Auditor Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Auditor Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Auditor Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AUDITOR FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year auditor financial model pro forma template in Excel integrates advanced financial modeling techniques to generate accurate cash flow forecasting models, financial projections, and core metrics in GAAP/IFRS formats automatically. Designed to support financial planning and analysis, it includes robust financial model validation features and a financial model review checklist to ensure adherence to financial model best practices. The template facilitates investment financial modeling and company valuation financial models by enabling sensitivity analysis in financial models and risk analysis in financial models. Fully unlocked and editable, it streamlines the financial model audit process and enhances financial data analysis tools, making it an essential resource for budgeting and financial modeling as well as corporate finance modeling.

This ready-made financial model Excel template addresses common pain points by incorporating financial model best practices and a comprehensive financial model review checklist to ensure accuracy and reliability through an efficient financial model audit process. Built with advanced financial data analysis tools, it streamlines financial statement analysis models and budgeting and financial modeling tasks, allowing users to perform robust financial forecasting models and sensitivity analysis in financial models with ease. The integrated cash flow forecasting model and company valuation financial model enhance investment financial modeling and corporate finance modeling, while embedded risk analysis in financial models helps anticipate and mitigate uncertainties. Additionally, the model includes thorough financial model documentation and a financial projections template, facilitating seamless financial planning and analysis and enabling users to quickly adapt scenarios through financial scenario analysis, resulting in a dynamic tool that minimizes errors and maximizes actionable insights.

Description

Our auditor financial model Excel template integrates advanced financial modeling techniques, combining a comprehensive financial statement analysis model with detailed financial forecasting models to provide a robust company valuation financial model. This tool supports budgeting and financial modeling by projecting three key financial statements—profit and loss, balance sheet, and cash flow forecasting model—over a five-year period, while incorporating sensitivity analysis in financial models to assess risks and uncertainties. Designed with financial model best practices and a thorough financial model review checklist, it streamlines the financial model audit process and ensures accuracy through rigorous financial model validation. Additionally, the model facilitates investment financial modeling and corporate finance modeling by calculating critical metrics such as Free Cash Flows to the Firm, Internal Rate of Return, Discounted Cash Flow, and break-even points, all documented meticulously in the financial model documentation. By leveraging financial scenario analysis and risk analysis in financial models, this solution empowers users to conduct dynamic financial planning and analysis, optimize capital investment decisions, and enhance financial data analysis tools within Excel, ensuring effective financial projections and strategic business decision-making.

