IT Outsourcing Firm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

IT Outsourcing Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

IT Outsourcing Firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

IT OUTSOURCING FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

Comprehensive five-year IT outsourcing financial projections and business valuation model designed for startups and entrepreneurs seeking effective financial planning for outsourcing firms. This Excel template integrates key financial metrics for outsourcing firms, including revenue models, expense forecasting, and operational cost modeling, enabling detailed cost analysis and profitability modeling. It features built-in cash flow models, income statement models, break-even analysis, and budgeting strategies tailored for IT service providers, facilitating accurate financial forecasting and risk assessment. Fully customizable and unlocked for easy editing, this tool supports fundraising and strategic resource allocation to optimize financial performance indicators and outsourcing contract financial analysis.

This ready-made IT outsourcing financial model Excel template effectively addresses key pain points faced by buyers by integrating comprehensive financial forecasting for IT outsourcing companies, enhancing accuracy in revenue models and expense forecasting. It simplifies complex cost analysis for IT outsourcing firms through automated operational cost models and expense tracking, while providing robust outsourcing firm budgeting strategies to optimize resource allocation financial models. The template features detailed financial statement modeling for outsourcing firms, including income statement models, cash flow models, and break-even analysis, allowing users to closely monitor financial metrics and outsourcing firm financial performance indicators. By incorporating outsourcing contract financial analysis and financial risk assessment functionalities, it ensures thorough evaluation of contracts and potential risks, empowering users with a profitability model tailored to IT outsourcing and precise IT service provider financial models—ultimately facilitating strategic financial planning for outsourcing firms with dynamic summary tabs for NPV, IRR, investor equity valuation, and equity share calculations.

Description

This IT outsourcing firm financial model Excel template provides comprehensive financial forecasting for IT outsourcing companies, including detailed financial projections, expense forecasting, and operational cost model analysis tailored for startup or established outsourcing firms. It features a dynamic cash flow model, profit and loss statement, and balance sheet projections for up to five years, enabling thorough financial planning for outsourcing firms by incorporating key financial metrics and performance indicators. The model supports outsourcing firm budgeting strategies, break-even analysis, and cost analysis to evaluate profitability models and resource allocation financial models, while also integrating discounted cash flow valuation and financial risk assessment to optimize outsourcing contract financial analysis and business valuation.

