ALL IN ONE MEGA PACK INCLUDES:

Insurance Agency Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Insurance Agency Pro Forma Info

Highlights

Looking for a sophisticated 5 year insurance agency business plan financial template? Our insurance agency financial planning software provides financial projections, revenue forecasting, financial analysis and management, budgeting, reporting and performance analysis. You can evaluate your startup idea, plan your costs and project your financial performance with our insurance agency financial projection template excel. Even with minimal previous financial planning experience and minimal knowledge of Excel, our template is user-friendly and fully unlocked for editing.

Our insurance agency financial metrics include financial statement analysis, financial ratios and a financial dashboard. We provide reliable and quick results to help you plan your insurance agency financial management, profitability and growth.

For insurance agencies looking to improve their financial performance, utilizing financial planning tools such as budgeting, financial reporting, and revenue forecasting can be crucial. By analyzing financial metrics and using financial dashboard software, agencies can make informed decisions about their financial management and prioritize profitability. Additionally, using accounting and financial statement analysis can help agencies understand their current financial position and develop financial projections for the future. Utilizing a sophisticated insurance agency 5 year financial projection template in Excel can impress investors and demonstrate a solid financial model for the agency.

Description

This insurance agency financial model template startup developed by our team is an essential tool for estimating the financial feasibility of launching or running an insurance agency. The model provides a 5-year financial forecast based on assumptions about the company's performance in the future, in addition to historical performance. This tool enables you and your investors to analyze and monitor your company's financial performance to make informed business decisions.

The insurance agency Excel startup financial model template xls provides a summary of three financial statements for the next 5 years, including a forecasted income statement, balance sheet forecast, and cash flow projection. Additionally, it is a highly efficient way to calculate relevant metrics such as Free Cash Flows to the Firm, Internal Rate of Return, Discounted Cash Flow, and break-even analysis. With this tool, determining the volume of initial capital investments and working capital requirements essential to finance the project is now more straightforward, leading to better forecasting of monthly sales and expenses.

The objective of this financial model is to provide you with dynamic tools that present abstract representations of financial decision-making situations. Furthermore, it allows you to evaluate risks and cost-effectiveness against various input assumptions, to determine effective solutions in evaluating financial returns, and understand the impact of constraints to make the most optimal business decisions.

Business Plan For Insurance Agency Reports

All in One Place

Our financial planning software offers insurance agencies a complete suite of tools, including forecasting, budgeting, and reporting, to help them achieve optimal financial performance. With our intuitive dashboard, you can easily monitor your financial statements, analyze key metrics and ratios, and make informed decisions to improve profitability. Our automated templates, including P&L, balance sheet, and cash flow statements, take the guesswork out of financial planning, so you can focus on growing your business. Let us help you take your insurance agency to the next level with our cutting-edge financial analysis tools.

Dashboard

Our financial planning software presents insurance agency financial analysis and forecasting including revenue projections, budgeting, and financial reporting. We provide insurance agency financial management with financial statement analysis, financial ratios, and financial metrics. Our financial dashboard provides indicators in the form of charts, graphs, and excel statements that are ready for immediate application to improve insurance agency profitability. We prioritize accuracy and ensure the integrity of every insurance agency's financial projections with our advanced accounting system.

Company Financial Statement

Insurance agencies can use financial planning software to create financial projections, budgets, and reports. Financial analysis, statement analysis, and ratios are essential to evaluating the agency's profitability, financial performance, and revenue forecasting. An income statement or profit and loss projection is a critical financial statement template that focuses on revenue and expenses for a specific period. In contrast, a balance sheet snapshot shows the agency's net worth during a specific time. Remember that income statements don't differentiate between cash and non-cash transactions, which differs from a cash flow excel spreadsheet.

Use Of Funds

Effective financial planning is crucial for insurance agencies to improve profitability and maintain financial health. This involves tasks such as revenue forecasting, financial analysis, budgeting and financial reporting. With the help of financial planning software, insurance agencies can also track financial metrics, build financial projections, and monitor performance through financial dashboards. Financial statement analysis is also important to identify trends and ratios that can impact the overall financial performance of an agency. Proper financial management and accounting practices provide a strong foundation for insurance agencies to achieve long-term success.

