Airport Construction and Expansion Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Airport Construction and Expansion Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Airport Construction and Expansion Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AIRPORT CONSTRUCTION AND EXPANSION FINANCIAL MODEL FOR STARTUP INFO

Highlights

Develop a comprehensive 5-year airport expansion project financial plan featuring detailed financial forecasting for airport development, including profit and loss projections, financial statements, and key financial ratios in GAAP or IFRS formats. This robust airport infrastructure investment model enables precise airport construction budget planning and cash flow modeling, facilitating the financial evaluation of startup ideas and capital expenditure models for airport terminal construction and airfield expansion cost estimation. Fully unlocked and editable, this airport project finance modeling technique helps assess the financial viability and ROI of airport capacity expansion, ensuring effective airport project funding and economic feasibility analysis for successful infrastructure upgrades.

The ready-made airport construction financial analysis model in Excel offers a comprehensive solution to common pain points such as time-consuming financial forecasting for airport development, complex budget planning, and uncertainty in cost estimation. By integrating a capital expenditure model for airport expansion and airfield expansion cost estimation, it streamlines airport project funding and financial modeling, allowing users to accurately evaluate airport infrastructure investment and runway construction financial forecasts with ease. Additionally, its financial evaluation model for airport upgrades and airport construction ROI financial model help buyers mitigate risks by providing clear visibility into cash flow modeling and economic feasibility, ensuring robust airport capacity expansion financial analysis and airport terminal construction financial planning are both efficient and precise.

Description

Developing a comprehensive airport construction financial analysis model is essential for accurately forecasting capital expenditures, operating costs, and revenue projections associated with airport infrastructure investment and expansion projects. This airport expansion project financial plan integrates detailed airport construction budget planning and cash flow modeling to provide a robust framework for assessing economic feasibility and financial viability. Utilizing advanced airport project finance modeling techniques, the model supports airfield expansion cost estimation and airport terminal construction financial planning by generating five-year profit and loss projections, balance sheets, and cash flow forecasts. It also calculates critical metrics such as internal rate of return, discounted cash flow, and return on investment to facilitate informed decision-making regarding airport development funding and capacity expansion financial analysis. By simulating various scenarios, this financial modeling for airport projects helps stakeholders evaluate risks, optimize funding strategies, and ensure sustainable growth in airport infrastructure expansion budgeting models.

