ALL IN ONE MEGA PACK INCLUDES:

Locksmith Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

Locksmith Startup Budget Info

Highlights

A comprehensive and advanced locksmith business plan is crucial for your business's financial management and success. Utilizing financial tools such as revenue streams, financial analysis, profitability, cash flow, budgeting, financial forecasting, break-even analysis, cost management, financial performance, financial planning, financial projections, financial statements, financial management, and financial strategy can ultimately increase your business's potential. With a 5-year forecast template, this plan can estimate your startup costs, support future financial planning, and turn your business idea into reality. Whether you have previous financial planning experience or minimal knowledge of Excel, this template is designed to provide quick and reliable results that are fully customizable to fit any business size and stage of development. So, unlock the potential of your business and edit everything to fit your needs with this unlocking financial modeling for startups.

A locksmith business plan must include financial analysis, budgeting, forecasting, statement, management, strategy, projections, and cost management. Profitability, revenue stream, cash flow, and break-even analysis are important financial performance metrics. Use a locksmith financial projection excel template, being detail-oriented, and ideal for the locksmith business to monitor investors’ equity valuation, analyze and project financials to make smart decisions. The financial planning objective is to grow the business, keep threats away, improve financial wealth, and build a good reputation within the community.

Description

Starting a locksmith business requires a solid financial plan to ensure its success. Our team has developed a comprehensive locksmith bottom-up financial model to provide a detailed reporting and evaluation tool for your business. Our locksmith 5-year cash flow projection template in Excel includes a projected income statement, balance sheet, and cash flow statement. The financial model calculates relevant metrics such as Free Cash Flows to the Firm, Internal Rate of Return, Discounted Cash Flow, and break even point in sales dollars, allowing you to determine the initial capital investments and working capital requirements needed to finance the project. With this tool, you can also make monthly sales and expenses forecasts, evaluate financial returns, and understand the impact of financial constraints to make optimal business decisions.Locksmith Financial Plan Reports

All in One Place

Creating a comprehensive locksmith business plan involves financial analysis and planning. By using financial projections and cash flow forecasts, entrepreneurs can determine revenue streams, manage costs, and assess profitability. Break-even analysis helps to determine the point at which a locksmith business becomes profitable. Effective financial planning and budgeting strategies are crucial for success in the industry. A well-thought-out financial model template allows entrepreneurs to make informed decisions about their business, including financial performance, forecasting, and management. Overall, proper financial management strategies are essential to building and sustaining a successful locksmith business.

Dashboard

Sharing access to your locksmith business's cash flow projection and financial statement dashboard can enhance your financial analysis, budgeting, and forecasting capabilities. By expanding your financial management strategy, you will gain insights for cost management, break-even analysis, and revenue stream projections. This information will help you make smart financial decisions and improve your locksmith profitability and financial performance. As a professional locksmith, it's important to engage in financial planning and create financial projections that align with your company's goals and vision.

Financial Statements Format

Our locksmith business plan relies on careful locksmith financial analysis and planning for profitability. We prioritize locksmith cost management and financial statement tracking alongside budgeting and cash flow forecasting. Our locksmith financial strategy includes regular financial performance reviews and break-even analysis to ensure we're on track to meet financial projections. Using cutting-edge tools, we ensure our locksmith financial management is optimized to achieve our revenue stream goals. Our locksmith financial planning is built on solid foundations, with financial projections generated by our automated financial projection startup.

Sources And Uses Chart

The sources and uses of capital statement is a vital tool for locksmith businesses to identify revenue streams and manage their financial performance. By outlining where capital comes from and how it will be spent, locksmiths can create a financial plan that includes forecasting, budgeting, cost management, and break-even analysis. This report helps businesses evaluate their financial position and make informed decisions on recapitalization, restructuring, or M&A transactions. With accurate financial projections, locksmiths can ensure profitability and maintain a healthy cash flow while achieving their long-term financial goals.

Break Even Point Analysis

As a locksmith entrepreneur, it's crucial to have a comprehensive financial plan that includes a budget, financial statements, cash flow analysis, and financial projections. Conducting a break-even analysis and other financial indicators such as cost management and revenue streams can also help in determining the profitability of the business. Moreover, using financial forecasting tools like CVP graphs and setting a financial strategy can aid in achieving long-term success. Therefore, as a start-up, it's essential to understand the company's financial performance and make informed decisions to ensure financial stability and growth.

