Apartments Acquisition Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Apartments Acquisition Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Apartments Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

APARTMENTS ACQUISITION FINANCIAL MODEL FOR STARTUP INFO

Highlights

The apartments acquisition financial model is a comprehensive 5-year real estate investment financial model designed for companies operating within the multifamily acquisition and apartment building acquisition space. This versatile commercial apartments financial model serves both startups and established businesses by providing an in-depth real estate acquisition financial model to evaluate and plan startup costs, project profit and loss, and perform detailed real estate acquisition analysis. Fully unlocked and editable, this property acquisition financial model is an essential tool for developing accurate apartment acquisition pro forma statements, rental property financial models, and multifamily property valuation models, ensuring thorough financial feasibility and strategic decision-making for real estate deal financial modeling and acquisition and development financial models.

This multifamily acquisition financial model template addresses common challenges faced by investors and developers by providing a comprehensive, user-friendly real estate acquisition financial model that seamlessly integrates an apartment building acquisition model with detailed rental property financial projections and commercial apartments financial model features. It eliminates manual errors and time-consuming calculations through an automated real estate cash flow model, including 5-year forecasts, balance sheets, profit and loss statements, and valuation charts, supporting real estate acquisition analysis and multifamily property valuation at every stage. The acquisition and development financial model incorporates sensitivity analyses and an apartment acquisition underwriting model that empowers users to assess investment feasibility using NPV and free cash flow metrics, mitigating risks associated with property investment financial models and ensuring precise apartment portfolio financial model performance for real estate deal financial decision-making.

Description

Our comprehensive apartments acquisition financial model template is expertly designed to facilitate multifamily acquisition financial modeling with a detailed 5-year projection, integrating key components such as profit and loss statements, balance sheets, equity valuation, and break-even analysis to support precise real estate acquisition analysis and informed decision-making. This property acquisition financial model incorporates a multifamily asset acquisition model and rental property financial model features, enabling users to conduct real estate investment financial modeling and apartment acquisition underwriting model assessments without requiring advanced technical skills. With its multifaceted approach, including a commercial apartments financial model and apartment portfolio financial model capabilities, this real estate acquisition financial model provides clear insights into cash flow, profitability planning, and valuation, ensuring robust financial feasibility and strategic planning for apartment building acquisition and multifamily development projects.

APARTMENTS ACQUISITION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover our intuitive and comprehensive apartments acquisition financial model, designed for seamless real estate acquisition analysis. This robust multifamily acquisition financial model offers a flexible bottom-up approach, empowering users to customize and expand worksheets to fit diverse property investment strategies. Ideal for both novices and seasoned professionals, it provides a clear roadmap for apartment building acquisition, rental property financial modeling, and multifamily development projects. Elevate your real estate investment decisions with a sophisticated yet user-friendly real estate cash flow model tailored to unlock value and optimize acquisition underwriting.

