Auto Towing and Roadside Assistance Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Auto Towing and Roadside Assistance Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Auto Towing and Roadside Assistance Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AUTO TOWING AND ROADSIDE ASSISTANCE FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year tow truck business financial analysis and roadside assistance growth model is designed for startups and entrepreneurs aiming to impress investors and secure funding. Featuring a detailed auto towing cost structure model, emergency roadside service budgeting, and a robust roadside help income statement, it provides key financial charts, summaries, and metrics essential for effective vehicle recovery financial planning. The template also incorporates a tow and roadside assistance revenue model, towing service expense breakdown, and roadside assistance cash flow model, all essential for accurate tow company profitability forecasting and emergency vehicle towing financial plan development. Fully unlocked and customizable, this auto tow business financial summary template excels at estimating required startup costs and supporting comprehensive roadside support business valuation.

This ready-made auto towing financial projection model addresses the critical pain points faced by business owners by providing a comprehensive roadside assistance revenue forecast alongside an emergency roadside service budgeting tool, allowing users to accurately assess the vehicle recovery financial planning aspects. It simplifies the tow truck business financial analysis by integrating a detailed towing service expense breakdown and auto towing cost structure model, which helps users clearly understand the capital requirements and operational costs. The template’s tow company profitability forecast and roadside assistance cash flow model deliver actionable insights for maintaining positive liquidity, while the emergency vehicle towing financial plan and roadside support business valuation components assist stakeholders in making informed funding or loan decisions. By including a car towing income projection and a tow truck operation financial report, this model enhances the ability to track performance and predict growth through the roadside assistance growth model and vehicle towing service financial forecast. Overall, this auto tow business financial summary and roadside rescue financial modeling package effectively tackles the challenges of forecasting, budgeting, and profitability analysis in the tow and roadside assistance revenue model domain.

Description

This comprehensive auto towing financial projection model integrates a detailed roadside assistance revenue forecast alongside vehicle recovery financial planning to deliver a robust tow truck business financial analysis. Through its emergency roadside service budgeting and towing service expense breakdown features, the model offers an insightful roadside assistance cash flow model and a thorough auto towing cost structure model, facilitating accurate tow company profitability forecasts and emergency vehicle towing financial plans. Designed for small and medium-sized enterprises, it includes a five-year monthly and yearly roadside help income statement, comprehensive tow truck operation financial reports, and key performance indicators to support roadside assistance growth modeling. Additionally, the model incorporates investment and debt service coverage analyses, enabling precise roadside support business valuation and empowering users with a reliable car towing income projection and emergency roadside assistance budget management tool.

AUTO TOWING AND ROADSIDE ASSISTANCE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Elevate your tow truck business with our comprehensive auto towing financial projection model. Designed for precision, it integrates roadside assistance revenue forecasts, expense breakdowns, and cash flow modeling to deliver a clear picture of profitability. Our editable templates enable seamless financial planning—from vehicle recovery budgeting to towing service income projections—empowering you to optimize operations and drive growth. Perfect for startups seeking an intuitive yet powerful tool, this model combines operational analysis with detailed financial reporting, helping you craft a winning emergency roadside service budget and maximize your tow company’s valuation.

