Automated Compliance Solutions Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Automated Compliance Solutions Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Automated Compliance Solutions Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AUTOMATED COMPLIANCE SOLUTIONS FINANCIAL MODEL FOR STARTUP INFO

Highlights

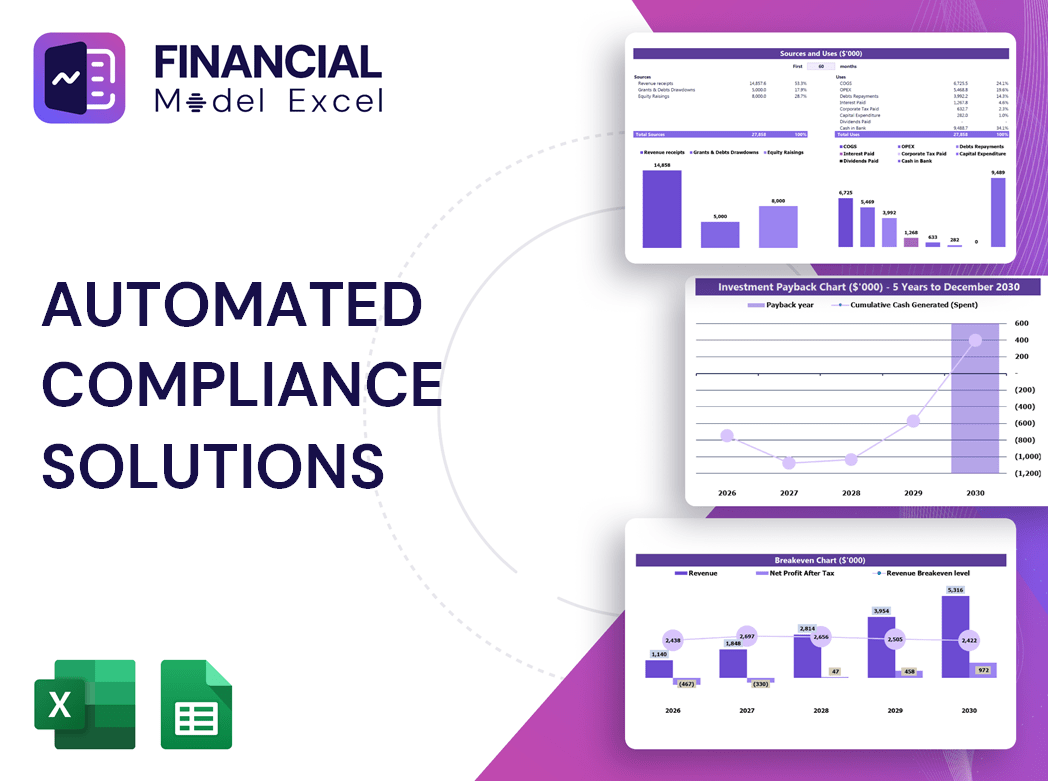

This five-year financial model for regulatory compliance software offers a comprehensive automated compliance software financial model designed for startups and entrepreneurs to impress investors and secure funding. Featuring key financial charts, summaries, and automated compliance metrics financial planning, this template integrates compliance automation impact on financial model with detailed compliance workflow automation financial analysis. The built-in automated compliance cost analysis financial model and regulatory compliance financial projection tools help estimate required startup costs and provide accurate funding forecasts, making it a powerful financial plan incorporating automated audit compliance financial strategy and financial modeling for compliance solutions.

This ready-made Excel financial model for compliance automation effectively alleviates common pain points by integrating automated compliance metrics financial planning with detailed regulatory compliance financial projections, enabling users to streamline their compliance workflow automation financial analysis without extensive expertise. By incorporating a financial model integrating compliance automation, it facilitates automated regulatory reporting financial models alongside automated risk management financial models, ensuring accurate compliance process automation financial forecasts that enhance decision-making. The template provides comprehensive financial compliance tools financial modeling, allowing for an automated audit compliance financial strategy that reduces manual errors and saves time, while its automated compliance cost analysis financial model function delivers clarity on cost drivers, improving budgeting and resource allocation. With intuitive graphs and KPIs geared toward financial forecast compliance automation tools, users gain a clear, actionable overview of profitability outcomes, investment planning, and salary assessments, making it an indispensable assistant for seamless financial modeling for compliance solutions.

