ALL IN ONE MEGA PACK INCLUDES:

Freelance Platform Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Freelance Platform Financial Model For Startup Info

Highlights

A financial model tailored for the freelance economy, including online freelance platforms, gig economy, crowdsourcing, peer-to-peer marketplaces, self-employment, independent contractor work, virtual workforces, outsourcing, freelance talent management, and freelance businesses. This model offers a five-year forecast to impress investors and secure funding, with built-in graphs, summaries, metrics, and funding forecasts. It is specifically created to evaluate a freelance platform business before it is sold, with full editing capabilities available. Use this model to ensure the success of your freelance marketplace and thrive in the ever-growing freelance economy.

This comprehensive package includes a set of investor-ready reports for various aspects of the freelance economy. The package provides a financial model for a freelance marketplace, an online freelance platform, and a peer-to-peer marketplace. It also includes reports on the gig economy, crowdsourcing, self-employment, independent contractors, virtual workforce, outsourcing, freelance management, freelance talent, freelance services, and freelance economy financial planning. The reports cover a range of financial projections, including profit and loss, cash flow, and financial ratios. With the package, investors can confidently evaluate the financial viability of a freelance business.

Description

The freelance marketplace financial model is an essential tool for any entrepreneur aiming to establish or scale up their freelance business operation. Our online freelance platform financial model provides a comprehensive 5-year financial plan, complete with industry-specific revenue assumptions, 3 statement financial reports, and performance KPIs. The freelance economy financial model also includes a startup summary plan, allowing potential investors to make informed decisions about your freelance talent and services. With our freelance management financial model, you can focus on running and growing your business, leaving complicated calculations behind. Optimize your time for marketing activities, operational management, and customer satisfaction through our freelance economy financial planning.Freelance Platform Financial Model Reports

All in One Place

Investors seeking opportunities in the gig economy must prioritize the freelance platform's financial models. The budget model offers insight into funding requirements and expected returns. A comprehensive financial projection template excel gives investors confidence in the start-up's planning and execution. A well-prepared business plan for small business strengthens the pitch and reduces risk. With self-employment, independent contractors, and outsourcing becoming more prevalent, the freelance economy financial planning is essential for success. A detailed freelance business financial model, with a focus on freelance services and freelance management, can help attract investors and secure funding.

