Alternative Lending Marketplace Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Alternative Lending Marketplace Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Alternative Lending Marketplace Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ALTERNATIVE LENDING MARKETPLACE FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year alternative lending financial modeling template is designed specifically for businesses operating within the digital lending business model and marketplace lending sectors. Ideal for both startups and established companies, it incorporates critical elements such as loan origination financial projections, peer to peer lending cost modeling, and marketplace lending profitability metrics. The template supports robust P2P lending risk assessment and alternative finance credit risk models, facilitating accurate alternative finance valuation methods and marketplace lending growth forecasting. By leveraging this tool, companies can optimize online lending platform economics and showcase marketplace lending investor returns, enhancing their ability to secure funding from banks, angels, grants, and VC funds with confidence.

This ready-made alternative lending financial model template effectively addresses common pain points such as the complexity of peer to peer lending financial analysis and the challenge of accurate marketplace lending revenue model forecasting by providing a comprehensive three-statement framework with customizable input tables, detailed loan origination financial projections, and integrated digital lending revenue streams. It simplifies P2P lending risk assessment and alternative finance credit risk model implementation by incorporating dynamic KPIs and marketplace lending investor returns metrics, ensuring clear visibility into online lending platform economics. By supporting alternative lending cash flow analysis and marketplace lending profitability metrics, the model alleviates difficulties around alternative finance valuation methods and peer to peer lending cost modeling, enabling users to confidently present financial sustainability scenarios and growth forecasting insights to investors while adapting to specific business needs and funding strategies.

Description

This alternative lending financial model Excel template offers comprehensive tools for marketplace lending revenue model analysis, enabling detailed loan origination financial projections and peer to peer lending financial analysis for startups and established businesses over a 60-month horizon. It integrates key online lending platform KPIs, alternative finance valuation methods, and P2P lending risk assessment to support profitability planning and digital lending business model optimization. The model features fully dynamic projected profit and loss statements, cash flow analyses, and balance sheets, along with marketplace lending growth forecasting, peer to peer lending cost modeling, and alternative lending funding strategies to evaluate investor returns and overall financial sustainability. Additionally, it includes diagnostic tools, sales analysis, feasibility matrices, and financing options assessments, facilitating strategic decisions for alternative lending cash flow management and marketplace lending investor returns without requiring advanced financial expertise.