Break Even Point In Sales Dollars

Effective financial planning is crucial for the success of insurance agencies, which require accurate revenue forecasting, financial projections and analysis, and effective management of financial performance. Insurance agencies can benefit from using financial planning software, financial metrics, financial dashboards, and financial statement analysis to understand their financial ratios and make informed decisions. Break even analysis reports also offer insights by showing the amount of annual revenue needed to cover variable and fixed costs. With proper budgeting, reporting, and accounting practices, insurance agencies can optimize their profitability and financial stability.

Top Revenue

In the realm of insurance agencies, financial planning is crucial for ensuring profitability and success. Revenue forecasting and financial projections are key aspects of this planning, as are financial analysis and reporting. Budgeting is also essential for managing agency finances and ensuring financial performance. Insurance agency financial management software provides a valuable tool for implementing these strategies. When evaluating agency financial performance, metrics such as top-line growth and bottom-line profit are particularly important. By analyzing financial statements and ratios, analysts and investors can gain insights into an insurance agency's financial health and potential for growth.

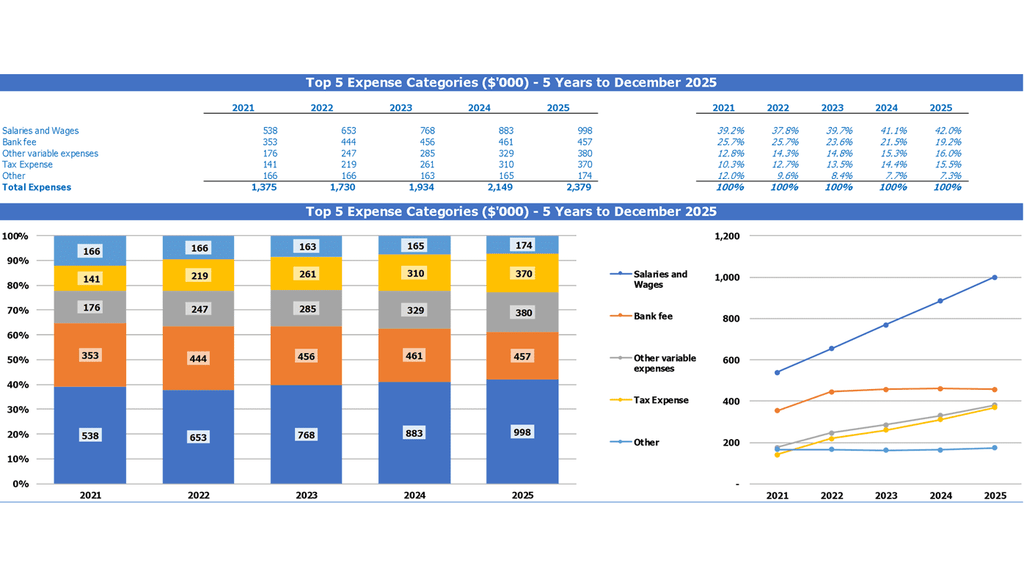

Business Top Expense Categories

Effective financial planning is vital for insurance agencies aiming to maximize profitability. Insurance agency financial analysis can be performed using metrics and ratios to inform budgeting and revenue forecasting. Financial statement analysis, reporting, and projections can be made simpler by implementing financial planning software with a dashboard to track the agency's financial performance over time. Remember, expenses are a crucial component of financial management, utilize tools like projected cash flow statement templates to analyze expenses and optimize budgets for maximum insurance agency profitability.

Business Plan Insurance Agency Expenses

Costs

Our comprehensive financial planning software offers insurance agencies efficient tools for analyzing financial performance, creating financial projections, and managing budgets. Our financial modeling template incorporates expense forecasting capabilities, allowing for detailed expense planning and cost budgeting. With features such as percentage of revenues and growth rates, our template offers flexibility in expense categories such as COGS, variable or fixed expenses, and Wages or CAPEX, ensuring accurate financial reporting and analysis with detailed financial metrics and a financial dashboard.

Capital Expenditure Forecast

For insurance agencies, financial planning is crucial for ensuring profitability and growth. This involves forecasting revenue, analyzing financial data, and creating budgets and projections using financial planning software. Financial reporting, statement analysis, and the use of financial metrics and dashboards are essential components of insurance agency financial management. Additionally, monitoring financial ratios and accounting for capital expenditures can provide a complete picture of the company's financial position and aid in predicting future growth. Overall, effective financial planning is key to success in the insurance industry.