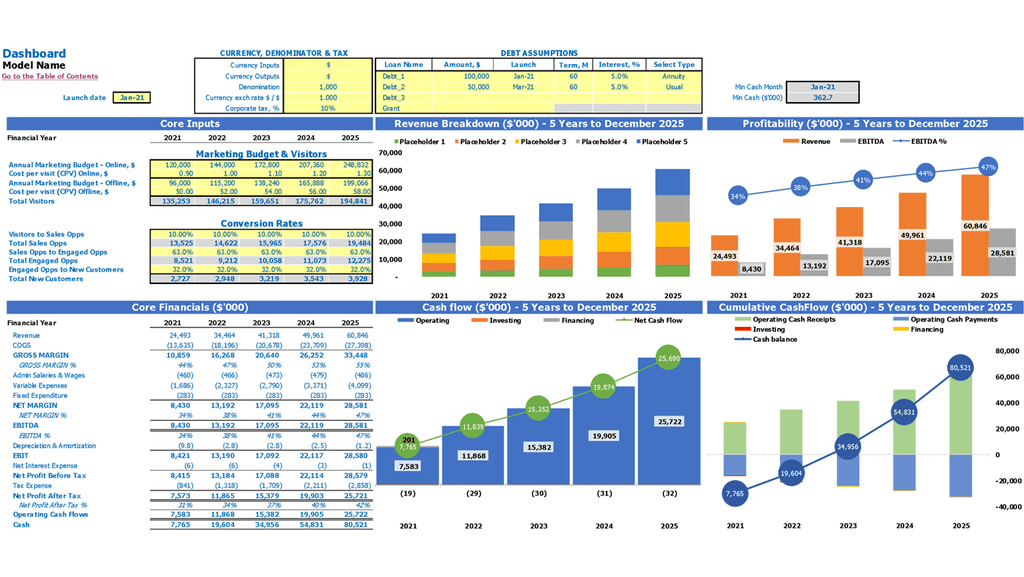

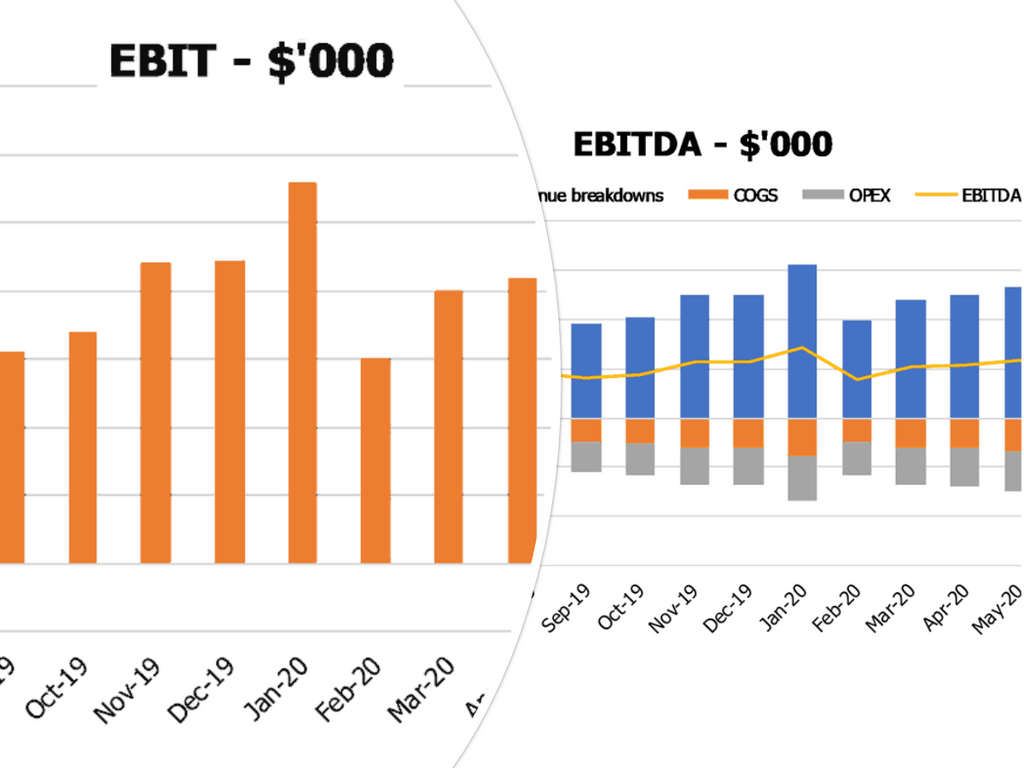

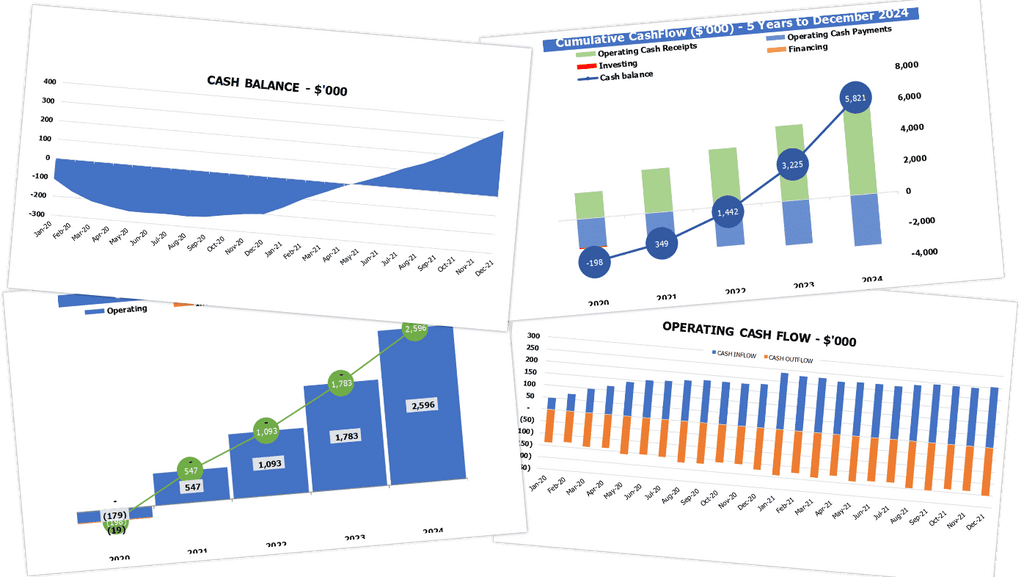

Dashboard

Our freelance marketplace financial model offers a comprehensive financial planning tool for independent contractors, virtual workforces, and freelance businesses of all sizes. Our platform includes a dashboard that summarizes information from other spreadsheets of the financial forecast template, enabling you to set key performance indicators (KPIs) and monitor your progress over time. With our flexible dashboard, you can track core financial data on a month-by-month basis and adjust your strategies to optimize your profits. Whether you work in the gig economy, crowdsourcing, or freelance talent, our financial model can help you achieve your goals.