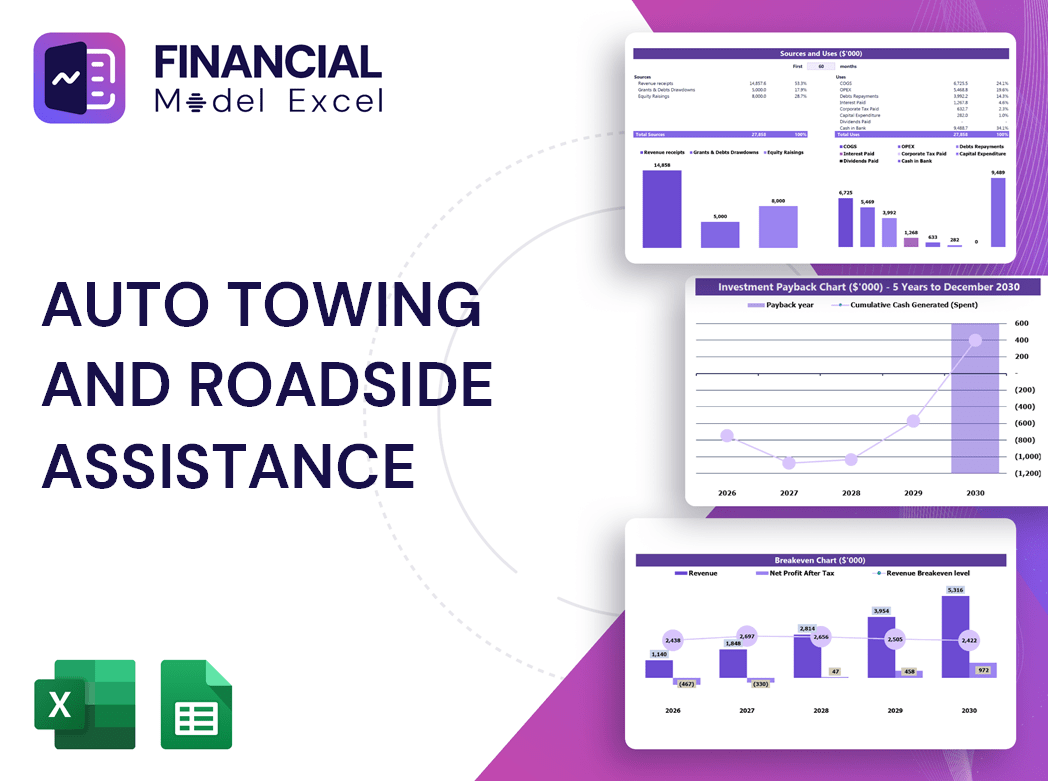

Dashboard

Our auto towing financial projection model features a dynamic dashboard designed for comprehensive vehicle recovery financial planning and tow truck business financial analysis. It delivers clear charts and graphical insights, simplifying the roadside assistance revenue forecast and emergency roadside service budgeting processes. This powerful tool enhances roadside assistance cash flow modeling and towing service expense breakdowns, empowering stakeholders with precise data to drive accurate car towing income projections and tow company profitability forecasts. Optimize your roadside support business valuation and emergency vehicle towing financial plan with our intuitive dashboard, crafted to maximize the effectiveness of your roadside rescue financial modeling and growth strategy.

Business Financial Statements

A comprehensive auto towing financial projection model relies on all three accounting statements to deliver a 360° view of business performance. The forecasted income statement offers critical insight into revenue streams and expense breakdowns driving profitability. Meanwhile, the pro forma balance sheet and roadside assistance cash flow model emphasize capital management, asset allocation, and liquidity. Together, these tools empower tow truck business financial analysis and roadside support business valuation, supporting strategic planning and enhancing tow company profitability forecasts with precision and clarity.

Sources And Uses Statement

A well-structured sources and uses schedule is essential for transparent financial planning within the tow truck business financial analysis. It precisely traces capital inflows and maps them to targeted expenditures, supporting accurate emergency roadside service budgeting and enhancing the auto towing cost structure model. This clarity empowers stakeholders to optimize the roadside assistance revenue forecast and refine the vehicle recovery financial planning, ultimately driving a robust tow company profitability forecast and a comprehensive roadside assistance cash flow model.

Break Even Point In Sales Dollars

This auto towing financial projection model features an integrated break-even analysis, enabling precise identification of when revenue surpasses total costs. This critical insight empowers tow truck businesses to forecast profitability and optimize their roadside assistance revenue forecast. Understanding the interplay between fixed and variable costs through this vehicle recovery financial planning tool is vital for effective emergency roadside service budgeting. Investors and creditors rely on these projections within the tow company profitability forecast to evaluate risk and potential returns, ensuring sound financial decisions and successful towing service expense management from day one.

