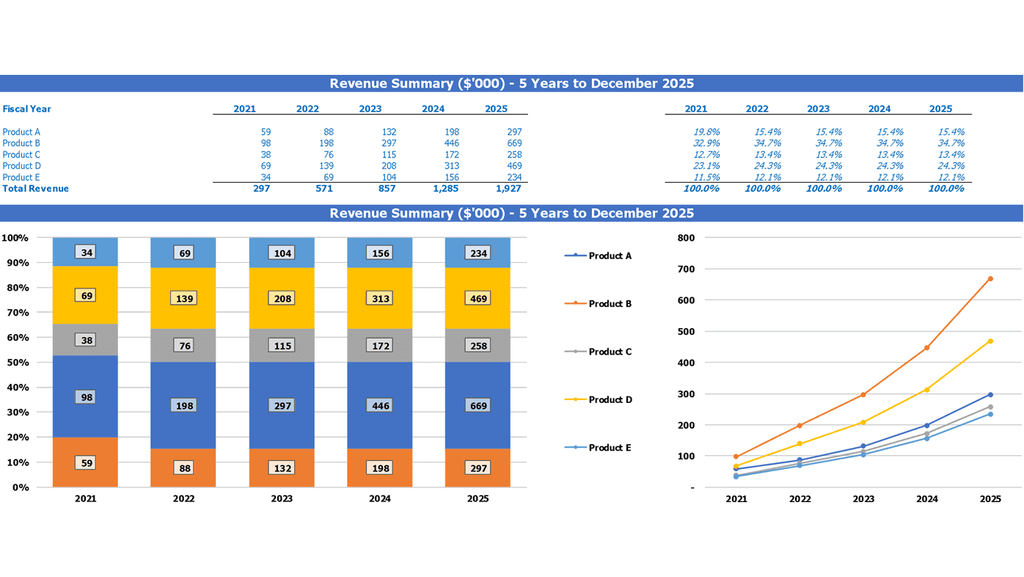

Top Revenue

When creating a financial plan for your dropshipping business, it's important to consider all revenue streams and their associated costs. Manage cash flow effectively by utilizing budgeting strategies to control expenses while maximizing profit margins. Inventory management and sales forecasting can help inform pricing strategy and ensure the return on investment is optimized. Tools for payment processing and marketing are essential to keep expenses in check, and financial analysis can provide valuable insights into your performance. The Top revenue tab is particularly useful for summarizing revenue and understanding which products are driving the most success.

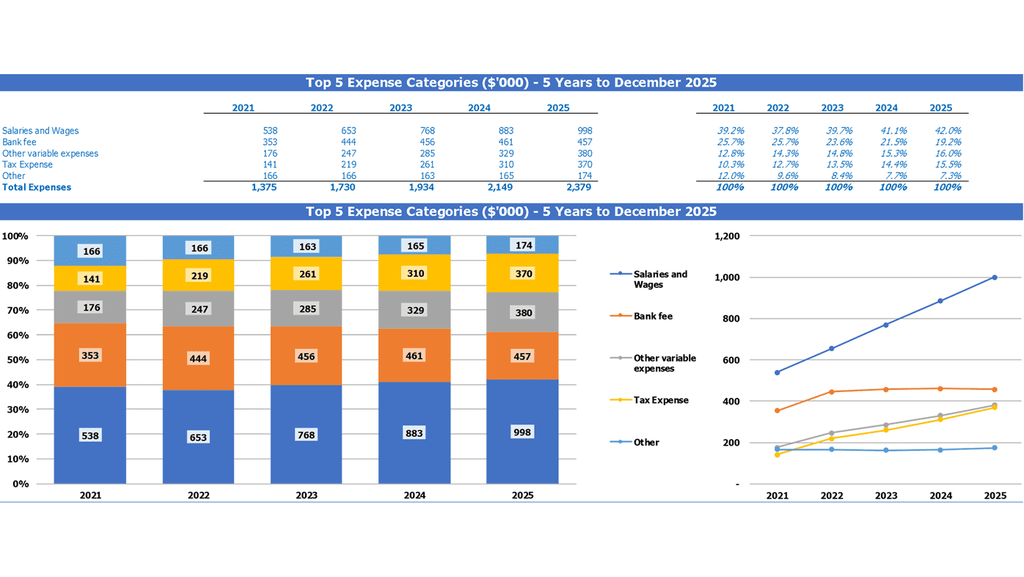

Company Top Expenses List

The financial plan for dropshipping requires a clear understanding of the various revenue streams, profit margins, and budgeting strategies involved in ecommerce dropshipping finances. An effective dropshipping pricing strategy and inventory management system are vital components, as is effective cash flow management and payment processing. Marketing budgets must be calculated alongside sales forecasting to determine ROI and financial analysis. The Top expenses tab in the financial projection model provides an overall view of the dropshipping expenses, including customer acquisition costs, COSS, wages & salaries, fixed and variable expenses, and other expenses.

