At Home Cooking Class Service Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

At Home Cooking Class Service Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

At Home Cooking Class Service Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AT HOME COOKING CLASS SERVICE FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year financial forecast offers a detailed revenue model for home cooking classes, integrating critical financial planning for cooking class business startups. It includes a thorough cost analysis for cooking class service, expense estimation, and operational costs cooking class business insights to ensure accurate income statement cooking class business preparation. The model provides break-even analysis cooking class service, cash flow model for cooking classes, and financial sustainability of home cooking classes, supporting startup financial projections and funding requirements for cooking class startup. With customizable financial statements for cooking class startup and investment plan for cooking class business features, this tool empowers entrepreneurs to develop a home-based cooking class budget model and implement an effective home cooking class pricing strategy while assessing financial risks in cooking class service to optimize profitability of cooking class business.

This comprehensive home-based cooking class budget model addresses common pain points by providing a clear and customizable financial planning framework tailored specifically for cooking class businesses, enabling users to effortlessly conduct break-even analysis cooking class service and cost analysis for cooking class service with accuracy. It simplifies financial statements for cooking class startup preparation, including income statement cooking class business and cash flow model for cooking classes, reducing the complexity of revenue model for home cooking classes while highlighting operational costs cooking class business and investment plan for cooking class business to support robust funding requirements for cooking class startup. By incorporating cooking class service financial assumptions and expense estimation, the template enhances the profitability of cooking class business insights and financial sustainability of home cooking classes, ensuring users can confidently devise home cooking class pricing strategy and mitigate financial risks in cooking class service.

Description

The financial planning for a home-based cooking class business involves a comprehensive budget model and startup financial forecast designed to capture all operational costs and revenue streams through a detailed cost analysis for the cooking class service. This financial model integrates essential financial statements—income statement, balance sheet forecast, and cash flow model for cooking classes—that dynamically update to reflect changes in pricing strategies and funding requirements, ensuring accurate expense estimation and profitability assessment. Incorporating break-even analysis and financial metrics for cooking classes, the model supports the evaluation of financial risks and sustainability, allowing entrepreneurs to develop a strategic investment plan and optimize the revenue model for home cooking classes while maintaining financial assumptions aligned with industry standards and investor expectations.

AT HOME COOKING CLASS SERVICE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our home-based cooking class budget model offers a comprehensive financial forecast, integrating your startup’s income statement, balance sheet, and cash flow projections for five years. Unlike simplified models focusing solely on profit and loss, our robust financial planning tool enables detailed break-even analysis and scenario planning. This empowers you to assess operational costs, pricing strategy, and financial risks accurately, ensuring the financial sustainability and profitability of your cooking class business. Make informed decisions with a dynamic revenue model and expense estimation tailored specifically for your cooking class service.

