ALL IN ONE MEGA PACK - CONSIST OF:

Office Property Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

OFFICE PROPERTY ACQUISITION REAL ESTATE PROFORMA TEMPLATE INFO

Highlights

The Office Property Acquisition real estate pro forma is a full-dimensional 5-year financial planning template for a company operating in a Office Property Acquisition business niche. The template would suit both a Office Property Acquisition startup as well as a running small Office Property Acquisition. Office Property Acquisition financing real estate development used to evaluate startup ideas, plan startup pre-launch expenses, and get funded by banks, angels, grants, and VC funds. Unlocked - edit all.

The Office Property Acquisition Excel real estate proforma template excel is exceptionally adaptable and flexible, generating a complete financial framework to accurately estimate key financial statements and KPIs over the five years. The model then uses financial ratio analysis and contains a DCF valuation framework to monitor its actual worth. Moreover, anyone can easily edit this real estate cash flow model with basic knowledge of excel and finance by adding information itself. All metrics will be updated automatically after made adjustments in the input sheet. The online toy store model is not solely needed to attract funds, but it also plays a vital role in organizing and analyzing everything correctly from the beginning.

Description

This Inventory Control Software Financial Model In Excel Template will help you to:

- Present main economics of an investment opportunity;

- Estimate rates of return and measure NPV for a Office Property Acquisition;

- Measure operating, capital and financing costs;

- Present the cash flow of an investment;

- Perform valuation of an investment property;

- Assess the feasibility of the refinancing option and an amount of taking out;

- Assess a range of rental and exit scenarios;

- Assess a range of financing options.

The contents are as follows:

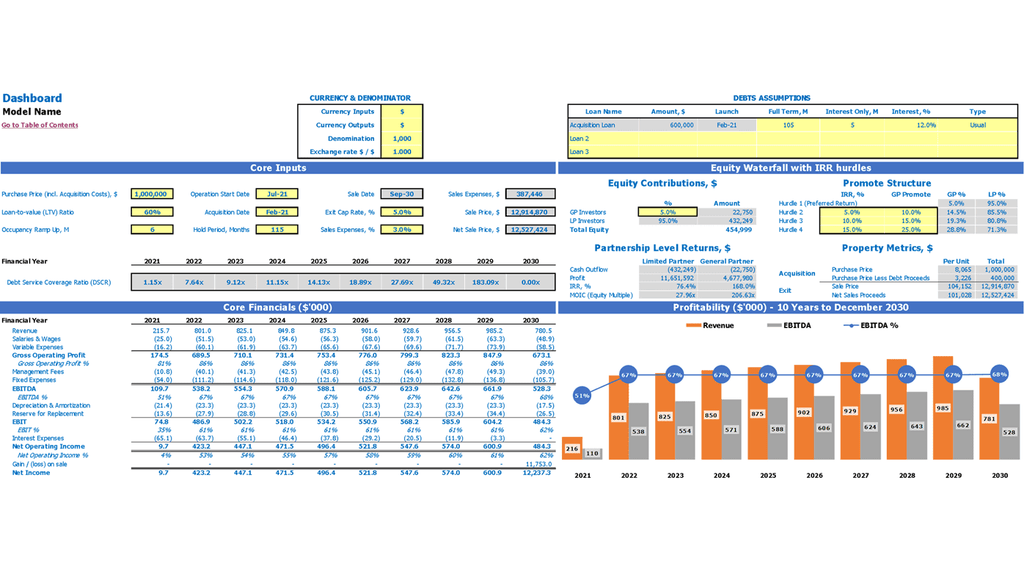

- Dashboard Tab: flexible acquisition and exit dates, mortgage financing assumptions, re-financing assumptions, acquisition costs, growth rates, and sale costs assumptions.

- The renovation schedule based on the number of units renovated and flexible timing of renovation.

- Equity Waterfall Tab: Includes 10 years of monthly cash flow, costs and revenues, IRR, Equity Multiple, Profit Margin, Net Profit, DSCR, Debt Yield, Operating Margin, Cash on Cash, NPV, DCF.

- Monthly Cash Flow: includes operating revenues, operating costs, NOI, capital costs (leasing fees and CAPEX), debt service, and net income.

- Annual Cash Flow.

- Rent Roll with a flexible number of units. Projection of the operating expenses and additional income.

- Project Financing with senior debt amortization, re-financing option, supplemental loan option, and mezzanine financing.

Key Metrics

- Cost/Square Footage (Sqm), Sale Price/Unit, Net Rental Revenue;

- NOI, Debt Service, Net Leveraged Cash Flow;

- NPV, DCF Valuation;

- DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit.

- Exit value for the property is calculated automatically based on NOI for a period and cap rate you assume in your projection.

OFFICE PROPERTY ACQUISITION REAL ESTATE MODEL REPORTS

All in One Place

Get a refined however simple to-utilize real estate financial model xls that is completely expandable. Our strong and incredible Office Property Acquisition real estate pro forma excel template will be your guide for some, extraordinary business models. On the off chance that you have financial experience, you can grow and tailor all sheets as wanted.

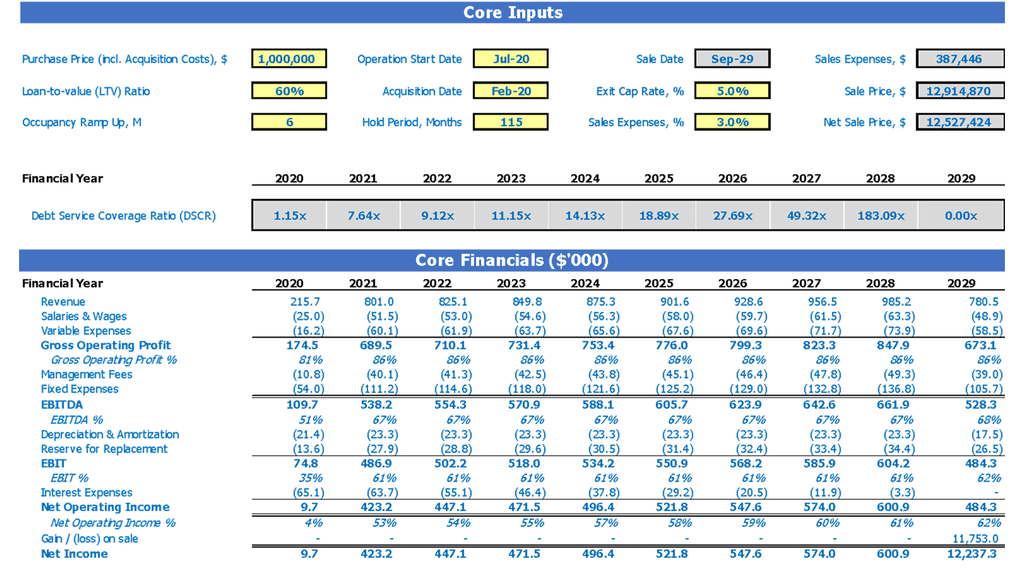

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

NOI & EBITDA

Net Operating Income and EBIDTA chart

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

OFFICE PROPERTY ACQUISITION REAL ESTATE PROFORMA TEMPLATE ADVANTAGES

Mortgage financing assumptions

Flexible unit occupancy feature

Flexible Office Property Acquisition and exit dates

Flexible Office Property operations start date

After creating a real estate proforma, our real estate analysis software will automatically calculate useful financial metrics such as IRR, NPV, cash on cash return, gross rent multiplier, debt service coverage, breakeven occupancy, and more. Plus, get additional financial metrics such as a maximum loan analysis, rent roll, and even a full sensitivity analysis.