Dropshipping Financial Projection Expenses

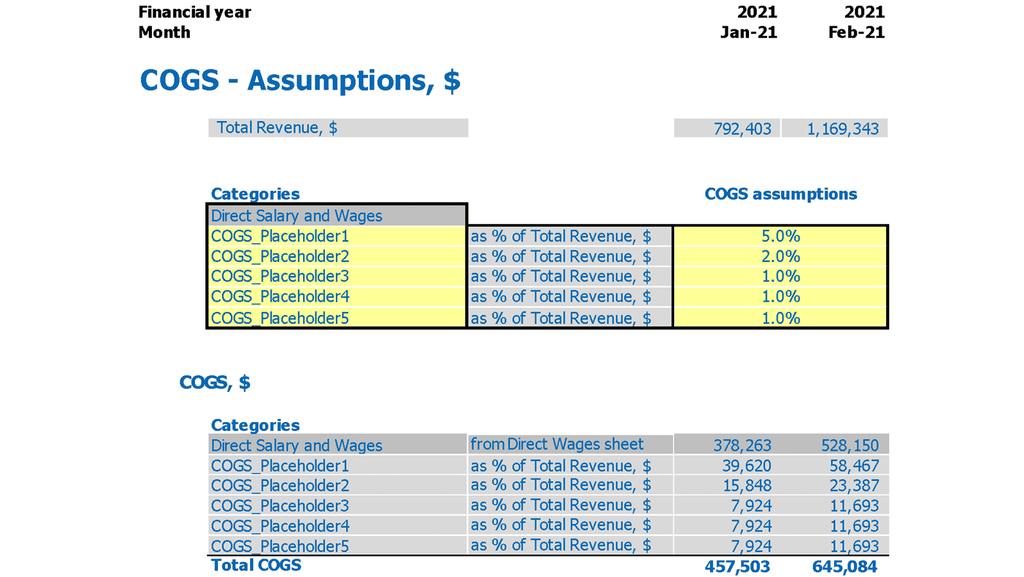

Costs

In the competitive world of ecommerce, a well-planned financial strategy is crucial for a successful dropshipping business model. Proper cash flow management, inventory management, and pricing strategies are all important factors to consider. Our dropshipping financial analysis can provide valuable insights into revenue streams, profit margins, and return on investment. With our proforma for start-up costs, you can create detailed cost budgets and monitor expenses from the outset. Sales forecasting, marketing budgets, and payment processing all play a part in a comprehensive financial plan for dropshipping.

Capital Expense Budget

When starting a dropshipping business, it's important to have a solid financial plan that includes budgeting strategies and cash flow management. Consider factors such as inventory management, payment processing, and sales forecasting when creating dropshipping revenue streams. Additionally, determine a dropshipping pricing strategy that takes into account profit margins and return on investment. Monitor expenses and keep a marketing budget in mind to attract new customers. Understanding CAPEX and its role in financial analysis is crucial to ensure a successful dropshipping business model. Remember to approach the initial budget with care and make informed investment decisions.