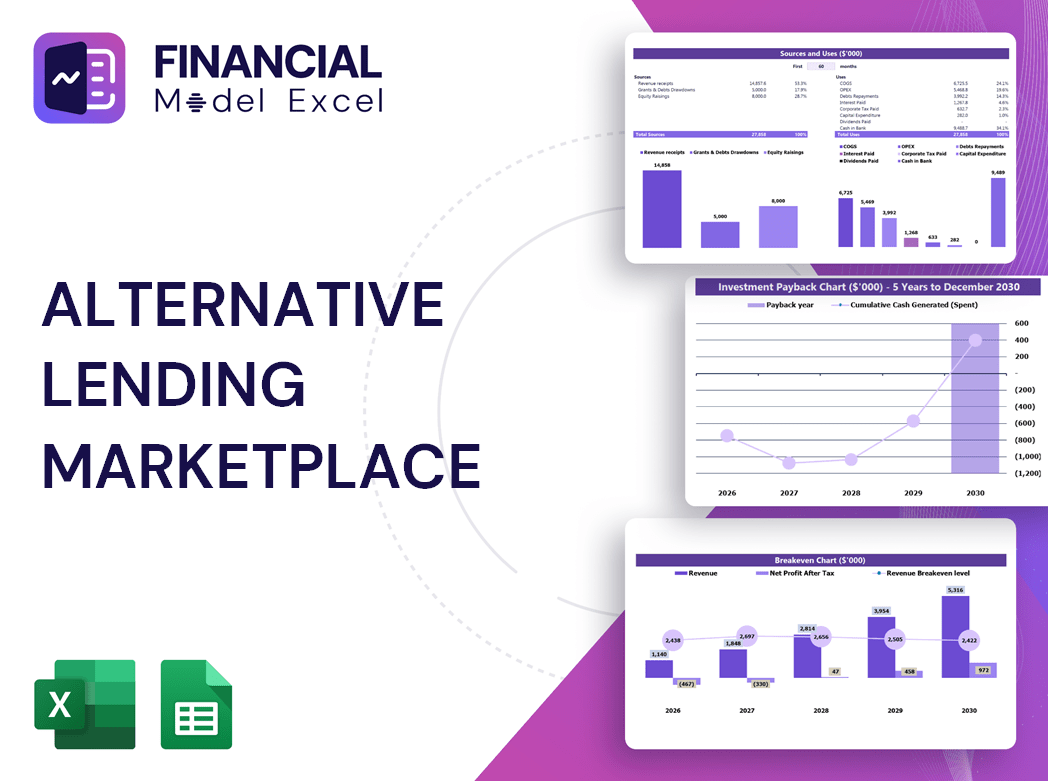

ALTERNATIVE LENDING MARKETPLACE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Make informed strategic decisions with our comprehensive 5-year financial projection template, tailored for alternative lending and digital lending business models. Effortlessly generate detailed loan origination financial projections, cash flow analysis, and pro forma balance sheets. Integrated online lending platform KPIs and marketplace lending profitability metrics offer clear insights into your startup’s financial sustainability. Designed for intuitive use, this tool streamlines peer to peer lending financial analysis and alternative finance valuation methods—empowering you to forecast growth, assess risk, and optimize revenue streams with confidence. Elevate your financial modeling and secure the best future for your lending business today.

Dashboard

Our comprehensive financial projections template features an intuitive dashboard designed for seamless online lending platform economics analysis. Embedded calculations streamline alternative lending financial modeling, enabling precise tracking of revenues, expenses, and cash flow forecasts. Effortlessly monitor key marketplace lending KPIs, assess risk through peer to peer lending cost modeling, and evaluate profitability metrics. This tool empowers you to optimize your digital lending business model and make data-driven decisions that drive sustainable growth and investor returns.

Business Financial Statements

Our comprehensive three-statement financial model features pre-built proformas for startup balance sheets, profit and loss forecasts, and cash flow statements. Designed for both monthly and annual projections, it empowers users to generate detailed financial analyses grounded in their business plan assumptions. Ideal for alternative lending financial modeling, this template supports precise loan origination financial projections, marketplace lending revenue model assessment, and online lending platform economics. Streamline your peer to peer lending financial analysis and enhance decision-making with this dynamic, professional-grade tool.

Sources And Uses Statement

This Excel-based financial model offers a comprehensive framework for analyzing online lending platform economics and alternative lending cash flow analysis. It highlights critical marketplace lending revenue models, loan origination financial projections, and peer to peer lending cost modeling. Designed to enhance financial sustainability, the tool supports alternative finance valuation methods and P2P lending risk assessment, empowering you to optimize digital lending revenue streams and forecast marketplace lending growth effectively. Stay ahead by leveraging key online lending platform KPIs to drive profitability and strategically increase investor returns while maintaining operational efficiency.

Break Even Point In Sales Dollars

This 5-year financial projection incorporates a dynamic Excel-based break-even analysis, detailing unit sales thresholds both numerically and visually through charts. Tailored for alternative lending platforms, it integrates marketplace lending profitability metrics and online lending platform KPIs to provide clear insights into revenue streams and cost modeling. Ideal for evaluating digital lending business models, this comprehensive tool supports informed decision-making by combining loan origination financial projections with peer-to-peer lending risk assessment for sustainable growth forecasting.

Top Revenue

Topline revenue and bottom line profitability are critical metrics in alternative lending financial modeling, especially within online lending platform economics. Investors and analysts closely track marketplace lending revenue models and EBITDA to assess financial sustainability. Growth in peer to peer lending revenue streams signifies strong marketplace lending profitability metrics, driving positive outcomes in loan origination financial projections. Monitoring these KPIs quarterly ensures robust P2P lending risk assessment and informs alternative finance valuation methods, ultimately maximizing marketplace lending investor returns and optimizing digital lending business models for sustained success.