Top Revenue

A locksmith business plan requires careful consideration of various financial aspects, such as revenue streams, profitability, cash flow, budgeting, financial forecasting, and cost management. To ensure financial success, locksmiths must focus on financial planning, projections, statements, performance, strategy, and break-even analysis. Both investors and analysts pay close attention to topline revenue growth and bottom line profits or EBITDA, making it crucial for locksmiths to monitor trends in these financial metrics on a quarterly and annual basis. Implementing effective financial management can positively impact a locksmith's overall business performance.

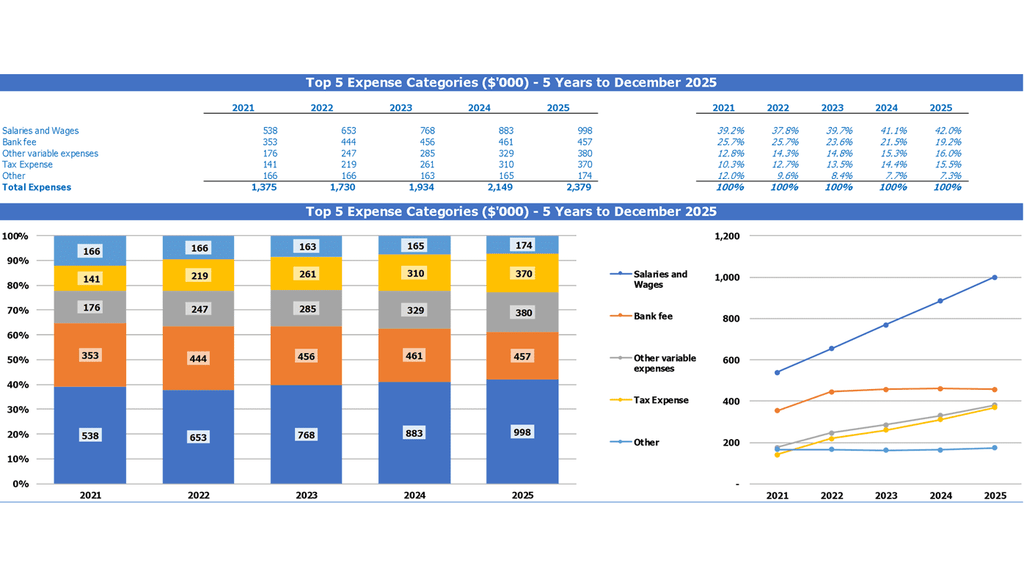

Business Top Expenses List

A locksmith business plan should include financial analysis and planning such as revenue streams, cash flow, budgeting, forecasting, break-even analysis, cost management, and financial projections. Understanding the top line and bottom line of a profit and loss statement are essential for investors and analysts to gauge a company's potential for success. Top-line growth refers to total revenue or gross sales and is expected to positively impact a company's financials. Bottom-line growth refers to net income, indicating growth in a company's profitability net of overhead expenses. A sound financial strategy is crucial for a locksmith's financial performance.

Locksmith Financial Projection Expenses

Costs

A comprehensive financial plan is essential to the success of any locksmith business. By creating financial projections and budgeting for expenses up to 5 years, you can make informed decisions about cost management and revenue streams. Our financial plan template includes preliminary parameters such as income percentages, payroll, current and recurring costs, and more. Variable and fixed expenses, COGS, wages, and startup budget are all allocated and tracked to get a clear picture of your financial performance. Forecasting expenses is critical, and our locksmith financial projection template provides an invaluable tool for financial planning.

Capital Expenditure Forecast

When creating a locksmith business plan, it is essential to consider financial management. This includes a financial analysis of revenue streams, cash flow, cost management, and budgeting. It is also necessary to forecast financial performance, create financial projections and break-even analysis, as well as develop a financial strategy for growth. Capital expenditures (CAPEX) play a significant role in the locksmith business model, as they represent development and performance increases. By analyzing CAPEX budget reports, locksmiths can allocate resources and make informed decisions to maximize profitability.

