Adaptive Reuse Hotel Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Adaptive Reuse Hotel Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Adaptive Reuse Hotel Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ADAPTIVE REUSE HOTEL FINANCIAL MODEL FOR STARTUP INFO

Highlights

The adaptive reuse hotel financial model offers a comprehensive tool for startups or established companies aiming to secure funding from investors or banks by providing precise adaptive reuse hotel investment analysis, cash flow projections, and budgeting models. This financial plan template excels in adaptive reuse hotel project financing, enabling users to estimate costs accurately, forecast profitability, and perform break-even analysis, which are essential for enhancing business plans and ensuring financial feasibility. Additionally, it supports detailed adaptive reuse hotel renovation financials, capital expenditure tracking, operating expense management, and debt service analysis, making it invaluable for scenario planning and optimizing funding strategies. By leveraging this unlocked, fully editable model, businesses can confidently navigate the complexities of adaptive reuse hotel revenue models and ROI calculations to improve their chances of successful funding and sustainable growth.

This adaptive reuse hotel financial model template addresses common pain points by consolidating complex analyses such as adaptive reuse hotel investment analysis, cost estimation, and capital expenditure tracking into one streamlined dashboard, eliminating the need to toggle between multiple sheets. It supports comprehensive adaptive reuse hotel project financing and funding strategies, enabling clear cash flow projection, debt service analysis, and operating expenses management within a single view. The inclusion of adaptive reuse hotel break-even analysis, profitability forecast, and return on investment calculations accelerates financial feasibility assessment and scenario planning. Additionally, the model’s adaptive reuse hotel revenue model and expense tracking enhance accuracy in budgeting, while integrated tax impact modeling and valuation tools facilitate robust decision-making for investors and developers alike.

Description

This adaptive reuse hotel financial model incorporates comprehensive investment analysis and project financing inputs, enabling precise cost estimation, capital expenditure planning, and cash flow projection over a 5-year horizon. It integrates a robust revenue model alongside detailed operating expenses and debt service analysis, facilitating an accurate break-even analysis and profitability forecast tailored for both startups and existing hotels. The model also supports adaptive reuse hotel budgeting, expense tracking, and financial feasibility assessments, while providing tax impact modeling and return on investment calculations critical for funding strategies and valuation. Scenario planning features empower stakeholders with insights into varying market conditions and renovation financials, making this tool essential for thorough adaptive reuse hotel financial management and investor presentations.

ADAPTIVE REUSE HOTEL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive adaptive reuse hotel financial model to evaluate strategic decisions impacting your project’s future. Our all-in-one Excel template integrates adaptive reuse hotel investment analysis, cost estimation, cash flow projections, and break-even analysis. It automatically generates projected income statements, pro forma balance sheets, and cash flow forecasts, offering precise adaptive reuse hotel profitability forecasts and capital expenditure insights. The dynamic dashboard presents critical KPIs clearly, supporting effective budgeting, funding strategies, and financial feasibility assessments—empowering confident, data-driven decisions for your adaptive reuse hotel investment.

