ALL IN ONE MEGA PACK - CONSIST OF:

Industrial Property Development Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

INDUSTRIAL PROPERTY DEVELOPMENT REAL ESTATE PROFORMA TEMPLATE INFO

Highlights

Generates 5-year Industrial Property Development pro forma excel template, cash flow forecasting model excel, financial dashboard, and core metrics in GAAP/IFRS formats automatically. Industrial Property Development pro forma excel template real estate helps to estimate required startup costs. Unlocked - edit all.

The Industrial Property Development pro forma excel template is an ideal Industrial Property Development for your Industrial Property Development business which enables you to reduce and manage risk in your financial plans and provides you an in-depth analysis of future financial projection, investors equity valuation, and cash inflows and outflows with all relevant input tables, charts, and graphs. The model use various functionality of loan, investment, capital injection, realistic assumptions, and sensitivities on unit sales and pricing. Summary tabs also have been added for NPV, Share in Equity, IRR, and break even excel.

Description

This Inventory Control Software 3 Way Financial Model is a very detailed Financial Projection Excel that takes into account the specifics of the real-estate niche that is the Industrial Property industry.

This is a tool for modeling a new Industrial Property , including the development costs, refinance, operational projections and eventual sale. The template is monthly in nature, and it is a 100% unlocked Excel file with fully transparent formulas that can be further tailored to suit your particular needs.

The development expenses are modeled following a bell-curve with spiky, medium and flat opt-in, meaning that construction expenses are projected in a way that you may distribute costs from the beginning till the end using 3 ways of ramp up.

Taking into account key assumptions as occupancy rates, the average check per different room types, and the combination of fixed and variable costs, this Financial Projection Model Template provides a framework to project a monthly and annual Industrial Property cash flow analysis template, and thus reckoning the unique attributes of the segment. The Budget Financial Model also forecasts the expected Income, Balance sheet and cash flow chart excel on a monthly and annual basis; however for financial modeling, valuation, and investment analysis, the users should focus on the startup cash flow statement.

The Inventory Control Software Financial Projection Model also contains a standard 4-tier IRR hurdle waterfall model to distribute proceeds between the general partner and limited partner. The user has the ability to adjust the equity share for GP and LP as well as the hurdle rate in each tier.

The Cash Flow Format In Excel also allows the user to develop scenarios based on the variation of key metrics, namely occupancy rate, COGS, supplies costs, and changing in average check per guest. After modeling the scenarios, the user can make the comparison between them side-by-side.

INDUSTRIAL PROPERTY DEVELOPMENT REAL ESTATE MODEL REPORTS

All in One Place

Our organized Industrial Property Development real estate development models joins and partners all you need for examiners' social occasion. It has financial assumptions, proformas, tallies, pay measures, and various templates. What's more, our real estate waterfall model xls presents it in a theorist friendly way.

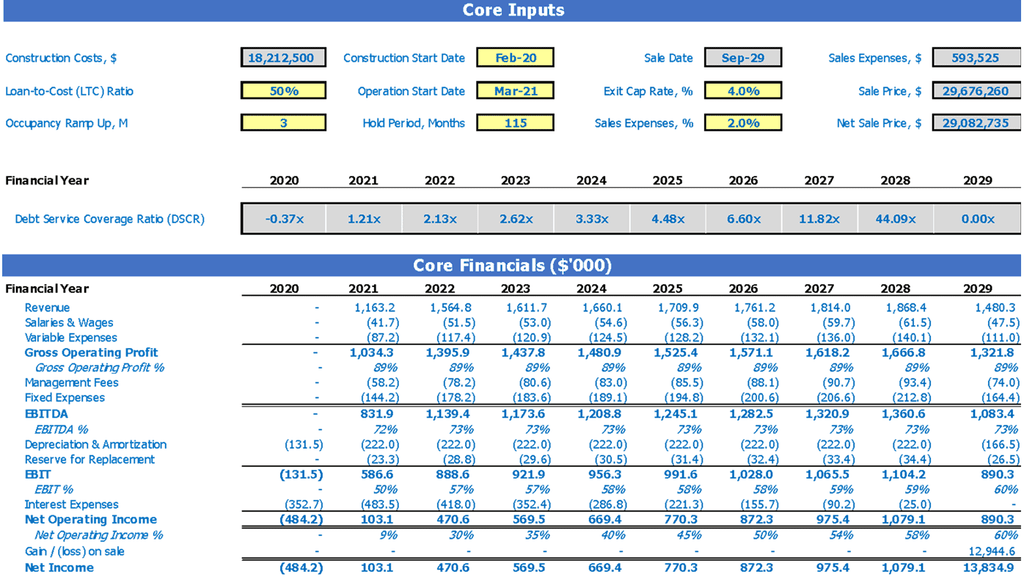

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

NOI & EBITDA

Net Operating Income and EBIDTA chart

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

INDUSTRIAL PROPERTY DEVELOPMENT PROFORMA REAL ESTATE ADVANTAGES

Mortgage financing assumptions

Inventory Control Software Finance Projection with a Dynamic hard cost allocation based on a Straight Line

Bell Curve distribution of Soft Costs by individual line item

Our real estate analysis software lets you quickly build a real estate proforma for any income producing property. Easily handle complex lease terms with changing rent escalations, lease expirations, reimbursements, tenant improvements, leasing commissions, market leasing assumptions, and even renewal probabilities.

Inventory Control Software Three Statement Financial Model with a dynamic hard cost allocation based on a Bell-Shaped (Spiky, Medium, and flat) curve