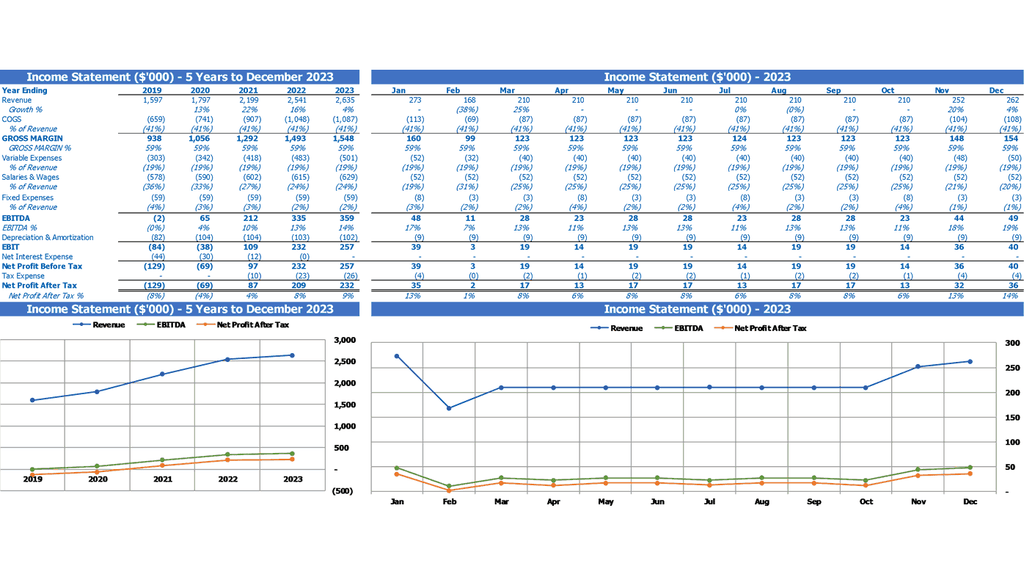

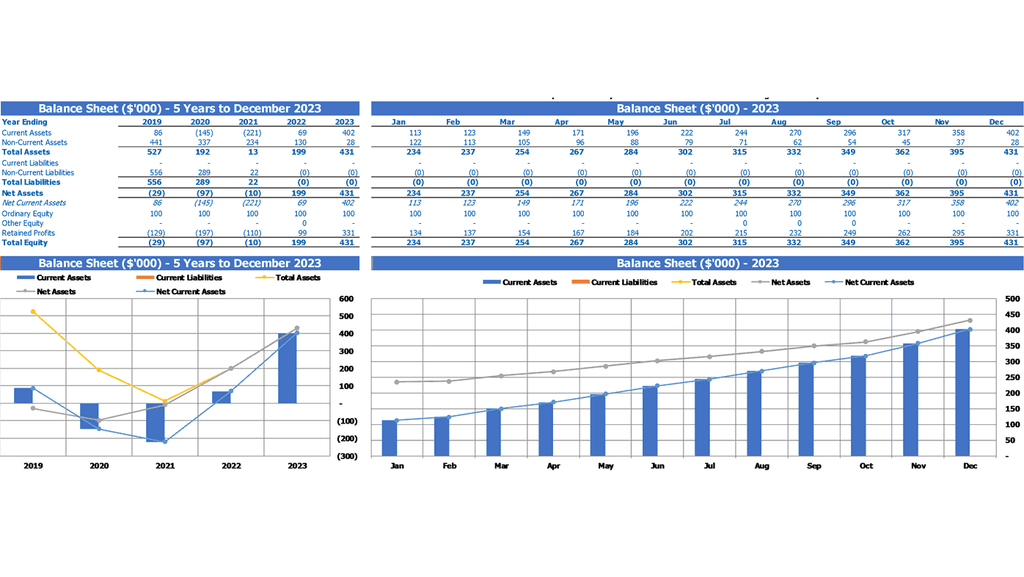

Startup Financial Statement

Understanding the financial model of a freelance marketplace is crucial for its success. The gig economy, freelance economy, crowdsourcing, and peer-to-peer marketplace financial models are all important components of the equation. Freelance management, talent, and freelance business financial models need to be considered in the freelance services financial planning. When analyzing a company's financial performance, three statements are crucial - the profit and loss statement, the balance sheet, and cashflow forecast. Collectively, they provide a comprehensive overview of a company's financial health, including income flow, capital structure, and financial activities.