Description

This automated compliance software financial model offers a comprehensive framework for regulatory compliance financial projection, enabling businesses to streamline compliance automation financial planning with precision. Designed as an advanced financial compliance system model, it integrates automated risk management financial model features to enhance accuracy in compliance process automation financial forecast. By leveraging sophisticated financial compliance tools financial modeling, this solution supports automated audit compliance financial strategy development alongside compliance workflow automation financial analysis. The financial model for compliance automation incorporates automated regulatory reporting financial model capabilities, ensuring robust financial modeling for compliance solutions and delivering automated compliance metrics financial plan insights. Its adaptability in financial forecast compliance automation tools allows businesses to assess compliance automation impact on financial model integrity, backed by a financial model for regulatory compliance software optimized for automated compliance cost analysis financial model scrutiny. Ultimately, this financial model integrating compliance automation fosters automated compliance efficiency financial model enhancements alongside dynamic financial scenario planning compliance automation, empowering organizations to align their operations with evolving regulatory requirements while maintaining financial discipline.

AUTOMATED COMPLIANCE SOLUTIONS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Navigate investment management confidently with our advanced financial model integrating compliance automation. Designed to streamline regulatory compliance financial projections and automate risk management, this model ensures accurate financial planning and forecasting. Leverage automated compliance metrics and workflow automation to deliver presentation-ready financial analysis that impresses even the most discerning investors. Optimize your startup’s valuation and cost analysis with a comprehensive financial compliance system model, turning complex compliance requirements into clear, actionable insights. Elevate your business strategy with cutting-edge financial modeling for compliance solutions—your secret weapon for winning investor trust and driving sustainable growth.

Dashboard

Our automated compliance software financial model integrates regulatory compliance and financial planning seamlessly. It offers comprehensive financial projections, including cash flow forecasts and monthly income statements, enhanced by compliance automation tools. Interactive charts and graphs provide clear compliance workflow automation financial analysis, ensuring precise control and strategic insights. This financial compliance system model empowers small businesses to streamline audit processes and regulatory reporting while optimizing risk management. By leveraging automated compliance metrics, companies maintain order and drive growth with a robust, data-driven financial strategy tailored for regulatory compliance and operational efficiency.

Business Financial Statements

Our automated compliance software financial model streamlines regulatory compliance financial projection by integrating income statements, balance sheets, and cash flow statements. This compliance automation financial planning tool provides a comprehensive financial compliance system model that highlights income, expenses, assets, liabilities, and cash movements. By leveraging compliance workflow automation financial analysis, firms can accurately forecast financial performance, ensuring assets balance with liabilities and equity, while effectively managing cash flow. This financial model for compliance automation enhances automated risk management financial strategies, delivering precise financial forecasts with automated reporting and audit compliance for optimal decision-making.

Sources And Uses Statement

The sources and uses of funds statement within this financial model for compliance automation offers a clear overview of the company’s funding origins and strategic allocations. Leveraging automated compliance software and financial compliance tools, the statement supports accurate financial projections and regulatory compliance. This integrated financial planning approach ensures seamless compliance process automation, enhancing financial forecast reliability and optimizing resource deployment in alignment with automated risk management financial models.

Break Even Point In Sales Dollars

The break-even point marks when a company’s revenue precisely covers its fixed and variable costs, indicating no profit or loss. Understanding this critical juncture is essential in financial modeling for compliance automation, as it clarifies cost structures and informs automated compliance cost analysis financial models. Businesses with lower fixed costs typically achieve break-even faster, optimizing compliance workflow automation financial forecasts. Integrating automated risk management financial models and compliance process automation tools enhances accuracy in regulatory compliance financial projections, driving strategic financial planning and improved compliance efficiency across the organization.

