ALL IN ONE MEGA PACK INCLUDES:

Exchange Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Exchange Bank Startup Budget Info

Highlights

With the constantly evolving financial marketplace, a successful financial institution must have a strong model in place to ensure growth and profitability. This is where financial modeling for the banking industry comes in. Whether it's a banking system model, financial services model, or banking revenue model, there are multiple models that can be utilized to drive success. By utilizing a financial institution business model, banking operations model, and banking performance model, financial institutions can develop core metrics and financial projections that help evaluate startup ideas and plan for costs. With the ability to automatically generate templates for a 5-year exchange bank business plan, cash flow budget, and financial dashboard in GAAP/IFRS formats, financial modeling for banks can help establish a solid foundation for long-term success.

Develop a comprehensive financial institution model by utilizing financial modeling for banking industry. With the exchange bank business model, we can create a fully-integrated pro forma profit and loss statement, cash flow forecasting tools, and Balance Sheet projections for up to 5 years. Our banking operations model allows for automatic aggregation of monthly and annual summaries on the financial summary report. By implementing banking revenue model and banking profitability model, it becomes easier to project the financial performance of the banking industry model. Additionally, banking risk model ensures effective risk management strategies are in place for the banking management model. Through the use of financial services model, a robust banking system model can be designed to optimize profits and streamline financial transactions.

Description

Our team has created a comprehensive financial framework in the form of an exchange bank startup pro forma template that includes all relevant financial statements and performance metrics for sound decision-making. This financial modeling for banking industry allows for dynamic financial planning and projection for a 5-year period. The template also consolidates financial performance ratios, KPIs, and projected free cash flows for the banking revenue model, making it easier for banks and investors to estimate business profitability and liquidity. The banking operations model is highly adaptable and can be easily edited with basic excel and finance knowledge. It includes necessary financial and valuation reports, such as cash flow projections, startup costs, projected balance sheets, and profit and loss statements. This professional and engaging model is crucial for predicting future profit and making wise decisions in the banking sector.Exchange Bank Financial Plan Reports

All in One Place

Financial institutions use various models, including the banking system, exchange bank, and financial services models, to manage their operations, revenue, profitability, and risk. Financial modeling for the banking industry involves creating holistic Excel models that account for changes over time. At the end of each year, financial institutions prepare business revenue model templates regardless of their business size or scope. These models are essential to track performance and plan for the future of the institution.