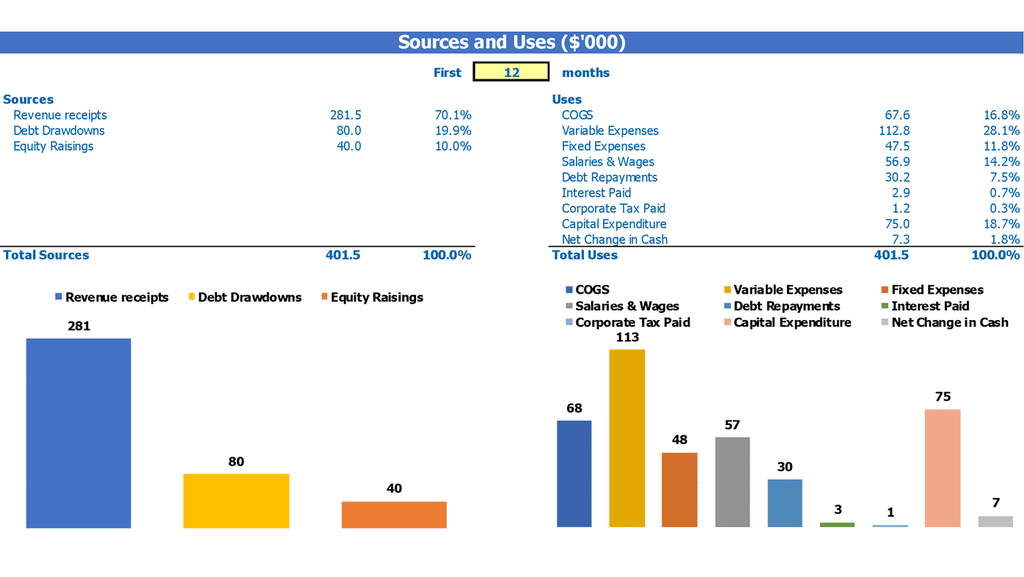

Source And Use Of Funds

A financial model is essential for any freelance marketplace, online platform, or peer-to-peer marketplace operating in today's gig economy. It helps to keep track of sources and intended expenditures, and can help plan for future growth. The model includes a use of funds tab that shows sources of funding and intended destinations for the income. This ensures that business owners can keep track of their finances, make informed decisions, and maintain a steady cash flow. With the right freelance business financial planning, entrepreneurs can build a successful virtual workforce and manage their freelance talent effectively.

Break Even In Sales

A financial model is crucial to any freelance marketplace, gig economy, or crowdsourcing platform. It helps provide a break even point calculation that is used to determine when a company starts making profits from its operations. To build an effective financial model, one must consider factors like the contribution margin, sales price per unit, and variable cost per unit. Using a five-year projection template, one can easily calculate the break even in sales and make adjustments to improve the company's overall profitability. These practices will be essential to the success of any freelance business or virtual workforce.