Top Revenue

The Top Revenue tab leverages automated compliance financial modeling to deliver precise demand reports for your Café products and services. Access profitability and financial compliance system metrics tailored to your assumptions. Quickly analyze revenue depths and bridges using compliance automation financial forecasts, providing projections for periods like weekdays or weekends. With these financial compliance tools, optimize resource allocation by identifying when current capacity meets demand or when expansion is needed. Harness compliance workflow automation financial analysis for smarter, data-driven decisions that enhance your Café’s financial strategy and operational efficiency.

Business Top Expenses Spreadsheet

The Top Expenses tab in this financial model for compliance automation provides a clear breakdown of company costs across four key categories. Featuring an integrated annual expense chart, it highlights essential expenditures linked to client base growth and employee compensation. Both fixed and variable costs are meticulously detailed, enabling comprehensive financial planning. This automated compliance financial model empowers organizations to align their compliance workflow automation with precise financial analysis, enhancing regulatory compliance financial projections and optimizing cost management within compliance processes.

AUTOMATED COMPLIANCE SOLUTIONS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurately measuring start-up costs is essential for any business. Our automated compliance software financial model streamlines this process, delivering precise financial planning and regulatory compliance projections. This dynamic financial forecast tool enables entrepreneurs to monitor expenses, generate instant reports, and adjust assumptions with ease. By integrating compliance automation into your financial model, you gain clarity and control, minimizing costly risks and ensuring a robust financial strategy. Empower your start-up with efficient compliance workflow automation and data-driven financial analysis for confident decision-making and sustainable growth.

CAPEX Spending

The initial startup costs reflect the total investment required to maintain, develop, and accelerate growth within the automated compliance software financial model—excluding headcount and operating expenses. Our analysis identifies key assets for strategic investment, maximizing value and optimizing financial planning. Since capital expenditures differ by business type, integrating this compliance automation financial forecast into your comprehensive financial model ensures precise regulatory compliance and efficient resource allocation. Harnessing financial modeling for compliance solutions enables smarter, data-driven decisions that drive sustainable growth and regulatory adherence.

Loan Financing Calculator

Much like amortizing assets within a financial forecasting model, loan amortization systematically spreads loan repayments across multiple reporting periods. This process entails fixed scheduled payments—typically monthly but sometimes quarterly or annually—allowing businesses to manage cash flow efficiently. Integrating automated compliance financial models enhances this approach by aligning repayment schedules with regulatory compliance and risk management frameworks, ensuring accuracy and transparency. Leveraging compliance automation financial planning tools streamlines reporting and supports robust financial strategies, making loan management both compliant and financially sound.

AUTOMATED COMPLIANCE SOLUTIONS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA, or Earnings Before Interest, Tax, Depreciation, and Amortization, is a crucial financial metric derived from regulatory compliance financial projections and automated compliance financial models. Unlike cash flow, EBITDA encompasses both monetary and non-monetary items, providing a clear view of a company's operational profitability. Leveraged buyouts across industries rely on this metric, enhanced by compliance automation financial planning and financial modeling for compliance solutions, to gauge potential profitability accurately. Integrating automated compliance metrics into financial forecasts strengthens risk management and strategic decision-making, ensuring a robust financial compliance system model.

Cash Flow Forecast Excel

A startup cash flow statement is essential in financial modeling, providing a clear picture of cash generation and liquidity. Integrating automated compliance software enhances accuracy in regulatory compliance financial projections and streamlines compliance process automation. This financial model for compliance automation enables startups to forecast cash flows effectively, identify funding gaps, and improve financial planning with real-time compliance metrics. Leveraging compliance automation tools alongside financial analysis ensures informed decisions, boosting investor confidence and optimizing financial strategy in a highly regulated environment.

KPI Benchmarks

The benchmark tab in a financial model integrating compliance automation evaluates key financial indicators against industry averages, highlighting performance gaps. Start-ups benefit significantly from this automated compliance software financial model by gaining insights for strategic financial planning and regulatory compliance. Leveraging compliance process automation financial forecasts enables companies to simulate scenarios, optimize decisions, and enhance financial compliance efficiency. Accurate tracking and analysis of financial compliance metrics within the automated risk management financial model ensure better control, supporting informed, strategic growth—making it essential for businesses aiming to outperform competitors and manage compliance seamlessly.