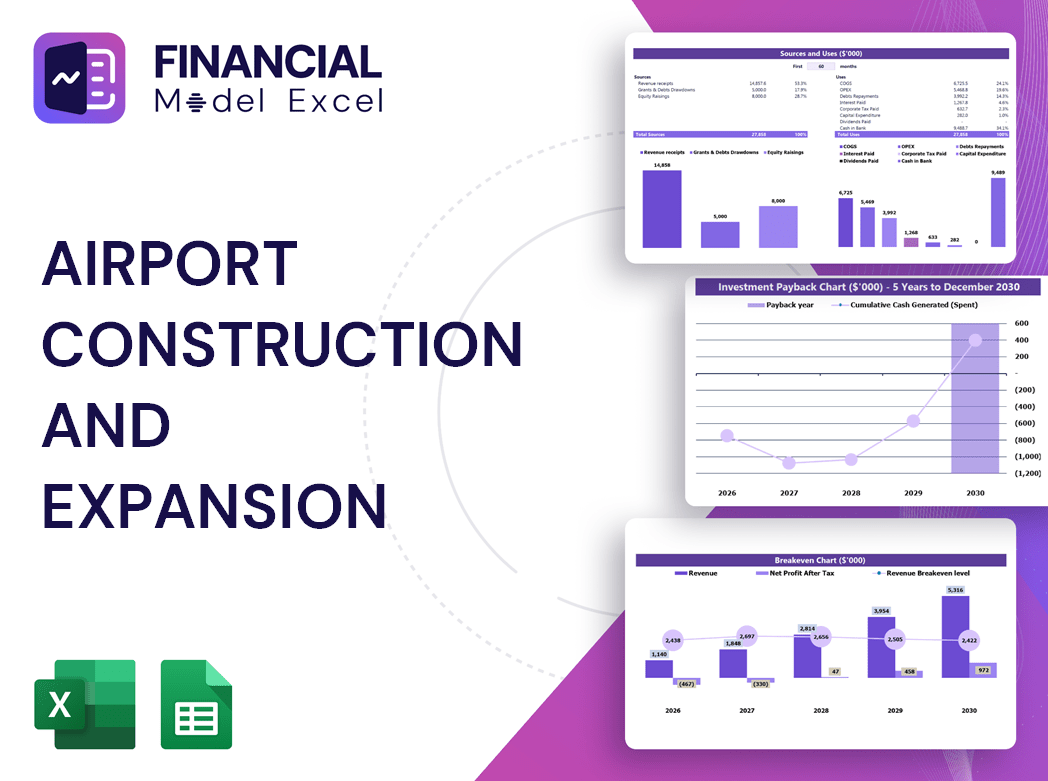

AIRPORT CONSTRUCTION AND EXPANSION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover a comprehensive airport construction financial analysis model designed for robust, scalable financial forecasting in airport development. Our adaptable excel template supports airport expansion project financial plans by integrating advanced airport infrastructure investment and cash flow modeling techniques. Engineered to withstand varied assumptions, it enables precise airport construction budget planning, runway construction financial forecasts, and ROI financial modeling. Tailored for unique project needs, users can customize, add, or adjust any financial data, ensuring reliable financial evaluation for airport upgrades and capital expenditure modeling—empowering smarter decision-making for airport capacity expansion and infrastructure investment projects.

Dashboard

An airport construction financial analysis model offers a dynamic dashboard that streamlines financial forecasting for airport development. It enables precise evaluation of key indicators like capital expenditure, cash flow, and ROI, essential for airport expansion project financial plans. This comprehensive tool supports airport infrastructure investment models by consolidating diverse financial data, enhancing decision-making, and ensuring transparency. With accurate airport construction budget planning and financial modeling for airport projects, stakeholders can confidently assess economic feasibility, optimize resource allocation, and build trust through clear reporting—driving successful airport capacity expansion and terminal construction initiatives.

Business Financial Statements

When developing an airport construction financial analysis model, it’s crucial to incorporate all key components in a clear, intuitive format. Whether building an airport expansion project financial plan or an airfield expansion cost estimation model, a well-structured, 5-year financial forecasting template ensures transparency and ease of review. This approach enhances the effectiveness of airport infrastructure investment models and supports informed decision-making in airport project finance modeling techniques, ultimately driving successful capital expenditure planning and robust airport construction ROI financial models.

Sources And Uses Statement

The airport construction financial analysis model clearly outlines funding sources and capital allocation, ensuring a balanced airport construction budget planning process. This key statement details, line-by-line, where funds originate and how they’ll be utilized in the airport expansion project financial plan. Ideally, sources should equal or exceed uses—signaling sufficient capital for airport infrastructure investment models and potential expansion. If uses surpass sources, additional funding is required, highlighting the importance of precise airport project finance modeling techniques for robust financial forecasting and ensuring the airport development financial viability model aligns with project goals.

Break Even Point In Sales Dollars

The break-even revenue calculator offers a comprehensive financial evaluation model for airport upgrades, providing clear insights into profits across various sales levels. This tool supports airport construction budget planning and financial forecasting for airport development by generating organized reports on revenue performance. Additionally, it highlights the safety margin, indicating how much sales can decline before losses occur. Ideal for airport project finance modeling techniques and airport infrastructure investment models, it ensures informed decision-making to optimize ROI in airport expansion and terminal construction financial plans.

Top Revenue

This airport construction financial analysis model offers a dedicated section for an in-depth breakdown of revenue streams. It categorizes revenues by specific services and products, enabling precise financial forecasting for airport development. Designed to support airport expansion project financial plans, this tool facilitates accurate airport construction budget planning and enhances the airport infrastructure investment model. With its detailed financial evaluation model for airport upgrades, stakeholders gain valuable insights into revenue drivers, ensuring robust airport construction cash flow modeling and optimized capital expenditure for sustainable growth.

