IT Equipment Rental Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

IT Equipment Rental Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

IT Equipment Rental Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

IT EQUIPMENT RENTAL FINANCIAL MODEL FOR STARTUP INFO

Highlights

The IT equipment rental financial model and financial projection for startups or established companies is an essential tool for raising funds from investors or lenders by providing accurate cash flow projections, financial budgeting, and equipment rental profitability analysis. This comprehensive financial forecasting model for IT equipment rental helps businesses develop revenue models, track expenses with rental equipment expense tracking models, and perform financial scenario analysis for equipment rental ventures. By utilizing an IT equipment rental startup financial model or a financial model for IT asset rental business, companies can effectively plan pre-launch expenses, evaluate startup ideas using feasibility study templates in Excel, and create detailed financial dashboards and KPI models to enhance business plans and secure funding from banks, angels, grants, or VC funds.

The it equipment rental financial model in Excel addresses the common pain points faced by rental business owners by offering a comprehensive financial forecasting model for IT equipment rental that simplifies complex financial planning and budgeting tasks. It provides an integrated platform for cash flow projection, expense tracking, and revenue modeling, enabling users to gain clear visibility into profitability and financial performance through dynamic dashboards and KPI analysis. The model’s scenario analysis features allow businesses to simulate various growth and market conditions, minimizing risk and enhancing decision-making accuracy. Additionally, it supports detailed investment analysis, leasing revenue forecasting, and asset valuation, making it an essential tool for startups and established companies seeking to optimize their financial strategies and attract potential investors with reliable, data-driven insights.

Description

This comprehensive it equipment rental financial model serves as a robust financial forecasting tool tailored for IT equipment leasing and rental businesses, providing a detailed 5-year projection of key financial statements including income statements, balance sheets, and cash flow projections. It integrates essential components such as rental equipment cash flow projection models, financial budgeting models for equipment rental, and expense tracking to deliver accurate profitability analysis and revenue forecasting. With built-in financial scenario analysis and investment evaluation features, this model enables startups and established companies alike to assess working capital needs, initial capital investments, and operational KPIs, ultimately supporting strategic financial planning and data-driven decision-making for optimal asset rental business performance.

IT EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This IT equipment rental financial model is expertly designed for ease of use and adaptability. With fully integrated, dynamic formulas, all updates seamlessly reflect across the entire equipment rental financial statement model. Assumptions are clearly centralized in a single worksheet, enabling swift adjustments via highlighted input cells. Simply update your parameters, and the financial forecasting model for IT equipment rental instantly generates accurate profit and loss projections, ensuring reliable insights for financial planning, budgeting, and profitability analysis in your IT asset rental business.

