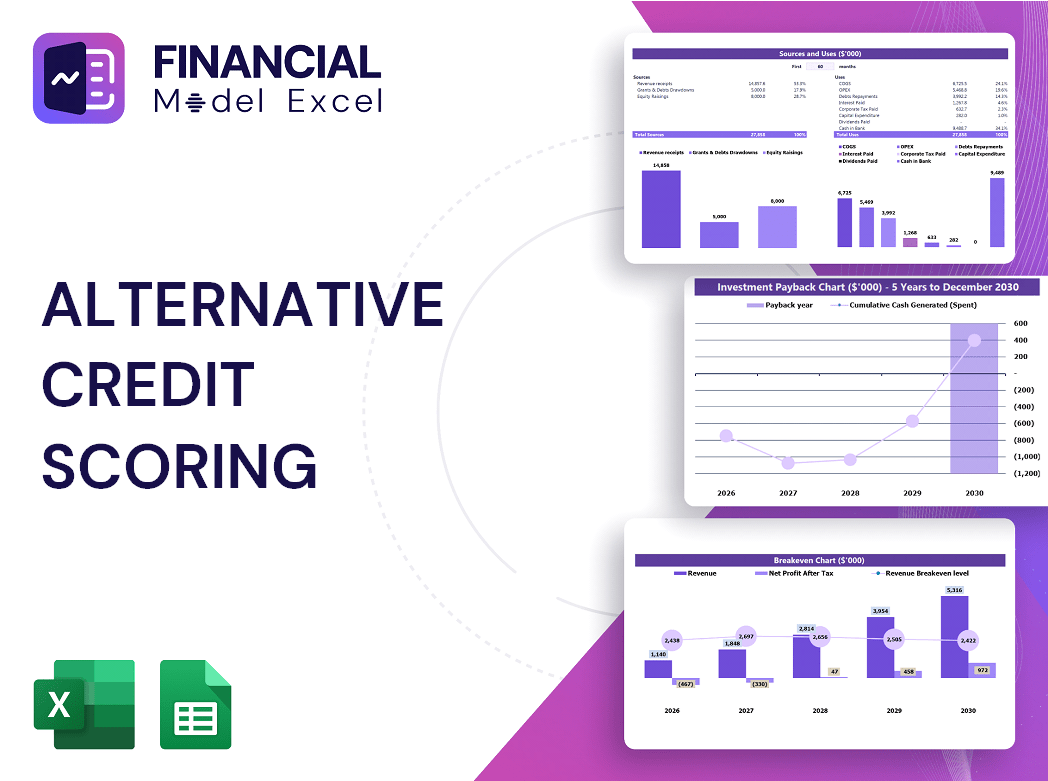

Alternative Credit Scoring Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Alternative Credit Scoring Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Alternative Credit Scoring Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ALTERNATIVE CREDIT SCORING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Creates a comprehensive 5-year alternative credit scoring financial model featuring advanced alternative credit scoring algorithms and machine learning credit scoring models, complete with financial projections in Excel, income and expenditure templates, detailed financial statements, and key financial ratios in both GAAP and IFRS formats. This alternative credit scoring system template enables you to conduct robust credit scoring financial analysis and credit risk financial model assessments, empowering you to effectively evaluate your startup idea or plan startup costs. Fully unlocked and customizable, it supports credit scoring model development using non-traditional credit scoring techniques and alternative data credit scoring tools to enhance your credit evaluation financial model and optimize lending decisions.

This comprehensive alternative credit scoring financial model template addresses the common pain points faced by lenders and startups by integrating advanced alternative credit scoring algorithms and non-traditional credit scoring techniques, allowing for a more accurate credit risk financial model beyond traditional credit evaluation. With built-in machine learning credit scoring models and AI credit scoring systems, users can leverage alternative data credit scoring tools to improve predictive accuracy and make smarter lending decisions, while the detailed input tables, charts, and graphs streamline credit scoring financial analysis and financial modeling for lending. This robust credit scoring model development facilitates continuous monitoring of investor equity valuation and liquidity management, ultimately enhancing credit scoring predictive models and financial model credit risk assessment to boost business growth and borrower reputation within the alternative scoring for loans ecosystem.

