Automated Vertical Farming Startup Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Automated Vertical Farming Startup Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Automated Vertical Farming Startup Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

AUTOMATED VERTICAL FARMING STARTUP FINANCIAL MODEL FOR STARTUP INFO

Highlights

The automated vertical farming financial projections template provides a comprehensive 5-year financial planning solution designed specifically for vertical farming startups and small businesses. This vertical farming startup investment analysis tool is ideal for evaluating the financial feasibility and profitability of an automated agriculture business before scaling or selling. Featuring customizable vertical farming revenue model templates and expense budgeting components, it supports detailed financial scenario planning and startup valuation of vertical farming technology ventures. With fully unlocked, editable fields, this financial modeling tool serves as an essential resource for developing automated vertical farm profit calculations, cash flow projections, and cost structure automation analysis, enabling informed decision-making and strategic funding requirements analysis.

This automated vertical farming financial model excel template alleviates common pain points by providing a comprehensive vertical farming cost analysis model and automated farming operational budget model that streamline expense budgeting and cash flow projections, enabling precise startup financial forecasting vertical farming ventures require. It integrates vertical farming revenue model templates and financial scenario planning vertical farming to simplify the complexity of automated vertical farm profit calculation while offering a robust vertical farming startup investment analysis and funding requirements analysis to clarify investment and financing strategies. Users benefit from a vertical farming financial feasibility study embedded within the model, facilitating financial risk assessment vertical farming startup initiatives face, alongside a dynamic automated vertical farm financial dashboard for real-time tracking of key performance indicators and startup valuation vertical farming technology evaluations, reducing guesswork and enhancing decision-making confidence.

Description

This comprehensive automated vertical farming financial projections model offers a robust framework for startup financial forecasting in vertical farming, featuring a 5-year forecast that integrates vertical farming revenue model templates, cost analysis models, and cash flow projections. Designed for ease of use, this financial modeling for vertical farming businesses allows users with basic Excel proficiency to input key assumptions and automatically update critical financial metrics such as profit loss projections, startup valuation, and expense budgeting. The model incorporates financial scenario planning, risk assessment, and funding requirements analysis to support investment analysis and financial feasibility studies, while providing an automated vertical farm profit calculation and operational budget model. Equipped with all essential financial statements and a financial dashboard, this vertical farming startup investment analysis tool enables efficient management and strategic decision-making to optimize profitability and secure sustainable growth.

AUTOMATED VERTICAL FARMING STARTUP FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Harness the power of our automated vertical farming financial projections template—designed for dynamic startup valuation and accurate revenue modeling. This customizable, scalable financial dashboard adapts seamlessly to changing assumptions, delivering robust cash flow projections and expense budgeting without manual recalculations. Thoroughly tested for diverse scenarios, it supports financial feasibility studies, funding requirements analysis, and risk assessments unique to vertical farming startups. Empower your automated agriculture business plan with precise financial modeling and startup profitability forecasting, ensuring your investment analysis and operational budget models evolve as your venture grows.