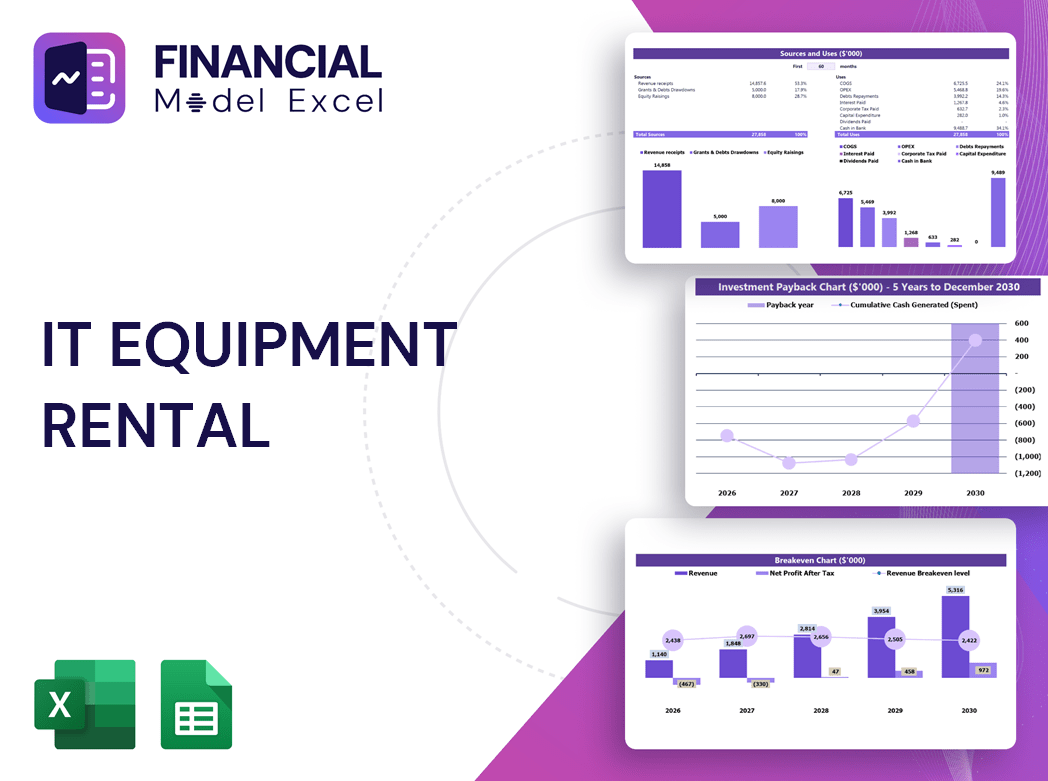

Dashboard

Our IT equipment rental startup financial model features a comprehensive financial dashboard that visualizes key company metrics over time. Utilizing advanced revenue models, cash flow projection templates, and income statement forecasts, it delivers precise financial forecasting for IT asset rental businesses. This streamlined dashboard enhances financial planning by presenting critical data—such as equipment leasing revenue, expense tracking, and profitability analysis—in clear graphs and charts. Designed for accuracy and ease, it empowers strategic decision-making and effective financial scenario analysis, making your equipment rental business’s growth and valuation insights both accessible and actionable.

Business Financial Statements

An IT equipment rental financial model includes a profit and loss statement that highlights your rental business’s revenue, expenses, gains, and losses over a specific period. Unlike cash flow projections, this income statement focuses on profitability without distinguishing cash from non-cash transactions. Paired with financial forecasting and budgeting models, it provides a comprehensive view for equipment rental profitability analysis and strategic financial planning. Use this financial model to optimize your IT asset rental business, track expenses, and accurately forecast revenue streams, ensuring robust financial health and informed decision-making.

Sources And Uses Statement

The Sources and Uses tab in the IT equipment rental financial model offers a clear overview of capital inflows and outflows, essential for strategic financial planning. This detailed breakdown highlights funding sources alongside expenditures, enabling precise cash flow projection and expense tracking. For IT equipment rental startups, this component is vital, supporting effective financial forecasting, budgeting, and profitability analysis. By leveraging this data, businesses can optimize their equipment rental revenue model and enhance overall financial health, ensuring informed decision-making and sustainable growth.

Break Even Point In Sales Dollars

This IT equipment rental financial forecasting model includes an integrated break-even analysis, pinpointing when revenue surpasses total costs—marking the start of profitability. Essential for the financial planning model of IT asset rental businesses, this insight empowers investors and creditors to assess risks and returns confidently. By examining the interplay of fixed and variable expenses with rental equipment revenue models, companies can optimize financial budgeting and enhance equipment rental profitability analysis. This proactive approach is vital for successful IT equipment leasing financial models and startup financial projections, ensuring informed decision-making and sustainable growth.

Top Revenue

The Top Revenue tab in our IT equipment rental financial model offers a clear summary of your company’s revenue, segmented by product line. Coupled with comprehensive financial forecasting models for IT equipment rental, it delivers an annual breakdown of revenue streams, total revenue per segment, and detailed revenue bridges. This enables precise financial planning and supports robust equipment rental profitability analysis, ensuring your IT rental business financial projection stays accurate and insightful for strategic decision-making.

Business Top Expenses Spreadsheet

In the Top Expenses section of our 5-year IT equipment rental financial forecasting model, expenses are categorized into four key groups for clear analysis. Additionally, an ‘Other’ category allows you to input custom data tailored to your business needs. This flexible approach ensures comprehensive financial budgeting and expense tracking, empowering precise financial planning models for your IT asset rental business. Harness this tool to optimize your equipment rental profitability analysis and strengthen your rental equipment cash flow projection model.

IT EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

For IT equipment rental businesses, a robust financial forecasting model is essential for accurate cost prediction and strategic planning. Our IT equipment rental financial model streamlines your budgeting process, providing a clear framework for managing revenues, expenses, and cash flow. This comprehensive tool supports equipment rental profitability analysis, enhances investor communication, and strengthens loan application success. By leveraging our rental equipment cash flow projection and expense tracking models, you gain confidence in your financial decisions and drive sustainable business growth.

CAPEX Spending

CapEx start-up expenses represent significant investments in assets crucial for scaling your IT equipment rental business. Each investment is timed for precise financial planning within your financial forecasting model for IT equipment rental. Integrating these costs into your pro forma balance sheet and cash flow projection model ensures accurate expense tracking and profitability analysis. Properly accounted, CapEx enhances operational efficiency and technology quality, driving higher returns. This approach is essential in an IT equipment leasing financial model and supports robust financial scenario analysis for equipment rental startups.

Loan Financing Calculator

Accurately forecasting loan or mortgage payments is vital for IT equipment rental startups. Our 3-year IT equipment rental financial projection model includes a detailed loan amortization schedule and calculator, simplifying this complex task. Designed to enhance financial planning, it supports precise cash flow projections and expense tracking, empowering your equipment rental business to optimize budgeting and profitability analysis with confidence.

IT EQUIPMENT RENTAL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The IT equipment rental financial model offers a comprehensive 5-year cash flow projection with key KPIs—revenue growth, gross margin, EBITDA, cash burn rate, and runway. Tailor assumptions and reports to your business needs, selecting relevant metrics like customer lifetime value, acquisition costs, and churn rate. This versatile financial forecasting and budgeting tool empowers startups and established businesses alike to optimize profitability, manage expenses, and strategically plan capital raising. Whether for leasing, asset rental, or tech equipment, this model delivers critical insights for sustainable growth and financial success in the IT equipment rental industry.