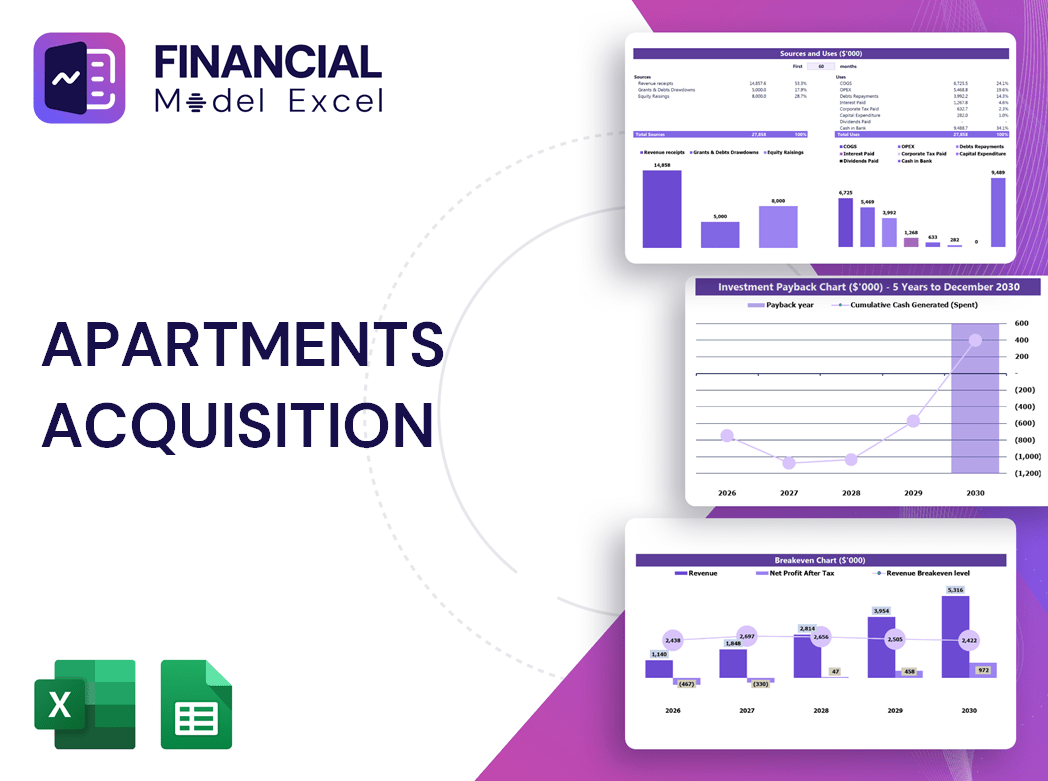

Dashboard

Our real estate acquisition financial model features a dynamic dashboard highlighting key financial indicators over selected timeframes. This comprehensive apartment acquisition pro forma includes detailed cash flow forecasts, annual revenue breakdowns, profit projections, and overall fund flow analysis. Designed for multifamily acquisition and property investment, it supports strategic decision-making with clear, actionable insights to optimize your real estate deal underwriting and portfolio valuation.

Business Financial Statements

Our multifamily acquisition financial model features a pre-built, integrated financial summary consolidating data from all core spreadsheets, including a projected balance sheet template, pro forma income statement, and comprehensive real estate cash flow model. Expertly designed, this summary streamlines real estate acquisition analysis and is fully formatted to enhance your pitch deck presentation. Empower your property acquisition financial model with precise insights and professional readiness for seamless investment decision-making.

Sources And Uses Statement

The Sources and Uses statement within our multifamily acquisition financial model clearly details all funding origins alongside the strategic allocation of capital. This essential component provides transparency in your real estate acquisition analysis, ensuring every dollar is accounted for within your property acquisition financial model. Tailored for apartment building acquisitions and commercial apartments financial modeling, it supports precise real estate investment decision-making and enhances your real estate cash flow model accuracy. Elevate your apartment acquisition underwriting model by integrating this comprehensive funding breakdown, optimizing financial feasibility and maximizing investor confidence.

Break Even Point In Sales Dollars

The break-even analysis is a vital component of our real estate acquisition financial model template. This key metric helps investors determine the revenue threshold needed to cover all expenses, including taxes, ensuring informed decision-making for multifamily acquisition or apartment building acquisition. Reaching this level signals when a property or portfolio begins generating profit, marking the point where your investment starts to pay off. Incorporate this essential analysis within your apartment acquisition pro forma or multifamily development financial model to accurately assess project feasibility and optimize your real estate investment strategy.

Top Revenue

The Top Revenue tab in your apartments acquisition financial model enables detailed demand reporting, spotlighting the profitability of various investment scenarios to inform strategic decisions. Additionally, the startup financial model template offers a revenue bridge analysis, demonstrating revenue impacts from factors like unit volume and pricing over time. This insight supports accurate demand forecasting across periods—weekdays versus weekends—facilitating optimized resource allocation for your sales team. Together, these tools elevate your multifamily acquisition financial model’s precision, driving smarter property acquisition and development strategies with real estate cash flow clarity.

Business Top Expenses Spreadsheet

Effective cost management is crucial in real estate acquisition and development. Our multifamily acquisition financial model template features a comprehensive top expense report, highlighting the four largest expense categories alongside an 'other' category for streamlined tracking. This enables investors and property managers to monitor expense trends annually, optimizing profitability within their apartment portfolio or commercial apartments financial models. Whether launching a new project or managing existing assets, leveraging a real estate acquisition financial model ensures precise cost control and maximizes returns through informed decision-making.

APARTMENTS ACQUISITION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The multifamily acquisition financial model template streamlines 5-year financial projections, expense budgeting, and cost variation monitoring. It integrates key parameters like income percentages, payroll, and recurring costs to ensure precise forecasting. Allocate expenses across categories such as Variable and Fixed Expenses, COGS, Wages, and CAPEX effortlessly. This real estate acquisition financial model functions as a sophisticated, dynamic 3-way cash flow tool, delivering accurate insights into future financial viability. Perfect for apartment building acquisition models and rental property financial analysis, it empowers sound investment decisions with comprehensive real estate acquisition analysis and financial feasibility.

CAPEX Spending

CapEx represents a company’s total investment in acquiring or developing long-term assets within a given period. These significant expenditures, tracked in real estate acquisition financial models and multifamily acquisition financial models, include assets purchased or constructed to generate sustained value beyond a single reporting period. Consequently, CapEx is reflected in projected balance sheets rather than fully expensed in profit and loss statements, ensuring accurate financial forecasting in apartment building acquisition models, rental property financial models, and comprehensive real estate investment financial models.

Loan Financing Calculator

Start-ups and growing companies often require loans to support growth. Incorporating loan commitments into a real estate acquisition financial model or multifamily acquisition financial model ensures accurate tracking of repayment schedules, interest, and maturity terms. This detailed loan repayment pro forma integrates seamlessly with cash flow forecasts, balance sheets, and budget templates, providing a comprehensive real estate cash flow model. Monitoring these inputs enables precise real estate acquisition analysis and informs strategic decisions by revealing impacts on financial ratios and overall feasibility. Leverage this professional property acquisition financial model to optimize your investment’s financial planning and growth potential.