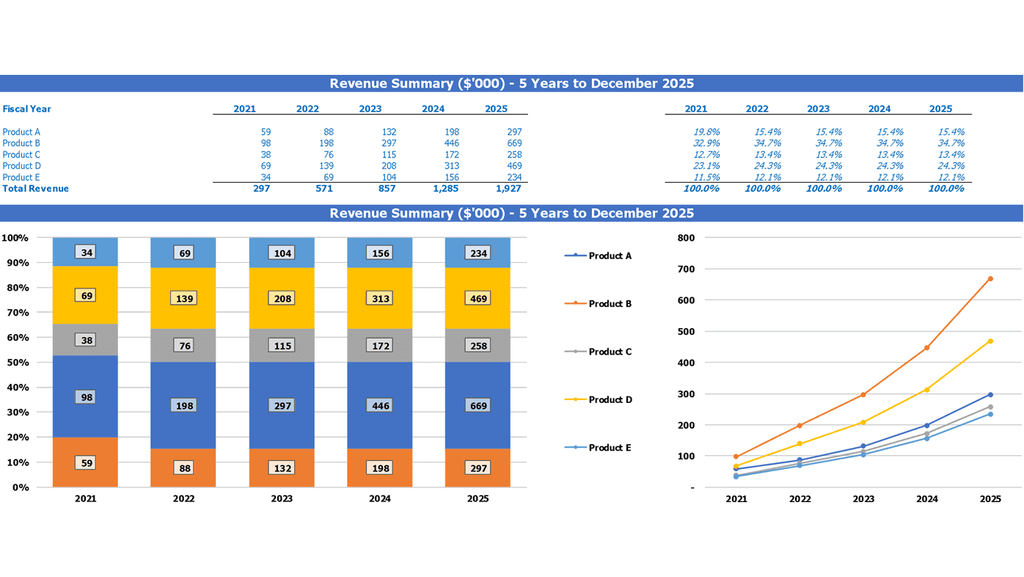

Top Revenue

When it comes to the freelance economy, financial planning is crucial. Understanding the financial model of gig platforms, crowdsourcing, and virtual workforce management is essential to success. Knowing the revenue and profit metrics, including topline and bottom line, will provide valuable insight for investors and stakeholders. The projected profit and loss statement highlights top-line growth, indicating an increase in revenue or sales. Freelance businesses should monitor these financial trends quarterly and annually to ensure optimal performance. Proper financial planning is vital for self-employment, independent contractors, and freelance talent in managing freelance services.

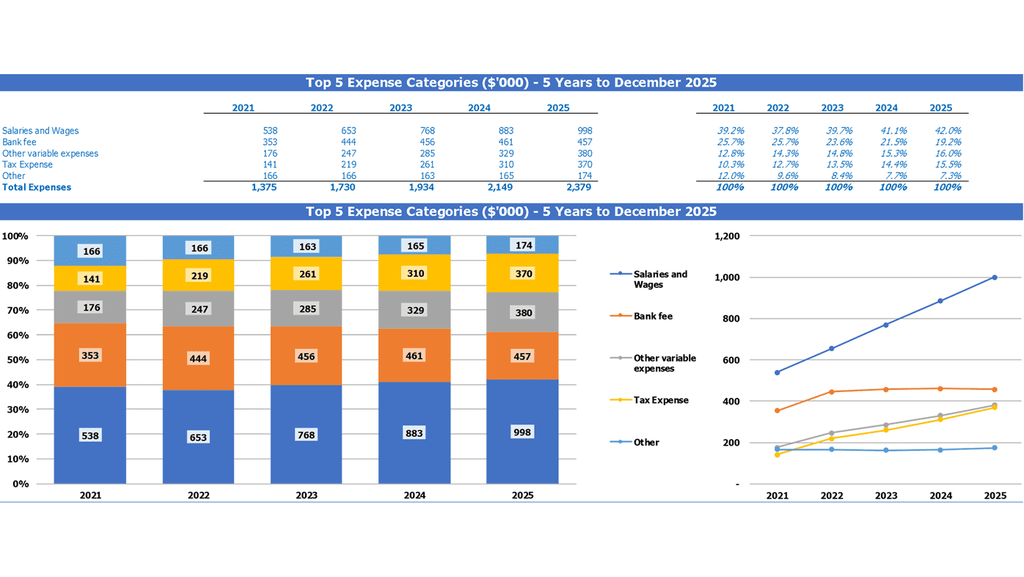

Company Top Expenses List

To achieve maximum profitability in the freelance economy, it's crucial to plan and analyze the cost of services. Our freelance management financial model offers a top expense tab on our P&L template excel, which summarizes the top four expenses, enabling users to view and plan better strategies to decrease them. It's equally vital for both startups and established companies to monitor their services' cost and plan strategies for high profitability in the ever-growing gig economy. Don't miss out on optimizing your business's financial model- start planning today!