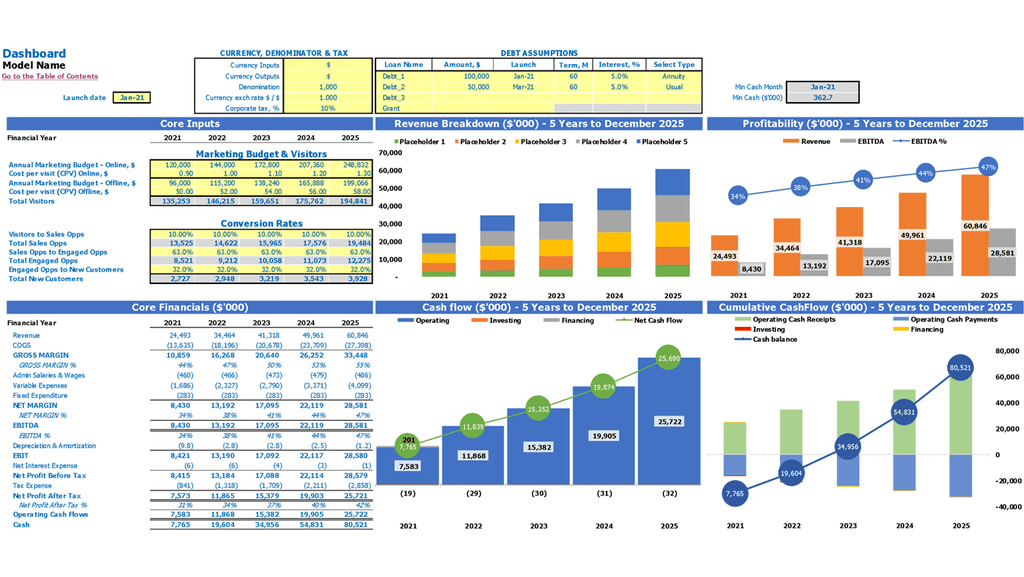

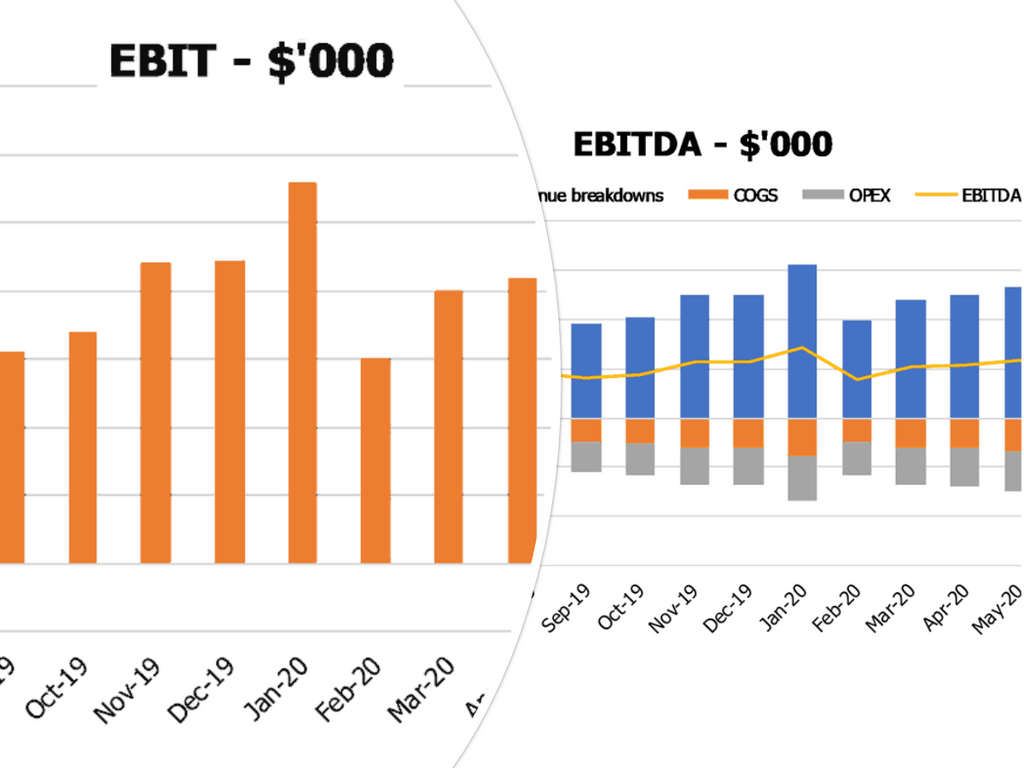

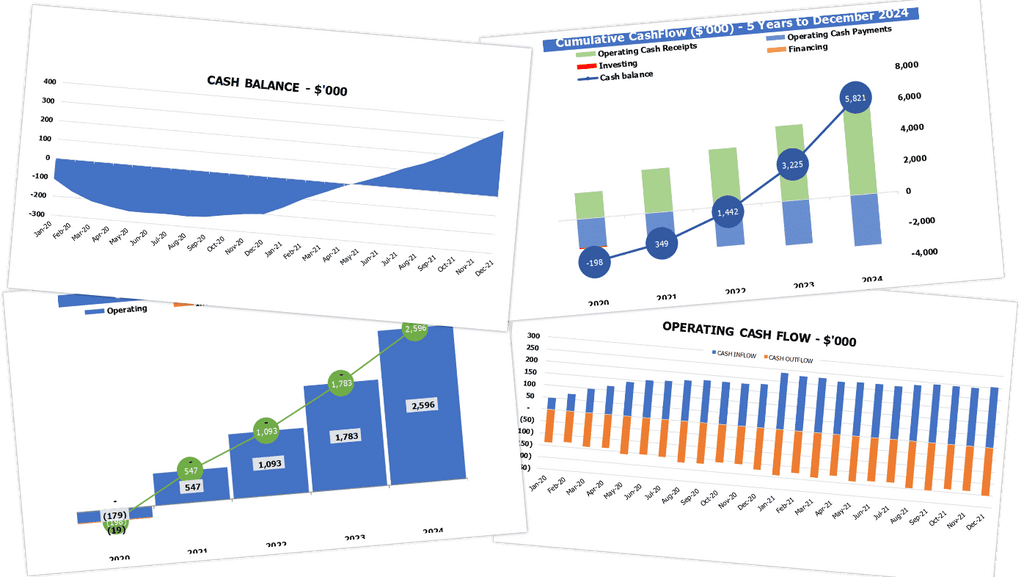

Dashboard

Gain insight into your financial institution's performance with our advanced financial modeling for banking industry. Our banking sector model provides you with an accurate representation of your banking operations model, banking management model, and banking revenue model. With our banking risk model and banking profitability model, you'll have access to the information you need to make informed decisions. Using our exchange bank business model and financial services model, you'll be able to analyze your banking system model and banking industry model. Present your financial projection excel with confidence to stakeholders using our intuitive dashboard.