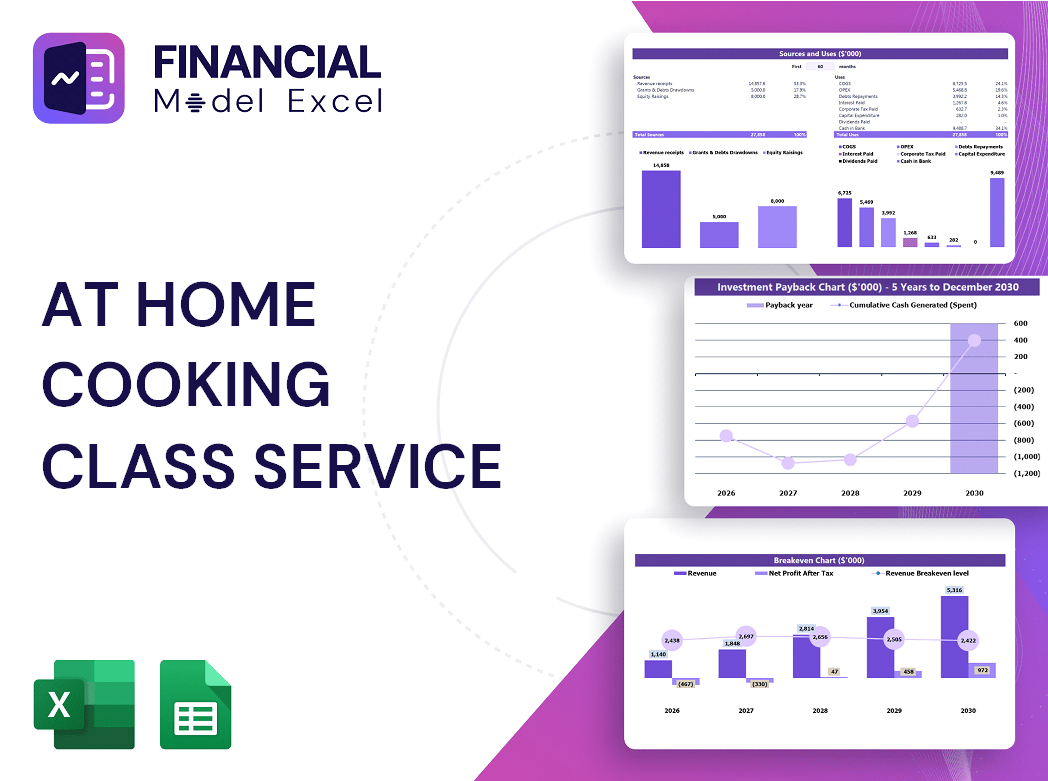

Dashboard

Our home-based cooking class financial projection template features an intuitive dashboard that provides comprehensive financial statements from startup to growth phases. It visualizes key metrics including projected cash flow models, income statements, and revenue models for home cooking classes. The dashboard also presents annual revenue breakdowns, cost analysis, and profitability insights through clear charts and graphs. Designed for effective financial planning and expense estimation, this tool supports break-even analysis, funding requirements, and investment planning, ensuring your cooking class business achieves financial sustainability and informed decision-making at every stage.

Business Financial Statements

Leverage our flexible business plan financial projections template to generate detailed financial statements tailored for your home cooking class service. By inputting your assumptions—such as operational costs, pricing strategy, and revenue model—you can produce comprehensive income statements, cash flow models, and break-even analyses. These precise financial metrics and forecasts not only facilitate effective financial planning and expense estimation but also enhance the credibility of your cooking class startup when presenting to investors and lenders. Empower your business with a clear investment plan and ensure financial sustainability through robust financial projections.

Sources And Uses Statement

The pro forma template’s Sources and Uses chart clearly outlines capital inflows and their corresponding expenditures, ensuring precise alignment between funding and deployment. This essential financial statement supports robust financial planning for cooking class businesses by offering transparent cash flow models and cost analysis. Designed for ease of use, it facilitates informed decisions around funding requirements, investment plans, and operational costs. Critical for both internal management and external stakeholders, this tool enhances financial sustainability and supports refinancing, restructuring, or M&A activities within the home-based cooking class service sector.

Break Even Point In Sales Dollars

Understanding the break-even analysis for your cooking class service is crucial for financial planning. It identifies the sales volume at which total revenue covers fixed and variable costs, resulting in zero profit or loss. This insight aids in evaluating the profitability of your home cooking class business by highlighting the minimum unit sales required to sustain operations. Utilizing marginal costing principles, this approach provides clarity on financial risks and supports strategic decisions for pricing, budgeting, and growth within your cooking class startup’s financial forecast.

Top Revenue

In the financial planning for your home-based cooking class business, top-line growth—an increase in revenues or gross sales—is crucial. This revenue model directly impacts your cooking class startup financial forecast, influencing profitability and overall financial sustainability. Investors and stakeholders closely monitor these financial metrics quarterly and annually through income statements and cash flow models. A well-crafted budget model and cost analysis for cooking class services ensure accurate expense estimation and break-even analysis, enabling effective financial management and strategic pricing to maximize returns and mitigate financial risks.

Business Top Expenses Spreadsheet

To maximize your home-based cooking class business’s profitability, effective financial planning is essential. Our cooking class startup financial forecast outlines key expense categories, enabling precise cost analysis and operational cost control. Understanding your revenue model and conducting break-even analysis empowers you to optimize spending and enhance financial sustainability. With clear financial statements and a robust cash flow model, you can strategically direct investments and minimize financial risks. Leverage this insight to refine your home cooking class pricing strategy and ensure your business thrives with a strong, profit-driven budget model.

AT HOME COOKING CLASS SERVICE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our home-based cooking class budget model offers a comprehensive 3-year financial projection, empowering entrepreneurs to manage operational costs and forecast revenue with precision. This financial planning tool integrates key assumptions—including cost of goods sold, payroll, fixed and variable expenses—to deliver accurate cash flow models and profitability analyses. Ideal for startups, it supports break-even analysis, expense estimation, and investment planning, ensuring financial sustainability and clarity for your cooking class business. Harness our intuitive revenue model and financial statements to confidently navigate funding requirements and optimize your home cooking class pricing strategy.

CAPEX Spending

The CAPEX forecast outlines the total investment required to sustain, grow, and optimize your home cooking class service, excluding personnel and operational costs. Our detailed cost analysis identifies key assets for strategic investment, enhancing your cooking class startup’s financial sustainability. Recognizing that capital expenditures differ across businesses, incorporating this report into your financial planning and home-based cooking class budget model ensures informed decisions. This insight supports accurate financial projections, streamlines your revenue model for home cooking classes, and fortifies your investment plan, ultimately boosting profitability and mitigating financial risks.

Loan Financing Calculator

A well-designed loan amortization schedule is essential for any home-based cooking class business’s financial planning. It outlines periodic payments, showing how principal and interest are paid over time, supporting accurate expense estimation and cash flow modeling. Integrated into a cooking class startup financial forecast, this tool helps track outstanding debts and informs investment plans and break-even analyses. By leveraging a pre-built amortization calculator, entrepreneurs can enhance their revenue model for home cooking classes while managing financial risks and ensuring the financial sustainability of their cooking class service.