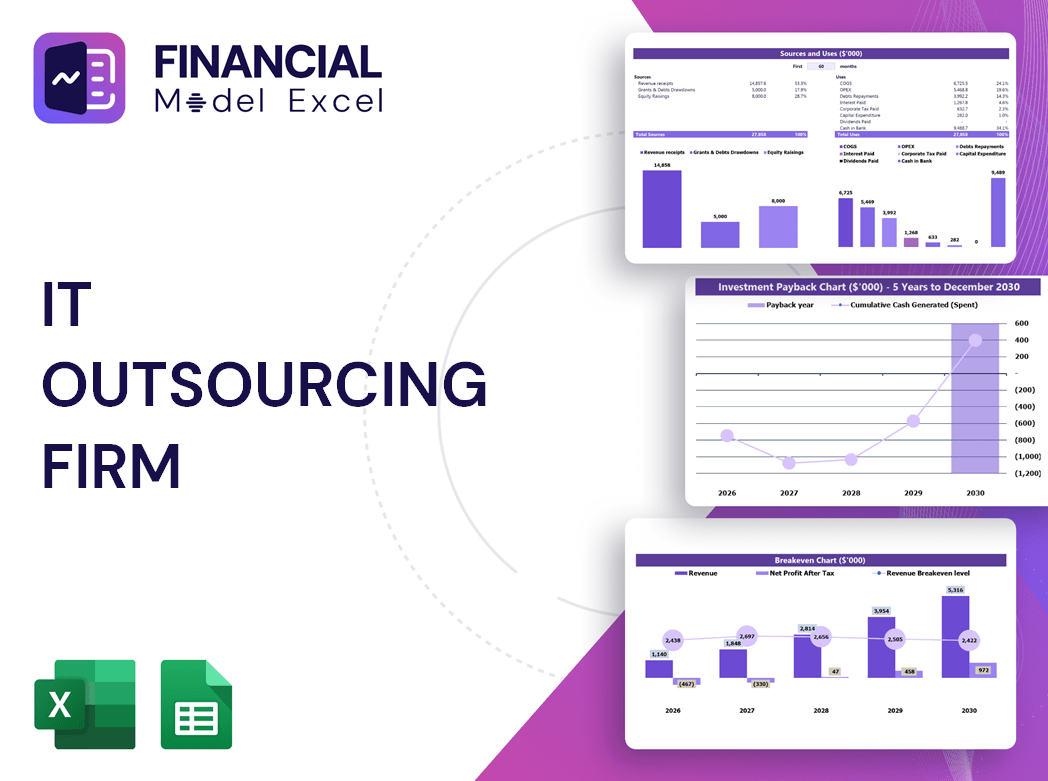

IT OUTSOURCING FIRM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Seeking investment? A comprehensive IT outsourcing firm financial model is essential to demonstrate your business’s potential. Utilize financial forecasting for IT outsourcing companies to validate capital requirements and project profitability confidently. Developing an accurate IT outsourcing revenue model and conducting cost analysis enables precise expense forecasting and break-even analysis, highlighting your firm’s financial viability. Investors demand detailed financial planning for outsourcing firms, including cash flow models and financial risk assessments. Presenting robust outsourcing firm budgeting strategies and financial statement modeling ensures credibility and attracts serious investors. Don’t risk missed opportunities—secure funding with a professional IT outsourcing financial projection today.

Dashboard

Our startup’s financial planning dashboard delivers comprehensive insights into key financial metrics for IT outsourcing firms. It features detailed cash flow models, annual revenue breakdowns based on proven IT outsourcing revenue models, and profitability forecasting tailored for outsourcing companies. This dynamic panel enables precise financial forecasting and expense analysis, supporting effective budgeting strategies and resource allocation. By integrating critical financial statement modeling and outsourcing firm performance indicators, it empowers informed decision-making and strategic growth within the IT outsourcing sector.

Business Financial Statements

Our comprehensive IT outsourcing financial model streamlines startup cost analysis, enabling precise financial forecasting and expense forecasting for outsourcing firms. It supports the development of key financial statements—including income statements and cash flow models—while facilitating effective communication of results through dynamic graphs and charts. This tool enhances outsourcing firm budgeting strategies and profitability models, equipping business owners to present clear financial metrics and contract financial analysis to stakeholders and investors with confidence.

Sources And Uses Statement

This financial projections template is expertly designed for IT outsourcing companies to accurately model revenue streams, expense forecasting, and cash flow. It facilitates comprehensive cost analysis and budgeting strategies, enabling firms to optimize resource allocation and assess financial risks. By integrating key financial metrics and income statement modeling, IT service providers can conduct thorough outsourcing contract financial analysis and profitability assessments. This tool supports precise financial planning and operational cost modeling, empowering outsourcing firms to evaluate their break-even points and overall business valuation with confidence.

Break Even Point In Sales Dollars

A break-even analysis is a critical financial model for IT outsourcing firms, pinpointing when the company or a new service becomes profitable. By integrating fixed and variable costs, this model guides precise financial forecasting for IT outsourcing companies. Leveraging this tool enhances financial planning for outsourcing firms by revealing necessary sales volumes to cover expenses, optimize resource allocation, and inform budgeting strategies. Ultimately, the break-even model supports robust financial statement modeling and expense forecasting, empowering IT service providers to drive sustainable growth and maximize profitability.