Excel Financial Statement Template

Financial modeling for banking industry is made easy with our integrated proformas template. It includes a projected balance sheet, income statement, and cash flow spreadsheet that can be filled with either historical or forecasted financial data. With this tool, banks can create different scenarios and explore risk and profitability models. Our 3-year financial projection template excel also helps stakeholders to understand the company's performance under different conditions, allowing management to make informed decisions and see the economic impact of their choices, like affecting prices. This well-built proforma template is perfect for the banking sector model, financial institution business model, and banking revenue model.

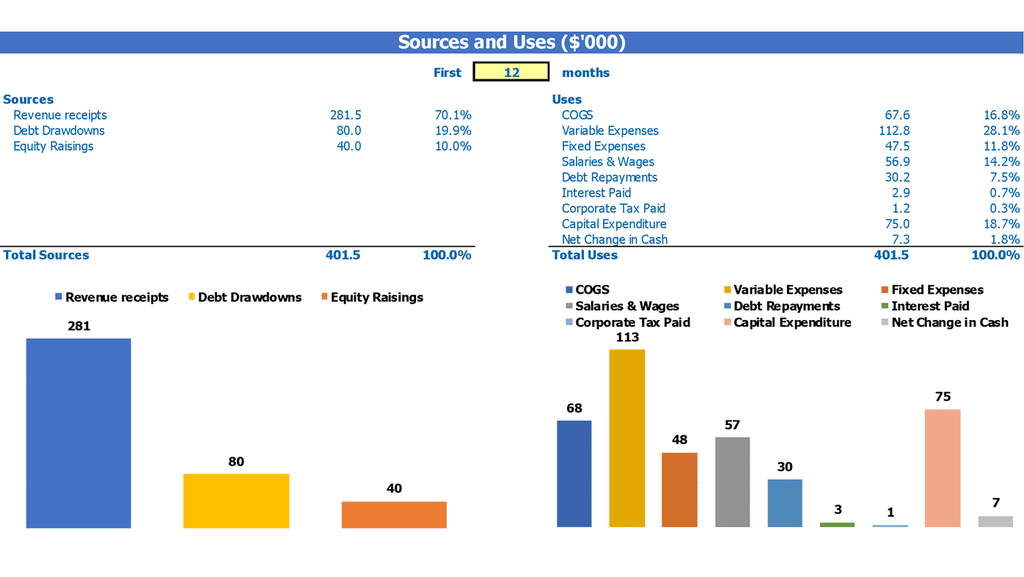

Use Of Funds

The financial modeling for banks provides a comprehensive analysis of a banking institution's performance and profitability. Using the banking system model, financial services model, and banking sector model, this tool uses the banking revenue model to assess revenue generation and identify potential risks. Additionally, the banking operations model and banking management model provide insight into the daily operations and overall management of the financial institution. Furthermore, the banking risk model offers solutions for managing and mitigating financial risks. This Excel template is a must-have tool for any exchange bank business model, financial institution business model, or banking profitability model.

Cvp Graph

Financial institutions use various models to understand their business operations, risk, profitability, and revenue streams. Some of the commonly used models include the banking system model, exchange bank business model, banking industry model, financial services model, and banking management model. Financial modeling for banks also involves analyzing the break-even point, contribution margin, and other performance indicators to evaluate the company's profitability. Such models help companies to determine the number of units to sell or revenue needed to cover total costs and sales prices for their products, ultimately impacting their profitability.