Freelance Platform Financial Projection Expenses

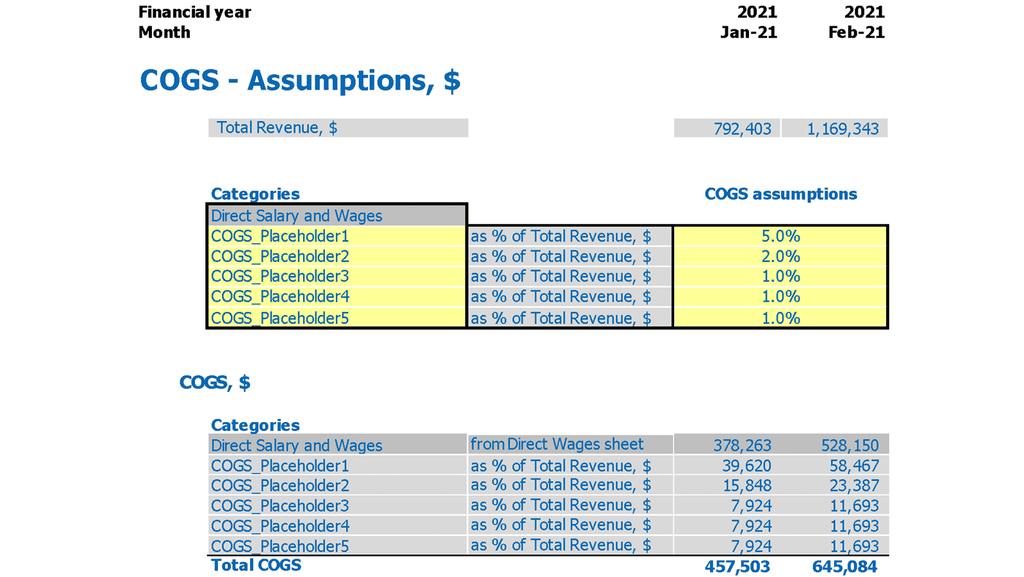

Costs

A robust financial model is crucial for the success of a freelance marketplace or online platform. It can help businesses forecast expenses, identify cost-saving opportunities, and secure funding from investors and loans. Whether you're operating in the gig economy, crowdsourcing, or peer-to-peer marketplace, having a well-developed financial plan is essential. As a freelancer or independent contractor, understanding your financial model can provide insights into virtual workforce management, outsourcing, and talent acquisition. Developing a financial model for a freelance business or services can help navigate the challenges and opportunities of the freelance economy.

Startup Budget

In today's freelance economy, financial planning is crucial for success. Startups and growing companies alike must consider CapEx as part of their financial models. For savvy investors and financial analysts, capital expenditures are a key indicator of a company's health. While they may not significantly impact monthly cash flow statements, they can represent a significant portion of company expenditures. Effective financial management means reflecting CapEx in projected balance sheets for startup businesses. Don't overlook this important factor when building your own freelance marketplace or peer-to-peer platform.

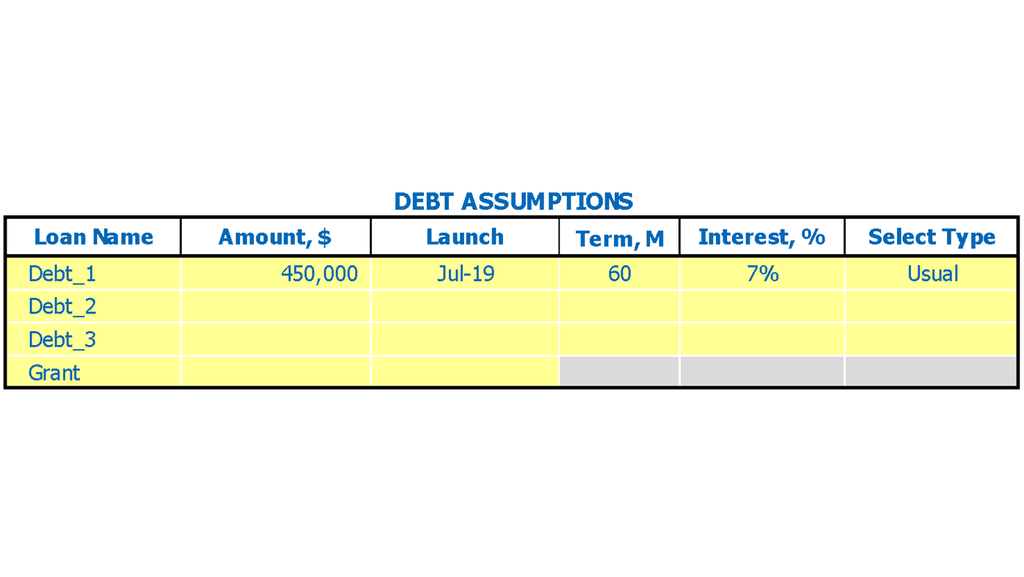

Loan Financing

Our freelance marketplace financial model incorporates a comprehensive financial plan for the gig economy, including online freelance platforms, crowdsourcing, and peer-to-peer marketplaces. We provide a professional and engaging financial model for self-employment, independent contractors, virtual workforces, and outsourcing services. Our model includes pre-built algorithms to calculate the repayment schedule for any loans the company may have, indicated by loan amortization planning. With our template, businesses can stay on track for their financial goals with ease and precision. Our freelance talent financial model also provides management tools to optimize performance and improve profitability in the freelance business.