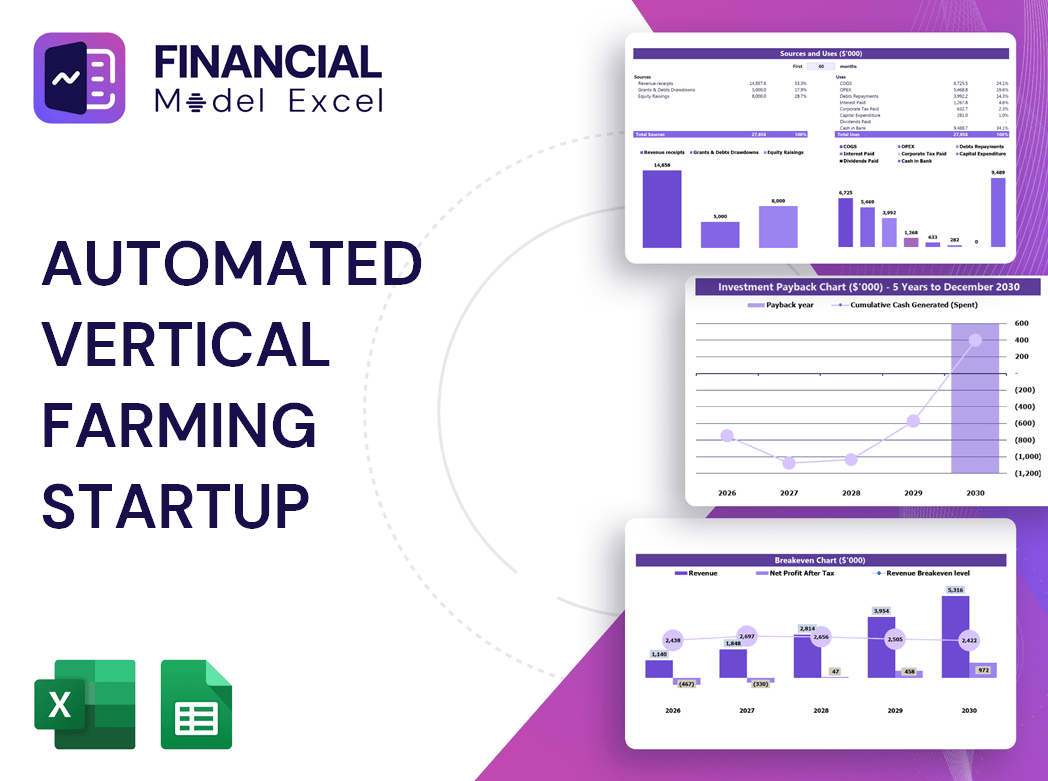

Dashboard

This automated vertical farming financial dashboard offers a comprehensive view of critical financial indicators across your projected timelines. Easily analyze annual revenue breakdowns, monthly cash flow projections, and expense budgeting—all formatted in Excel for seamless use. Ideal for vertical farming startup investment analysis, this tool supports robust financial modeling and scenario planning. It’s an essential asset for developing a detailed automated farming business plan financials, enabling clear insights into funding requirements, profitability models, and overall financial health to guide strategic decision-making and ensure business success.

Business Financial Statements

Our comprehensive 3-way financial model delivers robust automated vertical farming financial projections, including startup financial forecasting, revenue models, and expense budgeting. Equipped with dynamic charts and reports, this vertical farming startup investment analysis tool simplifies communication with investors by clearly illustrating your funding requirements, profitability models, and cash flow projections. Designed for seamless financial scenario planning and risk assessment, it empowers entrepreneurs to showcase their automated farming business plan financials confidently and professionally, accelerating informed investment decisions and business growth.

Sources And Uses Statement

The automated vertical farming financial projections template clearly outlines funding sources and their uses, guiding capital flow and business development. Customizable to fit unique startup needs, this vertical farming cost analysis model enables precise financial scenario planning. The Sources section details funding timelines, while the Uses section maps out capital allocation steps. A surplus in Sources indicates excess funding, whereas a deficit signals the need for more investment. This user-friendly financial modeling tool supports vertical farming startup investment analysis with clarity and reliability, requiring no specialized expertise for effective financial forecasting and cash flow projections.

Break Even Point In Sales Dollars

Breakeven analysis is essential in financial modeling for vertical farming businesses, pinpointing when automated farming operations will cover all expenses and generate profit. To forecast your 5-year breakeven, distinguish fixed costs—such as rent and salaried staff—from variable costs, which fluctuate with production volume like inventory and shipping. Integrating this into your vertical farming startup investment analysis ensures precise vertical farm expense budgeting and informs automated agriculture financial plans, driving strategic decision-making and enhancing the financial feasibility study for your innovative vertical farming venture.

Top Revenue

In vertical farming startup investment analysis, the top line represents revenue growth, reflecting increased sales and market traction. This metric drives critical financial modeling for vertical farming businesses, influencing cash flow projections and profit calculations. Equally important, the bottom line indicates net profit, revealing operational efficiency and long-term sustainability. Automated vertical farming financial projections rely heavily on these figures, guiding startup financial forecasting and financial scenario planning. Investors and analysts closely monitor revenue models and expense budgeting to assess financial feasibility and funding requirements, ensuring a robust automated farming business plan financials tailored for scalable success.