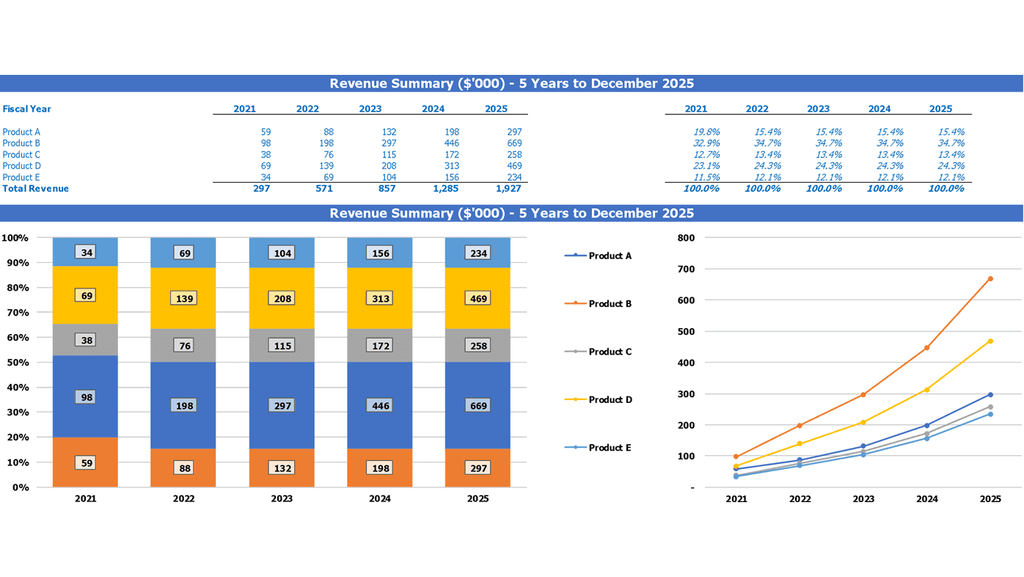

Top Revenue

This financial modeling for banks includes a specialized tab that provides detailed revenue analysis of revenue streams for financial institutions. The template enables banking professionals to assess revenue by product or service category, allowing for thorough evaluations of each stream's profitability, risk and performance. With the banking industry model, it's become easier, faster and effective in assessing revenue and other crucial financial parameters to analyze and improve a financial institution's business model.

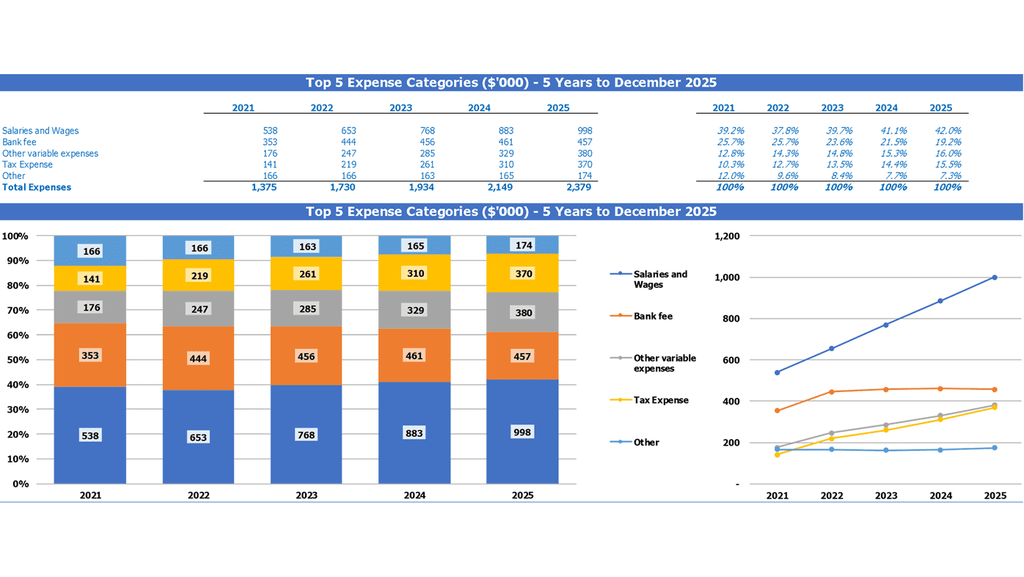

Small Business Top Expenses List

Financial institutions utilize a variety of models to manage their operations, risk, and profitability. These models include the banking system model, exchange bank business model, financial modeling for banks, and the banking industry model. Additionally, financial services models and banking revenue models are essential for managing finances. The banking operations model and banking management model are critical for ensuring optimal performance, while the banking risk model helps institutions identify threats and minimize them. Ultimately, financial modeling for the banking industry is integral to ensuring financial institutions can maximize profitability and maintain sustainable growth.