Loan Financing

As a locksmith business owner, it's crucial to have a sound financial plan in place to ensure profitability and steady cash flow. This includes budgeting, financial forecasting, cost management, and effective revenue stream strategies. With our 3-statement financial model template, you'll have access to a loan amortization schedule to track loan repayment, including principal and interest. This valuable tool will help you analyze your financial statements and make informed decisions to improve financial performance and profitability. Don't leave your financial strategy to chance. Implement effective financial management practices today.

Locksmith Income Statement Metrics

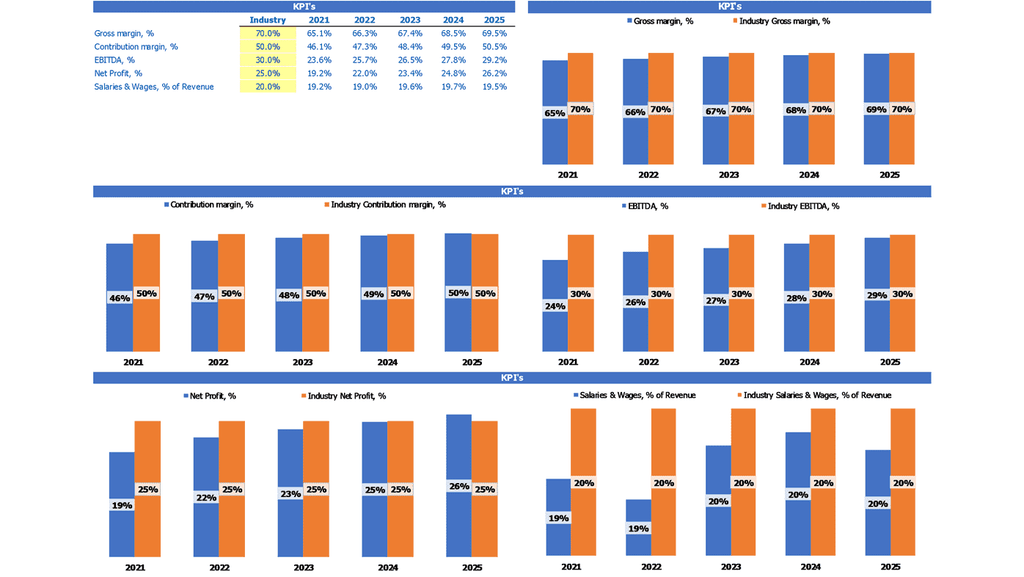

Profitability KPIs

Looking for a comprehensive financial analysis tool for your locksmith business plan? Look no further than our 3-way financial model template! With pre-built financial templates including profit and loss forecast, balance sheet, and cash flow analysis, you can easily monitor and manage your locksmith business's revenue streams, costs, profitability, and cash flow. Use this tool for financial planning, reporting, or investor presentations with confidence. Make informed decisions with key performance indicators and financial ratios at your fingertips. Transform your locksmith financial performance with our expert analysis and forecasting tools.