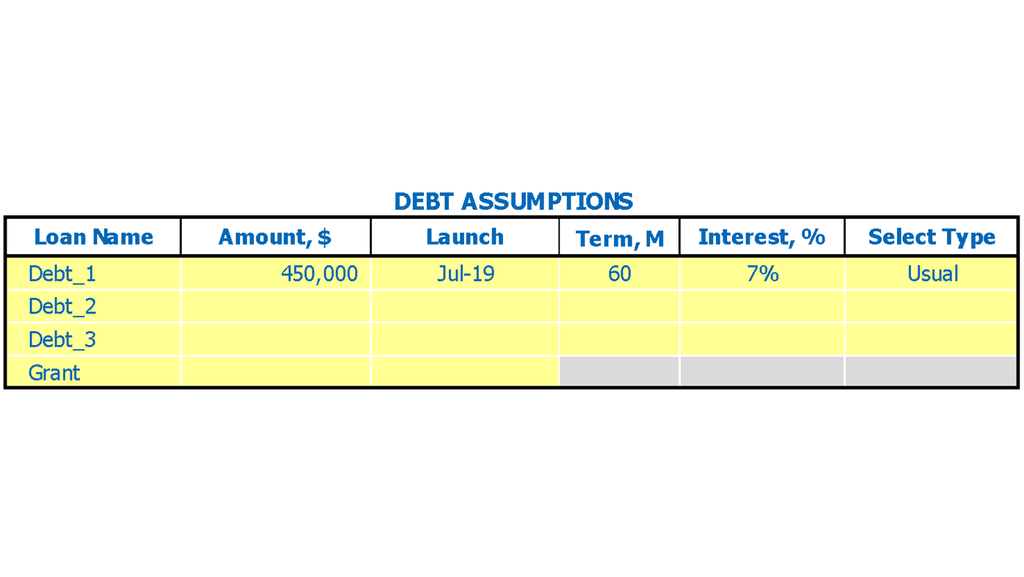

Loan opt-in

For a successful dropshipping business model, effective financial planning and management are essential. Consider the various revenue streams, profit margins, budgeting strategies, and cash flow management options to ensure your eCommerce dropshipping finances are on track. Reliable inventory management, payment processing, sales forecasting, and marketing budgeting can help optimize dropshipping expenses and boost return on investment. Don't forget to perform a thorough financial analysis, using tools like a loan amortization schedule, to track loans, interests, and equity. Access these proformas with built-in formulas through the Capital tab to stay on top of your dropshipping financial game.

Dropshipping Income Statement Metrics

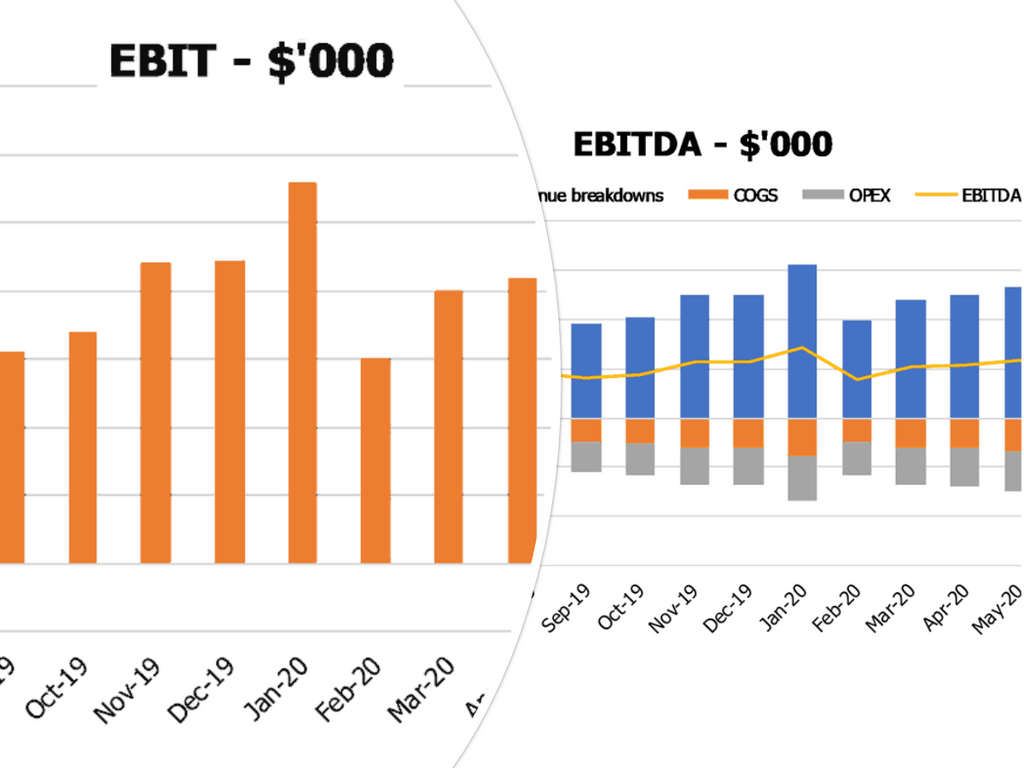

Financial KPIs

When running an ecommerce dropshipping business, it's crucial to have a solid financial plan for dropshipping. This includes a dropshipping budgeting strategy, cash flow management, and analysis of dropshipping revenue streams. A proper dropshipping pricing strategy, inventory management, and payment processing can also impact dropshipping profit margins. To ensure a positive dropshipping return on investment, consider sales forecasting and marketing budget. It's essential to track all dropshipping expenses and regularly perform dropshipping financial analysis to make informed decisions. Use financial forecasting templates with KPIs such as EBITDA/EBIT, cash flows, and cash balance to analyze and optimize performance.