Exchange Bank Financial Projection Expenses

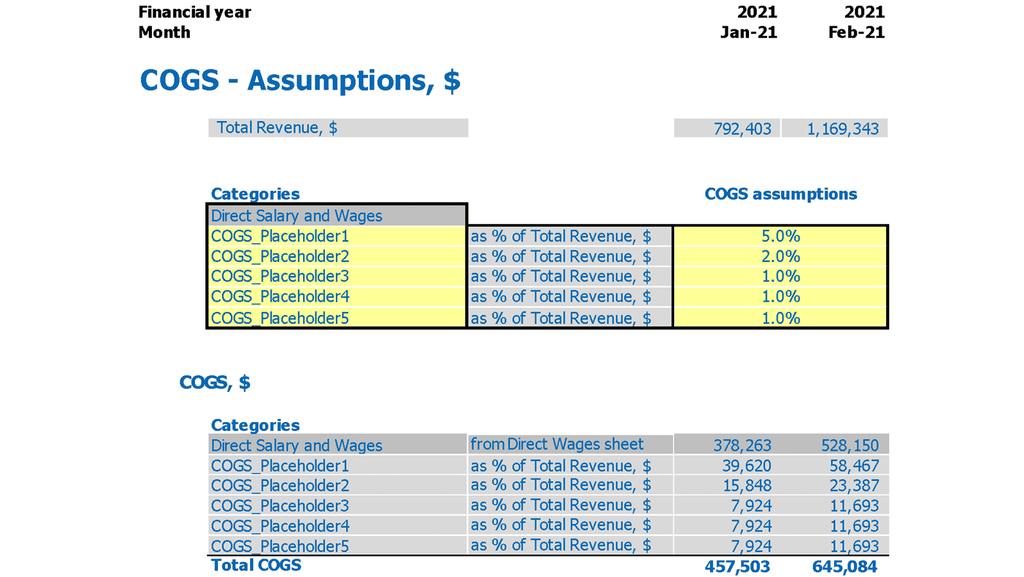

Costs

Creating effective financial models is crucial for financial institutions to manage and understand their banking operations. From revenue and profitability to risk management, using a precise banking system model provides invaluable insights into the banking sector model. With our excel pro forma template, forecasting expenses and forecasting revenue for financial modeling for banks is easy, so financial institutions can determine the best financial services model and banking management model for their business. Our expense forecasting template lets you set expenses over time in various expense categories with a detailed expense plan, including COGS, variable or fixed expenses, Wages, or CAPEX.

Initial Startup Costs

Creating a solid financial institution business model involves understanding the different components that contribute to banking performance and profitability. This includes developing a strong banking revenue model, banking risk model, and banking operations model. A financial modeling for banking industry can help in forecasting and monitoring capital expenditure, which is a vital aspect of any startup. Effective CAPEX calculations should consider the depreciation and disposal of assets in relation to property, plant, and equipment. By understanding these factors and implementing them into their exchange bank business model, financial institutions can better manage their investments and achieve long-term success.