APARTMENTS ACQUISITION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our comprehensive multifamily acquisition financial model template streamlines real estate acquisition analysis with pre-built pro formas for P&L, 5-year balance sheet projections, and cash flow statements. Designed for apartment building acquisition and property investment, it enables effortless tracking of cash flows, sales, costs, and profitability. Gain insights through profitability ratios, liquidity analysis, and KPIs, ensuring robust real estate financial feasibility and investor-ready presentations. Ideal for multifamily development, rental property financial planning, and apartment portfolio management, this real estate acquisition financial model empowers confident decision-making and efficient asset valuation.

Cash Flow Forecast Excel

The real estate cash flow model provides a clear view of your company’s capacity to generate sufficient cash to meet liabilities. For lenders, a precise apartments acquisition financial model is essential to confidently assess your ability to service loans. Utilizing a robust multifamily acquisition financial model ensures accurate projections, strengthening your real estate acquisition analysis and enhancing credibility in financing negotiations.

KPI Benchmarks

Benchmarking studies empower real estate firms to evaluate their performance against industry leaders using critical metrics like profit margin, cost per unit, and productivity margin. Applying a multifamily acquisition financial model or apartment acquisition pro forma allows companies to identify strengths and areas for improvement. For start-ups and seasoned investors alike, combining benchmarking with a comprehensive real estate acquisition financial model or rental property financial model offers actionable insights to optimize operations, enhance asset valuation, and implement best practices—driving smarter property investment and multifamily development decisions in a competitive market.

P&L Statement Excel

A comprehensive real estate acquisition financial model hinges on an accurate income statement—often integrated within multifamily acquisition or apartment building acquisition models. This profit & loss template critically maps revenue streams against expenses, revealing true profitability. Without a meticulously prepared real estate cash flow model or apartment acquisition pro forma, investors and stakeholders may doubt the success of any deal. Whether using a multifamily property valuation model or a commercial apartments financial model, a rigorous income statement ensures credibility and confidence throughout acquisition and development financial modeling.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet is an essential component of any real estate acquisition financial model, offering a clear snapshot of assets, liabilities, and equity over a set period. Whether analyzing multifamily acquisition financial models or apartment portfolio financial models, it summarizes funding, expenses, and operations cohesively. Our pro forma business plan template delivers an accurate, customizable pro forma balance sheet Excel model—empowering investors and developers to evaluate financial feasibility and performance monthly or annually with confidence and precision.

APARTMENTS ACQUISITION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock confident investment decisions with our comprehensive real estate acquisition financial model. Designed for multifamily and commercial apartments acquisition, this model incorporates Net Present Value (NPV) by discounting all future cash flows to present value, ensuring precise profitability analysis. It seamlessly integrates key metrics including Investment Required, Equity Raised, Future Values, Net Income, Total Investment, WACC, EBITDA, and Growth Rate. Ideal for apartment building acquisition models, rental property financial models, and multifamily development financial models, this tool empowers thorough real estate acquisition analysis and strategic property investment planning.

Cap Table

The cap table model provides a comprehensive overview of a company’s ownership structure, detailing common and preferred shares, warrants, and options. It clearly identifies stakeholders and their respective equity positions. Regular updates to this data are essential for informed decision-making and maximizing profitability. Integrating this with a real estate acquisition financial model or an apartment acquisition pro forma enhances strategic insights, ensuring precise investment analysis and optimized returns across multifamily and commercial property portfolios.

APARTMENTS ACQUISITION 5 YEAR CASH FLOW PROJECTION TEMPLATE ADVANTAGES

Optimize costs and streamline operations expertly with our apartments acquisition financial model template for confident investment decisions.

The multifamily acquisition financial model accurately forecasts break-even points and maximizes return on investment for confident decision-making.

Start a new business with apartments acquisition financial model to ensure accurate projections and maximize real estate investment returns.

Streamline your multifamily acquisition with our detailed financial model, ensuring precise 5-year cost and profitability analysis.

Set clear objectives to optimize your apartments acquisition financial model for informed, profitable real estate investment decisions.

APARTMENTS ACQUISITION FINANCIAL FORECASTING MODEL ADVANTAGES

Our multifamily acquisition financial model delivers comprehensive reports for confident, data-driven real estate investment decisions.

Our apartments acquisition financial model streamlines reporting, meeting lender requirements with comprehensive, ready-to-use Excel templates.

Run different scenarios effortlessly with our multifamily acquisition financial model for smarter, data-driven real estate decisions.

The multifamily acquisition financial model enables dynamic scenario analysis to optimize cash flow and maximize investment returns.

Optimize investments and identify cash gaps early with our comprehensive multifamily acquisition financial model template.

The multifamily acquisition financial model forecasts cash flow, enabling proactive decisions to prevent deficits and optimize growth.

Streamline decisions with our all-in-one multifamily acquisition financial model offering comprehensive real estate investment insights.

Our multifamily acquisition financial model delivers comprehensive forecasts, KPIs, and detailed cash flow analysis for confident investment decisions.

Optimize returns and attract investors with our comprehensive multifamily acquisition financial model tailored for confident real estate deals.

Secure investor meetings effortlessly using the apartments acquisition financial model for precise, compelling real estate analysis.