Debt Financing

Financial planning for insurance agencies includes forecasting revenue, projecting financials, analyzing profitability, managing finances, budgeting, reporting financial performance, accounting, and using financial planning software to track metrics and create dashboards. One crucial aspect is financial statement analysis, including ratios and a loan amortization schedule that details loan amount, interest rate, maturity, payment periods, and amortization method. Loan methods include straight line, declining balance, annuity, bullet, balloon, and negative amortization, all of which should be considered when creating a startup costs spreadsheet for insurance agencies.

Insurance Agency Startup Business Plan Metrics

Profitability KPIs

When it comes to financial planning for insurance agencies, it's crucial to consider revenue forecasting, financial projections, analysis, and management. Effective budgeting, reporting, and accounting practices are necessary to improve profitability and ensure financial performance. Utilizing financial planning software and metrics, along with a financial dashboard, can maximize the impact of strategies implemented by the agency. Financial statement analysis and ratios, including internal rate of return (IRR), are essential indicators to evaluate return on investment for investors and analysts.

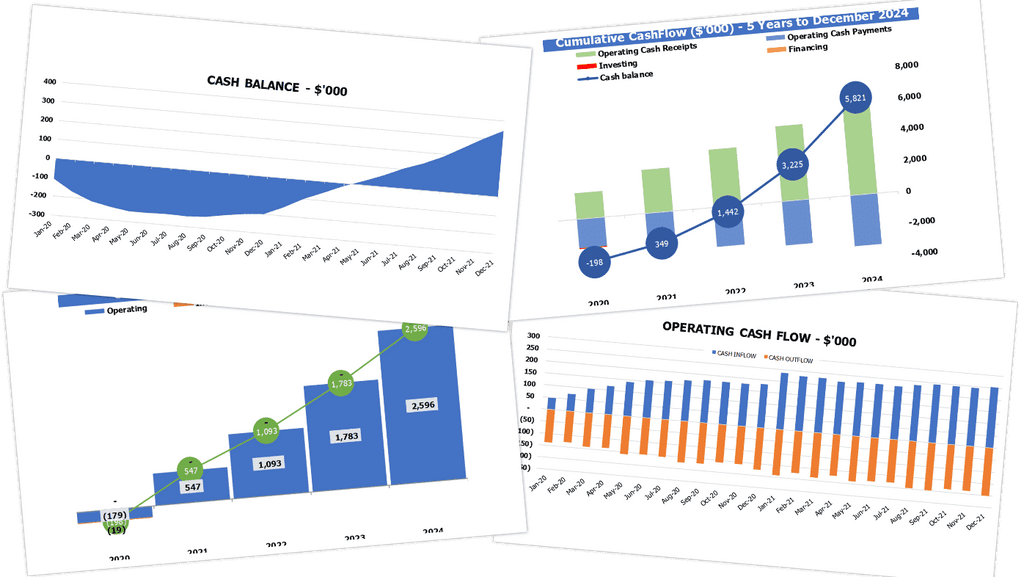

Cash Flow Statement Excel Template

Insurance agencies can greatly benefit from financial planning, analysis, and reporting. By using financial management tools such as budgeting, revenue forecasting, and financial statement analysis, agencies can improve their profitability and overall financial performance. Utilizing financial metrics, dashboards, and ratios can also provide insights into an agency's financial health. Implementing financial planning software can streamline financial reporting and projections, giving agencies a broader view of cash flows. A well-designed business plan financial projections template excel can provide a 5 year cash flow projection, allowing agencies to plan and make informed financial decisions.