P&L Statement Excel

The monthly profit and loss statement delivers precise financial analysis, integrating automated compliance software financial models to enhance accuracy and forecast reliability. Leveraging compliance automation in financial planning ensures robust regulatory compliance financial projections, crucial for strategic decision-making. Utilizing a financial model for compliance automation streamlines the creation of annual and gross profit reports, providing comprehensive insights into company performance. This synergy between compliance workflow automation and financial modeling empowers businesses to optimize risk management and regulatory reporting, strengthening their financial strategy with data-driven confidence.

Pro Forma Balance Sheet Template Excel

Incorporating automated compliance software into your financial model enhances regulatory compliance and streamlines financial forecasting. Integrating compliance automation with profit and loss projections and cash flow statements creates a comprehensive financial planning system. This unified financial compliance system model not only ensures accurate automated regulatory reporting but also strengthens risk management and audit processes. Utilizing financial modeling for compliance solutions empowers businesses to present realistic, efficiency-driven projections to investors, highlighting key metrics like return on equity and invested capital. Ultimately, compliance workflow automation elevates financial analysis, driving informed decision-making and investor confidence.

AUTOMATED COMPLIANCE SOLUTIONS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our financial model for compliance automation to access critical investor metrics with ease. The Weighted Average Cost of Capital (WACC) illustrates the minimum expected return on invested capital, reassuring stakeholders of your enterprise’s financial health. Additionally, Free Cash Flow (FCF) highlights available cash for operations and growth, while Discounted Cash Flow (DCF) accurately values all anticipated future cash flows today. Integrating automated compliance metrics into your financial planning enhances transparency and drives informed decision-making, positioning your business for sustainable success.

Cap Table

A comprehensive financial model for regulatory compliance software integrates automated compliance metrics to provide clear insights into a company’s financial condition. Much like a capitalization table reveals ownership structure and security distribution, compliance automation financial planning tools detail equity allocations, preferred shares, and options. This automated compliance workflow enhances financial forecast accuracy by streamlining risk management and audit processes, enabling precise financial scenario planning. Harnessing compliance process automation with financial modeling empowers organizations to optimize their financial strategy, reduce costs, and maintain regulatory adherence with confidence and efficiency.

AUTOMATED COMPLIANCE SOLUTIONS FINANCIAL PLAN EXCEL ADVANTAGES

Automated compliance software enhances financial models by ensuring accurate, efficient regulatory compliance and proactive risk management.

Automated compliance software financial models ensure accurate, timely updates, enhancing trust with external stakeholders like banks.

Boost investor confidence with automated compliance financial models delivering accurate projections and streamlined regulatory reporting.

Automated compliance financial models streamline processes, enhancing accuracy and boosting strategic financial planning efficiency.

Boost accuracy and efficiency with an automated compliance software financial model for seamless regulatory financial planning.

AUTOMATED COMPLIANCE SOLUTIONS FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Automated compliance financial models proactively identify cash shortfalls, ensuring precise and timely financial planning.

The automated compliance financial model enhances forecasting accuracy, serving as an early warning system for cash flow risks.

Automated compliance software financial model saves time and money by streamlining regulatory compliance and enhancing financial planning accuracy.

The automated compliance financial model streamlines startup projections, eliminating complex tasks and costly consultants for effortless growth planning.

Automated compliance software financial model enhances accuracy and efficiency, optimizing regulatory adherence and financial planning outcomes.

Automated compliance financial modeling enhances cash flow forecasting accuracy, enabling proactive decisions and sustained business growth.

Simplify financial planning with our automated compliance software financial model for accurate, efficient, and reliable projections.

Our automated compliance financial model ensures quick, reliable results with minimal Excel experience, enhancing your strategic planning.

Leverage automated compliance financial models to enhance accuracy, streamline audits, and confidently plan for future growth.

Automated compliance financial models streamline forecasting, enhancing accuracy and efficiency for strategic financial planning and risk management.