Top Revenue

When developing an IT outsourcing financial model, crafting accurate revenue projections is paramount. Effective financial forecasting for IT outsourcing companies hinges on detailed revenue models that capture growth assumptions grounded in historical data. Financial planning for outsourcing firms must integrate comprehensive cash flow models, expense forecasting, and profitability analysis to ensure robust business valuation. Incorporating outsourcing firm budgeting strategies and financial risk assessments enhances the precision of income statement modeling and operational cost models. Prioritizing these financial metrics and resource allocation models empowers IT service providers to optimize long-term financial performance and confidently navigate market uncertainties.

Business Top Expenses Spreadsheet

This Excel financial model’s Top Revenue tab enables IT outsourcing firms to forecast demand by product or service, supporting robust financial planning for outsourcing firms. By simulating profitability and analyzing revenue bridges, companies gain critical insights into their it outsourcing revenue models and expense forecasting. Detailed demand forecasts—such as weekdays versus weekends—facilitate precise resource allocation financial models for outsourcing, optimizing manpower and inventory scheduling. This comprehensive approach enhances financial forecasting for IT outsourcing companies, driving strategic budgeting strategies and elevating overall financial performance indicators.

IT OUTSOURCING FIRM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurate financial forecasting for IT outsourcing companies is key to effective expense management and long-term profitability. Our 5-year IT outsourcing firm financial model enables detailed expense forecasting and budgeting, incorporating income percentages, payroll, fixed and variable costs, COGS, wages, and CAPEX. By allocating expenses into major categories and integrating cash flow and profit-loss projections, this tool supports outsourcing firm budgeting strategies, cost analysis, and break-even analysis. Designed for robust financial planning and operational cost modeling, it empowers IT service providers with vital financial metrics and risk assessments to optimize resource allocation and drive sustainable growth.

CAPEX Spending

Successful IT outsourcing companies leverage strategic financial planning, including CAPEX investments, to drive growth and innovation. Capital expenditures, reflected on the projected balance sheet over five years, represent asset acquisitions that enhance operational capacity. Incorporating CAPEX into financial forecasting for IT outsourcing firms enables accurate depreciation scheduling and informs budgeting strategies. This proactive financial modeling supports profitability models, cost analysis, and effective resource allocation—key financial metrics that underpin sustainable expansion and increased market competitiveness within the IT outsourcing sector.

Loan Financing Calculator

Our feasibility study template Excel features an integrated loan amortization schedule, expertly designed for IT outsourcing firms. It calculates payment amounts by incorporating principal, interest rate, loan duration, and payment frequency. This tool supports precise financial forecasting for IT outsourcing companies, enhancing cash flow models and profitability analysis. Ideal for outsourcing firm budgeting strategies and financial planning, it streamlines expense forecasting and operational cost modeling, empowering your firm with accurate financial projections and robust resource allocation models—essential for optimizing IT outsourcing business valuation and financial performance indicators.

IT OUTSOURCING FIRM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our financial forecasting template for IT outsourcing companies integrates key financial metrics such as earnings growth, net income progression, and expense forecasting. Designed to support IT outsourcing revenue models and operational cost analysis, this tool ensures accurate tracking of sales, profitability, and cash flow. Ideal for financial planning and resource allocation, it empowers outsourcing firms to monitor financial performance indicators and implement effective budgeting strategies, driving sustained business growth and informed decision-making from startup through expansion.

Cash Flow Forecast Excel

The cash flow model for IT outsourcing companies is essential for accurate financial forecasting and efficient resource allocation. This financial planning tool enables firms to track inflows and outflows, enhancing budgeting strategies and operational cost management. By leveraging this model, outsourcing firms can perform in-depth expense forecasting and cash flow analysis, driving improved profitability and capital turnover. Utilizing an Excel-based cash flow statement empowers IT service providers to optimize their financial performance indicators, mitigating risks and supporting informed decision-making for sustainable growth.

KPI Benchmarks

A 5-year cash flow model for IT outsourcing companies enables precise financial forecasting and benchmarking by analyzing key financial metrics and performance indicators. Comparing outsourcing firm financial performance with industry peers supports informed financial planning, cost analysis, and profitability modeling. This approach aids startups in resource allocation and expense forecasting, ensuring steady revenue growth and minimizing losses. Effective outsourcing firm budgeting strategies and financial risk assessments rely on accurate income statement and operational cost models, empowering IT service providers to optimize their revenue models and confidently plan long-term business success.