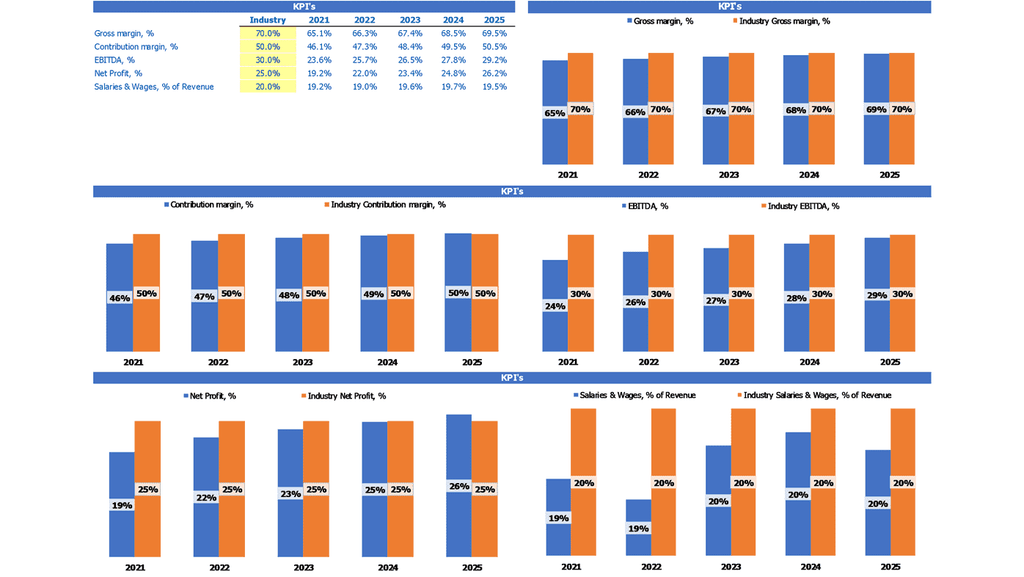

Business Benchmarks

Effective financial planning is crucial for insurance agencies to maintain profitability and manage their budgets. This involves regular financial forecasting and analysis, as well as utilizing financial planning software and metrics. A financial dashboard and statement analysis can help evaluate the company's performance and determine the best methods for success. Startups, in particular, benefit from this kind of analysis to guarantee positive results and enable strategic management. By tracking and recording all financial indicators and ratios, insurance agencies can make informed decisions and maintain financial stability.

Profit And Loss Forecast Template

For insurance agencies to boost monetary profits, a robust financial management strategy must be implemented. The usage of financial planning software, thorough budgeting and revenue forecasting significantly increases profitability. Financial analytics, performance, and reporting tools aid in breaking down metrics, ratios, margins, and financial statement analysis, all vital for evaluating insurance agency financial performance. Additionally, yearly forecasting for income statements gives comprehensive insights into revenue, operating expenses, and net income percentage, ultimately giving creative approaches for enhancing profitability.

Balance Sheet Forecast

Financial planning for insurance agencies is a crucial aspect of ensuring profitability and success. Using insurance agency financial planning software can assist with insurance agency financial projections, budgeting, and revenue forecasting. Insurance agency financial reporting, analysis, and accounting can provide valuable insights to improve financial performance. Measuring financial metrics through insurance agency financial dashboard and statement analysis can help in developing financial ratios. Among these, forecasting the projected balance sheet template excel forms a critical role in developing the cash flow forecast excel, allowing investors to measure profitability ratios and determine net income projections' realism.