AT HOME COOKING CLASS SERVICE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our comprehensive three-statement model for home cooking class services delivers essential financial metrics, including net income growth—key to assessing your business’s expansion. Entrepreneurs rely on this indicator to confirm rising sales and effective cost management within their cooking class startup financial forecast. By integrating detailed income statements and expense estimations, our template supports precise financial planning for cooking class businesses, ensuring profitability and sustainable growth. Optimize your revenue model and operational costs with confidence using our professional financial projections tailored for at-home cooking class services.

Cash Flow Forecast Excel

A comprehensive cash flow model for home cooking classes is essential to track financial inflows and outflows accurately. Utilizing a monthly cash flow statement format in Excel enables precise financial planning for your cooking class business, ensuring transparency and informed decision-making. This tool supports cost analysis, expense estimation, and helps forecast profitability, promoting the financial sustainability of your home-based cooking class startup.

KPI Benchmarks

Benchmarking is a vital tool in the financial planning for cooking class businesses, enabling a comprehensive cost analysis and profitability assessment. By comparing key financial metrics—such as gross profit margins, expense estimations, and operational costs—with industry leaders, home-based cooking class startups can refine their revenue models and pricing strategies. This comparative analysis highlights financial risks and uncovers weaknesses, guiding strategic decisions to improve financial sustainability. Incorporating benchmarking into your cooking class service financial forecast enhances the accuracy of cash flow models and break-even analysis, ultimately driving informed investment plans and long-term success.

P&L Statement Excel

The projected pro forma income statement is essential for a home-based cooking class business, delivering accurate financial projections and profit-loss forecasts. This financial planning tool aids in developing a solid revenue model and expense estimation, ensuring profitability and financial sustainability. By incorporating core financial metrics and assumptions, it provides clear insights into net profit after taxes. Ideal for startups, this comprehensive financial forecast supports break-even analysis, cash flow modeling, and effective budgeting—empowering you to make informed decisions and optimize your cooking class service’s operational costs and funding requirements for long-term success.

Pro Forma Balance Sheet Template Excel

The projected balance sheet is a vital financial statement for any cooking class startup, offering a comprehensive view of the business’s financial health. It underpins revenue models and expense estimations, revealing the funding requirements and operational costs essential for profitability. Integrated within the financial planning for cooking class businesses, this pro forma balance forecast guides strategic decisions, evaluates financial risks, and ensures the financial sustainability of home-based cooking classes by pinpointing the investment plan and cash flow models necessary to achieve long-term success.

AT HOME COOKING CLASS SERVICE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our at-home cooking class service financial projections incorporate robust financial planning tools, including discounted cash flow (DCF) and weighted average cost of capital (WACC) analyses. This comprehensive financial model offers an insightful forecast of the cooking class startup's revenue streams, expense estimation, and overall profitability. Designed to support strategic decisions, it integrates cash flow models, break-even analysis, and investment plans, ensuring financial sustainability and optimized home cooking class pricing strategies. By leveraging these financial metrics, entrepreneurs can confidently navigate funding requirements and mitigate financial risks within the cooking class business.

Cap Table

Our financial projections integrate a comprehensive cap table model within the cash flow framework, aligning funding rounds with financial instruments like equity and convertible notes. This approach provides clear visibility into the impact of funding decisions on ownership structure and dilution. By incorporating this into our cooking class startup financial forecast, we ensure accurate financial statements and robust financial planning for home-based cooking class budgets. This methodology supports informed investment plans, enhances the revenue model for home cooking classes, and underpins the financial sustainability and profitability of the cooking class business.

AT HOME COOKING CLASS SERVICE FINANCIAL PROJECTION STARTUP ADVANTAGES

Our financial model centralizes all assumptions, simplifying accurate projections and enhancing strategic planning for your cooking class business.

Optimize profitability by using a 5-year cash flow model tailored for at-home cooking class service financial projections.

Our financial model accurately predicts cash flow, ensuring proactive management of shortages and surpluses for sustained profitability.

Grow your cooking class business confidently with our precise financial model for revenue, costs, and profitability forecasting.

Evaluate your home cooking class’s success confidently using our comprehensive financial projections and budgeting model.

AT HOME COOKING CLASS SERVICE FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Our financial model saves you time by streamlining budgeting, forecasting, and profitability analysis for your cooking class business.

Our home cooking class financial model streamlines planning, boosting profitability and freeing you to grow your business confidently.

Optimize your home cooking class startup with a financial model that ensures funding success and profitability clarity.

Impress investors with a strategic cooking class financial model driving profitability and sustainable home-based business growth.

Our financial model offers a convenient, all-in-one dashboard with clear, visual insights for cooking class profitability and planning.

Our financial model’s Excel dashboard centralizes all vital cooking class metrics for instant, seamless decision-making.

Our 5-year financial model ensures sustainable growth and profitability for your home-based cooking class business.

Our financial model ensures precise, automated 5-year projections for at-home cooking class startups, optimizing profitability and planning.

Our financial model ensures accurate projections, maximizing profitability and securing investor confidence for your home cooking class business.

Our financial model ensures accurate profitability forecasts with detailed income statements, cash flows, and key metrics for cooking classes.