Top Revenue

In an auto towing financial projection model, the top line represents total revenue from services like emergency roadside assistance and vehicle recovery. Tow truck business financial analysis focuses on this figure to track growth through roadside assistance revenue forecasts and tow company profitability forecasts. Investors scrutinize variations in sales and earnings quarterly to assess business health. A strong roadside assistance cash flow model and a well-structured towing service expense breakdown directly impact the bottom line, reflecting net profit. Understanding both lines is critical for effective emergency roadside service budgeting and long-term vehicle towing service financial planning.

Business Top Expenses Spreadsheet

The company’s expenses are detailed within the auto towing financial projection model, segmented into four key categories for clarity. An added ‘other’ category allows for flexible input of additional costs. Utilizing the P&L template Excel enhances the vehicle recovery financial planning by providing a historical perspective spanning up to five years. This comprehensive approach supports accurate roadside assistance revenue forecasting and tow truck business financial analysis, enabling strategic emergency roadside service budgeting and informed decision-making for sustained tow company profitability.

AUTO TOWING AND ROADSIDE ASSISTANCE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The auto towing financial projection model is a powerful tool designed to evaluate business feasibility by analyzing total costs and profit potential. This comprehensive roadside assistance revenue forecast and vehicle recovery financial planning template empowers users to pinpoint operational challenges and implement effective solutions. By integrating towing service expense breakdowns with emergency roadside service budgeting, it delivers insightful tow truck business financial analysis and cash flow modeling. Ideal for optimizing tow company profitability forecasts, this model ensures accurate roadside support business valuation and supports strategic growth in the competitive vehicle towing service market.

CAPEX Spending

The startup expenses are meticulously outlined within our cash flow forecasting model, emphasizing capital expenditures essential for launch. This comprehensive financial summary also integrates alternative income streams, enhancing the tow and roadside assistance revenue model. Such detailed financial planning ensures precise emergency roadside service budgeting and supports strategic decision-making for maximizing tow truck business profitability forecasts.

Loan Financing Calculator

Effective loan repayment schedules are crucial for startups and growing tow truck businesses, forming a key component of emergency roadside service budgeting and cash flow modeling. These schedules detail principal amounts, terms, maturity, and interest rates, directly impacting the auto towing cost structure model and roadside assistance cash flow forecasts. Monitoring repayments ensures accurate vehicle recovery financial planning and supports reliable towing service expense breakdowns. Integrating loan schedules into the roadside assistance revenue forecast enhances the tow company profitability forecast and towing operation financial reports, fostering sound financial analysis and strategic growth in the competitive roadside help industry.

AUTO TOWING AND ROADSIDE ASSISTANCE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings before interest, taxes, depreciation, and amortization (EBITDA) serve as a key indicator of operating performance in tow truck business financial analysis. Within an auto towing financial projection model, EBITDA provides critical insight into profitability before non-operating expenses. This metric forms the foundation of comprehensive roadside assistance cash flow models and vehicle recovery financial planning, enabling accurate emergency roadside service budgeting and towing service expense breakdowns. Leveraging EBITDA empowers tow and roadside assistance revenue models to forecast sustainable growth and optimize the roadside support business valuation with precision and confidence.

Cash Flow Forecast Excel

Develop a comprehensive roadside assistance cash flow model using Excel to drive your auto towing financial projection. This essential tool integrates operating, investing, and financing cash flows, ensuring accurate reconciliation with your pro forma balance sheet. Perfect for emergency roadside service budgeting or tow truck business financial analysis, it supports detailed expense breakdowns and revenue forecasts. By aligning each cash flow item with your financial statements, this model enables precise vehicle recovery financial planning and tow company profitability forecasting, forming the backbone of a robust auto tow business financial summary.

KPI Benchmarks

The Benchmarking tab is a critical component of our auto towing financial projection model, offering key industry and financial benchmarks. It enables a clear analysis of your tow truck business financial performance compared to top industry players. By leveraging these benchmark indicators, you gain valuable insights into strengths and identify areas needing improvement, enhancing your vehicle recovery financial planning and roadside assistance revenue forecast. This tool empowers data-driven decisions to optimize your emergency roadside service budgeting and drive sustainable growth.