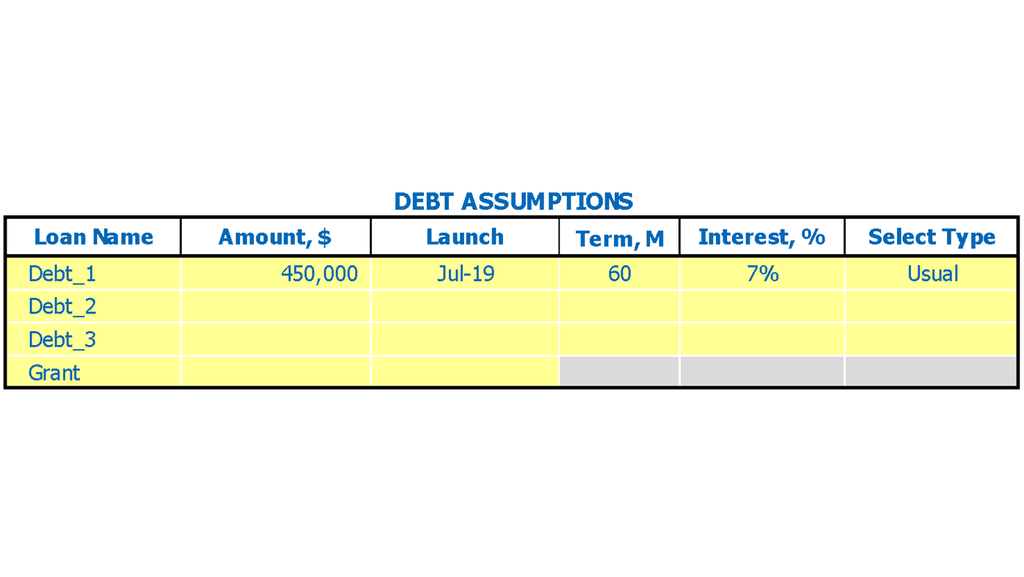

Debt Repayment Schedule

Start-up and growing companies must carefully monitor and manage their loan repayments. A loan repayment schedule provides valuable information about the company's debt breakdown, including maturity terms and amounts. This schedule is essential in analyzing a company's cash flow and projecting interest expenses, closing debt balance, and principal repayments. Using cash flow budget templates in excel helps companies plan financing activities, calculate projected cash flow, and maintain financial management. In summary, proper monitoring and maintenance of loan repayments schedules are vital in the financial institution business model.

Exchange Bank Income Statement Metrics

Profitability KPIs

Financial institutions rely on various models, including the banking system, exchange bank, financial services, and banking operations models, to ensure profitability and manage risk. Financial modeling for banking industry typically includes the banking revenue, performance, and profitability models to forecast earnings growth. To monitor such growth, experts recommend using income and expenditure template excel to track the company's development trajectory through sales and revenue growth. New companies can determine earning growth using metrics such as net earnings to determine the success of their financial institution business model.

Excel Spreadsheet Cash Flow

Financial modeling for banks includes various models such as the banking revenue model, banking performance model, and banking risk model. These models are essential components of the banking system model or the financial institution model. A cash flow projection template excel is also a vital part of this modeling and is used to analyze operating, investing, and financing cash flows. It helps reconcile changes in the projected balance sheet for 5 years in excel format on a year-to-year basis. This template is crucial for a startup's pro forma balance sheet since it cannot balance without the correct excel spreadsheet cash flow.

KPI Benchmarks

The financial modeling for banking industry offers a variety of models to choose from such as banking operations model, banking sector model, banking risk model and more. These models enable financial institutions to forecast their revenue, performance, and profitability levels. The banking management model allows businesses to benchmark and analyze financial benchmarks, identifying areas that need improving. With the exchange bank business model and financial services model, companies can learn how to operate effectively in the banking industry and compete with other successful firms in the same sector.

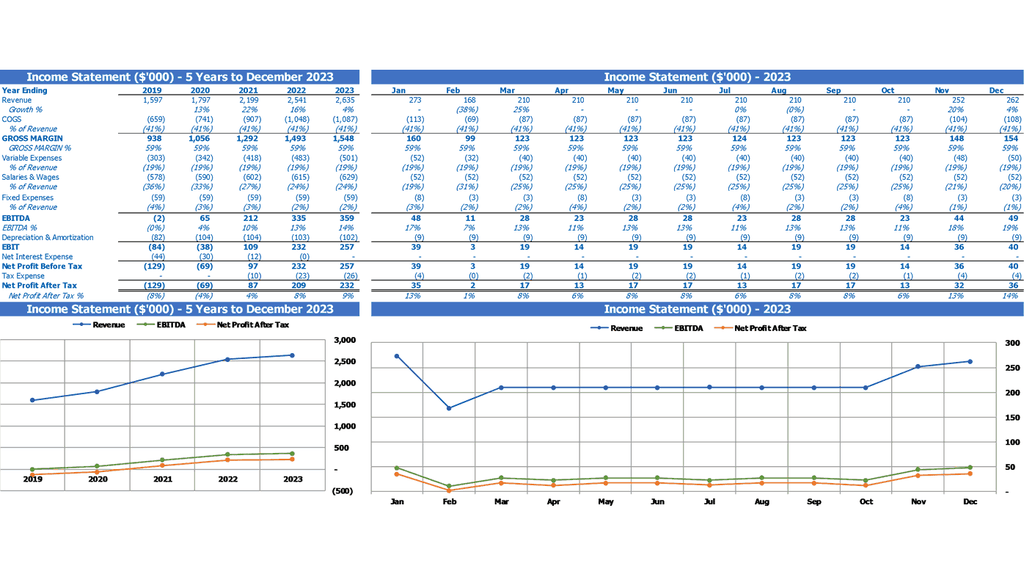

Profit And Loss Projection Template

Financial modeling for the banking industry is an essential part of running a successful financial institution. Whether you're working with a banking system model or an exchange bank business model, it's crucial to understand the banking sector model, financial services model, and banking operations model. Additionally, a banking revenue model, banking performance model, banking profitability model, and banking risk model are all important elements that will inform your financial institution business model. Fortunately, financial modeling tools like a profit loss projection template can make calculating projected income statements much easier.