Description

Our alternative credit scoring financial model startup costs spreadsheet offers a robust 5-year forecast specifically designed for businesses employing alternative credit scoring methods, including AI credit scoring models and machine learning credit scoring models. This comprehensive financial model for credit scoring integrates alternative credit scoring algorithms and alternative data credit scoring, enabling users to perform detailed credit scoring financial analysis and credit evaluation financial model assessments. The template consolidates key financial statements such as projected balance sheets, P&L statements, and cash flow projections, alongside valuation charts, break-even analysis, and KPIs, all dynamically updated in response to input changes. Its user-friendly interface requires minimal financial expertise, allowing seamless financial modeling for lending and credit risk financial model evaluation, thereby supporting informed decision-making in credit scoring model development and alternative scoring for loans.

ALTERNATIVE CREDIT SCORING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive startup financial model template integrating alternative credit scoring models and AI-driven credit risk financial analysis. This solution automates key financial reports—including projected profit and loss, balance sheets, and cash flow statements—while incorporating advanced machine learning credit scoring algorithms for more accurate credit evaluation. Essential KPIs and insights are seamlessly visualized in a dynamic dashboard, empowering strategic decision-making and enhancing lending risk assessments. Leverage cutting-edge alternative credit scoring techniques and financial modeling for lending to predict and optimize your startup’s financial future with precision and confidence.

Dashboard

A startup financial model template featuring an intuitive dashboard is an essential alternative credit scoring tool. It enables swift, accurate financial analysis and credit risk assessment using alternative credit scoring models and AI-driven algorithms. By integrating alternative data credit scoring and machine learning credit scoring models, it provides real-time insights into financial health, optimizing management decisions and strategic planning. This credit scoring predictive model enhances transparency and builds trust with stakeholders through reliable financial reporting. Embracing advanced financial modeling for lending ensures startups leverage non-traditional credit scoring techniques to strengthen credit evaluation and drive sustainable growth.

Business Financial Statements

Our advanced financial model for credit scoring integrates alternative credit scoring models with comprehensive pro forma financial statements, including balance sheets, profit and loss projections, and cash flow forecasts. Designed for seamless credit evaluation financial analysis, this system supports both GAAP and IFRS formats. The model incorporates machine learning credit scoring algorithms and alternative data credit scoring tools to deliver accurate five-year financial forecasts and credit risk assessments, empowering lenders with non-traditional credit scoring techniques and alternative scoring for loans. Experience streamlined credit scoring model development combined with robust financial modeling for lending decisions.

Sources And Uses Statement

The sources and uses of funds statement is essential for transparent financial modeling for lending. It clearly tracks all income sources and directs funds efficiently, supporting accurate credit risk financial models. Leveraging alternative credit scoring systems and AI credit scoring models further enhances credit evaluation financial models, enabling more precise credit scoring predictive models. Integrating alternative data credit scoring and machine learning credit scoring models helps develop robust credit scoring model development strategies, optimizing alternative scoring for loans and strengthening overall credit risk assessment.

Break Even Point In Sales Dollars

Integrating a break-even analysis within this startup financial model provides a clear view of the sales volume—or units sold—required to cover all fixed and variable costs. This essential financial modeling tool guides strategic decision-making by revealing the critical threshold for profitability. In credit scoring model development, combining such financial models with alternative credit scoring techniques and AI credit scoring models enhances credit risk financial analysis, enabling more precise credit evaluation and smarter lending decisions through advanced alternative data credit scoring and machine learning credit scoring models.

Top Revenue

In financial modeling for lending, alternative credit scoring models—such as machine learning credit scoring algorithms and AI credit scoring tools—enhance traditional credit risk assessment. These non-traditional credit scoring techniques utilize alternative data to build predictive credit scoring financial models, offering deeper credit evaluation. Just as top-line revenue growth signals business expansion and bottom-line net income reflects profitability, robust alternative credit risk models drive smarter lending decisions and improved loan performance. Integrating alternative credit scoring systems transforms credit scoring model development, delivering more accurate financial model credit risk assessments and unlocking potential in underserved markets.