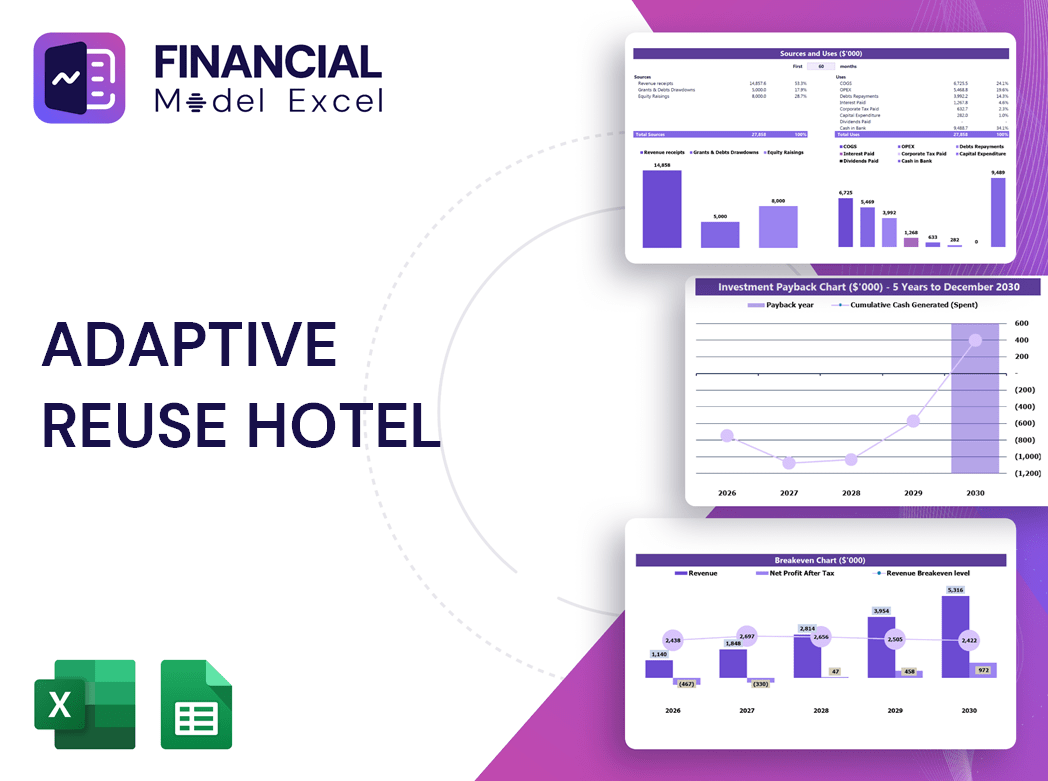

Dashboard

Our adaptive reuse hotel financial dashboard is a powerful tool for comprehensive investment analysis and project financing. It integrates cost estimation, cash flow projection, and operating expense tracking to deliver precise, visual financial insights. Designed to enhance budgeting models and scenario planning, it supports profitability forecasts, break-even analysis, and ROI evaluation. This dashboard empowers stakeholders with accurate renovation financials and capital expenditure details, facilitating robust financial feasibility assessments and optimized funding strategies for successful adaptive reuse hotel projects.

Business Financial Statements

Our specialized adaptive reuse hotel financial model integrates three essential statements: the Income Statement captures revenues, operating expenses, depreciation, and taxes; the Balance Sheet details assets, liabilities, and equity to ensure financial equilibrium; and the Cash Flow Statement tracks cash inflows and outflows, providing clear cash flow projections. This comprehensive framework supports accurate cost estimation, budgeting models, and cash flow projection, enabling informed investment analysis, profitability forecasting, and financing strategies for adaptive reuse hotel projects.

Sources And Uses Statement

Our adaptive reuse hotel cash flow projection and budgeting model offers investors a clear, data-driven view of financial performance over time. This precision tool enables accurate forecasting of profitability, capital expenditure, and operating expenses, empowering stakeholders to evaluate return on investment and conduct break-even analysis with confidence. By regularly inputting key financials, owners gain timely insights to optimize funding strategies and expansion decisions. Designed for clarity and reliability, this model is an essential asset for adaptive reuse hotel project financing and financial feasibility assessments, ensuring informed, strategic growth based on real-world data.

Break Even Point In Sales Dollars

An adaptive reuse hotel break-even analysis identifies the precise revenue point where total costs meet total income, essential for informed investment decisions. By integrating cost estimation, operating expenses, and capital expenditure, this model pinpoints required sales volume and pricing strategies. Understanding the contribution margin through revenue models guides profitability forecasts and cash flow projections. Incorporating this analysis into adaptive reuse hotel financial feasibility and budgeting models empowers investors to optimize funding strategies and enhance return on investment, ensuring a confident and data-driven approach to project financing and renovation financials.

Top Revenue

Accurate revenue modeling is critical in adaptive reuse hotel investment analysis. Our adaptive reuse hotel financial feasibility template integrates comprehensive revenue models and 5-year cash flow projections, capturing multiple income streams. Designed for precise adaptive reuse hotel cost estimation and renovation financials, it incorporates historical growth rates and scenario planning to forecast profitability and operating expenses. Financial analysts can confidently evaluate cash flow, break-even points, and return on investment, ensuring robust adaptive reuse hotel project financing and capital expenditure strategies. Unlock expert insights with our adaptive reuse hotel budgeting model and funding strategies to maximize your investment’s success.