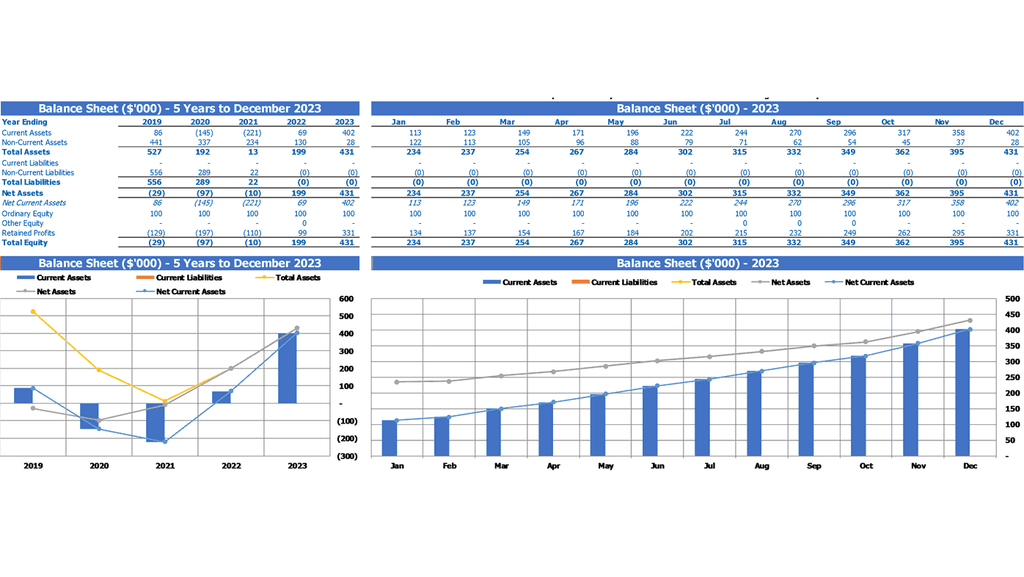

Projected Balance Sheet Template Excel

Financial modeling is an essential tool for assessing the performance and predicting the future of a financial institution. Pro forma balance sheets give stakeholders an overview of the company's assets, liabilities, and equities, while the balance sheet projected for the next five years helps management prepare for future investments. When complemented with the profit and loss statement in excel format, the three statement financial model is a critical tool for predicting future financial performance and preparing for growth. Accurate projections allow companies to confidently prepare for future revenues while managing interrelated risks.