Business Top Expenses Spreadsheet

The Top Expenses tab enables you to generate detailed cost summaries vital for accurate financial modeling and credit risk assessment. Leveraging organized expense data supports alternative credit scoring models, enhancing predictive accuracy. Comparing actual versus planned expenses uncovers variances, informing strategic decisions in credit evaluation financial models and startup financial planning. This comprehensive expense reporting aids in developing robust alternative credit scoring techniques and machine learning credit scoring models, optimizing loan risk analysis and financial modeling for lending. Stay compliant and prepared for tax time while empowering your credit scoring model development with precise, actionable cost insights.

ALTERNATIVE CREDIT SCORING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effectively managing start-up costs is crucial to prevent cash flow issues and funding shortfalls. Leveraging alternative credit scoring models and advanced financial modeling for lending empowers businesses to assess credit risk accurately from the outset. Our Pro-forma templates integrate credit scoring predictive models and alternative credit scoring algorithms, enabling precise expense planning and robust credit evaluation financial analysis. With these tools, you can confidently control costs while optimizing financial strategies, ensuring your business launches on a solid financial foundation.

CAPEX Spending

Our advanced financial model for credit risk assessment integrates alternative credit scoring techniques and AI-driven credit scoring algorithms to enhance loan evaluation accuracy. By leveraging alternative data credit scoring and machine learning credit scoring models, users can perform precise credit scoring financial analysis and develop robust credit scoring predictive models. This innovative approach supports non-traditional credit scoring systems, optimizing credit evaluation financial models for lending decisions. Experience seamless financial modeling for lending with automated depreciation calculations, including straight-line and double-declining balance methods, ensuring comprehensive capital expenditure (CAPEX) forecasts within your credit scoring model development framework.

Loan Financing Calculator

Our startup's financial modeling for lending includes a comprehensive loan amortization schedule, designed with embedded formulae to clearly detail repayment timelines. This credit evaluation financial model breaks down each installment into principal and interest components, providing precise, time-based insights—monthly, quarterly, or annually. Leveraging alternative credit scoring tools and advanced financial model credit risk assessment techniques, our system ensures accurate forecasting and improved loan management.

ALTERNATIVE CREDIT SCORING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net profit margin is a key financial metric that reveals how effectively a company converts revenue into profits. Integrated within financial modeling for lending and credit evaluation financial models, it offers valuable insights into operational efficiency. Utilizing alternative credit scoring techniques and credit scoring predictive models alongside net profit margin analysis enhances credit risk financial models, enabling more accurate assessments. This metric is crucial for forecasting long-term growth, showing how income exceeds costs and guiding informed lending decisions with alternative credit risk models and AI credit scoring models to optimize credit scoring model development.

Cash Flow Forecast Excel

The startup financial model template incorporates advanced financial modeling for lending, emphasizing operating cash flow projections. This credit scoring financial analysis highlights cash generated strictly from core business operations, excluding alternative data credit scoring elements such as interest or investment income. Integrating alternative credit scoring techniques with a credit risk financial model ensures precise credit evaluation financial models, empowering lenders with superior insights through machine learning credit scoring models and AI credit scoring models. Such sophisticated alternative credit scoring algorithms enhance credit scoring predictive models for robust credit risk assessment and informed alternative scoring for loans.

KPI Benchmarks

The financial projection benchmark tab leverages alternative credit scoring models and credit risk financial models to generate key performance indicators (KPIs) for comparable companies. These KPIs, drawn from industry data, create averages that serve as benchmarks—crucial in credit scoring financial analysis and financial modeling for lending. This benchmarking process supports strategic planning and credit evaluation financial model development, especially benefiting start-ups by providing industry-standard metrics. Utilizing alternative credit scoring algorithms and AI credit scoring models, companies can measure their performance against peers, enhancing decision-making and optimizing credit risk assessment with robust, non-traditional credit scoring tools.