Business Top Expenses Spreadsheet

Effective adaptive reuse hotel investment analysis demands rigorous expense tracking and cost optimization. Our adaptive reuse hotel budgeting model includes a top spending report that highlights the four largest operating expenses, categorizing all others as ‘other.’ This enables investors and managers to monitor trends and variances annually, supporting precise adaptive reuse hotel cost estimation and cash flow projection. By closely analyzing and controlling capital expenditures and operating expenses, both startups and established projects can enhance their adaptive reuse hotel profitability forecast and ensure sustainable return on investment.

ADAPTIVE REUSE HOTEL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurate adaptive reuse hotel cost estimation is critical from the outset of any investment. Our comprehensive budgeting model incorporates start-up costs within a dynamic financial feasibility framework, enabling precise tracking and validation to prevent underfunding. Utilizing our adaptive reuse hotel cash flow projection and expense tracking tools, investors and managers gain clear insight into capital expenditure, operating expenses, and debt service analysis. This proactive approach enhances profitability forecasts and supports sound funding strategies, ensuring your adaptive reuse hotel project financing remains robust and aligned with your return on investment goals.

CAPEX Spending

Adaptive reuse hotel capital expenditures (CAPEX) represent significant investments in acquiring and upgrading assets essential for project success. These costs, critical for adaptive reuse hotel renovation financials, vary over time and must be accurately reflected in cash flow projections and budgeting models. Effective expense tracking ensures optimized operating expenses while supporting accurate profitability forecasts and ROI analyses. Incorporating CAPEX into adaptive reuse hotel financial feasibility studies and break-even analyses helps secure project financing and guide funding strategies, ultimately strengthening the project's market position and long-term sustainability.

Loan Financing Calculator

The loan amortization schedule within this adaptive reuse hotel financial model provides a detailed breakdown of periodic loan repayments, including principal and interest components. It enables precise adaptive reuse hotel debt service analysis by outlining payment timelines until full loan settlement. This clarity supports accurate adaptive reuse hotel cash flow projection, capital expenditure planning, and enhances the overall adaptive reuse hotel financial feasibility. By integrating this schedule, investors and developers can confidently assess funding strategies and optimize adaptive reuse hotel profitability forecasts throughout the project's lifecycle.

ADAPTIVE REUSE HOTEL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In adaptive reuse hotel investment analysis, EBITDA serves as a key metric within the 5-year cash flow projection to evaluate operating performance. It calculates earnings before interest, taxes, depreciation, and amortization, focusing solely on core revenue minus operating expenses. This approach provides a clear view of profitability before capital expenditure and debt service impact, essential for accurate adaptive reuse hotel financial feasibility and profitability forecasts. Use EBITDA to inform renovation financials, budgeting models, and funding strategies, ensuring a robust adaptive reuse hotel revenue model and comprehensive break-even analysis.

Cash Flow Forecast Excel

The cash balance in an adaptive reuse hotel financial projection represents the available funds within the company's accounts, ensuring sufficient liquidity to cover current operating expenses and debt service. Maintaining an optimal cash reserve is crucial for adaptive reuse hotel project financing, supporting smooth operations, timely capital expenditures, and unforeseen costs. Accurate cash flow projection and expense tracking help investors and managers confidently navigate budgeting models, enhancing profitability forecasts and overall financial feasibility.

KPI Benchmarks

This pro forma Excel template offers a comprehensive adaptive reuse hotel financial feasibility tool, incorporating benchmarking and market analysis. Business owners can analyze adaptive reuse hotel profitability forecasts, cash flow projections, and expense tracking to evaluate their performance against industry competitors. The template supports scenario planning and funding strategies, enabling informed decisions on capital expenditure, renovation financials, and operating expenses. By leveraging this adaptive reuse hotel return on investment model, owners can identify strategic opportunities and optimize their investment for maximum results.