Exchange Bank Income Statement Valuation

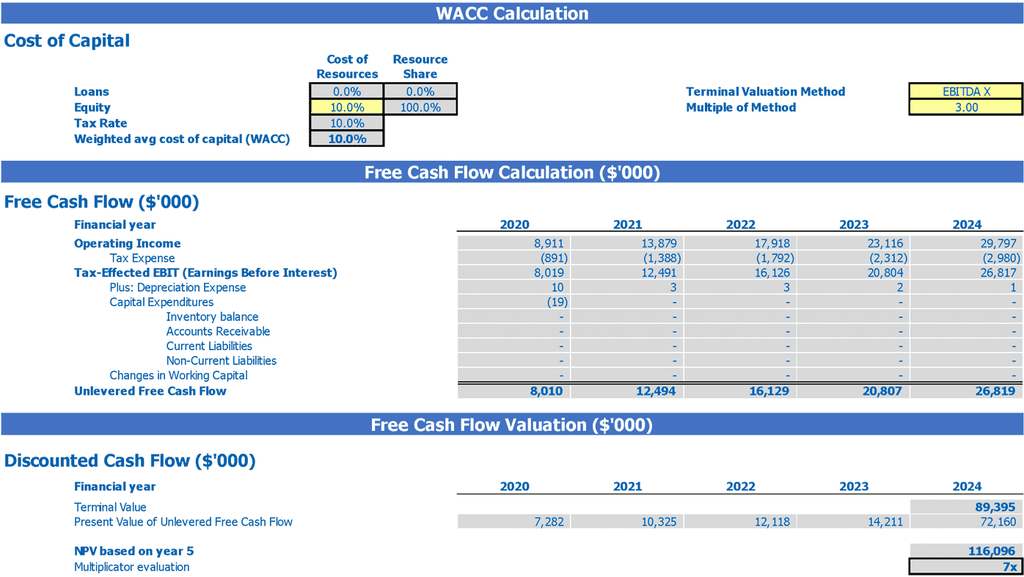

Pre Money Valuation Startup

With our financial modeling for banking industry, you can easily analyze the banking operations model, financial services model, and banking sector model. Our banking revenue model, banking performance model, and banking profitability model will provide you with a comprehensive understanding of your financial institution business model. Plus, our banking risk model is designed to help you assess and manage potential risks. Take advantage of our exchange bank business model and banking management model to boost your bank's financial institution model. With our valuation report template, you can perform Discounted Cash Flow valuations with just a few simple rate inputs in the Cost of Capital.

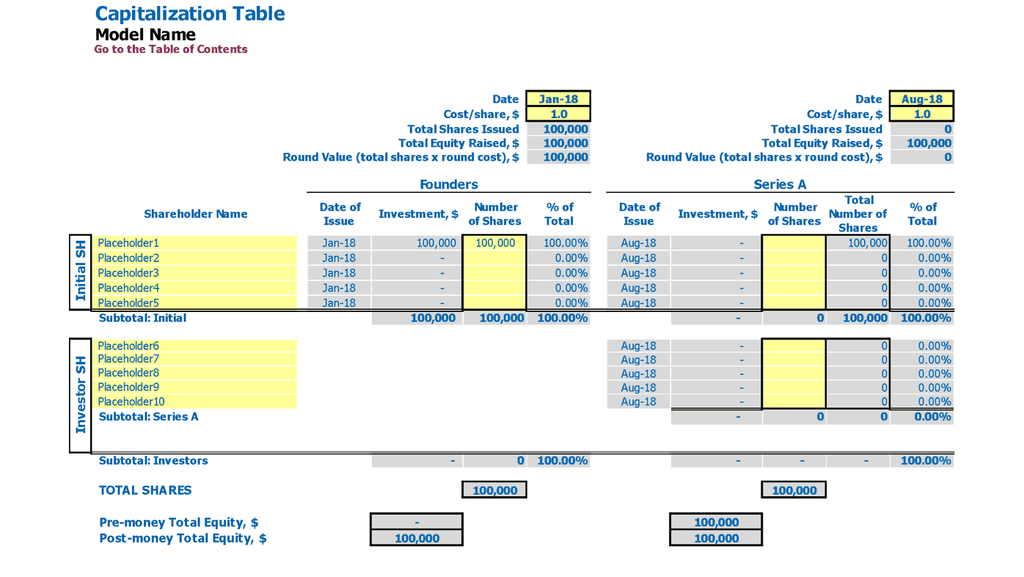

Equity Cap Table

Financial modeling is essential for the banking industry to design and implement robust financial institution models. These models are used to analyze and optimize banking operations, revenue, performance, and profitability, as well as to manage banking sector risks. Among the models used are exchange bank business models, financial services models, banking management models, and banking system models. To enhance financial modeling for banking industry, sophisticated spreadsheets and cap tables are used, providing investors with comprehensive data on the distribution and value of a company's securities. Such models ensure that banking institutions operate optimally and meet the needs of customers and stakeholders.

Exchange Bank Business Forecast Template Key Features

5 years forecast horizon

Create a comprehensive 5-year financial plan for an exchange bank with monthly updates and automatic annual summaries.

Update anytime

Financial modeling for banking industry allows for easy input adjustments to refine forecasts.

External stakeholders, such as banks, may require a regular forecast

Banks ask for regular exchange bank proforma business plan templates for businesses with loans.

Generate growth inspiration

Creating a financial institution model requires evaluating different scenarios to determine the best options for banking operations, profitability, and risk.

Key Metrics Analysis

Efficiently generate exchange bank financial statements and ratios in GAAP or IFRS formats with a 5-year projection.

Exchange Bank Feasibility Study Template Excel Advantages

Develop financial institution models to project banking revenue, performance, profitability, and risk.

Gain clarity with Exchange Bank's Excel financial modeling for the banking industry.

Revamp your banking operations with a financial institution model.

Make informed decisions with our financial modeling templates for different banking models.

Financial modeling is a vital aspect of financial planning that utilizes Excel templates for the banking industry.