Business Top Expenses Spreadsheet

This robust airport construction financial analysis model features a comprehensive Top Expenses tab, categorizing costs into four primary sections plus an ‘Other’ category for miscellaneous expenditures. Designed to enhance airport expansion project financial planning, it supports accurate budgeting, cost estimation, and cash flow modeling. Ideal for financial forecasting and capital expenditure assessment, this model streamlines airport infrastructure investment evaluation and construction budget planning, ensuring reliable financial viability insights for runway, terminal, and airfield development projects.

AIRPORT CONSTRUCTION AND EXPANSION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The airport construction financial analysis model offers robust financial forecasting for airport development, enabling accurate five-year projections and detailed budget planning. It supports airport construction cash flow modeling by monitoring cost variations and incorporating essential parameters like income percentages, payroll, and recurring expenses. This sophisticated airport infrastructure investment model allocates costs across variable and fixed expenses, COGS, wages, and CAPEX, ensuring precise financial evaluation for airport upgrades. With this comprehensive financial planning tool, you gain clear insights into capital expenditure, enhancing the economic feasibility and ROI of your airport expansion project financial plan.

CAPEX Spending

A comprehensive capital expenditure (CAPEX) model is essential for effective airport construction budget planning and financial forecasting for airport development. This model captures capitalized investments—such as terminals, runways, or infrastructure expansions—reflected on the pro forma balance sheet rather than the income statement. By leveraging airport construction cash flow modeling and project finance modeling techniques, stakeholders can evaluate the financial viability and ROI of airport expansion projects, ensuring informed decisions for funding, budgeting, and economic feasibility. Such rigorous financial evaluation models drive strategic airport capacity expansion and infrastructure investment planning with precision.

Loan Financing Calculator

Our airport construction financial analysis model includes a comprehensive loan amortization schedule within the 'Capital' tab. This feature offers pre-built proformas with integrated formulas to accurately track loans, interest, and equity. Designed to enhance your airport expansion project financial plan, it supports precise financial forecasting for airport development and streamlines capital expenditure modeling for airport expansions. Optimize your airport construction budget planning and financial modeling for airport projects with this reliable tool, ensuring robust airport infrastructure investment modeling and cash flow management throughout your airfield expansion or terminal construction initiatives.

AIRPORT CONSTRUCTION AND EXPANSION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBIT (Earnings Before Interest and Tax) is a critical metric integrated into airport construction financial analysis models and expansion project financial plans. Representing operating performance, EBIT excludes non-operational income and expenses, offering a clear view of core profitability. This measure is essential in financial forecasting for airport development, enabling project stakeholders to evaluate operational efficiency and make informed decisions. Incorporating EBIT into airport infrastructure investment models and financial evaluation models ensures accurate assessment of project viability, supporting effective airport construction budget planning and capital expenditure modeling for successful airport expansion initiatives.

Cash Flow Forecast Excel

The airport construction cash flow modeling is crucial for effective financial planning in airport development projects. Utilizing an airport construction financial analysis model, it tracks cash inflows and outflows, incorporating key inputs like payables, receivables, working capital, and long-term debt. This enables accurate forecasting of net cash flow and cash balances, ensuring robust airport expansion project financial plans. Ideal for airport infrastructure investment models, it supports budgeting, financial viability assessments, and ROI analysis, ultimately facilitating sound airport construction budget planning and successful capital expenditure management.

KPI Benchmarks

The financial benchmarking feature in this airport construction financial analysis model enables companies to evaluate key performance indicators against industry peers. By leveraging best practices from leading firms, businesses enhance their financial forecasting for airport development and optimize airport construction budget planning. This comparative approach is vital for refining airport expansion project financial plans, improving cash flow modeling, and boosting ROI. Ultimately, financial benchmarking serves as a critical tool for airport infrastructure investment models, guiding start-ups and established firms toward more efficient, data-driven decision-making in airport project finance and capital expenditure planning.