Freelance Platform Excel Financial Model Metrics

Performance KPIs

Tracking sales growth is crucial for any type of freelance marketplace or online platform that operates in the gig economy. The financial planning model should monitor year-to-date sales growth, allowing users to track sales volumes on a daily, weekly, monthly, or annual basis. This gives freelance management insight into where sales are increasing or decreasing and helps track progress towards goals. If there are multiple sales teams, the metric should be monitored separately to monitor each team's individual achievements. This data is essential for the success of freelance business financial planning and freelance economy financial models.

Pro Forma Cash Flow

A solid financial model is key for any successful freelance marketplace or online platform. Whether you're operating in the gig economy, using crowdsourcing, or offering a peer-to-peer marketplace, understanding the financial underpinnings of self-employment and independent contracting is critical. By carefully planning your virtual workforce, outsourcing strategies, and freelance talent management, you can create a sustainable business model that maximizes revenue and minimizes risk. Accurate financial projections and reporting are key to this, so make sure your freelance business financial model includes detailed cash flow forecasts and future planning to ensure success in the competitive freelance services market.

KPI Benchmarks

Our financial modeling tool is perfect for analyzing the freelance economy. Whether you're running a self-employed business or managing a virtual workforce, our projections will help you plan for success. With our benchmarking capabilities, you can compare your performance to industry standards and identify areas for improvement. Whether you're using a freelance marketplace, a crowdsourcing platform or a peer-to-peer marketplace, our tool will provide valuable insights into your financial performance. Let us help you plan for a prosperous freelance business with our intuitive financial model.

Forecasted Income Statement

Creating a financial model for a freelance marketplace or online platform requires careful attention to forecasting projections. Historical data is crucial in making assumptions or following pre-existing patterns to ensure the accuracy of the projected income statement template, which impacts the balance sheet and cash flows. Financial planning for the gig economy or freelance economy also requires vigilance in factoring various challenges to create accurate assumptions for the monthly profit and loss statement template, essential for business owners, investors, and creditors to verify profitability. Additionally, freelance management and talent, as well as outsourcing and crowdsourcing, require different financial models to support self-employment and independent contractors in the virtual workforce.

Pro Forma Balance Sheet Template Excel

Our startup offers financial planning for freelance businesses in the gig economy. Our pre-built proforma balance sheet helps stakeholders see the relation of assets and liabilities with income and expenses. For instance, sales growth affects the revenue section in profit/loss projections and assets section in balance sheets. Our platform helps manage freelance talent, providing a virtual workforce to outsource work, making self-employment as an independent contractor easier. With our online freelance marketplace financial model, we offer a comprehensive solution for crowdsourcing and freelance management. Our freelance services financial model provides useful insights to manage your freelance business efficiently.