P&L Statement Excel

The forecasted pro forma profit and loss statement offers critical insights into your company’s financial operations, essential for effective financial modeling and credit risk assessment. Utilizing advanced alternative credit scoring models and financial modeling for lending, this approach not only reveals net operating and gross profit margin ratios but also enhances your confidence in forecasting profitability. Integrating AI-driven credit scoring algorithms and alternative credit risk models provides a robust foundation to evaluate creditworthiness and predict financial outcomes, strengthening your organization’s position and decision-making capabilities in a competitive market.

Pro Forma Balance Sheet Template Excel

A projected balance sheet template offers a clear snapshot of your organization’s assets, liabilities, and equity over a specific period. By integrating financial modeling for lending and credit scoring financial analysis, this tool enhances your ability to assess credit risk through alternative credit scoring models and predictive techniques. Utilize our projected balance sheet template in Excel to empower your credit evaluation financial model development, ensuring precise financial model credit risk assessment and informed decision-making aligned with advanced alternative credit scoring algorithms.

ALTERNATIVE CREDIT SCORING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This feasibility study template Excel integrates an advanced financial model for credit risk assessment, enabling users to perform a Discounted Cash Flow valuation effortlessly. By leveraging alternative credit scoring techniques and customizable cost of capital inputs, it streamlines credit evaluation financial model development. Ideal for professionals seeking efficient financial modeling for lending, this tool supports alternative scoring for loans by combining traditional methods with innovative alternative credit scoring models and algorithms to enhance predictive accuracy and decision-making confidence.

Cap Table

A pro forma cap table is an essential financial model for credit risk assessment, detailing the distribution of a company’s securities among investors. It provides a comprehensive credit evaluation financial model by outlining shares, preferred shares, and their respective prices. This alternative credit scoring tool offers critical insights into ownership percentages, enabling more accurate credit scoring predictive models and financial modeling for lending decisions. Integrating such detailed equity data enhances alternative credit scoring techniques, improving the precision of AI credit scoring models and other alternative credit risk models in evaluating loan eligibility and investment risks.

ALTERNATIVE CREDIT SCORING FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Alternative credit scoring models unlock new opportunities by enhancing accuracy and inclusivity in credit risk financial assessments.

Alternative credit scoring models enhance accuracy and efficiency in credit risk financial analysis and lending decisions.

Alternative credit scoring models enhance accuracy, enabling smarter lending decisions and improved credit risk financial assessments.

Set clear objectives to maximize accuracy and efficiency in your alternative credit scoring financial model management.

Easily forecast cash flow and enhance risk assessment with our advanced alternative credit scoring financial model.

ALTERNATIVE CREDIT SCORING FINANCIAL MODELING EXCEL TEMPLATE ADVANTAGES

Alternative credit scoring models proactively identify cash shortfalls, enhancing financial risk assessment and lending decisions.

Alternative credit scoring models act as early warning systems, enhancing accuracy and reducing loan default risks effectively.

Alternative credit scoring models enhance accuracy, boosting stakeholder trust through advanced financial risk assessment and predictive analysis.

Alternative credit scoring models enhance accuracy and build stakeholder trust, enabling smoother investment and lending decisions.

Alternative credit scoring models enable precise credit risk assessment, enhancing lending accuracy and financial decision-making efficiency.

Our alternative credit scoring financial model simplifies compliance by providing ready-made, lender-approved reports and calculations.

Alternative credit scoring models enhance loan approval accuracy while reducing risk through advanced financial modeling and AI algorithms.

Impress investors with a reliable alternative credit scoring financial model that ensures precise credit risk assessment every time.

Alternative credit scoring models offer accurate, efficient credit risk assessment through a convenient all-in-one dashboard.

Alternative credit scoring models enhance accuracy by integrating comprehensive financial forecasts, KPIs, and detailed performance analytics.