Cash Flow Forecast Excel

Today, an advanced rental equipment cash flow projection model is essential for effective financial management. Utilizing a financial forecasting model for IT equipment rental ensures precise tracking of cash inflows and outflows. This enables IT asset rental businesses to optimize budgeting, enhance profitability, and make informed financial planning decisions. Incorporating an equipment rental financial dashboard model further streamlines expense tracking and revenue analysis, empowering startups and established firms alike to drive growth with confidence.

KPI Benchmarks

Our IT equipment rental financial modeling template includes a comprehensive benchmarking feature, empowering clients to compare their financial performance against industry standards and top competitors. Utilize this financial forecasting model for IT equipment rental to pinpoint operational strengths and areas for improvement. Designed to enhance your rental equipment cash flow projection model and profitability analysis, it supports strategic decision-making to maximize outcomes. Elevate your IT rental business financial projection with actionable insights derived from reliable benchmarks, driving growth and ensuring sustainable success in the competitive equipment rental market.

P&L Statement Excel

The Profit and Loss Statement in your IT equipment rental financial model highlights key revenue streams and major expense categories, offering stakeholders clear insight into profitability and cost structure. This essential financial forecasting tool enables you to evaluate income, expenses, and loan repayment capacity effectively. Utilizing such a financial budgeting model for equipment rental allows you to project future profitability, empowering informed decision-making for your IT equipment rental startup or ongoing business operations.

Pro Forma Balance Sheet Template Excel

The IT equipment rental startup financial model integrates a comprehensive 5-year monthly and yearly projected balance sheet, seamlessly linked with cash flow projections, profit and loss templates, and key financial inputs. This robust financial forecasting model for IT equipment rental offers a complete overview of your assets, liabilities, and equity accounts, empowering informed decision-making. Designed for precision, it supports detailed equipment rental revenue modeling, expense tracking, and profitability analysis—essential tools for optimizing your IT asset rental business’s financial planning and growth strategies.

IT EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This IT equipment rental financial model includes a comprehensive valuation report template, enabling users to perform Discounted Cash Flow (DCF) valuation effortlessly. By inputting key rates within the Cost of Capital section, this financial forecasting model for IT equipment rental streamlines equipment rental profitability analysis. Ideal for financial planning and investment analysis, it empowers businesses to assess asset value accurately while supporting robust financial budgeting and cash flow projection. Designed for IT equipment rental startups and established firms alike, this model enhances decision-making through precise scenarios and KPI tracking within an intuitive financial dashboard.

Cap Table

The simple cap table is an essential tool for startups, providing critical insights into shareholder ownership dilution across multiple funding rounds. By integrating this data into a financial forecasting model for IT equipment rental or related asset rental businesses, companies can accurately project equity changes and investment impacts. Utilizing a comprehensive cap table enhances financial planning models, enabling precise scenario analysis and supporting strategic decisions in equipment leasing or rental ventures. This approach ensures robust financial budgeting and profitability analysis, empowering startups to navigate growth with confidence and clarity.

IT EQUIPMENT RENTAL STARTUP FINANCIAL MODEL TEMPLATE EXCEL ADVANTAGES

Optimize profitability by reassessing assumptions with the comprehensive IT equipment rental financial model pro forma template.

The IT equipment rental financial model empowers precise forecasting, enhancing profitability and strategic decision-making.

The IT equipment rental financial model enables proactive problem identification, optimizing cash flow and profitability forecasting.

Identify cash shortfalls early using the IT equipment rental financial model to optimize cash flow and enhance profitability.

The financial model ensures precise spending control, optimizing profitability and driving smarter IT equipment rental decisions.

IT EQUIPMENT RENTAL FINANCIAL PLAN FOR BUSINESS PLAN ADVANTAGES

The IT equipment rental financial model empowers better decision making through precise forecasting and profitability analysis.

Optimize decisions confidently using the IT equipment rental financial forecasting model with dynamic cash flow scenario analysis.

Optimize profits and streamline budgeting with our adaptable financial model for IT equipment rental businesses—update anytime.

Easily refine your IT equipment rental financial model by adjusting inputs anytime for precise, dynamic business forecasting.

Optimize cash flow and manage accounts receivable efficiently with our advanced financial model for IT equipment rental.

The rental equipment cash flow projection model reveals payment delays, improving cash flow accuracy and financial decision-making.

Leverage the IT equipment rental financial model to accurately plan for future growth and maximize profitability.

The financial forecasting model for IT equipment rental empowers accurate growth planning and strategic cash flow management.

Gain confidence in your IT equipment rental business with our precise financial forecasting and profitability analysis model.

Our IT equipment rental financial model empowers precise planning, risk management, and accurate 5-year cash flow forecasting.