P&L Statement Excel

Utilizing a comprehensive airport construction financial analysis model ensures precise forecasting of future revenues and expenses. Incorporating monthly profit and loss statements within airport expansion project financial plans offers clear visibility into cash flow and enhances decision-making. This advanced financial modeling for airport projects empowers stakeholders to evaluate investment viability, optimize budget planning, and confidently manage capital expenditures. By leveraging proven airport infrastructure investment models, airport developers can maintain authoritative control over every financial aspect, driving successful and sustainable airport capacity expansions with accuracy and confidence.

Pro Forma Balance Sheet Template Excel

The projected balance sheet is integral to airport construction financial analysis models, offering crucial insights into assets, liabilities, and equity. Incorporated within financial forecasting tools, this report supports comprehensive airport expansion project financial plans by enabling precise calculation of key financial ratios and metrics. Leveraging such a pro forma balance sheet enhances accuracy in airport infrastructure investment models, construction budget planning, and capital expenditure forecasting—empowering stakeholders to assess the financial viability of airport development projects with confidence and clarity.

AIRPORT CONSTRUCTION AND EXPANSION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive airport construction financial analysis model delivers precise insights for your airport expansion project financial plan. It incorporates weighted average cost of capital (WACC) to highlight the minimum expected return on investments. Utilizing discounted cash flow and free cash flow valuation, the model accurately forecasts available cash for investors beyond operational needs. This dynamic financial modeling for airport projects ensures robust financial forecasting for airport development, empowering you to demonstrate the economic feasibility and ROI of your airport infrastructure investment with confidence and clarity.

Cap Table

The airport construction financial analysis model is a vital tool for effective airport expansion project financial planning. It provides detailed financial forecasting for airport development, encompassing capital expenditure models, cash flow projections, and ROI analysis. Utilizing advanced airport project finance modeling techniques, this model ensures accurate budgeting, cost estimation, and economic feasibility assessments for airfield and terminal construction. With comprehensive airport infrastructure investment models and financial evaluation tools, stakeholders gain clear insights into project viability, funding strategies, and optimized financial planning, ensuring successful and sustainable airport capacity expansion.

AIRPORT CONSTRUCTION AND EXPANSION FINANCIAL MODELLING EXCEL TEMPLATE ADVANTAGES

The airport construction financial analysis model enhances credibility and confidence for investors and stakeholders.

Accurately calculate capital demand using advanced airport construction and expansion financial modeling for strategic project success.

Optimize your airport expansion success with a comprehensive financial model ensuring accurate revenue and cost forecasting.

Maximize investment returns with our airport construction and expansion financial model for precise project financial planning.

The airport construction financial analysis model enables precise 5-year cost planning, optimizing project funding and ROI effectively.

AIRPORT CONSTRUCTION AND EXPANSION 3 WAY FINANCIAL MODEL ADVANTAGES

Leverage our airport construction financial analysis model to secure funding with confident, precise, and compelling investment plans.

Impress investors with a strategic airport construction financial model that ensures precise forecasting and maximizes project ROI effectively.

The airport construction financial analysis model optimizes budgeting, ensuring accurate cost control and maximizing project ROI.

Delivers dynamic 5-year airport construction financial models with proforma and GAAP/IFRS statements for informed expansion decisions.

Our airport construction financial analysis model drives strategic investment and maximizes ROI for sustainable airport expansion growth.

The airport construction financial analysis model enables strategic cash flow forecasting to identify the most viable funding and growth options.

The airport construction financial analysis model ensures accurate 5-year forecasts, optimizing investment decisions and budgeting efficiency.

Optimize your airport expansion with a 5-year integrated financial model featuring automated monthly and annual summaries.

Get a robust airport construction financial model offering accurate forecasting and flexible expansion for superior project planning.

This robust airport construction financial model ensures precise planning, maximizing ROI and enabling tailored, detailed project analysis.