Business Top Expenses Spreadsheet

Our digital lending financial model offers detailed expense reporting, categorizing key costs for precise cash flow analysis and expense optimization. By tracking top expense areas and historical trends, it empowers online lending platforms to pinpoint growth opportunities and manage costs effectively. Essential for both startups and expanding firms, this tool supports robust marketplace lending profitability metrics and alternative lending funding strategies, ensuring financial sustainability and improved revenue streams. Proactively monitoring expenses is crucial to drive profitability and sustain scalable growth in the evolving digital lending business model.

ALTERNATIVE LENDING MARKETPLACE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our alternative lending marketplace financial model streamlines profit and loss projections, providing clear insights into costs and investments. This digital lending business model template simplifies tracking expenses, supporting accurate loan origination financial projections and cash flow analysis. Leveraging marketplace lending profitability metrics and alternative finance valuation methods, users can confidently forecast growth and assess financial sustainability. By utilizing this comprehensive model, online lending platforms enhance P2P lending cost modeling and risk assessment, ensuring informed decisions that drive marketplace lending investor returns and long-term success.

CAPEX Spending

Capital expenditure (CAPEX) plays a critical role in alternative lending financial modeling, enabling precise loan origination financial projections and digital lending business model planning. Financial analysts incorporate CAPEX budgets to track investments in fixed assets, including property, plant, and equipment, while accounting for depreciation, additions, disposals, and leased assets. This rigorous alternative lending cash flow analysis ensures accurate marketplace lending profitability metrics and supports robust P2P lending risk assessment, ultimately enhancing marketplace lending investor returns and optimizing online lending platform economics.

Loan Financing Calculator

Effective loan origination financial projections and peer to peer lending cost modeling are vital for startups and growth-stage companies. Utilizing advanced online lending platform KPIs and alternative finance credit risk models ensures accurate monitoring of repayment schedules, outstanding balances, and key covenants. A detailed marketplace lending revenue model highlights interest expenses and principal milestones, directly impacting digital lending cash flow analysis. Clear alignment of loan repayments with the balance sheet and cash flow forecasts enhances financial transparency, enabling businesses to assess their debt obligations and optimize alternative lending funding strategies for sustained marketplace lending profitability metrics.

ALTERNATIVE LENDING MARKETPLACE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net profit margin is a vital marketplace lending profitability metric that reveals how efficiently your digital lending business model converts revenue into profit. It measures the effectiveness of your online lending platform economics by showing how each dollar of income contributes to the bottom line. Utilizing net profit margin in loan origination financial projections and alternative lending cash flow analysis enables precise growth forecasting and enhances financial sustainability. This KPI is essential for optimizing alternative finance valuation methods and maximizing investor returns within peer to peer lending financial analysis frameworks.

Cash Flow Forecast Excel

In alternative lending financial modeling, the cash flow proforma is a critical tool for tracking inflows and outflows, ensuring the online lending platform’s liquidity to meet obligations. Accurate cash flow analysis underpins marketplace lending profitability metrics and informs loan origination financial projections. This detailed financial structure is essential for lenders and investors, as it demonstrates the digital lending business model’s capacity to service debt and generate sustainable returns. Incorporating robust P2P lending risk assessment and alternative finance valuation methods enhances credibility when presenting to financial institutions or securing funding through innovative marketplace lending strategies.

KPI Benchmarks

The Benchmarking tab is a vital component of our digital lending business model forecast. It delivers key industry and financial benchmarks essential for comprehensive marketplace lending profitability metrics and alternative lending cash flow analysis. By comparing your online lending platform economics against top performers, it offers valuable insights into peer to peer lending financial analysis and P2P lending financial sustainability. This allows you to identify performance gaps and target improvement areas, enhancing your loan origination financial projections and strengthening your alternative finance valuation methods. Harness these benchmarks to optimize your marketplace lending investor returns and drive sustainable growth.