Pro Forma Cash Flow

An effective financial plan for dropshipping should include strategies for managing cash flow, forecasting sales, and analyzing revenue streams. Budgeting for expenses such as inventory management, payment processing, and marketing is crucial for maintaining healthy profit margins. Pricing strategies must balance competitive pricing with the need for profitability. The dropshipping business model requires careful attention to cash flow management and return on investment. Using financial statement templates like the cash flow format in excel can help record and analyze the company's financial health.

Business Benchmarks

The dropshipping business model requires a strong financial plan to ensure profitability. Effective dropshipping budgeting strategies and cash flow management are crucial for success. Managing dropshipping revenue streams and analyzing dropshipping financial data is key to establishing proper pricing strategies and conducting sales forecasting. Additionally, proper dropshipping inventory management, payment processing, and marketing budget allocation are important considerations. Analyzing dropshipping expenses and return on investment is essential to determine the overall financial health of the company. By keeping track of essential financial indicators, dropshipping businesses can make informed decisions and improve their financial analysis for a better future.

Profit And Loss Statement Template Excel

Creating a financial plan for a successful dropshipping business requires attention to key areas such as pricing strategy, inventory management, sales forecasting, and cash flow management. By analyzing financial data and building a solid forecasting model, business owners can develop effective budgeting strategies and identify revenue streams, profit margins, and expenses. It's crucial to invest wisely in marketing and payment processing, while also keeping an eye on return on investment and financial analysis. A well-designed financial plan can help businesses grow and achieve long-term success in the competitive world of ecommerce dropshipping finances.

Projected Balance Sheet Template Excel

Managing finances is crucial for success in ecommerce dropshipping. Developing a strategic financial plan for dropshipping requires carefully evaluating revenue streams, profit margins, expenses, and return on investment. Accurately forecasting sales, cash flow, and inventory management are key components of effective budgeting strategies. Implementing a pricing strategy and optimizing payment processing can also improve profits. Consistent analysis and monitoring of financial data, including a balance sheet and profit loss projection, are essential for understanding trends and driving growth. A solid financial plan and management strategy can help entrepreneurs thrive and succeed in the competitive world of dropshipping.

