ALL IN ONE MEGA PACK - CONSIST OF:

Retail Property Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

RETAIL PROPERTY ACQUISITION REAL ESTATE PROFORMA TEMPLATE INFO

Highlights

Generates 5-year Retail Property Acquisition financing real estate development, cash flow projection template excel, financial dashboard, and core metrics in GAAP/IFRS formats automatically. Used to evaluate a Retail Property Acquisition business before selling it. Unlocked- edit all.

This versatile Retail Property Acquisition real estate spreadsheets is a detailed and ideal pro forma excel template real estate for Retail Property Acquisition business with all relevant input tables, charts, and graphs that enable you to monitor your financial plans and projecting future cash flow analysis spreadsheet and investor’s equity valuation. The model perfectly suits any Retail Property Acquisition business whether it’s a startup or a well-established business. We have included all important financial metrics important for investors, owners, and higher management. These metrics will enable the user to take key management decisions. The model can be used for a financial and business plans, seeking investors and loans.

Description

This Inventory Control Software Excel Financial Model will help you to:

- Present main economics of an investment opportunity;

- Estimate rates of return and measure NPV for a Retail Property Acquisition;

- Measure operating, capital and financing costs;

- Present the cash flow of an investment;

- Perform valuation of an investment property;

- Assess the feasibility of the refinancing option and an amount of taking out;

- Assess a range of rental and exit scenarios;

- Assess a range of financing options.

The contents are as follows:

- Dashboard Tab: flexible acquisition and exit dates, mortgage financing assumptions, re-financing assumptions, acquisition costs, growth rates, and sale costs assumptions.

- The renovation schedule based on the number of units renovated and flexible timing of renovation.

- Equity Waterfall Tab: Includes 10 years of monthly cash flow, costs and revenues, IRR, Equity Multiple, Profit Margin, Net Profit, DSCR, Debt Yield, Operating Margin, Cash on Cash, NPV, DCF.

- Monthly Cash Flow: includes operating revenues, operating costs, NOI, capital costs (leasing fees and CAPEX), debt service, and net income.

- Annual Cash Flow.

- Rent Roll with a flexible number of units. Projection of the operating expenses and additional income.

- Project Financing with senior debt amortization, re-financing option, supplemental loan option, and mezzanine financing.

Key Metrics

- Cost/Square Footage (Sqm), Sale Price/Unit, Net Rental Revenue;

- NOI, Debt Service, Net Leveraged Cash Flow;

- NPV, DCF Valuation;

- DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit.

- Exit value for the property is calculated automatically based on NOI for a period and cap rate you assume in your projection.

RETAIL PROPERTY ACQUISITION REAL ESTATE MODEL REPORTS

All in One Place

This Retail Property Acquisition real estate model reflects all the major pieces of your business. It will be a guide that engages business individuals to understand their business and their perspectives. As a start-up real estate financial modeling xls, it will help appreciate livelihoods and choose the cash utilization rate. This is huge for any business since it shows how long money will last and which accomplishments the business owner can achieve with these employments.

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

NOI & EBITDA

Net Operating Income and EBIDTA chart

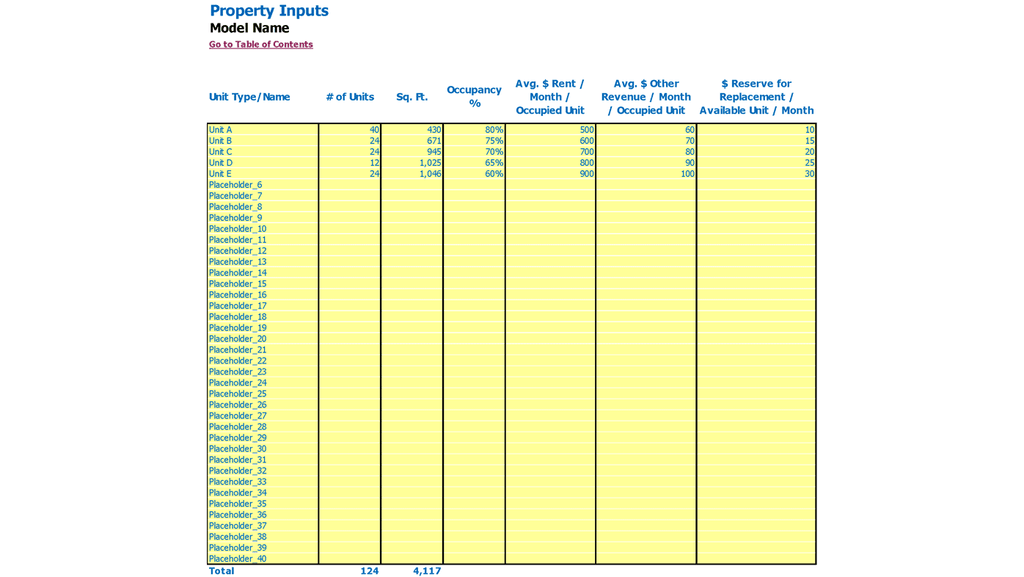

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

RETAIL PROPERTY ACQUISITION PRO FORMA EXCEL TEMPLATE ADVANTAGES

Summary of revenues and expenses

Exit Property Sale Price is calculated on NOI and assumed exit cap rate

Capital Sources and Uses

Core metrics like IRR, Equity Multiple, Profit Margin, Net Profit, DSCR, Operating Margin, Cash on Cash, Revenue/NOI

Retail Property Acquisition costs