P&L Statement Excel

The pro forma profit and loss statement is essential for alternative lending financial modeling, enabling accurate forecasting of revenues and expenses as they occur. Unlike cash flow analysis that tracks actual cash movements, this P&L projection incorporates non-cash items like depreciation, reflecting their impact over multiple years. This distinction is critical for digital lending business models and peer to peer lending financial analysis, ensuring comprehensive marketplace lending profitability metrics and informed loan origination financial projections. Leveraging these models enhances P2P lending risk assessment and supports sustainable growth forecasting within online lending platform economics.

Pro Forma Balance Sheet Template Excel

Our 5-year projected balance sheet template in Excel offers a clear financial snapshot of your alternative lending venture’s assets, liabilities, and equity over time. Ideal for digital lending business models, this statement supports in-depth financial modeling, including loan origination projections and marketplace lending profitability metrics. Utilize this tool to enhance your peer-to-peer lending financial analysis, evaluate alternative finance credit risk models, and forecast online lending platform KPIs. Empower your strategic decisions with precise, forward-looking insights into your company’s financial position and growth potential.

ALTERNATIVE LENDING MARKETPLACE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive financial model Excel template empowers users with advanced alternative finance valuation methods, including Discounted Cash Flow (DCF) analysis. It facilitates in-depth peer to peer lending financial analysis by evaluating key metrics such as residual value, replacement costs, market comparables, and recent transaction comparables. Ideal for marketplace lending growth forecasting and online lending platform economics, this tool supports robust loan origination financial projections and alternative lending cash flow analysis, enabling precise marketplace lending profitability metrics and investor returns assessments. Elevate your digital lending business model with a reliable framework for effective financial modeling and strategic decision-making.

Cap Table

A comprehensive cap table is a critical financial tool for startups, especially within digital lending business models. Our 3-year financial projection template integrates four funding rounds, enabling precise marketplace lending growth forecasting and alternative lending cash flow analysis. This framework helps project ownership stakes and potential dilution across equity shares, preferred shares, employee stock options, convertible bonds, and more. By visualizing peer to peer lending cost modeling and investor returns, startups can align fundraising strategies with marketplace lending profitability metrics and optimize alternative finance valuation methods for sustainable growth.

ALTERNATIVE LENDING MARKETPLACE FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Forecast all three financial statements effortlessly using the alternative lending marketplace financial model for precise, data-driven insights.

Avoid cash flow problems with our alternative lending marketplace financial model, ensuring accurate 5-year projections in Excel.

Optimize startup loan repayments confidently with the alternative lending marketplace financial model’s 5-year projection advantage.

Optimize cash flow timing using a startup pro forma template for precise alternative lending financial modeling and forecasting.

Our financial model empowers precise forecasting of cash shortages and surpluses, optimizing alternative lending profitability.

ALTERNATIVE LENDING MARKETPLACE FINANCIAL MODEL TEMPLATE FOR BUSINESS PLAN ADVANTAGES

Alternative lending financial modeling enables proactive identification of cash shortfalls, ensuring timely funding and sustained growth.

The alternative lending financial model empowers proactive risk management, boosting long-term cash flow accuracy and business resilience.

The digital lending business model streamlines loan origination financial projections, saving you time and boosting profitability.

The alternative lending financial model streamlines cash flow analysis, enabling focus on product innovation and business growth.

Our digital lending revenue streams optimize profitability while predicting the influence of upcoming regulatory changes effectively.

Alternative lending cash flow analysis enables precise forecasting of new investments’ impact, enhancing financial decision-making confidence.

Our digital lending business model drives scalable growth with optimized revenue streams and precise risk assessment.

Alternative lending cash flow analysis reveals optimal funding strategies, accelerating growth beyond traditional organic methods.

Our digital lending revenue model maximizes profitability while optimizing risk through advanced financial analysis—We do the math.

Unlock accurate marketplace lending profitability metrics effortlessly—no formulas, formatting, or costly consultants required!