Business Top Expenses Spreadsheet

Leverage an automated vertical farming cost analysis model to generate detailed expense reports, breaking down operational costs by category for accurate budgeting and tax planning. Utilize these insights to enhance your vertical farming startup investment analysis and refine your financial modeling for vertical farming businesses. By comparing actual expenses against projections, you can perform financial risk assessment, optimize your vertical farm expense budgeting, and improve startup financial forecasting. This data-driven approach supports robust vertical farming cash flow projections and strengthens your automated farming business plan financials, driving informed decision-making and sustainable growth in automated vertical farming operations.

AUTOMATED VERTICAL FARMING STARTUP FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurate startup cost analysis is crucial for any vertical farming business and directly impacts financial projections and funding strategies. Our comprehensive vertical farming startup investment analysis, featuring a robust three-statement financial model, enables precise monitoring of expenses and funding requirements. This automated farming business plan financials template supports effective cost management and budgeting within your resources, helping you avoid funding shortfalls or overestimation. Empower your vertical farming startup with data-driven financial forecasting, ensuring sustainable growth and profitability from day one.

CAPEX Spending

The CAPEX expenses in an automated vertical farming financial model capture all investments essential for enhancing operational performance and scaling the startup. These development costs exclude ongoing operating expenses like salaries. A detailed vertical farming startup cost analysis model highlights crucial areas for resource allocation, ensuring strategic budgeting. Given that capital expenditures vary across businesses, it’s vital to clearly outline CAPEX within the automated farming business plan financials. This transparency supports accurate financial forecasting and strengthens your vertical farming startup investment analysis.

Loan Financing Calculator

For vertical farming startups, precise loan repayment schedules are essential to effective financial forecasting and cash flow projections. These schedules detail loan amounts, maturity terms, and interest expenses, directly impacting automated farming business plan financials and cash flow statements. Principal repayments are integrated into financing activities, influencing the balance sheet and overall financial scenario planning. Incorporating a vertical farming cost analysis model and automated vertical farm profit calculation ensures accurate financial risk assessment and supports robust startup valuation within the vertical farming technology sector.

AUTOMATED VERTICAL FARMING STARTUP FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The gross profit margin (GPM) is a vital indicator in automated vertical farming financial projections, reflecting the gap between sales revenue and associated costs. An improving GPM signals increasing efficiency—rising revenues alongside decreasing sales expenses—directly enhancing profitability. For vertical farming startups, integrating GPM analysis within financial modeling and cost analysis models is essential for accurate startup financial forecasting and profitability assessments. Monitoring GPM through automated vertical farm financial dashboards enables insightful financial scenario planning and risk assessment, ensuring informed decision-making for sustainable growth and optimized automated agriculture financial plans.

Cash Flow Forecast Excel

The cash balance in an automated vertical farming financial projection reflects the total funds available in the company’s accounts. Maintaining an adequate cash reserve is crucial to meet operational obligations and ensure smooth business continuity. Incorporating this into a comprehensive vertical farming startup investment analysis or financial modeling for vertical farming businesses provides clear insights into liquidity management. Effective cash flow projections and expense budgeting help optimize the automated farming operational budget model, supporting informed decision-making and sustainable growth within the vertical farming sector.

KPI Benchmarks

The benchmark tab in a vertical farming financial model enables precise analysis by comparing key performance indicators against industry peers. This critical step in financial modeling for vertical farming startups ensures thorough evaluation of operational and financial metrics. By leveraging benchmark data, companies can optimize their financial feasibility studies, improve cost structures, and enhance profitability models. Understanding these indicators empowers startups to refine expense budgeting and revenue forecasting, minimizing losses while sustaining consistent profits. Effective benchmarking is essential for strategic financial planning and risk assessment, guiding informed decision-making and maximizing investment potential in automated vertical farming ventures.