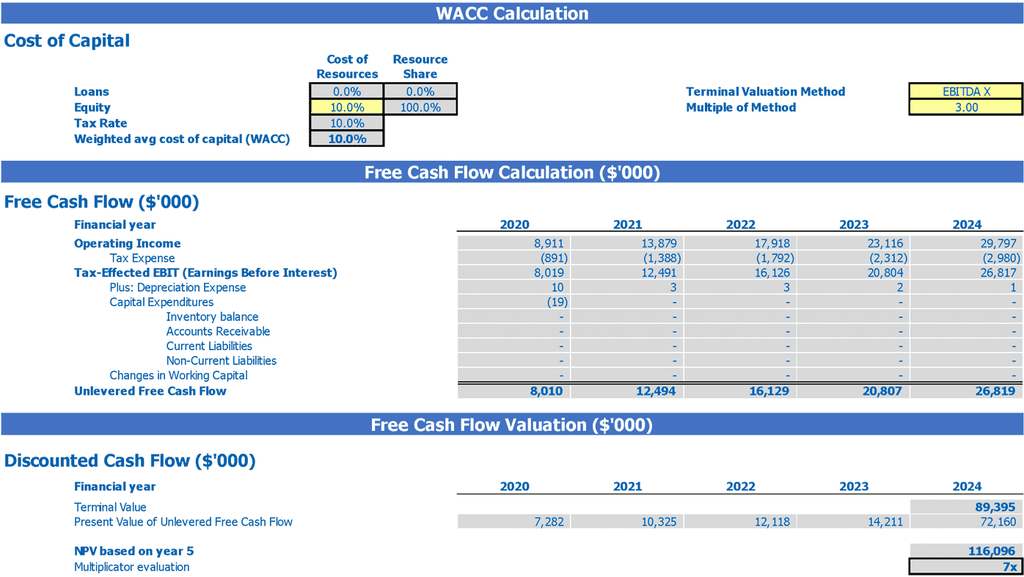

Dropshipping Income Statement Valuation

Startup Valuation Model

Our comprehensive dropshipping financial plan covers all aspects of managing finances for an ecommerce dropshipping business. It includes budgeting strategies, pricing, inventory and cash flow management, payment processing, sales forecasting, marketing budget, expenses, return on investment, and financial analysis. Our valuation analysis template calculates DCF, residual value, replacement costs, market comparables, and relative value, so you can easily assess the value of your business. This is an all-in-one solution for dropshippers looking to succeed financially.

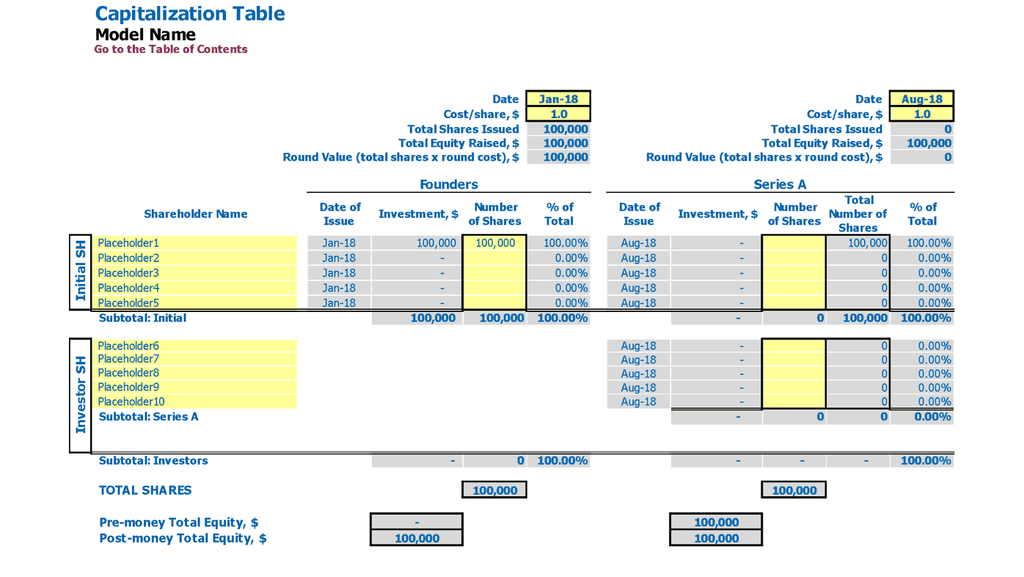

Cap Table Excel

Our platform offers comprehensive financial guidance for ecommerce dropshipping businesses. Our tools cover various aspects such as dropshipping profit margins, inventory management, payment processing, and sales forecasting. We provide budgeting strategies to manage expenses effectively while maximizing return on investment. Our dropshipping financial analysis also includes cash flow management and pricing strategies. Moreover, our dropshipping revenue streams include a marketing budget to boost sales. Our financial plan for dropshipping includes a cap table feature for startups to assess ownership dilution based on up to four rounds of funding.

Dropshipping Three Statement Financial Model Key Features

Saves you time

Streamline your ecommerce finances with effective dropshipping budgeting and cash flow management strategies.

Avoid cash flow problems

Regularly monitoring cash flow is crucial for dropshipping business success and can be done through monthly forecasting and the use of a pro forma cash flow statement template.

Predict the Influence of Upcoming Changes

Utilize cash flow analysis and forecasting in Excel to make informed financial decisions for your ecommerce dropshipping business.

Consistent formatting

Creating a clear and organized financial plan with tabs dedicated to dropshipping revenue streams, expenses, and cash flow management is key for success.

It is part of the reports set you need

Proper financial planning, including cash flow projections and sales forecasting, is essential for the success of a dropshipping business.

Dropshipping 5 Year Financial Projection Template Excel Advantages

Use a comprehensive and professional financial plan to manage cash flow, expenses, inventory, sales forecasting, pricing, and ROI in your dropshipping business model.

Improve financial decisions with a dropshipping financial plan using strategies such as inventory management and pricing.

Discover effective financial strategies for your dropshipping business with our comprehensive Excel model template.

Forecast future dropshipping expenses to optimize financial plan.

Maximize your dropshipping profits with our comprehensive financial analysis and budgeting strategies.