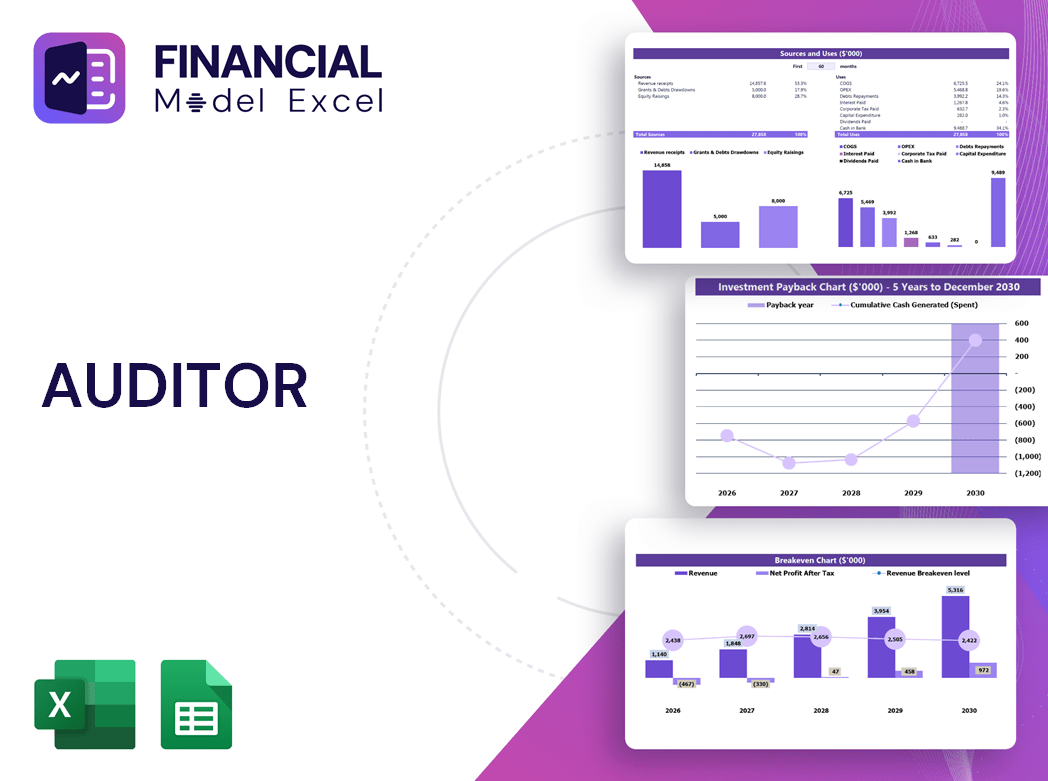

AUDITOR FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

No need to be a financial expert to create a dynamic business revenue model for your startup. Our Excel financial model offers comprehensive templates and financial data analysis tools designed for budgeting, cash flow forecasting, and investment financial modeling. Equipped with best practices, financial model validation, and a detailed financial model review checklist, it ensures accuracy and flexibility. Streamline your financial planning and analysis with robust financial forecasting models, sensitivity analysis, and scenario planning—all within a user-friendly framework tailored to help your startup thrive.

Dashboard

To perform comprehensive financial planning and analysis, leveraging advanced financial modeling techniques is essential. Our Excel-based financial projections template streamlines organizing critical financial data, enabling accurate cash flow forecasting, company valuation, and profit and loss projections. With integrated financial data analysis tools and customizable charts, clients gain clear insights and enhanced reporting efficiency. This approach aligns with financial model best practices, ensuring reliable financial model validation and facilitating informed decision-making through robust financial scenario analysis.

Business Financial Statements

In financial modeling, three core financial statement templates form the foundation: the Income Statement, tracking revenues, expenses, taxes, and interest; the Balance Sheet, a snapshot of assets, liabilities, and equity ensuring they balance; and the Cash Flow Statement, detailing cash inflows and outflows from operations, investments, and financing. Mastery of these templates, integrated through best practices and rigorous financial model validation, is essential for accurate company valuation, budgeting, and financial forecasting models, enhancing both risk analysis and strategic financial planning within corporate finance modeling frameworks.

Sources And Uses Statement

Companies leverage investor capital to accelerate profit growth efficiently. Utilizing financial modeling techniques, including cash flow forecasting models and financial statement analysis models, enables business leaders to gain clear insights into their company’s financial health. A comprehensive financial model review checklist and validation process ensure accuracy, helping to identify strengths, weaknesses, and risks. Accurate financial projections templates and budgeting and financial modeling empower informed decision-making, preventing deficits and supporting sustainable growth. For startups, integrating best practices in corporate finance modeling and financial model documentation is essential to optimize capital use and drive strategic success.

Break Even Point In Sales Dollars

A break-even analysis chart is a vital tool in financial planning and analysis, integrating revenue and sales data to identify profitability thresholds. It’s crucial to distinguish between sales, revenue, and profit: revenue represents total income from product sales, while profit is calculated by subtracting all fixed and variable expenses from revenue. Utilizing financial modeling techniques, such as financial statement analysis models and cash flow forecasting models, enhances accuracy. Incorporating risk analysis in financial models and following a financial model review checklist ensures robust financial projections and supports strategic decision-making.