P&L Statement Excel

The automated vertical farming financial model offers a comprehensive income statement template to analyze monthly and yearly profit and loss projections. This dynamic tool supports vertical farming startup investment analysis by detailing revenue streams, operating expenses, cost structures, and profit margins. With integrated financial scenario planning and expense budgeting, it enables precise financial forecasting and risk assessment. The model’s dashboards provide clear insights into cash flow projections, profitability, and funding requirements, empowering stakeholders to make informed decisions for sustainable growth in automated agriculture businesses. Ideal for scalable vertical farming startups seeking robust financial modeling and feasibility studies.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet for a vertical farming startup provides a snapshot of assets, liabilities, and equity, essential for financial scenario planning and funding requirements analysis. Combined with a profit and loss statement template, it captures operational performance and cash flow projections over time. This financial modeling for vertical farming businesses highlights liquidity, solvency, and efficiency ratios, aiding automated vertical farm profit calculation and cost structure optimization. Together, these tools support a comprehensive vertical farming financial feasibility study and strengthen startup valuation in investment analysis.

AUTOMATED VERTICAL FARMING STARTUP FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock strategic insights with our automated vertical farming financial projections template. Designed for vertical farming startups, this comprehensive financial modeling tool integrates investment analysis, cash flow projections, and expense budgeting. It calculates Net Present Value (NPV) by discounting all future cash flows, reflecting accurate startup valuation and profitability models. Key metrics include required investment, equity raised, WACC, EBITDA, growth rate, and net income, empowering stakeholders with precise financial scenario planning and risk assessment. Optimize funding decisions and operational budgets with a robust vertical farming financial feasibility study that supports data-driven investment strategies and sustainable growth.

Cap Table

The cap table is an essential component of startup financial projections, offering a comprehensive breakdown of a company’s securities, investor shares, valuations, and dilution over time. For vertical farming startups, integrating the cap table within financial modeling and automated farming business plan financials enhances investment analysis and funding requirements assessment. This clarity supports robust startup financial forecasting and valuation in vertical farming technology, empowering founders to navigate financial risk and optimize capital allocation for sustainable growth.

AUTOMATED VERTICAL FARMING STARTUP 3 STATEMENT FINANCIAL MODEL TEMPLATE ADVANTAGES

Optimize surplus cash effortlessly with our automated vertical farming startup financial model for precise, strategic financial management.

Gain precise control and optimize profits with our automated vertical farming startup financial model’s dynamic forecasting.

Effortlessly forecast cash flow and investment needs with our automated vertical farming startup financial model template.

Automated vertical farming financial models ensure precise cash flow forecasts, securing funds to pay suppliers and employees timely.

Capture investor interest swiftly with an automated vertical farming financial model streamlining projections and boosting clarity.

AUTOMATED VERTICAL FARMING STARTUP STARTUP FINANCIAL MODEL TEMPLATE EXCEL FREE ADVANTAGES

Our automated vertical farming financial model empowers startups with precise forecasting to drive scalable, profitable growth confidently.

Automated vertical farming cash flow projections reveal optimal growth strategies and funding impacts to maximize your startup’s financial success.

Automated vertical farming financial models optimize investment decisions, maximizing returns and minimizing risks—investors ready.

Our automated vertical farming financial model ensures precise monthly profit, cash flow, and comprehensive ratio analysis for informed decisions.

Our automated vertical farming financial model ensures precise, regular forecasts, boosting investor confidence and securing essential funding.

The automated vertical farming financial model streamlines 5-year cash flow projections, ensuring clear, accurate lender reporting.

Our automated vertical farming financial model ensures precise projections, boosting investor confidence and maximizing startup profitability.

Accelerate funding with our vertical farming financial model, delivering precise metrics to impress investors and streamline negotiations.

Our automated vertical farming financial model efficiently predicts profitability, empowering strategic investment decisions with precise data.

Unlock precise automated vertical farming financial projections instantly, with zero formula writing, formatting, or costly consultants needed.