P&L Statement Excel

A comprehensive auto towing financial projection model hinges on an accurate profit and loss statement. This key document captures gross and net profits, guiding strategic decisions with data-driven insights. Incorporating a detailed roadside assistance income statement and towing service expense breakdown ensures transparent financial analysis. Even a thriving tow truck business requires robust financial planning— including vehicle recovery financial forecasting and emergency roadside service budgeting—to build stakeholder trust. Without precise roadside assistance cash flow models and tow company profitability forecasts, perceived success lacks credibility. Elevate your towing operation’s financial strength through meticulous, professional financial reporting and growth modeling.

Pro Forma Balance Sheet Template Excel

A comprehensive auto towing financial projection model integrates the balance sheet forecast, detailing assets and liabilities, with the roadside assistance revenue forecast to provide a clear picture of profitability. The pro forma balance sheet reveals net worth and equity-versus-debt ratios, crucial for vehicle recovery financial planning. Meanwhile, the projected income statement—capturing income and expenses over time—guides emergency roadside service budgeting. Together, these tools enable tow truck business financial analysis, offering insights into cash flow, cost structure, and overall tow company profitability forecasts for strategic decision-making and sustainable growth.

AUTO TOWING AND ROADSIDE ASSISTANCE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive auto towing financial projection model to drive your tow truck business financial analysis with precision. This template offers detailed proformas for startup valuation, including Discounted Cash Flow (DCF) and roadside assistance revenue forecast, enabling accurate vehicle recovery financial planning. Optimize your emergency roadside service budgeting and towing service expense breakdown while maximizing tow company profitability forecast through clear roadside assistance cash flow modeling. Empower your roadside support business valuation and vehicle towing service financial forecast with a robust auto tow business financial summary, designed to elevate your roadside rescue financial modeling and ensure sustained growth.

Cap Table

The business plan template XLS includes a comprehensive capitalization table—an essential tool for start-ups. It clearly outlines the company’s ownership structure, detailing equity shares, preferred shares, and stock options. This financial snapshot reveals who holds what percentage of ownership and at what valuation, providing critical insight for investors and stakeholders. Integrating this with your auto towing financial projection model or tow truck business financial analysis ensures precise roadside assistance revenue forecasts and a solid foundation for your vehicle recovery financial planning and emergency roadside service budgeting.

AUTO TOWING AND ROADSIDE ASSISTANCE FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Optimize profitability and growth with a comprehensive auto towing and roadside assistance financial projection model.

Optimize profits and plan future growth confidently with our comprehensive auto towing financial projection model.

The auto towing financial projection model proactively identifies cash gaps and surpluses, optimizing your business’s financial health.

The auto towing financial projection model empowers precise cash flow forecasting for confident, strategic business growth decisions.

Optimize cash flow and boost profitability with the auto towing financial projection model’s precise forecasting tools.

AUTO TOWING AND ROADSIDE ASSISTANCE BUSINESS REVENUE MODEL TEMPLATE ADVANTAGES

Simplify success with our auto towing financial projection model—clear insights drive profitable, confident business decisions.

Unlock precise towing service financial forecasting with our simple yet sophisticated, user-friendly roadside assistance revenue model.

Auto towing financial projection model enables better decision making through accurate revenue and expense forecasting.

Optimize your towing service profitability with accurate roadside assistance cash flow model scenarios for confident decision-making.

Boost investor confidence with our precise auto towing financial projection model designed for strategic funding success.

Impress investors with a strategic auto towing financial model that ensures accurate forecasts and maximizes profitability outcomes.

Optimize profitability with our auto towing financial projection model, accurately predicting the impact of upcoming industry changes.

Our auto towing financial projection model empowers precise cash flow forecasting for confident, profitable equipment and service expansions.

Optimize startup growth with our comprehensive auto towing financial projection model for accurate revenue and expense forecasting.

Accurately forecast tow company profitability with our 5-year auto towing financial projection model, perfect for investor pitches.