Insurance Agency Startup Business Plan Valuation

Pre Revenue Startup

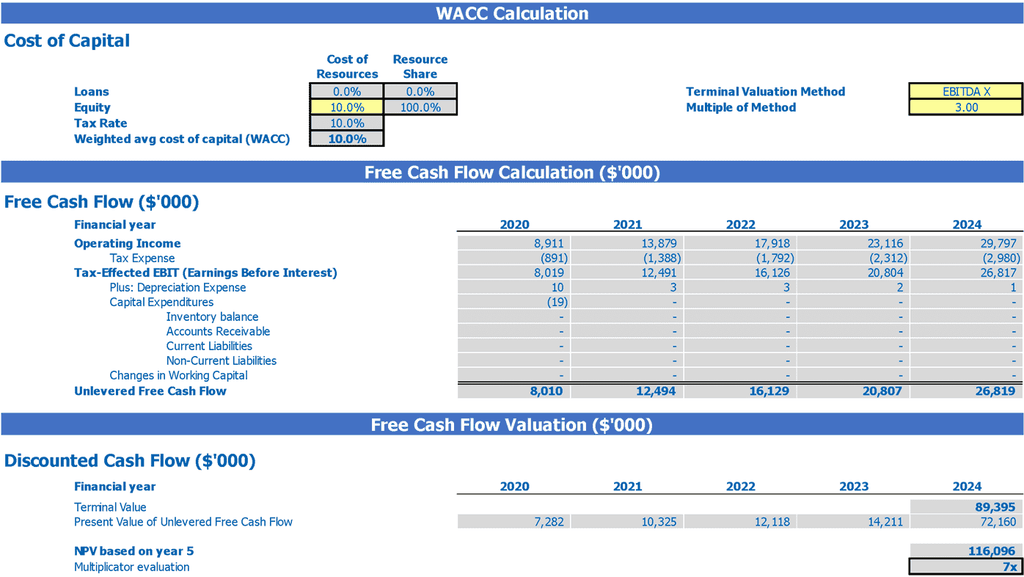

Effective financial planning is crucial for insurance agencies to achieve profitability and sustainability. This involves revenue forecasting, financial projections, analysis, budgeting, reporting, and performance measurement. By utilizing financial planning software and metrics, insurance agencies can create financial dashboards and perform statement and ratio analysis to ensure efficient financial management. Net Present Value (NPV) is a key tool used to evaluate investment opportunities and foresee future cash flows. Financial forecast templates also include crucial information such as investment requirements, equity raised, future values, net income, total investment, WACC, EBITDA, and growth rates to aid in strategic decision making.

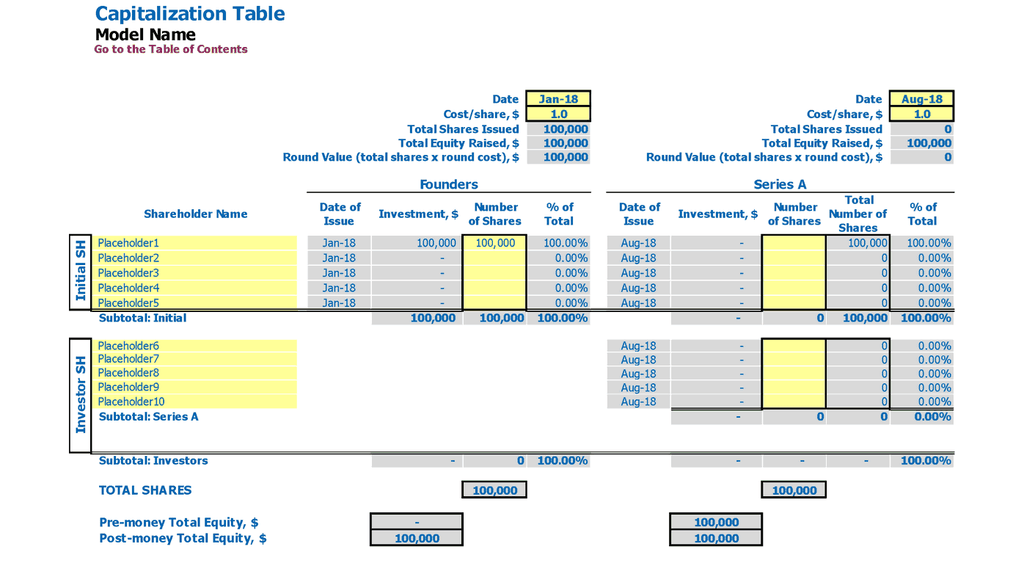

Capitalization Table

Maximize the profitability of your insurance agency with our comprehensive suite of financial planning solutions. Leverage our advanced financial planning software to accurately forecast revenue and analyze financial metrics, ratios, and statements. Our simple cap table helps you evaluate exit value and investor returns, while our built-in proformas enable you to calculate discounted cash flows and EBIT valuations effortlessly. With our powerful financial dashboard, budgeting, reporting, and performance tracking tools, you can stay on top of your agency's financial health and make informed decisions to drive growth and success.

Insurance Agency Startup Financial Model Template Excel Free Key Features

Easy to follow

Streamline insurance agency financial planning with a comprehensive, user-friendly software featuring 15+ color-coded tabs.

Simple-to-use

Maximize insurance agency profitability with user-friendly financial planning software and comprehensive financial analysis tools.

Simple-to-use

Efficiently project insurance agency financial performance with an easy-to-use template requiring minimal planning experience and basic Excel skills.

Works for startups

Maximize insurance agency profitability with financial planning software and detailed financial analysis.

Spot problems with customer payments

Maximize insurance agency profitability through financial planning, budgeting, forecasting, and analysis using financial metrics, dashboard, statement analysis, and ratios.

Insurance Agency Proforma Business Plan Template Advantages

Create accurate financial projections with our comprehensive insurance agency financial planning software.

Utilize financial planning software for insurance agencies to forecast revenue and analyze financial performance with metrics and a dashboard.

Maximize insurance agency profitability with effective financial planning software.

Utilize financial planning software to create accurate projections for insurance agency expenses.

Create a comprehensive revenue model for your insurance agency using financial planning tools and analysis.