Top Revenue

Accurate revenue forecasting is crucial in building financial models in Excel, as it directly impacts company valuation and overall financial projections. Utilizing financial forecasting models and a comprehensive financial model review checklist ensures precise assumptions based on historical data. Incorporating risk analysis in financial models and financial scenario analysis further strengthens revenue predictions. Adhering to financial model best practices and thorough financial model validation enhances the reliability of startup financial models, empowering management to make informed decisions for sustainable growth and robust financial planning and analysis.

Business Top Expenses Spreadsheet

The Top Expenses tab generates a detailed internal cost report, essential for budgeting and financial modeling. Use this to track expenses by category, streamline tax preparation, and support accurate financial forecasting models. By comparing actual costs to projections, you can perform sensitivity analysis in financial models, evaluate business performance, and refine revenue model templates. This data also informs risk analysis in financial models and guides the financial model audit process, enhancing overall financial planning and analysis. Leveraging such insights ensures robust corporate finance modeling and effective financial scenario analysis for future growth.

AUDITOR FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effortlessly track all FTEs and PTEs with our comprehensive salary cost template, tailored for individual and group budgeting needs. Integrated within our advanced financial modeling framework, this tool ensures seamless data flow throughout your entire financial model. Designed with financial model best practices, it simplifies workforce cost analysis while enhancing accuracy in budgeting and financial modeling. Leverage this solution alongside your financial forecasting models and cash flow forecasting templates for streamlined financial planning and analysis.

CAPEX Spending

CAPEX investment expenses are essential in financial modeling, reflecting a company’s capital allocation toward enhancing fixed assets and operational capacity. Due to the significant scale and timing involved, CAPEX impacts all major financial statements—pro forma balance sheet, forecasted profit & loss, and cash flow forecasting models. Incorporating CAPEX accurately is critical in financial planning and analysis, company valuation financial models, and risk analysis in financial models. Employing financial model best practices and a robust financial model review checklist ensures precise budgeting and financial modeling, supporting reliable investment decisions and comprehensive financial model validation.

Loan Financing Calculator

Start-ups and growing businesses must meticulously manage loan payback schedules using financial modeling techniques. These schedules detail loan amounts, maturity terms, and key metrics essential for accurate financial forecasting models. Integrating the loan payback plan into cash flow forecasting models ensures precise tracking of interest expenses and principal repayments. This integration directly impacts the company’s cash flow and is reflected in the projected balance sheet templates. Employing best practices in financial model validation and leveraging financial data analysis tools enhances accuracy and supports effective financial planning and analysis for sustainable growth.

AUDITOR FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Profit Margin is a crucial financial ratio integrated within financial forecasting models, illustrating a company’s efficiency in converting revenue into profit. In building financial models in Excel, especially startup templates, this metric guides financial planning and analysis by projecting long-term growth. Utilizing a robust financial model review checklist ensures accurate net profit margin computation, supporting strategic decision-making. Incorporating sensitivity analysis in financial models further refines forecasts, helping businesses evaluate scenarios where income surpasses sales costs, ultimately enhancing investment financial modeling and corporate finance modeling best practices.

Cash Flow Forecast Excel

Ensure your company’s liquidity with our comprehensive cash flow forecasting model, designed using financial modeling best practices. This Excel-based template integrates key inputs—Payable and Receivable Days, working capital, debt levels—to deliver accurate cash flow projections. Ideal for a 5-year horizon, it supports effective financial planning and analysis, helping you avoid additional financing needs. Incorporate this tool into your budgeting and financial modeling process to monitor net cash flow, beginning and ending cash balances, and enhance your financial model validation and review checklist for robust corporate finance modeling.

KPI Benchmarks

Our financial forecasting models include a robust financial benchmarking tool designed for comparative analysis. By leveraging financial statement analysis models and key performance indicators, companies can evaluate their losses against industry peers. This financial model validation process ensures accurate insights, guiding strategic decisions for growth. Using our financial model review checklist and best practices, startups can identify performance gaps and optimize operations. Understanding these financial data analysis tools enables businesses to enhance their financial planning and analysis, driving continuous improvement and long-term financial success.