P&L Statement Excel

The adaptive reuse hotel profit and loss template is essential within the financial feasibility model, capturing both gross and net profits. A comprehensive P&L statement ensures accurate tracking of operating expenses, revenue models, and capital expenditures, empowering data-driven decisions. Regardless of apparent success, without detailed financial statements—including break-even analysis and cash flow projections—stakeholders cannot confidently assess the project's profitability forecast or return on investment. Accurate financial reporting is critical to validate the strength and viability of any adaptive reuse hotel investment.

Pro Forma Balance Sheet Template Excel

Integrating the projected balance sheet with profit and loss forecasts is essential in adaptive reuse hotel investment analysis. This approach accurately determines the capital expenditure and funding strategies required to sustain projected revenues and profitability. A comprehensive balance sheet forecast underpins effective adaptive reuse hotel financial feasibility assessments, enabling precise cash flow projections and budgeting models. Ultimately, this financial alignment empowers stakeholders to forecast operating expenses, debt service analysis, and return on investment confidently, ensuring informed decision-making and optimized project financing for adaptive reuse hotel ventures.

ADAPTIVE REUSE HOTEL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This adaptive reuse hotel investment analysis offers a comprehensive financial feasibility study, integrating all revenue streams, operating expenses, and capital expenditures. Our detailed cash flow projection and budgeting model account for precise timing of each transaction, ensuring accurate profitability forecasts. With robust break-even analysis and return on investment metrics, this report supports informed funding strategies and project financing decisions. Trust this adaptive reuse hotel financial plan to guide your investment towards maximizing value while effectively managing renovation financials and debt service analysis.

Cap Table

Our adaptive reuse hotel financial projection model includes a comprehensive cap table Excel, enabling precise calculation of shareholder ownership dilution across up to four funding rounds. Whether applying one, two, or all four rounds, investors can seamlessly integrate these scenarios into their adaptive reuse hotel investment analysis, enhancing accuracy in funding strategies and return on investment forecasts. This dynamic tool supports robust budgeting models and financial feasibility assessments essential for successful project financing and profitability forecasting.

ADAPTIVE REUSE HOTEL BUSINESS PLAN FINANCIAL PROJECTIONS TEMPLATE ADVANTAGES

Adaptive reuse hotel budgeting model ensures precise expense tracking for optimized spending and maximized profitability.

The adaptive reuse hotel financial model ensures precise break-even analysis and maximizes return on investment confidently.

Maximize returns and reduce risk with our adaptive reuse hotel financial model featuring dual valuation methods and 5-year projections.

Maximize returns by leveraging the adaptive reuse hotel financial model’s precise 5-year financial projection for smart asset acquisition.

Adaptive reuse hotel financial models optimize budgeting and cash flow, maximizing profitability and investment returns efficiently.

ADAPTIVE REUSE HOTEL 3 WAY FINANCIAL MODEL TEMPLATE ADVANTAGES

The adaptive reuse hotel financial model optimizes cash flow, enhancing surplus cash management for improved investment returns.

Adaptive reuse hotel cash flow projection ensures precise surplus cash planning, optimizing reinvestment and debt repayment decisions confidently.

Adaptive reuse hotel financial models streamline budgeting and forecasting, enhancing investment confidence with easy-to-follow insights.

Streamlined adaptive reuse hotel financial model ensures clear, transparent planning with color-coded tabs for precise budgeting and forecasting.

Our adaptive reuse hotel financial model simplifies budgeting, boosting profitability and ensuring precise investment analysis and cash flow projections.

Our adaptive reuse hotel financial model delivers quick, reliable insights with minimal planning experience and basic Excel skills needed.

Save time and money with our adaptive reuse hotel financial model, optimizing budgeting, forecasting, and investment analysis.

Adaptive reuse hotel financial models streamline planning, eliminating complex formulas and consultants for effortless, efficient investment analysis.

Our integrated adaptive reuse hotel financial model ensures accurate profitability forecasts to confidently attract and convince investors.

The adaptive reuse hotel financial model integrates all data, delivering investor-ready insights for confident, deal-proven decision-making.