P&L Statement Excel

An accurate IT outsourcing firm income statement model is critical for clear financial forecasting and effective profitability analysis. This essential financial statement drives informed decision-making by revealing true operational costs and revenue streams. Without a meticulously crafted P&L template, IT service providers risk obscuring their bottom line and overlooking key profitability drivers. Comprehensive financial planning for outsourcing firms demands precise income statement modeling to ensure authentic results, enabling robust budgeting strategies, cash flow management, and insightful financial risk assessment—ultimately safeguarding sustainable growth and business valuation in a competitive market.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet template in Excel offers a comprehensive overview of your IT outsourcing firm’s financial position, detailing assets, liabilities, and equity accounts. Integrated with cash flow models and financial forecasting tools, it supports accurate financial planning for outsourcing firms. This enables effective cost analysis, budgeting strategies, and profitability modeling, essential for informed decision-making and resource allocation. Ideal for capturing the financial metrics and performance indicators critical to IT service providers, this tool streamlines financial statement modeling and enhances forecasting accuracy across a 5-year horizon.

IT OUTSOURCING FIRM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our IT outsourcing financial projections integrate key metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) into a comprehensive profitability model. WACC provides a critical financial risk assessment by weighting equity and debt costs, vital for lenders and investors. The DCF method offers precise financial forecasting for IT outsourcing companies by valuing future cash flows, essential for informed investment decisions. This robust financial planning framework supports effective budgeting strategies, resource allocation, and contract financial analysis, enhancing the overall financial performance and valuation of IT outsourcing firms.

Cap Table

The financial projection model for IT outsourcing companies includes an equity cap table—a crucial tool for startups. It clearly details the company’s ownership structure, illustrating who owns shares, their quantities, and valuation. This cap table captures equity shares, preferred shares, options, and associated stakeholder pricing, providing vital insights for financial planning and business valuation. Integrating this into your IT outsourcing firm’s financial forecasting and profitability models ensures accurate resource allocation and strategic decision-making.

IT OUTSOURCING FIRM BUSINESS PLAN FORECAST TEMPLATE ADVANTAGES

Make informed hiring decisions confidently using the comprehensive IT outsourcing firm financial model proforma template.

Easily model IT outsourcing firm financials to optimize budgeting, forecasting, and profitability with precision and efficiency.

Optimize profitability and cash flow with a tailored financial model designed for IT outsourcing firms’ unique needs.

Maximize business value and investment appeal with a precise IT outsourcing firm financial model and strategic financial plan.

Attract investors effectively with a precise IT outsourcing firm financial model showcasing strong revenue and profitability forecasts.

IT OUTSOURCING FIRM STARTUP FINANCIAL MODEL TEMPLATE EXCEL FREE ADVANTAGES

Optimize resource allocation and manage surplus cash effectively with a robust IT outsourcing financial forecasting model.

Accurate cash flow models for IT outsourcing enable proactive surplus management, driving strategic reinvestment and financial stability.

A robust IT outsourcing financial model empowers better decision-making through precise forecasting and cost analysis.

Enhance decision-making with IT outsourcing cash flow models, confidently forecasting impacts on staffing and equipment investments.

Optimize cash flow and enhance profitability using a tailored financial model for IT outsourcing firms managing accounts receivable.

A cash flow model for IT outsourcing reveals late payments’ impact, enhancing financial forecasting and improving revenue management.

The IT outsourcing financial model simplifies budgeting and boosts profitability through clear, actionable financial forecasting and analysis.

Streamlined, color-coded financial models enhance accuracy and clarity in IT outsourcing business projections and strategic planning.

Get a powerful financial model that enhances IT outsourcing profitability and streamlines accurate expense forecasting.

This robust IT outsourcing financial model empowers precise planning, customization, and insightful financial forecasting for superior profitability.