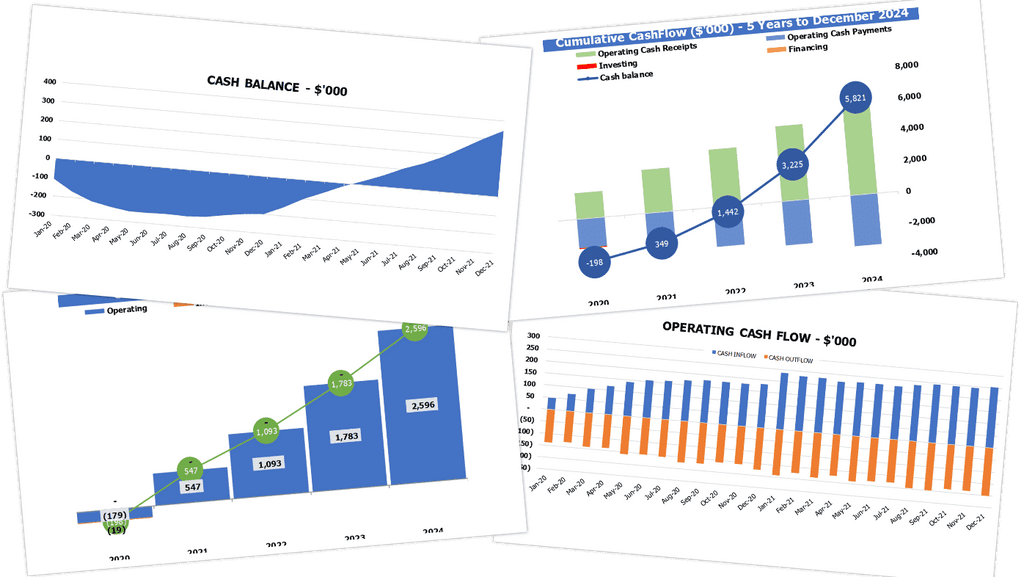

Cash Flow Budget Template Excel

The financial performance of a locksmith business heavily relies on proper budgeting and cost management. A financial analysis, including break-even analysis and financial forecasting, can aid in understanding revenue streams and profitability. Financial planning should focus on strategic projections and effective financial strategies to sustain financial stability, as revealed in financial statements. A focused locksmith financial management strategy can ensure reliable and consistent cash flow, and contribute to the business's success.

KPI Benchmarking Report

Benchmarking is key to the success of any locksmith business plan. By utilizing the financial analysis tools like revenue streams, cash flow, and budgeting, you can determine profitability and make cost management decisions. You can also create financial forecasts and break-even analyses to assess your financial performance and make projections. Utilizing these tools is crucial for both startups and established businesses, allowing you to understand strengths and weaknesses and find the right direction for growth. Don't neglect benchmarking, as it sets the foundation for solid financial planning and management strategies.

Profit And Loss Statement Format Excel

A strong financial strategy is vital for any locksmith business. By developing a comprehensive business plan, budgeting, and financial forecasting, locksmiths can analyze their revenue streams, cash flow, and cost management to ensure profitability. A break-even analysis can help set goals and monitor financial performance. Financial statements, including projected forecasts and annual reports, provide important insights into the locksmith's financial activities and support effective decision-making. A sound financial strategy is crucial for the long-term success of any locksmith business.

Projected Balance Sheet Template

As a locksmith business owner, effective financial management is crucial to ensure profitability and success. Utilizing tools such as budgeting, financial forecasting, and break-even analysis can aid in cost management and promoting financial planning. Additionally, keeping an eye on revenue streams and monitoring cash flow can help to maintain steady financial performance. By developing a comprehensive financial strategy that includes financial statements and projections, locksmiths can stay on track with their financial goals and ensure the longevity and growth of their business.

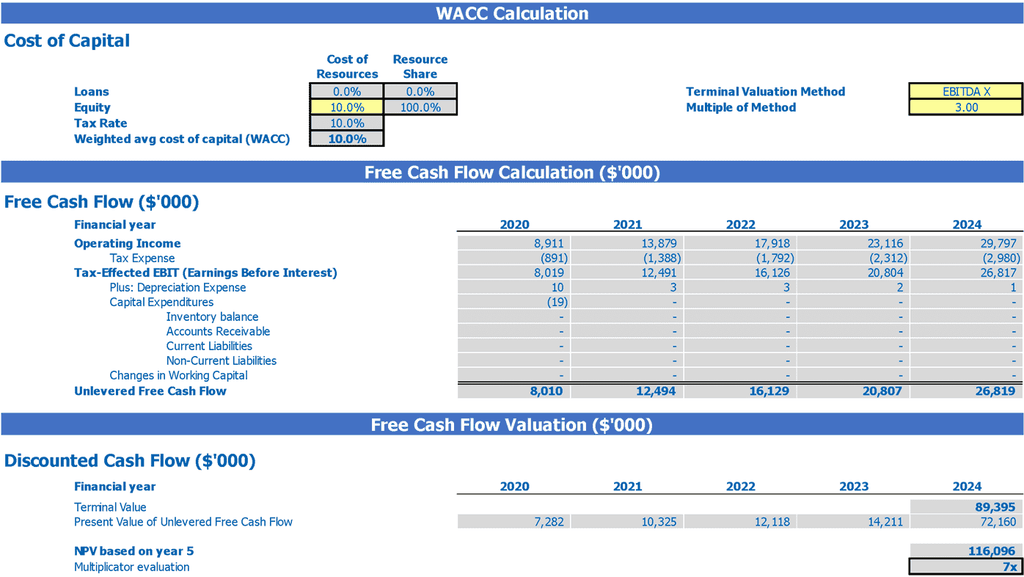

Locksmith Income Statement Valuation

Pre Seed Valuation

Our locksmith business plan includes financial analysis and planning for profitability, cash flow, and cost management. We offer financial forecasting, budgeting, and financial statement analysis to help you achieve optimal financial performance. Our locksmith financial projections include a break-even analysis and a financial strategy for managing revenue streams. We also provide pre-built startup valuations using weighted average cost of capital, free cash flow, and discounted cash flow to show investors the value of your enterprise funds. Let us help you achieve your financial goals with our comprehensive locksmith financial management services.