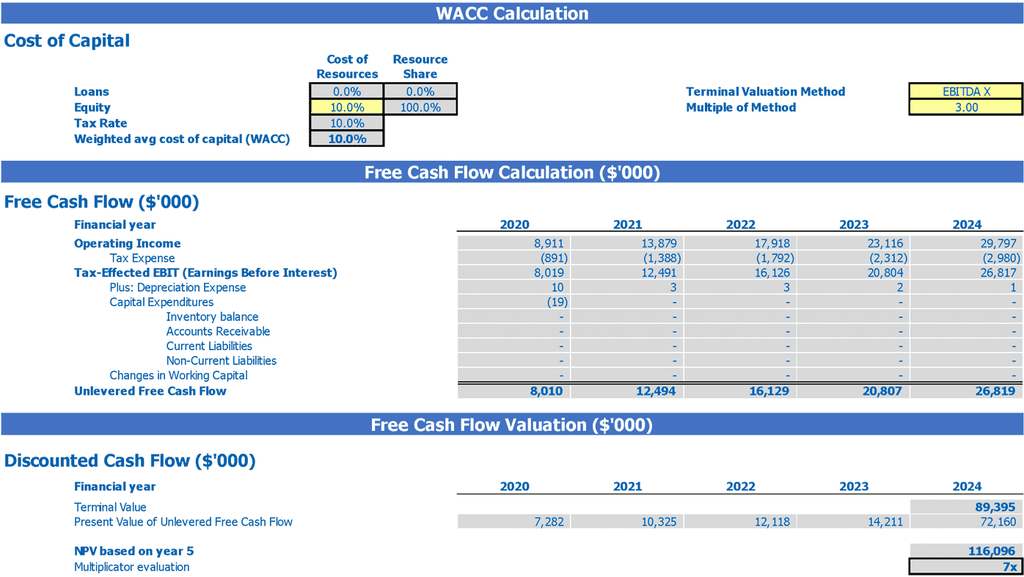

Freelance Platform Financial Projection Template Valuation

Startup Valuation Revenue Multiple

Our 5 year financial projection includes two valuation methodologies to accurately predict a freelance marketplace's financial performance. Our discounted cash flow (DCF) and weighted average cost of capital (WACC) computations align with current industry standards and ensure reliable projections. Our financial planning covers a range of freelance services, including online platforms, peer-to-peer marketplaces, and crowdsourcing. We also consider the growing trend of self-employment and the virtual workforce, making our freelance economy financial model a comprehensive and valuable resource for freelance management and talent.

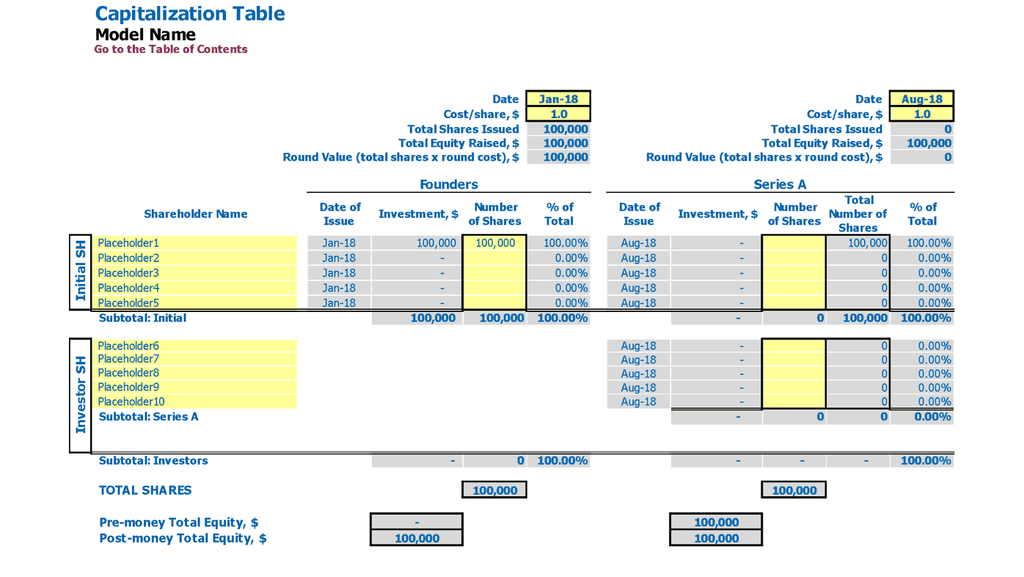

Capitalization Table

A strong financial model is key for any freelance marketplace or gig economy platform. Whether it's a peer-to-peer or crowdsourcing platform, proper financial planning is essential for success. Our freelance economy financial model helps self-employed contractors and virtual workers manage finances, while also providing a clear view of profits for investors. Our freelance management and talent models ensure that freelance services are allocated correctly, making it easier for companies to manage outsourcing. With our freelance economy financial planning, you can streamline your business and maximize profits with ease. And with our cap table excel, investors can rest assured that they're investing in the right place.

Freelance Platform Five Year Financial Projection Template Key Features

Run different scenarios

Using a financial model tailored to the freelance economy, freelancers can forecast their cash flow and adjust input amounts to see the impact on their business.

Integrated Model to convince Investors

Our freelance marketplace financial model forecasts earnings and expenses for 5 years.

Get it Right the First Time

Understand the benefits and drawbacks of freelance marketplace financial planning with our business forecast template.

Better decision making

Improve decision-making with pro forma cash flow scenarios in Excel for better financial planning in the freelance economy.

Saves you time

Maximize your freelance earnings with a solid financial model tailored to the gig economy.

Freelance Platform Business Plan Financial Projections Template Excel Advantages

Utilize two valuation methods with our financial model template for a freelance platform startup.

Ensure financial stability with a 5-year cash flow projection template for your freelance marketplace.

Create a solid financial model for your freelance business using our business plan projections template.

Make informed hiring decisions with a profit and loss projection of your chosen freelance marketplace's financial model.

{Accurately predict future earnings and expenses with a freelance financial model.}