P&L Statement Excel

The Income Statement, a pivotal component in financial modeling techniques, details revenue flow and key expenses from top-line to bottom-line. Utilizing a robust profit and loss forecast template in Excel, it enables clear financial statement analysis, helping stakeholders assess profitability and expense management. Integrated within financial forecasting models, this statement supports financial projections, investment financial modeling, and cash flow forecasting models. Combined with financial model validation and review checklists, it ensures accuracy and insight for effective financial planning and analysis, empowering users to anticipate future business performance with confidence.

Pro Forma Balance Sheet Template Excel

A projected balance sheet template in Excel is an essential tool for comprehensive financial planning and analysis. It consolidates a company’s assets, liabilities, and equity over a specified period, offering critical insights into financial health. By integrating financial modeling techniques and adhering to financial model best practices, this template supports accurate cash flow forecasting and investment financial modeling. Utilize a financial model review checklist and validation processes to ensure reliability. Whether for monthly or annual evaluations, this pro forma balance sheet empowers businesses to make informed decisions and optimize budgeting and financial modeling strategies effectively.

AUDITOR FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our pre-revenue startup valuation model leverages advanced financial modeling techniques, integrating Weighted Average Cost of Capital (WACC), Discounted Cash Flow (DCF), and Free Cash Flow (FCF) calculations. WACC assesses cost of capital and risk, crucial in investment financial modeling and financing decisions. DCF applies robust financial forecasting models to discount future cash flows to present value, enabling precise company valuation. This structured approach aligns with financial model best practices and incorporates risk analysis, ensuring accuracy and reliability throughout the financial model audit process and validation stages, ultimately supporting strategic financial planning and analysis.

Cap Table

The pro forma cap table is an essential tool for business owners to accurately assess shareholder ownership dilution. Incorporated within our feasibility study Excel template, it features up to four funding rounds, allowing users to customize their financial projections by applying one or multiple rounds. This integration supports robust financial modeling techniques and enhances investment financial modeling by providing clear visibility into equity structure changes throughout fundraising stages.

AUDITOR 5 YEAR FINANCIAL PROJECTION TEMPLATE ADVANTAGES

Detect potential shortfalls in auditor financial model cash balances using advanced financial model validation techniques for accuracy and reliability.

Enhance investor trust using a comprehensive financial model audit process with our free startup template in Excel.

Streamline startup loan repayments effortlessly with our auditor-approved financial model startup pro forma template for precise forecasting.

Financial modeling best practices ensure accurate forecasting, helping businesses confidently manage cash flow and investment decisions.

The 3-year financial projection template in Excel enables accurate prediction of cash shortages and surpluses for better planning.

AUDITOR 3 STATEMENT FINANCIAL MODEL TEMPLATE ADVANTAGES

Our financial model validation ensures accuracy and reliability, empowering confident, data-driven business decisions.

Streamline financial planning with our Excel model—no formulas, programming, or costly consultants required.

Financial forecasting models identify cash gaps and surpluses early, enabling proactive financial planning and risk management.

A cash flow forecasting model empowers proactive financial planning to prevent deficits and optimize growth opportunities confidently.

Master financial modeling techniques to deliver precise forecasts, enhancing investor confidence and accelerating funding opportunities.

Streamline investor meetings with our auditor financial model template, enhancing accuracy and confidence in your financial projections.

Master financial modeling techniques to enhance accuracy, optimize forecasts, and confidently secure your funding pitch.

Impress bankers and investors with a validated financial model that ensures accuracy, reliability, and confident decision-making every time.

Save time and money by mastering financial modeling techniques for accurate forecasting and efficient decision-making.

Streamline strategy development with financial modeling best practices, eliminating costly consultants through effortless, accurate pro forma projections.