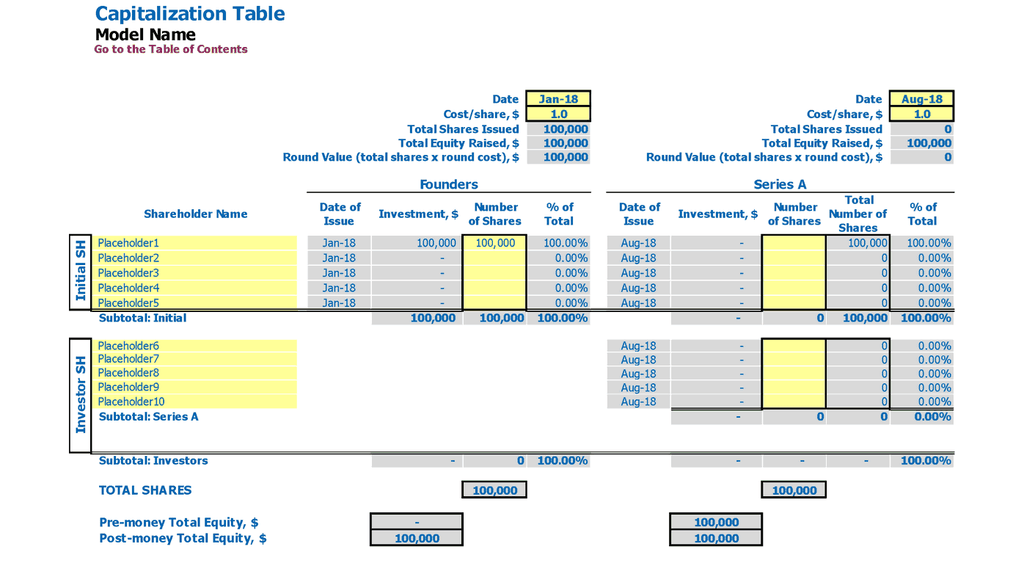

Pro Forma Cap Table

A solid locksmith business plan entails comprehensive financial analysis and planning. Maintaining a steady locksmith revenue stream, managing cash flow and cost, and setting up a feasible budget and financial forecast are essential steps to ensure locksmith profitability. Conducting break-even analysis, financial forecasting, and regular financial statement reviews can help determine locksmith financial performance and make necessary adjustments to optimize locksmith financial management. A well-designed locksmith financial strategy should include financial projections and a cap table, allowing for efficient allocation of assets and better investor communication on expected profits.

Locksmith Financial Model Template Excel Key Features

Convenient All-In-One Dashboard

Our locksmith business plan includes comprehensive financial analysis, budgeting, and forecasting to ensure profitability and efficient cost management.

Identify cash gaps and surpluses before they happen

Effective cash flow projection is crucial for locksmiths to avoid financial crisis and make informed decisions about investment and growth opportunities.

Works for startups

The Startup Pro Forma Template simplifies financial analysis for pitch decks.

Manage accounts receivable

Proactively manage cash flow with projected statements and analyze late payments' impact.

Easy to follow

Maximize locksmith profitability with our comprehensive business plan template featuring 15+ tabs for financial analysis, budgeting, forecasting, and more.

Locksmith Five Year Financial Projection Template Advantages

Maximize your locksmith business plan with a three-statement financial model for improved financial management and decision-making.

Take charge of your locksmith business's financial performance with our comprehensive financial management tools.

Develop a comprehensive locksmith business plan by conducting financial analysis and forecasting revenue, expenses, and cash flow.

Craft a comprehensive financial plan for a locksmith business to ensure profitability and effective cost management.

Maximize cash flow by optimizing accounts payable and receivable timing with a financial projections spreadsheet.